How To Buy Hedera Hashgraph (HBAR)?

A common question you often see on social media from crypto beginners is “Where can I buy Hedera Hashgraph?” Well, you’ll be happy to hear it is actually quite a simple and straightforward process.

Step 1: Create an account on an exchange that supports Hedera Hashgraph (HBAR)

First, you will need to open an account on a cryptocurrency exchange that supports Hedera Hashgraph (HBAR).

We recommend the following based on functionality, reputation, security, support and fees:

1

Binance

Fees (Maker/Taker) 0.075%*-0.1%*

Cryptocurrencies

Available for Trade 500+

Sign-up bonus

10% reduced trading fees*

Available in

Europe, Asia, Oceania, Africa

2

Gate.io

Fees (Maker/Taker) 0.2%*-0.2%*

Cryptocurrencies

Available for Trade 1000+

Sign-up bonus

Up to $100 in USDT vouchers*

Available in

North America, South America, Europe, Asia, Oceania, Africa

In order to sign up, you will need to enter some basic information, such as your email address, password, full name and, in some cases, you might also be asked for a phone number or address.

Note: On specific exchanges, you might need to complete a Know Your Customer (KYC) procedure in order to be able to purchase cryptocurrency. This is most commonly the case with licensed and regulated exchanges.

Step 2: Deposit funds into your account

Many cryptocurrency exchanges will allow you to purchase Hedera Hashgraph (HBAR) with fiat currencies, such as EUR, USD, AUD and others. Furthermore, they will also provide you with multiple deposit methods through which you can fund your fiat account, such as credit and debit cards, ewallets or direct bank transfers.

Note: Some payment methods will have higher fees than others, such as credit card payments. Before funding your fiat account on your chosen exchange, make sure to do your due diligence to find out the fees involved with each payment method to avoid unnecessary costs.

Step 3: Buy Hedera Hashgraph (HBAR)

This process is similar across almost every cryptocurrency exchange. All you have to do is find a navigation bar or a search bar, and search for Hedera Hashgraph (HBAR) or Hedera Hashgraph (HBAR) trading pairs. Look for the section that will allow you to buy Hedera Hashgraph (HBAR), and enter the amount of the cryptocurrency that you want to spend for Hedera Hashgraph (HBAR) or the amount of fiat currency that you want to spend towards buying Hedera Hashgraph (HBAR). The exchange will then calculate the equivalent amount of Hedera Hashgraph (HBAR) based on the current market rate.

Note: Make sure to always double-check your transaction details, such as the amount of Hedera Hashgraph (HBAR) you will be buying as well as the total cost of the purchase before you end up confirming the transaction. Furthermore, many cryptocurrency exchanges will offer you their own proprietary software wallet where you will be storing your cryptocurrencies; however, you can create your own individual software wallet, or purchase a hardware wallet for the highest level of protection.

How to create a Binance account

Show Detailed Instructions

Hide Detailed Instructions

Step 1: Go to the Binance website.

Step 2: On the registration page, enter your email address, and create a password for your account.

Then, read and agree to the Terms of Service and click “Create Account”.

Note: Your password must be a combination of numbers and letters.

It should contain at least 8 characters, one UPPER CASE letter, and one number.

Step 3: Complete the Security Verification.

Step 4: The system will send a verification code to your email. The verification code is valid for 30 minutes. If you can’t find the email in your inbox, check your other mail folders as well, or click “Resend Email” to resend.

How to complete KYC (ID Verification) on Binance

Step 1: Log in to your Binance account and click “User Center” and then “Identification”.

Step 2: click “Start Now” to verify your account.

Step 3: Select your country of residence.

Ensure that your country of residence is consistent with your ID documents.

Step 5: Enter your personal information and click “Continue.”

You won’t be able to change it once confirmed.

Refer to the respective options offered for your country.

Step 7: Follow the instructions to upload photos of your document. Your photos should clearly show the full ID document.

Do not wear hats, glasses, or use filters, and make sure that the lighting is sufficient.

Once your application has been verified, you will receive an email notification.

How to buy cryptocurrency on Binance

Step 1: Log in to your Binance account and click “Buy Crypto” and then “Credit/Debit Card”.

Step 2: Here you can choose to buy crypto with different fiat currencies. Enter the fiat amount you want to spend and the system will automatically display the amount of crypto you can get. When you have selected the amount you wish to spend then press “Continue”.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

Step 3: Click “Add New Card”. Then enter your credit card details and your billing address.

Step 4: Check the payment details and confirm your order within 1 minute. After 1 minute, the price and the amount of crypto you will get will be recalculated. You can click “Refresh” to see the latest market price. You will then be redirected to your bank’s OTP Transaction Page. Follow the on-screen instructions to verify the payment.

How to Conduct Spot Trading on Binance

Step 1: Log in to your Binance account.

Click on “Classic” under “Trade” on the top navigation bar.

Step 2: Search and enter the cryptocurrency you want to trade.

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can place a “Market Order” to set the buying/selling price automatically.

