How To Buy Cardano (ADA)?

A common question you often see on social media from crypto beginners is “Where can I buy Cardano?” Well, you’ll be happy to hear it is actually quite a simple and straightforward process. Thanks to its massive popularity, you can now buy Cardano on most cryptocurrency exchanges, including Coinbase and Binance in 3 simple steps.

Step 1: Create an account on an exchange that supports Cardano (ADA)

First, you will need to open an account on a cryptocurrency exchange that supports Cardano (ADA).

We recommend the following based on functionality, reputation, security, support and fees:

1

Bybit

Fees (Maker/Taker) 0.1%*-0.1%*

Cryptocurrencies

Available for Trade 400+

Sign-up bonus

15% reduced trading fees & up to $30,000 sign-up bonus*

Available in

Europe, Asia, Oceania, Africa

2

Binance

Fees (Maker/Taker) 0.075%*-0.1%*

Cryptocurrencies

Available for Trade 500+

Sign-up bonus

10% reduced trading fees*

Available in

Europe, Asia, Oceania, Africa

In order to sign up, you will need to enter some basic information, such as your email address, password, full name and, in some cases, you might also be asked for a phone number or address.

Note: On specific exchanges, you might need to complete a Know Your Customer (KYC) procedure in order to be able to purchase cryptocurrency. This is most commonly the case with licensed and regulated exchanges.

Step 2: Deposit funds into your account

Many cryptocurrency exchanges will allow you to purchase Cardano (ADA) with fiat currencies, such as EUR, USD, AUD and others. Furthermore, they will also provide you with multiple deposit methods through which you can fund your fiat account, such as credit and debit cards, ewallets or direct bank transfers.

Note: Some payment methods will have higher fees than others, such as credit card payments. Before funding your fiat account on your chosen exchange, make sure to do your due diligence to find out the fees involved with each payment method to avoid unnecessary costs.

Step 3: Buy Cardano (ADA)

This process is similar across almost every cryptocurrency exchange. All you have to do is find a navigation bar or a search bar, and search for Cardano (ADA) or Cardano (ADA) trading pairs. Look for the section that will allow you to buy Cardano (ADA), and enter the amount of the cryptocurrency that you want to spend for Cardano (ADA) or the amount of fiat currency that you want to spend towards buying Cardano (ADA). The exchange will then calculate the equivalent amount of Cardano (ADA) based on the current market rate.

Note: Make sure to always double-check your transaction details, such as the amount of Cardano (ADA) you will be buying as well as the total cost of the purchase before you end up confirming the transaction. Furthermore, many cryptocurrency exchanges will offer you their own proprietary software wallet where you will be storing your cryptocurrencies; however, you can create your own individual software wallet, or purchase a hardware wallet for the highest level of protection.

For more in-depth instructions, our ‘Absolute Beginner’s Guide To Cryptocurrency Investing‘ will take you through the process step-by step. In addition to providing instructions for sending and receiving your cryptocurrency.

And if you’re completely new to crypto our beginner, intermediate and advanced level articles will get you up to speed with everything you need to know about the cryptocurrency space starting out.

What is Cardano (ADA)?

Cardano is a proof-of-stake blockchain platform that says its goal is to allow “changemakers, innovators and visionaries” to bring about positive global change.

The open-source project also aims to “redistribute power from unaccountable structures to the margins to individuals” — helping to create a society that is more secure, transparent and fair.

Charles Hoskinson was 1 of 8 co-founders of Ethereum, but left the project in 2014 when Vitalik Buterin opted to make Ethereum a non-profit organization. This disagreement led Hoskinson to start his own smart contract blockchain competitor, known as Cardano. Cardano began development in 2015 and launched in 2017, although smart contracts are still not supported by the network.

Cardano opted to launch its network with multiple layers. Currently, the Cardano settlement layer handles ADA transactions, and eventually the Cardano Computation Layer will handle smart contracts. The Cardano Settlement Layer launched in 2017 along with the ICO of its native asset, ADA, which began trading for $0.02.

In the spirit of many open source projects, Cardano did not begin with a comprehensive roadmap or even an authoritative white paper. Rather it embraced a collection of design principles, engineering best practices and avenues for exploration. These include the following:

- Separation of accounting and computation into different layers

- Implementation of core components in highly modular functional code

- Small groups of academics and developers competing with peer reviewed research

- Heavy use of interdisciplinary teams including early use of InfoSec experts

- Fast iteration between white papers, implementation and new research required to correct issues discovered during review

- Building in the ability to upgrade post-deployed systems without destroying the network

- Development of a decentralized funding mechanism for future work

- A long-term view on improving the design of cryptocurrencies so they can work on mobile devices with a reasonable and secure user experience

- Bringing stakeholders closer to the operations and maintenance of their cryptocurrency

- Acknowledging the need to account for multiple assets in the same ledger

- Abstracting transactions to include optional metadata in order to better conform to the needs of legacy systems

- Learning from the nearly 1,000 altcoins by embracing features that make sense

- Adopt a standards-driven process inspired by the Internet Engineering Task Force using a dedicated foundation to lock down the final protocol design

- Explore the social elements of commerce

- Find a healthy middle ground for regulators to interact with commerce without compromising some core principles inherited from Bitcoin

From this unstructured set of ideas, the principals working on Cardano began both to explore cryptocurrency literature and to build a toolset of abstractions. The output of this research is IOHK’s extensive library of papers, numerous survey results such as this recent scripting language overview as well as an Ontology of Smart Contracts, and the Scorex project. Lessons yielded an appreciation for the cryptocurrency industry’s unusual and at times counterproductive growth.

The team behind the layered blockchain say that there have already been some compelling use cases for its technology, which aims to allow decentralized apps and smart contracts to be developed with modularity.

Cardano is used by agricultural companies to track fresh produce from field to fork, while other products built on the platform allow educational credentials to be stored in a tamper-proof way, and retailers to clamp down on counterfeit goods.

Cardano is one of the biggest blockchains to successfully use a proof-of-stake consensus mechanism, which is less energy intensive than the proof-of-work algorithm relied upon by Bitcoin. Although the much larger Ethereum is going to be upgrading to PoS, this transition is only going to take place gradually.

The project has taken pride in ensuring that all of the technology developed goes through a process of peer-reviewed research, meaning that bold ideas can be challenged before they are validated. According to the Cardano team, this academic rigor helps the blockchain to be durable and stable — increasing the chance that potential pitfalls can be anticipated in advance.

Cardano’s two native wallets are:

Daedalus – A full node wallet available on desktop.

Yoroi – A light wallet, available as a browser extension, and mobile apps.

Cardano Blockchain Architecture

The Cardano blockchain consists of two core components. The Cardano Settlement Layer (CSL) acts as a unit of account and is the place where token holders can send and receive ADA instantaneously with minimal transaction fees. The Cardano Computational Layer (CCL) is a set of protocols, which is the backbone of the blockchain, and helps to run smart contracts, ensure security and compliance, and allow for other advanced functionality, such as blacklisting and identity recognition. The Cardano open-source code is written using Haskell, a universally recognized and secure programming language.

Cardano works on a specially designed proof-of-stake (PoS) blockchain protocol for consensus called Ouroboros. This consensus mechanism allows for ADA to be sent and received easily and securely at all times, while also ensuring the safety of smart contracts on the Cardano blockchain. At the same time, as a PoS consensus mechanism, Ouroboros provides rewards to token holders who stake their ADA to the network and help ensure network consensus.

The greatest benefit of Ouroboros is its mathematical security in choosing blockchain validators. Other blockchains claim that they choose block validators at random, but these claims cannot be verified. On the other hand, Ouroboros offers a provable way to randomly select a validator and ensure that all token holders who stake ADA to the Cardano blockchain have a fair chance of mining a block and receiving the associated reward. This eliminates any need for excessive computational power prevalent in proof-of-work (PoW) blockchain networks and guarantees an objectively fair staking model that is not found in any other PoS blockchain protocol.

What is the ADA Token?

ADA is the cryptocurrency for the Cardano platform. Cardano’s coin is named after Ada Lovelace, a 19th-century mathematician known as the first computer programmer.

People use ADA tokens to pay transaction fees for using the platform. It’s also given out to the validators as a reward for running the proof of stake system.

What are Cardano native tokens?

On March 1, 2021, the Cardano blockchain introduced the ability to create native tokens. Like Ethereum tokens — which can include things like NFTs or stablecoins like USD Coin — Cardano native assets can be created and distributed on the blockchain and are able to interact with smart contracts.

But unlike Ethereum-based tokens, Cardano native tokens aren’t created via smart contract. Instead, they run on the same architecture as the ADA cryptocurrency itself. According to the nonprofit Cardano Foundation, this makes Cardano native assets “first-class citizens” on the blockchain. Their native architecture can theoretically make these tokens more secure and reduce the fees associated with transactions.

What makes Cardano unique?

The major difference between Cardano and other cryptocurrencies is its reliance on peer-reviewed research and evidence-based methods in its development. While most of the crypto market moves fast, Cardano veers in the opposite direction. It takes a slower, more methodical approach. The benefit is that this makes it more likely that developers catch potential threats.

However, there are drawbacks to Cardano’s approach. Its development process tends to take much longer than its competitors, which can cause it to fall behind. Critics have also pointed out that today’s peer-review system has its issues, so relying on it isn’t necessarily an advantage.

Another way that Cardano crypto stands out is that it uses a proof-of-stake protocol to validate transactions. Proof of stake is much more energy-efficient than proof of work, the original consensus mechanism introduced by Bitcoin.

Cardano (ADA) Roadmap

Unlike other blockchain technology, Cardano is still relatively new. It was only launched in 2017 and has spent the first several years of its existence under development.

Cardano has laid out five distinct phases for its blockchain. Currently, Cardano is past its Shelley stage of the process, and is working toward finishing the second half of its five phases:

- Byron — Creates the foundational architecture of the network and tests the initial functionality so the network runs properly.

- Shelley — Launches the Cardano mainnet and begins decentralization of the blockchain network.

- Goguen — Implements a smart contract platform, allowing for the function of building decentralized applications.

- Basho — Scaling solutions are to be implemented, allowing for blockchain optimization and improved performance.

- Voltaire — Introduces treasury and voting systems to create a self-sustaining network.

Even though these are five distinct phases, many parts of each phase run in parallel with one another. Each phase goes through a variety of processes before being integrated into Cardano. There is heavy academic research that has gone into each step of the process. Prototyping is also an important part of the process, as each piece of open-source code must be rigorously tested to meet predetermined technical specifications before being implemented.

While these roadmap phases have often been delayed, Charles Hoskinson and the developers of Cardano are quite confident in their ability to follow through with the roadmap as promised, and deliver the next generation of PoS blockchain protocols to the world.

Cardano Development Updates in 2023

Cardano has made significant strides in 2023, marking important developments in its blockchain technology and ecosystem. Here are the key updates:

-

Lace Wallet Updates: The Lace team released a new version, Lace v.1.2, bringing improvements like new browser support, new organization features for NFTs, new privacy features, and enhanced speed.

-

Smart Contract Improvements: The Plutus tool team worked on Marconi GetUtxoFromAddress and GetTokenBurnEvent indexers for the Sidechain Tribe and updated marconi-sidechain JSON-RPC requests and responses to reflect API specifications. Additionally, they improved inlining for functions in Plutus Core and enhanced the metatheory of the embedded machine, among other technical advancements.

-

Basho (Scaling) Phase and Hydra Development: The Hydra team focused on operating a head on the mainnet, addressing bugs, and preparing for the release of version 0.11.0. This update is expected to bring many improvements and bug fixes.

-

Vasil Upgrade: The Vasil Upgrade is designed to make Cardano more efficient in processing transactions and also more energy-efficient.

-

Other Key Projects:

- Project Catalyst: A decentralized funding platform enabling the Cardano community to vote on which projects should receive funding.

- Atala Prism: A decentralized identity platform allowing users to securely store and manage personal data.

- Milkomeda: Enhances Cardano’s interoperability with other blockchains.

- EVM Sidechains: Supports Ethereum-based DApps on Cardano.

- Hydra Head Start: Tests the Hydra scaling solution for improving Cardano’s scalability.

-

Hydra: Cardano’s Layer 2 scalability solution, aiming to increase transaction speed through low latency and high throughput, and minimizing transaction costs.

-

Oracles: Following the launch of Charli3, Cardano’s first decentralized oracle network, there is an expectation of further developments concerning oracles, which facilitate the connection of on-chain and off-chain data.

-

Interoperability and Governance Initiatives: These include efforts to enhance network interoperability and introduce decentralized decision-making through blockchain technology on Cardano. The Valentine SECP upgrade in February 2023 was a step in this direction, improving network security and supporting cross-chain interoperability.

-

Midnight Sidechain: A solution for fully confidential transactions, competing with established privacy coins and serving as a smart contract platform.

-

Stablecoins: Introduction of Djed, a decentralized stablecoin, and USDA, a centralized stablecoin similar to Tether and USDC, expected to be closely integrated with the dApps.

-

Developer Ecosystem Growth: The Cardano Foundation is focused on advancing open source technologies in collaboration with the community, planning to release more open source repositories and conducting surveys to assess the technical landscape and understand the developer community’s preferences and challenges.

These updates reflect Cardano’s commitment to evolving as a robust, efficient, and secure blockchain platform, with a strong focus on scalability, interoperability, and community-driven governance.

Official website: https://cardano.org/

Best cryptocurrency wallet for Cardano (ADA)

There are plenty of different crypto wallets available. The best one for you depends on your general trading habits and which provides the most security in your situation. There are two main types of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical). Both have their pros and cons, and there is not necessarily a right or wrong answer when it comes to figuring out which crypto wallet is best for you.

HOW DO I DECIDE WHICH cryptocurrency WALLET TO USE for Cardano (ADA)?

Deciding which type of wallet to use depends on a variety of factors, including:

- How often you trade. In general, hot wallets are better for more active cryptocurrency traders. Quick login ability means you are only a few clicks and taps away from buying and selling crypto. Cold wallets are better suited for those looking to make less frequent trades.

- What you want to trade. As mentioned earlier, not all wallets support all types of cryptocurrencies. However, some of the best crypto wallets have the power to trade hundreds of different currencies, providing more of a one-size-fits-all experience.

- Your peace of mind. For those worried about hacking, having a physical cold wallet stored in a safe deposit box at the bank or somewhere at home, provides the safest, most secure option. Others might be confident in their ability to keep their hot wallets secure.

- How much it costs. It is important to investigate the costs associated with each wallet. Many hot wallets will be free to set up. Meanwhile, cold wallets, like any piece of hardware, will cost money to purchase.

- What it can do. While the basics of each cryptocurrency wallet are the same, additional features can help set them apart. This is especially true of hot wallets, many of which come with advanced reporting features, insights into the crypto market, the ability to convert cryptocurrencies and more. Security features can also be a good differentiator.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re going to be dealing in larger volumes of crypto, investing in cold storage might prove advantageous.

Most widespead examples of this being the Ledger Nano and the Trezor.

Ledger manufactures cold storage wallets designed for users who want increased security. Their wallets are a physical device that connects to your computer. Only when the device is connected can you send your cryptocurrency from it. Ledger offers a variety of products, such as the Ledger Nano S and the Ledger Nano X (a bluetooth connected hardware wallet).

Trezor is a pioneering hardware wallet company. The combination of world-class security with an intuitive interface and compatibility with other desktop wallets, makes it ideal for beginners and experts alike. The company has gained a lot of the Bitcoin community’s respect over the years. Trezor offers two main models – The Trezor One and Trezor Model T (which has a built in touch screen).

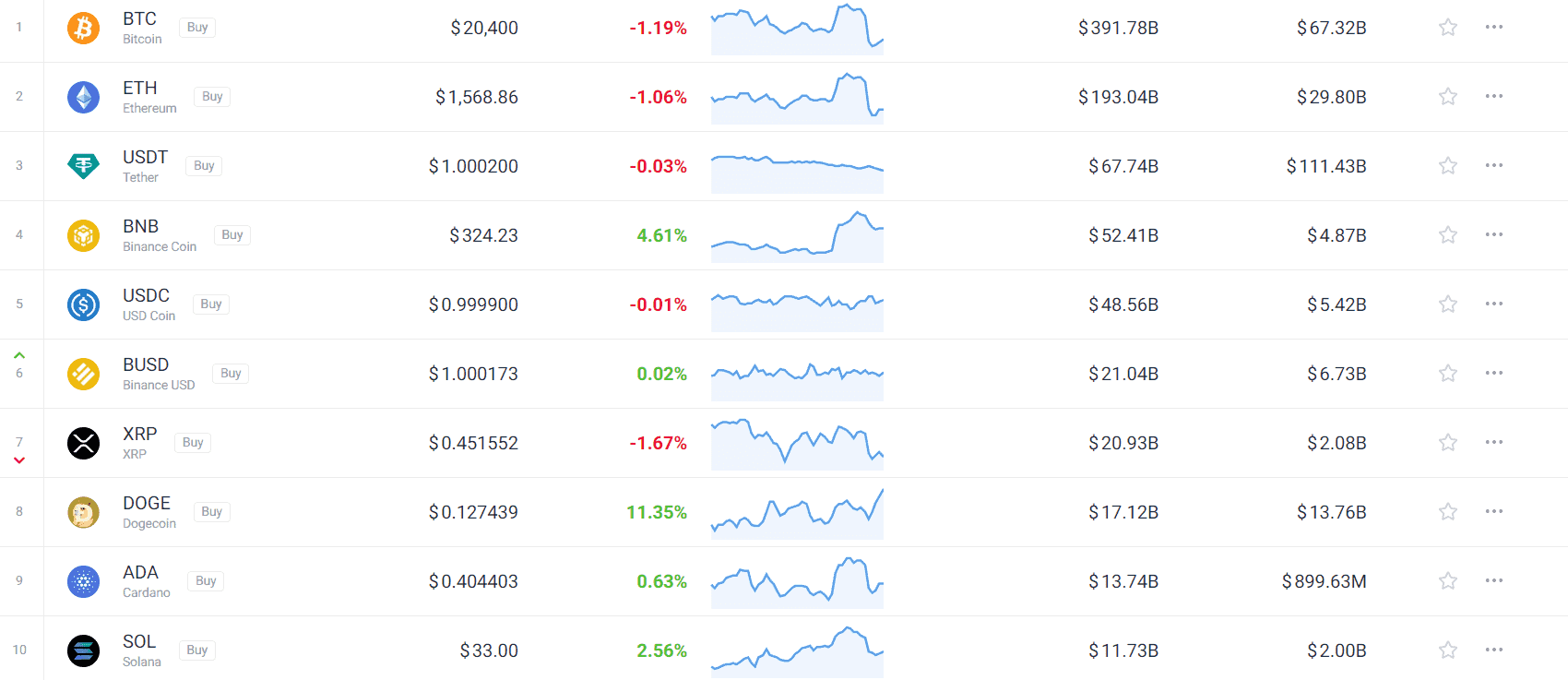

Cardano (ADA) Price & Charts

- Market Capitalization And Daily Trading Volume

- Current Market Price Of Every Cryptocurrency Relative To USD (And Some Local Currencies)

- Circulating And Total Supply

- Historical Charts With Prices Relative To USD, Bitcoin (BTC), And Ethereum (ETH).