How To Buy WOO Network (WOO)?

A common question you often see on social media from crypto beginners is “Where can I buy WOO Network?” Well, you’ll be happy to hear it is actually quite a simple and straightforward process.

Step 1: Create an account on an exchange that supports WOO Network (WOO)

First, you will need to open an account on a cryptocurrency exchange that supports WOO Network (WOO).

We recommend the following based on functionality, reputation, security, support and fees:

1

Binance

Fees (Maker/Taker) 0.075%*-0.1%*

Cryptocurrencies

Available for Trade 500+

Sign-up bonus

10% reduced trading fees*

Available in

Europe, Asia, Oceania, Africa

2

MEXC

Fees (Maker/Taker) 0.2%*-0.2%*

Cryptocurrencies

Available for Trade 1500+

Sign-up bonus

10% reduced trading fees & up to $170 in USDT vouchers*

Available in

North America, South America, Europe, Asia, Oceania, Africa

In order to sign up, you will need to enter some basic information, such as your email address, password, full name and, in some cases, you might also be asked for a phone number or address.

Note: On specific exchanges, you might need to complete a Know Your Customer (KYC) procedure in order to be able to purchase cryptocurrency. This is most commonly the case with licensed and regulated exchanges.

Step 2: Deposit funds into your account

Many cryptocurrency exchanges will allow you to purchase WOO Network (WOO) with fiat currencies, such as EUR, USD, AUD and others. Furthermore, they will also provide you with multiple deposit methods through which you can fund your fiat account, such as credit and debit cards, ewallets or direct bank transfers.

Note: Some payment methods will have higher fees than others, such as credit card payments. Before funding your fiat account on your chosen exchange, make sure to do your due diligence to find out the fees involved with each payment method to avoid unnecessary costs.

Step 3: Buy WOO Network (WOO)

This process is similar across almost every cryptocurrency exchange. All you have to do is find a navigation bar or a search bar, and search for WOO Network (WOO) or WOO Network (WOO) trading pairs. Look for the section that will allow you to buy WOO Network (WOO), and enter the amount of the cryptocurrency that you want to spend for WOO Network (WOO) or the amount of fiat currency that you want to spend towards buying WOO Network (WOO). The exchange will then calculate the equivalent amount of WOO Network (WOO) based on the current market rate.

Note: Make sure to always double-check your transaction details, such as the amount of WOO Network (WOO) you will be buying as well as the total cost of the purchase before you end up confirming the transaction. Furthermore, many cryptocurrency exchanges will offer you their own proprietary software wallet where you will be storing your cryptocurrencies; however, you can create your own individual software wallet, or purchase a hardware wallet for the highest level of protection.

How to create a Binance account

Show Detailed Instructions

Hide Detailed Instructions

Step 1: Go to the Binance website.

Step 2: On the registration page, enter your email address, and create a password for your account.

Then, read and agree to the Terms of Service and click “Create Account”.

Note: Your password must be a combination of numbers and letters.

It should contain at least 8 characters, one UPPER CASE letter, and one number.

Step 3: Complete the Security Verification.

Step 4: The system will send a verification code to your email. The verification code is valid for 30 minutes. If you can’t find the email in your inbox, check your other mail folders as well, or click “Resend Email” to resend.

How to complete KYC (ID Verification) on Binance

Step 1: Log in to your Binance account and click “User Center” and then “Identification”.

Step 2: click “Start Now” to verify your account.

Step 3: Select your country of residence.

Ensure that your country of residence is consistent with your ID documents.

Step 5: Enter your personal information and click “Continue.”

You won’t be able to change it once confirmed.

Refer to the respective options offered for your country.

Step 7: Follow the instructions to upload photos of your document. Your photos should clearly show the full ID document.

Do not wear hats, glasses, or use filters, and make sure that the lighting is sufficient.

Once your application has been verified, you will receive an email notification.

How to buy cryptocurrency on Binance

Step 1: Log in to your Binance account and click “Buy Crypto” and then “Credit/Debit Card”.

Step 2: Here you can choose to buy crypto with different fiat currencies. Enter the fiat amount you want to spend and the system will automatically display the amount of crypto you can get. When you have selected the amount you wish to spend then press “Continue”.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

Step 3: Click “Add New Card”. Then enter your credit card details and your billing address.

Step 4: Check the payment details and confirm your order within 1 minute. After 1 minute, the price and the amount of crypto you will get will be recalculated. You can click “Refresh” to see the latest market price. You will then be redirected to your bank’s OTP Transaction Page. Follow the on-screen instructions to verify the payment.

How to Conduct Spot Trading on Binance

Step 1: Log in to your Binance account.

Click on “Classic” under “Trade” on the top navigation bar.

Step 2: Search and enter the cryptocurrency you want to trade.

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can place a “Market Order” to set the buying/selling price automatically.

Hide Detailed Instructions

How to create a Gate.io account

Show Detailed Instructions

Hide Detailed Instructions

Step 1: Go to the Gate.io website.