Hide Detailed Instructions

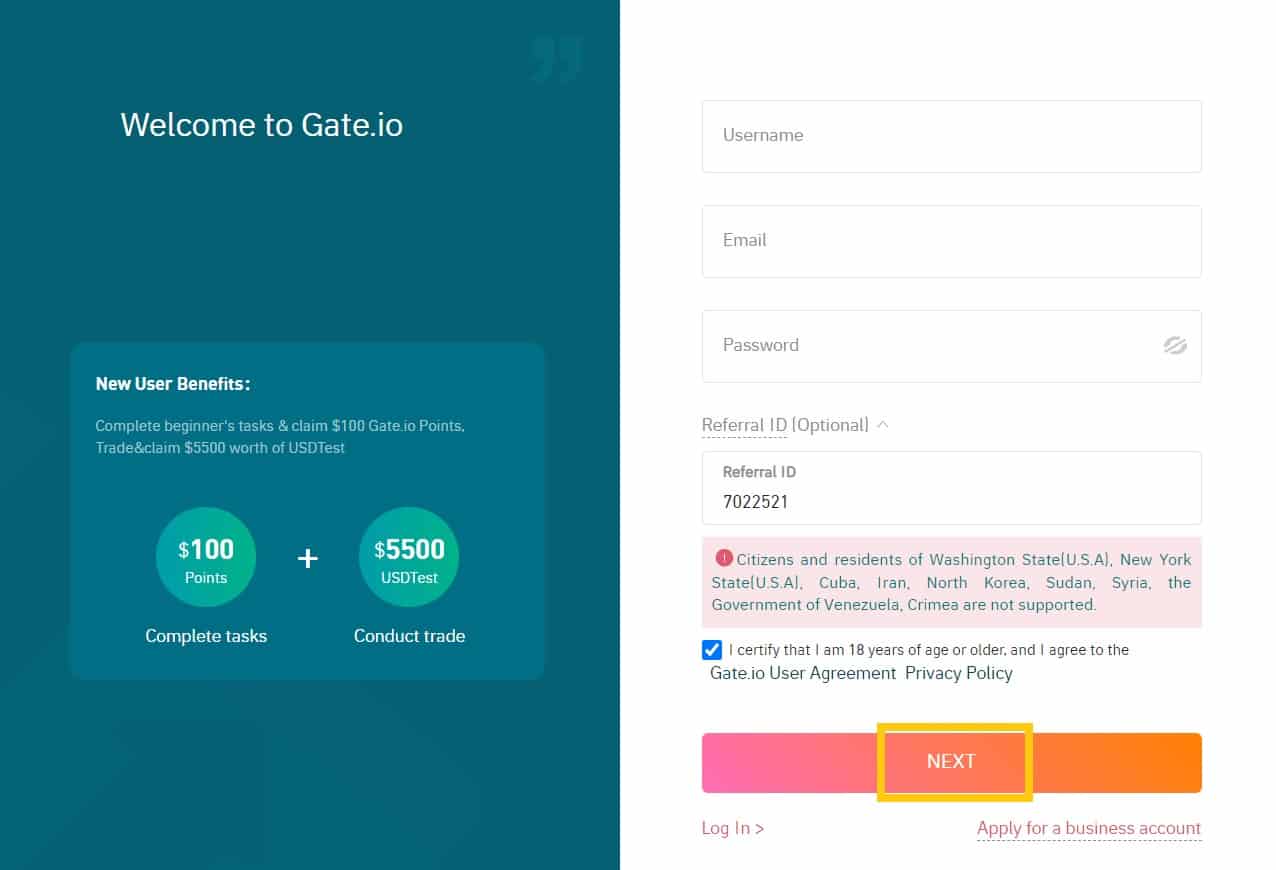

How to create a Gate.io account

Show Detailed Instructions

Hide Detailed Instructions

Step 1: Go to the Gate.io website.

Step 2: Choose your username, your email address and your password. Then check “I certify that I am 18 years of age or older, and I agree to the Gate.io User Agreement Privacy Policy” and click “NEXT”.

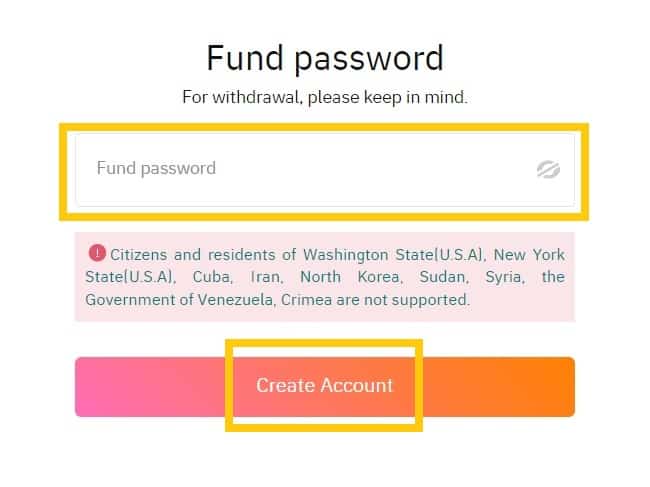

Step 3: Set your fund password and click “Create account”.

Note: Your fund password must contain at least 6 characters and can not be the same as your login password.

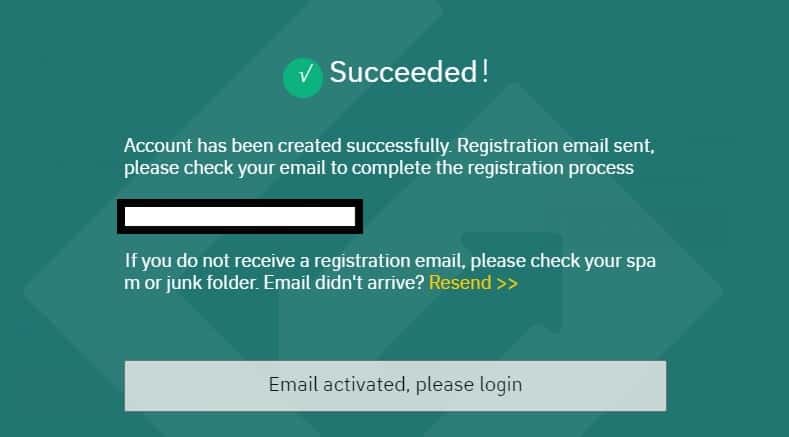

Step 4: An activation email will be sent to your email address. Complete the rest of the registration process by following the instructions in the email to activate your account. Once this is done done, click “Email activated, please log in”.

