What is TENET (TENET)?

In this comprehensive guide to TENET (TENET), we will delve deeper into the intricate workings of the project, and also offer practical advice on how to buy and securely store your TENET (TENET) tokens. Understanding the context of Tenet’s creation, its underlying technology, and its mission are essential to appreciate the value it brings to the ecosystem, giving you the knowledge and confidence to join the TENET (TENET) community.

Where to buy TENET (TENET)?

First things first. Buying TENET (TENET) involves a three-step process. First, set up an account on a reputable cryptocurrency exchange that supports TENET (TENET). Next, deposit funds into your account, taking into consideration the different fee structures associated with various payment methods such as credit and debit cards, e-wallets, and direct bank transfers. Lastly, purchase TENET (TENET) on the exchange by inputting the amount you wish to spend, with the platform calculating the equivalent amount of TENET (TENET) based on the current market rate. We recommend buying TENET (TENET) on any of the following cryptocurrency exchanges:

1

Bybit

Fees (Maker/Taker) 0.1%*-0.1%*

Cryptocurrencies

Available for Trade 400+

Sign-up bonus

$30,000 sign-up bonus*

Available in

Europe, Asia, Oceania, Africa

2

MEXC

Fees (Maker/Taker) 0.2%*-0.2%*

Cryptocurrencies

Available for Trade 1500+

Sign-up bonus

10% reduced trading fees & up to $170 in USDT vouchers*

Available in

North America, South America, Europe, Asia, Oceania, Africa

Understanding TENET (TENET):

An In-depth Guide to Its Features and Use Cases

Website: https://tenet.org/

Twitter: https://twitter.com/tenet_org

Tenet (TENET) is an innovative Layer-1 blockchain solution compatible with the Ethereum Virtual Machine (EVM). It aims to bring new liquidity and yield opportunities to Liquid Staking Derivatives (LSDs) by using them as collateral for network validators. This process serves to enhance network security while also improving the inclusivity of the governance model.

Actively staking providers on the Tenet network can issue a Tenet Liquid Staking Derivative (tLSD), which represents LSDs staked with network validators. This makes tLSDs a unique financial instrument as they combine two sources of yield and serve as pristine collateral in an ever-expanding ecosystem of LSDfi (Liquid Staking Derivative Finance) protocols.

In addition, Tenet employs a mechanism at the chain level to direct emissions from block rewards and other decentralized application (dApp) user incentives. Users who lock the Tenet asset in this mechanism can receive yield from protocols deployed across the ecosystem.

LSDC, a token representative of the Tenet blockchain, is minted against overcollateralized positions of tLSDs. It adds a third yield opportunity for capital deployed to Tenet. In essence, Tenet offers a more capital-efficient solution for users of neighboring chains and enables DeFi protocols to benefit from several yield sources.

How does Tenet (TENET) work?