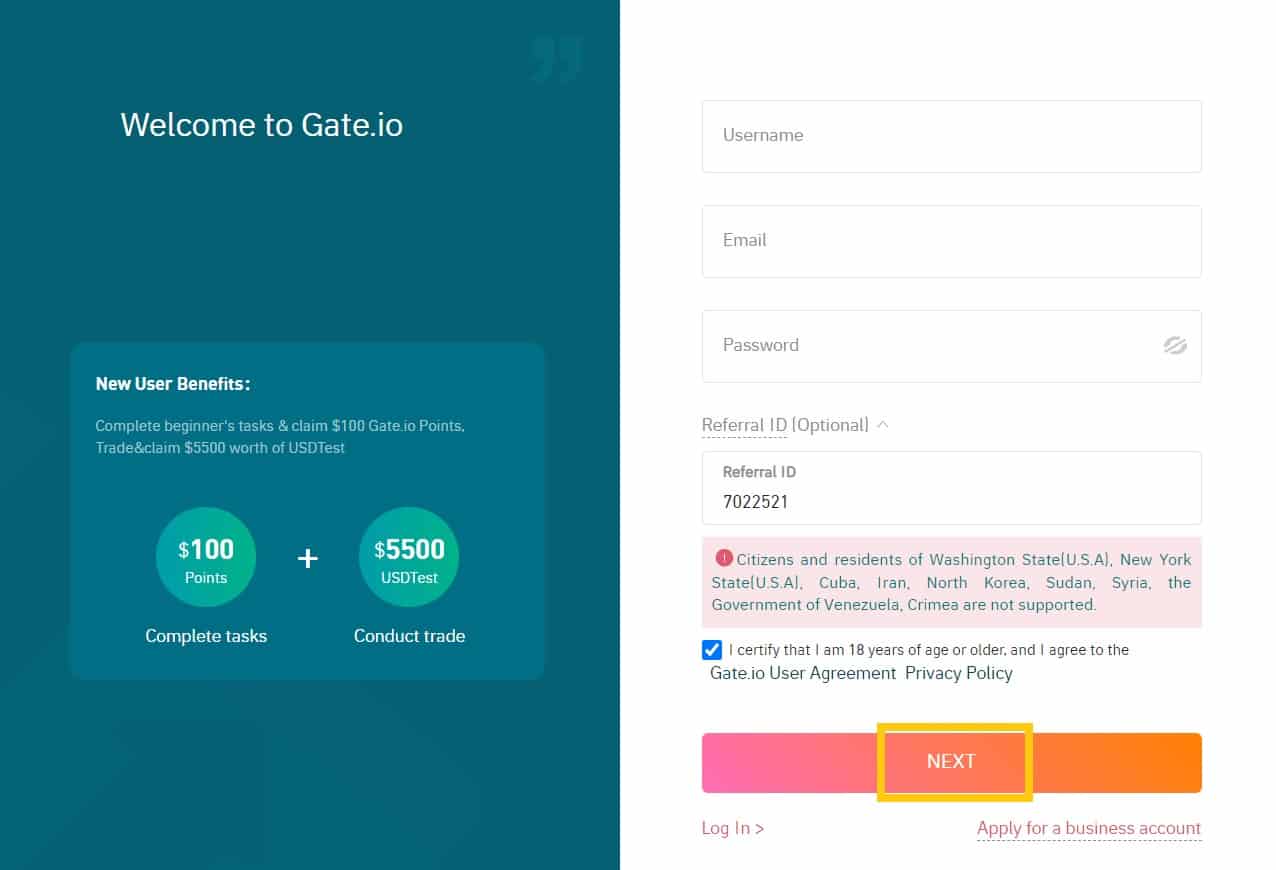

Step 2: Choose your username, your email address and your password. Then check “I certify that I am 18 years of age or older, and I agree to the Gate.io User Agreement Privacy Policy” and click “NEXT”.

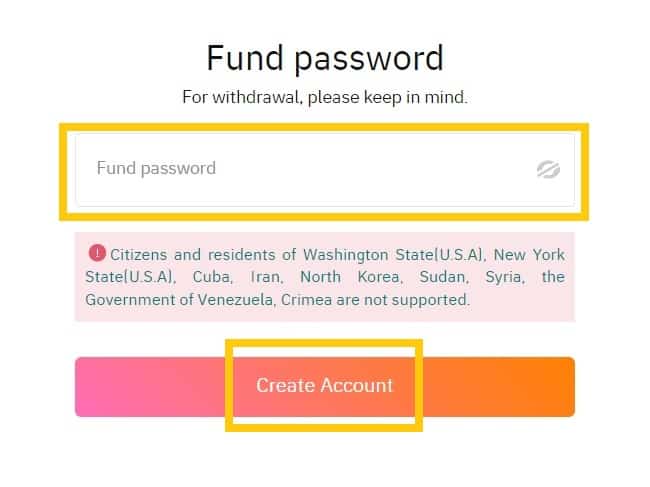

Step 3: Set your fund password and click “Create account”.

Note: Your fund password must contain at least 6 characters and can not be the same as your login password.

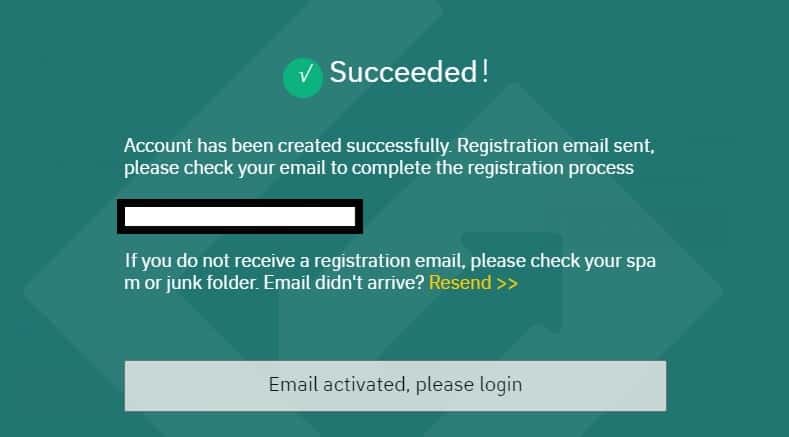

Step 4: An activation email will be sent to your email address. Complete the rest of the registration process by following the instructions in the email to activate your account. Once this is done done, click “Email activated, please log in”.

How to complete KYC (ID Verification) on Gate.io

In order to ensure the safety of your assets, and to reduce fraud, money laundering, blackmail, and other illegal activities, Gate.io makes it mandatory that all users obtain KYC ID Verification. Only after your account has obtained KYC ID verification, can you withdraw funds or use credit cards or debit cards to buy cryptocurrencies.