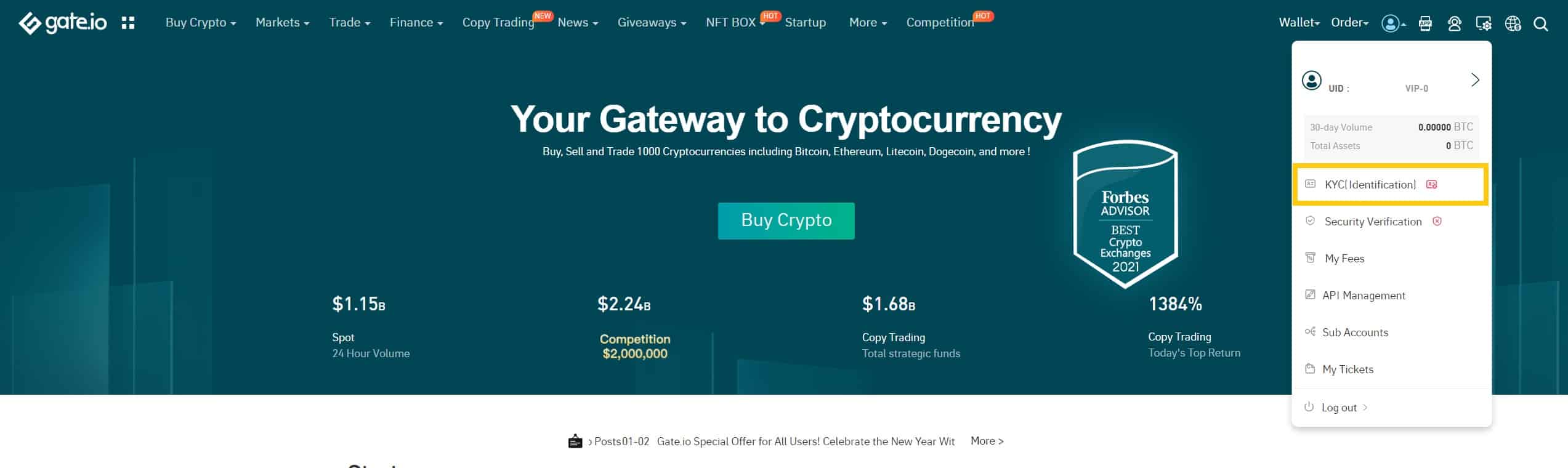

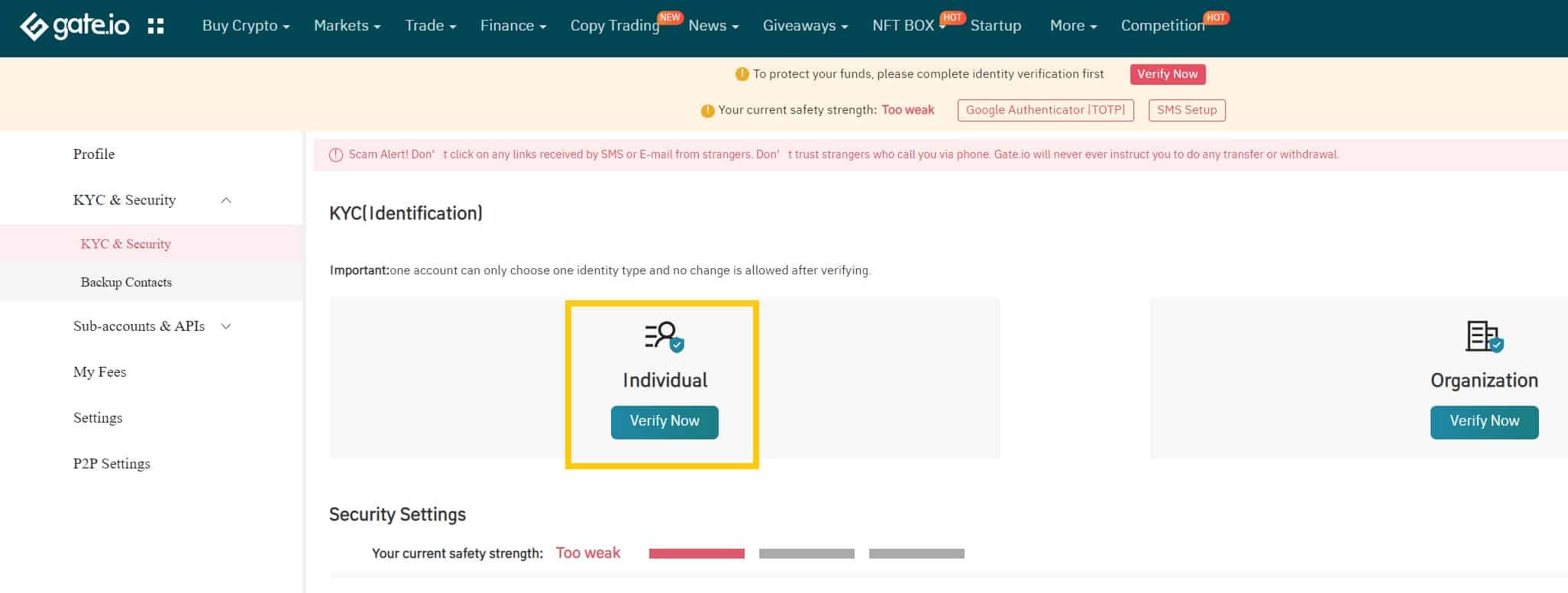

How to complete KYC (ID Verification) on Gate.io

In order to ensure the safety of your assets, and to reduce fraud, money laundering, blackmail, and other illegal activities, Gate.io makes it mandatory that all users obtain KYC ID Verification. Only after your account has obtained KYC ID verification, can you withdraw funds or use credit cards or debit cards to buy cryptocurrencies.

Step 1: Log in to your Gate.io account.

Place your cursor on the top-right profile icon and go to “KYC (ID Verification)”

Step 2: Click “Individual (Verify now)”

