Is It Worth Investing in Bitcoin Mining in 2022?

Bitcoin mining is the only way to earn bitcoins without buying them at a crypto exchange. Mining involves solving complex mathematical problems to validate bitcoin transactions and to ensure the security of the bitcoin network.

With Bitcoin price breaching the $61,000 mark in October 2021, many tech-savvy investors started to think about trying their hand at Bitcoin mining. Mining is the only way to bring new Bitcoins into circulation.

Investors who want to profit from the Bitcoin boom essentially have two options. The first is to buy BTC the regular way — by converting fiat currency into Bitcoin at a crypto exchange.

Buying BTC with fiat is easy and straightforward, but the surging prices may encourage BTC enthusiasts to look for alternative ways. The only alternative? Investing in Bitcoin mining.

How does Bitcoin mining work?

Mining Bitcoin involves solving complex hashing puzzles in order to earn BTC without having to pay explicitly for it.

Bitcoin miners essentially work as auditors on the bitcoin network, verifying the legitimacy of transactions and preventing incidents of ‘double spending’.

Double spending is the fraudulent practice of spending the same Bitcoin twice.

The culprit makes a copy of the digital token and uses it to make a purchase, while retaining the original Bitcoin to spend later.

Think of it as the digital version of counterfeit currency.

Digital currencies are inherently more prone to fraud, so it’s best to use an established, reliable exchange to buy BTC. You should also store BTC on a cold wallet for good security. These are security aspects that Bitcoin miners have no control over.

Bitcoin miners perform the complex computational work of verifying the validity of BTC transactions, and are rewarded for it with a certain number of Bitcoins. Currently, you can earn 6.25 BTC for being the first to complete one ‘block’ of verified transactions.

The supply and demand of Bitcoin

This number is halved every four years, in order to maintain a steady supply of Bitcoin. For instance, when Bitcoin mining first began in 2009, miners earned 50 BTC for each block of transactions they verified.

In 2012, the reward for verifying one block of transactions was halved to 25 BTC. This number was further halved to 12.5 BTC in 2016 and then again to 6.25 BTC in May of 2020.

This is done because the total supply of Bitcoin will be capped at 21 million BTC. So far, 19 million Bitcoins have already been mined, with only 2 million remaining for miners to extract.

For this reason, the rate of Bitcoin mined is slowly reducing over time. At this rate, the last Bitcoin won’t be put into circulation until the year 2140.

To mine a fresh batch of Bitcoins, miners have to produce a 64-digit hexadecimal number (known commonly as a ‘hash’) that is either less than the target hash or equal to it.

If multiple miners come up with such a hash, the first miner to produce one will be rewarded with 6.25 Bitcoins.

As of May 25, 2022, one Bitcoin was equal to USD $29,655, which means that a Bitcoin miner could potentially earn $185,344 (6.25 x 29,655) by successfully verifying a single block of transactions.

It is not hard to see, therefore, why so many investors are eager to get into Bitcoin mining, despite the complexity of the task and the high barriers to entry.

Equipment needed for mining Bitcoin

If you don’t want to put down the cash to buy BTC, then Bitcoin mining may seem like a viable option to make a profit from this popular cryptocurrency.

However, you must remember that mining Bitcoin requires some special hardware and equipment.

Whether or not mining Bitcoin in 2022 is worth it for you will depend, to a large extent, on how much money you spend on your equipment and mining gear.

The more you spend, the longer it will take you to recoup the costs and start turning a profit on your investment.

However, if you refuse to invest in high-quality equipment, it will be harder for you to compete with other miners, who are all trying to be the first to solve the hashing puzzles.

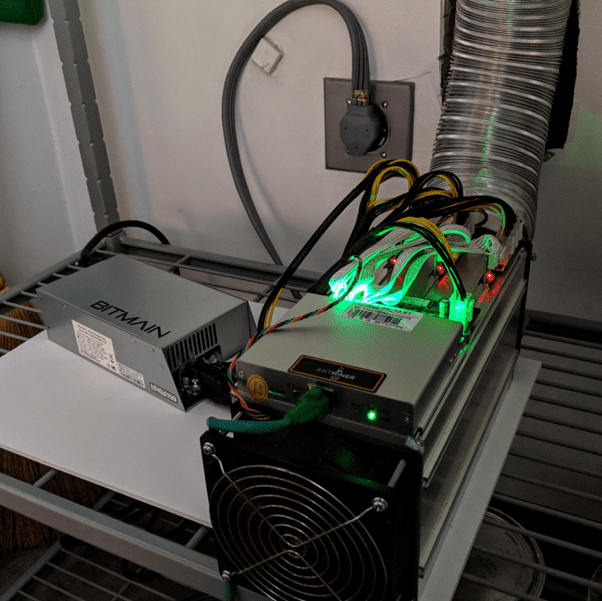

You’ll need a graphics processing unit (GPU) or an application-specific integrated circuit (ASIC) in order to successfully mine Bitcoins. These custom mining devices are not cheap, and setting up a high-quality mining rig could cost you upwards of tens of thousands of dollars.

The role of ASIC machines

ASIC machines are a type of specialized cryptocurrency mining hardware that are more powerful – in terms of their computer processing power – than both CPUs and GPUs.

An ASIC machine comprises multiple microprocessors combined and packed together within a single circuit. This circuit can be connected to a computer using a USB port. A high-quality ASIC machine can set you back by $8,000 or more.

With the development of new chips every few months, ASIC machines are gaining more hashing power and becoming more energy efficient with time.

Despite this, setting up a Bitcoin mining rig requires a huge amount of electricity. Miners who can afford the astronomical energy bills often run their rigs for 24 hours at a time, in order to maximize the chances of being the first to find a block.

Factors that determine the profitability of Bitcoin mining

In the early days of Bitcoin mining, the competition was quite low. Very few people knew about Bitcoin and even fewer wanted to put in the effort involved in mining.

Miners could solve the hashing puzzles using their personal computers, and earn Bitcoin without using any specialized equipment.

Cost of Equipment

Before Bitcoin started gaining massive popularity in 2017, individual miners only had to compete against other individuals on their personal computers, with similar computing power.

Now, however, most Bitcoin mining is done by professional crypto mining centers with almost unlimited computing power. Individual miners are forced to invest in new, more expensive mining equipment in order to compete.

Operating high-end equipment, such as ASIC machines, also leads to higher energy costs. All this can quickly chip away at mining profits and make Bitcoin mining less appealing as an investment option.

The Value of Bitcoin

Needless to say, the price of Bitcoin will help determine whether or not mining it is a worthwhile investment. The cryptocurrency market is relatively new and still quite volatile.

When the price of Bitcoin was at its peak around October of 2021, many new businesses started their own bitcoin mining operations. However, by May 2022, the price of Bitcoin had fallen quite steeply from its 2021 high.

This has had a negative impact on Bitcoin miners and lowered their return on investment (ROI). But the value of Bitcoin may rise once again, making mining more profitable in the near future.

Energy Costs

The cost of energy can vary significantly depending on geographic region, time of day, season, and other such factors.

As Bitcoin mining is an extremely energy-intensive process, you need to ensure that your profits are not all getting swallowed up by astronomical electricity bills.

Electricity is required for everything in the Bitcoin mining process – right from running computations on the ASIC machines to preventing your mining rig from overheating.

To ensure that investing in Bitcoin mining is profitable for you in 2022, you might consider moving to a state or country where the cost of electricity is relatively lower.

You may also mitigate your energy costs by joining a mining pool, where you will be combining your resources with a larger group of miners, in return for a share of the profits.

The use of mining pools

As Bitcoin mining has become more competitive and cost-intensive, individual miners have found it increasingly harder to compete against large, well-funded crypto mining centers.

To find a way around this problem, many individual miners have combined their resources to create Bitcoin mining pools.

These mining pools help increase the speed and efficiency of mining activities, ensuring that all participants stand a much better chance of being the first to solve a hashing problem and receive the reward of 6.25 Bitcoins.

As part of a mining pool, you will also be sharing any profits you make. The two main profit-sharing methods used by mining pools are known as:

- Proportional mining: You will only receive payment if and when the mining pool solves a hashing problem, and your share of the reward will be proportional to the amount of work you did to solve the problem.

- Pay-per-share method: You will receive a flat fee based on the total mining power of the entire pool, leading to lower but more consistent payouts.

Joining a Bitcoin mining pool will mean that you’ll receive less money for every block of transactions you verify, since the reward of 6.25 Bitcoins will have to be shared among multiple participants.

Of course, it will also lower the initial amount of investment required for setting up your own mining rig.

Moreover, having more people working on the same problem will increase your chances of winning the reward. As a result, your overall profits might very well increase once you join a mining pool, instead of working as an individual miner.

Bitcoin Mining: Worth the Investment?

Once you’ve taken all the above-mentioned points into consideration, you can do a cost-benefit analysis to determine whether or not Bitcoin mining would be worth the investment in 2022.

There are many web-based profitability calculators that will help you figure out the Bitcoin price level at which mining will become profitable for you.

Author Bio: Arjun Ruparelia

Email – ruparelia.arjun@gmail.com

An accountant turned writer, Arjun writes financial blog posts and research reports for clients across the globe, including Skale. Arjun has five years of financial writing experience across verticals. He is a CMA and CA (Intermediate) by qualification.