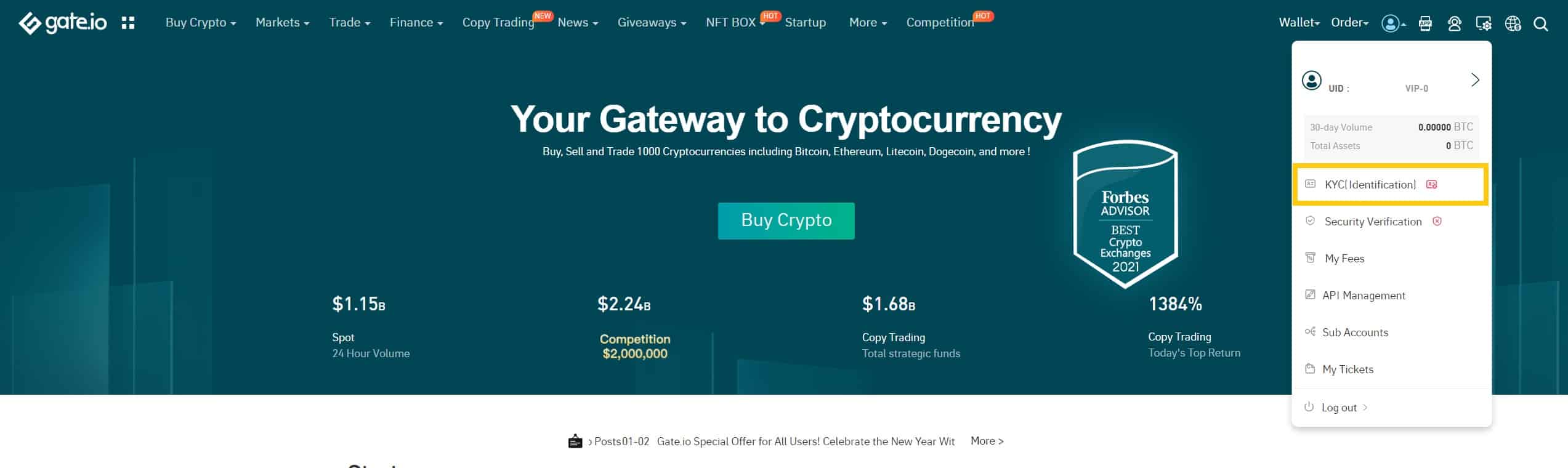

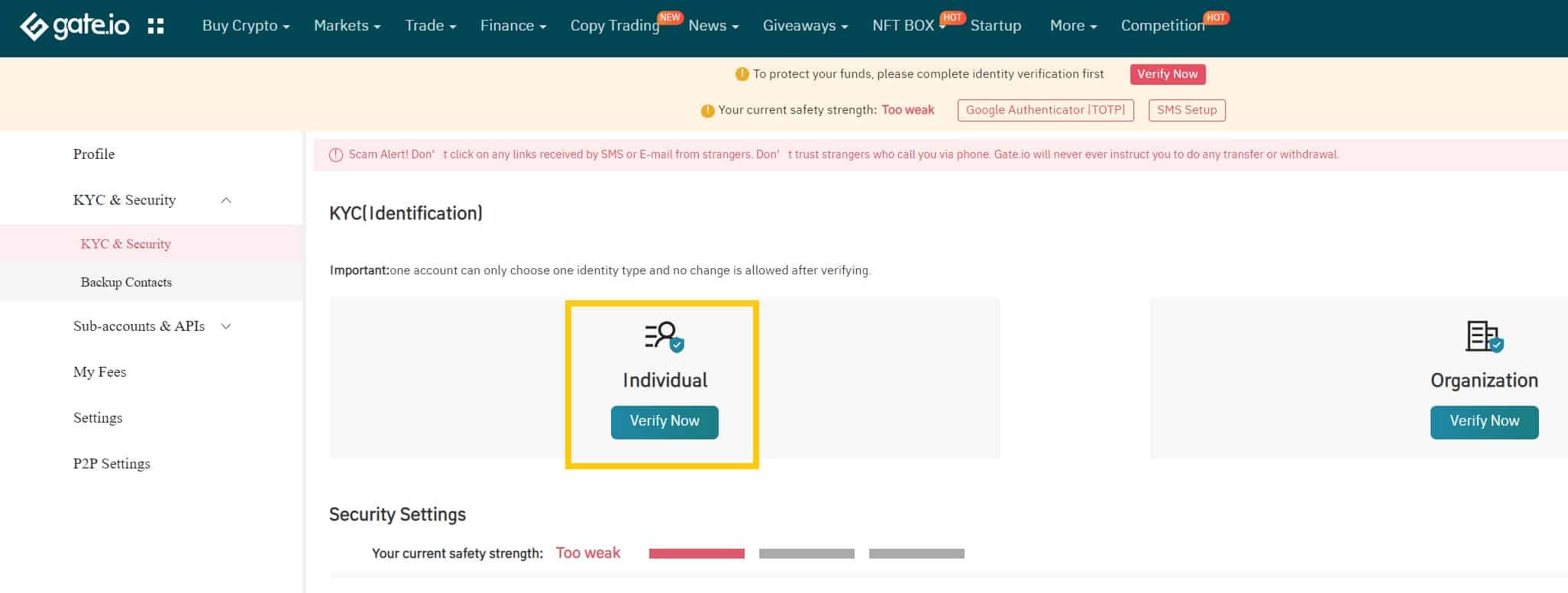

Step 1: Log in to your Gate.io account.

Place your cursor on the top-right profile icon and go to “KYC (ID Verification)”

Step 2: Click “Individual (Verify now)”