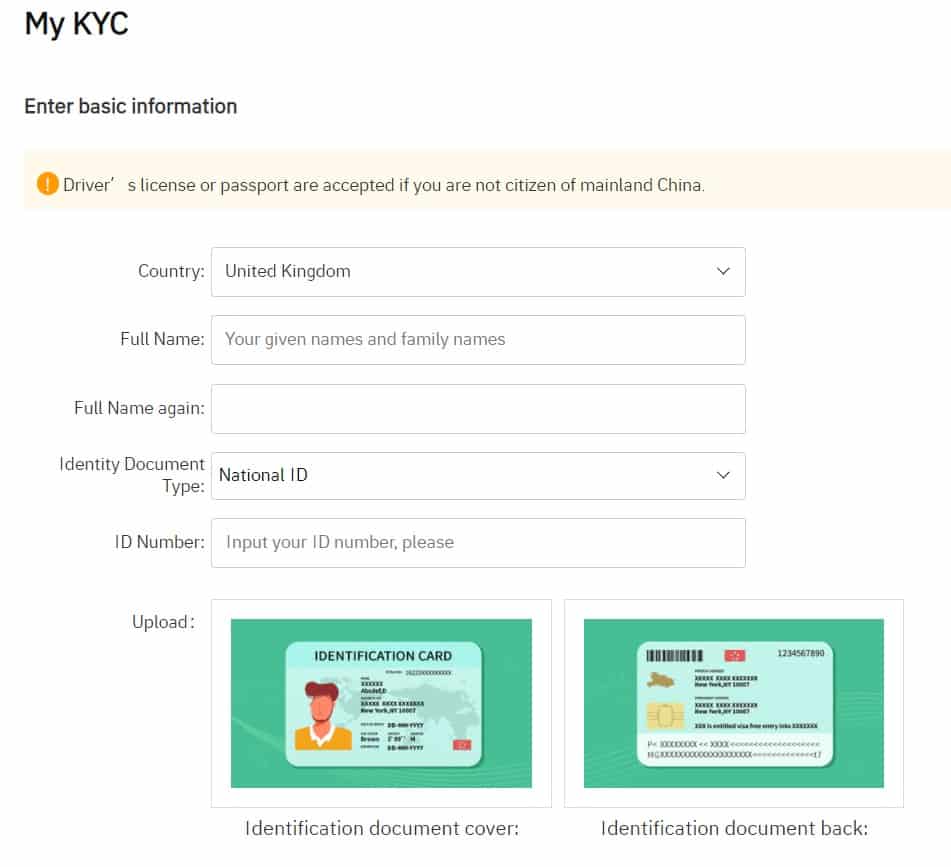

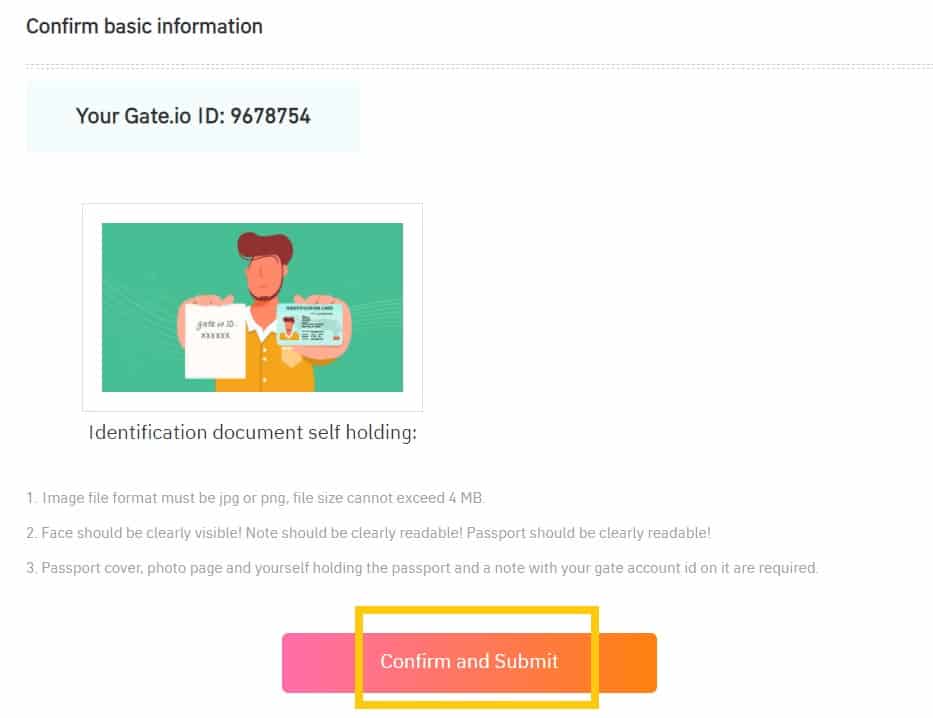

Step 3: Select your country, input your full legal name (twice), fill in your ID information, upload photos of both sides of your ID card, and a photo of you holding your ID together with your User ID (UID) for Gate.io. You will see your User ID by placing the cursor on the top-right profile icon on the main page. Make sure everything is filled in correctly and then click on “Confirm and Submit”.

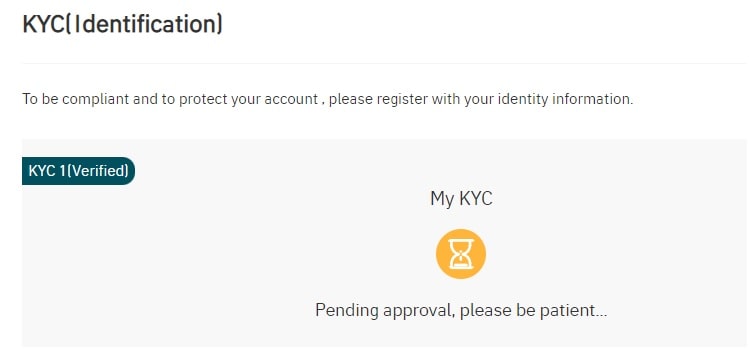

Step 4: After you have submitted all the requested information, you will see the pending approval.

Approval can take anywhere from a few hours to a few days to complete.

Once the KYC is approved, you’re ready to make your first cryptocurrency purchase.

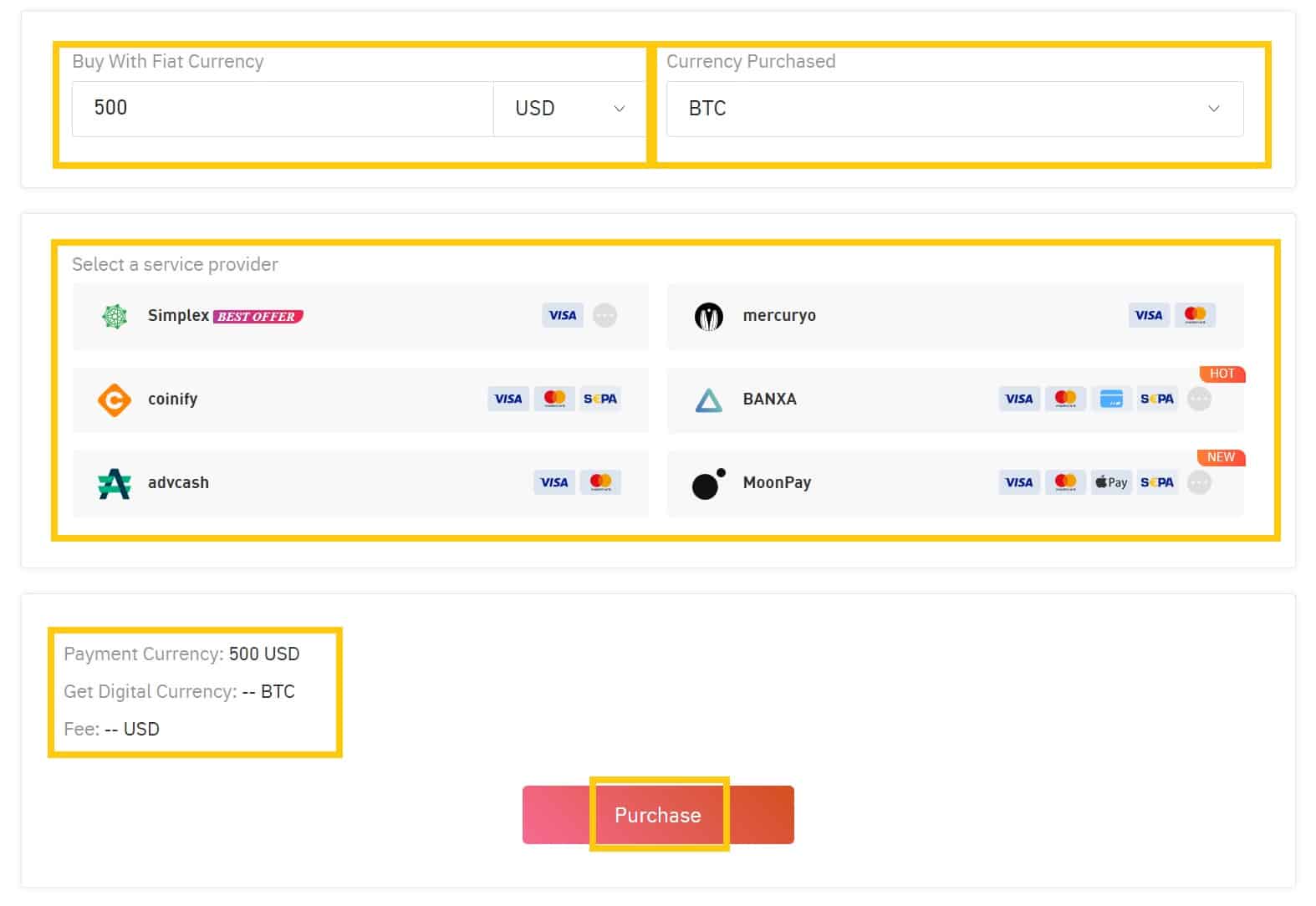

How to buy cryptocurrency on Gate.io

Step 1: Log in to your Gate.io account.

Then in the Menu Bar at the top of the page, click “Buy Crypto” and select “Credit Card”.