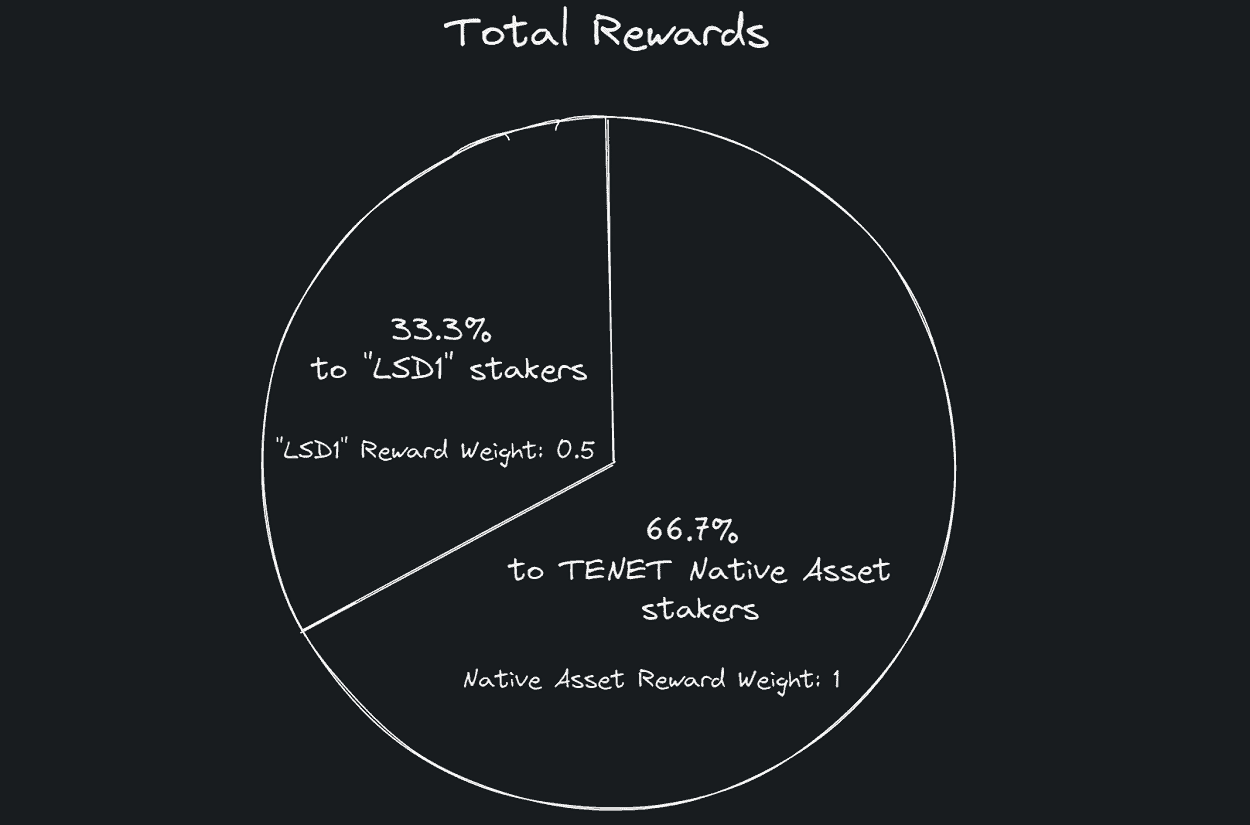

Tenet operates on a novel Proof of Stake framework known as Diversified Proof of Stake (DiPoS). While retaining all the benefits of traditional Proof of Stake models, such as reduced fees and increased scalability, DiPoS enhances security compared to legacy PoS models. The innovative design of DiPoS allows network consensus to be reached by validators that stake a diverse basket of assets, which reduces the risk of the network being controlled by a single large asset holder.

The DiPoS model permits consensus to approve additional assets to participate in network security. The initial stake in network security is allocated to ETH, ATOM, BNB, MATIC, ADA, and DOT, along with TENET. This diversification improves network security by relying on the shared market strength and difficulty of mass control of this robust basket of assets.

Tenet’s DiPoS enables multiple assets to be staked on a blockchain. Assets from one chain can be staked on another, creating a mutually beneficial economic partnership through interchain staking. The advantage is that all participating chains can benefit from the cross-chain relationship, providing users with a wider range of diverse assets and yield opportunities.

The DiPoS concept is implemented using the Cosmos SDK, a powerful and reliable framework for building blockchains. This allows the DiPoS logic to be implemented as an additional module to a Cosmos SDK-based blockchain without requiring changes to consensus or major modifications to core modules. The module enables whitelisted assets to be staked and earn rewards, therefore wrapping around a chain’s native staking module.

TENET (TENET) Tokenomics

The native token of the Tenet blockchain is $TENET. It serves two primary functions on the blockchain: transaction execution as a gas token and staking in validators through Tenet’s innovative DiPoS mechanism. This means that to transact and interact on the Tenet blockchain, one needs TENET.

TENET tokens can be staked with a Tenet Staking Provider. Once staked, an LSD (Liquid Staking Derivative) of TENET, referred to as tTENET, is issued to the staker. It’s important to note that to receive validation rewards from securing the blockchain, the staker must also stake the received tTENET with the corresponding Staking Provider.

One of the cornerstones of the Tenet network is the use of LSDs. Major LSDs from other blockchains can also be used as validator collateral for TENET. Each time a validator is created, Tenet issues a new LSD, enabling users to reuse existing liquidity on Tenet DeFi protocols.

tTENET, the LSD of TENET, carries additional utility within the Tenet DeFi ecosystem. The tokenomic model employed by TENET is inspired by veTokenomics. tTENET can be locked to produce vote-escrowed TENET, or veTENET. The principle is straightforward: the more tTENET you lock and the longer the lock period, the more veTENET you receive.

The main objective of Tenet’s veTokenomic model is twofold. First, it incentivizes users in the Tenet DeFi ecosystem with the opportunity to earn additional tokens. Second, it encourages wide-ranging participation in the governance of the Tenet ecosystem. By implementing the veTokenomic model at the base layer of its blockchain, Tenet leverages its strengths to incentivize a diverse DeFi landscape and foster a robust user engagement.

What is the Tenet stablecoin protocol?

The Tenet Stablecoin Protocol is a decentralized stablecoin protocol that employs the Liquity model, which allows users to draw interest-free loans against yield-bearing collateral assets. Loans are paid out in LSDC, a stablecoin pegged to the USD. To ensure the system remains robust and over-collateralized, loans must maintain a minimum collateral ratio.

The protocol adds an extra layer of security for the loans by utilizing a Stability Pool containing LSDC and fellow borrowers acting as the final guarantors. The protocol is non-custodial, building on Liquity’s codebase, but has been expanded to support multiple, custom collateral types and a unique governance system secured by a base layer protocol.

The Tenet Stablecoin Protocol creates a more efficient and user-friendly method for borrowing stablecoins against a decentralized collateral base, taking decentralization a step further by distributing governance (and therefore security) across the network. This approach aims to protect against governance-based attacks seen in other DeFi protocols and prevents stagnation by allowing for the introduction of new collateral types.

Unlike other decentralized stablecoins such as DAI and LUSD, which are minted against static collateral, LSDC is minted against Liquid Staking Derivatives (LSDs) of assets staked on Tenet Validators. This dynamic collateral allows the end-user to continue earning interest while also benefiting from on-demand liquidity via stablecoin minting.

The Tenet Stablecoin Protocol supports all tLSDs minted on the Tenet blockchain at genesis and aims to include more assets over time. The smart contracts underpinning the protocol are upgradeable, but upgrades need to be approved by the validator network, which prevents potential governance attacks.

Users can utilize the Tenet Stablecoin Protocol to borrow LSDC against collateral or to contribute LSDC to the Stability Pool in exchange for rewards. In addition, if the LSDC peg falls below $1, users can redeem 1 LSDC for 1 USD worth of collateral. LSDC stands for Liquid Staking Dollar, as it’s backed by LSDs from the Tenet network.

Fees are applied for borrowing LSDC and redeeming LUSD. Borrowers are charged a fee as a percentage of the loan, while redeemers are charged a fee when exchanging LSDC for collateral. However, repaying a loan as a borrower is free.

As a non-custodial system, tokens sent to the protocol are managed algorithmically, meaning your funds are subject to the rules in the smart contract code. While the system is audited and primarily based on robust, proven code, risk of loss due to a hack or bug can never be completely ruled out.

The Tenet Stablecoin Protocol originated from a fork of Liquity, a stablecoin protocol on Ethereum Mainnet. It has since been extended to include governance capability and multiple collateral type support. The majority of the documentation for the protocol is derived from Liquity.

What is the Stability Pool and how does it work?

The Stability Pool is an integral part of the Tenet Stablecoin Protocol. It is a pool of LSDC tokens which is used to absorb the collateral from any liquidated CLIPs. Stability Pool depositors gain from the liquidation process and earn rewards in Tenet tokens. These rewards are proportional to the size of their deposit relative to the total LSDC in the pool. Moreover, if a liquidation event cannot be covered completely by the Stability Pool, the depositors also receive a portion of the liquidated collateral.

When a CLIP undergoes liquidation, the Stability Pool steps in and absorbs as much of the debt as possible. In return, an equal value of the liquidated collateral is transferred to the depositor. Additionally, the Stability Pool receives a liquidation bonus of 10% which is added to the received collateral.

A phenomenon called ‘redistribution’ might result in random increases in your CLIP’s debt and collateral. When a CLIP is liquidated, its collateral and debt are distributed among all CLIP owners. Therefore, your CLIP’s debt and collateral may see sporadic increases due to this redistribution process.

The redemption mechanism is another crucial aspect of the Tenet Stablecoin Protocol. It allows anyone to exchange their LSDC for collateral from the system, providing a crucial stabilizing feature. If the price of LSDC on the market falls below 1 USD, users can purchase LSDC at a cheaper rate and redeem it against the system for collateral. This reduces the LSDC supply and creates upward pressure on the LSDC price, bringing it back to its peg.

The leveraging ability of the Tenet Stablecoin Protocol allows for capital efficiency and additional liquidity. Users can sell their borrowed LSDC on the market, buy accepted collateral and use it to increase the collateral of their CLIP. By repeating this process, users can achieve their desired leverage ratio. If the market price is stable (1 LSDC = $1), the maximum achievable leverage ratio is 5x. This is calculated using the formula: Maximum leverage ratio = 1/(MCR – 100%), where MCR is the Minimum Collateral Ratio.

TENET development updates in 2023

TENET (TENET) cryptocurrency has undergone several key developments in 2023, reflecting its evolving position in the blockchain ecosystem. Here are the most significant updates:

-

Price Performance and Predictions: TENET’s price showed fluctuations throughout 2023. By November 2023, the price was around $0.083942. Price predictions for the future suggest variability, with expectations of growth in the upcoming years. For instance, by the end of 2023, the price might reach around $0.108760, and looking forward to 2024, it could increase significantly to $0.235811. Long-term forecasts for 2025 and 2030 predict further growth, potentially reaching as high as $0.808923 in 2025 and $0.748110 in 2030.

-

Partnerships: TENET has collaborated with Conflux (CFX) and Qtum (QTUM) to enhance liquid staking in China. This partnership is part of a broader strategy to deepen the roots of liquid staking and consolidate TENET’s position in the blockchain space.

-

Developmental Progress: TENET has been focusing on enhancing its Layer-1 Ecosystem for Liquid Staking Derivatives (LSDs), aiming to unlock liquidity and safely increase yields. The platform is innovating in the DeFi sector, especially concerning LSDs, which have emerged as a significant component in DeFi. TENET’s core technology emphasizes security, liquidity, and simplicity, making it a unique player in the DeFi landscape.

-

Tokenomics and Governance: TENET’s tokenomics model was inspired by the veToken system, which is designed to maximize network participation. The platform operates a testnet, and it conducted a public sale in Q2 2023 before listing on exchanges. TENET’s mainnet is scheduled to launch in Q3 2023, followed by the release of a suite of applications including a decentralized exchange (DEX) and lending market.

-

Wallet and User Interface: A significant development is the introduction of the Eva Wallet, a non-custodial wallet designed for simplicity and security. This wallet is aimed at retail investors and is integrated into the broader TENET ecosystem. It enables users to stake assets, optimize LSDs, and interact with on-chain actions through a Mobile Wallet AI chat.

These developments indicate that TENET is actively expanding its capabilities and influence in the blockchain sector, focusing on innovation in DeFi and user accessibility.

How to safely store your TENET (TENET) Tokens

Best cryptocurrency wallet for TENET (TENET)

Navigating the world of cryptocurrency wallets can be quite an adventure, as there are numerous options available to suit different needs. To find the perfect wallet for you, consider your trading habits and the level of security you require. Generally, there are two main categories of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical).

Each type of wallet comes with its own set of advantages and drawbacks, so there isn’t necessarily a one-size-fits-all solution. As you embark on your journey to find the best crypto wallet for your TENET (TENET) tokens, remember to keep an open mind and explore the features that align with your personal preferences and requirements.

When choosing the right wallet for your TENET (TENET) tokens, consider the following factors:

- Trading frequency: Hot wallets are generally more suitable for active traders due to their quick login capabilities, allowing for seamless buying and selling of crypto. Cold wallets, on the other hand, are better suited for those who make less frequent trades.

- Supported cryptocurrencies: Although not all wallets cater to every cryptocurrency, some of the best ones can trade a vast array of currencies, offering a versatile experience. Make sure the wallet you choose supports TENET (TENET).

- Security concerns: If you’re worried about potential hacking incidents, a physical cold wallet stored in a safe deposit box or a secure location at home provides the highest level of protection. However, if you’re confident in safeguarding your hot wallet, you might prefer its convenience.

- Associated costs: Investigate the costs of each wallet option. While many hot wallets are free to set up, cold wallets, being hardware devices, will require an upfront investment.

- Wallet features: While the basic functions of cryptocurrency wallets remain the same, additional features can distinguish one wallet from another. Hot wallets often come with advanced reporting tools, crypto market insights, and currency conversion capabilities. Security features can also be an essential factor when making your decision.

By considering all of these aspects, you’ll be better equipped to select the perfect cryptocurrency wallet for your TENET (TENET) tokens.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re planning to handle larger amounts of crypto, investing in cold storage can be a wise decision. Two of the most popular cold storage options are the Ledger Nano and the Trezor.

Ledger creates cold storage wallets designed for users who prioritize security. Their wallets are physical devices that connect to your computer, and you can only send cryptocurrency from them when they’re connected. Ledger offers a range of products, including the Ledger Nano S and the Ledger Nano X, which features Bluetooth connectivity.

Trezor, a trailblazer in the hardware wallet industry, combines top-notch security with an intuitive interface and compatibility with various desktop wallets. This blend makes it suitable for both beginners and experienced users. Trezor has earned a great deal of respect within the Bitcoin community over time. They offer two primary models – the Trezor One and the Trezor Model T, which comes with a built-in touchscreen.

TENET (TENET) Price & Charts

- Market Capitalization And Daily Trading Volume

- Current Market Price Of Every Cryptocurrency Relative To USD (And Some Local Currencies)

- Circulating And Total Supply

- Historical Charts With Prices Relative To USD, Bitcoin (BTC), And Ethereum (ETH).

Frequently Asked Questions (FAQ)

Where is the best place to buy TENET (TENET)?

We recommend either Bybit, MEXC or Gate.io as these platforms excel in functionality, reputation, security, customer support, and competitive fees.

How to buy TENET (TENET) in Europe?

In Europe, acquiring TENET (TENET) tokens is a seamless process, with numerous reputable cryptocurrency exchange platforms available to cater to your needs. Among the top choices, we recommend Bybit, MEXC, or Gate.io due to their outstanding performance in key areas such as functionality, reputation, security, customer support, and competitive fees.

These platforms have established a strong presence not only in Europe but also globally, offering an extensive range of cryptocurrencies, including TENET (TENET).

How to buy TENET (TENET) in the US?

For the United States, buying TENET (TENET) tokens is also an effortless process, we particularly recommend MEXC, a top-tier exchange that excels in functionality, reputation, security, customer support, and competitive fees.

MEXC has established a strong presence in the US and across the globe, offering a wide range of cryptocurrencies, including TENET (TENET). Catering to US-based customers, MEXC provides a user-friendly interface, responsive customer support, and multiple payment options, making it easy for users throughout the country to invest in digital currencies.

How much does TENET (TENET) cost to buy?

Unlike traditional trading options, cryptocurrency allows for fractional purchases, so you don’t need to buy whole coins. This flexibility means you can begin investing in TENET (TENET) and other digital currencies with an investment as low as $1!

Is it safe to buy TENET (TENET)?

Safeguarding your investments is a joint effort, and adhering to recommended security practices is crucial. The first step to safely buying TENET (TENET) is selecting a reputable exchange known for its reliability and strong security measures. Make sure to choose an exchange with a proven track record and positive reputation in the industry to minimize potential risks.

Is it Possible to Convert TENET (TENET) to Cash?

Absolutely! After choosing your preferred cryptocurrency exchange platform, you can effortlessly convert your TENET (TENET) tokens into cash at the current market rate using the exchange’s user-friendly trading interface.

What is the TENET (TENET) Crypto Price Forecast?

Accurately predicting the TENET (TENET) price for any time frame is challenging, but various fundamental factors offer insight into the token’s potential price fluctuations and volatility. Essential aspects to consider include:

- Adoption Rate – Increased on-chain activity, driven by the growing number of developers and users on the TENET (TENET) platform, may lead to higher demand and value for it. This expansion could also boost investor confidence, prompting more people to buy and hold the tokens.

- Innovative Developments – The introduction of innovative features that improve TENET (TENET)‘s capabilities can make the project more attractive for usage or investment, potentially driving up the token price. Furthermore, the TENET (TENET) cryptocurrency value may experience a surge following announcements of new partnerships and investments in the project.

- Market Sentiment – The overall market outlook significantly impacts TENET (TENET) crypto price trends. A risk-on attitude among global investors encourages buying activity in the crypto market, supporting TENET (TENET)‘s price. On the other hand, bearish or risk-averse sentiment can trigger sell-offs that may negatively affect the price in the market.