What Is Blockchain?

What is Blockchain?

Blockchain may seem sophisticated, and it can be, but its underlying notion is really extremely simple. A blockchain is an electronic database. To comprehend blockchain, it is necessary to first grasp what a database is.

A database is a collection of data that is electronically stored on a computer system. Database information, or data, is often organized in table style to facilitate searching and filtering for particular information. What is the difference between storing information in a spreadsheet and a database?

Spreadsheets are intended for storing and accessing limited quantities of information by one person or a small number of individuals. A database, on the other hand, is intended to contain substantially greater volumes of information that can be accessed, filtered, and changed rapidly and simply by any number of users at the same time.

Large databases do this by storing data on servers comprised of powerful computers. These servers are often designed with hundreds or thousands of computers to provide the processing power and storage capacity required for several users to access the database at the same time. While a spreadsheet or database may be accessed by anybody, it is usually owned by a company and maintained by an assigned person who has total control over how it functions and the data contained inside it.

So, what distinguishes a blockchain from a database?

Blockchain Storage Structure

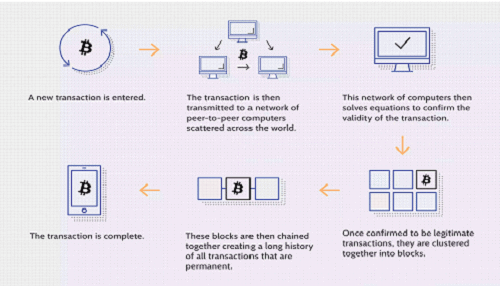

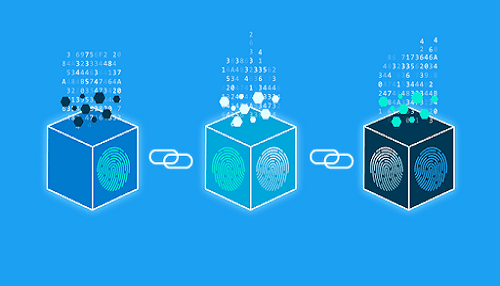

The way data is organized differs significantly between a traditional database and a blockchain. A blockchain accumulates information in groupings known as blocks, which include sets of information. When a block’s storage capacity is reached, it is chained onto the previously full block, producing a data chain known as the “blockchain.” All new information that follows that newly added block is assembled into a newly formed block, which is then added to the chain once it is complete.

A database organizes data into tables, but a blockchain, as the name suggests, organizes data into chunks (blocks) that are connected together. As a result, although all blockchains are databases, not all databases are blockchains. When implemented in a decentralized manner, this method creates an irreversible data timeline. When a block is completed, it becomes permanent and forms a part of this timeline. When a block is added to the chain, it is assigned a precise timestamp.

Transaction Process of a Blockchain

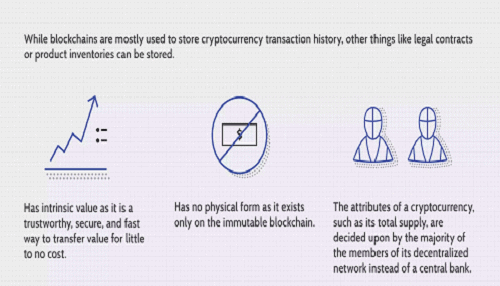

Attributes of Cryptocurrency

Decentralization in the context of a Blockchain

It is helpful to consider blockchain in the perspective of how it has been implemented by Bitcoin in order to comprehend it. Bitcoin, like a database, requires a group of computers to keep its blockchain. This blockchain is just a form of database that keeps every Bitcoin transaction ever done. In the case of Bitcoin, and unlike other databases, these computers are not all housed under the same roof, and each computer or set of computers is run by a distinct person or group of people.

Assume a corporation has a server with 10,000 machines and a database containing all of its clients’ account information. This corporation has a warehouse where all of these computers are housed under one roof, and it has complete authority over all of these systems and the information stored inside them. Similarly, Bitcoin is made up of thousands of computers, but each computer or group of computers that holds its blockchain is at a distinct geographical location and is run by different persons or groups of people. Nodes are the machines that make up the Bitcoin network.

The blockchain of Bitcoin is utilized decentralizedly in this paradigm. However, private, centralized blockchains exist, in which the machines that comprise the network are owned and maintained by a single company.

