How To Buy Cardiocoin (CRDC)?

A common question you often see on social media from crypto beginners is “Where can I buy Cardiocoin?” Well, you’ll be happy to hear it is actually quite a simple and straightforward process.

Step 1: Create an account on an exchange that supports Cardiocoin (CRDC)

First, you will need to open an account on a cryptocurrency exchange that supports Cardiocoin (CRDC).

We recommend the following based on functionality, reputation, security, support and fees:

In order to sign up, you will need to enter some basic information, such as your email address, password, full name and, in some cases, you might also be asked for a phone number or address.

Note: On specific exchanges, you might need to complete a Know Your Customer (KYC) procedure in order to be able to purchase cryptocurrency. This is most commonly the case with licensed and regulated exchanges.

Step 2: Deposit funds into your account

Many cryptocurrency exchanges will allow you to purchase Cardiocoin (CRDC) with fiat currencies, such as EUR, USD, AUD and others. Furthermore, they will also provide you with multiple deposit methods through which you can fund your fiat account, such as credit and debit cards, ewallets or direct bank transfers.

Note: Some payment methods will have higher fees than others, such as credit card payments. Before funding your fiat account on your chosen exchange, make sure to do your due diligence to find out the fees involved with each payment method to avoid unnecessary costs.

Step 3: Buy Cardiocoin (CRDC)

This process is similar across almost every cryptocurrency exchange. All you have to do is find a navigation bar or a search bar, and search for Cardiocoin (CRDC) or Cardiocoin (CRDC) trading pairs. Look for the section that will allow you to buy Cardiocoin (CRDC), and enter the amount of the cryptocurrency that you want to spend for Cardiocoin (CRDC) or the amount of fiat currency that you want to spend towards buying Cardiocoin (CRDC). The exchange will then calculate the equivalent amount of Cardiocoin (CRDC) based on the current market rate.

Note: Make sure to always double-check your transaction details, such as the amount of Cardiocoin (CRDC) you will be buying as well as the total cost of the purchase before you end up confirming the transaction. Furthermore, many cryptocurrency exchanges will offer you their own proprietary software wallet where you will be storing your cryptocurrencies; however, you can create your own individual software wallet, or purchase a hardware wallet for the highest level of protection.

Alternative ways to buy Cardiocoin (CRDC)

Because the project is very new, it is only offered directly on a select number of exchanges. If you’re not comfortable connecting your bank account to any of these smaller exchanges, or if you cannot connect your bank account to them for geographical reasons. Then you can instead create an account on any of the major exchanges and simply transfer the funds from there.

Out of the major exchanges we recommend the following based on functionality, reputation, security, support and fees:

1

Binance

Fees (Maker/Taker) 0.075%*-0.1%*

Cryptocurrencies

Available for Trade 500+

Sign-up bonus

10% reduced trading fees*

Available in

Europe, Asia, Oceania, Africa

2

Bybit

Fees (Maker/Taker) 0.1%*-0.1%*

Cryptocurrencies

Available for Trade 400+

Sign-up bonus

$30,000 sign-up bonus*

Available in

Europe, Asia, Oceania, Africa

How to create a Binance account

Show Detailed Instructions

Hide Detailed Instructions

Step 1: Go to the Binance website.

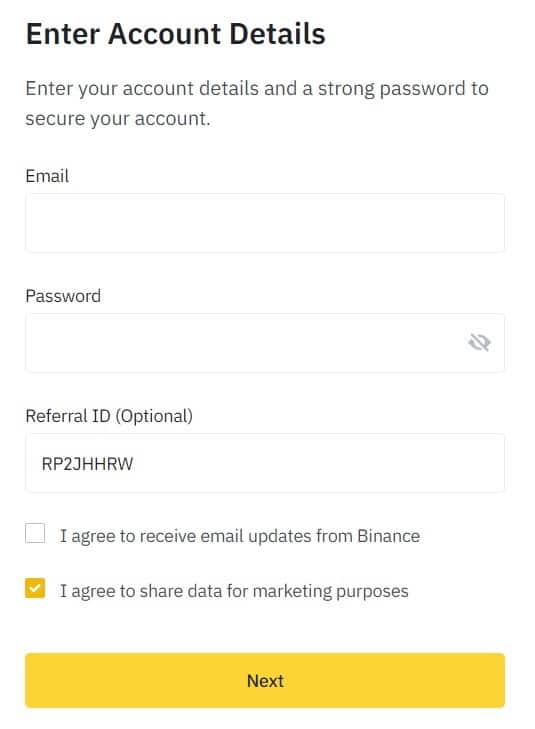

Step 2: On the registration page, enter your email address, and create a password for your account.

Then, read and agree to the Terms of Service and click “Create Account”.

Note: Your password must be a combination of numbers and letters.

It should contain at least 8 characters, one UPPER CASE letter, and one number.

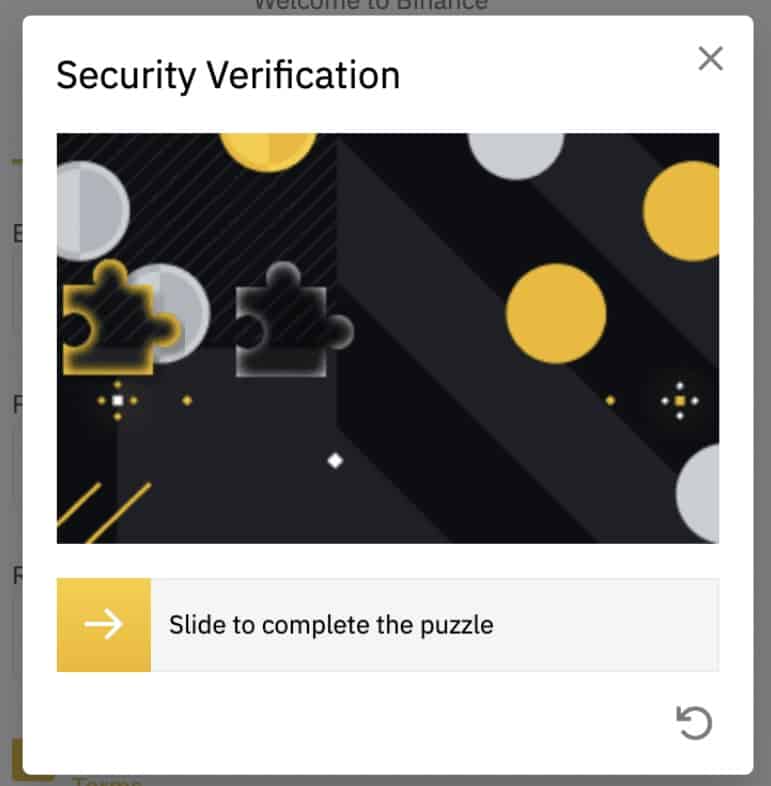

Step 3: Complete the Security Verification.

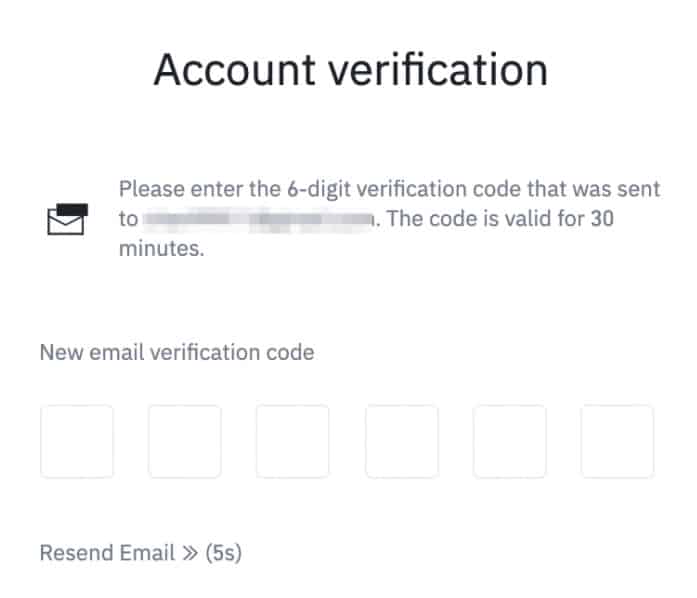

Step 4: The system will send a verification code to your email. The verification code is valid for 30 minutes. If you can’t find the email in your inbox, check your other mail folders as well, or click “Resend Email” to resend.

How to complete KYC (ID Verification) on Binance

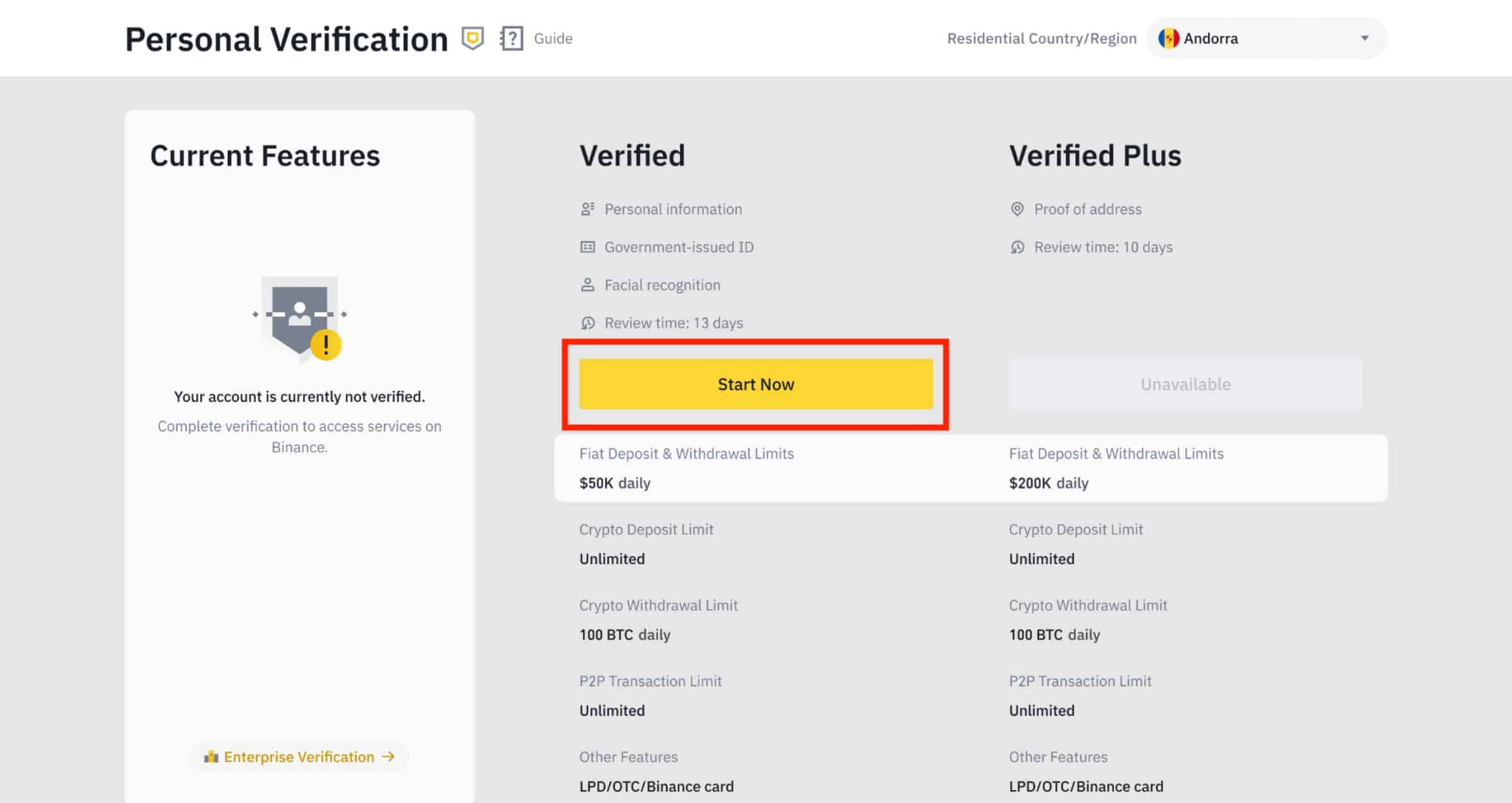

Step 1: Log in to your Binance account and click “User Center” and then “Identification”.

Step 2: click “Start Now” to verify your account.

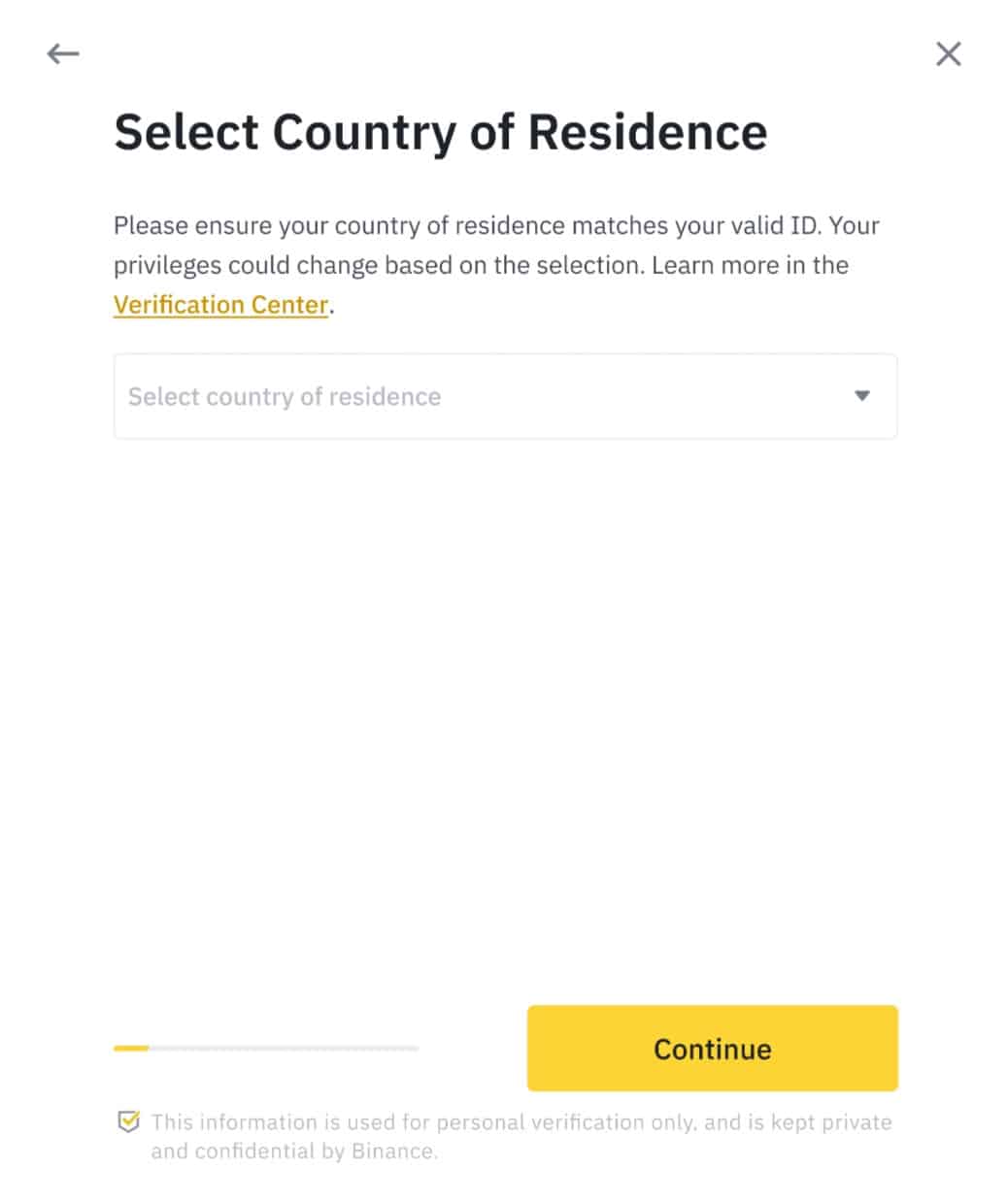

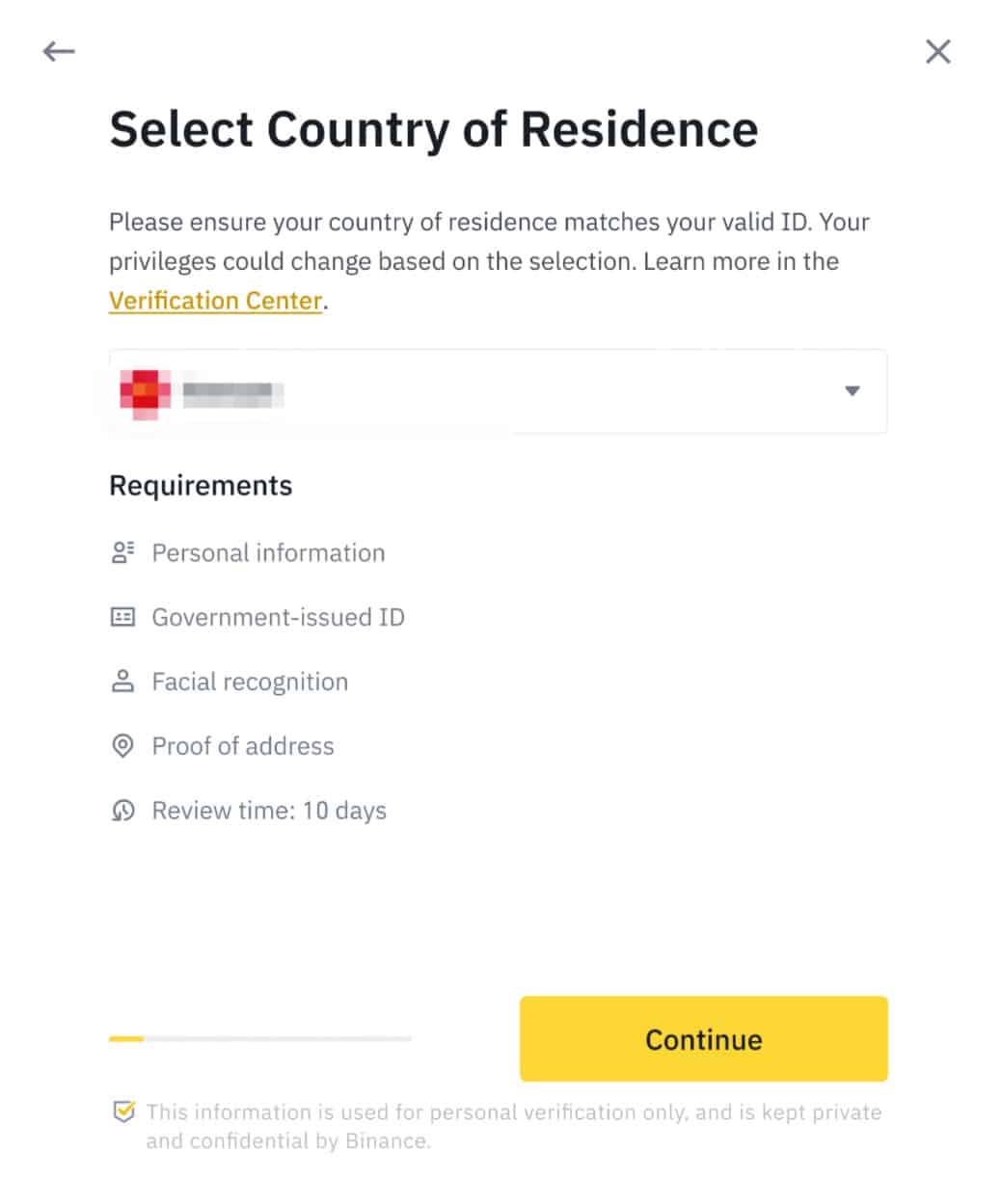

Step 3: Select your country of residence.

Ensure that your country of residence is consistent with your ID documents.

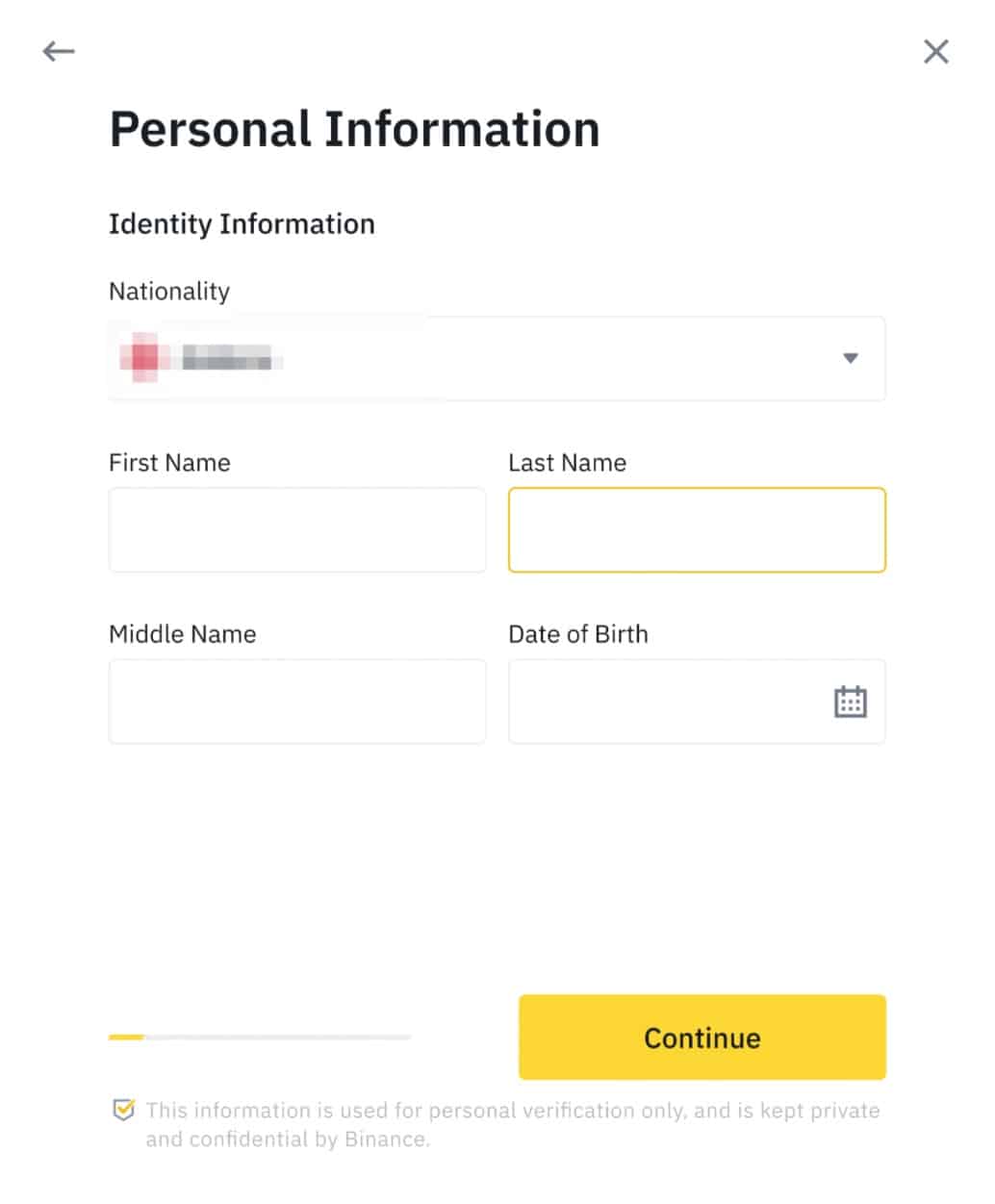

Step 5: Enter your personal information and click “Continue.”

You won’t be able to change it once confirmed.

Refer to the respective options offered for your country.

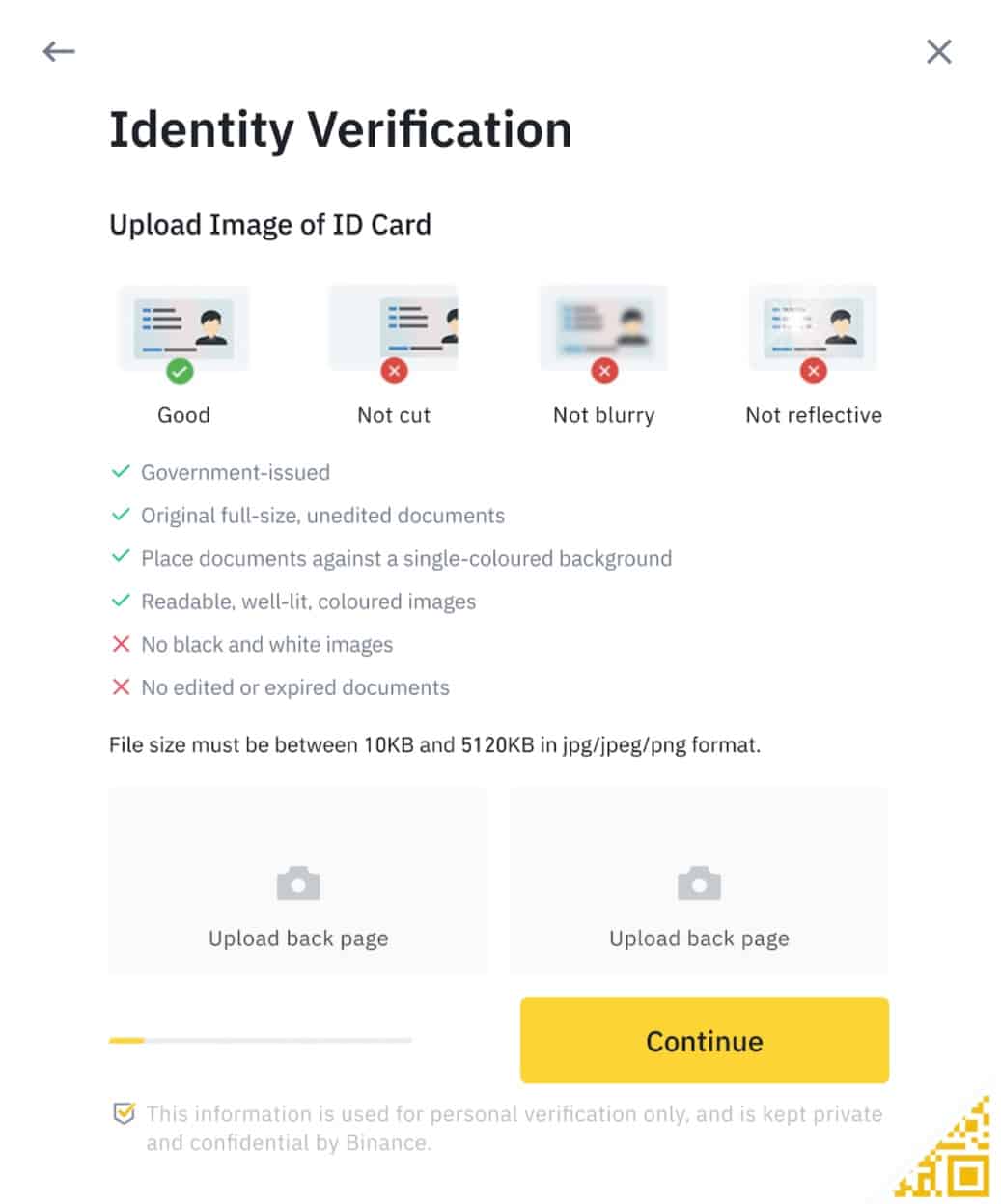

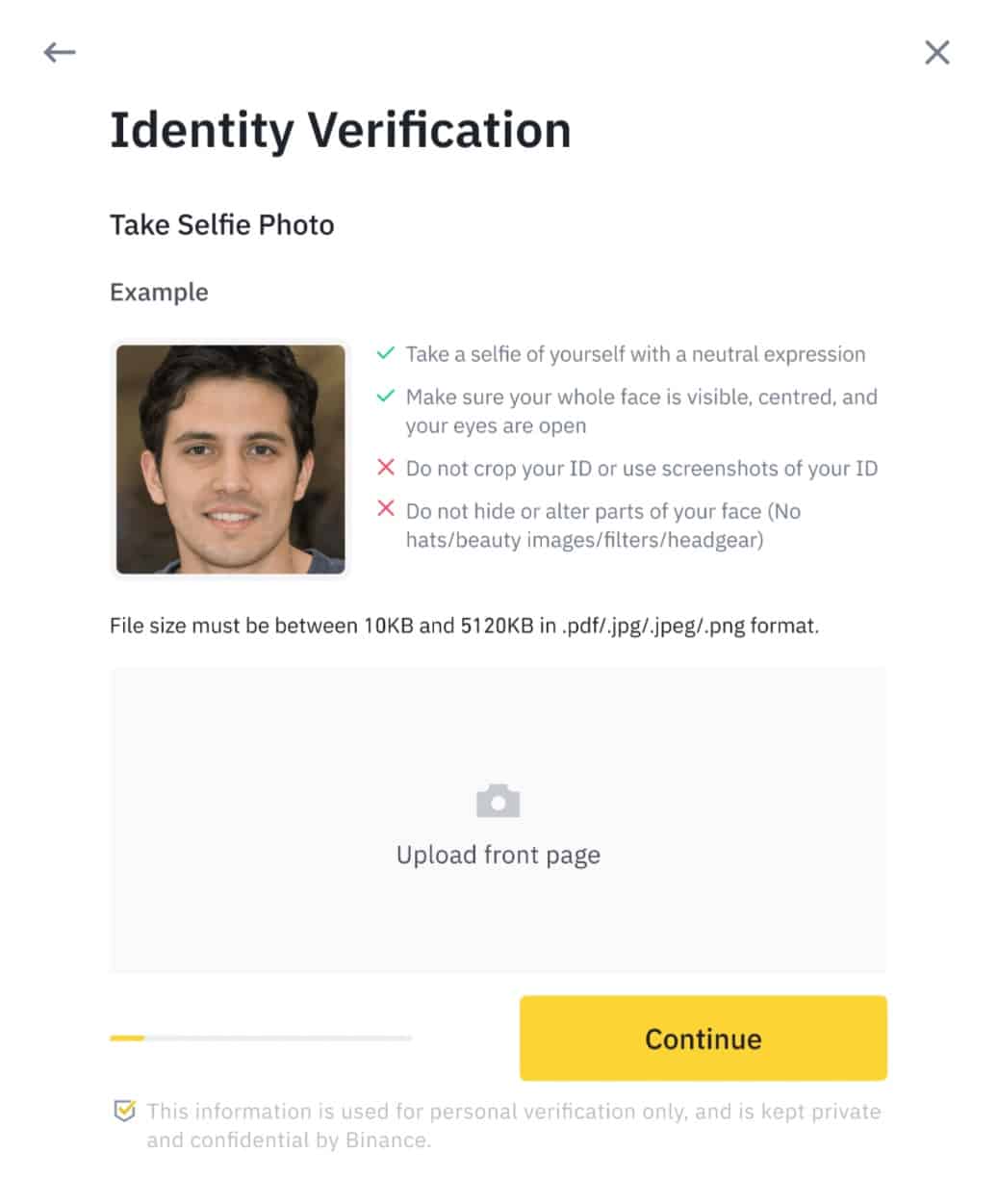

Step 7: Follow the instructions to upload photos of your document. Your photos should clearly show the full ID document.

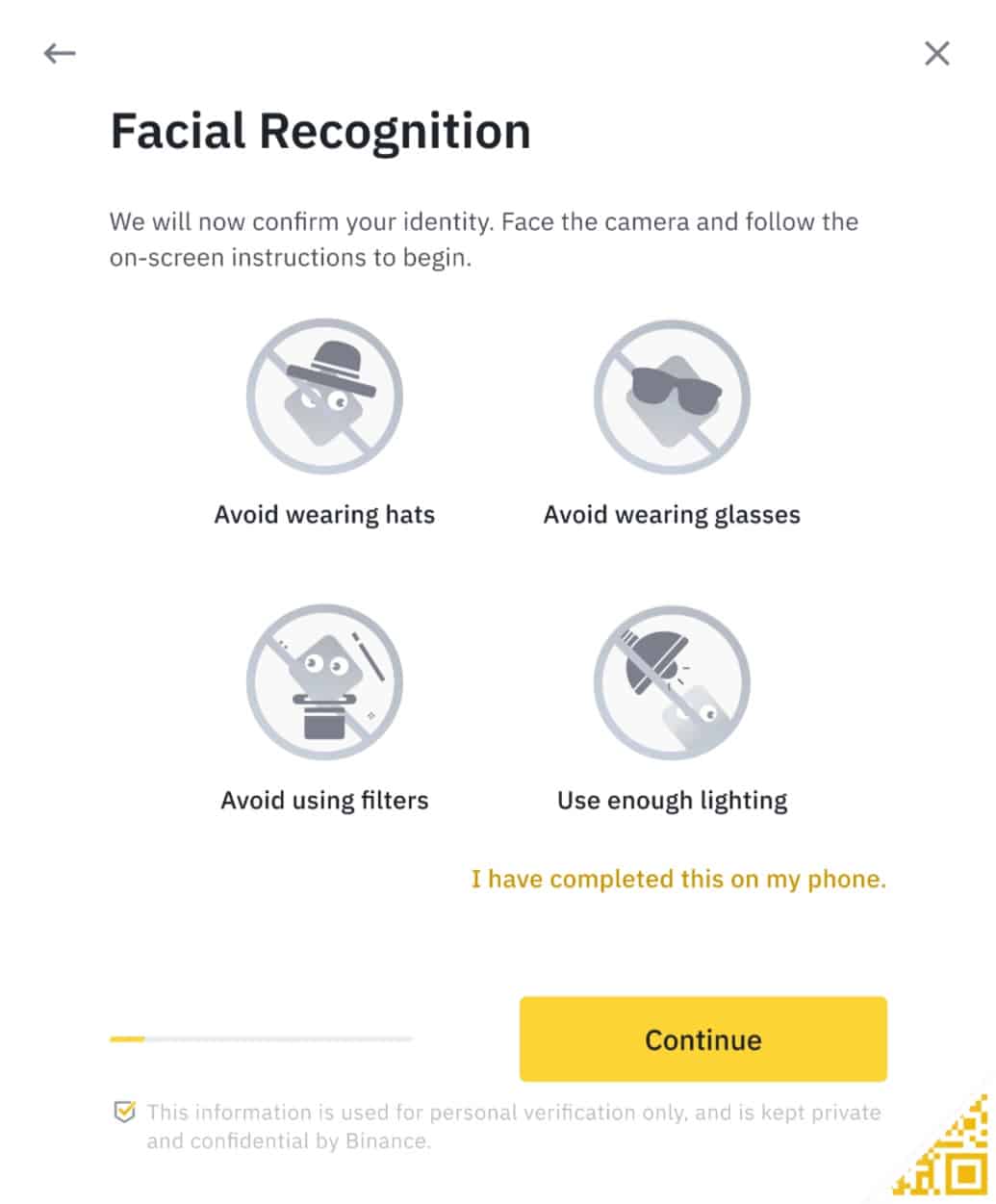

Do not wear hats, glasses, or use filters, and make sure that the lighting is sufficient.

Once your application has been verified, you will receive an email notification.

How to buy cryptocurrency on Binance

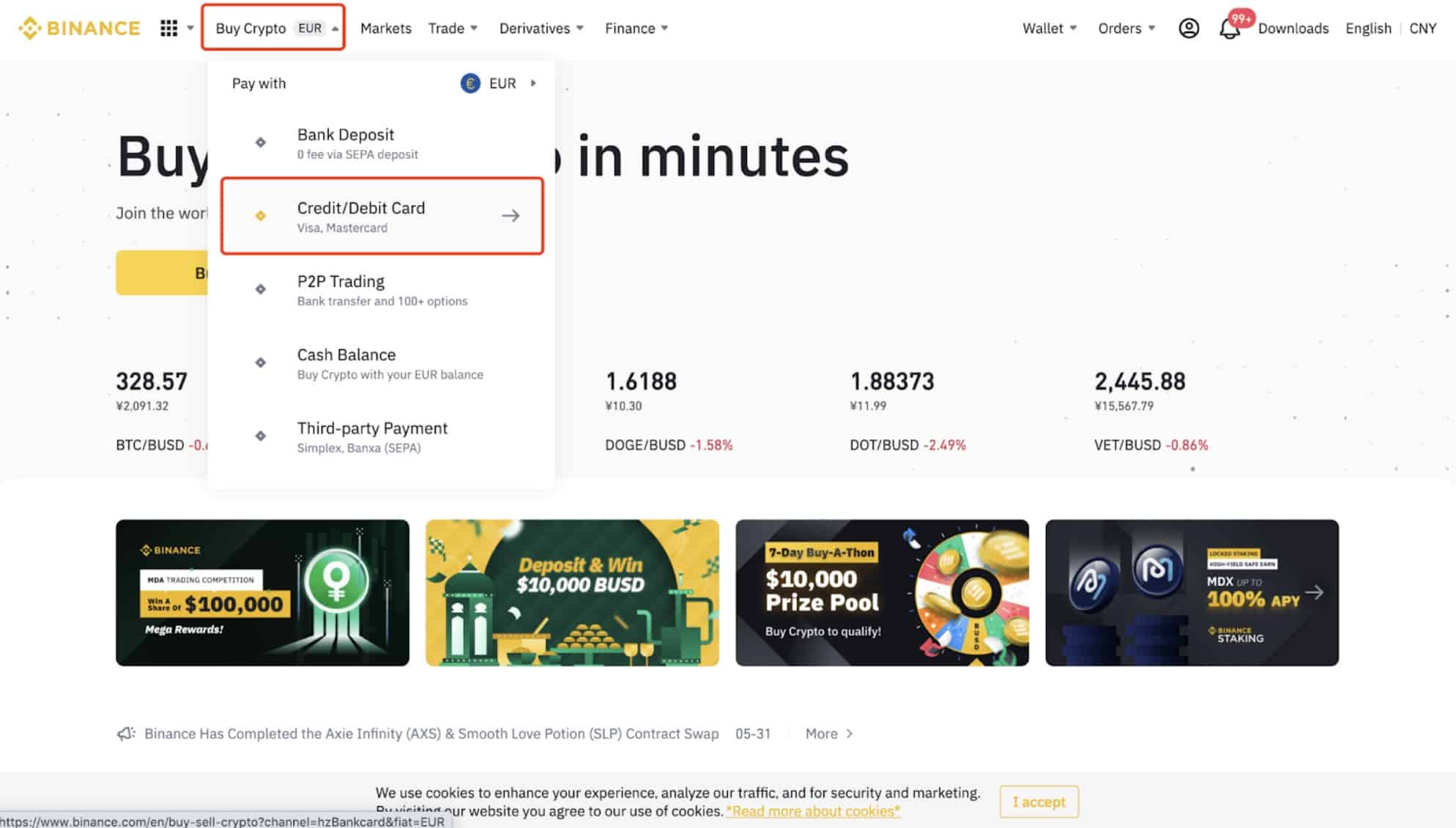

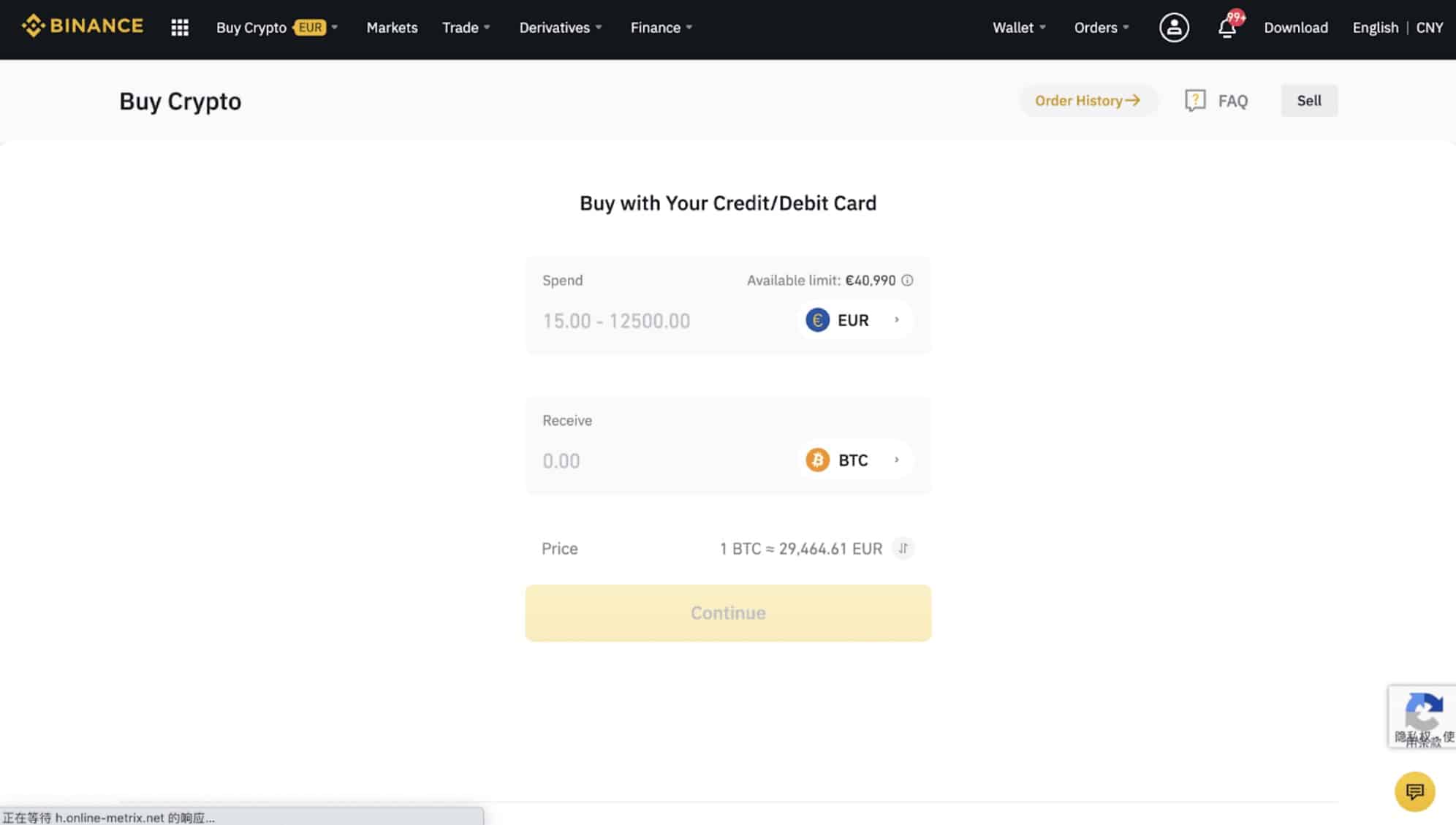

Step 1: Log in to your Binance account and click “Buy Crypto” and then “Credit/Debit Card”.

