How to buy TrueFi (TRU)

If you’re interested in purchasing TrueFi (TRU), this helpful step-by-step guide will show you how. We’ll walk you through the process so you can learn how to buy TrueFi (TRU) with ease. Whether you’re new to cryptocurrency or just looking to expand your portfolio, this guide can provide you with the information you need to get started. So why not give it a try and learn how to buy TrueFi (TRU) today?

Step 1: Create an account on an exchange that supports TrueFi (TRU)

First, you will need to open an account on a cryptocurrency exchange that supports TrueFi (TRU).

We recommend the following based on functionality, reputation, security, support and fees:

1

Binance

Fees (Maker/Taker) 0.075%*-0.1%*

Cryptocurrencies

Available for Trade 500+

Sign-up bonus

10% reduced trading fees*

Available in

Europe, Asia, Oceania, Africa

2

MEXC

Fees (Maker/Taker) 0.2%*-0.2%*

Cryptocurrencies

Available for Trade 1500+

Sign-up bonus

10% reduced trading fees & up to $170 in USDT vouchers*

Available in

North America, South America, Europe, Asia, Oceania, Africa

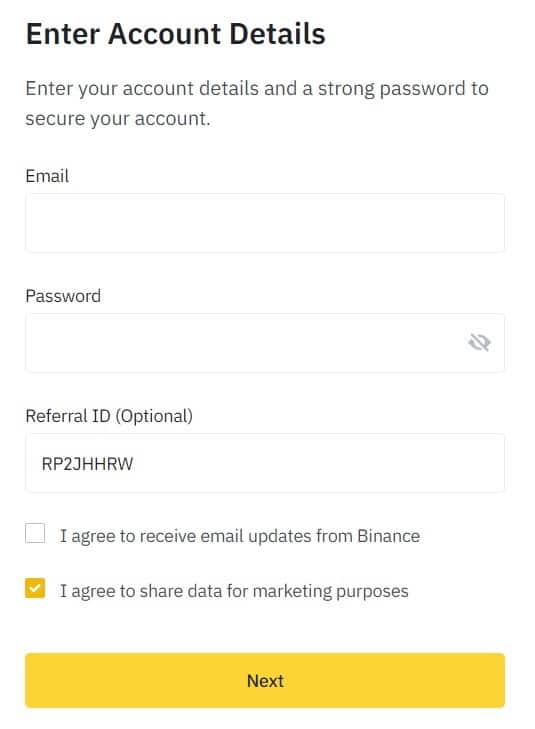

When you’re signing up for a cryptocurrency exchange, you’ll typically need to provide some basic information. This might include your email address, password, and full name. Depending on the exchange, you may also be asked for additional details like your phone number or address.

It’s worth noting that some exchanges have more stringent requirements, such as a “Know Your Customer” (KYC) procedure. This is typically the case with licensed and regulated exchanges. KYC procedures help ensure that exchanges comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. If you’re required to complete a KYC procedure, you’ll typically be asked to provide additional information, such as a government-issued ID or proof of address.

Step 2: Deposit funds into your account

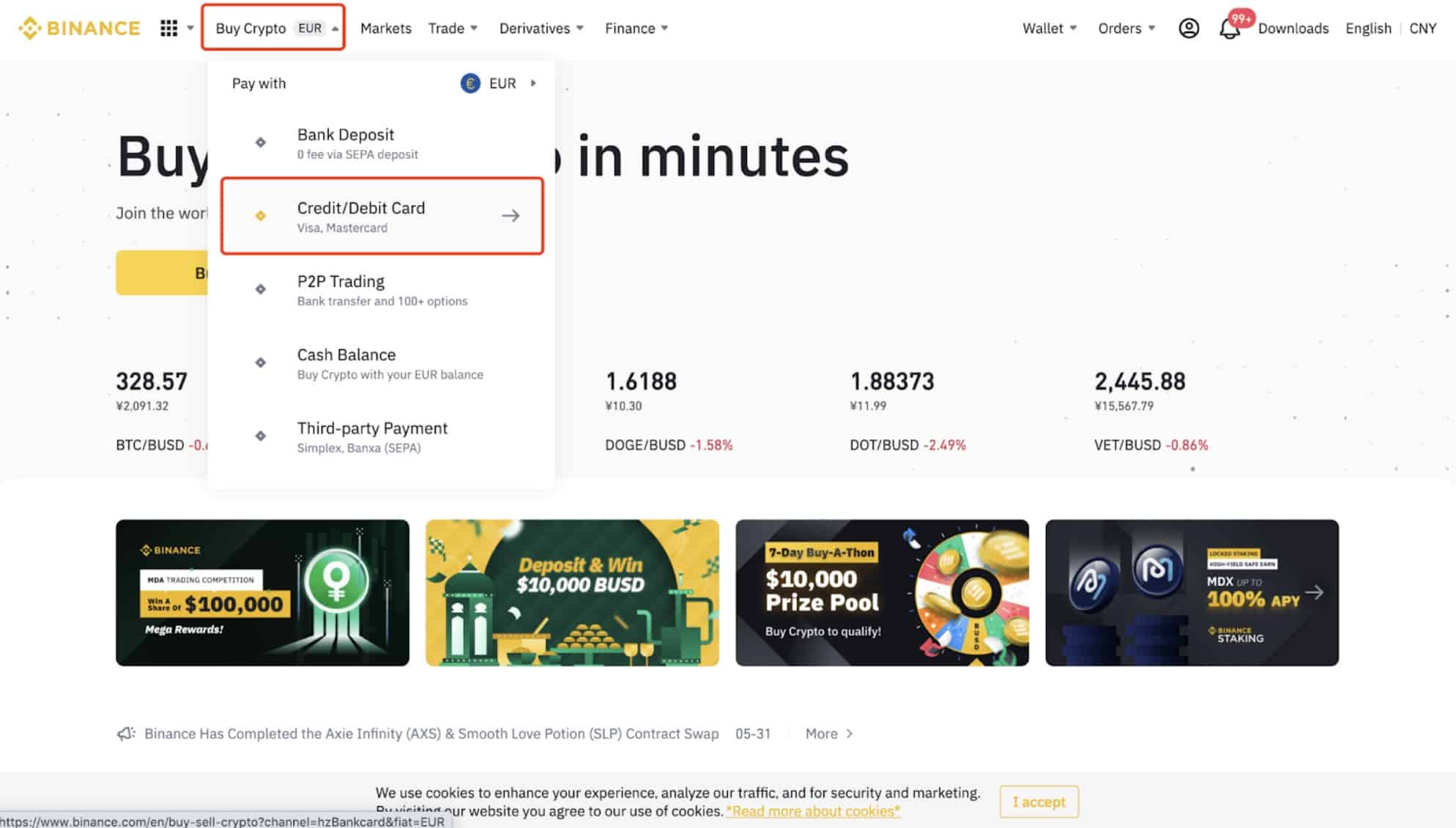

When buying TrueFi (TRU) on a cryptocurrency exchange, many of them allow you to use fiat currencies like EUR, USD, and AUD to make your purchase directly. To do this, you’ll need to fund your account with one of several deposit methods, including credit and debit cards, e-wallets, and direct bank transfers. If this is not an option on the cryptocurrency exchange that you have chosen, then simply move onto the next step in this guide.

It’s important to note that different payment methods may have varying fees associated with them. For example, credit card payments may have higher fees than other options. To avoid paying unnecessary costs, it’s a good idea to research the fees for each payment method before funding your account.

Step 3: Buy TrueFi (TRU)

Buying TrueFi (TRU) on a cryptocurrency exchange is a simple process. Look for the search bar or navigation menu and search for TrueFi (TRU) or TrueFi (TRU) trading pairs. Next, find the section that allows you to buy TrueFi (TRU). Enter the amount of cryptocurrency you want to spend or the amount of fiat currency you want to use to buy TrueFi (TRU). The exchange will calculate the equivalent amount of TrueFi (TRU) based on the current market rate.

Before confirming your purchase, always double-check the transaction details, such as the amount of TrueFi (TRU) you’ll receive and the total cost of the purchase. Additionally, some exchanges offer a proprietary software wallet to store your TrueFi (TRU), but you can also create your own software wallet or purchase a hardware wallet for the highest level of protection.

How to create a Binance account

Show Detailed Instructions

Hide Detailed Instructions

Step 1: Go to the Binance website.

Step 2: On the registration page, enter your email address, and create a password for your account.

Then, read and agree to the Terms of Service and click “Create Account”.

Note: Your password must be a combination of numbers and letters.

It should contain at least 8 characters, one UPPER CASE letter, and one number.

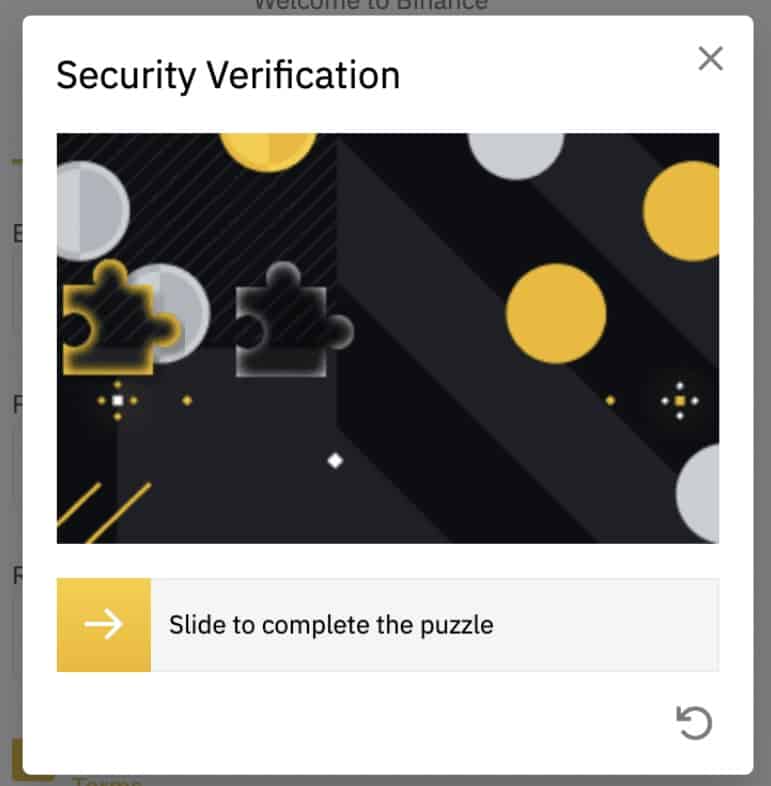

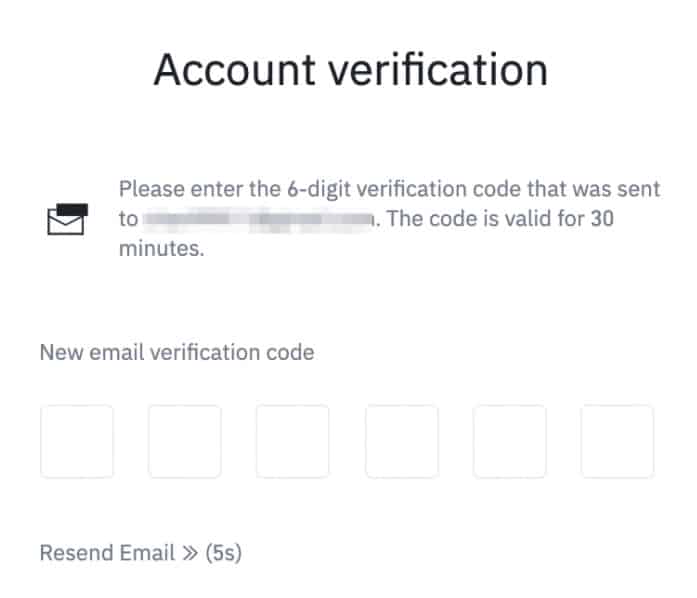

Step 3: Complete the Security Verification.

Step 4: The system will send a verification code to your email. The verification code is valid for 30 minutes. If you can’t find the email in your inbox, check your other mail folders as well, or click “Resend Email” to resend.

How to complete KYC (ID Verification) on Binance

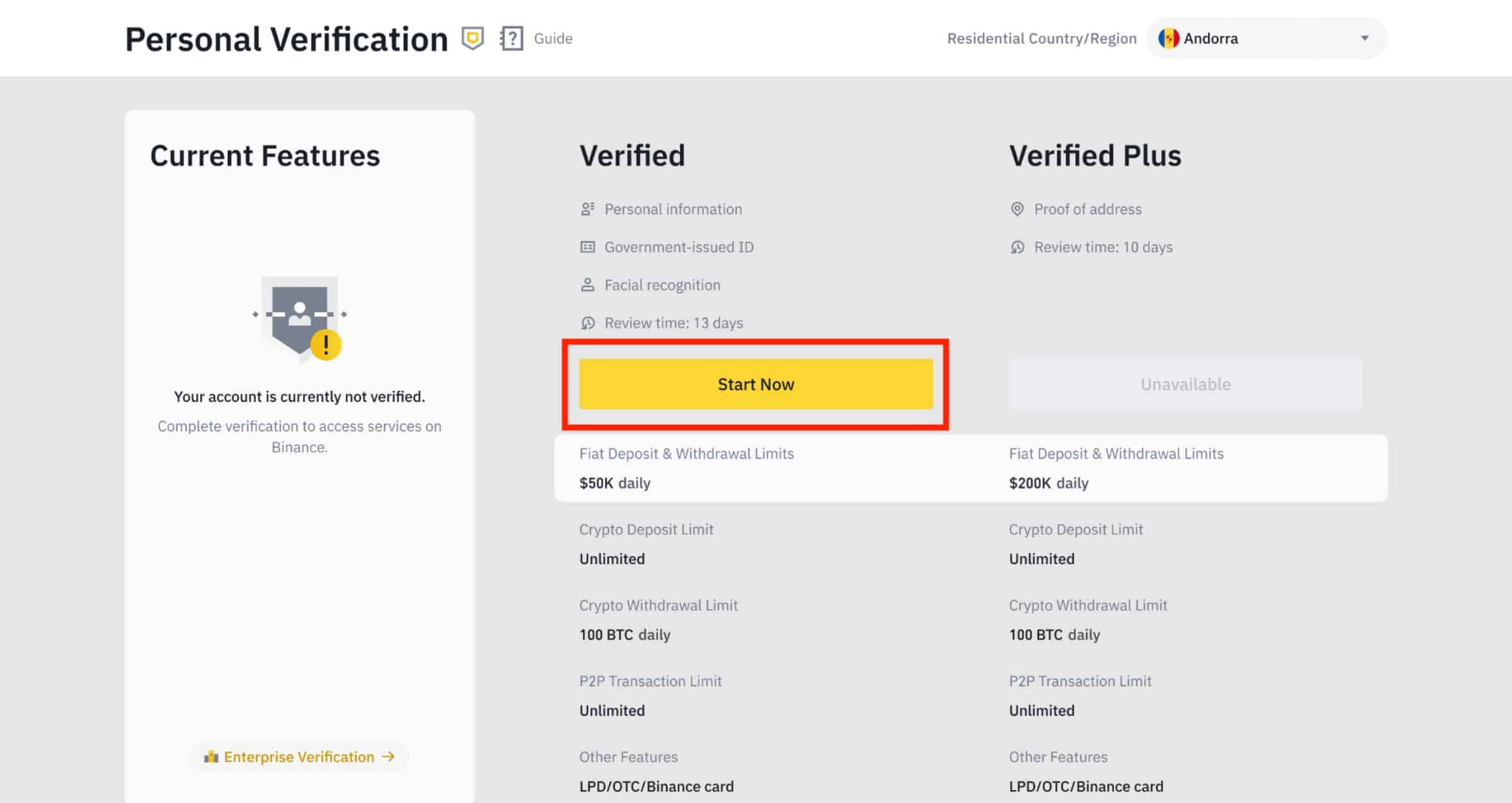

Step 1: Log in to your Binance account and click “User Center” and then “Identification”.

Step 2: click “Start Now” to verify your account.