Each node in a blockchain contains a complete record of the data that has been recorded on the blockchain from its start. The data for Bitcoin is the whole history of all Bitcoin transactions. If a node’s data has a mistake, it may utilize the thousands of other nodes as a reference point to rectify itself. This manner, no one node in the network may change the information stored inside it. As a result, the history of transactions in each block of Bitcoin’s blockchain is irreversible.

If a single user tampers with Bitcoin’s transaction record, the other nodes will cross-reference each other and readily identify the node with inaccurate information. This method aids in the establishment of a precise and visible sequence of occurrences. This information is a record of transactions for Bitcoin, however a blockchain may also include a variety of information such as legal contracts, state identifications, or a company’s goods inventory.

To modify how that system functions or the information stored inside it, a majority of the processing power in the decentralized network must agree on the modifications. This guarantees that any changes that are implemented are in the best interests of the majority.

What is a Smart Contract?

Smart contracts are programmed contracts that may be performed or enforced on the blockchain without the need for human intervention. When certain circumstances are satisfied, they may be programmed to define and execute an agreement or transaction. Smart contracts are distributed and immutable on the blockchain.

After a smart contract is formed, it cannot be changed once it is placed on the Blockchain. The contract’s code cannot be changed by a third party or the contract’s author. Everyone viewing the Blockchain, including stakeholders and interested third parties, validates the smart contract result.

Automobile insurance contracts are an example of a real-world use case for Smart Contracts. When the circumstances of a Smart Contract alter in an insured event, such as a car accident, the claims procedure is immediately launched. The event’s parameters, such as travel speed, location, and time of day, may be recorded on the blockchain. If the smart contract’s variables exceed specific pre-agreed-upon criteria, the claims procedure is automatically activated, and the precise amount of cash settlement may be given without the need for human interaction.

If you manufacture, purchase, or sell items, the ability to make each stage of the supply chain more visible may benefit your company. Smart contracts enable product tracking from the production to the retail shelves. IoT devices may directly publish location data to a smart contract, simplifying the tracking process. This capability allows you real-time view of the whole supply chain. If your delivered products get stopped at customs, you will be notified promptly. Advanced tracking also helps to reduce the danger of fraud and theft.

Not only does the smart contract decrease administrative expenses connected with policy fulfillment, but it also demonstrates openness and confidence in the process to all regulatory agencies and stakeholders.

What is consensus and known variations of consensus?

Consensus is often used to describe broad agreement among members of a group or society. Consensus in blockchain refers to a majority of people who are mining or have power declaring they sign off on a block of transactions. As previously said, decentralization necessitates the involvement of more individuals in decision-making processes; agreement is established when a conclusion is made.

Consensus is required in a blockchain solution for blocks to be published on the chain; rejected transactions are not recorded on the chain. This approach is what makes blockchain technology tamper-proof since adding or editing erroneous data would require compromising the majority of network members rather than just one server in a data center (example: Equifax, Target, etc.).

There are several kinds of consensus models. These models are fueled by compensating users in bitcoin or by other methods to keep individuals that comprise the consensus honest and motivated to continue confirming transactions. Among the popular consensus models are:

- Proof of Work: A proof of work is a piece of data that is difficult (expensive, time-consuming) to generate yet simple for others to verify and that meets particular criteria. To date, Bitcoin and the majority of blockchains follow the PoW consensus mechanism. It is well-known for its great security, but it has substantial scalability issues, leading in poor speeds and hefty transaction costs. PoW also uses a significant amount of power.

- Proof of Stake: In PoS-based cryptocurrencies, the next block’s author is determined using a mix of random selection and wealth or age (i.e., the stake). PoS may be set to be a more efficient consensus mechanism than PoW, leading in reduced energy consumption, cheaper transaction costs, and perhaps greater scalability. The long-term security of PoS systems is currently being investigated.

- Proof of Authority: In PoA-based networks, transactions and blocks are validated by approved accounts, known as validators. Validators use software that allows them to group transactions into blocks. The procedure is automated, so validators do not need to continually check their computers. It does, however, need keeping the computer (the authority node) uncompromised. PoA uses trustworthy validators to significantly boost blockchain efficiency, resulting in substantially better scalability and cheaper transaction costs while maintaining a safe chain.

Transparency

Because of the decentralized nature of Bitcoin’s blockchain, all transactions can be transparently viewed by either having a personal node or by using blockchain explorers that allow anyone to see transactions occurring live. Each node has its own copy of the chain that gets updated as fresh blocks are confirmed and added. This means that if you wanted to, you could track Bitcoin wherever it goes.

For example, exchanges have been hacked in the past where those who held Bitcoin on the exchange lost everything. While the hacker may be entirely anonymous, the Bitcoins that they extracted are easily traceable. If the Bitcoins that were stolen in some of these hacks were to be moved or spent somewhere, it would be known.

Is a Blockchain Secure?

In numerous ways, blockchain technology addresses the concerns of security and trust. To begin, new blocks are always kept in a linear and chronological order. That is, they are always appended to the blockchain’s “end.” If you look at the Bitcoin blockchain, you’ll see that each block has a location on the chain known as a “height.” The block’s height has reached 656,197 blocks as of November 2020.

It is very difficult to go back and change the contents of a block once it has been appended to the end of the blockchain unless the majority agrees to do so. This is due to the fact that each block has its own hash, as well as the hash of the block before it and the previously stated time stamp. A math function generates hash codes by converting digital data into a string of numbers and characters. If that information is changed in any manner, the hash code also changes.

Here’s why that matters for security. Assume a hacker want to change the blockchain in order to take Bitcoin from everyone else. If they changed their single copy, it would no longer be in sync with everyone else’s copy. When everyone else compares their copies, they will see that this one copy stands out, and the hacker’s version of the chain will be dismissed as invalid.

To be successful, the hacker must simultaneously possess and change 51 percent of the copies of the blockchain such that their new copy becomes the majority copy and hence the agreed-upon chain. Such an assault would also need an enormous amount of money and resources, since they would have to rewrite all of the blocks due to the varied timestamps and hash codes.

Because of the scale of Bitcoin’s network and how quickly it is developing, the expense of accomplishing such a feat would very certainly be impossible. This would not only be enormously costly, but it would also most likely be futile. Such an action would not go unnoticed by network participants, who would detect such substantial changes to the blockchain. Members of the network would then branch off to a new version of the chain that was not impacted.

This would lead the value of the targeted version of Bitcoin to collapse, rendering the assault ultimately futile since the bad actor now controls a worthless asset. The same thing would happen if a bad actor attacked the next Bitcoin split. It is designed in this manner so that participating in the network is significantly more economically encouraged than attacking it.

Blockchain vs. Bitcoin

Blockchain’s purpose is to enable digital information to be recorded and disseminated, but not altered. Stuart Haber and W. Scott Stornetta, two academics who aimed to develop a system where document timestamps could not be manipulated with, proposed blockchain technology in 1991. But it wasn’t until over two decades later, with the January 2009 introduction of Bitcoin, that blockchain saw its first real-world implementation.

A blockchain is the foundation of the Bitcoin protocol. Bitcoin’s pseudonymous developer, Satoshi Nakamoto, described the digital currency in a research paper as “a new electronic cash system that’s totally peer-to-peer, with no trusted third party.”

The crucial point to remember here is that although Bitcoin utilizes blockchain to transparently record a ledger of payments, blockchain may theoretically be used to immutably store any amount of data items. As previously said, this might take the shape of transactions, election votes, goods inventories, state identifications, deeds to residences, and much more.

There are already a plethora of blockchain-based initiatives attempting to use blockchain for purposes other than transaction logging. One such example is the use of blockchain to vote in democratic elections. Because of the immutability of blockchain, fraudulent voting would become much more difficult.

A voting system, for example, may be designed such that each citizen of a nation receives a separate coin or token. Each candidate would then be assigned a unique wallet address, and voters would transmit their token or cryptocurrency to the address of the candidate for whom they want to vote. Because blockchain is transparent and traceable, it eliminates the need for human vote counting and the possibility of bad actors to interfere with physical votes.

Blockchain vs. Banks

Banks and decentralized blockchains are vastly different. To see how a bank differs from blockchain, let’s compare the banking system to Bitcoin’s implementation of blockchain.

| Feature | Banks | Bitcoin |

|---|---|---|

| Transaction Speed | •Card payments: 24-48 hours •Checks: 24-72 hours to clear •ACH: 24-48 hours •Wire: Within 24 hours unless international *Bank transfers are typically not processed on weekends or bank holidays |

Bitcoin transactions can take as little as 15 minutes and as much as over an hour depending on network congestion. |

| Transaction Fees | •Card payments: This fee varies based on the card and is not paid by the user directly. Fees are paid to the payment processors by stores and are usually charged per transaction. The effect of this fee can sometimes make the cost of goods and services rise. •Checks: can cost between $1 and $30 depending on your bank. •ACH: ACH transfers can cost up to $3 when sending to external accounts. •Wire: Outgoing domestic wire transfers can cost as much as $25. Outgoing international wire transfers can cost as much as $45. |

Bitcoin has variable transaction fees determined by miners and users. This fee can range between $0 and $50 but users have the ability to determine how much of a fee they are willing to pay. This creates an open marketplace where if the user sets their fee too low their transaction may not be processed. |

| Security | Assuming the client practices solid internet security measures like using secure passwords and two-factor authentication, a bank account’s information is only as secure as the bank’s server that contains client account information. | The larger the Bitcoin network grows the more secure it gets. The level of security a Bitcoin holder has with their own Bitcoin is entirely up to them. For this reason it is recommended that people use cold storage for larger quantities of Bitcoin or any amount that is intended to be held for a long period of time. |

| Privacy | Bank account information is stored on the bank’s private servers and held by the client. Bank account privacy is limited to how secure the bank’s servers are and how well the individual user secures their own information. If the bank’s servers were to be compromised then the individual’s account would be as well. | Bitcoin can be as private as the user wishes. All Bitcoin is traceable but it is impossible to establish who has ownership of Bitcoin if it was purchased anonymously. If Bitcoin is purchased on a KYC exchange then the Bitcoin is directly tied to the holder of the KYC exchange account. |

| Know Your Customer Rules | Bank accounts and other banking products require “Know Your Customer” (KYC) procedures. This means it is legally required for banks to record a customer’s identification prior to opening an account. | Anyone or anything can participate in Bitcoin’s network with no identification. In theory, even an entity equipped with artificial intelligence could participate. |

| Hours open | Typical brick-and-mortar banks are open from 9:00 am to 5:00 pm on weekdays. Some banks are open on weekends but with limited hours. All banks are closed on banking holidays. | No set hours; open 24/7, 365 days a year. |

| Ease of Transfers | Government-issued identification, a bank account, and a mobile phone are the minimum requirements for digital transfers. | An internet connection and a mobile phone are the minimum requirements. |

| Approved Transactions | Banks reserve the right to deny transactions for a variety of reasons. Banks also reserve the right to freeze accounts. If your bank notices purchases in unusual locations or for unusual items they can be denied. | The Bitcoin network itself does not dictate how Bitcoin is used in any shape or form. Users can transact Bitcoin how they see fit but should also adhere to the guidelines of their country or region. |

| Account Seizures | Due to KYC laws, governments can easily track people’s banks accounts and seize the assets within them for a variety of reasons. | If Bitcoin is used anonymously governments would have a hard time tracking it down to seize it. |

How is Blockchain Used?

Blocks on Bitcoin’s blockchain, as we now know, hold data about monetary transactions. However, it has been shown that blockchain is also a viable method of recording data about other sorts of transactions.

Walmart, Pfizer, AIG, Siemens, Unilever, and a slew of other corporations have already used blockchain. VeChain, for example, has created a “market-ready, blockchain-enabled food safety solution.” This is based on ToolChain, a one-stop data Blockchain-as-a-Service (BaaS) platform that traces the trip that food goods take to arrive to their destinations.

Why are you doing this? Countless outbreaks of e Coli, salmonella, and listeria, as well as hazardous compounds being mistakenly introduced into meals, have occurred in the food business. It used to take weeks to figure out where these outbreaks were coming from or what was causing individuals to become ill.

Using blockchain, marketers can follow a food product’s journey from its origin through each stop along the way, and ultimately to its delivery. If a meal is proven to be tainted, it may be tracked back through each stop to its source. Not only that, but these firms can now see everything else with which they have come into touch, enabling the issue to be identified far sooner and perhaps saving lives. This is only one example of a blockchain in action; there are other different types of blockchain implementation.

Banking and Finance

Perhaps no sector will gain more from incorporating blockchain into its business processes than banking. Financial institutions are only open five days a week during business hours. That means that if you attempt to deposit a check on Friday at 6 p.m., you’ll probably have to wait until Monday morning for the funds to appear in your account. Even if you make your deposit during business hours, it may take one to three days for the transaction to be verified owing to the enormous amount of transactions that banks must settle. In contrast, Blockchain never sleeps.

By incorporating blockchain into banks, users may expect their transactions to be completed in as little as 10 minutes, which is the time it takes to add a block to the blockchain, regardless of holidays or time of day or week. Banks may also use blockchain to trade money across institutions more swiftly and securely. In the stock trading industry, for example, the settlement and clearing procedure may take up to three days (or more if dealing overseas), which means that the money and shares are frozen during that time.

Given the magnitude of the funds involved, even a few days in transit might incur enormous expenses and hazards for institutions. The potential savings, according to European bank Santander and its research partners, range from $15 billion to $20 billion each year. According to Capgemini, a French consulting firm, blockchain-based apps may save customers up to $16 billion in banking and insurance expenses each year.

Currency

Blockchain is the foundation for cryptocurrencies such as Bitcoin. The Federal Reserve controls the US currency. A user’s data and cash are theoretically at the mercy of their bank or government under this central authority structure. If a user’s bank gets hacked, the client’s personal information is compromised. The value of the client’s money may be jeopardized if their bank fails if they reside in a nation with an uncertain government. Some of the banks that ran out of money in 2008 were partly bailed out using government money. These are the concerns that led to the creation and development of Bitcoin.

Blockchain lets Bitcoin and other cryptocurrencies to function without the need for a central authority by distributing its activities over a network of computers. This decreases risk while also eliminating numerous processing and transaction expenses. It may also provide people in countries with volatile currencies or financial infrastructures with a more stable currency with more uses and a larger network of persons and organizations with whom they can do business both locally and globally.

Using bitcoin wallets for savings accounts or payment is particularly important for individuals who do not have state identity. Some nations may be in the midst of a civil war or have administrations that lack the necessary infrastructure to offer identification. Citizens in such nations may lack access to savings or brokerage accounts, leaving them with no means of securely storing money.

Healthcare

Blockchain may be used by health care professionals to securely keep their patients’ medical records. When a medical record is created and signed, it may be stored on the blockchain, giving patients evidence and assurance that the record cannot be altered. These personal health data might be encoded and kept on the blockchain with a private key, making them available only to certain persons and maintaining privacy.

Records of Property

If you’ve ever visited your local Recorder’s Office, you’ll be aware that the process of documenting property rights is both time-consuming and inefficient. A tangible deed must now be presented to a government employee at the local recording office, who manually enters it into the county’s central database and public index. Property claims must be reconciled with the public index in the event of a property dispute.

This procedure is not only expensive and time-consuming; it is also fraught with human error, with each mistake making monitoring property ownership less efficient. Blockchain has the ability to remove the necessity for document scanning and physical file tracking at a local recording office. Property owners may have confidence that their deed is accurate and permanently documented if it is kept and validated on the blockchain.

It may be virtually hard to verify property ownership in war-torn nations or locations with little to no government or financial infrastructure, and definitely no “Recorder’s Office.” Transparent and unambiguous timeframes of property ownership might be created if a group of individuals living in such a region is able to harness blockchain.

Smart Contracts

A smart contract is a piece of computer code that may be embedded in the blockchain to help facilitate, verify, or negotiate a contract agreement. Smart contracts function under a set of agreed-upon criteria. When certain requirements are satisfied, the agreement’s provisions are immediately implemented.

Assume a prospective renter wishes to lease an apartment via the use of a smart contract. The landlord promises to provide the renter with the apartment’s door code as soon as the tenant pays the security deposit. Both the renter and the landlord would transmit their respective halves of the agreement to the smart contract, which would save the door code and immediately swap it for the security deposit on the start date of the lease. If the landlord does not provide the door code by the lease expiration date, the smart contract returns the security deposit. This would avoid the expenses and procedures normally associated with using a notary, third-party mediator, or attorneys.

Supply Chains

Suppliers may utilize blockchain to record the provenance of items they have acquired, as shown by the Vechain Toolchain food safety system. Along with typical labels like “Organic,” “Local,” and “Fair Trade,” this would enable businesses to verify the legitimacy of their goods.

Voting

As previously stated, blockchain technology might be utilized to allow a contemporary voting system. Voting using blockchain has the potential to reduce election fraud while increasing voter participation, as shown in the November 2018 midterm elections in West Virginia. Using blockchain in this manner would make tampering with votes almost difficult. The blockchain protocol will also ensure transparency in the electoral process by lowering the number of people required to conduct an election and giving authorities with near-instant results. This would remove the need for recounts and any serious possibility of electoral fraud.

Advantages of Blockchain

Accuracy of the Chain

A network of thousands of computers approves transactions on the blockchain network. This eliminates practically all human participation in the verification process, resulting in reduced human error and a more accurate record of data. Even if a machine on the network committed a computational error, it would only affect one copy of the blockchain. That mistake would have to be made by at least 51 percent of the network’s computers in order to propagate to the remainder of the blockchain, which is almost impossible for a vast and developing network like Bitcoin’s.

Cost Reductions

Customers often pay a bank to authenticate a transaction, a notary to sign a document, or a priest to execute a marriage ceremony. The use of blockchain removes the requirement for third-party verification and the accompanying expenses. Businesses pay a tiny charge when they accept credit card payments, for example, since banks and payment processing providers must handle such transactions. Bitcoin, on the other hand, lacks a centralized authority and offers low transaction costs.

Decentralization

Blockchain does not keep any of its data in a centralized place. Rather, the blockchain is replicated and distributed over a network of computers. Every computer in the network updates its blockchain whenever a new block is added to the blockchain. Blockchain becomes more difficult to manipulate with by disseminating that information over a network rather than holding it in a single central database. If a hacker obtained a copy of the blockchain, just a single copy of the information, rather not the whole network, would be compromised.

Efficient Transactions

Transactions processed by a central authority might take several days to settle. If you try to deposit a check on Friday evening, for example, the cash may not appear in your account until Monday morning. Unlike financial institutions, which function during business hours and five days a week, blockchain operates 24 hours a day, seven days a week, and 365 days a year. Transactions may be done in as little as 10 minutes and are secure within a few hours. This is especially important for cross-border transactions, which often take substantially longer due to time zone differences and the fact that all parties must approve payment processing.

Private Transactions

Many blockchain networks function as public databases, which means that anybody with an internet connection may access the network’s transaction history. Although users may see transaction data, they cannot view identifying information about the people who made those transactions. It is a popular misconception that blockchain networks, such as bitcoin, are anonymous, whereas they are just secret.

That is, when a user conducts public transactions, their unique code, known as a public key, rather than their personal information, is stored on the blockchain. If a person purchases Bitcoin on an exchange that demands identification, their identity is still connected to their blockchain address; nonetheless, a transaction, even when attached to a person’s name, does not divulge any personal information.

Secure Transactions

Once a transaction is recorded, the blockchain network must validate its legitimacy. Thousands of computers on the blockchain race to certify that the purchase data are accurate. The transaction is added to the blockchain block once it has been verified by a machine. Each block on the blockchain has its own unique hash, as well as the unique hash of the previous block. When the information on a block is changed in any manner, the hashcode of that block changes; nevertheless, the hash code of the block following it does not. This disparity makes it incredibly difficult to update information on the blockchain without being noticed.

Transparency

The majority of blockchains are completely open-source software. This implies that anybody with access to the code may see it. This enables auditors to examine the security of cryptocurrencies such as Bitcoin. This also implies that there is no actual authority over who controls the Bitcoin code or how it is modified. As a result, anybody may propose adjustments or additions to the system. Bitcoin may be upgraded if a majority of network users believe that the new version of the code with the upgrade is sound and valuable.

Banking the Unbanked

Perhaps the most significant aspect of blockchain and Bitcoin is the potential for anybody to utilize it, regardless of race, gender, or cultural background. According to the World Bank, approximately 2 billion individuals lack bank accounts or other ways of keeping their money or wealth.

Almost many of these people reside in developing nations where the economy is still in its infancy and is totally based on cash.

These folks often earn minimal money that is paid in cash. They must then conceal this actual currency in their homes or places of residence, leaving them vulnerable to robbery or unwarranted violence. Keys to a Bitcoin wallet may be written on paper, saved on a cheap mobile phone, or even remembered if required. Most people’s alternatives are likely to be more readily concealed than a little amount of cash beneath a mattress.

Blockchains of the future are also exploring for ways to store medical information, property rights, and a number of other legal contracts in addition to serving as a unit of account for wealth storage.