Step 2: Here you can choose to buy crypto with different fiat currencies. Enter the fiat amount you want to spend and the system will automatically display the amount of crypto you can get. When you have selected the amount you wish to spend then press “Continue”.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

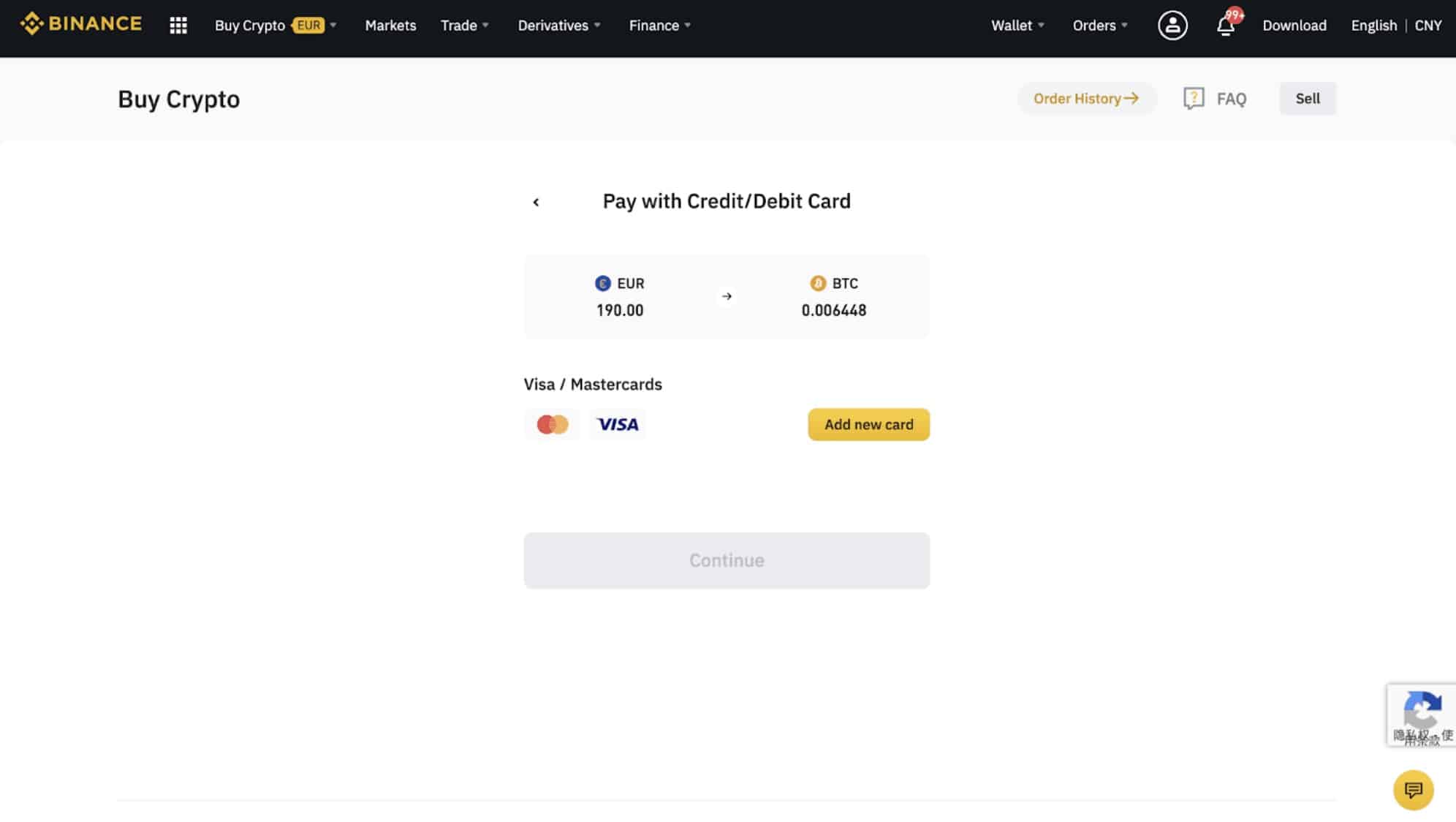

Step 3: Click “Add New Card”. Then enter your credit card details and your billing address.

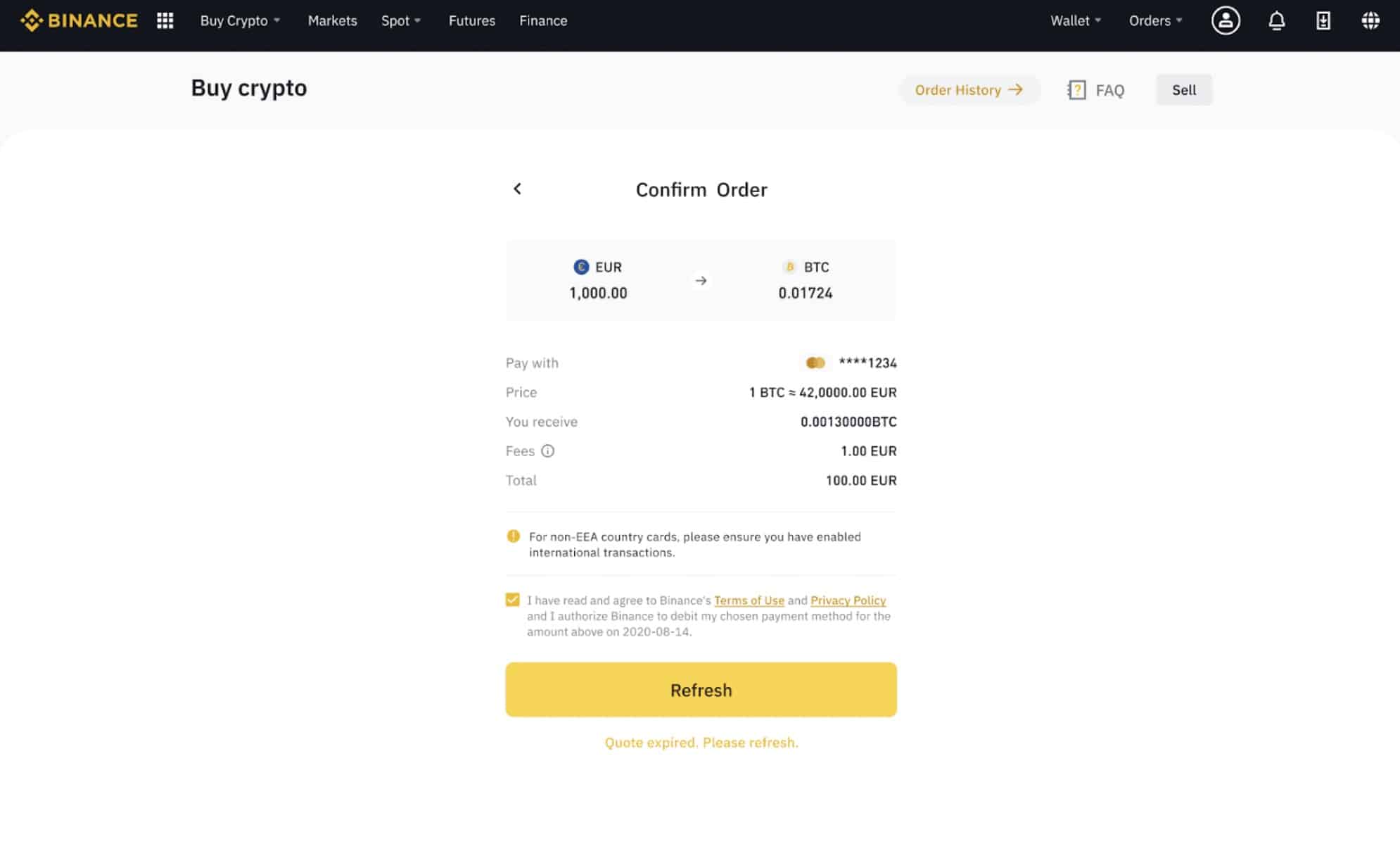

Step 4: Check the payment details and confirm your order within 1 minute. After 1 minute, the price and the amount of crypto you will get will be recalculated. You can click “Refresh” to see the latest market price. You will then be redirected to your bank’s OTP Transaction Page. Follow the on-screen instructions to verify the payment.

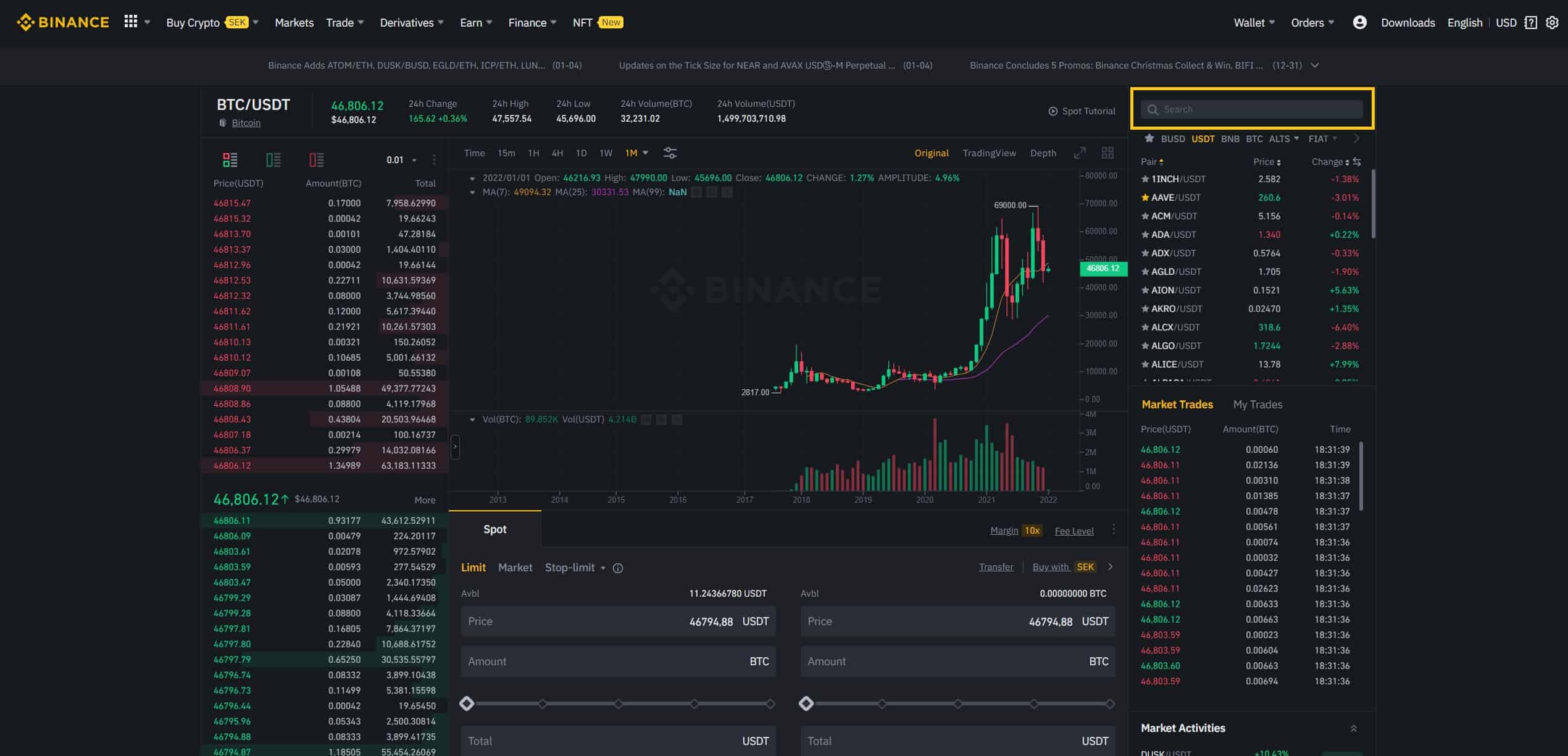

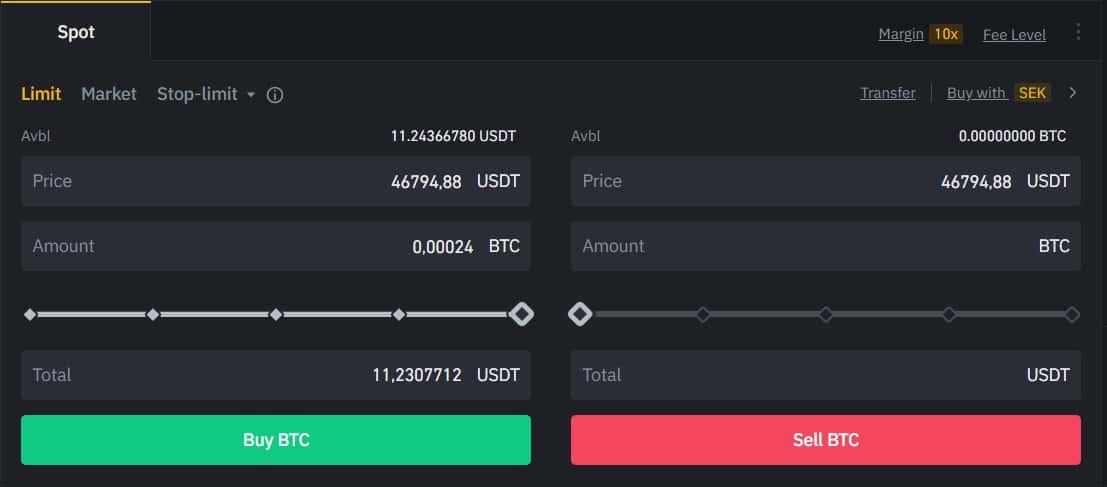

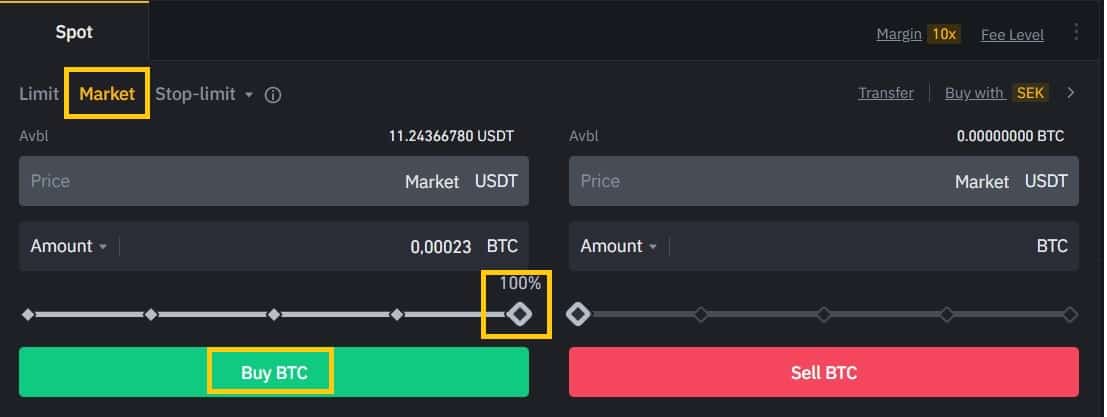

How to Conduct Spot Trading on Binance

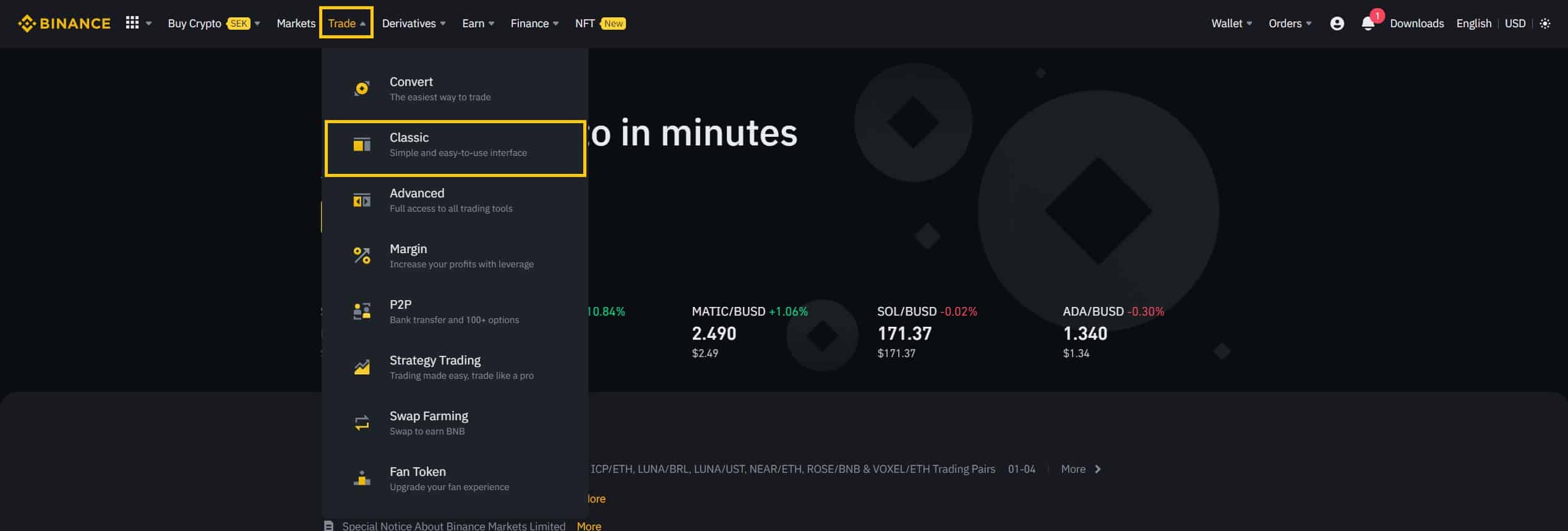

Step 1: Log in to your Binance account.

Click on “Classic” under “Trade” on the top navigation bar.

Step 2: Search and enter the cryptocurrency you want to trade.

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can place a “Market Order” to set the buying/selling price automatically.

Hide Detailed Instructions

For more in-depth instructions, our ‘Absolute Beginner’s Guide To Cryptocurrency Investing‘ will take you through the process step-by step. In addition to providing instructions for sending and receiving your cryptocurrency.

And if you’re completely new to crypto our beginner, intermediate and advanced level articles will get you up to speed with everything you need to know about the cryptocurrency space starting out.

Simplecryptoguide.com

What Is Cardiocoin (CRDC)?

Cardio Healthcare strives to promote a healthy and happy society by addressing the government’s and insurance companies’ excessive financial expenditure problem as a result of rising medical costs.

Cardio Healthcare solves this problem by providing technology and a platform that allows you to enjoy exercising in the metaverse. Users are issued Cardiocoin, a crypto asset that allows you to trade personal exercise data to connect your workout in the metaverse and the real world.

Cardio Healthcare’s token economy is a web 3.0 protocol that aims to restore the sovereignty of diverse data to the user while also pursuing the expansion of the company’s service and the sharing of user profits.

Cardio provides hardware interface parts that enhance existing fitness equipment from fitness equipment manufacturing businesses so that it may be retrofitted for usage on the metaverse, allowing the Cardiocoin protocol to grow quickly and benefit user health and the economy.

Existing games from game developers can be upgraded with exercise-type metaverse content. By providing APls with Cardio Healthcare’s metaverse service, Cardio Healthcare is developing an economy of coexistence made up of current economic entities. Cardio’s Web 3.0-based token economy is based on IOT (Internet-of-Things) sensor technology that collects validated (non-false) exercise data and middleware technology that can govern multiple metaverse contents.

In the future, Cardiocoin aims to create the world’s largest metaverse sports community that democratizes fitness data while providing 500 million global indoor bicycle and treadmill users with unlimited exercise and sports experiences in the metaverse space, all while monetizing their own exercise data.

How does Cardiocoin work?

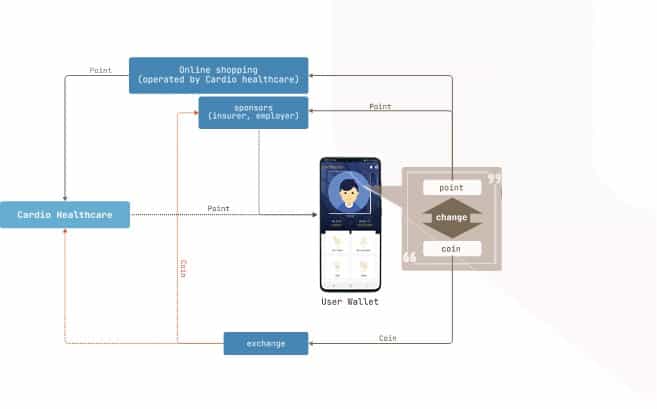

Cardio aims to create a direct-to-consumer distribution platform for healthcare products and services in order to reduce unnecessary intermediary distribution costs and create an ecosystem that can use the distribution costs saved by healthcare companies as the primary source of user fitness incentives.

Users will receive incentive-aligned monetary compensation in return for their health promotion activities if an insurance company provides CARDIO members with Cardio Points as reward for exercise or diet and allows the points to be used for payment of insurance premiums. Through direct-to-consumer insurance sales, the company will lower distribution costs, creating an ecosystem that benefits all protocol participants.

Preventive healthcare can be realized by utilizing this protocol economy, which promotes individual health through the market economy without the heavy requirement of governments or corporations to secure additional financial resources.

What are Cardio Points?

Cardio Points are a digital currency used for monetary exchange within the protocol as its value is constant compared to other legal currencies.

The blockchain system is not yet a widespread service platform as of 2022, making it challenging to integrate with existing financial service systems. If the rewards for exercising are confined to solely blockchain tokens, the use of these tokens will be restricted to a small number of blockchain services. The protocol’s scalability will suffer as a result, and users will find it less helpful. To alleviate this inconvenience, CARDIO’s protocol introduces Cardio Points, which can be utilized as an incentive for health-related actions off-chain and converted into crypto assets.

What is the CRDC Token?

Cardiocoin is a blockchain token used in our protocol (issuance is limited to 12 billion CRDC). It is a digital asset that corporate participants (sponsors) must stake when issuing Cardio Points for the purpose of payment to users within the ecosystem.

Cardiocoin (CRDC) is a blockchain token developed as an ERC-20 token based on the Ethereum network. Cardio Point is insufficient in and of itself as an incentive for health promotion in CARDIO’s protocol and necessitates the use of Cardiocoin as an essential factor for successfully running the Cardio Protocol service as detailed below.

The core of the Cardio Protocol is to give individual members the “motivation for increased health.”

Type 1 is a cash equivalent point that can be used virtually immediately (like cash). Cardio Points correspond to these cash equivalent points. These cash equivalent points are a costly method in that the entity providing (sponsoring) incentives, such as governments and corporations, must immediately prepare and use cash resources to finance this service.

Type 2 is a blockchain token, with a limited issuance amount and volatility in its value. Cardiocoin (CRDC) corresponds to this type, and the expectation that the price of the asset will rise is the primary motivation for acquisition. This means that, even apart from its current usefulness (utility), it can serve as an effort-driving incentive mechanism for users and lower the financial burden of governments and corporations in motivating improved health.

To highlight again, the difference is that Cardio Point, the driving force that moves people as a motive for health promotion, is the current usefulness, and Cardiocoin is the expectation of future value. In other words, when incentives are provided to the same number of people under the same conditions over the same period, the usage of Cardiocoin in that protocol allows savings on the overall cost of financial resources invested for the motivation of improved health.

Official website: https://www.cardiocoin.com/

Best cryptocurrency wallet for Cardiocoin (CRDC)

There are plenty of different crypto wallets available. The best one for you depends on your general trading habits and which provides the most security in your situation. There are two main types of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical). Both have their pros and cons, and there is not necessarily a right or wrong answer when it comes to figuring out which crypto wallet is best for you.

HOW DO I DECIDE WHICH cryptocurrency WALLET TO USE for Cardiocoin (CRDC)?

Deciding which type of wallet to use depends on a variety of factors, including:

- How often you trade. In general, hot wallets are better for more active cryptocurrency traders. Quick login ability means you are only a few clicks and taps away from buying and selling crypto. Cold wallets are better suited for those looking to make less frequent trades.

- What you want to trade. As mentioned earlier, not all wallets support all types of cryptocurrencies. However, some of the best crypto wallets have the power to trade hundreds of different currencies, providing more of a one-size-fits-all experience.

- Your peace of mind. For those worried about hacking, having a physical cold wallet stored in a safe deposit box at the bank or somewhere at home, provides the safest, most secure option. Others might be confident in their ability to keep their hot wallets secure.

- How much it costs. It is important to investigate the costs associated with each wallet. Many hot wallets will be free to set up. Meanwhile, cold wallets, like any piece of hardware, will cost money to purchase.

- What it can do. While the basics of each cryptocurrency wallet are the same, additional features can help set them apart. This is especially true of hot wallets, many of which come with advanced reporting features, insights into the crypto market, the ability to convert cryptocurrencies and more. Security features can also be a good differentiator.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re going to be dealing in larger volumes of crypto, investing in cold storage might prove advantageous.

Most widespead examples of this being the Ledger Nano and the Trezor.

Ledger manufactures cold storage wallets designed for users who want increased security. Their wallets are a physical device that connects to your computer. Only when the device is connected can you send your cryptocurrency from it. Ledger offers a variety of products, such as the Ledger Nano S and the Ledger Nano X (a bluetooth connected hardware wallet).

Trezor is a pioneering hardware wallet company. The combination of world-class security with an intuitive interface and compatibility with other desktop wallets, makes it ideal for beginners and experts alike. The company has gained a lot of the Bitcoin community’s respect over the years. Trezor offers two main models – The Trezor One and Trezor Model T (which has a built in touch screen).

Market Overview

Coinmarketcap.com

Coinmarketcap will be your cryptocurrency go-to for just about everything. Here you can see the following: