How To Buy Bytom (BTM)?

A common question you often see on social media from crypto beginners is “Where can I buy Bytom?” Well, you’ll be happy to hear it is actually quite a simple and straightforward process.

Step 1: Create an account on an exchange that supports Bytom (BTM)

First, you will need to open an account on a cryptocurrency exchange that supports Bytom (BTM).

We recommend the following based on functionality, reputation, security, support and fees:

1

MEXC

Fees (Maker/Taker) 0.2%*-0.2%*

Cryptocurrencies

Available for Trade 1500+

Sign-up bonus

10% reduced trading fees & up to $170 in USDT vouchers*

Available in

North America, South America, Europe, Asia, Oceania, Africa

In order to sign up, you will need to enter some basic information, such as your email address, password, full name and, in some cases, you might also be asked for a phone number or address.

Note: On specific exchanges, you might need to complete a Know Your Customer (KYC) procedure in order to be able to purchase cryptocurrency. This is most commonly the case with licensed and regulated exchanges.

Step 2: Deposit funds into your account

Many cryptocurrency exchanges will allow you to purchase Bytom (BTM) with fiat currencies, such as EUR, USD, AUD and others. Furthermore, they will also provide you with multiple deposit methods through which you can fund your fiat account, such as credit and debit cards, ewallets or direct bank transfers.

Note: Some payment methods will have higher fees than others, such as credit card payments. Before funding your fiat account on your chosen exchange, make sure to do your due diligence to find out the fees involved with each payment method to avoid unnecessary costs.

Step 3: Buy Bytom (BTM)

This process is similar across almost every cryptocurrency exchange. All you have to do is find a navigation bar or a search bar, and search for Bytom (BTM) or Bytom (BTM) trading pairs. Look for the section that will allow you to buy Bytom (BTM), and enter the amount of the cryptocurrency that you want to spend for Bytom (BTM) or the amount of fiat currency that you want to spend towards buying Bytom (BTM). The exchange will then calculate the equivalent amount of Bytom (BTM) based on the current market rate.

Note: Make sure to always double-check your transaction details, such as the amount of Bytom (BTM) you will be buying as well as the total cost of the purchase before you end up confirming the transaction. Furthermore, many cryptocurrency exchanges will offer you their own proprietary software wallet where you will be storing your cryptocurrencies; however, you can create your own individual software wallet, or purchase a hardware wallet for the highest level of protection.

Alternative ways to buy Bytom (BTM)

Because the project is very new, it is only offered directly on a select number of exchanges. If you’re not comfortable connecting your bank account to any of these smaller exchanges, or if you cannot connect your bank account to them for geographical reasons. Then you can instead create an account on any of the major exchanges and simply transfer the funds from there.

Out of the major exchanges we recommend the following based on functionality, reputation, security, support and fees:

1

Binance

Fees (Maker/Taker) 0.075%*-0.1%*

Cryptocurrencies

Available for Trade 500+

Sign-up bonus

10% reduced trading fees*

Available in

Europe, Asia, Oceania, Africa

2

Bybit

Fees (Maker/Taker) 0.1%*-0.1%*

Cryptocurrencies

Available for Trade 400+

Sign-up bonus

$30,000 sign-up bonus*

Available in

Europe, Asia, Oceania, Africa

How to create a Binance account

Show Detailed Instructions

Hide Detailed Instructions

Step 1: Go to the Binance website.

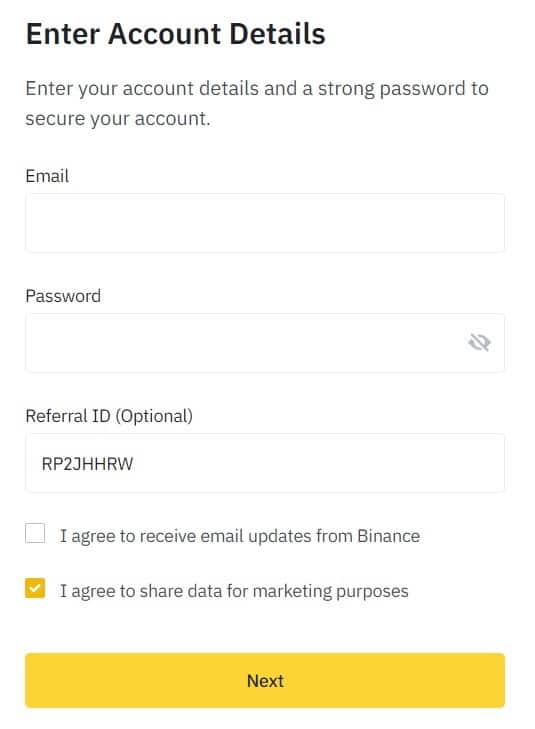

Step 2: On the registration page, enter your email address, and create a password for your account.

Then, read and agree to the Terms of Service and click “Create Account”.

Note: Your password must be a combination of numbers and letters.

It should contain at least 8 characters, one UPPER CASE letter, and one number.

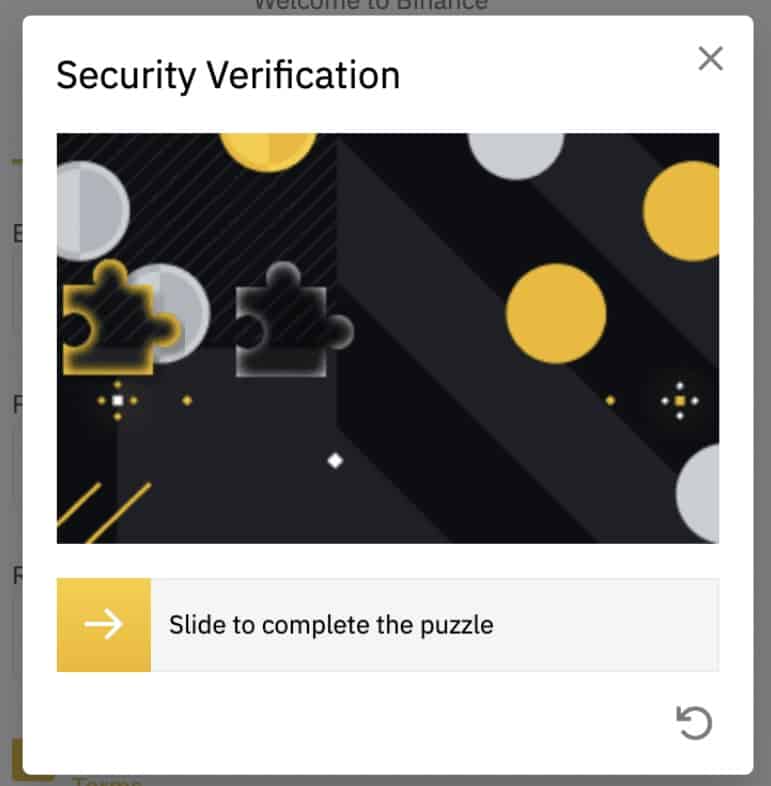

Step 3: Complete the Security Verification.

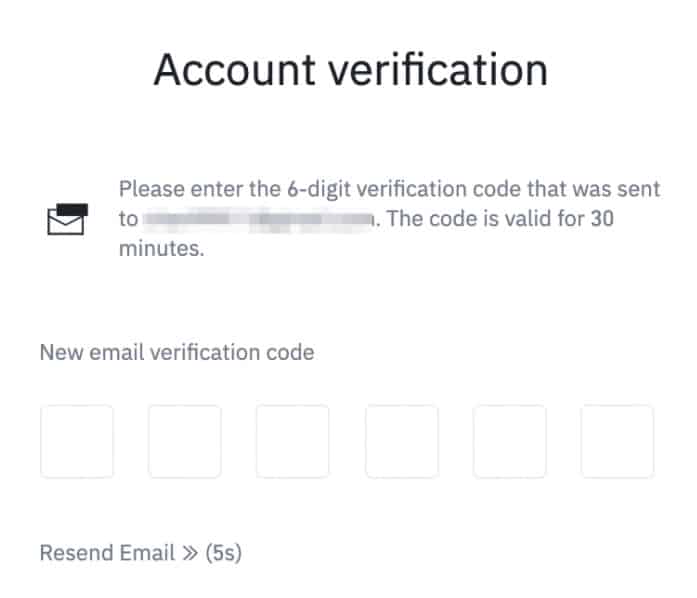

Step 4: The system will send a verification code to your email. The verification code is valid for 30 minutes. If you can’t find the email in your inbox, check your other mail folders as well, or click “Resend Email” to resend.

How to complete KYC (ID Verification) on Binance

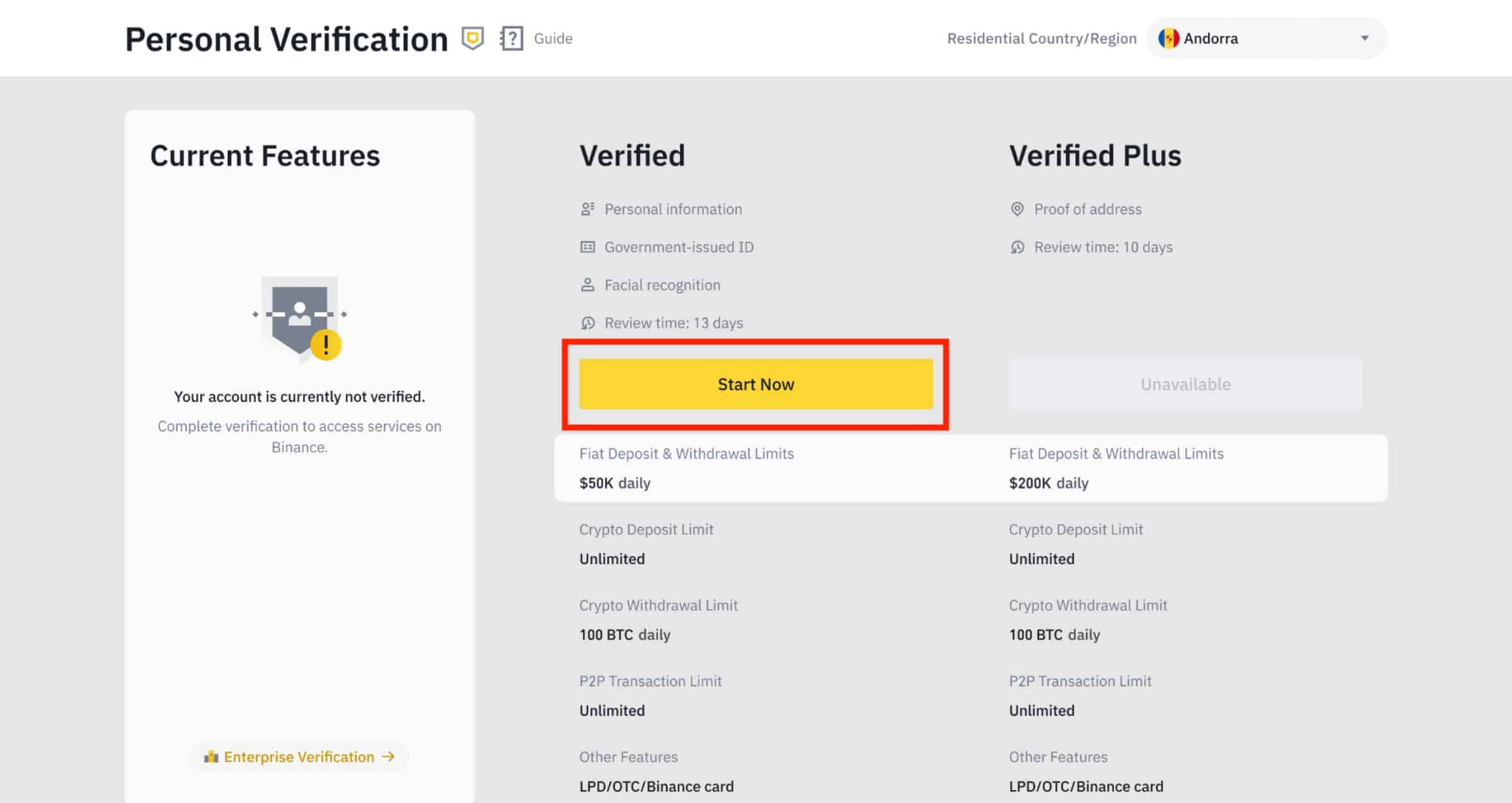

Step 1: Log in to your Binance account and click “User Center” and then “Identification”.

Step 2: click “Start Now” to verify your account.

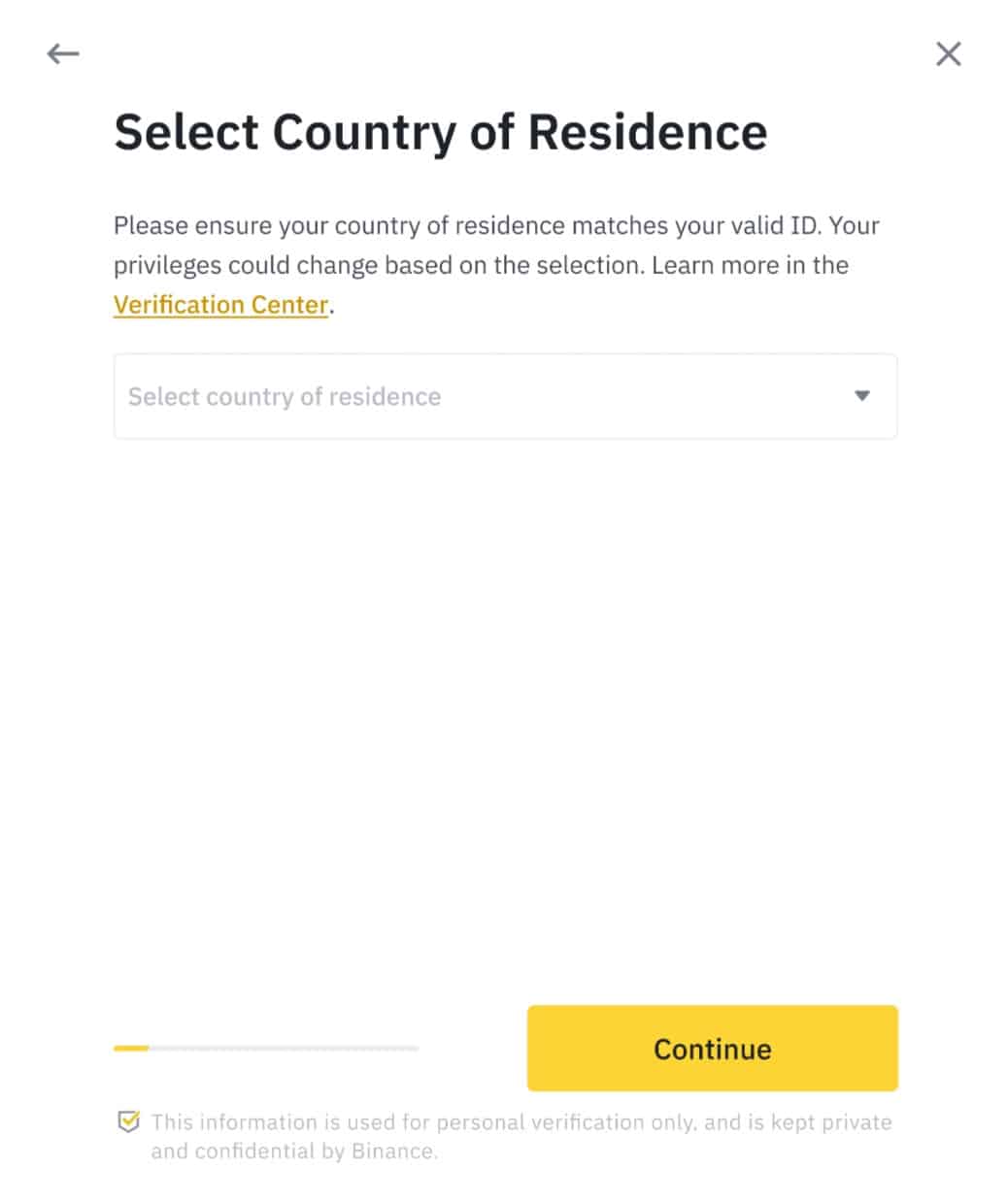

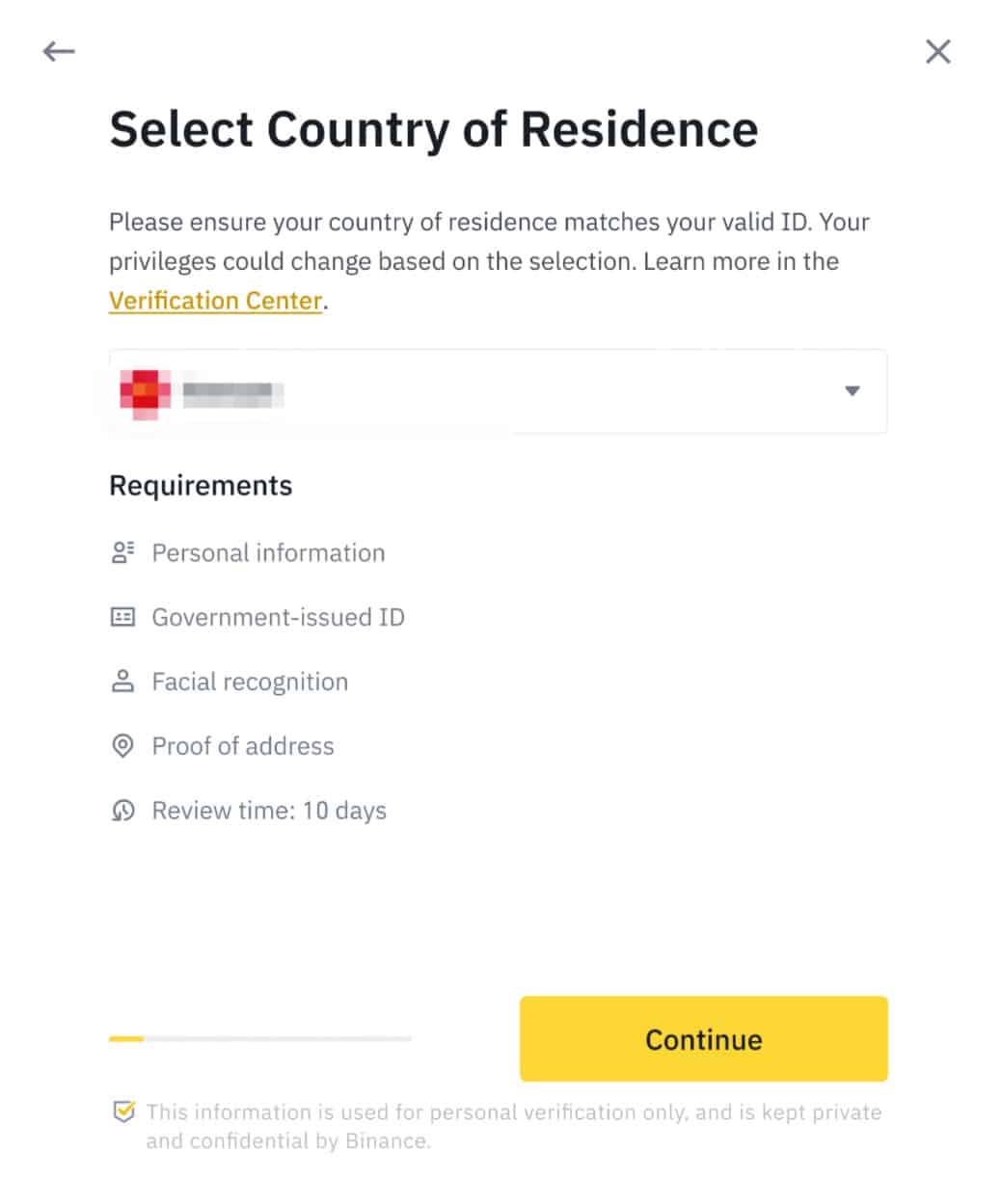

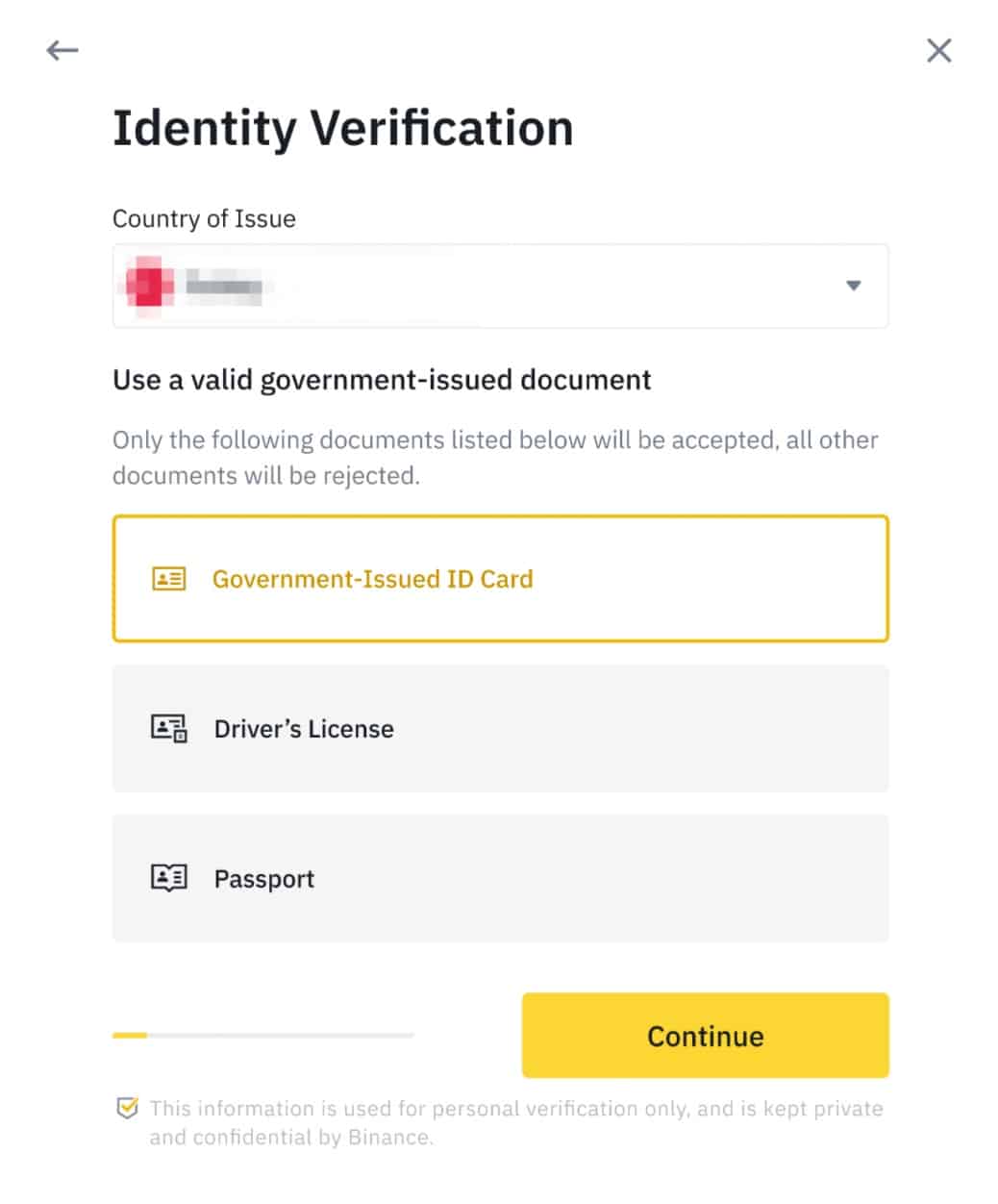

Step 3: Select your country of residence.

Ensure that your country of residence is consistent with your ID documents.

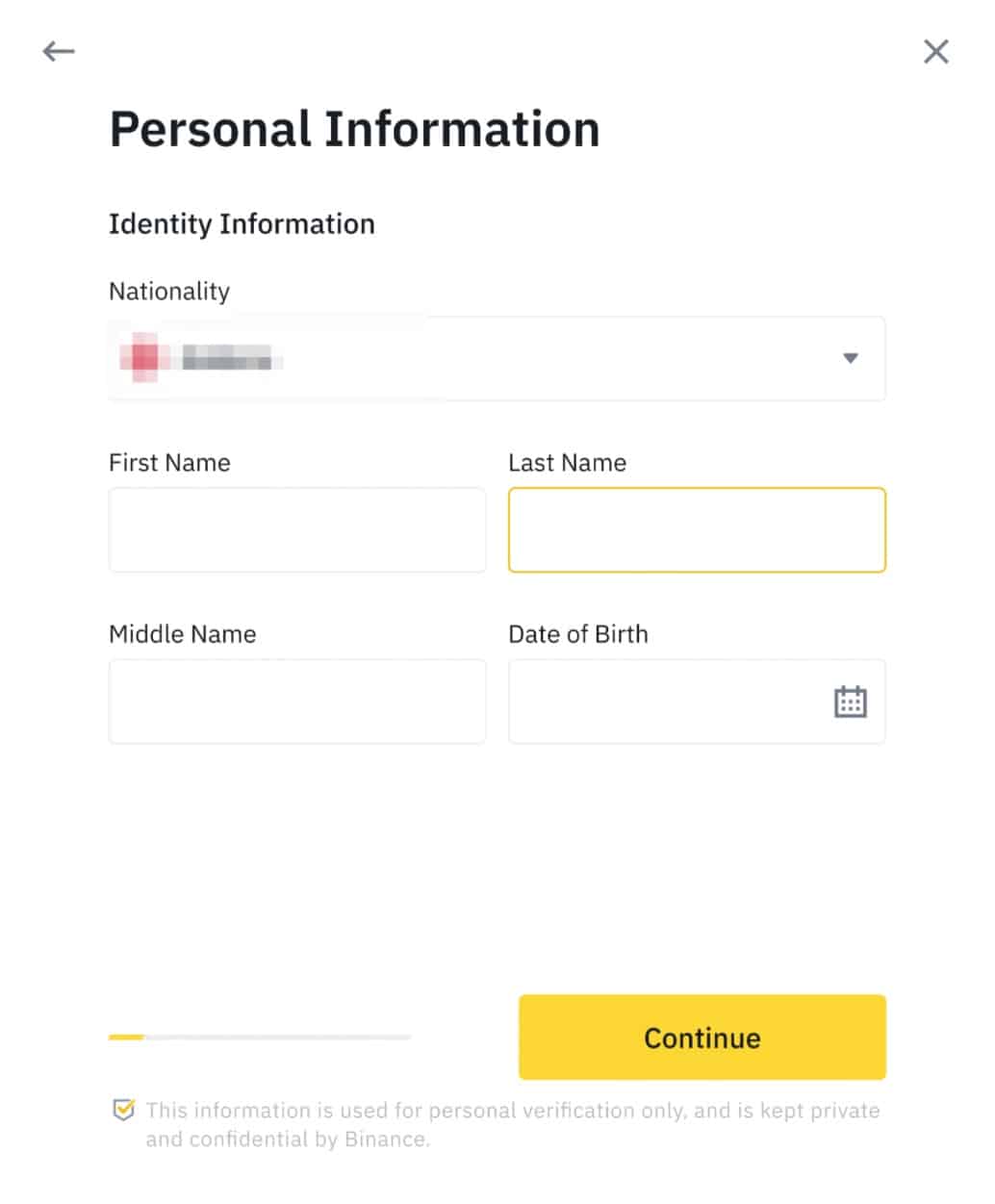

Step 5: Enter your personal information and click “Continue.”

You won’t be able to change it once confirmed.

Refer to the respective options offered for your country.

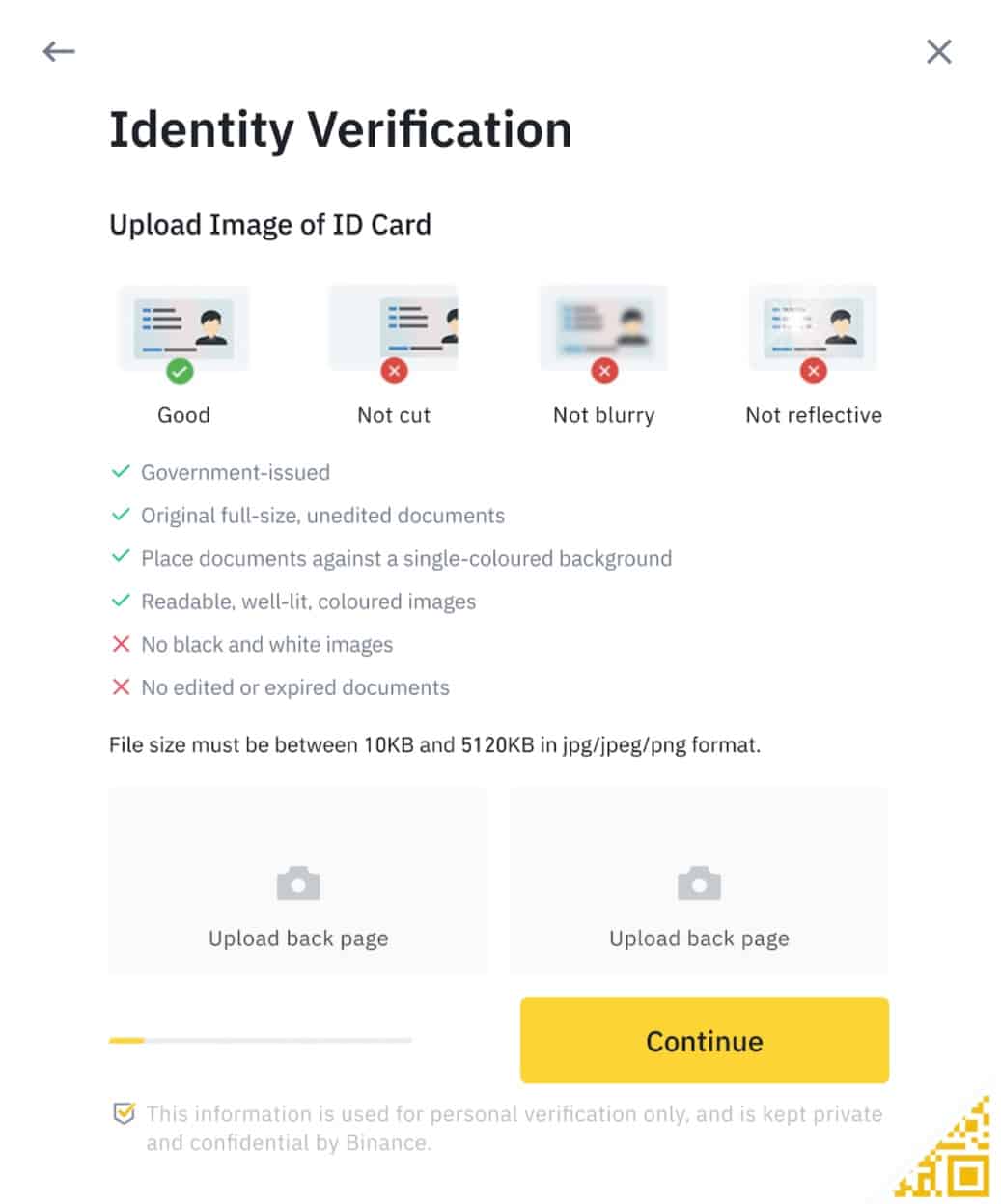

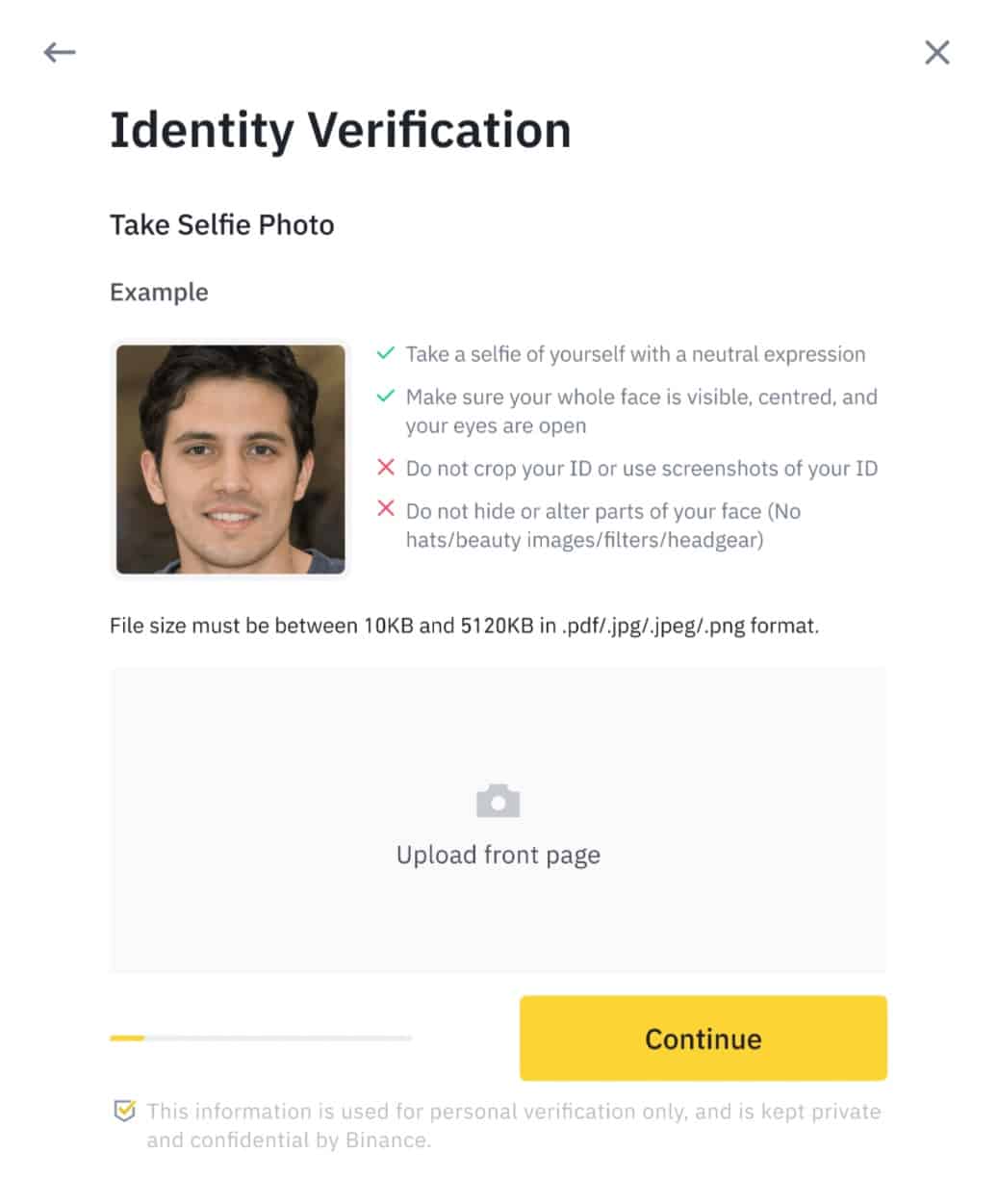

Step 7: Follow the instructions to upload photos of your document. Your photos should clearly show the full ID document.

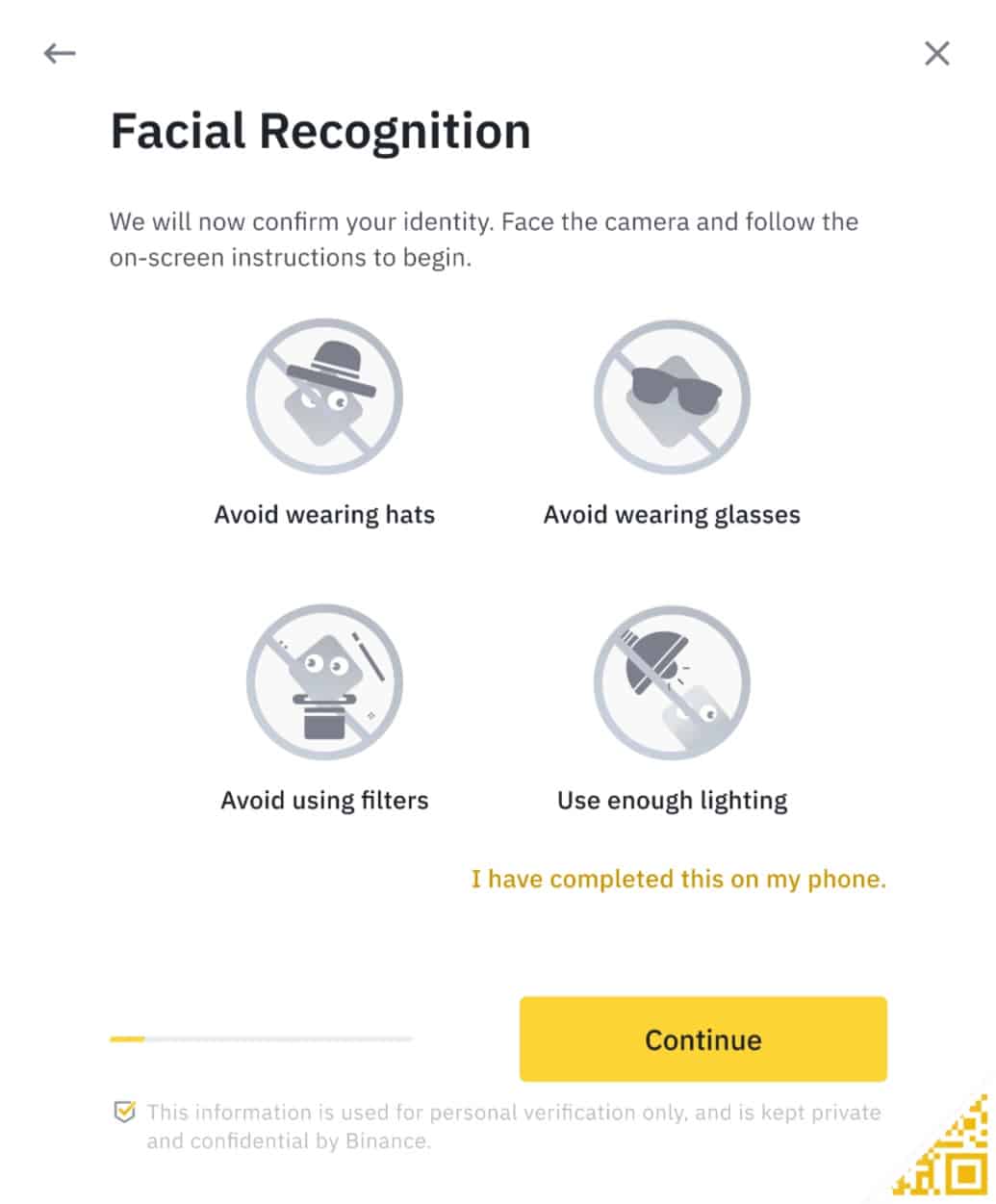

Do not wear hats, glasses, or use filters, and make sure that the lighting is sufficient.

Once your application has been verified, you will receive an email notification.

How to buy cryptocurrency on Binance

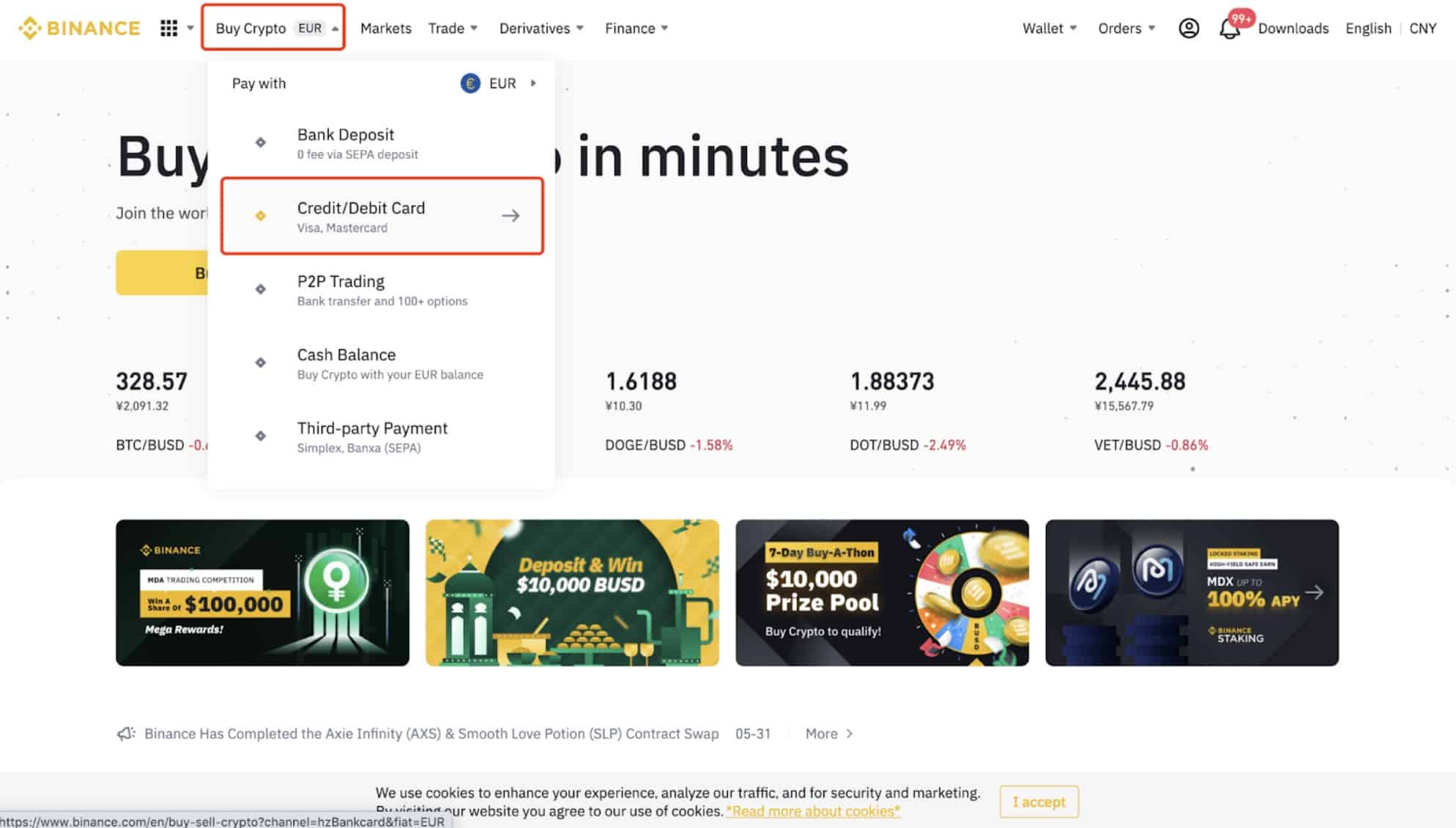

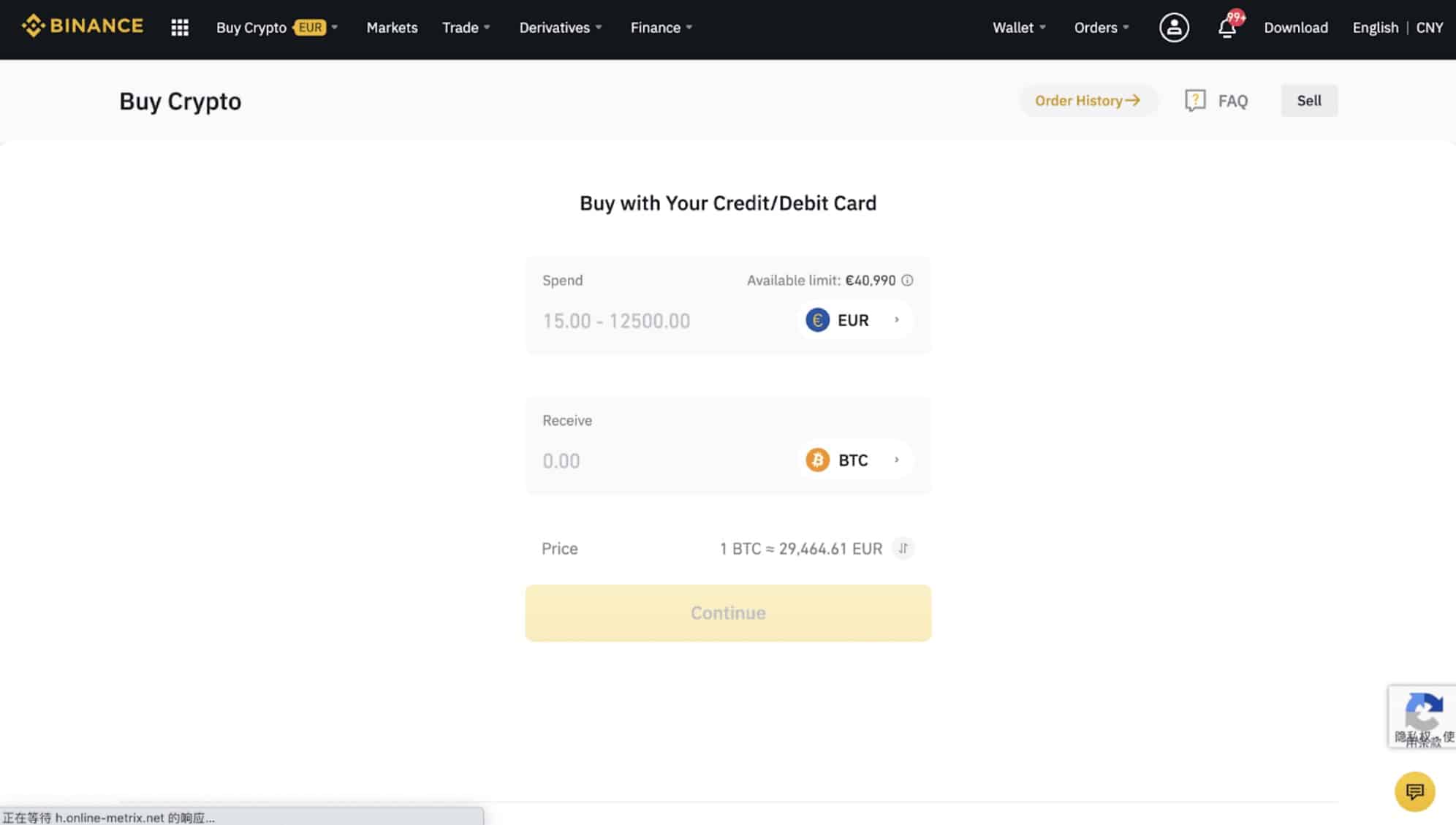

Step 1: Log in to your Binance account and click “Buy Crypto” and then “Credit/Debit Card”.

Step 2: Here you can choose to buy crypto with different fiat currencies. Enter the fiat amount you want to spend and the system will automatically display the amount of crypto you can get. When you have selected the amount you wish to spend then press “Continue”.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

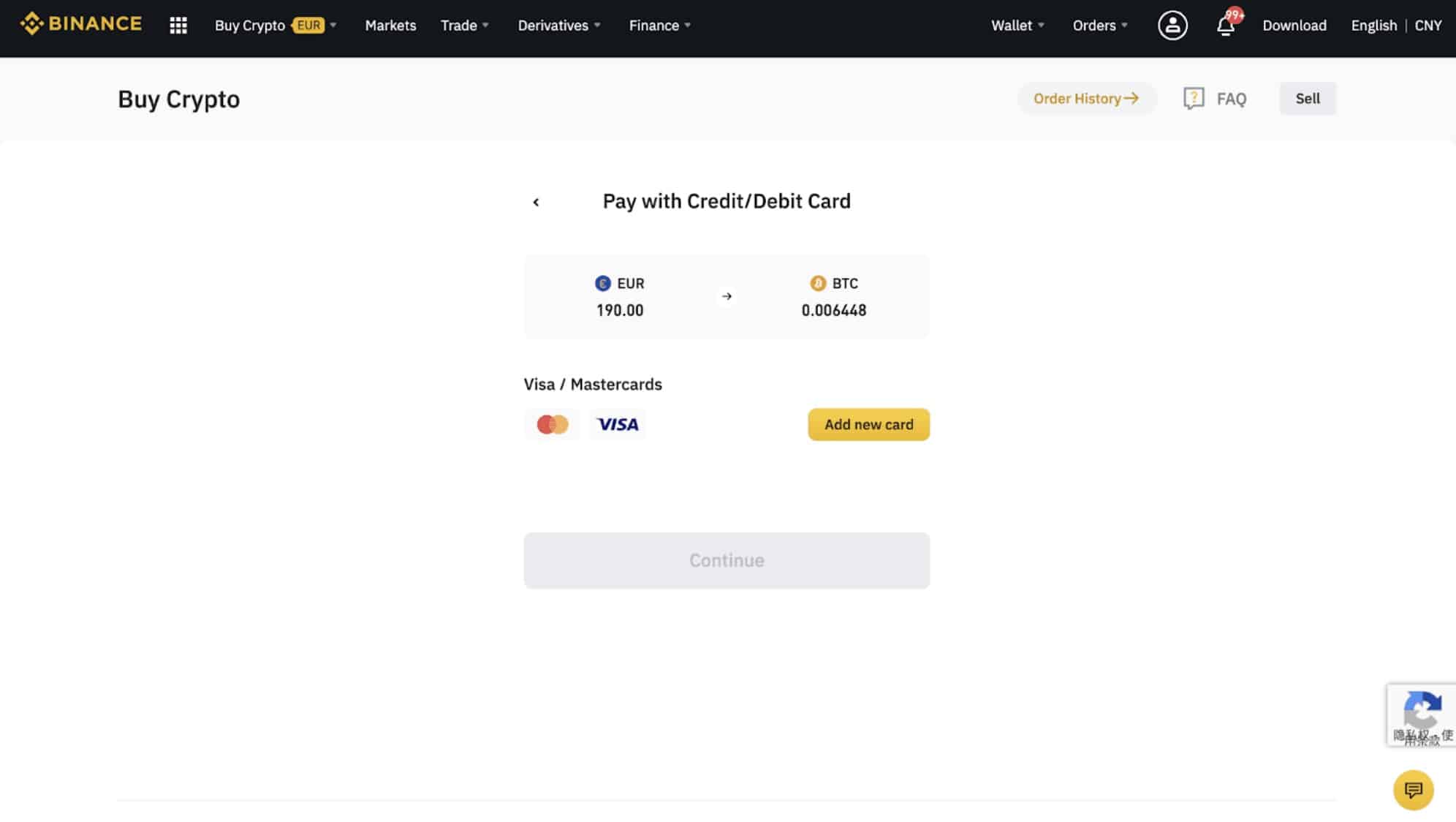

Step 3: Click “Add New Card”. Then enter your credit card details and your billing address.

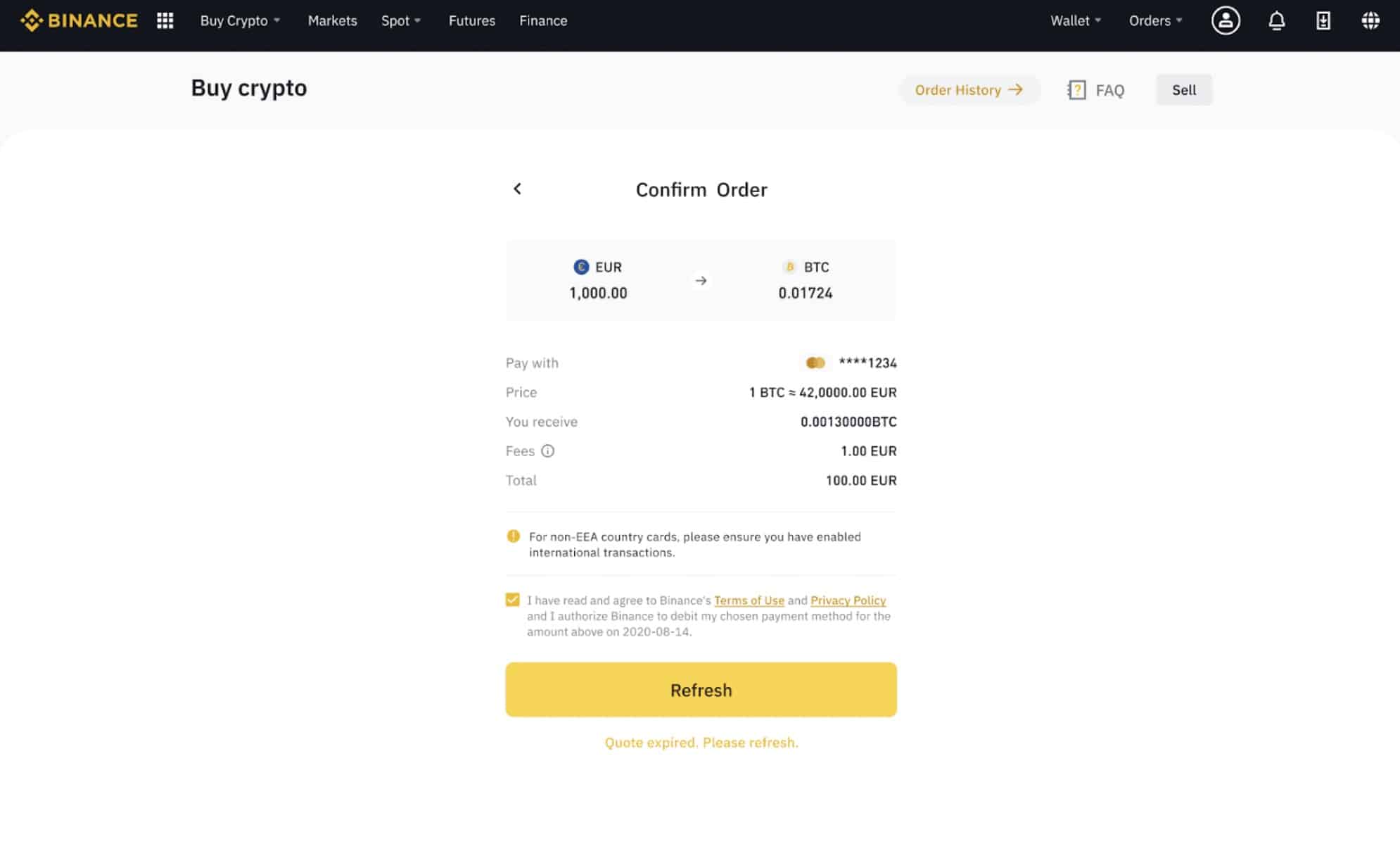

Step 4: Check the payment details and confirm your order within 1 minute. After 1 minute, the price and the amount of crypto you will get will be recalculated. You can click “Refresh” to see the latest market price. You will then be redirected to your bank’s OTP Transaction Page. Follow the on-screen instructions to verify the payment.

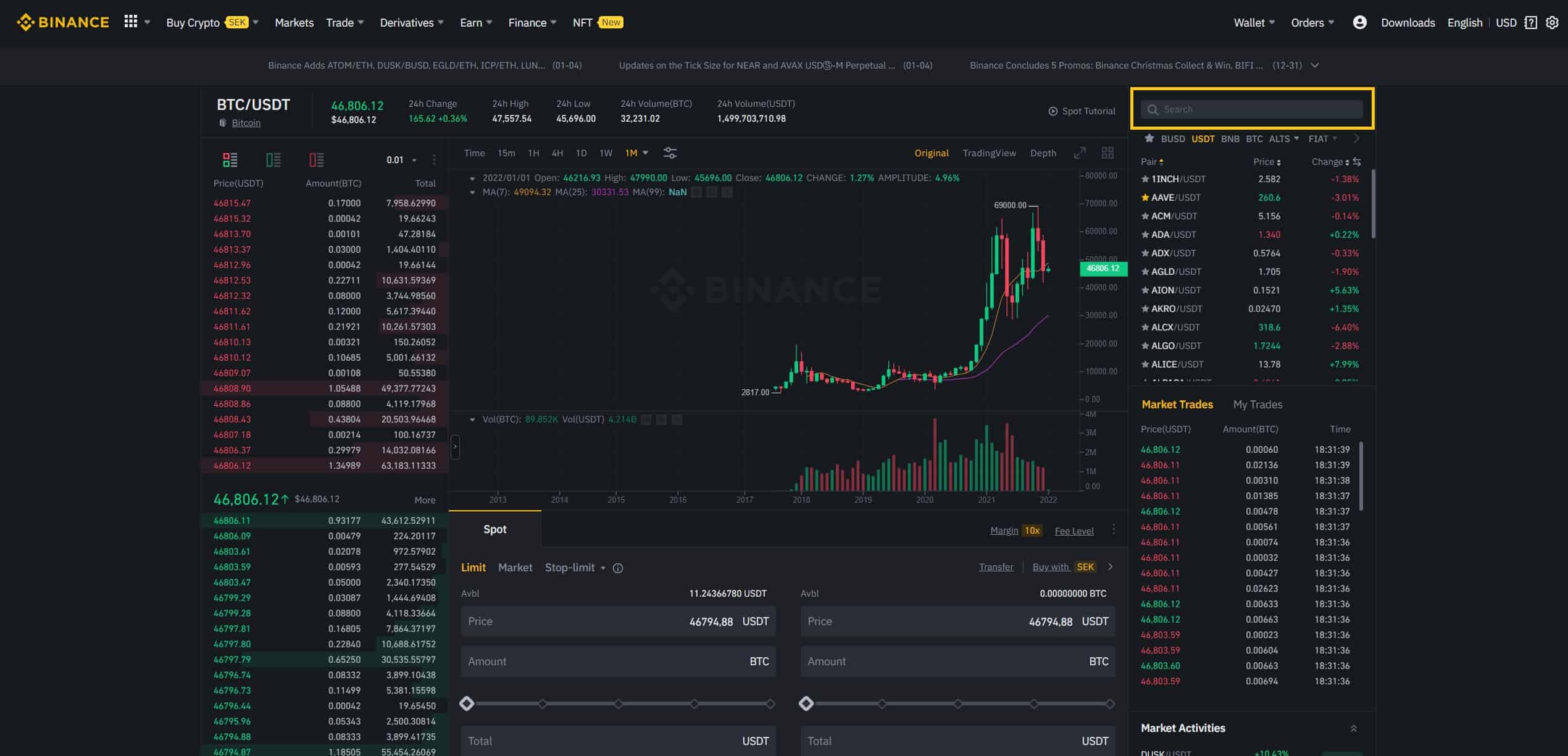

How to Conduct Spot Trading on Binance

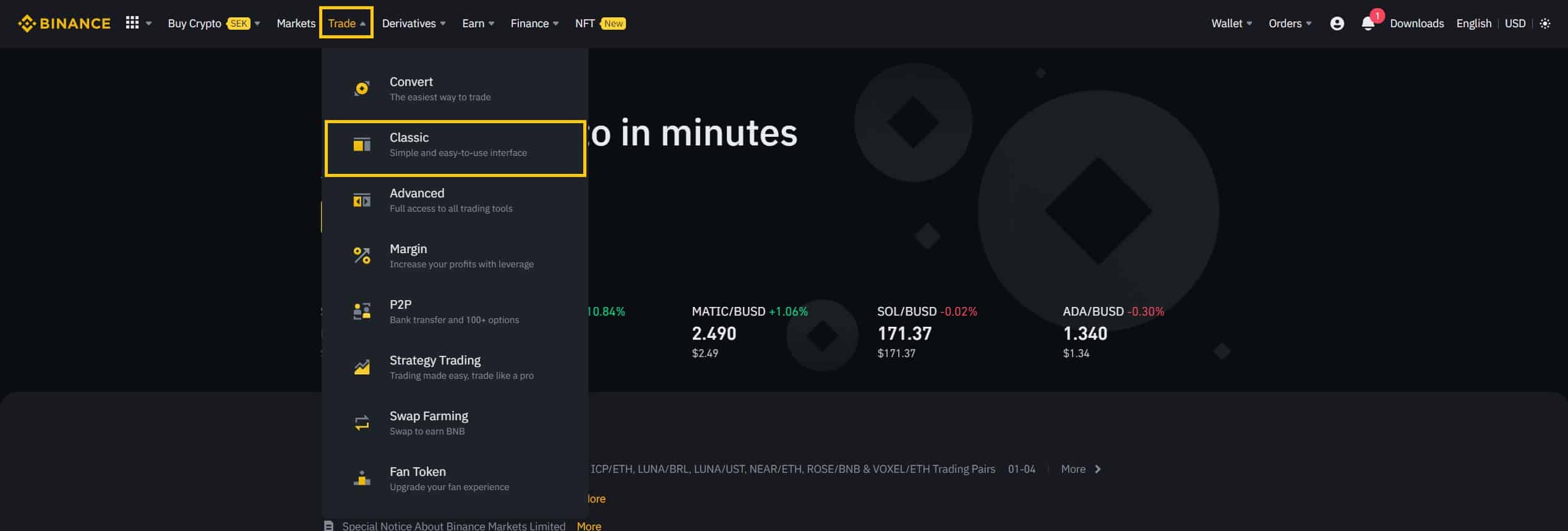

Step 1: Log in to your Binance account.

Click on “Classic” under “Trade” on the top navigation bar.

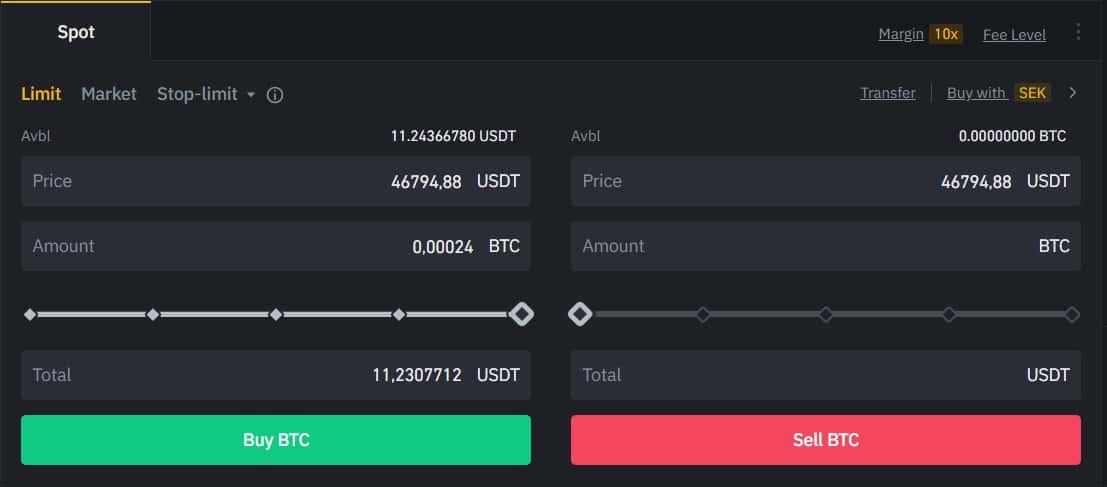

Step 2: Search and enter the cryptocurrency you want to trade.

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

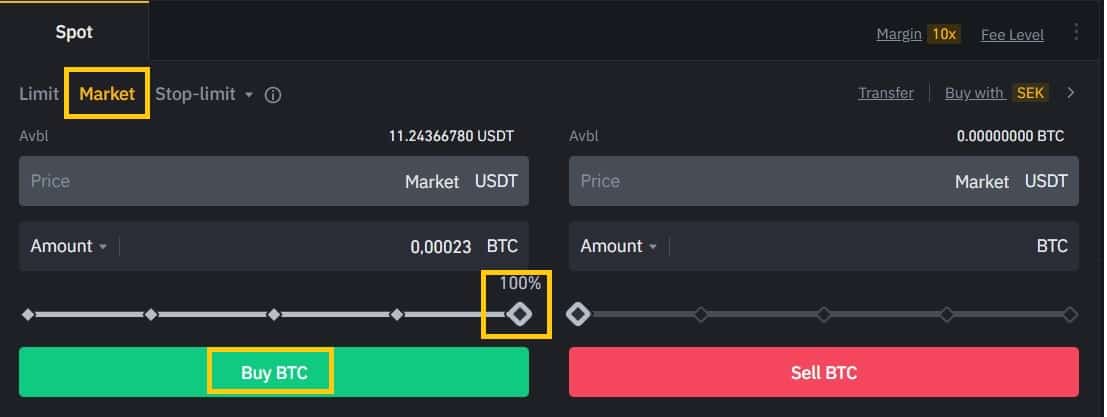

Step 4: If you don’t want to set a manual price, you can place a “Market Order” to set the buying/selling price automatically.

Hide Detailed Instructions

For more in-depth instructions, our ‘Absolute Beginner’s Guide To Cryptocurrency Investing‘ will take you through the process step-by step. In addition to providing instructions for sending and receiving your cryptocurrency.

And if you’re completely new to crypto our beginner, intermediate and advanced level articles will get you up to speed with everything you need to know about the cryptocurrency space starting out.

What is Bytom (BTM)?

Bytom is a blockchain system that can be used for financial and digital asset applications. Individuals and businesses alike can use the Bytom protocol to register and exchange not only digital assets (such as Bitcoin), but also traditional assets (i.e., securities, bonds, or even intelligence data).

At the heart of the Bytom project is its namesake chain which allows organizations and individual users to build and deploy peer-to-peer financial applications aimed at easier registration and exchange of digital and traditional physical assets. This will be accomplished with the assistance of the Bytom blockchain protocol and the Bytom token (BTM), both of which are components of the ecosystem in which the Bytom team hopes to lay the groundwork for a future asset-based Internet. All digital assets are supposed to be tokenized and managed as part of a single layer in this global network, while individual by-assets would exist on their own chains operating as parts of the larger Bytom network.

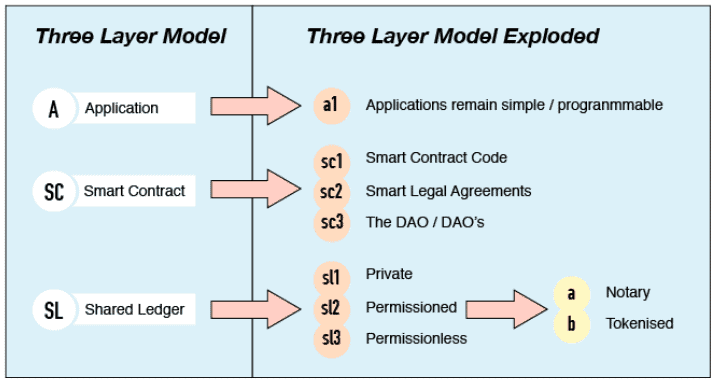

Bitcoin is a single-layer cryptocurrency, whereas Ethereum is a dual-layer blockchain that includes smart contracts and decentralized applications (dApps). Bytom goes a step further with a three-layer approach. Data transactions occur on one layer, transmissions on another, and asset interaction occurs on the third.

The Bytom chain project was founded after its creators determined that emerging blockchain technology could be useful in assisting users in gaining more control over their digital assets, at a time when the latter have nearly surpassed traditional physical assets in terms of value and accessibility. The main task of the Bytom project, which is supposed to bring together the best of both worlds, is to bridge the domains of traditional assets such as bonds, securities, or valuable data with those of digital origin (such as cryptocurrencies).

Tokenization of traditional assets is a growing trend that is being stifled by a lack of platforms that allow for easy mapping of assets that exist in both the digital and physical worlds. Real-world assets are increasingly being converted into tokens, aided by the rise of new technologies such as big data, with various deeds and transaction ledgers finding a home on the blockchain. The Bytom chain aims to enable users to complete all tokenization-related operations on a single platform, such as asset registration, settlement, transaction management, and so on.

How does Bytom work?

The Bytom architecture is separated into three layers: Application, Contract, and Ledger.

As an end user, you interact with the Application Layer. This includes any mobile or web apps that you use to manage your assets. Interacting with this layer causes contract calls to be made to, you guessed it, the Contract Layer.

There are two kinds of contracts in the Contract Layer. The Genesis Contract is responsible for issuing and auditing other smart contracts on the network. More importantly, it ensures that all assets using Bytom follow the protocol’s standardization rules.

The General Contract follows with two functions that are similar. The first function facilitates asset trading among protocol users. The second is in charge of setting up and verifying dividend distributions. To deploy a new asset via the General Contract, you must first send it to the Genesis Contract for approval.

Finally, the Ledger Layer serves as the foundation of the Bytom protocol. Bytom connects to the blockchain at this point. This blockchain has no permissions, is open to the public, and employs a Proof-of-Work (PoW) consensus algorithm. Unlike some other PoW projects, you can mine on the network with an ASIC, and the team even encourages it in their whitepaper.

In addition to enabling cross-chain interaction for asset management, Bytom wishes to assuage users who are concerned about the potential overloading of the network due to transaction verification requirements. To address this, Bytom developed the “compact verification” system. By using Merkle proof technology, Bytom can verify only relevant transactions, eliminating the need to check all transactions in a block.

At the same time, Bytom differs from Ethereum in that its BUTXO system supports parallel transaction verification. This will be accomplished through the use of a mechanism that allows only one transaction to quote each unspent output. This system should also prevent double-spends and other forms of fraud. The Bytom platform bills itself as a lighter solution than Ethereum, for example, because participants only need to remember the unspent outputs while the trading process itself provides for other relevant data such as asset ID.

Finally, the platform intends to fully implement the Open Data Index Name (ODIN) standards, which should ensure asset uniqueness across its platform. Instead of keeping a record of a character string, ODIN’s naming index is based on the blockchain height.

What is the BTM Token?

The Bytom Token (BTM) has three main uses in the Bytom ecosystem:

- Transaction fees

- Dividends

- Asset issuance deposits

There are currently 987 million BTM in circulation, with a total supply of 2.1 billion entering the market via mining. The team distributed 30% of the supply to ICO participants and created a mining reward pool with 33% of the total supply. The remaining tokens are being held in reserve, used for business development, or have been distributed to private investors.

Who are the founders of Bytom (BTM)?

The Bytom team is based in China and includes some heavy hitters in the blockchain space. Founder Chang Jia left the world of science fiction writing to found 8btc, one of China’s largest Bitcoin and blockchain news sites.

Duan Xinxing, the other founding partner, is the former Vice President of OKCoin, one of the world’s largest digital asset exchanges.

Since the project’s inception in January 2017, the team has made steady progress. They released their first testnet in September of that year, and the first version of the mainnet was released at the end of April of this year. The project has also officially passed the Howey Test, indicating that the token will not be classified as a security by the SEC.

There aren’t many other projects attempting to achieve the same objectives as Bytom. Ravencoin is another (currently much smaller) project that aims to improve asset transfers. Ravencoin, unlike Bytom, is ASIC-resistant. Projects that tokenize gaming assets, such as WAX and Enjin Coin, can also be viewed as competitors. Despite beginning in the gaming industry, the project teams intend to expand into other types of assets as well.

Bytom development updates in 2023

Bytom (BTM) has undergone several significant developments in 2023, marking a substantial evolution in its blockchain platform and ecosystem. Here’s an overview of the most notable updates:

-

Release of a New Whitepaper: Bytom has announced plans to introduce a new strategy and release an updated whitepaper on November 17, 2023. This whitepaper is expected to outline the platform’s innovative strategy and future trajectory, indicating a significant step in Bytom’s development.

-

Bytom 2.0 Roadmap: The Bytom 2.0 Roadmap has been released, marking a new era for the platform. This roadmap outlines several key steps, including “Earth Engine,” “Stop Rotation,” and “Driving out of the Solar System.” These steps are indicative of the platform’s ambitious plans for expansion and innovation.

-

Key Technological Advancements: Bytom has made several technological improvements, including:

- The introduction of an innovative PoS + BBFT consensus algorithm, which reduces average confirmation time to as low as 6 seconds.

- The development of a new smart contract platform and ecosystem.

- Initiatives in decentralized finance (DeFi) and the Metaverse, including standard application protocols and the creation of NFTs.

- A scalable cross-chain system for efficient asset transfer between Bytom and other blockchains.

- A robust oracle system that allows consensus nodes to become oracle service nodes.

-

Economic Model Reformation: Bytom 2.0 features a reformed economic model, characterized by a lower total supply of tokens, reduced inflation, and higher node rewards. This model aims to enhance the utility of BTM in governance, basic services, node campaigns, and other scenarios.

These developments signify Bytom’s continued commitment to innovation and its role in the evolving blockchain and cryptocurrency landscape. The platform’s focus on new technologies and economic models is poised to enhance its appeal and utility in the blockchain community.

Official website: https://bytom.io/

Best cryptocurrency wallet for Bytom (BTM)

There are plenty of different crypto wallets available. The best one for you depends on your general trading habits and which provides the most security in your situation. There are two main types of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical). Both have their pros and cons, and there is not necessarily a right or wrong answer when it comes to figuring out which crypto wallet is best for you.

HOW DO I DECIDE WHICH cryptocurrency WALLET TO USE for Bytom (BTM)?

Deciding which type of wallet to use depends on a variety of factors, including:

- How often you trade. In general, hot wallets are better for more active cryptocurrency traders. Quick login ability means you are only a few clicks and taps away from buying and selling crypto. Cold wallets are better suited for those looking to make less frequent trades.

- What you want to trade. As mentioned earlier, not all wallets support all types of cryptocurrencies. However, some of the best crypto wallets have the power to trade hundreds of different currencies, providing more of a one-size-fits-all experience.

- Your peace of mind. For those worried about hacking, having a physical cold wallet stored in a safe deposit box at the bank or somewhere at home, provides the safest, most secure option. Others might be confident in their ability to keep their hot wallets secure.

- How much it costs. It is important to investigate the costs associated with each wallet. Many hot wallets will be free to set up. Meanwhile, cold wallets, like any piece of hardware, will cost money to purchase.

- What it can do. While the basics of each cryptocurrency wallet are the same, additional features can help set them apart. This is especially true of hot wallets, many of which come with advanced reporting features, insights into the crypto market, the ability to convert cryptocurrencies and more. Security features can also be a good differentiator.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re going to be dealing in larger volumes of crypto, investing in cold storage might prove advantageous.

Most widespead examples of this being the Ledger Nano and the Trezor.

Ledger manufactures cold storage wallets designed for users who want increased security. Their wallets are a physical device that connects to your computer. Only when the device is connected can you send your cryptocurrency from it. Ledger offers a variety of products, such as the Ledger Nano S and the Ledger Nano X (a bluetooth connected hardware wallet).

Trezor is a pioneering hardware wallet company. The combination of world-class security with an intuitive interface and compatibility with other desktop wallets, makes it ideal for beginners and experts alike. The company has gained a lot of the Bitcoin community’s respect over the years. Trezor offers two main models – The Trezor One and Trezor Model T (which has a built in touch screen).

Bytom (BTM) Price & Charts

- Market Capitalization And Daily Trading Volume

- Current Market Price Of Every Cryptocurrency Relative To USD (And Some Local Currencies)

- Circulating And Total Supply

- Historical Charts With Prices Relative To USD, Bitcoin (BTC), And Ethereum (ETH).