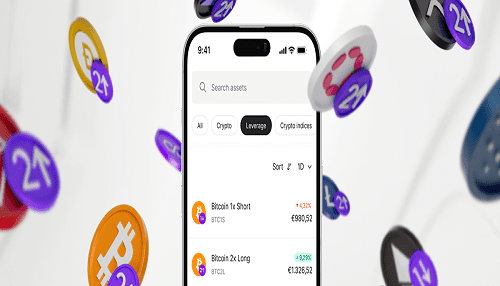

Bitpanda launches crypto leverage trading

- More than 10 new CFDs are now available to trade on the Bitpanda platform on crypto assets including Bitcoin, Ethereum, and

- With Bitpanda Leverage, investors can capitalise on short-term crypto market

- Bitpanda Leverage has been designed to offer potentially higher With an automatic 50% stop-loss and negative balance control included on all Bitpanda Leverage products, potential losses are capped at the original amount invested.

Vienna, 18 April 2023: Austrian fintech unicorn Bitpanda has launched a range of leverage trading products, to give investors more choice in how they trade. The new leverage products have been available to a limited number of Bitpanda customers since late last year, and are now being offered to all Bitpanda traders. Bitpanda Leverage is a new way for investors to trade on a short term horizon, regardless of market sentiment, with low trading fees.

Bitpanda Leverage currently offers more than ten leverage positions on some of the world’s best known cryptocurrencies. The performance of “Long” funds is double that of the underlying crypto asset, while the performance of “Short” funds is the inverse of the underlying asset.

Eric Demuth, CEO of Bitpanda, commented: “We want to give our users choice when it comes to how they invest. Yes, CFDs have a much greater risk reward ratio, but they are a valuable tool for people who want to capitalise on short term market sentiment.”

How does it work?

Bitpanda Leverage is a CFD (Contract for Difference) which considers the issue of margin call obligations for our customers. All Bitpanda Leverage products contain a margin close out control with a trigger of 50% of the initial margin automatically – this cannot be disabled. This means that a position will be automatically closed if a 50% loss has been incurred. A negative balance control ensures that potential losses of any position are capped at the original amount invested into Bitpanda Leverage.

CFDs are a product that acts as an agreement between an investor and a broker, in this case, Bitpanda. CFDs give investors the chance to potentially profit from price movement of a specified cryptocurrency without owning the underlying asset. CFDs can provide access to an underlying asset with the option to go long or short, but they also come with significant risk of losses.

While investors cannot lose more than they initially invest in Bitpanda Leverage, CFDs are a complex financial instrument and come with a great risk of losing money. CFDs are not suitable for buy and hold trading. They require constant monitoring over a short period of time. Even maintaining your investment overnight exposes you to greater risk and additional costs. Immediate action may be required to manage risk exposure.

DISCLAIMER

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts lose money when trading in CDs. You should consider whether you understand how CFDs work and whether you can afford to take the risk of losing your money.

The present does not constitute investment advice. Past performance is not an indication of future results.

You should seek advice from an independent and suitably licensed financial advisor and ensure that you have the risk appetite, relevant experience and knowledge before trading. Under no circumstances shall Bitpanda have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Ends

For further media information or for further comments, please contact: pr@bitpanda.com.

ABOUT BITPANDA

Bitpanda simplifies wealth creation. Founded in 2014 in Vienna, Austria by Eric Demuth, Paul Klanschek and Christian Trummer, Bitpanda exists to help people trust themselves enough to build financial freedom for their future. The user-friendly, trade-everything platform empowers both first-time investors and seasoned experts to invest in the cryptocurrencies, crypto indices, stocks, precious metals and commodities they want — 24/7. With 700 team members and over 4 million customers, the company is one of Europe’s most successful fintechs.