How To Buy Lend Flare Token (LFT)?

A common question you often see on social media from crypto beginners is “Where can I buy Lend Flare Token?” Well, you’ll be happy to hear it is actually quite a simple and straightforward process.

Step 1: Create an account on an exchange that supports Lend Flare Token (LFT)

First, you will need to open an account on a cryptocurrency exchange that supports Lend Flare Token (LFT).

We recommend the following based on functionality, reputation, security, support and fees:

In order to sign up, you will need to enter some basic information, such as your email address, password, full name and, in some cases, you might also be asked for a phone number or address.

Note: On specific exchanges, you might need to complete a Know Your Customer (KYC) procedure in order to be able to purchase cryptocurrency. This is most commonly the case with licensed and regulated exchanges.

Step 2: Deposit funds into your account

Many cryptocurrency exchanges will allow you to purchase Lend Flare Token (LFT) with fiat currencies, such as EUR, USD, AUD and others. Furthermore, they will also provide you with multiple deposit methods through which you can fund your fiat account, such as credit and debit cards, ewallets or direct bank transfers.

Note: Some payment methods will have higher fees than others, such as credit card payments. Before funding your fiat account on your chosen exchange, make sure to do your due diligence to find out the fees involved with each payment method to avoid unnecessary costs.

Step 3: Buy Lend Flare Token (LFT)

This process is similar across almost every cryptocurrency exchange. All you have to do is find a navigation bar or a search bar, and search for Lend Flare Token (LFT) or Lend Flare Token (LFT) trading pairs. Look for the section that will allow you to buy Lend Flare Token (LFT), and enter the amount of the cryptocurrency that you want to spend for Lend Flare Token (LFT) or the amount of fiat currency that you want to spend towards buying Lend Flare Token (LFT). The exchange will then calculate the equivalent amount of Lend Flare Token (LFT) based on the current market rate.

Note: Make sure to always double-check your transaction details, such as the amount of Lend Flare Token (LFT) you will be buying as well as the total cost of the purchase before you end up confirming the transaction. Furthermore, many cryptocurrency exchanges will offer you their own proprietary software wallet where you will be storing your cryptocurrencies; however, you can create your own individual software wallet, or purchase a hardware wallet for the highest level of protection.

Alternative ways to buy Lend Flare Token (LFT)

Because the project is very new, it is only offered directly on a select number of exchanges. If you’re not comfortable connecting your bank account to any of these smaller exchanges, or if you cannot connect your bank account to them for geographical reasons. Then you can instead create an account on any of the major exchanges and simply transfer the funds from there.

Out of the major exchanges we recommend the following based on functionality, reputation, security, support and fees:

1

Binance

Fees (Maker/Taker) 0.075%*-0.1%*

Cryptocurrencies

Available for Trade 500+

Sign-up bonus

10% reduced trading fees*

Available in

Europe, Asia, Oceania, Africa

2

Bybit

Fees (Maker/Taker) 0.1%*-0.1%*

Cryptocurrencies

Available for Trade 400+

Sign-up bonus

$30,000 sign-up bonus*

Available in

Europe, Asia, Oceania, Africa

How to create a Binance account

![]()

Show Detailed Instructions

Hide Detailed Instructions

Step 1: Go to the Binance website.

Step 2: On the registration page, enter your email address, and create a password for your account.

Then, read and agree to the Terms of Service and click “Create Account”.

Note: Your password must be a combination of numbers and letters.

It should contain at least 8 characters, one UPPER CASE letter, and one number.

Step 3: Complete the Security Verification.

Step 4: The system will send a verification code to your email. The verification code is valid for 30 minutes. If you can’t find the email in your inbox, check your other mail folders as well, or click “Resend Email” to resend.

How to complete KYC (ID Verification) on Binance

Step 1: Log in to your Binance account and click “User Center” and then “Identification”.

Step 2: click “Start Now” to verify your account.

Step 3: Select your country of residence.

Ensure that your country of residence is consistent with your ID documents.

Step 5: Enter your personal information and click “Continue.”

You won’t be able to change it once confirmed.

Refer to the respective options offered for your country.

Step 7: Follow the instructions to upload photos of your document. Your photos should clearly show the full ID document.

Do not wear hats, glasses, or use filters, and make sure that the lighting is sufficient.

Once your application has been verified, you will receive an email notification.

How to buy cryptocurrency on Binance

Step 1: Log in to your Binance account and click “Buy Crypto” and then “Credit/Debit Card”.

Step 2: Here you can choose to buy crypto with different fiat currencies. Enter the fiat amount you want to spend and the system will automatically display the amount of crypto you can get. When you have selected the amount you wish to spend then press “Continue”.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

Step 3: Click “Add New Card”. Then enter your credit card details and your billing address.

Step 4: Check the payment details and confirm your order within 1 minute. After 1 minute, the price and the amount of crypto you will get will be recalculated. You can click “Refresh” to see the latest market price. You will then be redirected to your bank’s OTP Transaction Page. Follow the on-screen instructions to verify the payment.

How to Conduct Spot Trading on Binance

Step 1: Log in to your Binance account.

Click on “Classic” under “Trade” on the top navigation bar.

Step 2: Search and enter the cryptocurrency you want to trade.

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can place a “Market Order” to set the buying/selling price automatically.

Hide Detailed Instructions

For more in-depth instructions, our ‘Absolute Beginner’s Guide To Cryptocurrency Investing‘ will take you through the process step-by step. In addition to providing instructions for sending and receiving your cryptocurrency.

And if you’re completely new to crypto our beginner, intermediate and advanced level articles will get you up to speed with everything you need to know about the cryptocurrency space starting out.

Simplecryptoguide.com

What Is Lend Flare Token (LFT)?

Lend Flare allows Curve investors to borrow against their LPs for a certain amount of time with a fixed borrow rate and no concerns for assets being liquidated due to price fluctuation.

The protocol utilizes Curve, Compound, and Convex to deliver a unique offering aimed at solving the following problems

- Maximizing efficiency and user yield.

- Risk of liquidation in the event of price fluctuation.

- Greater value generation for an individual’s collateralized assets.

How does Lend Flare work?

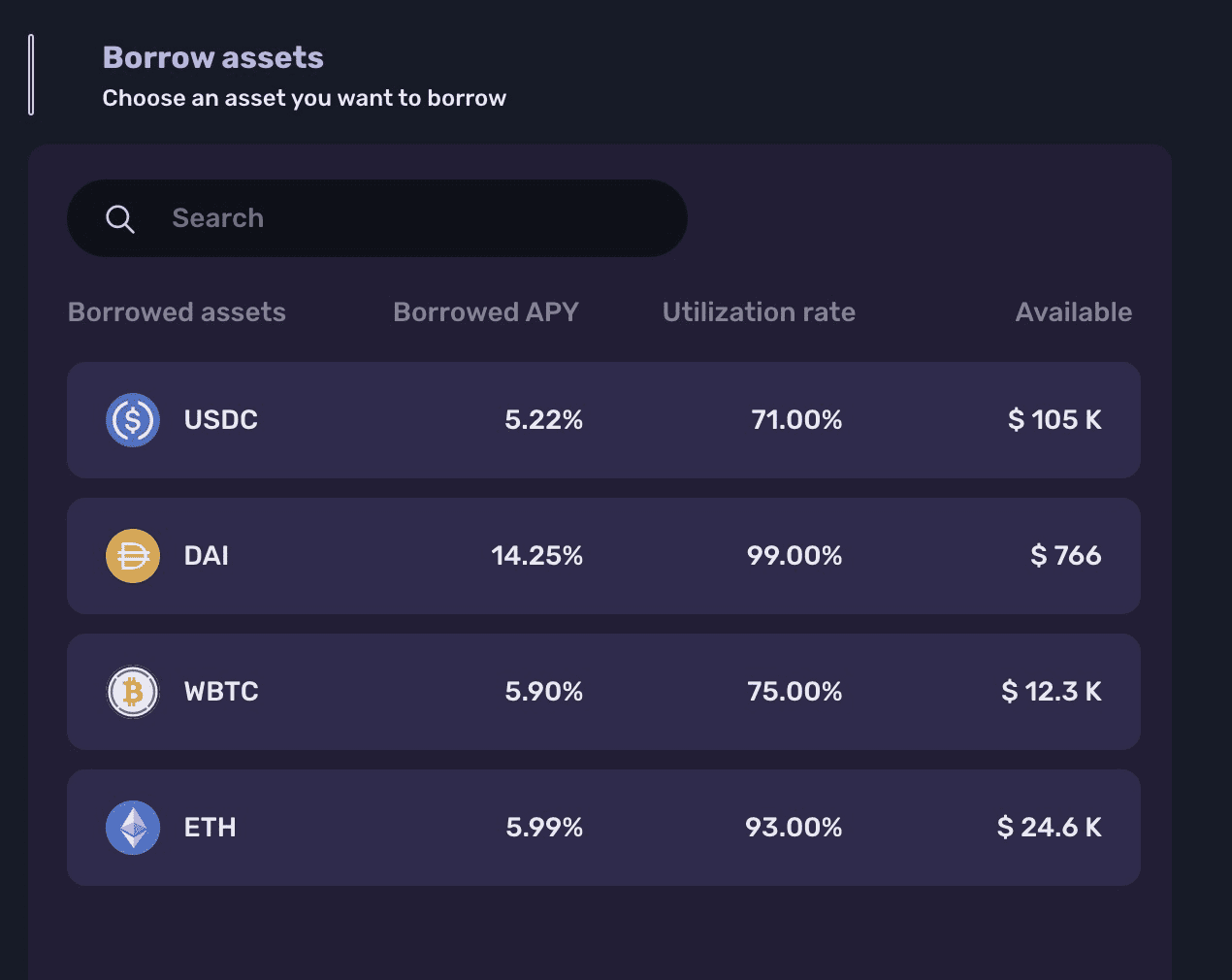

For borrowers, Lend Flare deposits their Curve LPs back into Curve via the Convex and takes them as collateral, allowing Curve investors to continue earning their maximum profits from their LPs. Also, Lend Flare only allows borrowers to borrow the same pegged tokens i.e. If you hold STETHCRV, you can only borrow ETH. As a result, borrowers will have a higher collateral ratio which means they can borrow more compared to other platforms without being worried about being liquidated due to price fluctuation but only time.

For lenders, their supplied assets will be deposited into Compound first to earn basic interest even when they are not being lent out yet. When borrowers borrow assets, they will have a borrow rate no lower than Compound’s. Lend Flare then withdraw the corresponding fund from Compound and transfer to borrower. Due to high collateral ratio, lenders will gain a much higher supplied interest rate than Compound. Moreover, Lend Flare’s contract is composable so that in the future, the unused loan liquidity can be deposited into other platforms that provides the highest interest.

Borrowers’ assets will not be lent out again and liquidated due to price fluctuation. If borrowers pay back loans on time, all the LPs will be given back instantly. Lenders’ assets that being lent out can be guaranteed because Lend Flare only allows borrowers to borrow same pegged token with an over collateralized LP for a certain amount of time. The value of LPs is steady because Lend Flare team will eliminate all factory pools at beginning.

Why borrow on Lend Flare?

For borrowers, who supply on Lend Flare, the main advantages are:

1. To unlock your staked Curve LPs

Lend Flare allows every Curve LPs hold to contract an over-collaterized loan, with Curve LP as collateral. You keep all the advantages of having curve LPs (see points below), and at same the opportunity to get an attractive loan.

2. While still earning your Curve and Convex rewards.

In addition to receive free assets when subscribing a loan, Curve LPs used as collaterals are deposited for you by Lend Flare smart contracts on Convex, and continue to earn rewards. Lend Flare doesn’t not any commission on the rewards earned, they are fully distributed to their respective recipients, exactly just like a normal staking on Convex.

What is the LFT Token?

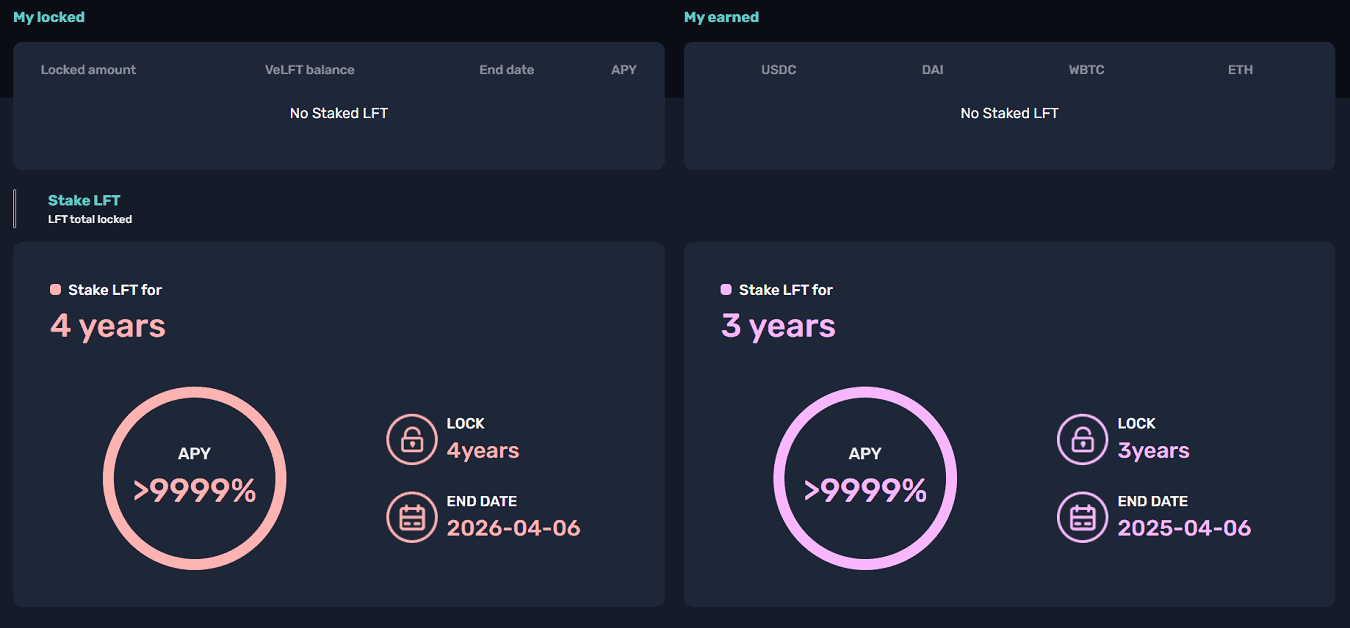

LFT is used to attract liquidity providers on Lend Flare, and also to incentive the users to govern the platform. Investors stakes LFT to receive VeLFT. VeLFT stands for vote-managed LFT tokens. The longer you lock the LFT, the more VeLFT tokens you will get.

Basic information

- Token name: Lend Flare Token (LFT)

- Contract Address:

- Blockchain: Ethereum (ERC-20)

- Total supply: 3.03 billion

The total supply of 3.03b is distributed as such:

- 62% liquidity provider

- 15% IDO participant,claim instantly

- 15% Uniswap permanent liquidity

- 3% Team, two-year vesting

- 4% Community , 4 year vesting

- 1% Airdrop, claim instantly

What is the VeLFT Token?

VeLFT is the “proof” for LFT tokens. The longer the user locks LFT tokens, the more VeLFT tokens he gets. The locking procedure depends on a number of factors

VeLFT tokens are not transferable.

Interest – VeLFT holders will share 50% of the loan interest of all pools on the platform. Also boost your LFT rewards up t0 2.5x.

Voting – VeLFT holders have the right to create their own proposal and vote. For more details, please see Lend Flare Dao.

Earnings boost – VeLFT automatically boosts LFT earnings. If boosting is not shown, LFT can be taken first. LFT boosting depends on the total number of VeLFTs and the total current pool liquidity.

What is the Lend Flare DAO?

The Lend Flare DAO allows investors to govern the platform together after the mainnet is launched. After the DAO has deployed, all the power will be transferred to the community, in other words veLFT holders. Lend Flare DAO will be separated into 2 different stages.

First Stage – All the contract parameters are controlled by a time-lock contract and can be changed by a multi-sig account. Those parameters such as adding pools and changing gauge weight are pre-set by the Lend Flare team and cannot be changed before the DAO comes out unless an emergency happens. Any parameter change will have a 2-day time delay.

Second Stage – Lend Flare DAO will be coming out around May 2022. Rules will be discussed in the official Telegram and Discord Group before launching. A potential test will be carried out in test-net. Lend Flare will use Snapshot and hand over all the powers to community.

Lend Flare Token development updates in 2023

Lend Flare, as of 2023, has made significant progress and developments in its platform and offerings. Here’s an overview of the most important updates:

Platform Focus: Lend Flare is a lending platform targeting Curve investors. It allows these investors to borrow against their Liquidity Provider (LP) tokens for a certain period with a fixed borrow rate. This approach helps eliminate the risk of asset liquidation due to price fluctuations.

Tokenomics and Governance: LFT, Lend Flare’s governance token, is rewarded to liquidity providers. The tokenomics of Lend Flare is inspired by the Curve model, where investors can stake LFT to receive VeLFT (vote-managed LFT tokens). These tokens grant voting rights in the platform’s governance. VeLFT holders also share 50% of all fees generated through the platform.

Capital Efficiency for Borrowers and Lenders:

- Borrowers: Can deposit their Curve LPs as collateral to borrow assets. Lend Flare redeposits these LPs into Curve via Convex, allowing them to continue earning trading fees. This system ensures a high collateral ratio for borrowers as they can only borrow the same pegged tokens.

- Lenders: When lenders supply assets like ETH, DAI, or USDC, these assets are deposited into Compound to earn interest. This ensures a high supply APY for lenders, contributing to an overall high collateral ratio on the platform.

Win-Win Situation: The platform’s borrowing and lending mechanisms create a mutually beneficial situation for both parties. Borrowers enjoy over-collateralization and stability in their LP values, while lenders benefit from safety due to the same pegged token borrowing and over-collateralization.

Comparison with Curve Gauge: Lend Flare aims to optimize returns for its users by combining several protocols, routing deposits through Convex Finance to provide additional DeFi yields. This approach ensures more profits than Curve gauge rewards, along with loan services.

Beta Test Airdrop: Lend Flare has conducted a Beta test on the Ethereum Rinkeby testnet to identify and fix issues before its mainnet launch. Participants in this test were eligible for LFT rewards.

Roadmap and Decentralization Goals: Lend Flare is working towards forming a DAO and aims to become completely community-driven. The project is also focusing on developing time lock contracts for enhanced security and trust.

These updates indicate Lend Flare’s commitment to providing an innovative and efficient lending platform in the DeFi ecosystem. The focus on Curve investors, combined with its unique borrowing and lending mechanisms, positions Lend Flare as a noteworthy platform in the cryptocurrency lending space.

Official website: https://lendflare.finance/

Best cryptocurrency wallet for Lend Flare Token (LFT)

There are plenty of different crypto wallets available. The best one for you depends on your general trading habits and which provides the most security in your situation. There are two main types of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical). Both have their pros and cons, and there is not necessarily a right or wrong answer when it comes to figuring out which crypto wallet is best for you.

HOW DO I DECIDE WHICH cryptocurrency WALLET TO USE for Lend Flare Token (LFT)?

Deciding which type of wallet to use depends on a variety of factors, including:

- How often you trade. In general, hot wallets are better for more active cryptocurrency traders. Quick login ability means you are only a few clicks and taps away from buying and selling crypto. Cold wallets are better suited for those looking to make less frequent trades.

- What you want to trade. As mentioned earlier, not all wallets support all types of cryptocurrencies. However, some of the best crypto wallets have the power to trade hundreds of different currencies, providing more of a one-size-fits-all experience.

- Your peace of mind. For those worried about hacking, having a physical cold wallet stored in a safe deposit box at the bank or somewhere at home, provides the safest, most secure option. Others might be confident in their ability to keep their hot wallets secure.

- How much it costs. It is important to investigate the costs associated with each wallet. Many hot wallets will be free to set up. Meanwhile, cold wallets, like any piece of hardware, will cost money to purchase.

- What it can do. While the basics of each cryptocurrency wallet are the same, additional features can help set them apart. This is especially true of hot wallets, many of which come with advanced reporting features, insights into the crypto market, the ability to convert cryptocurrencies and more. Security features can also be a good differentiator.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re going to be dealing in larger volumes of crypto, investing in cold storage might prove advantageous.

Most widespead examples of this being the Ledger Nano and the Trezor.

Ledger manufactures cold storage wallets designed for users who want increased security. Their wallets are a physical device that connects to your computer. Only when the device is connected can you send your cryptocurrency from it. Ledger offers a variety of products, such as the Ledger Nano S and the Ledger Nano X (a bluetooth connected hardware wallet).

Trezor is a pioneering hardware wallet company. The combination of world-class security with an intuitive interface and compatibility with other desktop wallets, makes it ideal for beginners and experts alike. The company has gained a lot of the Bitcoin community’s respect over the years. Trezor offers two main models – The Trezor One and Trezor Model T (which has a built in touch screen).

Market Overview

Coinmarketcap.com

Coinmarketcap will be your cryptocurrency go-to for just about everything. Here you can see the following: