How To Buy Aptos (APT)?

A common question you often see on social media from crypto beginners is “Where can I buy Aptos?” Well, you’ll be happy to hear it is actually quite a simple and straightforward process.

Step 1: Create an account on an exchange that supports Aptos (APT)

First, you will need to open an account on a cryptocurrency exchange that supports Aptos (APT).

We recommend the following based on functionality, reputation, security, support and fees:

1

Binance

Fees (Maker/Taker) 0.075%*-0.1%*

Cryptocurrencies

Available for Trade 500+

Sign-up bonus

10% reduced trading fees*

Available in

Europe, Asia, Oceania, Africa

2

MEXC

Fees (Maker/Taker) 0.2%*-0.2%*

Cryptocurrencies

Available for Trade 1500+

Sign-up bonus

10% reduced trading fees & up to $170 in USDT vouchers*

Available in

North America, South America, Europe, Asia, Oceania, Africa

In order to sign up, you will need to enter some basic information, such as your email address, password, full name and, in some cases, you might also be asked for a phone number or address.

Note: On specific exchanges, you might need to complete a Know Your Customer (KYC) procedure in order to be able to purchase cryptocurrency. This is most commonly the case with licensed and regulated exchanges.

Step 2: Deposit funds into your account

Many cryptocurrency exchanges will allow you to purchase Aptos (APT) with fiat currencies, such as EUR, USD, AUD and others. Furthermore, they will also provide you with multiple deposit methods through which you can fund your fiat account, such as credit and debit cards, ewallets or direct bank transfers.

Note: Some payment methods will have higher fees than others, such as credit card payments. Before funding your fiat account on your chosen exchange, make sure to do your due diligence to find out the fees involved with each payment method to avoid unnecessary costs.

Step 3: Buy Aptos (APT)

This process is similar across almost every cryptocurrency exchange. All you have to do is find a navigation bar or a search bar, and search for Aptos (APT) or Aptos (APT) trading pairs. Look for the section that will allow you to buy Aptos (APT), and enter the amount of the cryptocurrency that you want to spend for Aptos (APT) or the amount of fiat currency that you want to spend towards buying Aptos (APT). The exchange will then calculate the equivalent amount of Aptos (APT) based on the current market rate.

Note: Make sure to always double-check your transaction details, such as the amount of Aptos (APT) you will be buying as well as the total cost of the purchase before you end up confirming the transaction. Furthermore, many cryptocurrency exchanges will offer you their own proprietary software wallet where you will be storing your cryptocurrencies; however, you can create your own individual software wallet, or purchase a hardware wallet for the highest level of protection.

How to create a Binance account

Show Detailed Instructions

Hide Detailed Instructions

Step 1: Go to the Binance website.

Step 2: On the registration page, enter your email address, and create a password for your account.

Then, read and agree to the Terms of Service and click “Create Account”.

Note: Your password must be a combination of numbers and letters.

It should contain at least 8 characters, one UPPER CASE letter, and one number.

Step 3: Complete the Security Verification.

Step 4: The system will send a verification code to your email. The verification code is valid for 30 minutes. If you can’t find the email in your inbox, check your other mail folders as well, or click “Resend Email” to resend.

How to complete KYC (ID Verification) on Binance

Step 1: Log in to your Binance account and click “User Center” and then “Identification”.

Step 2: click “Start Now” to verify your account.

Step 3: Select your country of residence.

Ensure that your country of residence is consistent with your ID documents.

Step 5: Enter your personal information and click “Continue.”

You won’t be able to change it once confirmed.

Refer to the respective options offered for your country.

Step 7: Follow the instructions to upload photos of your document. Your photos should clearly show the full ID document.

Do not wear hats, glasses, or use filters, and make sure that the lighting is sufficient.

Once your application has been verified, you will receive an email notification.

How to buy cryptocurrency on Binance

Step 1: Log in to your Binance account and click “Buy Crypto” and then “Credit/Debit Card”.

Step 2: Here you can choose to buy crypto with different fiat currencies. Enter the fiat amount you want to spend and the system will automatically display the amount of crypto you can get. When you have selected the amount you wish to spend then press “Continue”.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

Step 3: Click “Add New Card”. Then enter your credit card details and your billing address.

Step 4: Check the payment details and confirm your order within 1 minute. After 1 minute, the price and the amount of crypto you will get will be recalculated. You can click “Refresh” to see the latest market price. You will then be redirected to your bank’s OTP Transaction Page. Follow the on-screen instructions to verify the payment.

How to Conduct Spot Trading on Binance

Step 1: Log in to your Binance account.

Click on “Classic” under “Trade” on the top navigation bar.

Step 2: Search and enter the cryptocurrency you want to trade.

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can place a “Market Order” to set the buying/selling price automatically.

Hide Detailed Instructions

How to create a Gate.io account

Show Detailed Instructions

Hide Detailed Instructions

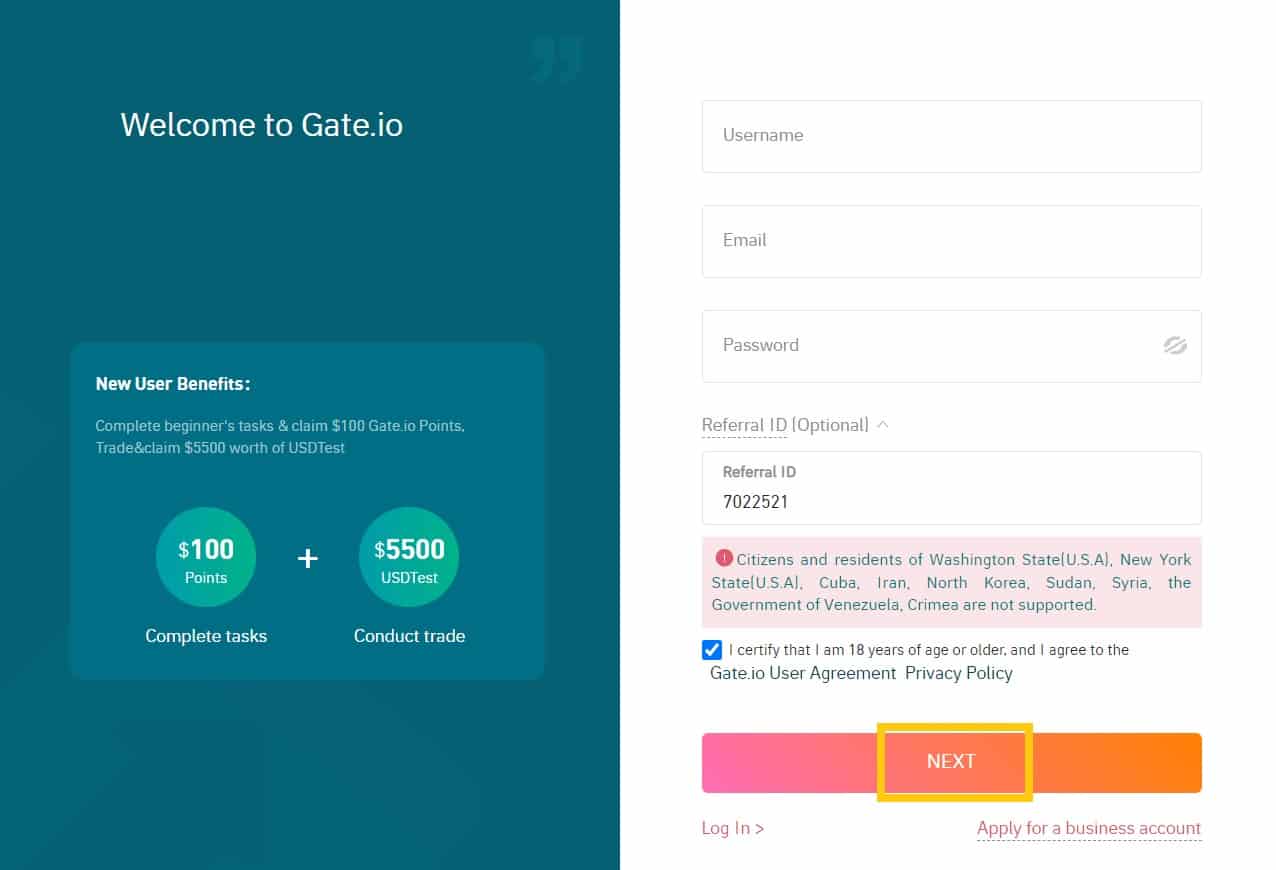

Step 1: Go to the Gate.io website.

Step 2: Choose your username, your email address and your password. Then check “I certify that I am 18 years of age or older, and I agree to the Gate.io User Agreement Privacy Policy” and click “NEXT”.

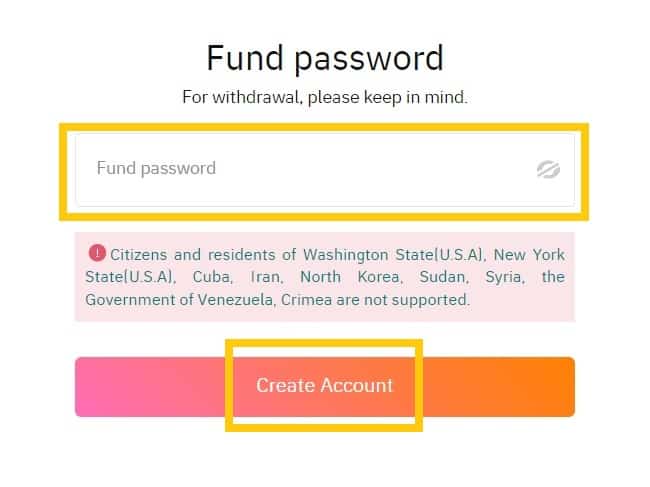

Step 3: Set your fund password and click “Create account”.

Note: Your fund password must contain at least 6 characters and can not be the same as your login password.

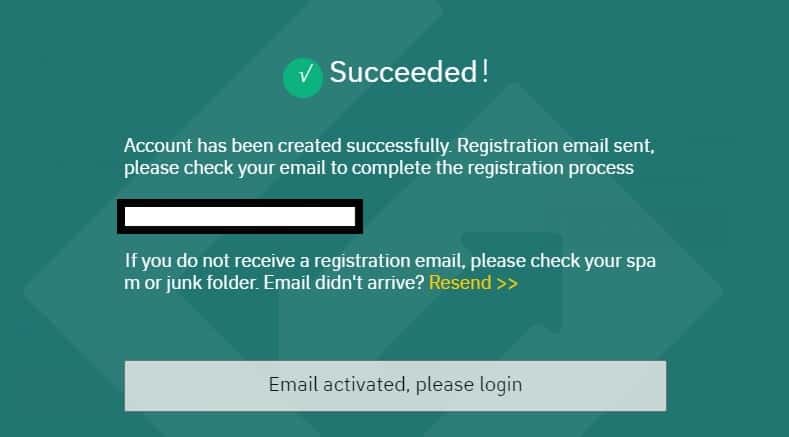

Step 4: An activation email will be sent to your email address. Complete the rest of the registration process by following the instructions in the email to activate your account. Once this is done done, click “Email activated, please log in”.

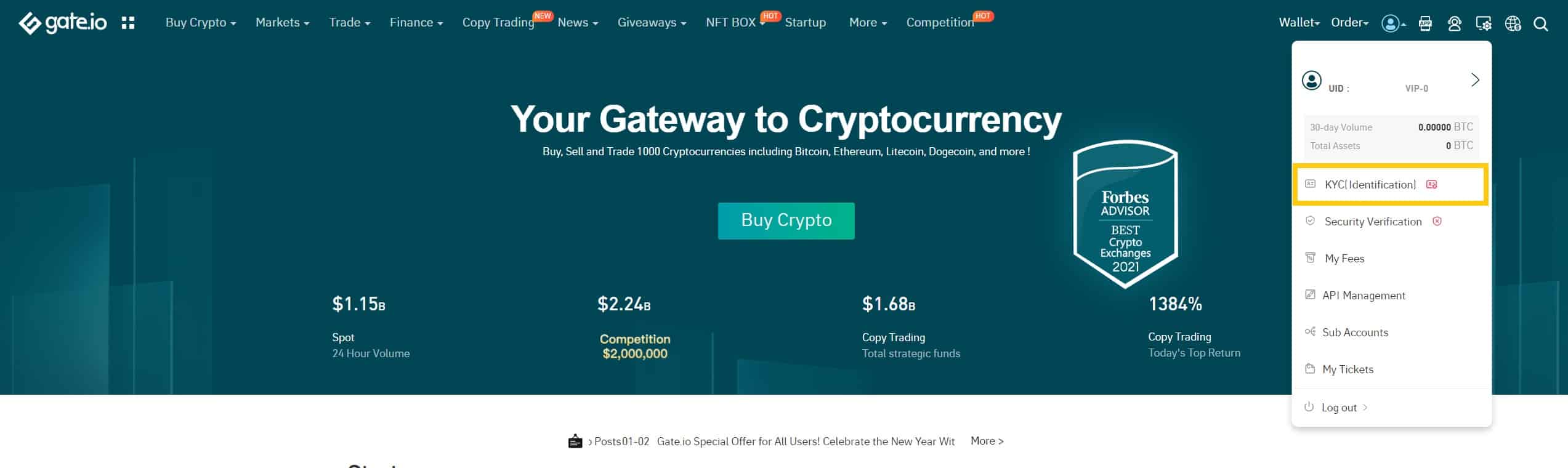

How to complete KYC (ID Verification) on Gate.io

In order to ensure the safety of your assets, and to reduce fraud, money laundering, blackmail, and other illegal activities, Gate.io makes it mandatory that all users obtain KYC ID Verification. Only after your account has obtained KYC ID verification, can you withdraw funds or use credit cards or debit cards to buy cryptocurrencies.

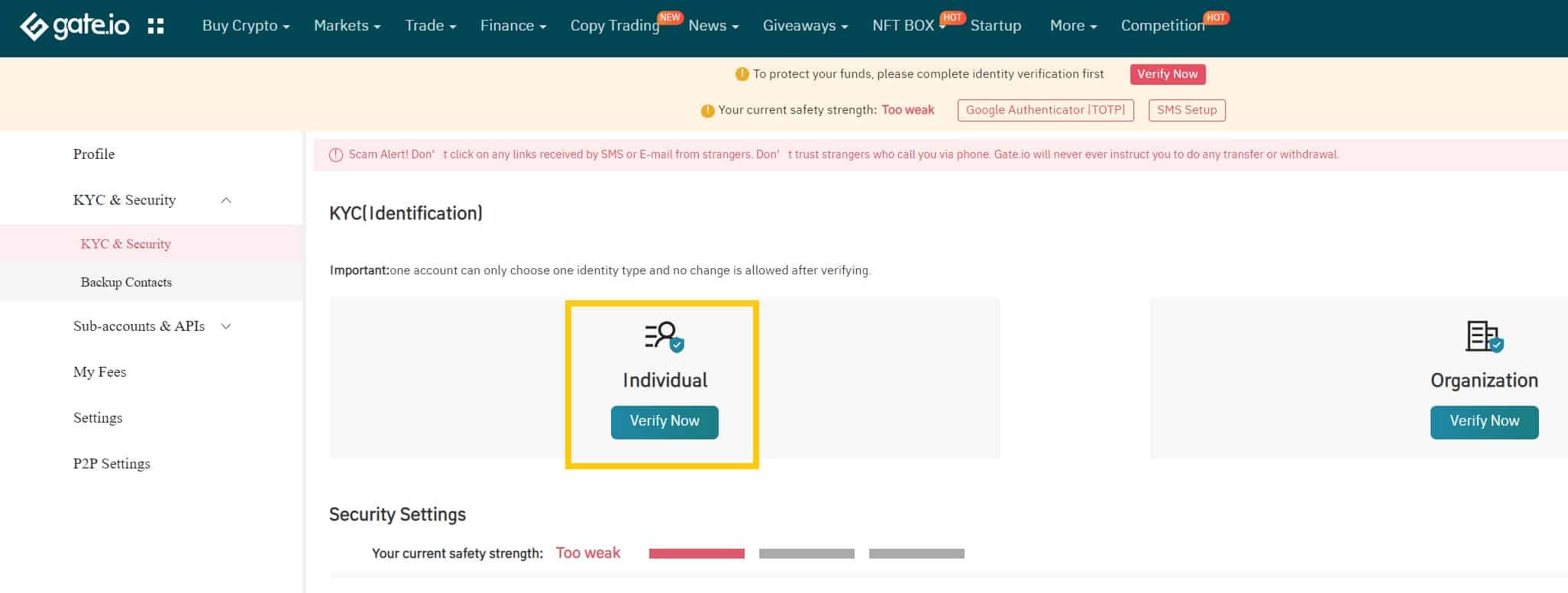

Step 1: Log in to your Gate.io account.

Place your cursor on the top-right profile icon and go to “KYC (ID Verification)”

Step 2: Click “Individual (Verify now)”

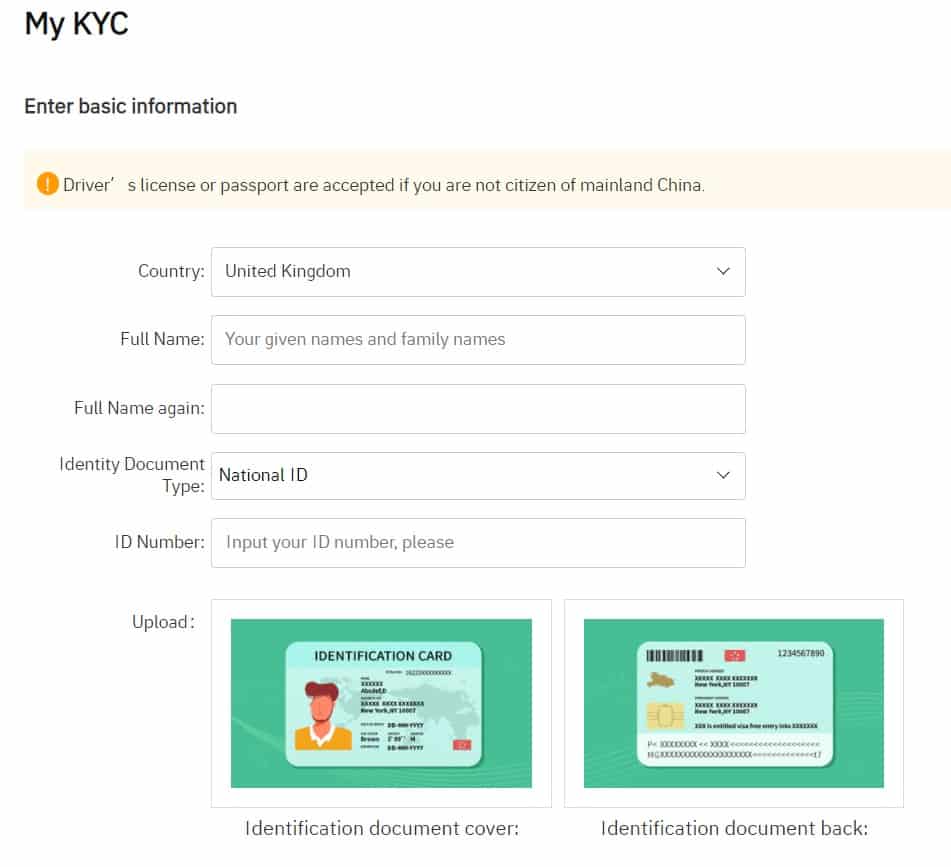

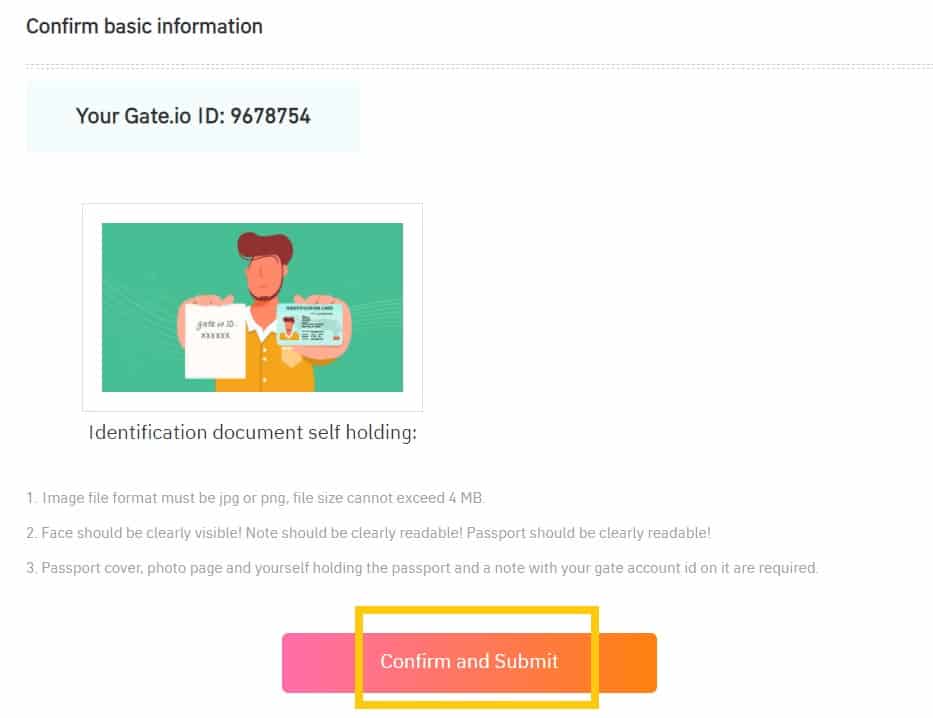

Step 3: Select your country, input your full legal name (twice), fill in your ID information, upload photos of both sides of your ID card, and a photo of you holding your ID together with your User ID (UID) for Gate.io. You will see your User ID by placing the cursor on the top-right profile icon on the main page. Make sure everything is filled in correctly and then click on “Confirm and Submit”.

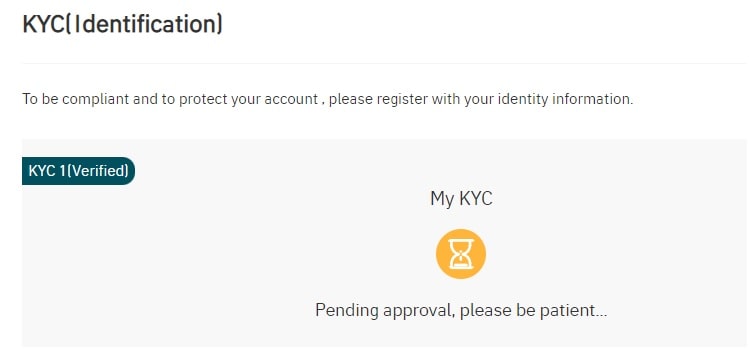

Step 4: After you have submitted all the requested information, you will see the pending approval.

Approval can take anywhere from a few hours to a few days to complete.

Once the KYC is approved, you’re ready to make your first cryptocurrency purchase.

How to buy cryptocurrency on Gate.io

Step 1: Log in to your Gate.io account.

Then in the Menu Bar at the top of the page, click “Buy Crypto” and select “Credit Card”.

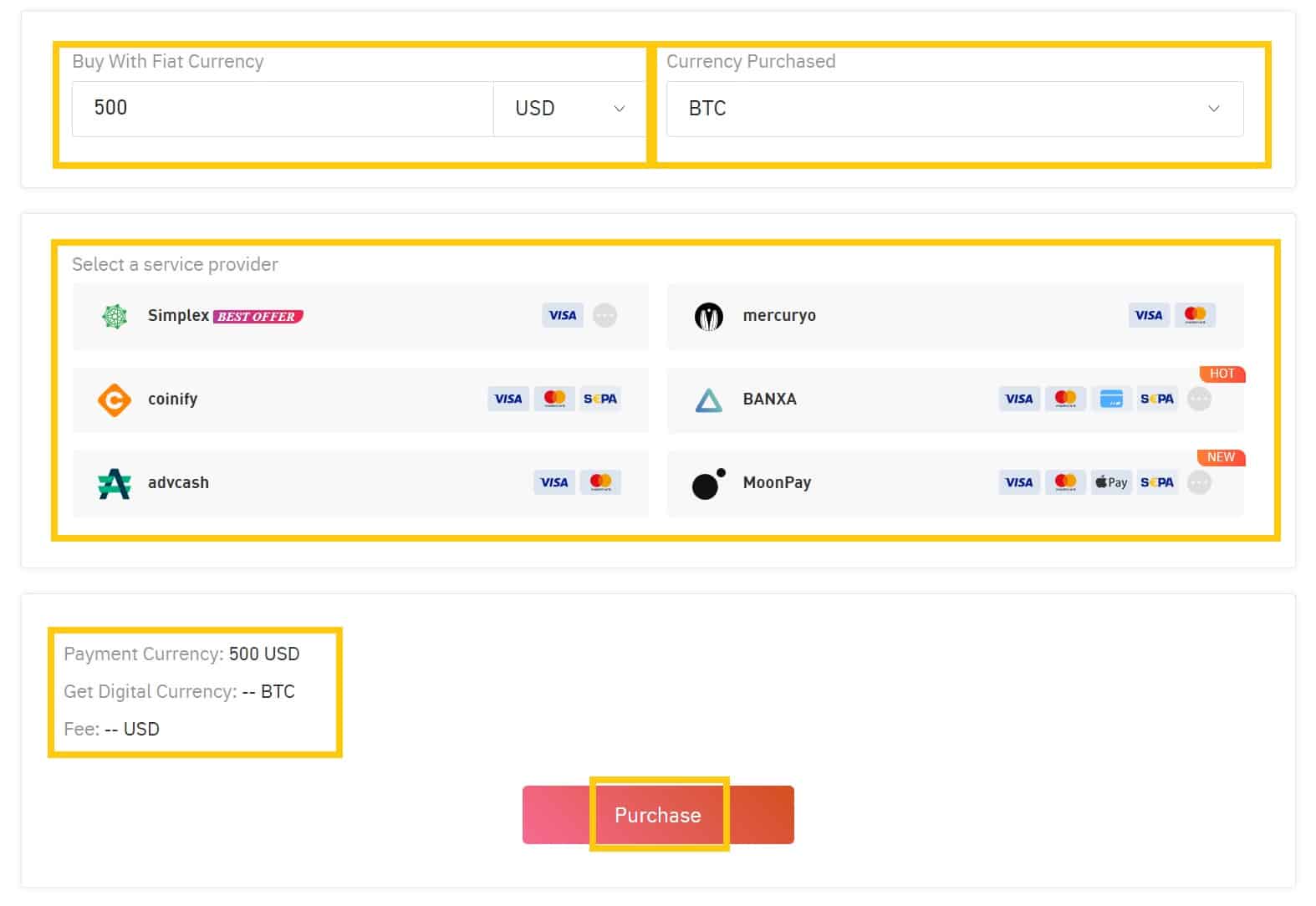

Step 2: Enter the amount you wish to spend in the “Buy with Fiat Currency” tab and select the cryptocurrency that you want to buy under the “Currency Purchased” field. Then select one of the “Service Providers” below and click the “Place Order” button to enter the confirmation page.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

Step 3: On the confirmation page, select “Buy Crypto” or the “Create Order” button to complete the payment.

Note: To ensure a quick and secure way of receiving the order, users might need to conduct an additional Identity Verification (KYC) with a third-party service provider. Once successfully verified, the service provider will immediately transfer the cryptocurrencies to your Gate.io account.

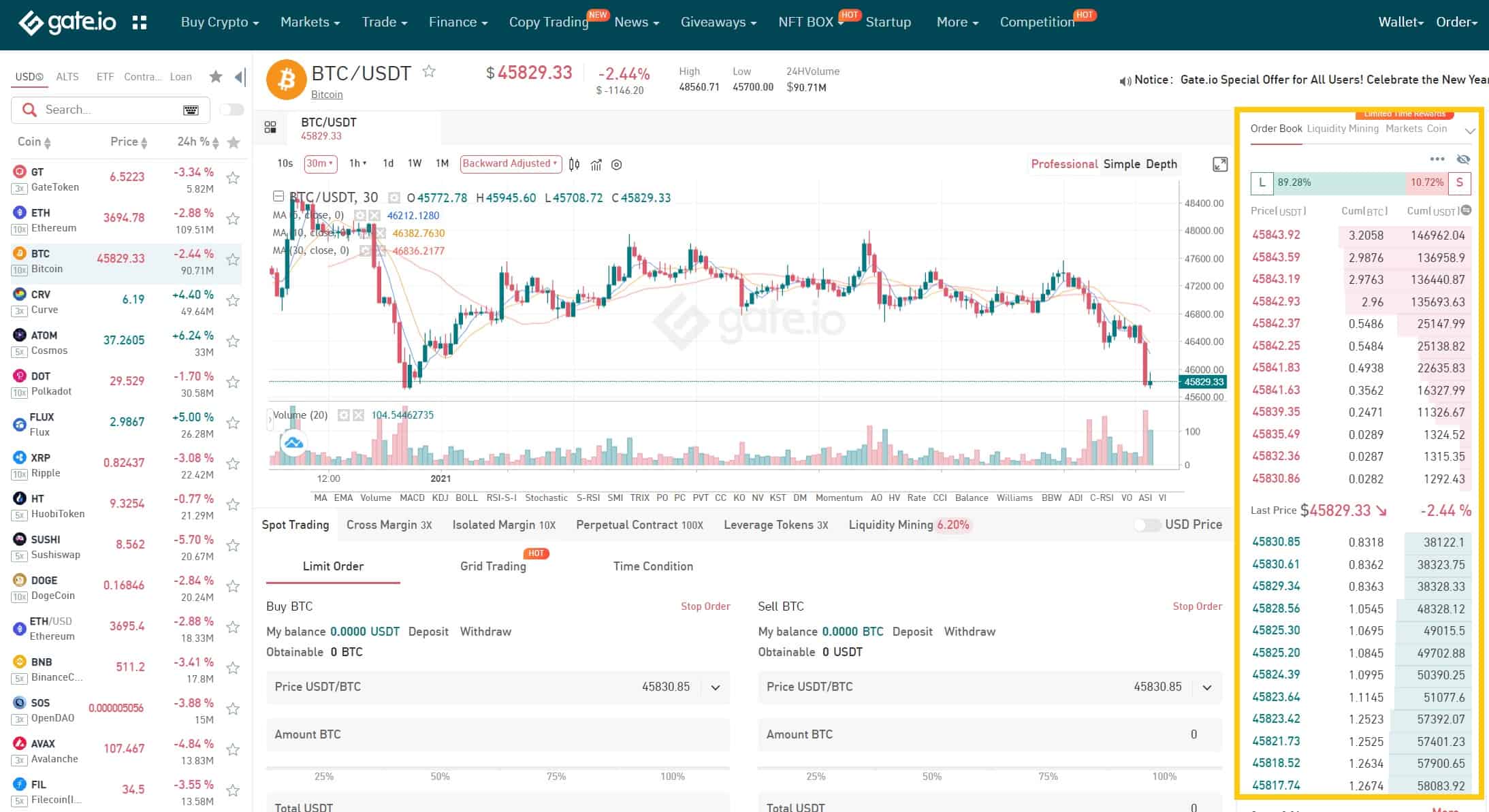

How to Conduct Spot Trading on Gate.io

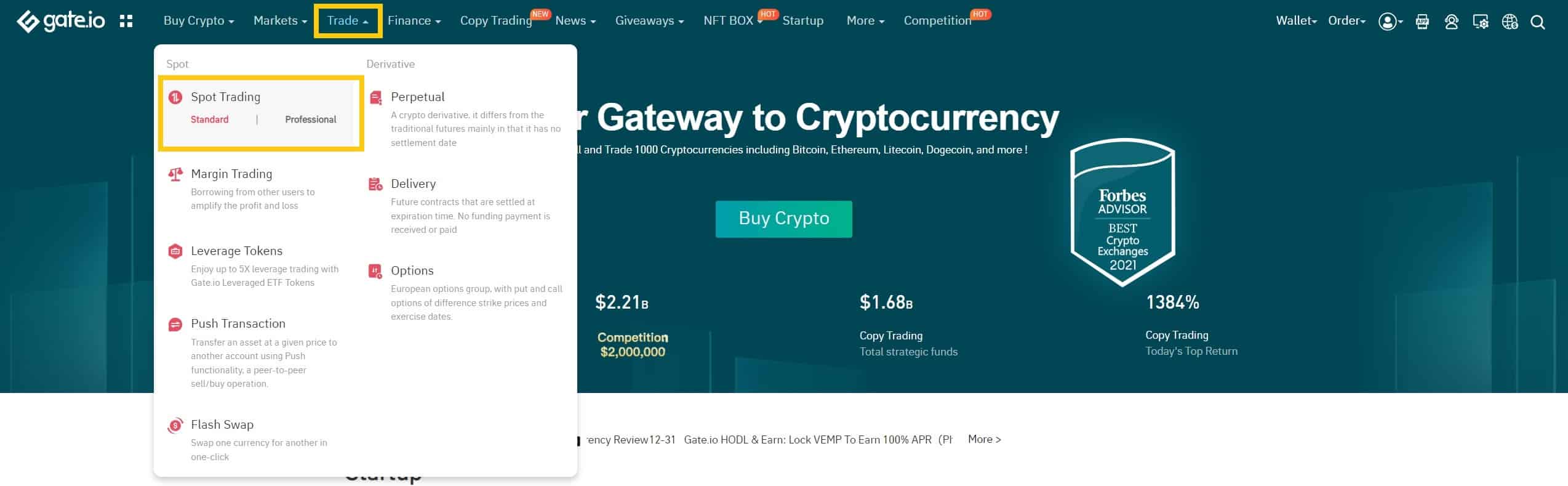

Step 1: Log in to your Gate.io account.

Click on “Spot Trading” under “Trade” on the top navigation bar.

You can either choose “standard” or “professional” version. This tutorial uses the standard version.

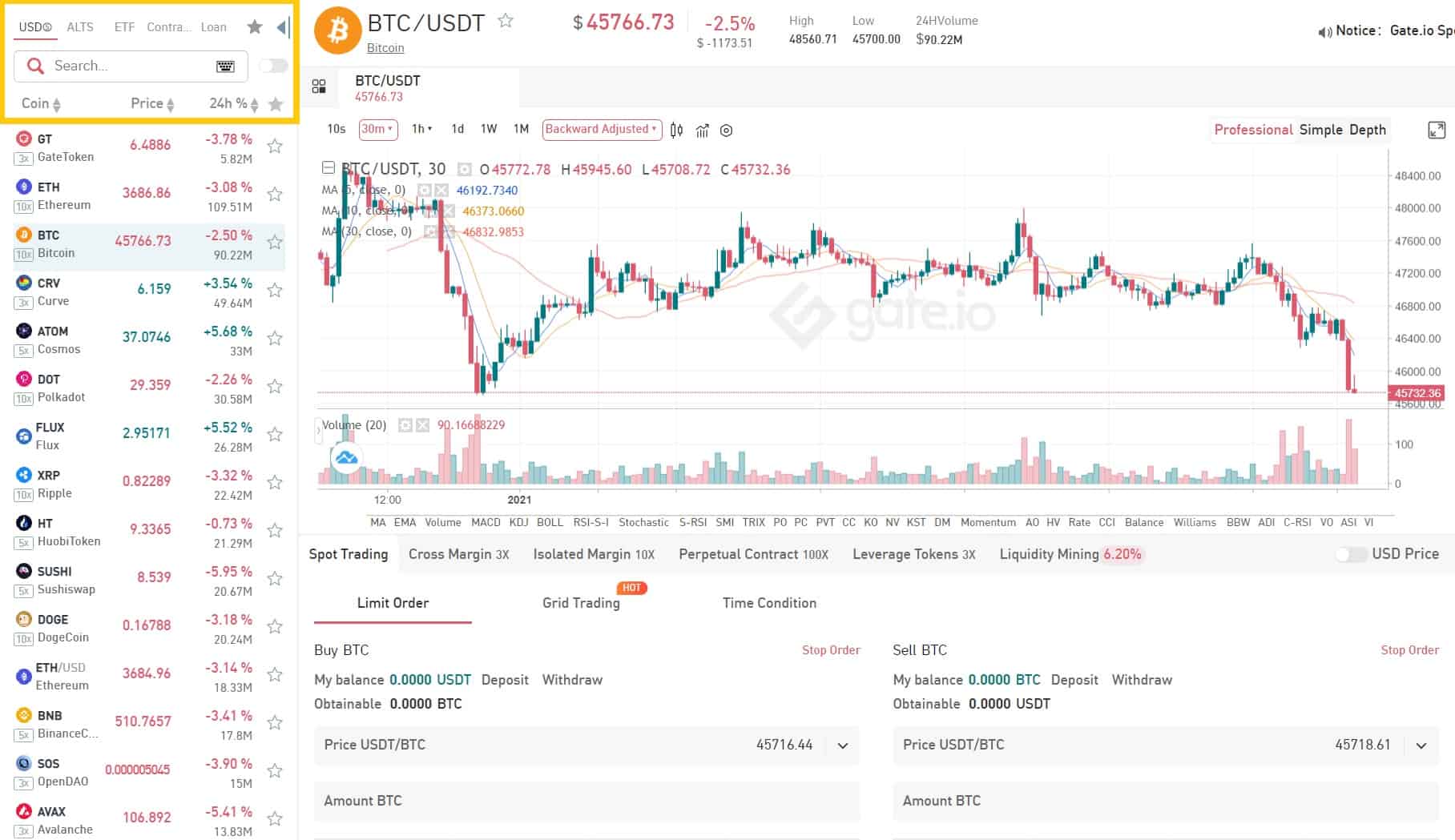

Step 2: Search and enter the cryptocurrency you want to trade.

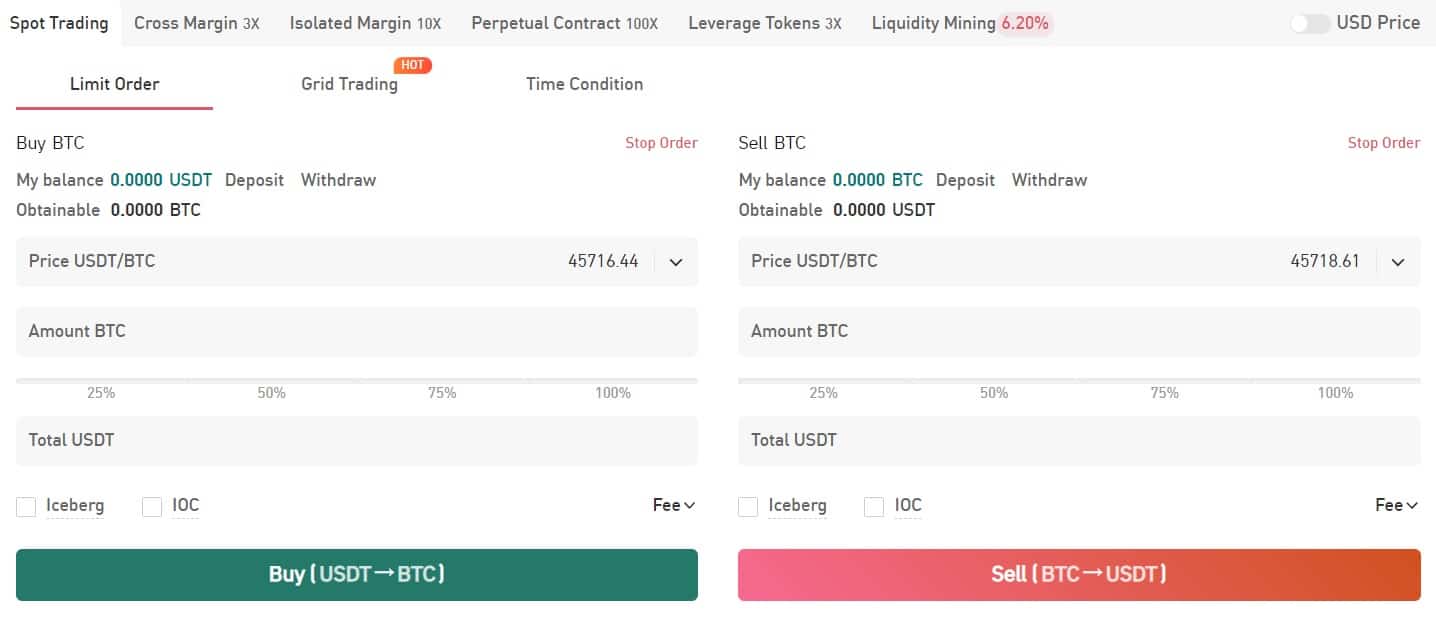

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can click on the last prices on the order book to set the buying/selling price automatically.

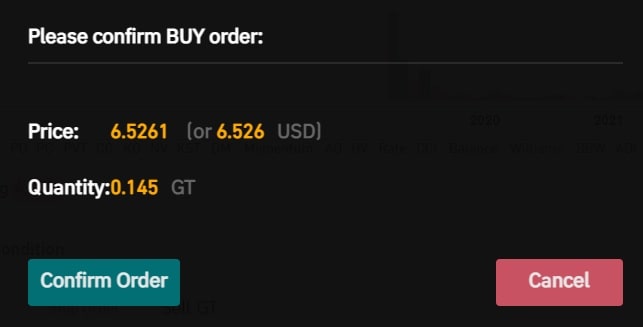

Step 5: Confirm the price and amount. Then click on “Place Order” to place the order, followed by “Confirm Order” to confirm it.

Hide Detailed Instructions

For more in-depth instructions, our ‘Absolute Beginner’s Guide To Cryptocurrency Investing‘ will take you through the process step-by step. In addition to providing instructions for sending and receiving your cryptocurrency.

And if you’re completely new to crypto our beginner, intermediate and advanced level articles will get you up to speed with everything you need to know about the cryptocurrency space starting out.

What is Aptos (APT)?

The Aptos blockchain is an innovative, Proof-of-Stake-based Layer 1 solution that promises to revolutionize the world of decentralized finance. Developed by Aptos Inc., this groundbreaking technology combines parallel transaction processing with a new smart contract language called Move, enabling a remarkable theoretical transaction throughput of over 100,000 transactions per second. Aptos has garnered significant attention and investment, owing to its impressive technology and the fact that it is considered the technological successor to Meta’s abandoned blockchain project, Diem. The project was conceived by two former Meta engineers, Mo Shaikh and Avery Ching.

In March, the news broke that Aptos had successfully secured $200 million in seed funding, led by the renowned venture capital firm Andreessen Horowitz. This milestone marked the beginning of Aptos’ impact on the cryptocurrency industry. Subsequently, a Series A funding round led by FTX Ventures and Jump Crypto raised an additional $150 million for the startup, resulting in a pre-money valuation of $1.9 billion in July. By September, Aptos’ valuation reached $4 billion following a venture round led by Binance Labs, bringing the total capital raised to $450 million.

It is worth noting that Aptos achieved all of these accomplishments before the launch of its blockchain, which officially took place on October 17 (mainnet launch date). To reward early adopters of its testnet and equitably distribute the initial token allocation, Aptos conducted an airdrop of 150 APT tokens, valued at approximately $1,237 each at launch. In total, 110,235 addresses were eligible for the airdrop.

According to data from CoinGecko, Aptos now boasts a fully diluted market valuation of around $9.2 billion. This impressive figure has been achieved despite the network’s recent launch and relatively limited activity thus far. The project’s pricing, alongside its history and connections to Meta, has sparked considerable debate within the cryptocurrency community.

Aptos, a state-of-the-art blockchain technology, incorporates essential elements derived from the Diem blockchain as well as the Move programming language. Move, based on Rust, was independently developed by Meta. Aptos stands out by claiming that its network can achieve a remarkable throughput of over 130 thousand transactions per second. This feat is made possible by utilizing a parallel execution engine called Block-STM, which ultimately results in reduced transaction costs for users.

The Aptos blockchain revolutionizes transaction processing by dividing it into separate, independent, and individually parallelizable stages. This approach mirrors modern, superscalar processor architectures and offers significant performance advantages. Moreover, it enables the Aptos blockchain to provide new modes of validator-client interaction.

Most blockchains either execute smart contracts sequentially or require substantial parallel workload for increased speed, both of which demand a significant amount of power. Aptos differentiates itself from other blockchains in that a single failed transaction will not impede the entire chain of transactions. Instead, each transaction is processed simultaneously and verified post-processing. Failed transactions are terminated and re-executed, facilitated by STM (software transactional memory) libraries that can identify and manage conflicts.

This combination of technologies enhances the throughput capacity of the entire network, which has been a considerable bottleneck for existing layer-1 blockchains. Aptos’ white paper, published in August 2022, highlights a condensed version of the company’s smart contract execution. Their business model is based on leveraging cloud infrastructure as a scalable, cost-effective platform for developing widely-used applications.

Aptos enables the establishment of DeFi projects on its blockchain, with approximately 30 different DeFi initiatives currently in various stages of development within the Aptos ecosystem. These projects include decentralized exchanges, lending protocols, and liquid staking, exemplified by the margin trading protocol known as Aries Markets.

What is the Aptos (APT) Token?

The native token of the Aptos platform, represented by the symbol APT, plays a crucial role in the blockchain’s ecosystem. APT serves as the primary means of payment for transaction and network fees on the Aptos blockchain, ensuring seamless and efficient operations.

All transactions on the network incur fees, denominated in Aptos tokens. Validators on the Aptos network have the power to prioritize high-value transactions and disregard those with lower values. Furthermore, validators can reject less valuable transactions, allowing the blockchain to continue functioning effectively even when operating at maximum capacity. In the future, network fees will be introduced, aligning the cost of using Aptos with the expenses of deploying hardware, maintaining infrastructure, and operating nodes.

APT also plays a significant role in securing the blockchain through a proof-of-stake mechanism. Additionally, the token enables governance voting on protocol changes and on/off-chain operations, providing users with a say in the platform’s future direction.

To participate in transaction validation, validators on the Aptos blockchain must hold a minimum amount of staked APT tokens. Validators enjoy the advantage of determining how rewards will be distributed among themselves and other staking parties. Stakeholders, conversely, can choose from any number of validators to invest their tokens with and receive a predetermined portion of the rewards. Validators and stakers both receive their rewards at the end of each epoch, acknowledging their contributions to the network.

Initially, the maximum reward rate for stakers is set to begin at 7% per annum, subject to reassessment at each epoch. Over time, the maximum return for staking will decrease by 1.5% annually until it reaches a stable rate of 3.25% per year. However, through the governance voting process, stakeholders can adjust incentive levels and processes as needed, ensuring the platform’s adaptability and responsiveness to user preferences.

Who are the founders of Aptos?

Aptos Labs, the organization responsible for the Aptos project, is led by co-founders Mo Shaikh and Avery Ching. The duo oversees a talented, multidisciplinary team of software developers, engineers, and business strategists committed to realizing their ambitious vision for the Aptos blockchain.

Shaikh and Ching first crossed paths while working on Meta’s Diem blockchain project, where they developed a strong professional rapport. Shaikh, an expert in scaling products, brings a wealth of experience from the private equity and venture capital industries. Ching, on the other hand, boasts an impressive background as a highly influential software engineer at Meta, where he spearheaded numerous innovative and forward-thinking development projects.

When Meta decided to abandon the Diem project, Shaikh and Ching seized the opportunity to join forces and establish Aptos Labs. Guided by their company motto, “Building a Layer 1 for everyone,” the pair remain steadfast in their commitment to developing a trustworthy, secure, and highly accessible blockchain network.

Despite being a relatively young venture, Aptos Labs has already garnered considerable support and achieved significant milestones. The company successfully raised over $350 million in capital through two separate funding rounds, launched its developer testnet, and effectively managed millions of transactions and thousands of nodes.

Under the leadership of Mo Shaikh and Avery Ching, Aptos Labs continues to make strides in the blockchain space. With a shared passion for innovation, a wealth of industry experience, and a dedication to creating a Layer 1 blockchain for everyone, the dynamic duo is well-positioned to shape the future of the blockchain ecosystem.

Aptos development updates in 2023

In 2023, Aptos (APT) has experienced significant developments, reflecting its growing influence in the cryptocurrency landscape. Here are some of the key advancements and updates:

-

Foundation and Financial Backing: Aptos, with its roots in Meta’s Novi project, has built a solid foundation in blockchain innovation, particularly with technologies like the Move language and the Narwhal/Bullshark/Shoal consensus mechanisms. This technical foundation is bolstered by impressive fundraising achievements, securing over $400 million from notable firms like Tiger Global and PayPal Ventures, which underlines confidence in Aptos’s vision and technical capabilities.

-

Technological Innovation and Network Scalability: Aptos has utilized the Move programming language to create efficient and secure smart contracts. The blockchain is distinguished for its parallel execution capability, allowing simultaneous transaction processing and significantly enhancing network throughput. This positions Aptos as a highly scalable blockchain capable of efficiently managing large transaction volumes.

-

Robust Total Value Locked (TVL): Aptos’s TVL, exceeding $50 million, reflects growing adoption and trust in the crypto community. Despite its relatively recent launch and challenging market conditions, such as the FTX exchange collapse, the stable and growing TVL is a strong indicator of user confidence in Aptos’s security and potential.

-

Expanding Network Activity: Aptos has shown substantial transactional activity, with daily transactions frequently in the hundreds of thousands, occasionally surpassing a million. This level of activity is comparable to established blockchains like Ethereum, showcasing Aptos’s potential for widespread adoption.

-

Ecosystem Expansions and Partnerships: Notable developments include the integration of Sushi, a decentralized exchange platform, and the collaboration with Coinbase Pay to enhance user experience in the Petra wallet. These partnerships enhance the financial products and services available on Aptos and simplify crypto transactions for users.

-

Move Virtual Machine Improvements: The MoveVM, the Aptos-native virtual machine, has undergone key improvements, enhancing transaction throughput and speeds and expanding the developer toolkit. This includes the introduction of a quorum store on the mainnet, a new digital asset standard, richer Move libraries, transaction shuffling, and adjustments in maximum staking rewards.

-

Market Performance and Future Potential: Despite a correction from its all-time high, the price of APT has remained significantly up from its yearly opening price. Aptos’s ecosystem continues to mature, and its recent developments and partnerships suggest a promising trajectory for the platform.

These developments indicate Aptos’s commitment to expanding its technological capabilities and enhancing its presence in the blockchain and cryptocurrency markets.

Official website: https://aptoslabs.com/

Best cryptocurrency wallet for Aptos (APT)

There are plenty of different crypto wallets available. The best one for you depends on your general trading habits and which provides the most security in your situation. There are two main types of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical). Both have their pros and cons, and there is not necessarily a right or wrong answer when it comes to figuring out which crypto wallet is best for you.

HOW DO I DECIDE WHICH cryptocurrency WALLET TO USE for Aptos (APT)?

Deciding which type of wallet to use depends on a variety of factors, including:

- How often you trade. In general, hot wallets are better for more active cryptocurrency traders. Quick login ability means you are only a few clicks and taps away from buying and selling crypto. Cold wallets are better suited for those looking to make less frequent trades.

- What you want to trade. As mentioned earlier, not all wallets support all types of cryptocurrencies. However, some of the best crypto wallets have the power to trade hundreds of different currencies, providing more of a one-size-fits-all experience.

- Your peace of mind. For those worried about hacking, having a physical cold wallet stored in a safe deposit box at the bank or somewhere at home, provides the safest, most secure option. Others might be confident in their ability to keep their hot wallets secure.

- How much it costs. It is important to investigate the costs associated with each wallet. Many hot wallets will be free to set up. Meanwhile, cold wallets, like any piece of hardware, will cost money to purchase.

- What it can do. While the basics of each cryptocurrency wallet are the same, additional features can help set them apart. This is especially true of hot wallets, many of which come with advanced reporting features, insights into the crypto market, the ability to convert cryptocurrencies and more. Security features can also be a good differentiator.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re going to be dealing in larger volumes of crypto, investing in cold storage might prove advantageous.

Most widespead examples of this being the Ledger Nano and the Trezor.

Ledger manufactures cold storage wallets designed for users who want increased security. Their wallets are a physical device that connects to your computer. Only when the device is connected can you send your cryptocurrency from it. Ledger offers a variety of products, such as the Ledger Nano S and the Ledger Nano X (a bluetooth connected hardware wallet).

Trezor is a pioneering hardware wallet company. The combination of world-class security with an intuitive interface and compatibility with other desktop wallets, makes it ideal for beginners and experts alike. The company has gained a lot of the Bitcoin community’s respect over the years. Trezor offers two main models – The Trezor One and Trezor Model T (which has a built in touch screen).

Aptos (APT) Price & Charts

- Market Capitalization And Daily Trading Volume

- Current Market Price Of Every Cryptocurrency Relative To USD (And Some Local Currencies)

- Circulating And Total Supply

- Historical Charts With Prices Relative To USD, Bitcoin (BTC), And Ethereum (ETH).