Exchange Order Types Explained

Think of trading as the exchange of assets between a buyer and a seller. The instruction to exchange one item, such as Bitcoin, for another asset within a certain price range or at a given price, is what we will refer to as a “trade order.” In addition, considering that all traders engage in both buying and selling, every trade order is either a buy or a sell order. In order to build a solid basis for trading cryptocurrencies, we will now examine the three order types that are the most common and discuss how each one works.

What Is a Limit Order?

A limit order is an order that you put on the order book with a particular limit price. You are in charge of setting the price. Therefore, if you choose to use a limit order, the transaction won’t take place until the current market price is higher than the limit price you specified (or better). As a result, you may use limit orders to either purchase at a price that is lower than the current market price or sell at a price that is higher than the current market price.

Limit orders, as opposed to market orders, in which transactions are carried out promptly at the current market price, are entered into the order book and are not carried out immediately. Because of this, you as a market maker are able to save money on transaction costs.

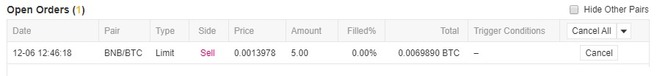

How to use a limit order?

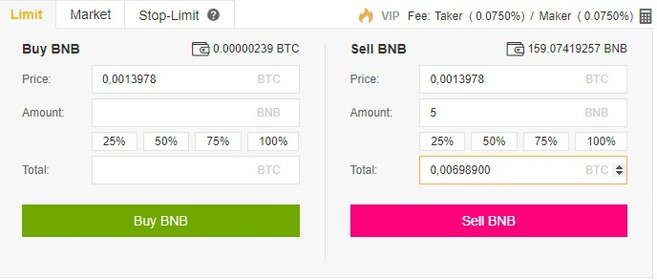

Let’s imagine you’re interested in selling BNB at a price that’s greater than what’s being bid on right now. After you have successfully logged in to your Binance account, go to the trading page and choose the BNB market of your choice (for example, BNB/BTC). The next step is to locate the Limit order tab, select it, then adjust the price and quantity before clicking the Sell BNB button. You may also specify the amount by clicking the percentage buttons, which will allow you to simply make a limit sell order for either 25%, 50%, 75%, or 100% of your current balance.

After that, you will see a confirmation message on the screen, and your limit order will be placed on the order book, with a small yellow arrow.

When should you use a limit order?

What Is a Market Order?

Market orders, as opposed to limit orders, which are put on the order book, are executed quickly at the current market price, which means you pay the costs as a market taker.

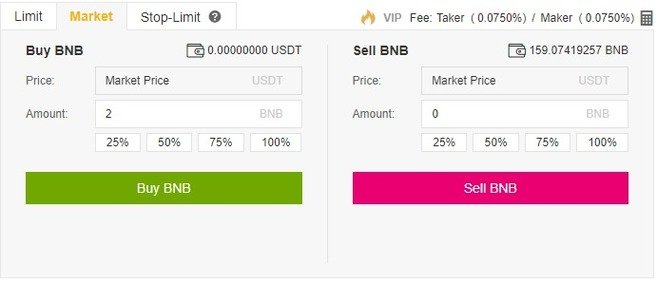

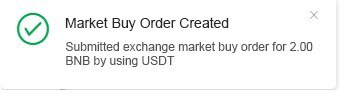

How to use a market order?

But suppose you wish to purchase 500 BNB at the current market price instead. Because the lowest limit sell order available will not be enough to satisfy your whole market purchase order, your order will match the subsequent limit sell orders, working its way up the order book until it is fulfilled. This is known as slippage, and it is the source of rising pricing and fees (because you are acting as a market taker).

When should you use a market order?

You may find yourself in a position where your stop-limit order was ignored and you need to buy/sell as quickly as feasible. So, if you need to jump into a transaction quickly or get out of difficulties, market orders come in useful.

However, if you’re new to cryptocurrency and using Bitcoin to purchase certain altcoins, avoid utilizing market orders since you’ll end up spending much more than you should. Limit orders should be used in this situation.

What is a Stop-Limit Order?

The easiest approach to understand a stop-limit order is to divide it into two parts: the stop price and the limit price. The stop price is simply the price that causes a limit order to be activated, and the limit price is the particular price of the triggered limit order. This implies that once your stop price is met, your limit order will be posted on the order book instantly.

The stop and limit prices may be the identical, although this is not required. In reality, it is safer to put the stop price (trigger price) slightly higher than the limit price (for sell orders) or slightly lower than the limit price (for purchase orders) (for buy orders). This enhances the likelihood that your limit order will be filled once the stop-limit is activated.

How to use a stop-limit order?

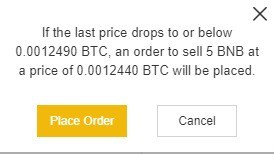

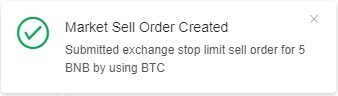

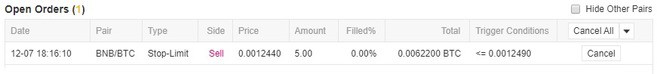

In this case, you may wish to create a stop-limit sell order to minimize your losses if your assumption is incorrect and the price begins to fall. Log in to your Binance account and go to the BNB/BTC market. Then, on the Stop-Limit page, enter the stop and limit prices, as well as the quantity of BNB to be sold.

So, if you feel that 0.0012700 BTC is a stable support level, you may place a stop-limit order close below this price (in case it fails). In this example, we will place a 5 BNB stop-limit order with a stop price of 0.0012490 BTC and a limit price of 0.0012440 BTC.

You can scroll down to see and manage your open orders.

It is important to note that the stop-limit order will only be placed if and when the stop price is achieved, and the limit order will only be filled if and when the market price hits your limit price. If your limit order is activated (by the stop price), but the market price does not reach the price you specify, the limit order is still open. That is, the stop-limit order will be converted into a limit order to purchase or sell at the limit price (or better).

You may find yourself in a position where the price decreases too quickly and your stop-limit order is ignored. In this instance, you may use market orders to exit the deal immediately.