Step 2: Enter the amount you wish to spend in the “Buy with Fiat Currency” tab and select the cryptocurrency that you want to buy under the “Currency Purchased” field. Then select one of the “Service Providers” below and click the “Place Order” button to enter the confirmation page.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

Step 3: On the confirmation page, select “Buy Crypto” or the “Create Order” button to complete the payment.

Note: To ensure a quick and secure way of receiving the order, users might need to conduct an additional Identity Verification (KYC) with a third-party service provider. Once successfully verified, the service provider will immediately transfer the cryptocurrencies to your Gate.io account.

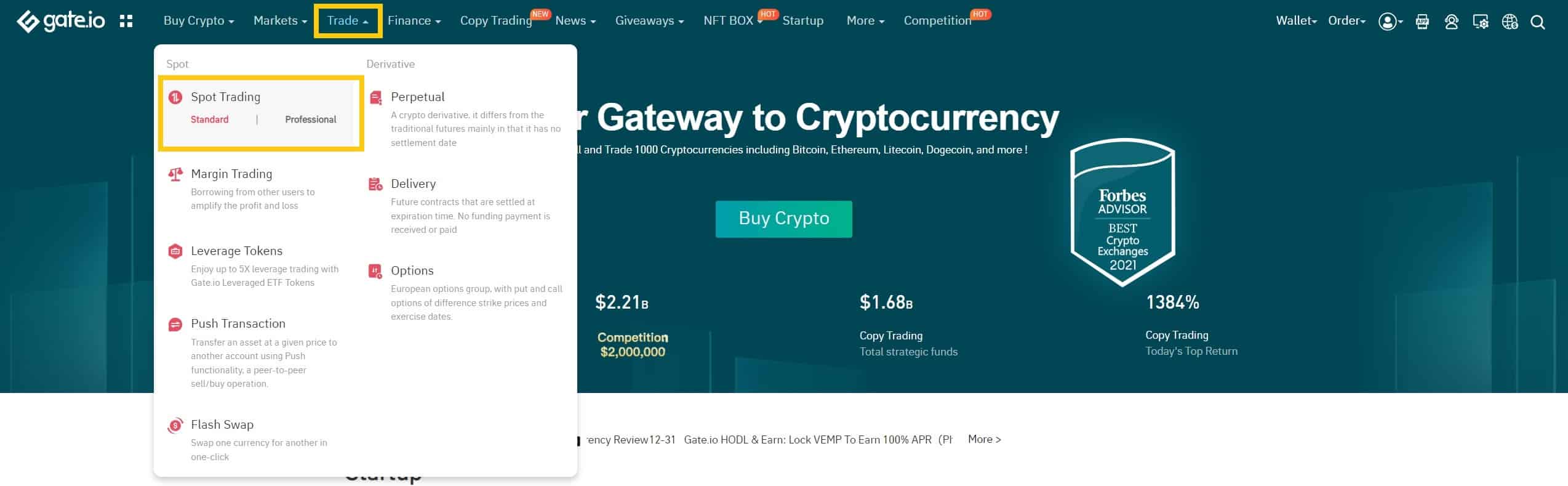

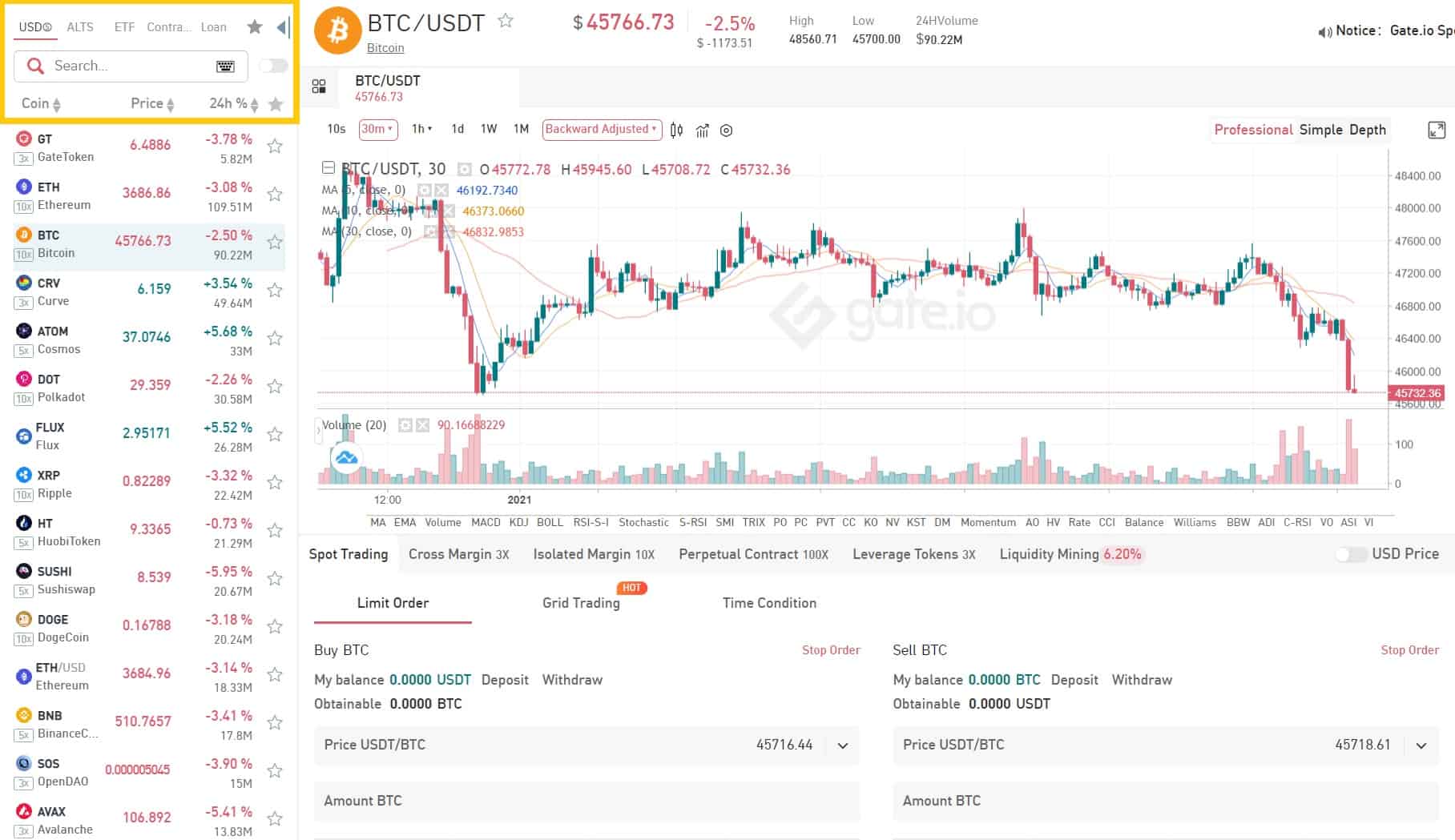

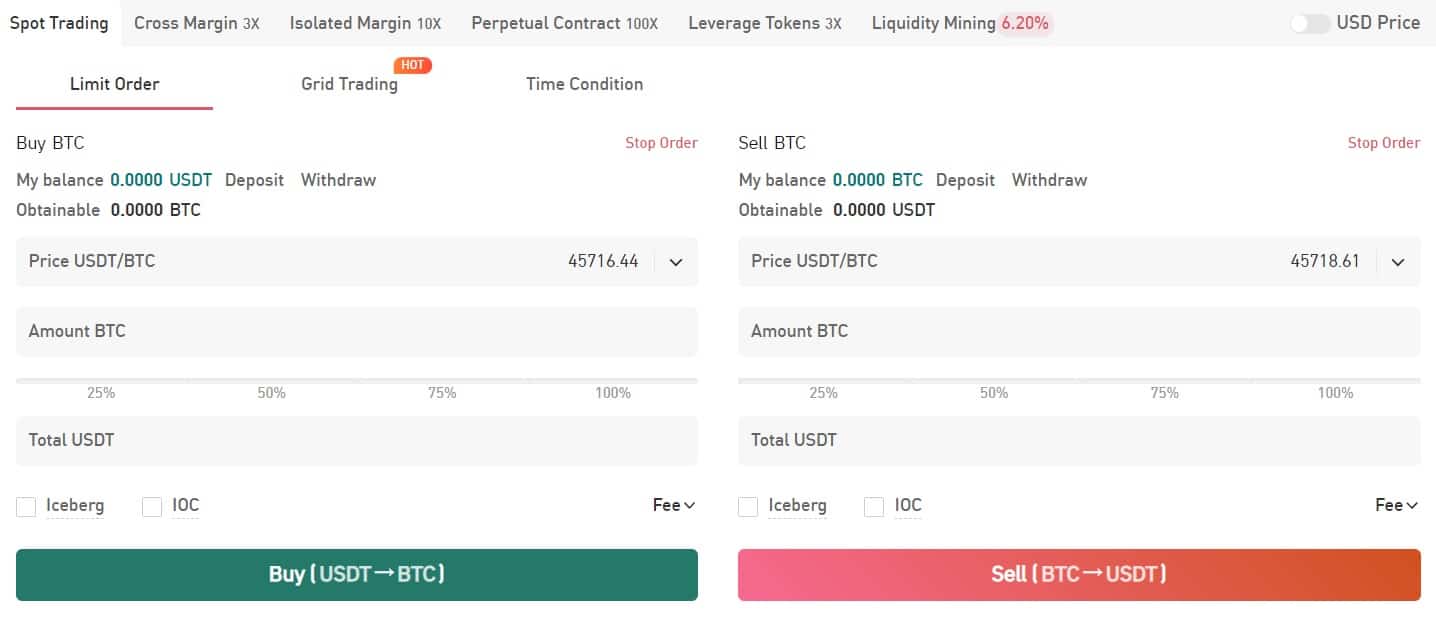

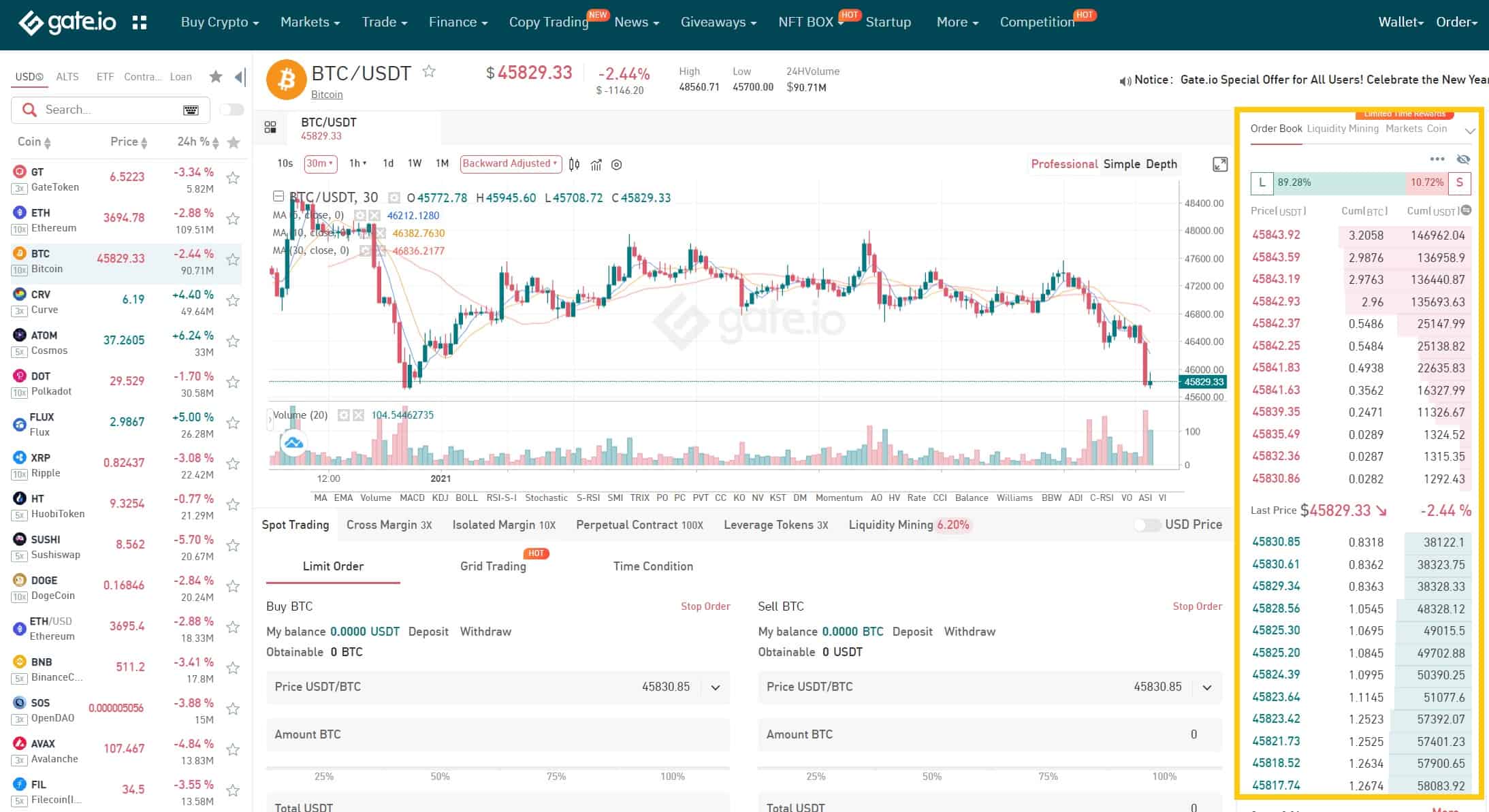

How to Conduct Spot Trading on Gate.io

Step 1: Log in to your Gate.io account.