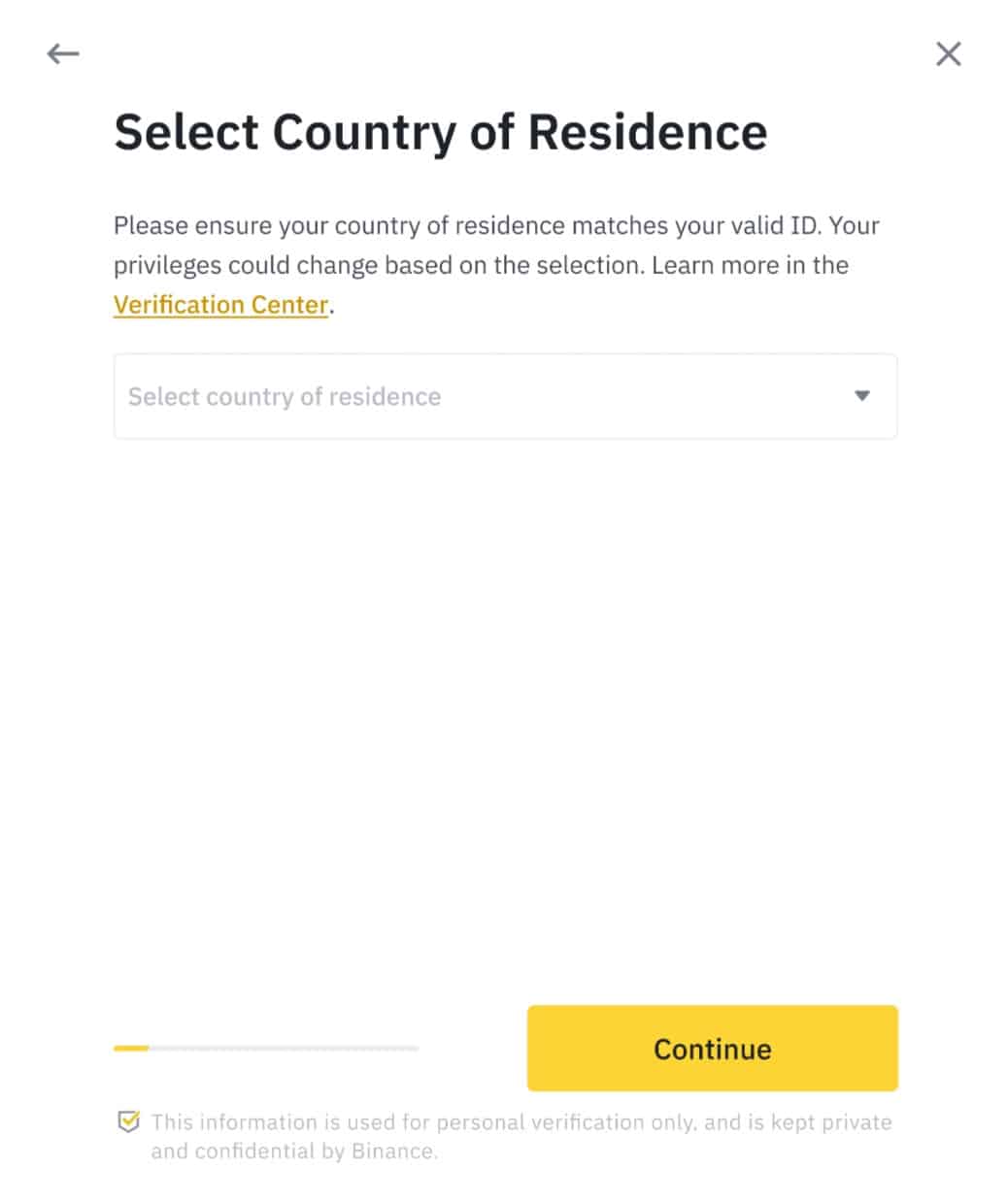

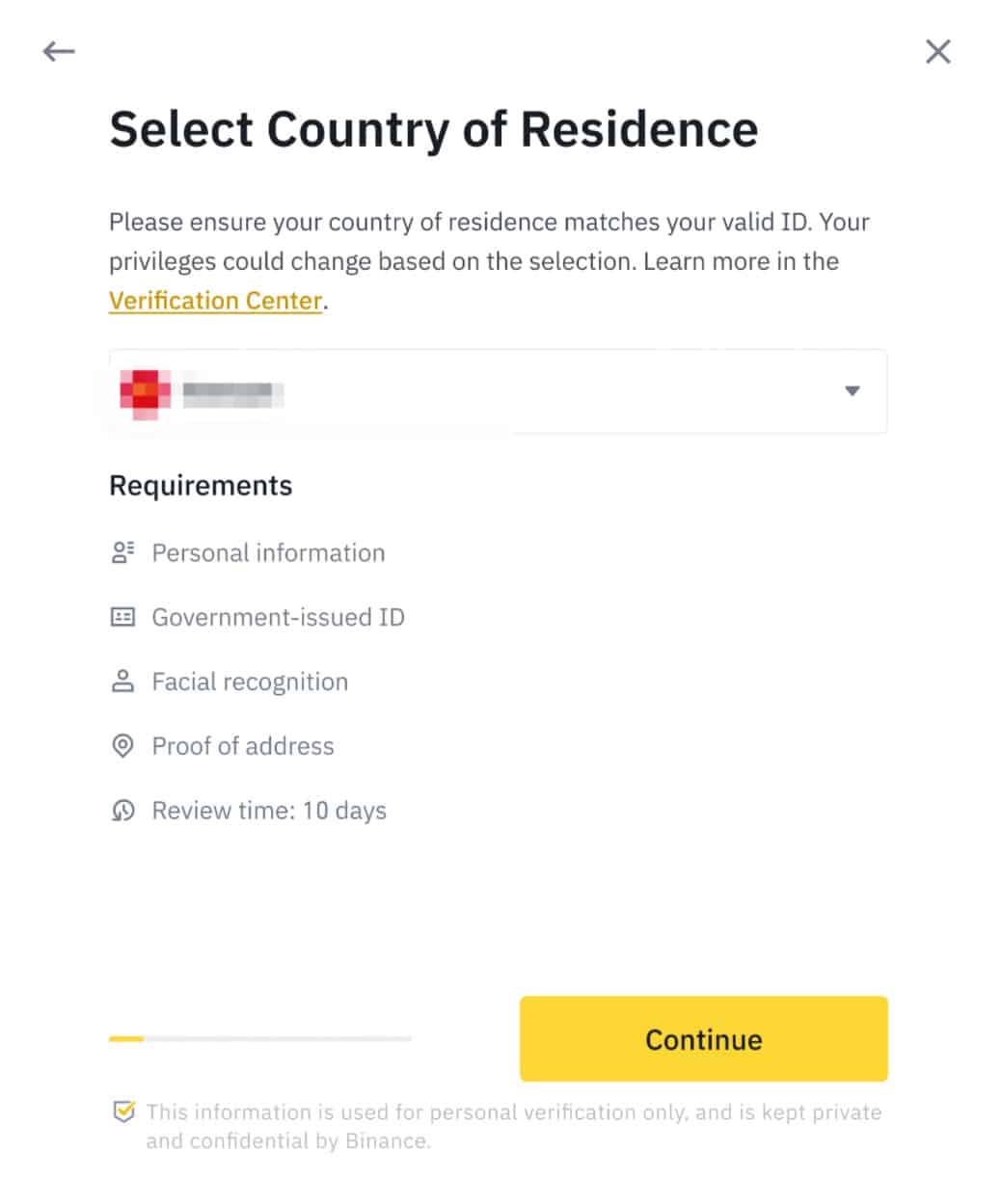

Step 3: Select your country of residence.

Ensure that your country of residence is consistent with your ID documents.

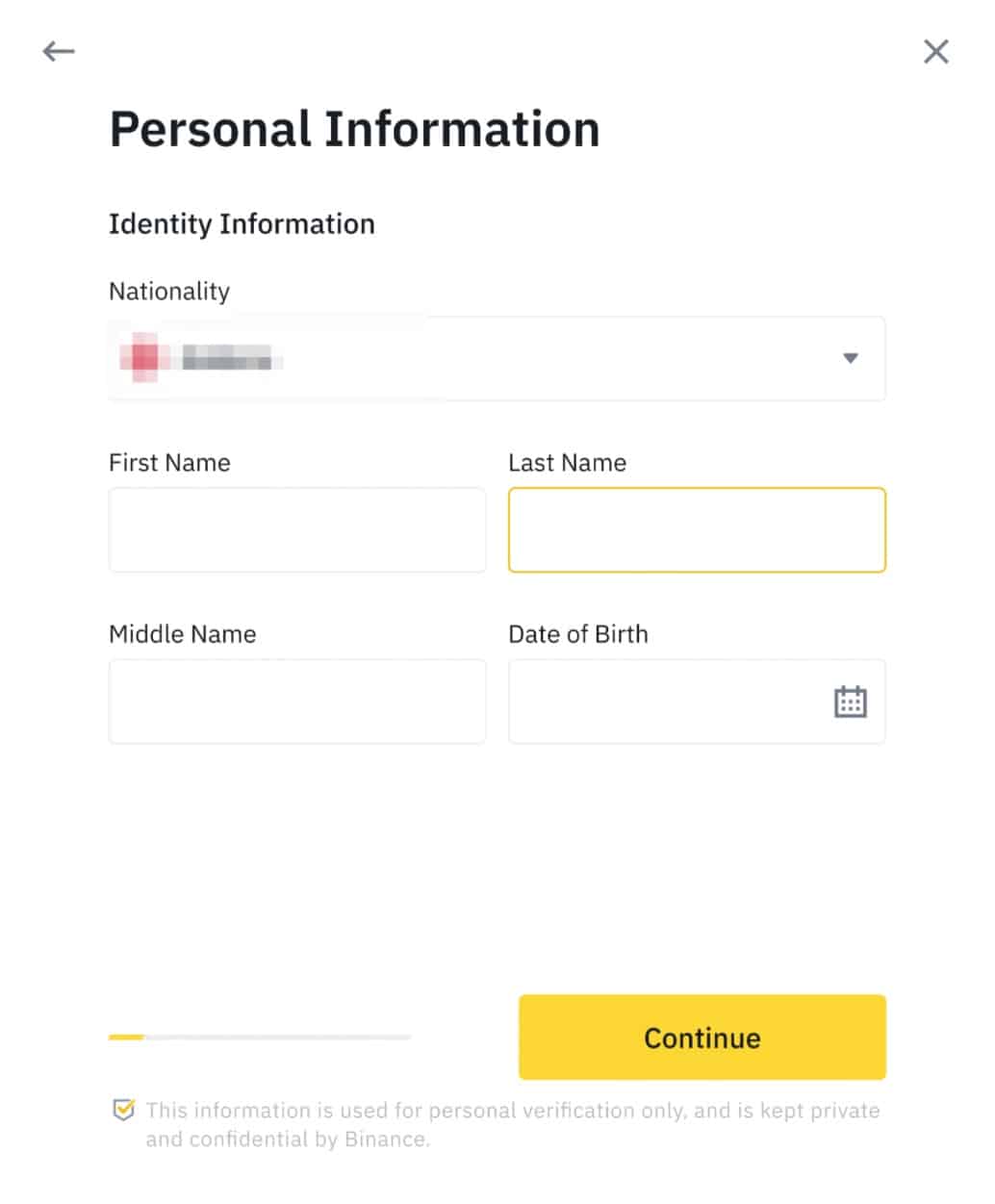

Step 5: Enter your personal information and click “Continue.”

You won’t be able to change it once confirmed.

Refer to the respective options offered for your country.

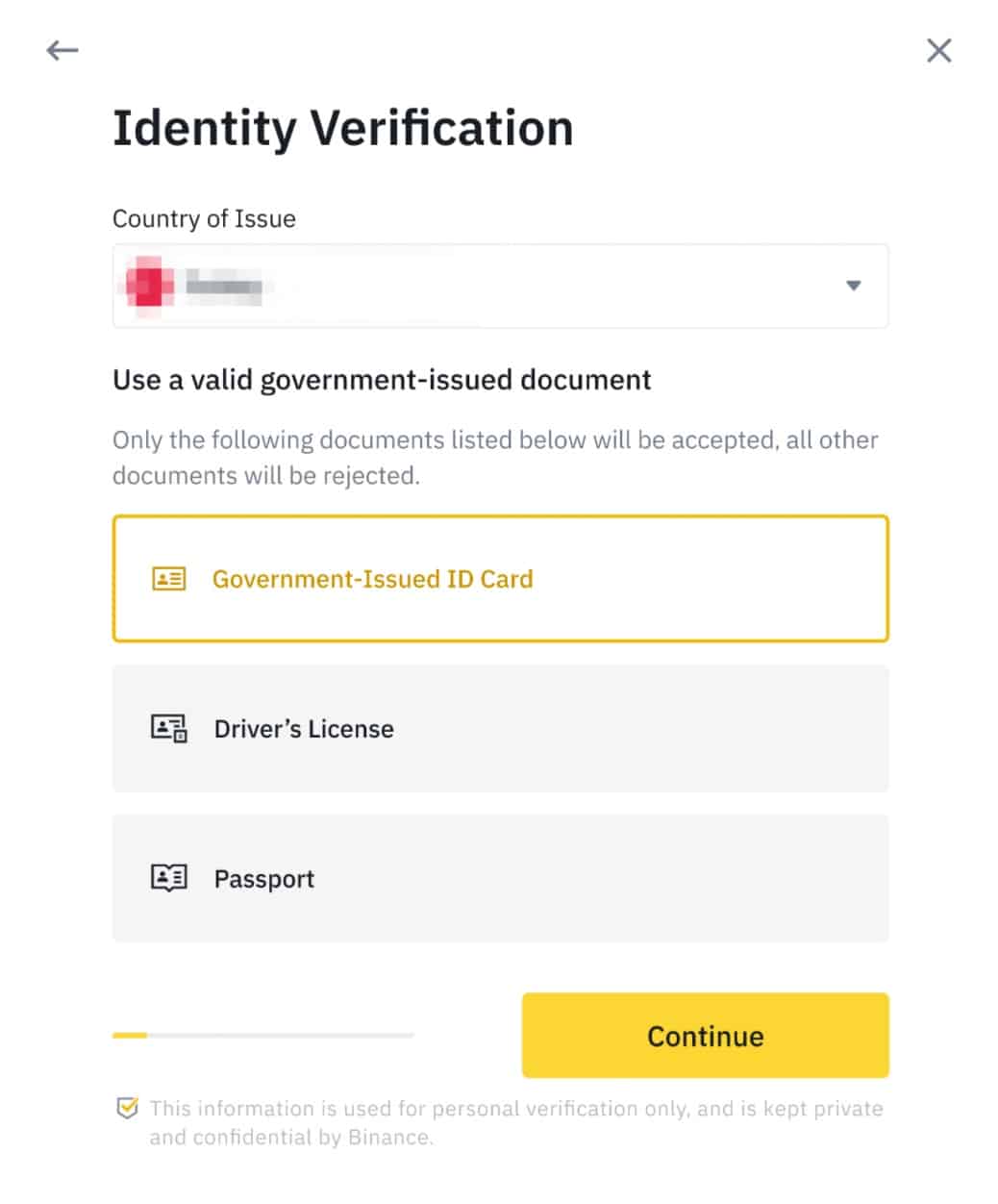

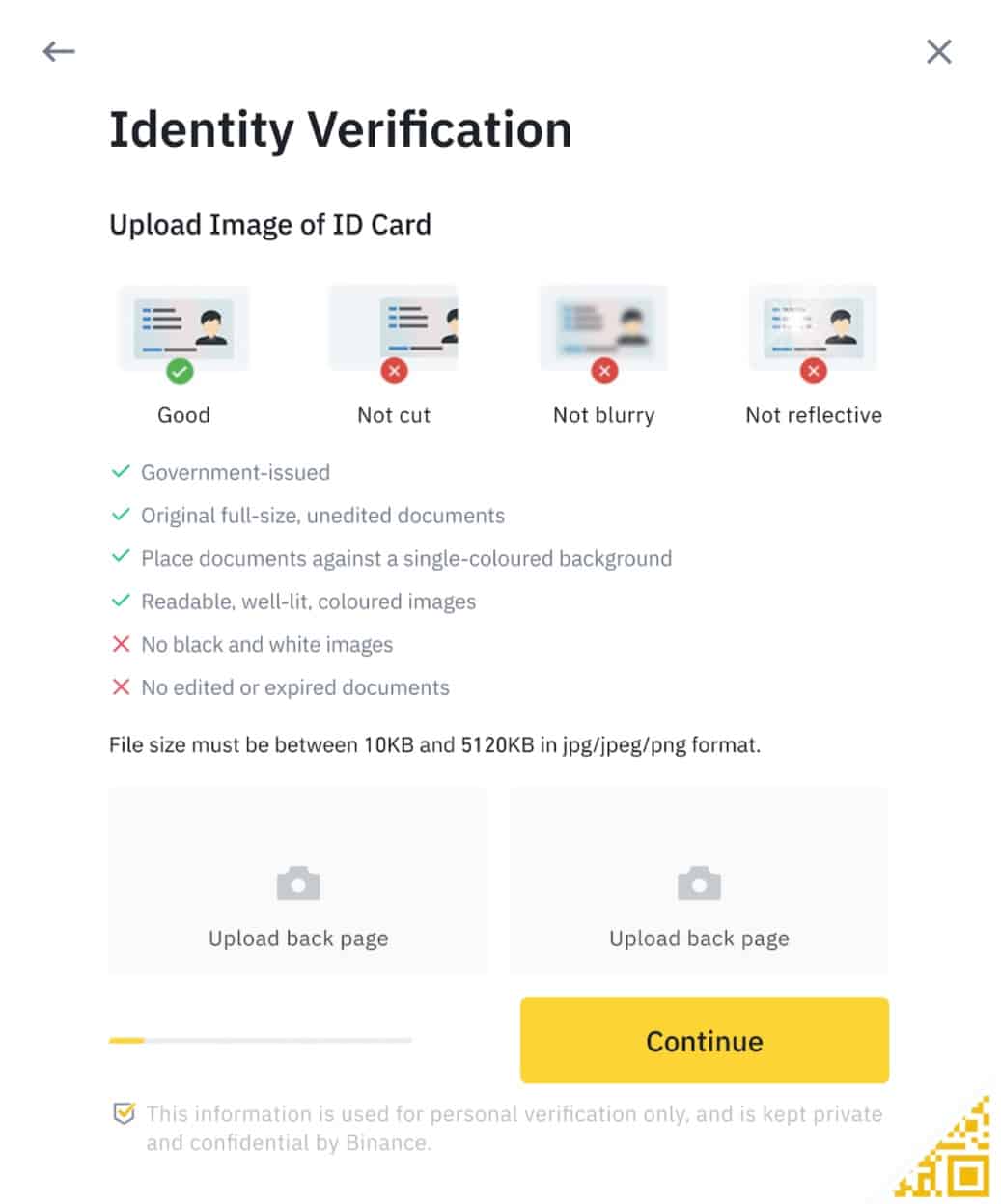

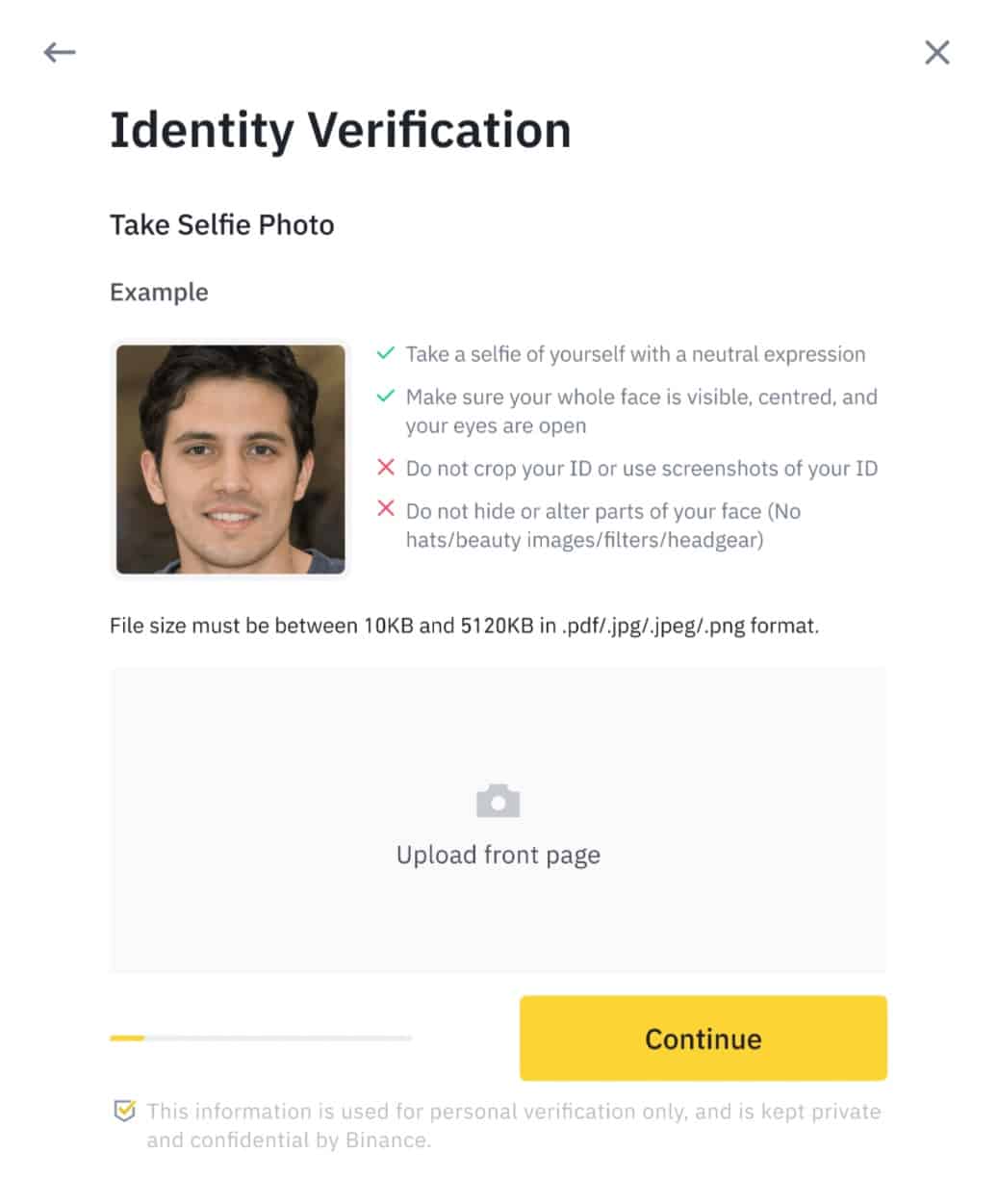

Step 7: Follow the instructions to upload photos of your document. Your photos should clearly show the full ID document.

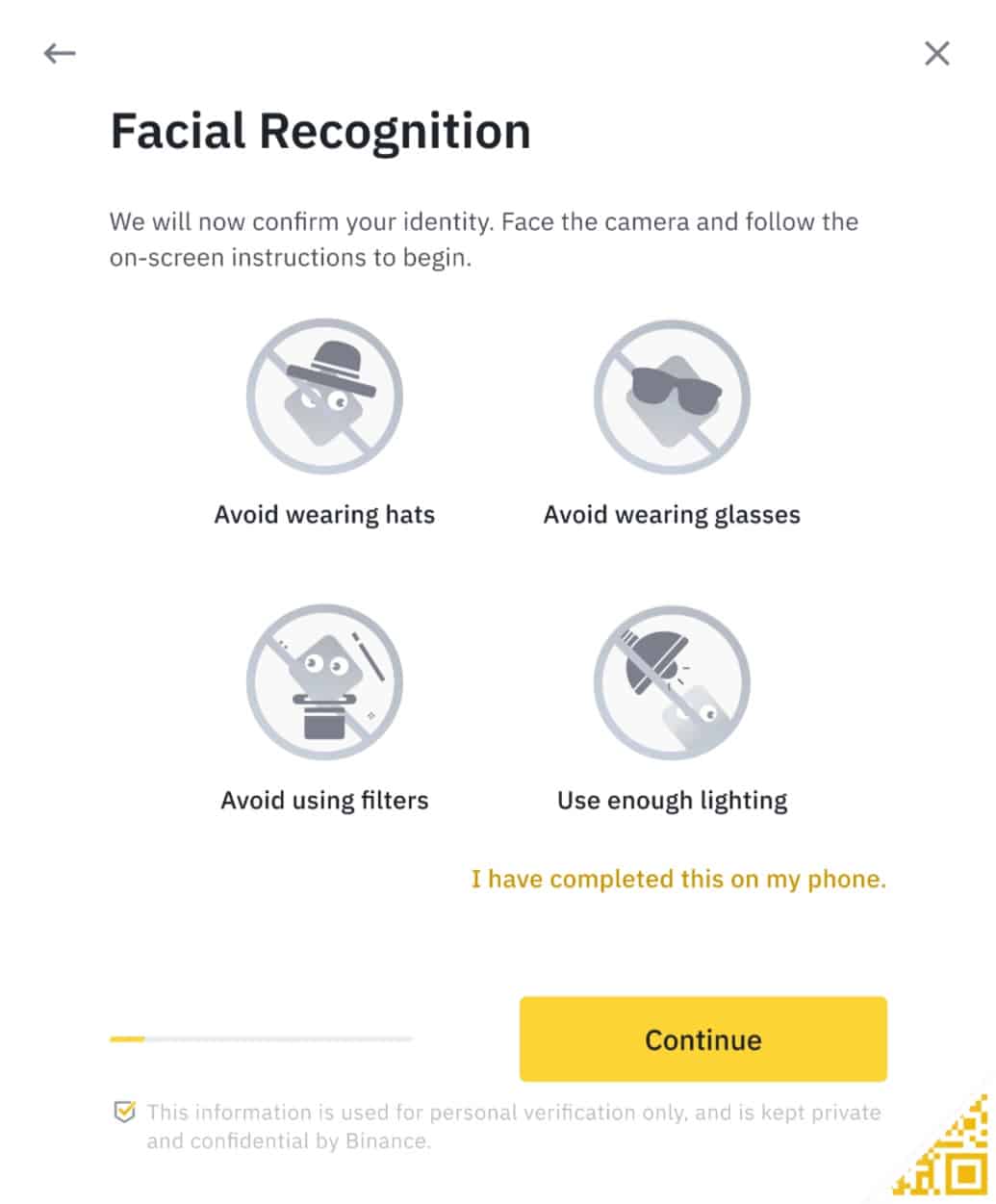

Do not wear hats, glasses, or use filters, and make sure that the lighting is sufficient.

Once your application has been verified, you will receive an email notification.

How to buy cryptocurrency on Binance

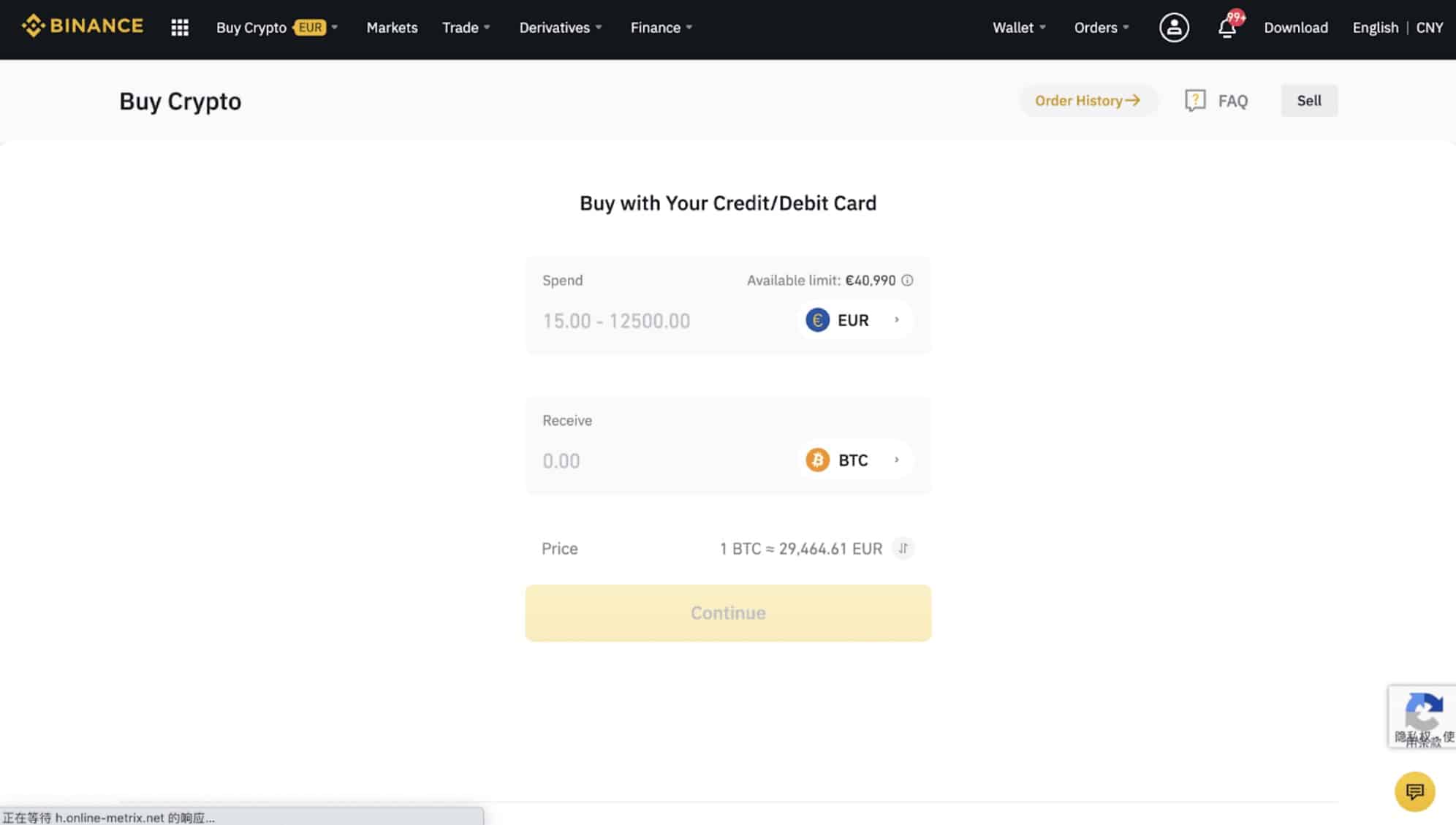

Step 1: Log in to your Binance account and click “Buy Crypto” and then “Credit/Debit Card”.

Step 2: Here you can choose to buy crypto with different fiat currencies. Enter the fiat amount you want to spend and the system will automatically display the amount of crypto you can get. When you have selected the amount you wish to spend then press “Continue”.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

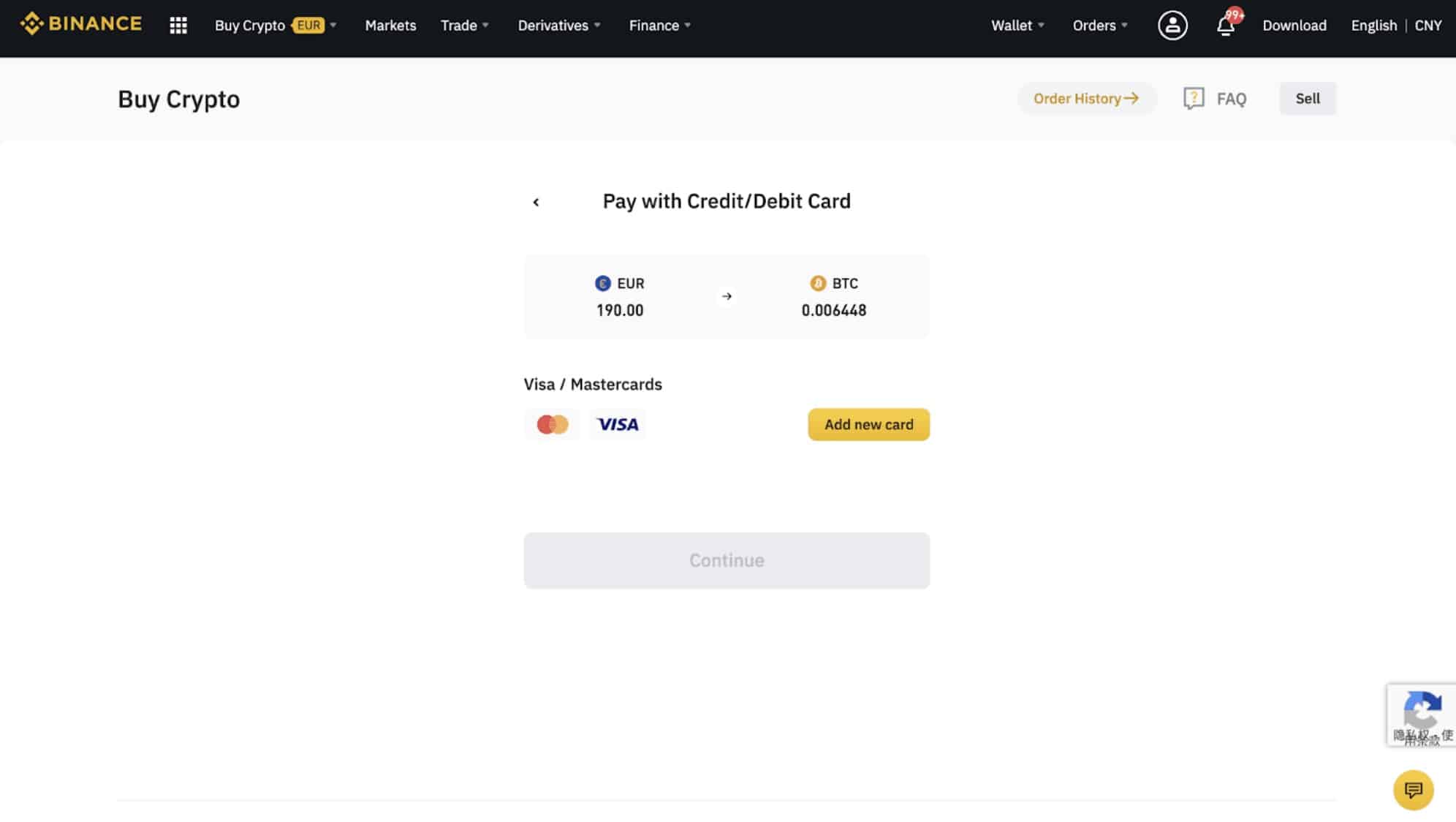

Step 3: Click “Add New Card”. Then enter your credit card details and your billing address.

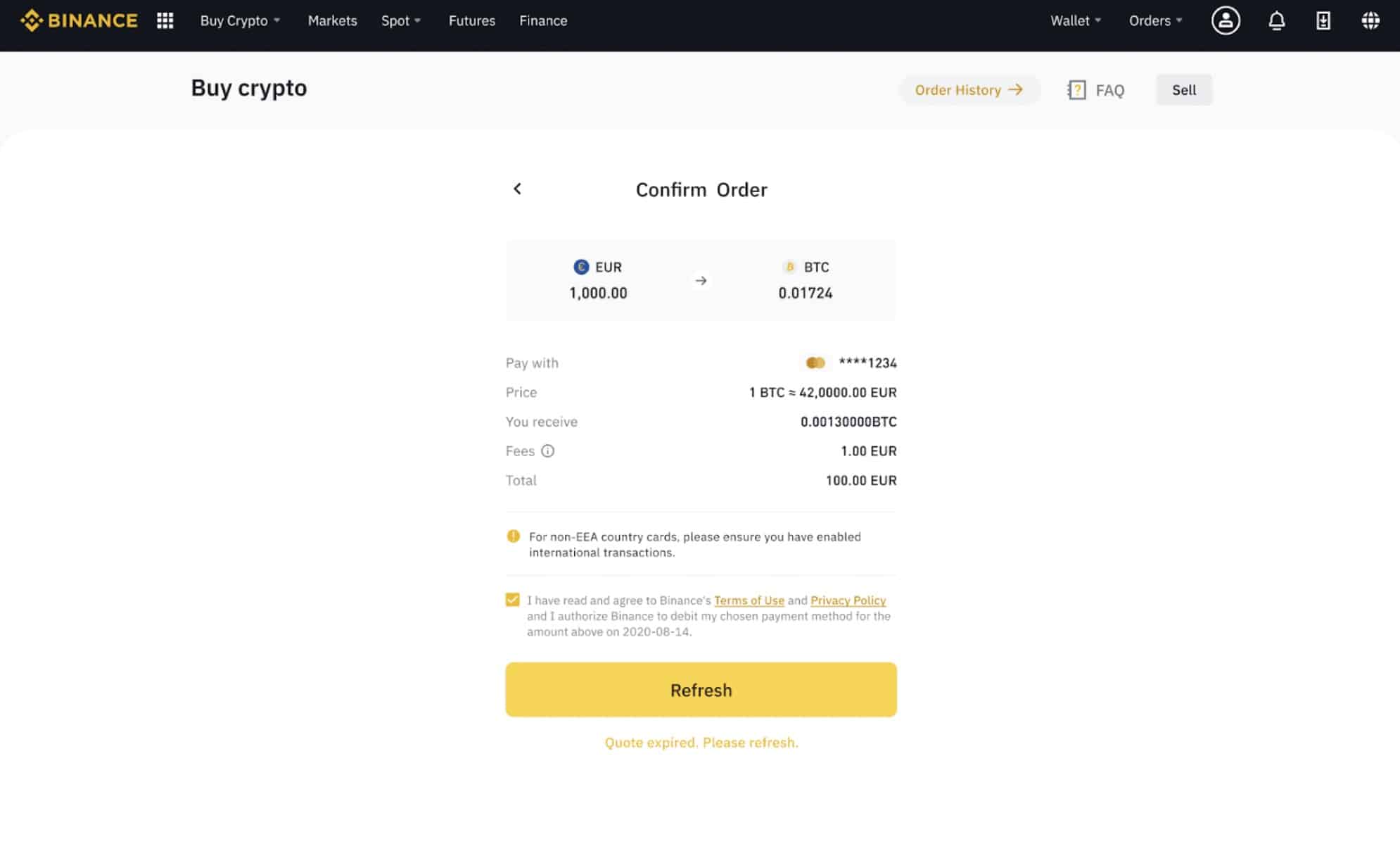

Step 4: Check the payment details and confirm your order within 1 minute. After 1 minute, the price and the amount of crypto you will get will be recalculated. You can click “Refresh” to see the latest market price. You will then be redirected to your bank’s OTP Transaction Page. Follow the on-screen instructions to verify the payment.

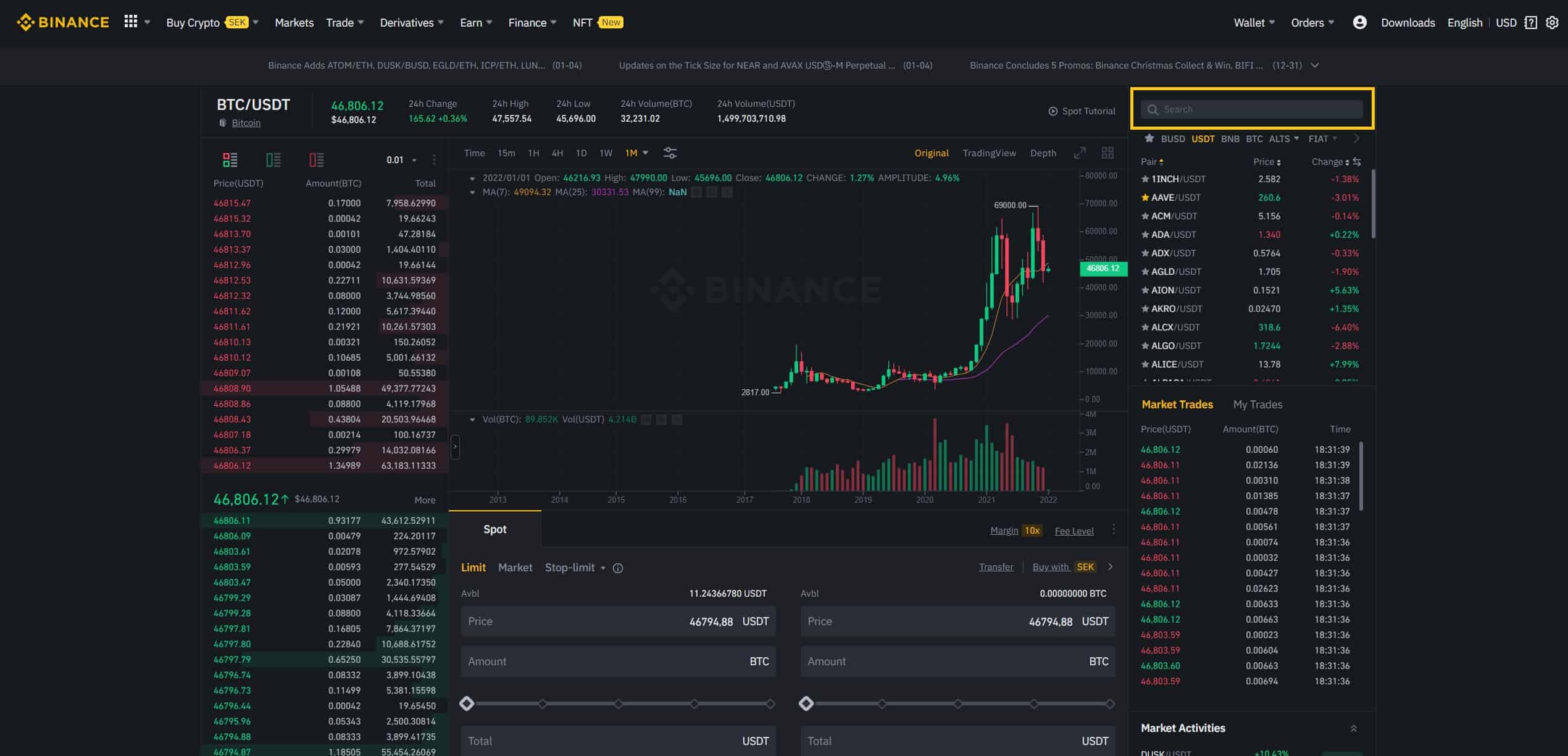

How to Conduct Spot Trading on Binance

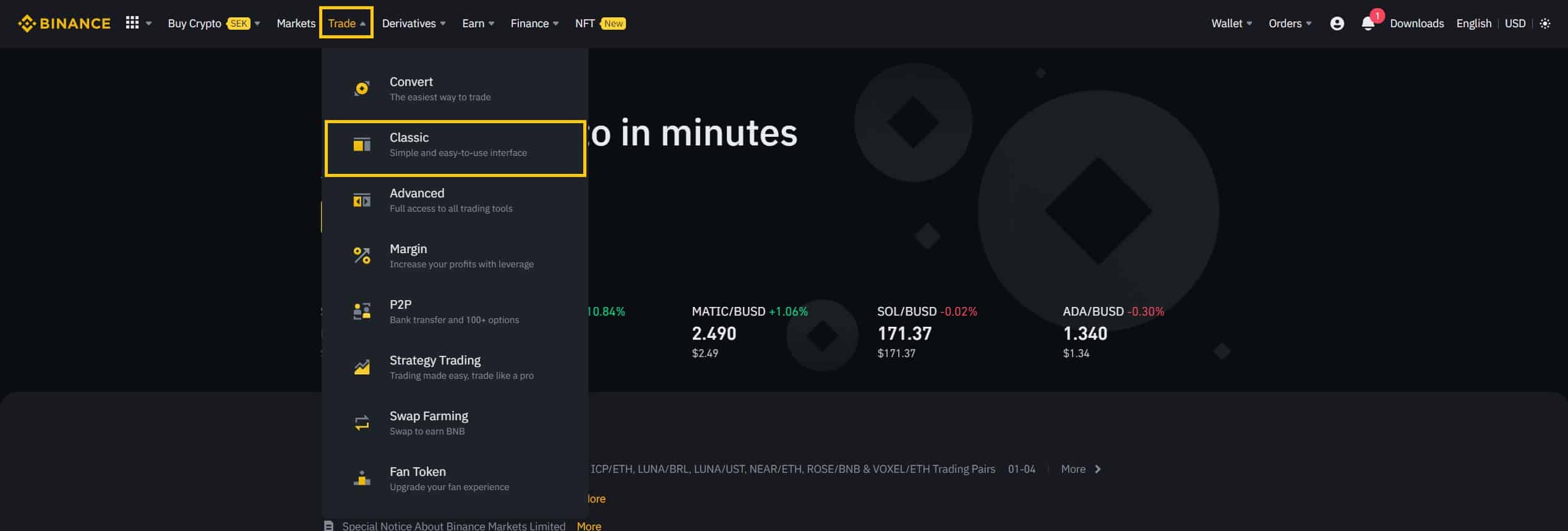

Step 1: Log in to your Binance account.

Click on “Classic” under “Trade” on the top navigation bar.

Step 2: Search and enter the cryptocurrency you want to trade.

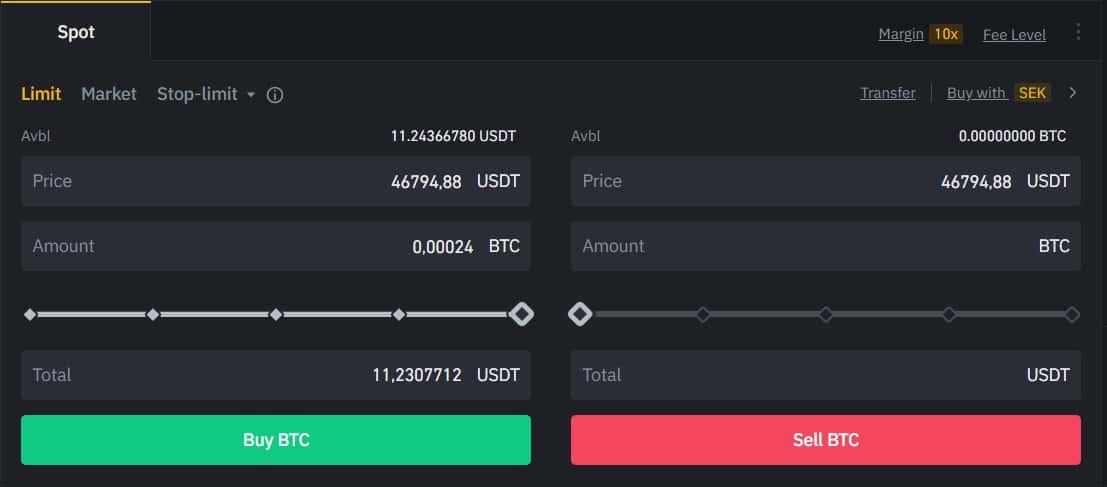

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

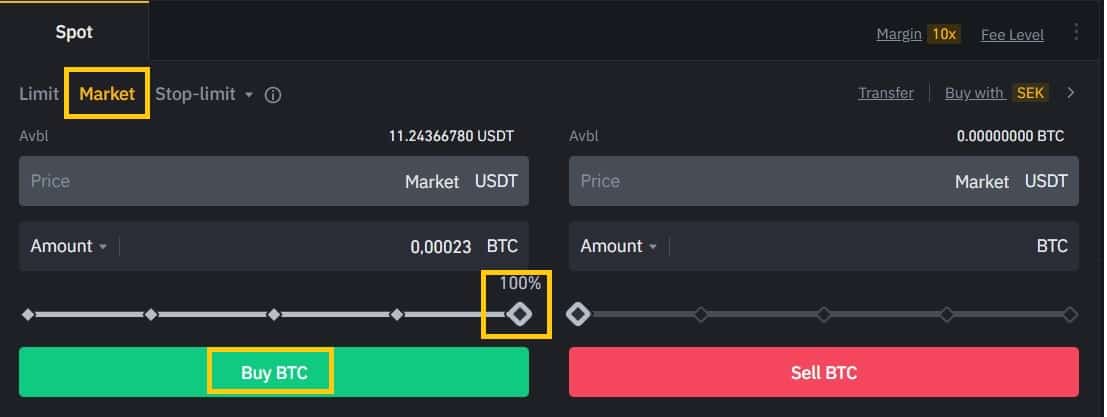

Step 4: If you don’t want to set a manual price, you can place a “Market Order” to set the buying/selling price automatically.

Hide Detailed Instructions

If you’re looking for more detailed instructions on buying cryptocurrency, our “Absolute Beginner’s Guide to Cryptocurrency Investing” can take you through the process step-by-step. This guide also covers how to send and receive cryptocurrency.

If you’re brand new to the world of cryptocurrency, don’t worry! We offer beginner, intermediate, and advanced level articles to help you get up to speed with everything you need to know. These articles cover a wide range of topics, so whether you’re just starting out or looking to expand your knowledge, we’ve got you covered. With our resources, you can confidently navigate the cryptocurrency space and make informed investment decisions.

What is TrueFi (TRU)?

In recent years, the global lending market has surged in value, nearing a staggering $8 trillion. However, the vast majority of this capital continues to rely on financial infrastructures and technologies that were established back in the 1970s, such as SWIFT. These outdated systems contribute to sluggish, costly, and exclusive investment processes, preventing retail investors from accessing highly attractive investment options like corporate debt, specialty real estate, and emerging market opportunities.

Fortunately, blockchain technology has emerged as a groundbreaking alternative for the efficient, rapid, and transparent allocation and movement of capital. Although blockchain technology alone does not resolve challenges such as evaluating borrowers’ creditworthiness, onboarding tangible collateral, or recovering defaulted loans, the TrueFi team has ingeniously crafted a hybrid structure to tackle these issues.

TrueFi, a pioneering multi-billion-dollar protocol, operates autonomously under the guidance of TRU token holders, facilitating a decentralized financial ecosystem. Furthermore, the platform attracts independent portfolio managers who can take advantage of TrueFi’s robust infrastructure while retaining control over the centralized components of underwriting and collections in the real world.

So, what exactly is TrueFi? It is a revolutionary blockchain-based platform that has successfully launched the first uncollateralized lending marketplace within the decentralized finance (DeFi) sector. TrueFi’s groundbreaking approach enables borrowers to obtain on-chain loans without the need for collateral lock-up, significantly enhancing their capital efficiency.

This innovative lending model has led to a remarkable surge in demand. Since TrueFi’s inception in November 2020, beginning with its first uncollateralized loan to Alameda Research, the protocol has facilitated nearly $2 billion in collateral-free loans. In addition, TrueFi has disbursed around $40 million to lenders while maintaining one of the industry’s most impressive underwriting track records.

Throughout 2021, TrueFi evolved from merely connecting crypto-native borrowers and DeFi lenders to creating a comprehensive marketplace of financial opportunities managed by independent portfolio managers, all built atop its cutting-edge lending infrastructure.

Today, TrueFi boasts a diverse and ever-expanding array of financial opportunities, encompassing emerging market investments, fintech financing, real estate investing, and gig worker lending. By doing so, TrueFi effectively bridges the gap between traditional real-world lending and assets with the dynamic world of DeFi, democratizing access to a wide range of investment opportunities for retail investors.

How does TruFi work?

TrueFi is an innovative public financial utility that provides a robust infrastructure for lending, borrowing, and asset management. The real power of TrueFi comes to life when these user groups come together, leveraging the platform as a marketplace to fulfill their financial requirements. As a decentralized protocol, TrueFi relies on the staking of its TRU governance token to offer loss protection to lenders, govern the protocol’s future, and contribute to the platform’s ongoing success.

Lenders, including retail and institutional investors from both the crypto and traditional finance sectors, turn to TrueFi to discover the most attractive risk-adjusted yields for their loaned capital. The platform offers a diverse array of portfolios, encompassing both crypto-native and real-world lending. Additionally, TrueFi’s uncollateralized loans create competitive earning opportunities across a wide range of asset types within the DeFi ecosystem.

To participate as a lender, one simply needs to use the TrueFi app, review the available pools and portfolios they qualify for, and allocate funds based on their preferred risk and return profile. Although not every portfolio is accessible to all lenders due to lender selection controlled by portfolio managers, TrueFi enables lenders to meet specific requirements, such as proof of identification or jurisdictional restrictions.

Lenders can generally exit their loan positions at any time using various methods. While some portfolios necessitate a minimum capital lock-up period, TrueFi’s popular DAO-managed pools and automated lines of credit (ALOCs) permit lenders to exit the pool for a nominal fee through Liquid Exit. This feature exchanges the lender’s loan token for unutilized capital within the pool. Alternatively, lenders can sell their loan tokens on a decentralized exchange (DEX) like Uniswap.

In the credit business, defaults are a common occurrence. However, TrueFi protects lenders against the full impact of defaults in several ways across specific portfolios. Firstly, up to 10% of staked TRU value is slashed in the event of a default and used to compensate affected lenders. Secondly, the TrueFi SAFU may utilize its reserve funds to provide additional coverage for lenders. Lastly, TrueFi may choose to initiate collections against defaulted borrowers to recover assets, which can then be liquidated to support any remaining affected lenders.

Prospective TrueFi borrowers must undergo a stringent creditworthiness evaluation that examines both off-chain and on-chain data. This includes company background, assets under management, asset exposure, leverage, and performance history. Once the Credit Committee deems a borrower creditworthy, TRU holders vote to approve or reject their application. If approved, a loan can be issued from any of TrueFi’s permissionless DAO pools at a market-determined rate, influenced by the borrower’s proprietary TrueFi credit score.

TrueFi has successfully originated over 130 loans for a diverse array of borrowers, maintaining a thriving and active lending book with frequent new loans. Borrowers choose TrueFi for its swift capital availability—often on the same day the borrower gains credit approval—and the absence of capital lock-up requirements, which maximizes their capital efficiency.

Starting in 2021, TrueFi extended support to independent portfolio managers, enabling fund managers and institutional investors to bring their business on-chain. TrueFi provides portfolio managers with the best aspects of both DeFi and institutional finance, allowing them to access global liquidity around the clock from the moment their portfolios are launched. This is achieved while enjoying the cost savings and transparency of a fully on-chain lending book.

These portfolio managers experience feature parity with institutional credit products, retaining full control over lender selection (including KYC requirements), portfolio and individual loan terms, as well as portfolio strategies, rates, and fees. Becoming a portfolio manager on TrueFi is similar to becoming a borrower, requiring community approval before listing a manager’s portfolio on the TrueFi app. However, since TrueFi utilizes open-source infrastructure, portfolio managers can deploy TrueFi’s smart contracts to launch their portfolios independently, without direct involvement from the TrueFi team.

Today, TrueFi’s portfolio managers utilize DeFi liquidity to allocate capital towards expanding the Latin American fintech sector, investing in emerging markets, supporting crypto mortgages, and more. These initiatives generate competitive, diversified returns for TrueFi’s lenders, further cementing the platform’s reputation as a powerful financial tool.

What is the TrustFi (TRU) Token?

As a decentralized lending protocol, TrueFi is driven by the input and active participation of its token holders and contributors to establish and accomplish key objectives. The platform employs a unique hybrid DAO (Decentralized Autonomous Organization) model, which combines the benefits of a real-world foundation to manage crucial off-chain tasks, such as tax filings, legal activities, and collections actions, with the decision-making power vested in TRU token holders through binding on-chain voting.

The TRU token serves as the cornerstone of TrueFi’s governance and loss protection mechanism. TRU stakers, who play a vital role in shaping the platform’s future, actively participate in token-gated DAO discussions and vote on Snapshot and Tally motions. This involvement allows them to have a direct impact on the protocol’s strategic direction, fostering a more democratic and inclusive decision-making process within the TrueFi ecosystem.

The TRU token not only empowers its holders with governance rights but also provides them with the first line of defense against loan defaults. By staking their TRU tokens, stakers contribute to the platform’s stability and security, ensuring the overall health of the TrueFi ecosystem. In the event of a loan default, a portion of the staked TRU is slashed and utilized to compensate affected lenders, further underlining the essential role TRU token holders play in the protocol.

In addition to their governance and loss protection functions, TRU tokens also offer potential incentives for users, such as yield farming rewards and other platform-specific benefits. This serves as an added motivation for users to participate actively in the TrueFi ecosystem and contribute to its ongoing growth and success.

TrueFi development updates in 2023

In 2023, TrueFi (TRU) experienced several notable developments, enhancing its position in the decentralized finance (DeFi) sector. Key updates include:

-

Transparency and Diversity in Lending: TrueFi has emphasized maximum transparency in its operations, allowing lenders to track every dollar loaned to borrowers in real-time. The platform serves a diverse range of borrowers and portfolio managers, spanning both “real-world” use cases and crypto-focused institutions. This approach underlines TrueFi’s commitment to both transparency and variety in its lending activities.

-

Governance Role of TRU Token: The TRU token plays a significant role in governing the TrueFi protocol. TRU holders are involved in approving new managers and borrowers, as well as managing key treasury and partnership decisions. This active governance model highlights the community-centric approach of TrueFi.

-

TrueFi’s Mission in Decentralized Lending: TrueFi aims to make credit more accessible and programmable by bringing debt infrastructure on-chain. This mission reflects the platform’s dedication to innovating in the DeFi space and making decentralized credit more mainstream.

-

Loan Process and User Engagement: TrueFi enables lenders to deposit TrueUSD into the TrueFi pool for agricultural loans, interest, and TRU tokens. Borrowers, such as exchanges and other protocols, submit loan proposals to the pool. The loan approval process involves TRU stakers voting on these proposals, adding a layer of decentralized decision-making.

-

Token Details and Allocation: The TRU token is an ERC-20 token on the Ethereum blockchain. The total supply of TRU is around 1.441 billion, with a circulating supply of approximately 343 million tokens. The token allocation includes private sales, prize distributions, allocations for the team and management, future team, and company subsidies.

-

Utility of TRU Tokens: TRU stakers participate in voting for or against loan approvals, reflecting the utility of the token in the protocol’s governance and lending processes.

-

Token Storage and Acquisition: TRU can be stored in various wallets, including both hot and cold storage options. It is available for purchase on multiple exchanges, offering accessibility to a wide range of investors.

These developments in 2023 have contributed to TrueFi’s growth and evolution as a prominent player in the DeFi lending space, offering transparent, diverse, and decentralized lending solutions.

Official website: https://truefi.io/

Best cryptocurrency wallet for TrueFi (TRU)

Navigating the world of cryptocurrency wallets can be quite an adventure, as there are numerous options available to suit different needs. To find the perfect wallet for you, consider your trading habits and the level of security you require. Generally, there are two main categories of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical).

Each type of wallet comes with its own set of advantages and drawbacks, so there isn’t necessarily a one-size-fits-all solution. As you embark on your journey to find the best crypto wallet for your TrueFi (TRU) tokens, remember to keep an open mind and explore the features that align with your personal preferences and requirements.

When choosing the right wallet for your TrueFi (TRU) tokens, consider the following factors:

- Trading frequency: Hot wallets are generally more suitable for active traders due to their quick login capabilities, allowing for seamless buying and selling of crypto. Cold wallets, on the other hand, are better suited for those who make less frequent trades.

- Supported cryptocurrencies: Although not all wallets cater to every cryptocurrency, some of the best ones can trade a vast array of currencies, offering a versatile experience. Make sure the wallet you choose supports TrueFi (TRU).

- Security concerns: If you’re worried about potential hacking incidents, a physical cold wallet stored in a safe deposit box or a secure location at home provides the highest level of protection. However, if you’re confident in safeguarding your hot wallet, you might prefer its convenience.

- Associated costs: Investigate the costs of each wallet option. While many hot wallets are free to set up, cold wallets, being hardware devices, will require an upfront investment.

- Wallet features: While the basic functions of cryptocurrency wallets remain the same, additional features can distinguish one wallet from another. Hot wallets often come with advanced reporting tools, crypto market insights, and currency conversion capabilities. Security features can also be an essential factor when making your decision.

By considering all of these aspects, you’ll be better equipped to select the perfect cryptocurrency wallet for your TrueFi (TRU) tokens.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re planning to handle larger amounts of crypto, investing in cold storage can be a wise decision. Two of the most popular cold storage options are the Ledger Nano and the Trezor.

Ledger creates cold storage wallets designed for users who prioritize security. Their wallets are physical devices that connect to your computer, and you can only send cryptocurrency from them when they’re connected. Ledger offers a range of products, including the Ledger Nano S and the Ledger Nano X, which features Bluetooth connectivity.

Trezor, a trailblazer in the hardware wallet industry, combines top-notch security with an intuitive interface and compatibility with various desktop wallets. This blend makes it suitable for both beginners and experienced users. Trezor has earned a great deal of respect within the Bitcoin community over time. They offer two primary models – the Trezor One and the Trezor Model T, which comes with a built-in touchscreen.

TrueFi (TRU) Price & Charts

- Market Capitalization And Daily Trading Volume

- Current Market Price Of Every Cryptocurrency Relative To USD (And Some Local Currencies)

- Circulating And Total Supply

- Historical Charts With Prices Relative To USD, Bitcoin (BTC), And Ethereum (ETH).