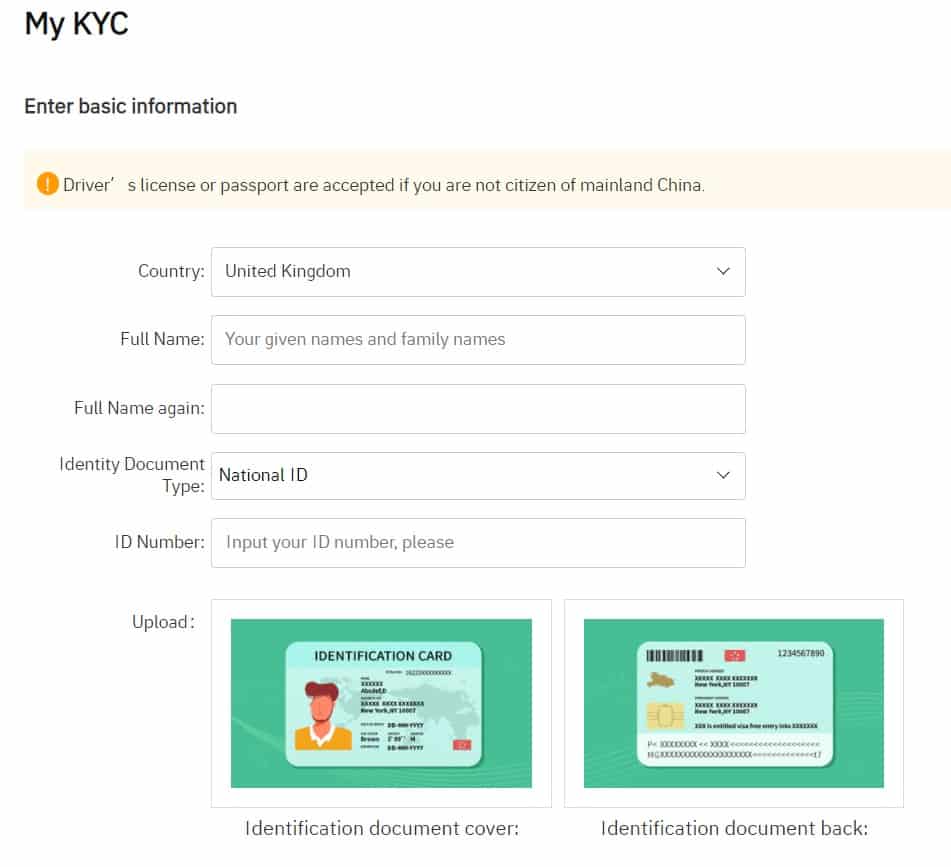

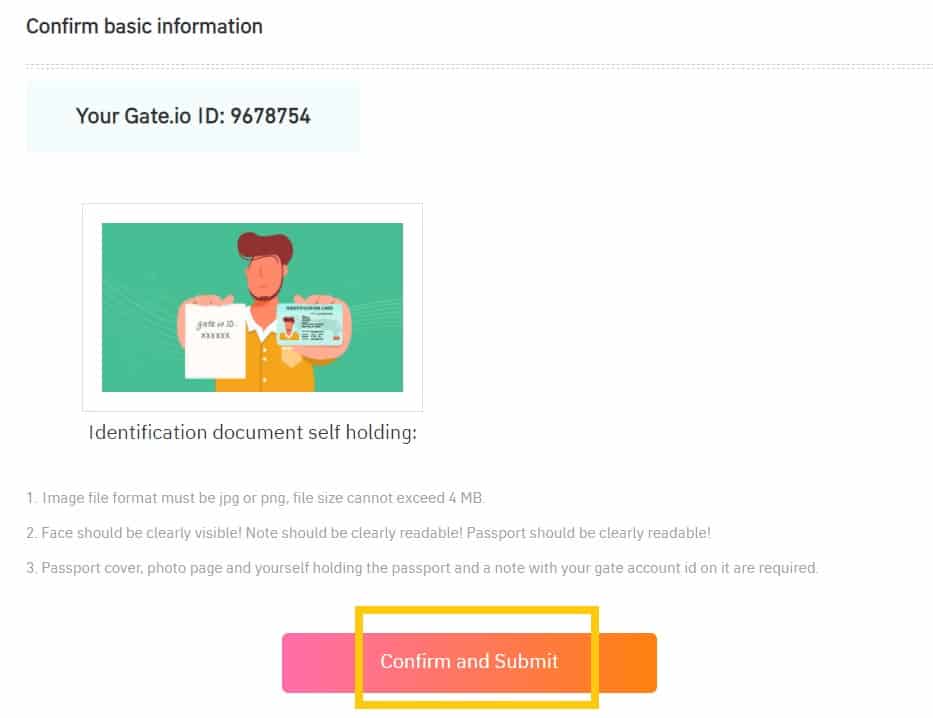

Step 3: Select your country, input your full legal name (twice), fill in your ID information, upload photos of both sides of your ID card, and a photo of you holding your ID together with your User ID (UID) for Gate.io. You will see your User ID by placing the cursor on the top-right profile icon on the main page. Make sure everything is filled in correctly and then click on “Confirm and Submit”.

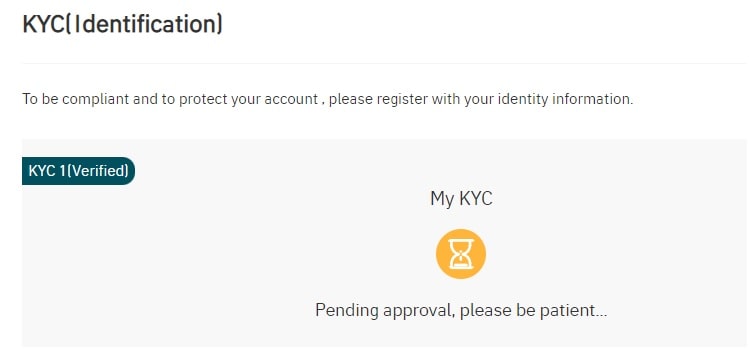

Step 4: After you have submitted all the requested information, you will see the pending approval.

Approval can take anywhere from a few hours to a few days to complete.

Once the KYC is approved, you’re ready to make your first cryptocurrency purchase.

How to buy cryptocurrency on Gate.io

Step 1: Log in to your Gate.io account.

Then in the Menu Bar at the top of the page, click “Buy Crypto” and select “Credit Card”.

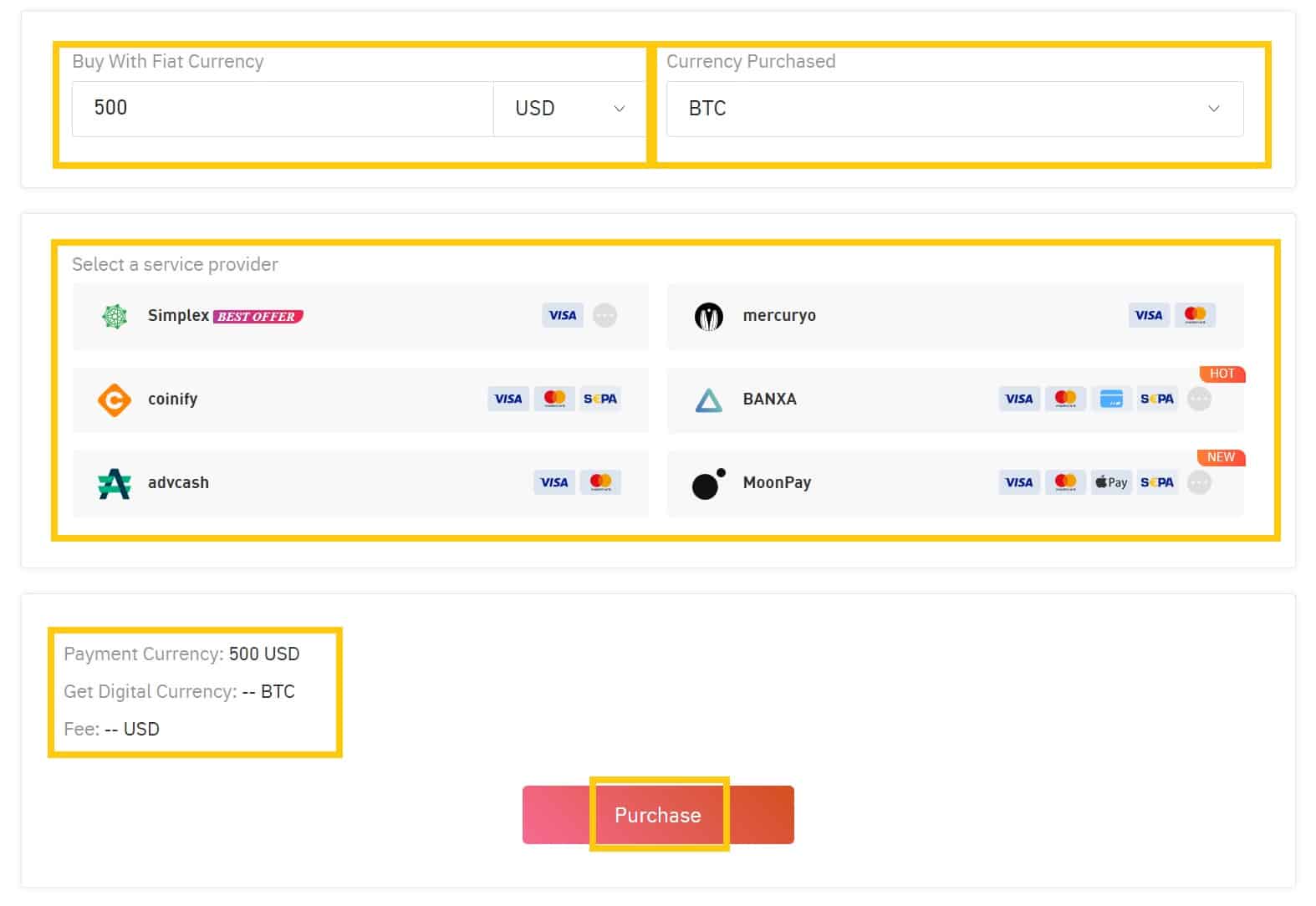

Step 2: Enter the amount you wish to spend in the “Buy with Fiat Currency” tab and select the cryptocurrency that you want to buy under the “Currency Purchased” field. Then select one of the “Service Providers” below and click the “Place Order” button to enter the confirmation page.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

Step 3: On the confirmation page, select “Buy Crypto” or the “Create Order” button to complete the payment.

Note: To ensure a quick and secure way of receiving the order, users might need to conduct an additional Identity Verification (KYC) with a third-party service provider. Once successfully verified, the service provider will immediately transfer the cryptocurrencies to your Gate.io account.

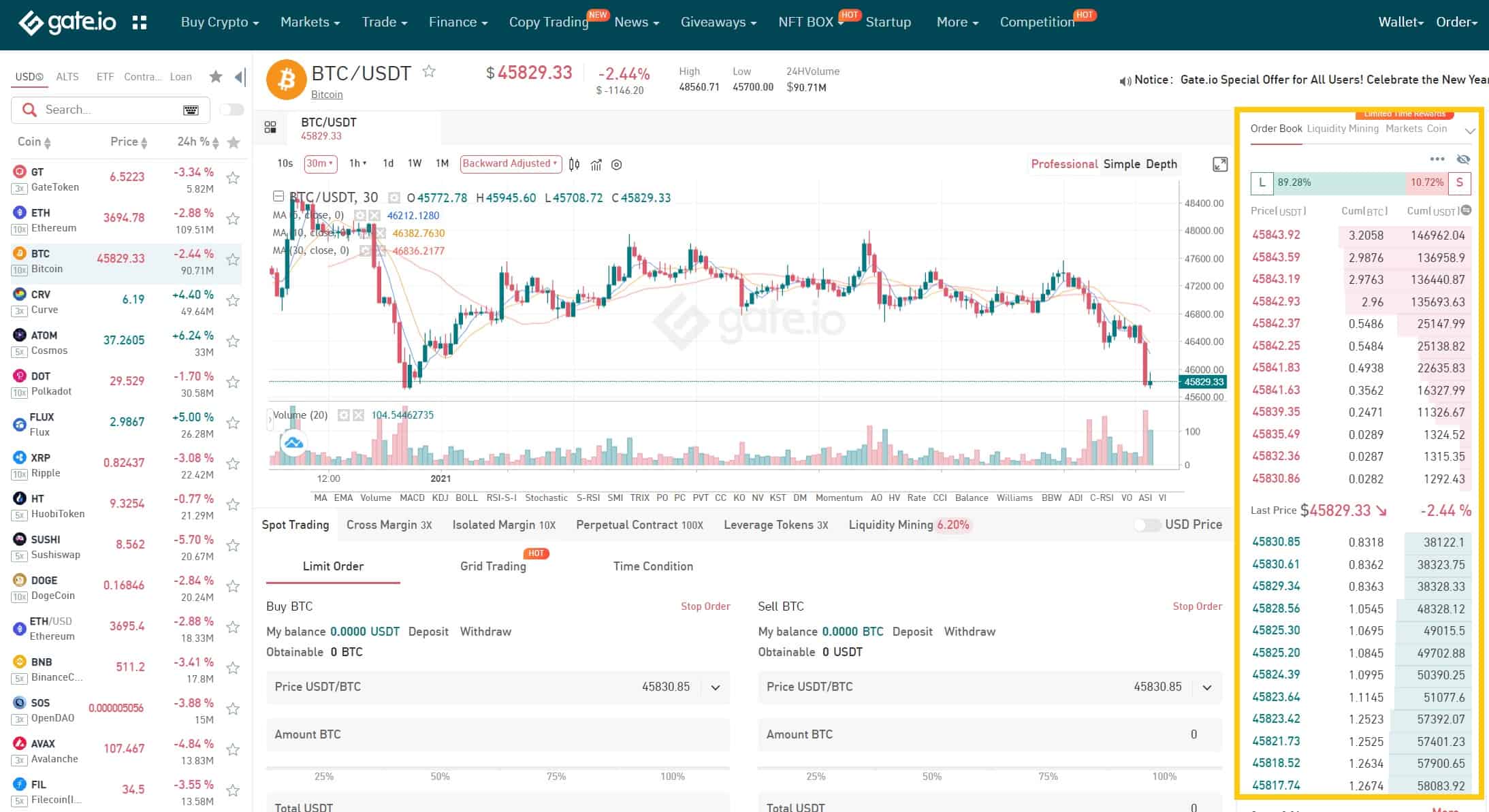

How to Conduct Spot Trading on Gate.io

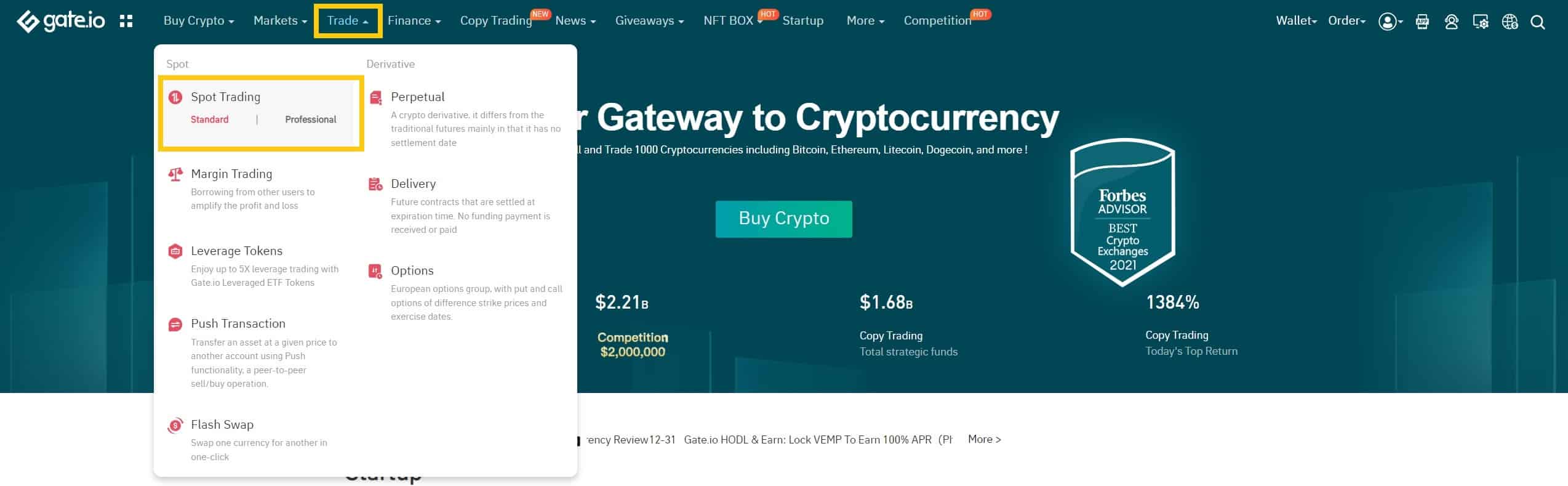

Step 1: Log in to your Gate.io account.

Click on “Spot Trading” under “Trade” on the top navigation bar.

You can either choose “standard” or “professional” version. This tutorial uses the standard version.

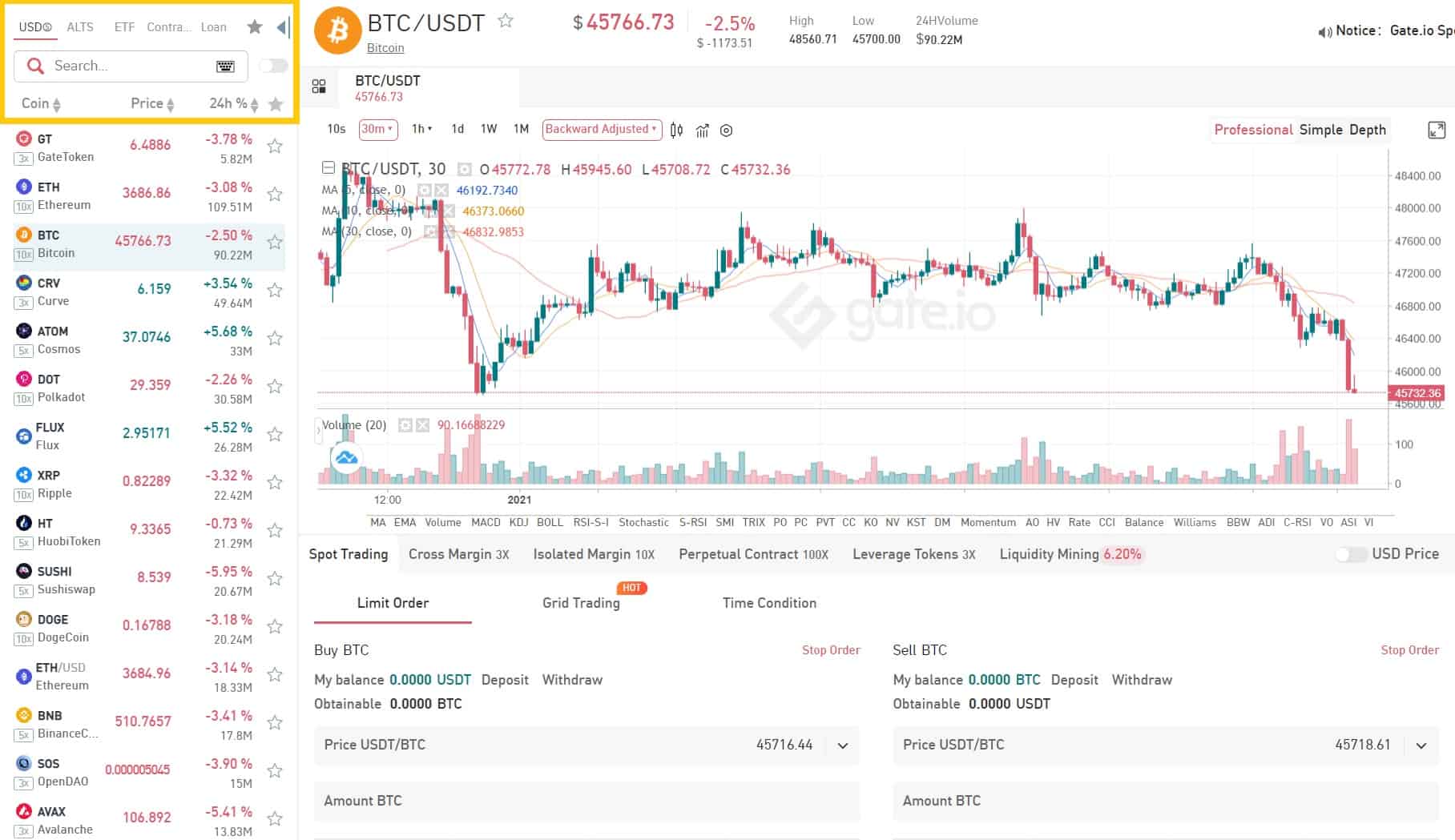

Step 2: Search and enter the cryptocurrency you want to trade.

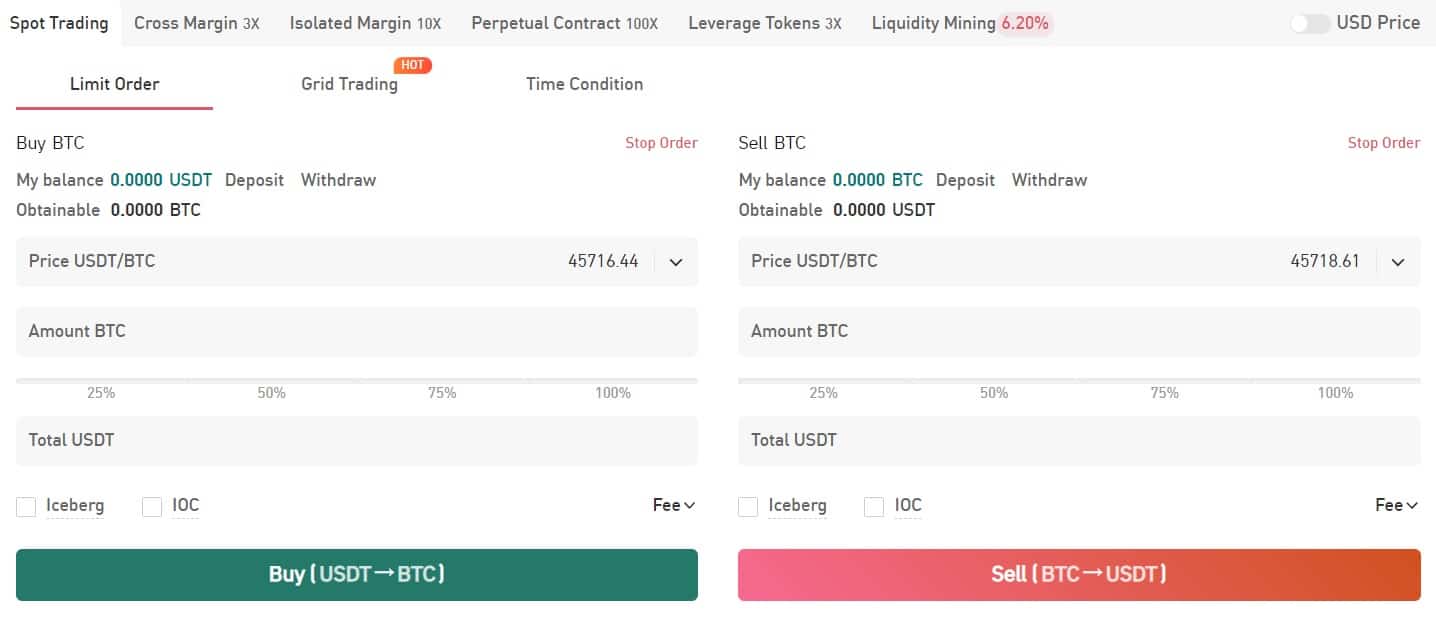

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can click on the last prices on the order book to set the buying/selling price automatically.

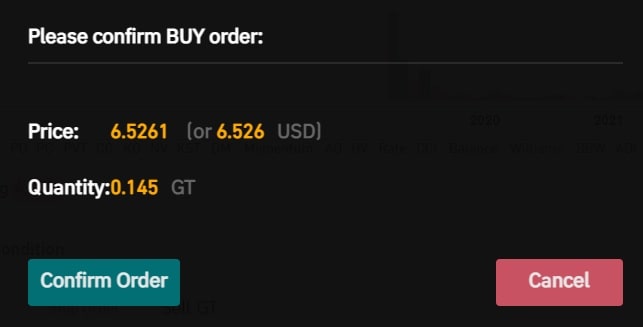

Step 5: Confirm the price and amount. Then click on “Place Order” to place the order, followed by “Confirm Order” to confirm it.

Hide Detailed Instructions

For more in-depth instructions, our ‘Absolute Beginner’s Guide To Cryptocurrency Investing‘ will take you through the process step-by step. In addition to providing instructions for sending and receiving your cryptocurrency.

And if you’re completely new to crypto our beginner, intermediate and advanced level articles will get you up to speed with everything you need to know about the cryptocurrency space starting out.

What is WOO Network (WOO)?

WOO Network is a deep liquidity network connecting traders, exchanges, institutions, and DeFi platforms with democratized access to the best-in-class liquidity, trading execution, and yield generation strategies at lower or zero cost. WOO Network was founded by Kronos Research, a multi-strategy trading firm that specializes in market making, arbitrage, CTA, and high-frequency trading (HFT), averaging around $5-10 billion of daily trading volume on global cryptocurrency exchanges.

Presently, a diverse set of products and services interfacing retail, institutions, CeFi, and DeFi, have been built:

-

WOO X is a zero-fee trading platform providing professional and institutional traders with the best-in-class liquidity and execution. It features fully customizable modules for workspace customization.

-

Wootrade is a gateway for institutional clients such as exchanges to access WOO Network’s liquidity to upgrade their order books to a depth deeper than top exchanges and tighten their bid/ask spread.

-

WooFi Pools are deployed across select DeFi protocols and applications to provide users with enhanced on-chain liquidity and execution. To achieve this, a combination of off-chain tools such as pricing oracles, quantitative trading and hedging strategies are bridged with on-chain liquidity pools.

What is Woo X?

WOO X is the flagship CeFi product built on WOO Network. WOO X is powered by the industry’s leading market makers, global pools of liquidity, and quantitative trading strategies.

WOO X features first-to-market zero-fee trading, deep liquidity, and fully customizable workspaces to provide the ultimate trading experience for professional and institutional traders.

Zero-Fee Trading

Manual non-API traders can reduce their maker and taker fees down to zero once they reach Tier 2 with 1,800 WOO tokens staked on WOO X.

Deep liquidity

One of the biggest differentiators on WOO X is its deep liquidity across trading pairs. A comparison of the liquidity scores of major trading pairs on https://coinmarketcap.com/exchanges/wootrade/ would reveal that WOO X’s market depth on the bid/ask books exceeds that of top exchanges. This deep liquidity allows large orders to be executed without heavy price slippage. Coupled with zero-fee trading, the cost-savings via low slippage and fees is ideal for any professional trader trading large amounts frequently. This allows for users to experience democratized liquidity that would otherwise only be accessible via over-the-counter trading.

Aside from organic liquidity generated from order flow on WOO X, the deep liquidity on WOO X is sourced from WOO Network’s internal liquidity pool: a combination of global liquidity aggregated from exchanges, top market makers, and trading institutions partnered in WOO Network.

The cornerstone liquidity provider in WOO Network is Kronos Research, a top quantitative trading and market-making firm trading $5-10B in daily trading volume across various global exchanges. The initial role of Kronos Research is to bootstrap liquidity on WOO X. This will provide immediate deep liquidity across a variety of token pairs to help the platform attract traders and attain a critical mass of users that would incentivize other market makers to further improve the liquidity.

Over time, the objective is to make the old saying materialize: liquidity begets liquidity. This maturation will allow for a virtuous cycle of liquidity deepening on WOO X.

Fully customizable workspaces

WOO X strives to be the ultimate platform for traders of various profiles and experience: retail, professional, and institutional. The first feature that stands out when you open WOO X is the customizable GUI. It’s complete with a diverse set of drag-drop and resizable trading data widgets, multi-charts integrated order entry modules, and workspace tabs.

Unlike other trading terminals, WOO X lets you decide what your trading dashboard looks like, offering tools and widget options that can be moved freely, deleted, or duplicated. By default, you can find 3 templates – standard, advanced, and customized.

Listing on WOO X

There is no listing fee for WOO X. Primary considerations for token listings are sustainable volume and liquidity, followed by a few prerequisites. First, the token should be on several major exchanges to ensure ample underlying liquidity for WOO Network to aggregate. Secondly, having several liquid futures markets is also important to support hedging exposure and reducing risk. Third, demand from institutional clients, users, and partner exchanges, since these stakeholders will be trading the token on the WOO X platform.

What is WooTrade?

Presently, traders looking to execute large transactions with low slippage have to resort to using only the biggest exchanges or over-the-counter trading. This leads to a vicious cycle where liquidity and users get siphoned away from smaller exchanges and promotes a monopoly of several top exchanges. To compete, smaller exchanges looking to acquire and retain traders on their platform have to resort to their own internal market-making teams or rely on expensive market makers to bootstrap liquidity for their order books.

Internal market-making carries its own share of high hedging costs due to sizable commissions on other exchanges. Hedging is the process of offsetting risk by trading an asset, usually on a secondary platform, to protect against adverse price movements in the market. In volatile cryptocurrency markets, this skill is crucial to protecting the financial stability of an exchange.

External market makers are also deterred by the opportunity cost of market-making on an illiquid exchange, considering that their assets could be deployed elsewhere with more trading volume to earn better returns. Furthermore, they face custodial risks by diversifying their assets across multiple smaller exchanges. The exchange must provide them with very favorable terms to account for these risks and opportunity costs, causing smaller exchanges to incur even more expenses.

Wootrade’s liquidity solution:

Democratizing access to the best liquidity pool

Wootrade disrupts the liquidity monopoly by democratizing access to deep liquidity. Exchanges can access WOO Network via API integration and immediately upgrade their order book depth and tighten their bid/ask spread, which allows for more direct competition with top exchanges.

On top of that, Wootrade enables partner exchanges to hedge on WOO X, without having to hedge on other exchanges with high commissions and slippage. Features such as full cross margin, competitive interest rates, and auto margin rebalancing are also provided.

The difference Wootrade’s liquidity as a service makes is easily visible. For example, our partner exchanges have been able to offer traders hundreds of thousands worth of USDT order execution at minimal slippage. Today, if an order is placed on partner exchanges like Gate.io, Ascendex, Hoo, and MXC, the liquidity may be sourced from Wootrade’s liquidity pool.

In essence, Wootrade is providing a base-layer liquidity solution that exchanges critically need. Instead of worrying about liquidity, these exchanges can now focus their resources on security, customer acquisition, and developing even more innovative products and services.

Ultimately, value accrues to the WOO token because when an exchange client onboards, they must either pay fees or stake WOO tokens as outlined in the Zealous Rhinos program.

What is WooFi?

DeFi is short for “Decentralized Finance”, an umbrella term for a variety of financial applications geared toward disrupting traditional financial intermediaries. As the DeFi sector matures, we expect it to gradually catch up to centralized exchanges, or CeFi, in terms of trading volume and value locked.

WOO Network aims to continue to expand its liquidity network to DeFi and helps DeFi users get the best pricing, tightest bid-ask spreads, and yielding opportunities when trading. Hence, we provide DeFi related products and offerings under the brand “WOOFi”.

WOO Network helps decentralized exchanges by bringing liquidity on-chain, using a combination of liquidity pools, on-chain price quoting and hedging strategies. In turn, this approach allows WOO Network to internalize DeFi order flow.

The first WOOFi product is the onchain liquidity pools providing the best trade execution for DeFi users. In addition, the on-chain trading strategies on Uniswap V3, dYdX and 0x, are actively being tested and will turn into future product offerings once finalized.

WOO Token Utility

WOO Token is a utility token deeply embedded within WOO Network’s CeFi and DeFi products and services with various staking, discount, yield, and governance utilities. Currently, 50% of revenue generated across all of WOO Network’s exchange, liquidity service, asset management services contribute to the monthly buyback and burn. Strong deflationary buyback and burn mechanisms are strategically designed to generate consistent demand through the purchasing of WOO tokens off the secondary market to remove them permanently from the circulating supply. Read the litepaper here: https://woo.org/Litepaper.pdf

Current WOO Token Utility:

[Retail Staking] Unlocking zero-fee trading, free withdrawals, and higher referral rebates.

-

All retail traders benefit from 0% Maker fees on WOO X by default, and WOO tokens can be staked to reduce Taker fees from a maximum of 0.05% down to 0%. Free withdrawals and referral rebates increase as staking tiers increase.

[Institutional Staking] Increased API trading rate limits and fee reductions

-

Trading institutions generating large volumes on WOO X can stake WOO tokens based on their volume and trading requirements to receive increased API trading rate limits and fee reductions.

[Yield] WOO Ventures token airdrops

-

A portion of tokens received from WOO Ventures early-stage project investments will be distributed to WOO token stakers on WOO X.

[DeFi] Liquidity Provision and Yield farming with WOO

-

WOO tokens are embedded within prominent DEXes on various chains: Bancor, Sushiswap, Uniswap, PancakeSwap, QuickSwap, and MDEX.

[DeFi] Borrowing and Lending with WOO

-

WOO tokens can be used as collateral for borrowing and lending on: CREAM Finance, Sushi Kashi, Rari Capital, KINE Finance, and Unit Protocol.

WOO Tokenomics

The Wootrade native token, WOO, has a cap set at 3,000,000,000 tokens. The WOO token achieves a deflationary tokenomics model through the a buyback and burn program. Each month, 50% of Wootrade’s income will be used to buy back WOO on the open market. While the buyback is performed on an ongoing basis, the token burn happens on the 10th of each month and is published on Twitter and Medium.

Woo Network development updates in 2023

WOO Network has seen a series of significant developments in 2023, marked by strategic initiatives, product upgrades, and a focus on transparency and trust. Here are some key highlights from the year:

-

Transparency and Trust Initiatives: In response to the market turbulence in the second half of 2022, WOO Network prioritized transparency by implementing a first-of-its-kind dashboard showcasing assets and liabilities, which updates every fifteen minutes. This move was part of an effort to establish WOO X as one of the most transparent trading venues.

-

Product and Feature Enhancements: WOO Network introduced several new features for WOO X, including Merkle tree proof of liabilities and assets, diverse spot pairs including USDC & BTC, enhanced earn products, and trading tools like hedge mode and TWAP orders. These features, along with elements of gamification like achievement badges and revamped staking, aimed to enrich the user experience on the platform.

-

Developments in DeFi: WOOFi, operating on multiple networks, introduced upgrades such as Swap v2, enhancing price execution and offering higher yields for WOOFi stakers through increased WOO buybacks. Additionally, WOOFi DEX began offering more spot markets and added perpetual futures.

-

Ecosystem Expansion and Community Growth: WOO Network’s strategic efforts included the expansion of its ecosystem through new hires, listing more assets on WOO X, supporting more chains on WOOFi, and exploring new partnerships. The focus was also on strengthening investor relations and revising tokenomics to increase the utility of the WOO token.

-

Tokenomics and Strategic Partnerships: The network updated its tokenomics, moving away from the burning mechanism and introducing a new staking program linked with new products like social trading and earn vaults. Strategic partnerships and community engagement were also emphasized, including events and meetups to foster relationships with traders and partners.

-

Staking and Network Statistics: The network reported that a significant portion of its circulating supply was locked in staking or vesting. WOOFi Swap emerged as a major revenue generator, with significant volumes originating directly from its front-end. WOOFi also successfully integrated with key players in the DeFi space, contributing to its growth.

These developments underscore WOO Network’s commitment to enhancing its products, expanding its ecosystem, and building a transparent and trustworthy platform in the cryptocurrency space.

Official website: https://woo.org/

Best cryptocurrency wallet for Woo Network (WOO)

There are plenty of different crypto wallets available. The best one for you depends on your general trading habits and which provides the most security in your situation. There are two main types of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical). Both have their pros and cons, and there is not necessarily a right or wrong answer when it comes to figuring out which crypto wallet is best for you.

HOW DO I DECIDE WHICH cryptocurrency WALLET TO USE for Woo Network (WOO)?

Deciding which type of wallet to use depends on a variety of factors, including:

- How often you trade. In general, hot wallets are better for more active cryptocurrency traders. Quick login ability means you are only a few clicks and taps away from buying and selling crypto. Cold wallets are better suited for those looking to make less frequent trades.

- What you want to trade. As mentioned earlier, not all wallets support all types of cryptocurrencies. However, some of the best crypto wallets have the power to trade hundreds of different currencies, providing more of a one-size-fits-all experience.

- Your peace of mind. For those worried about hacking, having a physical cold wallet stored in a safe deposit box at the bank or somewhere at home, provides the safest, most secure option. Others might be confident in their ability to keep their hot wallets secure.

- How much it costs. It is important to investigate the costs associated with each wallet. Many hot wallets will be free to set up. Meanwhile, cold wallets, like any piece of hardware, will cost money to purchase.

- What it can do. While the basics of each cryptocurrency wallet are the same, additional features can help set them apart. This is especially true of hot wallets, many of which come with advanced reporting features, insights into the crypto market, the ability to convert cryptocurrencies and more. Security features can also be a good differentiator.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re going to be dealing in larger volumes of crypto, investing in cold storage might prove advantageous.

Most widespead examples of this being the Ledger Nano and the Trezor.

Ledger manufactures cold storage wallets designed for users who want increased security. Their wallets are a physical device that connects to your computer. Only when the device is connected can you send your cryptocurrency from it. Ledger offers a variety of products, such as the Ledger Nano S and the Ledger Nano X (a bluetooth connected hardware wallet).

Trezor is a pioneering hardware wallet company. The combination of world-class security with an intuitive interface and compatibility with other desktop wallets, makes it ideal for beginners and experts alike. The company has gained a lot of the Bitcoin community’s respect over the years. Trezor offers two main models – The Trezor One and Trezor Model T (which has a built in touch screen).

Market Overview

Coinmarketcap.com

Coinmarketcap will be your cryptocurrency go-to for just about everything. Here you can see the following: