How to buy Creditcoin (CTC): A Simple Guide

In this comprehensive guide to Creditcoin (CTC), we will delve deeper into the intricate workings of the project, and also offer practical advice on how to buy and securely store your Creditcoin (CTC) tokens. Understanding the context of Creditcoin’s creation, its underlying technology, and its mission are essential to appreciate the value it brings to the ecosystem, giving you the knowledge and confidence to join the Creditcoin (CTC) community.

Where to buy Creditcoin (CTC)?

Buying Creditcoin (CTC) involves a three-step process. First, set up an account on a reputable cryptocurrency exchange that supports Creditcoin (CTC). Next, deposit funds into your account, taking into consideration the different fee structures associated with various payment methods such as credit and debit cards, e-wallets, and direct bank transfers. Lastly, purchase Creditcoin (CTC) on the exchange by inputting the amount you wish to spend, with the platform calculating the equivalent amount of Creditcoin (CTC) based on the current market rate. We recommend buying Creditcoin (CTC) on any of the following cryptocurrency exchanges:

1

Bybit

Fees (Maker/Taker) 0.1%*-0.1%*

Cryptocurrencies

Available for Trade 400+

Sign-up bonus

$30,000 sign-up bonus*

Available in

Europe, Asia, Oceania, Africa

2

MEXC

Fees (Maker/Taker) 0.2%*-0.2%*

Cryptocurrencies

Available for Trade 1500+

Sign-up bonus

10% reduced trading fees & up to $170 in USDT vouchers*

Available in

North America, South America, Europe, Asia, Oceania, Africa

Understanding Creditcoin (CTC):

An In-depth Guide to Its Features and Use Cases

Website: https://creditcoin.org/

Twitter: https://twitter.com/creditcoin

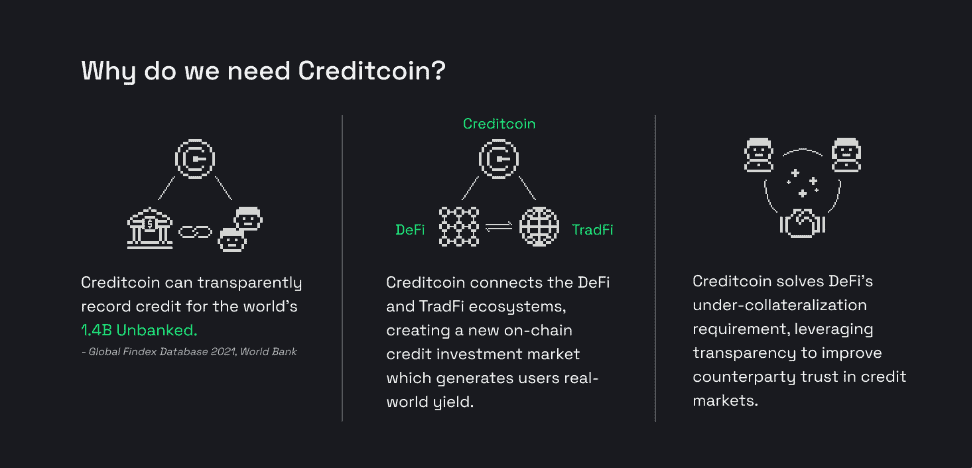

Creditcoin (CTC) is a revolutionary interoperable blockchain-agnostic lending protocol aimed at matching and recording cryptocurrency bullet-loan transactions. By functioning as a connecting bridge, Creditcoin unites investors or lenders with fundraisers or borrowers who are on the lookout for corresponding loan conditions, such as specific interest rates and maturity dates.

After matching parties with congruent loan conditions, Creditcoin allows them to view the credit transaction history of any matched partners. This facilitates a comprehensive evaluation of potential investment decisions. The power of choice resides in the hands of the involved parties, and upon agreeing to a match, they can settle their transactions on separate blockchain platforms, like BTC, Ethereum, ERC20, and Gluwacoin.

The complete loan process, including loan conditions and repayment records, is meticulously documented on Creditcoin. This is accomplished by mining nodes that use a specialized plugin to monitor the separate chains where the transactions occur. The result is an immutable record that acts as an unwavering testament to the credit transaction history for every loan and wallet.

However, the unique system of Creditcoin goes beyond mere transaction recording. Every announcement to the Creditcoin blockchain incurs a cost in CTC, its native currency. Creditcoin’s robust framework supports various functions that enable users to lend, borrow, and repay cryptocurrencies; access other users for financial transactions; trust and verify transaction history; view a decentralized public history of credit transactions; validate transactions through mining, receiving Creditcoin in return; and provide an open lending infrastructure that includes features like identification credentialing and credit scoring.

How does Creditcoin (CTC) work?

Creditcoin aims to address some fundamental challenges in real-world lending by reducing both the costs of verification and networking. Let’s delve into how Creditcoin functions to solve these problems.

Reducing the Costs of Verification: Trust in lending is traditionally built upon reliable market information, especially credit history. Creditcoin provides a transparent blockchain where on-chain credit transactions are recorded. This allows for the creation of an immutable, secure, and open credit transaction data pool, enhancing the verification and risk assessment processes. Even without access to a bank, individuals can build credit history through their crypto wallets if they are compatible with Creditcoin, which makes the system accessible to the unbanked population.

Creditcoin ensures the high reliability of recorded data, allowing lending intermediaries to assess the risk profiles of potential borrowers. This transparent credit history also helps in raising further lending capital, reducing counterparty risk, building trust, and allowing efficient capital flow into lending intermediaries. Additionally, programmable money or smart-contracts add further enforcement mechanisms to the Creditcoin ecosystem.

Reducing the Costs of Networking: The network effects describe the added economic value a network offers as its user base grows. However, these effects on centralized platforms can create monopolistic leverage. Creditcoin seeks to decentralize data, bypassing these network effects in the traditional credit system. By giving control of accumulated credit history to individuals, Creditcoin enables open competition for funding, investment, and application building, free from centralized control.

By broadening market information and access, Creditcoin increases the potential for competition and investment products, ultimately benefiting borrowers and lending intermediaries. It creates a reputational incentive for repayment, thereby reducing loan default rates and facilitating overall lending volume increases.

Furthermore, transparent networks like Creditcoin have broader positive macroeconomic effects. They reduce the likelihood of banking crises, especially in developing countries, by moderating risky loans. Creditcoin’s transparent international credit history standard can contribute to a more stable global financial system.

As the first open credit network, Creditcoin aligns itself with the legacy of innovation exhibited by the internet, Bitcoin, and Ethereum. By striving to create an accessible, transparent, and decentralized credit platform, Creditcoin lays the foundation for a new era in lending and borrowing, heralding the transformation of traditional financial structures.

Creditcoin Tokenomics

Total Supply and Dual-Token Structure

The Creditcoin tokenomics encompasses a total supply of 2 billion tokens, with a token sale capped at 200 million tokens, constituting 10% of the total supply. There are two distinct tokens in the ecosystem: CTC and G-CRE. CTC is the Creditcoin mainnet token utilized for transaction fees and mining rewards on the Creditcoin’s Substrate blockchain network. G-CRE, an ERC-20 token, functions as a trading and vesting token and can be exchanged for CTC using a one-way hook.

CTC Utility and Unique Token Model

CTC’s utility within the Creditcoin network is multifaceted. Used as a transaction fee, CTC is locked on the network for roughly a year, after which it’s returned to the user, thereby buying a permanent right to use the network. This approach was designed to minimize price volatility and uncertainty for parties transacting on Creditcoin. Over time, traditional transaction fees might be introduced to incentivize node operators as mining rewards decrease.

G-CRE’s Role and Limitations

G-CRE serves as a vesting and trading token within the Creditcoin ecosystem and cannot be directly used on the Creditcoin mainnet. While the Creditcoin token model seeks to reduce utility token price uncertainty, it doesn’t wholly mitigate it, particularly affecting short-term users. There’s a risk of short-term flexibility problems, especially for entities like credit unions that may experience sudden changes in demand.

Proposed Solution for Flexibility

To address the short-term flexibility issue, preliminary plans are in place to introduce a secondary market for CTC staking. In this model, CTC owners can lend their transaction capacity to others for a fee, enabling them to earn interest on their fixed CTC capital. This solution fosters a dynamic environment where parties can rent or purchase CTC, allowing both short-term and long-term transaction capacity decisions, thus providing the needed certainty.

Creditcoin Distribution and Allocation

Creditcoin’s distribution strategy covers four main participant groups: 70% to miners, 15% to Gluwa Inc., 10% to investors, and 5% to the Creditcoin Foundation. The tokens are distributed with a specific vesting schedule, ranging from 6 months for investors to 6 years for Gluwa Inc. and the Creditcoin Foundation. Investor discounts are also applied, depending on the vesting period, up to a maximum of 20% for a 3-year vesting term.

Conclusion and Impact

The Creditcoin tokenomics facilitates a decentralized credit investment economy, intertwining lenders and borrowers through an immutable blockchain. With distinct tokens for various purposes, coupled with unique features like the right to permanent network use and proposed staking solutions, Creditcoin aims to create a robust ecosystem. The allocation and vesting schemes are designed to encourage long-term engagement, governance, and community building, reflecting the strategic thinking underpinning the Creditcoin network.

Creditcoin development updates in 2023

Creditcoin has made substantial progress in 2023, marking significant milestones in its roadmap and offering new features to its users. Here’s an overview of the most important developments:

-

Transition to Proof-of-Stake (PoS): Creditcoin transitioned to a Proof-of-Stake consensus mechanism in 2023. This change enhances network security and decentralization while significantly reducing energy consumption.

-

Creditcoin 2.0+ Mainnet Launch: The launch of Creditcoin 2.0+ was a major event. It introduced faster block times and a reduced token issuance structure, optimizing the network for real-world asset investing.

-

G-CRE to CTC Swap Interface: Following the 2.0+ update, a new swap interface was introduced, allowing users to convert their ERC20 tokens to mainnet CTC tokens and participate in Creditcoin staking.

-

Development and Release of Creditcoin 3.0: The roadmap included the completion of Creditcoin 3.0 research and the beginning of its development, focusing on consensus and oracle implementation. The technical paper for Creditcoin 3.0 was also released, outlining its technical design and new features.

-

Creditcoin 3.0 Testnet Launch: Slated for the first quarter of 2024, the Creditcoin 3.0 testnet launch is an important step towards the next-generation multichain update.

-

NFT Integrations: The Credit Penguin Colony Collection was launched, alongside updates to the utility features of existing NFT collections like Cactus and Cherry Blossom. Special events and benefits were planned for NFT holders.

-

GATE Token and GatewayDAO Deployment: The GATE token and GatewayDAO are being incorporated into Creditcoin 3.0, aiming to simplify the customer experience with multi-chain protocols and introduce new features focused on real-world asset investment.

-

Block Explorer Updates: Updates to the Block Explorer and other improvements have been slated for after the release of Creditcoin 2.0+, ensuring alignment with the network’s architectural changes.

-

Creditcoin Foundation’s Engagement in CTC Staking: The Creditcoin Foundation is actively involved in CTC staking, both in its current state and post the launch of Creditcoin 2.0+, to ensure the network’s stability and security.

-

Clarification on CTC Supply: Creditcoin has clarified its token supply, particularly the maximum issuance of 600 million tokens for CTC (G-CRE | ERC-20), which are listed on exchanges. This clarification came in response to a recent designation investment warning issued for the CTC token on the Bithumb crypto exchange.

These updates collectively represent significant strides towards improving Creditcoin’s functionality and appeal to a broader user base, especially in the realm of interoperable cross-chain credit markets.

How to safely store your Creditcoin (CTC) Tokens

Best cryptocurrency wallet for Creditcoin (CTC)

Navigating the world of cryptocurrency wallets can be quite an adventure, as there are numerous options available to suit different needs. To find the perfect wallet for you, consider your trading habits and the level of security you require. Generally, there are two main categories of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical).

Each type of wallet comes with its own set of advantages and drawbacks, so there isn’t necessarily a one-size-fits-all solution. As you embark on your journey to find the best crypto wallet for your Creditcoin (CTC) tokens, remember to keep an open mind and explore the features that align with your personal preferences and requirements.

When choosing the right wallet for your Creditcoin (CTC) tokens, consider the following factors:

- Trading frequency: Hot wallets are generally more suitable for active traders due to their quick login capabilities, allowing for seamless buying and selling of crypto. Cold wallets, on the other hand, are better suited for those who make less frequent trades.

- Supported cryptocurrencies: Although not all wallets cater to every cryptocurrency, some of the best ones can trade a vast array of currencies, offering a versatile experience. Make sure the wallet you choose supports Creditcoin (CTC).

- Security concerns: If you’re worried about potential hacking incidents, a physical cold wallet stored in a safe deposit box or a secure location at home provides the highest level of protection. However, if you’re confident in safeguarding your hot wallet, you might prefer its convenience.

- Associated costs: Investigate the costs of each wallet option. While many hot wallets are free to set up, cold wallets, being hardware devices, will require an upfront investment.

- Wallet features: While the basic functions of cryptocurrency wallets remain the same, additional features can distinguish one wallet from another. Hot wallets often come with advanced reporting tools, crypto market insights, and currency conversion capabilities. Security features can also be an essential factor when making your decision.

By considering all of these aspects, you’ll be better equipped to select the perfect cryptocurrency wallet for your Creditcoin (CTC) tokens.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re planning to handle larger amounts of crypto, investing in cold storage can be a wise decision. Two of the most popular cold storage options are the Ledger Nano and the Trezor.

Ledger creates cold storage wallets designed for users who prioritize security. Their wallets are physical devices that connect to your computer, and you can only send cryptocurrency from them when they’re connected. Ledger offers a range of products, including the Ledger Nano S and the Ledger Nano X, which features Bluetooth connectivity.

Trezor, a trailblazer in the hardware wallet industry, combines top-notch security with an intuitive interface and compatibility with various desktop wallets. This blend makes it suitable for both beginners and experienced users. Trezor has earned a great deal of respect within the Bitcoin community over time. They offer two primary models – the Trezor One and the Trezor Model T, which comes with a built-in touchscreen.

Creditcoin (CTC) Price & Charts

- Market Capitalization And Daily Trading Volume

- Current Market Price Of Every Cryptocurrency Relative To USD (And Some Local Currencies)

- Circulating And Total Supply

- Historical Charts With Prices Relative To USD, Bitcoin (BTC), And Ethereum (ETH).

Frequently Asked Questions (FAQ)

Where is the best place to buy Creditcoin (CTC)?

We recommend either Bybit, MEXC or Gate.io as these platforms excel in functionality, reputation, security, customer support, and competitive fees.

How to buy Creditcoin (CTC) in Europe?

In Europe, acquiring Creditcoin (CTC) tokens is a seamless process, with numerous reputable cryptocurrency exchange platforms available to cater to your needs. Among the top choices, we recommend Bybit, MEXC, or Gate.io due to their outstanding performance in key areas such as functionality, reputation, security, customer support, and competitive fees.

These platforms have established a strong presence not only in Europe but also globally, offering an extensive range of cryptocurrencies, including Creditcoin (CTC).

How to buy Creditcoin (CTC) in the US?

For the United States, buying Creditcoin (CTC) tokens is also an effortless process, we particularly recommend MEXC, a top-tier exchange that excels in functionality, reputation, security, customer support, and competitive fees.

MEXC has established a strong presence in the US and across the globe, offering a wide range of cryptocurrencies, including Creditcoin (CTC). Catering to US-based customers, MEXC provides a user-friendly interface, responsive customer support, and multiple payment options, making it easy for users throughout the country to invest in digital currencies.

How much does Creditcoin (CTC) cost to buy?

Unlike traditional trading options, cryptocurrency allows for fractional purchases, so you don’t need to buy whole coins. This flexibility means you can begin investing in Creditcoin (CTC) and other digital currencies with an investment as low as $1!

Is it safe to buy Creditcoin (CTC)?

Safeguarding your investments is a joint effort, and adhering to recommended security practices is crucial. The first step to safely buying Creditcoin (CTC) is selecting a reputable exchange known for its reliability and strong security measures. Make sure to choose an exchange with a proven track record and positive reputation in the industry to minimize potential risks.

Is it Possible to Convert Creditcoin (CTC) to Cash?

Absolutely! After choosing your preferred cryptocurrency exchange platform, you can effortlessly convert your Creditcoin (CTC) tokens into cash at the current market rate using the exchange’s user-friendly trading interface.

What is the Creditcoin (CTC) Crypto Price Forecast?

Accurately predicting the Creditcoin (CTC) price for any time frame is challenging, but various fundamental factors offer insight into the token’s potential price fluctuations and volatility. Essential aspects to consider include:

- Adoption Rate – Increased on-chain activity, driven by the growing number of developers and users on the Creditcoin (CTC) platform, may lead to higher demand and value for it. This expansion could also boost investor confidence, prompting more people to buy and hold the tokens.

- Innovative Developments – The introduction of innovative features that improve Creditcoin (CTC)‘s capabilities can make the project more attractive for usage or investment, potentially driving up the token price. Furthermore, the Creditcoin (CTC) cryptocurrency value may experience a surge following announcements of new partnerships and investments in the project.

- Market Sentiment – The overall market outlook significantly impacts Creditcoin (CTC) crypto price trends. A risk-on attitude among global investors encourages buying activity in the crypto market, supporting Creditcoin (CTC)‘s price. On the other hand, bearish or risk-averse sentiment can trigger sell-offs that may negatively affect the price in the market.