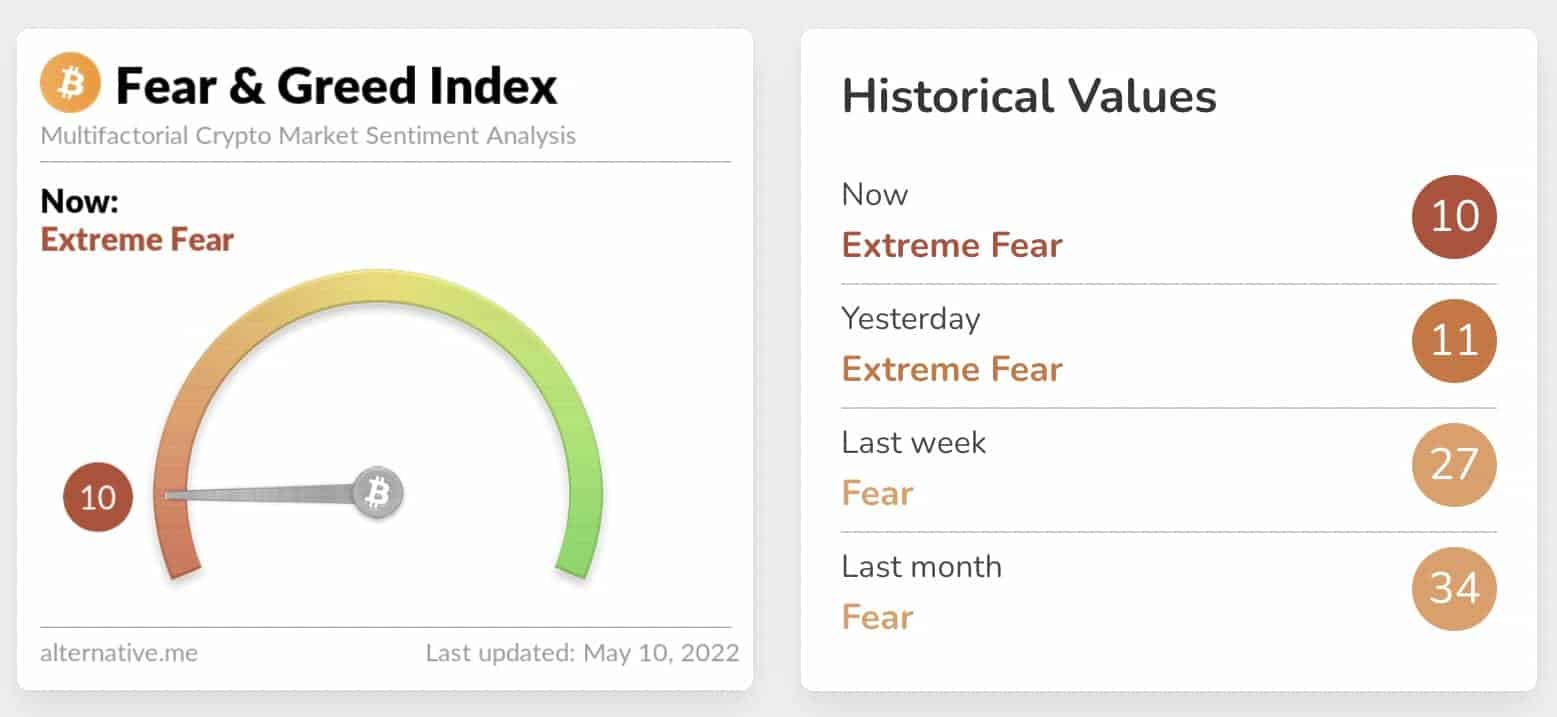

The Fear & Greed Index is a tool used to measure investor sentiment. It is based on a scale of 0 to 100, with a value of 0 indicating extreme fear and a value of 100 indicating extreme greed. The index is designed to provide a snapshot of how investors are feeling at any given moment, with the goal of helping investors make informed decisions about when to buy or sell stocks.

The Fear & Greed Index is calculated using a number of different indicators, including stock market volatility, trading volume, and the price of various assets. These indicators are weighted and combined to produce a single value that can be used to gauge investor sentiment.

There are several advantages to using the Fear & Greed Index. First, it provides a quick and easy way to measure investor sentiment, which can be useful for investors who are trying to make decisions in a volatile market. Second, the index is based on objective data, so it can be used to help investors avoid the pitfalls of emotional decision-making. Finally, the index is updated on a regular basis, so investors can use it to track changes in investor sentiment over time.

One of the main drawbacks of the Fear & Greed Index is that it is based on a limited number of indicators, so it may not provide a complete picture of investor sentiment. In addition, the index is based on historical data, so it may not accurately reflect the current state of the market. Finally, the index is not intended to be used as a stand-alone investment tool, so investors should not make decisions solely based on its readings.

Overall, the Fear & Greed Index is a useful tool for investors who want to get a sense of how investors are feeling at any given moment. By tracking changes in the index over time, investors can gain insight into shifts in investor sentiment and make more informed decisions about when to buy or sell stocks.

How Does the Fear & Greed Index Work in Crypto?

The Crypto Fear & Greed Index is calculated using a number of different indicators that are relevant to the cryptocurrency market. These indicators may include measures of volatility, market momentum, trading volume, and other factors that can provide insight into investor sentiment.

The specific indicators used and the weightings applied to them may vary depending on the provider of the index. In general, however, the index is designed to provide a single value that represents investor sentiment in the cryptocurrency market at any given moment. This value is then mapped onto a scale of 0 to 100, with a value of 0 indicating extreme fear and a value of 100 indicating extreme greed.

The Crypto Fear & Greed Index is updated on a regular basis, typically daily or weekly. This allows investors to track changes in investor sentiment over time and make more informed decisions about when to buy or sell cryptocurrencies. However, it is important to remember that the index is not intended to be used as a stand-alone investment tool. It should be used in conjunction with other forms of analysis and research.

What is the history behind the fear & greed index?

The exact history of the Fear & Greed Index is not clear, as it has been developed and maintained by various organizations over time. However, the concept of using indicators to measure investor sentiment has been around for many years.

One of the earliest versions of the Fear & Greed Index was created by the investment research firm CNN Money in the early 2000s. This index was based on a number of different indicators, such as the VIX index, which measures stock market volatility, and the put/call ratio, which is a measure of the number of put options (which allow investors to sell stocks at a predetermined price) compared to call options (which allow investors to buy stocks at a predetermined price).

Over time, other organizations have developed their own versions of the Fear & Greed Index. For example, the financial news and analysis website Investing.com currently maintains a Fear & Greed Index that is based on a different set of indicators. This index is updated daily and provides a snapshot of investor sentiment in the stock market.

In recent years, the concept of the Fear & Greed Index has been applied to the cryptocurrency market, with the development of the Crypto Fear & Greed Index. This index uses indicators that are relevant to the cryptocurrency market, such as volatility and trading volume, to provide a measure of investor sentiment in the crypto space.

How Is the Fear & Greed Index Measured?

The specific factors that make up the Fear & Greed Index may vary depending on the provider of the index. However, in general, the index is calculated using a combination of the following factors:

- Volatility: Volatility is a measure of how much the price of a stock or other asset is fluctuating. Higher volatility typically indicates a more volatile market, which can be a sign of investor fear.

- Market momentum: Market momentum is a measure of how much the price of a stock or other asset is moving in a particular direction. A positive momentum indicates that the market is moving upwards, while a negative momentum indicates that the market is moving downwards.

- Trading volume: Trading volume is a measure of the number of shares or other units of a stock or other asset that are being traded over a given period of time. Higher trading volume can be a sign of investor interest and can indicate that the market is moving in a particular direction.

- Other factors: In addition to the above factors, the Fear & Greed Index may also include other indicators that are relevant to the stock or cryptocurrency market. These could include measures of sentiment, such as the put/call ratio or the percentage of stocks that are trading above their moving average, as well as other indicators that provide insight into investor sentiment.

What does ‘Extreme Fear’ & ‘Extreme Greed’ tell you?

Extreme fear and extreme greed are two opposite ends of the Fear & Greed Index scale. A reading of 0 on the index indicates extreme fear, while a reading of 100 indicates extreme greed. These readings can provide insight into investor sentiment and can be useful for investors who are trying to make decisions about when to buy or sell stocks or cryptocurrencies.

A reading of extreme fear on the Fear & Greed Index can indicate that investors are feeling very negative about the stock or cryptocurrency market. This can be a sign that the market is about to experience a downturn, as investors may be selling off their assets in anticipation of further losses. In this situation, investors who are feeling very fearful may decide to sell their stocks or cryptocurrencies, which can cause the market to decline further.

On the other hand, a reading of extreme greed can indicate that investors are feeling very positive about the market. This can be a sign that the market is about to experience an upturn, as investors may be buying up assets in anticipation of further gains. In this situation, investors who are feeling very greedy may decide to buy more stocks or cryptocurrencies, which can cause the market to rise further.

It is important to note that the Fear & Greed Index is not intended to be used as a stand-alone investment tool. It provides a snapshot of investor sentiment at a specific moment in time, but it does not necessarily provide a complete picture of the market or predict future market movements. Additionally, the index is based on a limited number of indicators and may not accurately reflect the current state of the market.

Therefore, investors should not make investment decisions solely based on the readings of the Fear & Greed Index. Instead, they should use the index in conjunction with other forms of analysis and research to gain a more complete understanding of the market and make informed decisions about when to buy or sell stocks or cryptocurrencies.

Overall, extreme fear and extreme greed on the Fear & Greed Index can provide valuable insight into investor sentiment and can be useful for investors who are trying to navigate the stock or cryptocurrency market. However, it is important to use the index carefully and in conjunction with other forms of analysis and research to make informed investment decisions.