Click on “Spot Trading” under “Trade” on the top navigation bar.

You can either choose “standard” or “professional” version. This tutorial uses the standard version.

Step 2: Search and enter the cryptocurrency you want to trade.

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can click on the last prices on the order book to set the buying/selling price automatically.

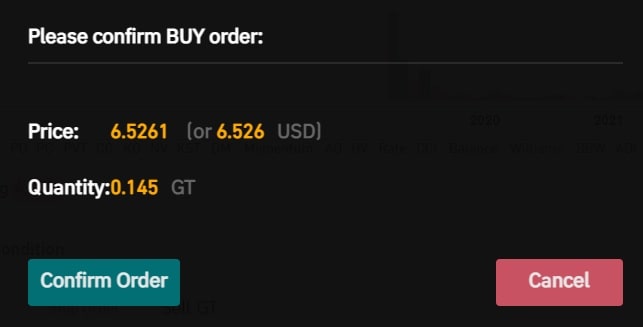

Step 5: Confirm the price and amount. Then click on “Place Order” to place the order, followed by “Confirm Order” to confirm it.

Hide Detailed Instructions

For more in-depth instructions, our ‘Absolute Beginner’s Guide To Cryptocurrency Investing‘ will take you through the process step-by step. In addition to providing instructions for sending and receiving your cryptocurrency.

And if you’re completely new to crypto our beginner, intermediate and advanced level articles will get you up to speed with everything you need to know about the cryptocurrency space starting out.

Simplecryptoguide.com

What Is Hedera Hashgraph (HBAR)?

Hedera is a public distributed ledger and governing body built from the ground-up to support new and existing applications running at web scale. Developers use distributed ledger technologies to build computational trust directly into their applications. This allows individuals and businesses who might not know or trust each other to quickly and inexpensively collaborate. Public distributed ledgers allow for creating and exchanging value, proving identity, verifying and authenticating important data, and much more.

The Hedera network is governed by a council of leading global enterprises, across multiple industries and geographies. Its vision is a cyberspace that is trusted and secure, without the need for centralized parties with inordinate influence. Its licensing and governance model protects users by eliminating the risk of forking, protecting the integrity of the codebase, and providing open access to review the underlying software code. Platform governance will be decentralized through the Hedera Governing Council, which will have a termlimited, rotating set of governing members that each have equal voting rights over key decisions relating to the platform.

What Makes Hedera Hashgraph Unique?

Unlike most other cryptocurrency platforms, Hedera Hashgraph isn’t built on top of a conventional blockchain. Instead, it introduces a completely novel type of distributed ledger technology known as a Hashgraph.

The Hedera network is a distributed ledger platform that resolves the factors that constrain adoption of public DLT by the mainstream. The platform is built on the hashgraph distributed consensus algorithm, invented by Dr. Leemon Baird. The hashgraph consensus algorithm provides near-perfect efficiency in bandwidth usage and consequently can process hundreds of thousands of transactions per second in a single shard (a fully connected, peer-to-peer mesh of nodes in a network). Initially, we anticipate that the Hedera network will be able to process 10,000 cryptocurrency transactions per second. Consensus latency is measured in seconds, not minutes, hours, or days.

How Is the Hedera Hashgraph Network Secured?

Hashgraph achieves the gold standard for security in the field of distributed consensus: asynchronous Byzantine Fault Tolerance (aBFT). Other platforms that use coordinators, leaders, or communication timeouts to improve performance tend to be vulnerable to Distributed Denial of Service (DDoS) attacks. Hashgraph is resilient to these types of attacks against the consensus algorithm because there is no such leader. Achieving this level of security at scale is a fundamental advance in the field of distributed systems. Many applications require that the consensus order of transactions match the actual order in which the transactions are received by the network. It should not be possible for a single party to prevent the flow of transactions into the network, nor influence the order of transactions in the eventual network consensus. A fair consensus algorithm ensures that if a user can submit a transaction to the network at all, then the transaction will be received by the network and the order in which it was received will be a fair ordering. Hashgraph uniquely ensures that the actual order transactions are received by the network will be reflected in the consensus order. In other words, hashgraph ensures both Fair Access and Fair Ordering.

Who Are the Founders of Hedera Hashgraph?

Hedera Hashgraph has two founders: Dr. Leemon Baird and Mance Harmon.

Dr. Leemon Baird is credited as the investor of the hashgraph distributed consensus algorithm and currently works as Hedera’s chief scientist. Prior to founding Hedera Hashgraph, Baird accumulated more than a decade of experience in various computer science and security roles and previously worked as a senior research scientist at the Academy Center by Cyberspace Research. He also holds the position of co-founder and CTO at Swirlds Inc., a platform for building DApps.

On the other hand, Mance Harmon is Hedera’s CEO and an experienced technology executive and seasoned entrepreneur. Harmon has around two decades of experience holding executive roles at prominent firms — many of which are in the IT security industry. Like Dr. Leemon Baird, Mance Harmon also holds a second position at Swirlds Inc., as its co-founder and CEO.

In addition to the founders, the Hedera leadership team also comprises more than a dozen individuals, many of which have had distinguished careers.

How is the Hedera network governed?

The Hedera network will be governed by a council of up to 39 leading global enterprises. Hedera Council members will bring needed experience in process and business expertise that has been absent in previous public ledger platforms. Council

membership is designed (i) to reflect a range of industries and geographies, (ii) to have highly respected brands and trusted market positions, and (iii) to encompass competing perspectives. The terms of governance ensure that no single Council member will have control, and no small group of members will have undue influence over the body as a whole.

How does the Hedera network handle forks?

If a small number of nodes wants to split off from the network and create a new ledger that is a fork of the current one,

these nodes have the technical ability to do so, and can even create the initial state of their new ledger to be identical

to the old ledger. So it is a fork. However, they will not be able to create an address book history reaching back to the

genesis address book, with the nodes of each address book signing the next one, because the majority of nodes (who

are not forking) will not sign the address book for the minority of nodes who are forking. This forces the new fork to

have a new genesis address book, and therefore a new unique identifier, and therefore a new name. Consequently, those

creating the fork will be unable to fool anybody into thinking the fork is the legitimate ledger. When a client submits a transaction to a node to send to the ledger, the client will receive in response from the node the cryptographic proof that their transaction has affected the shared state correctly. When Alice transfers cryptocurrency to Bob, both of them will be able to receive a cryptographic proof that the transaction succeeded. This proof includes the signatures reaching back to the genesis address book. So they not only verify that the transfer occurred, they verify that it occurred on the correct ledger. If a ledger forks, no client will ever be confused about which ledger they are dealing with because only one ledger at a time can have that name.

Furthermore, if the network’s stake of hbars were to split 50/50 between two groups of nodes, neither group of nodes would be able to prove a connection to the genesis address book. Rather than a fork, it would be the complete deconstruction of one ledger and the creation of two new ones. This would greatly reduce the value of the ledger to the nodes, because they would no longer be able to earn fees from the clients who want to access the original ledger. And all of the original cryptocurrency would, in a very real sense, cease to exist. This creates an enormous disincentive to forking. In this way, it is impossible to effectively create a deceptive fork of the Hedera ledger that would confuse users. Even if dishonest nodes create a forked copy of the Hedera ledger in order to try to deceive users into thinking the copy is the legitimate ledger, users would know that ledger isn’t valid because those nodes hosting the illegitimate fork would not be able to provide a valid state proof. And there is little incentive for nodes to openly create a forked copy, because there is unlikely to be much demand from users to shift to using an invalid version. So there are strong incentives to avoid forks, even aside from any legal incentives.

What function does the Hbar cryptocurrency serve to the network?

The purpose of Hedera is to provide a stable, trustworthy network for a wide variety of decentralized, enterprise-grade applications, not to provide a cryptocurrency. Like all public DLT networks, however, Hedera needs a cryptocurrency to function. Hbar is the native cryptocurrency of the Hedera network. Hbars are used to power decentralized applications, build peer-to-peer transactional models, and protect the network from malicious actors. Hbars serve two main functions:

Network Fuel – Hbars serve as a “fuel” to pay for network services and incentivize nodes to contribute computing resources to the network.

Network Security – As Hedera moves along the path to permissionless nodes, hbars will protect the network against cyberattacks through the network’s forthcoming coin-weighted, proof-of-stake consensus mechanism.

Hbars as “fuel” to pay for network services and incentivize node participation

All public DLTs need computers to serve as nodes in the decentralized network. These nodes serve two purposes:

Shared Ledger – Each node maintains a copy of the ledger of the balances in each network user’s account.

Execute Transactions – Nodes verify and execute new transactions and place those transactions into consensus order, so that user account balances are updated on an ongoing basis.

Each node must provide computing power to run the network’s consensus algorithm and process transactions. To incentivize nodes to participate—as computing power is not free—public DLTs typically compensate nodes with payment, often in the network’s native cryptocurrency. On the Hedera network, hbars are used as a “fuel” to pay for network services (i.e., to submit transactions, run smart contracts, store files, use the Hedera Consensus Service) and to reward nodes for providing their computing resources (bandwidth, processing power, memory) to the network. The fees per transaction are very low, requiring the ability to make micropayments in a form—an hbar—that is divisible to less than a penny. For example, transactions using the

cryptocurrency service or Hedera Consensus Service are expected to cost ~US$0.0001 (one one-hundredth of a cent).

Hedera Hashgraph development updates in 2023

Hedera Hashgraph has made significant progress in 2023, showcasing robust growth and innovation in various sectors. Here are some of the key developments and updates for Hedera Hashgraph in 2023:

-

Transaction Volume and Market Growth: In the first quarter of 2023, Hedera witnessed an almost forty-fold increase in transaction volume, with the average daily new accounts increasing by 170%, indicating its rising popularity and adoption.

-

Q3 2023 Achievements: Despite the broader cryptocurrency market downturn, HBAR, Hedera’s native token, experienced a 7.6% growth in circulating market capitalization, reaching $1.7 billion. The Hedera Consensus Service was a significant driver of this growth, with over 99% of the network’s transactions. Additionally, the number of active NFT addresses on the network grew by 162%.

-

Integration with Stablecoin Platforms: Hedera introduced the Stablecoin Studio, an open-source stablecoin issuance and management toolkit, enabling organizations to build stablecoin applications on the Hedera network.

-

Partnerships and Collaborations: Hedera has been actively partnering with different organizations. Notably, Électricité de France (EDF) completed a proof-of-concept using Hedera for automating renewable energy certificates transactions. Furthermore, Hedera’s technology has been utilized by Envision Blockchain for improving carbon credit management, supported by the United Nations.

-

Developer Ecosystem: Hedera announced plans to retire the hethers.js library to align with Ethereum Virtual Machine standards, encouraging developers to use EVM tools like ethers.js or web3.js. This move aims to simplify the development process on Hedera and enhance its compatibility with Ethereum-based tools.

-

Emission Tracking Innovations: At the 2023 United Nations Climate Change Conference (COP28), Hedera and Envision Blockchain unveiled innovative solutions for emissions tracking and carbon credit management. These solutions, built on Hedera Hashgraph technology, aim to make carbon credit management more efficient and transparent.

These developments demonstrate Hedera Hashgraph’s commitment to growth, sustainability, and innovation, further solidifying its position in the blockchain and cryptocurrency space.

Official website: https://hedera.com/

Best cryptocurrency wallet for Hedera Hashgraph (HBAR)

There are plenty of different crypto wallets available. The best one for you depends on your general trading habits and which provides the most security in your situation. There are two main types of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical). Both have their pros and cons, and there is not necessarily a right or wrong answer when it comes to figuring out which crypto wallet is best for you.

HOW DO I DECIDE WHICH cryptocurrency WALLET TO USE for Hedera Hashgraph (HBAR)?

Deciding which type of wallet to use depends on a variety of factors, including:

- How often you trade. In general, hot wallets are better for more active cryptocurrency traders. Quick login ability means you are only a few clicks and taps away from buying and selling crypto. Cold wallets are better suited for those looking to make less frequent trades.

- What you want to trade. As mentioned earlier, not all wallets support all types of cryptocurrencies. However, some of the best crypto wallets have the power to trade hundreds of different currencies, providing more of a one-size-fits-all experience.

- Your peace of mind. For those worried about hacking, having a physical cold wallet stored in a safe deposit box at the bank or somewhere at home, provides the safest, most secure option. Others might be confident in their ability to keep their hot wallets secure.

- How much it costs. It is important to investigate the costs associated with each wallet. Many hot wallets will be free to set up. Meanwhile, cold wallets, like any piece of hardware, will cost money to purchase.

- What it can do. While the basics of each cryptocurrency wallet are the same, additional features can help set them apart. This is especially true of hot wallets, many of which come with advanced reporting features, insights into the crypto market, the ability to convert cryptocurrencies and more. Security features can also be a good differentiator.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re going to be dealing in larger volumes of crypto, investing in cold storage might prove advantageous.

Most widespead examples of this being the Ledger Nano and the Trezor.

Ledger manufactures cold storage wallets designed for users who want increased security. Their wallets are a physical device that connects to your computer. Only when the device is connected can you send your cryptocurrency from it. Ledger offers a variety of products, such as the Ledger Nano S and the Ledger Nano X (a bluetooth connected hardware wallet).

Trezor is a pioneering hardware wallet company. The combination of world-class security with an intuitive interface and compatibility with other desktop wallets, makes it ideal for beginners and experts alike. The company has gained a lot of the Bitcoin community’s respect over the years. Trezor offers two main models – The Trezor One and Trezor Model T (which has a built in touch screen).

Market Overview

Coinmarketcap.com

Coinmarketcap will be your cryptocurrency go-to for just about everything. Here you can see the following: