Exploring Marginfi: The Innovative DeFi Lending Protocol on Solana

Introduction to Marginfi: A DeFi Game Changer

Marginfi, operating on the Solana blockchain, has made a notable entry into the decentralized finance (DeFi) landscape. As a decentralized lending protocol, it stands out for its commitment to risk management, providing a secure and efficient environment for users looking to leverage their digital assets for maximum capital efficiency.

At its core, Marginfi is built on a permissionless suite of smart contracts. This structure allows users to engage in lending and borrowing activities in a transparent and efficient manner, bypassing the intermediaries typical in traditional financial systems. The protocol’s operation on the Solana network brings additional benefits, such as high transaction speeds and lower costs, which are crucial in DeFi operations.

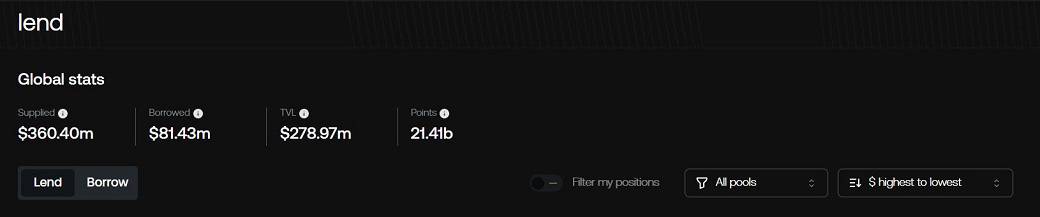

Marginfi has also sparked interest with its innovative points-based rewards program. This program incentivizes users to participate in the ecosystem by lending and borrowing, with points potentially leading to future rewards or a token airdrop. The anticipation of these rewards has driven a surge in the platform’s total value locked (TVL), marking a significant growth phase for Marginfi. This growth is a testament to the platform’s ability to attract and retain users, contributing to the vibrancy of the Solana-based DeFi community.

The integration of Marginfi with other DeFi services on the Solana ecosystem enhances its utility. Users can unify their on-chain portfolios, accessing a range of decentralized finance services through a single platform. This level of integration demonstrates Marginfi’s commitment to creating a comprehensive and user-friendly DeFi experience.

Marginfi’s emergence as a key player in the DeFi space is not just a result of its technological innovations but also due to the growing community around it. The platform’s user base has been expanding, driven by the engaging and rewarding experience it offers. As Marginfi continues to evolve, it remains a significant contributor to the DeFi movement, especially within the Solana network.

Understanding Marginfi’s Decentralized Lending Model

In the realm of decentralized finance (DeFi), Marginfi stands out with its innovative approach to lending, primarily facilitated through its unique decentralized lending model. This model, set against the backdrop of the Solana blockchain, represents a paradigm shift in how lending and borrowing transactions are conducted in the digital asset space.

The Core of Marginfi’s Lending Model

At its core, Marginfi’s lending model is built on a decentralized framework, meaning it operates without the need for traditional financial intermediaries. This approach leverages the power of blockchain technology to ensure transparency, security, and efficiency. By utilizing smart contracts on the Solana blockchain, Marginfi creates a trustless environment where lenders and borrowers can interact directly.

How Lending Works on Marginfi

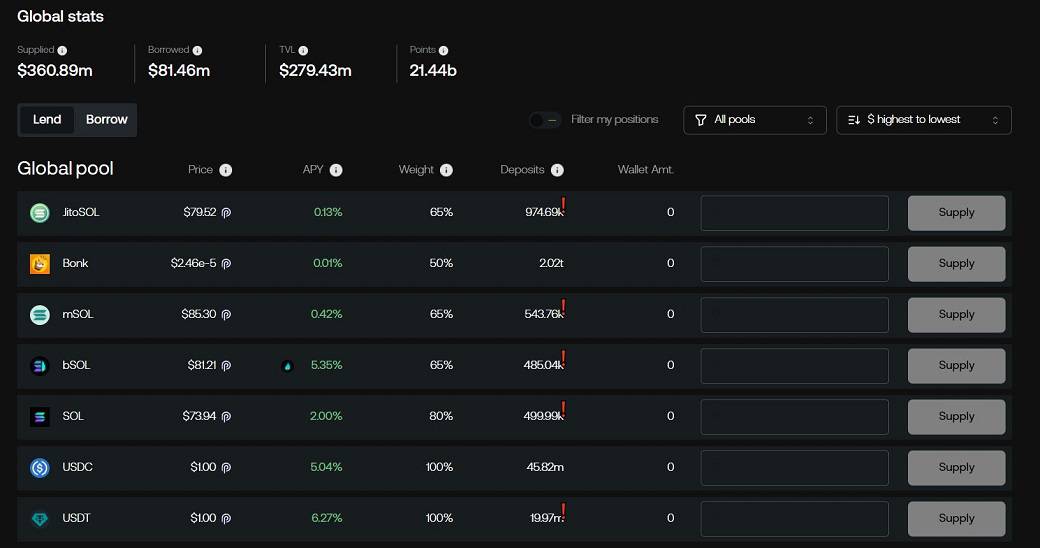

The lending process on Marginfi begins with lenders depositing their assets into a pool. These assets can range from cryptocurrencies to tokenized versions of traditional financial instruments. Once deposited, these assets become available for borrowing by other users on the platform.

Borrowers, on the other hand, can access these funds by providing collateral, which is also held in a decentralized manner on the blockchain. The key here is that the entire process — from depositing, borrowing, to managing collateral — is automated by smart contracts, ensuring a seamless and secure lending experience.

Interest Rates and Loan Terms

Interest rates on Marginfi are determined by a dynamic algorithm that considers various factors such as supply and demand, collateral quality, and market volatility. This ensures that rates are always fair and reflective of current market conditions. Moreover, the terms of loans, including duration and repayment schedules, are flexible and can be tailored to meet the diverse needs of users.

Advantages of Marginfi’s Decentralized Lending

The decentralized nature of Marginfi’s lending model offers several advantages:

- Reduced Counterparty Risk: By eliminating intermediaries, the risk of fraud or default is significantly lowered.

- Increased Accessibility: Users from anywhere in the world can participate without the need for traditional banking systems.

- Enhanced Privacy: Transactions are conducted on the blockchain, offering greater privacy than traditional banking systems.

- Flexibility and Autonomy: Users have more control over their lending or borrowing terms.

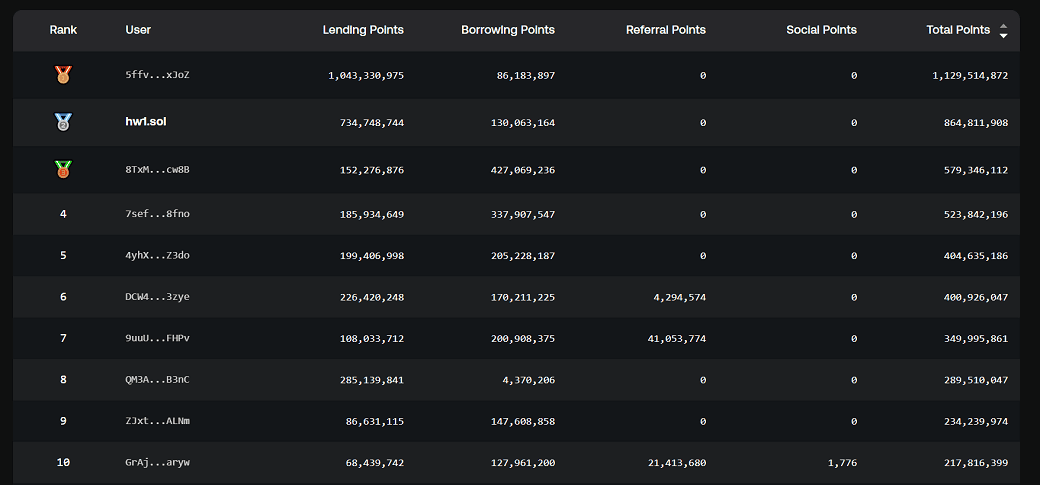

Marginfi’s Innovative Points-Based Rewards System

Marginfi sets itself apart in the DeFi landscape with its distinctive points-based rewards system, which serves as a cornerstone of its user engagement strategy. This system is designed to incentivize participation and bolster platform loyalty, creating a dynamic ecosystem where active participation is rewarded.

Overview of the Points System

The points system in Marginfi operates on a simple yet effective principle: users earn points for various activities within the platform. These activities can range from executing transactions, participating in lending and borrowing, to engaging in community-driven events. The key idea is to encourage users to be more active and involved in the Marginfi ecosystem.

Earning Points

Earning points on Marginfi is designed to be straightforward and accessible. Users accumulate points through their regular interactions with the platform. For example:

- Transaction-Based Points: Users earn points for each transaction they make, whether it’s lending, borrowing, or trading.

- Participation Points: Engaging in community polls, governance, or beta testing new features can also yield points.

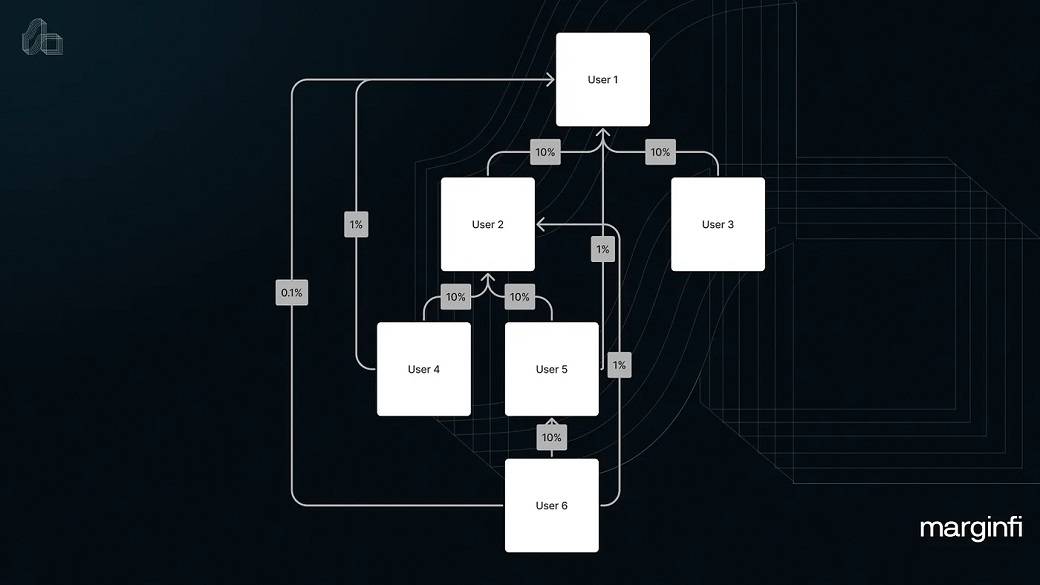

- Referral Points: Introducing new users to Marginfi rewards both the referrer and the referee with points.

Utility of Points

The points earned are not just a measure of activity but also carry tangible benefits:

- Fee Reductions: Points can be redeemed for discounts on transaction fees, making it more cost-effective for active users.

- Exclusive Access: Accumulating a certain number of points might grant access to special features or beta versions of upcoming updates.

- Voting Power: In some cases, points can translate into voting power, allowing users to have a say in platform decisions.

Points as a Motivator for Growth

Marginfi’s points-based rewards system is more than just a loyalty program; it’s a growth engine for the platform. It creates a virtuous cycle where increased user activity enhances the platform’s liquidity and overall health, which in turn attracts more users. This system fosters a community-centric approach, making users feel valued and part of Marginfi’s journey.

The Role of Overcollateralization in Marginfi’s Protocol

Marginfi’s protocol incorporates a critical element known as overcollateralization, a concept that is fundamental to the platform’s stability and security. This feature plays a pivotal role in ensuring the robustness of Marginfi’s lending and borrowing mechanisms within the volatile landscape of decentralized finance (DeFi).

Understanding Overcollateralization

Overcollateralization refers to the practice of providing more collateral than the loan amount one seeks to borrow. This is a common strategy in DeFi to mitigate the risks associated with the high volatility of digital assets. In Marginfi’s context, this means borrowers must lock in assets worth more than the amount they wish to borrow.

Why Overcollateralization is Crucial in Marginfi

- Risk Mitigation: The primary purpose of overcollateralization is to safeguard against market fluctuations. If the value of the collateral falls below a certain threshold due to market volatility, the excess collateral provides a buffer to protect the lender’s interests.

- Maintaining Platform Stability: By ensuring that loans are overcollateralized, Marginfi maintains a higher level of solvency, which is crucial for the overall stability of the platform, especially during market downturns.

- Building Trust: In a decentralized environment, trust is paramount. Overcollateralization helps build confidence among users by demonstrating that the platform has mechanisms in place to protect their assets.

How Overcollateralization Works on Marginfi

Marginfi’s protocol automatically calculates the required collateral based on various factors, including the volatility of the collateral asset, the loan amount, and current market conditions. This calculation ensures that the collateralization level is always adequate to cover potential losses.

Liquidation Mechanisms

In the event that the value of the collateral falls below the required threshold, Marginfi’s protocol initiates a liquidation process. This process is designed to be fair and transparent, minimizing the impact on the borrower while protecting the lender’s assets. The excess collateral acts as a safety net in such scenarios, ensuring that lenders are not left at a loss.

Benefits for Lenders and Borrowers

- For Lenders: The assurance of overcollateralization means reduced credit risk, encouraging more lending activity on the platform.

- For Borrowers: While overcollateralization requires more upfront capital, it allows access to funds in a decentralized manner, often with more favorable terms compared to traditional finance.

The Role of Overcollateralization in Marginfi’s Protocol

Marginfi’s protocol incorporates a critical element known as overcollateralization, a concept that is fundamental to the platform’s stability and security. This feature plays a pivotal role in ensuring the robustness of Marginfi’s lending and borrowing mechanisms within the volatile landscape of decentralized finance (DeFi).

Understanding Overcollateralization

Overcollateralization refers to the practice of providing more collateral than the loan amount one seeks to borrow. This is a common strategy in DeFi to mitigate the risks associated with the high volatility of digital assets. In Marginfi’s context, this means borrowers must lock in assets worth more than the amount they wish to borrow.

Why Overcollateralization is Crucial in Marginfi

- Risk Mitigation: The primary purpose of overcollateralization is to safeguard against market fluctuations. If the value of the collateral falls below a certain threshold due to market volatility, the excess collateral provides a buffer to protect the lender’s interests.

- Maintaining Platform Stability: By ensuring that loans are overcollateralized, Marginfi maintains a higher level of solvency, which is crucial for the overall stability of the platform, especially during market downturns.

- Building Trust: In a decentralized environment, trust is paramount. Overcollateralization helps build confidence among users by demonstrating that the platform has mechanisms in place to protect their assets.

How Overcollateralization Works on Marginfi

Marginfi’s protocol automatically calculates the required collateral based on various factors, including the volatility of the collateral asset, the loan amount, and current market conditions. This calculation ensures that the collateralization level is always adequate to cover potential losses.

Liquidation Mechanisms

In the event that the value of the collateral falls below the required threshold, Marginfi’s protocol initiates a liquidation process. This process is designed to be fair and transparent, minimizing the impact on the borrower while protecting the lender’s assets. The excess collateral acts as a safety net in such scenarios, ensuring that lenders are not left at a loss.

Benefits for Lenders and Borrowers

- For Lenders: The assurance of overcollateralization means reduced credit risk, encouraging more lending activity on the platform.

- For Borrowers: While overcollateralization requires more upfront capital, it allows access to funds in a decentralized manner, often with more favorable terms compared to traditional finance.

Marginfi’s Contribution to the ‘Solana Renaissance’

The term ‘Solana Renaissance’ refers to the recent surge in innovation and development within the Solana blockchain ecosystem. Marginfi, as a key player in this movement, has significantly contributed to this vibrant phase, demonstrating how decentralized finance (DeFi) platforms can drive growth and innovation in the broader blockchain community.

Pioneering DeFi Innovations on Solana

Marginfi’s advanced financial tools and services, built on the Solana blockchain, represent a leap forward in DeFi capabilities. By leveraging Solana’s high throughput and low transaction costs, Marginfi has been able to offer faster, more efficient, and cost-effective financial solutions. This has not only benefited Marginfi’s users but also showcased the potential of Solana as a leading blockchain for DeFi applications.

Enhancing Network Utilization and Value

Marginfi’s diverse offerings have attracted a significant user base to the Solana network, thereby increasing network utilization and, in turn, the intrinsic value of the Solana ecosystem. The platform’s innovative use of Solana’s technology has set a benchmark for performance and reliability, encouraging other developers to build on Solana.

Collaborations and Ecosystem Synergy

Marginfi has actively engaged in collaborations with other projects and protocols within the Solana ecosystem. These partnerships have created synergies that benefit the entire network, leading to more integrated and comprehensive DeFi solutions. Such collaborations foster a sense of community and shared purpose, which are essential in the blockchain world.

Driving Liquidity and Market Depth

Through its liquidity pools and integration with Solana-based decentralized exchanges (DEXs), Marginfi has played a significant role in enhancing the liquidity and market depth of Solana’s DeFi landscape. This improvement in liquidity is crucial for the growth of Solana’s DeFi ecosystem, as it attracts more traders and investors, creating a more vibrant and robust market.

Fostering Innovation and Adoption

Marginfi’s success on Solana has served as an inspiration and a model for other projects, demonstrating the viability and potential of building sophisticated DeFi platforms on this blockchain. This has spurred innovation, as more developers are encouraged to explore and create new applications on Solana, further enriching the ecosystem.

Educational and Community Engagement

Marginfi has also contributed to the ‘Solana Renaissance’ through educational initiatives and active community engagement. By educating users and developers about the benefits and capabilities of the Solana blockchain, Marginfi has played a pivotal role in broadening adoption and understanding of blockchain technology.

Marginfi’s Airdrop Strategy: Points and Participation

Marginfi’s airdrop strategy is a vital component of its ecosystem, intricately linked to its points-based rewards system and user participation. This strategy is not just a tool for user acquisition and retention, but also a method to foster a deeper sense of community and engagement within the platform.

The Concept of Airdrops in Marginfi

Airdrops in Marginfi involve distributing tokens or other digital assets to the platform’s users, usually for free. This distribution is often based on various criteria, such as the user’s level of participation or the number of points they have accumulated on the platform.

Linking Points to Airdrops

Marginfi has innovatively tied its points-based rewards system to its airdrop strategy. Here’s how it works:

- Accumulation of Points: Users earn points through various activities on the platform — trading, lending, borrowing, or participating in community events.

- Eligibility for Airdrops: The accumulated points serve as a metric to determine a user’s eligibility for airdrops. The more points a user has, the higher their likelihood or the greater the quantity of assets they might receive in an airdrop.

Motivation Behind the Airdrop Strategy

The airdrop strategy serves multiple purposes:

- Encouraging Active Participation: By rewarding active users through airdrops, Marginfi incentivizes continued engagement and participation on the platform.

- Distributing Ownership: Airdrops can be seen as a way to distribute ownership and governance rights among the most active users, aligning their interests with the platform’s success.

- Community Building: This strategy helps in building a strong and committed community. Users who receive airdrops are more likely to feel valued and become advocates for the platform.

Impact on User Behavior and Platform Growth

Marginfi’s airdrop strategy impacts user behavior and platform growth in several ways:

- User Retention: The potential for earning through airdrops encourages users to remain active on the platform.

- New User Acquisition: Word of mouth about airdrop opportunities can attract new users to Marginfi.

- Market Liquidity: As users trade or use their airdropped assets, it enhances the liquidity and dynamism of the market on Marginfi.

Marginfi’s Integration with Third-Party Protocols

Marginfi’s integration with third-party protocols is a strategic move that significantly enhances its functionality and appeal in the DeFi space. By establishing connections with other DeFi services and platforms, Marginfi creates a more comprehensive and interconnected financial ecosystem on the Solana blockchain.

The Nature of Integration

These integrations involve Marginfi connecting its platform with various other DeFi protocols for a range of services including but not limited to liquidity provision, lending and borrowing, trading, and risk management. The goal is to leverage the strengths of different platforms to offer a more robust and diverse range of services to its users.

Key Benefits of Integration

- Enhanced Liquidity: By integrating with liquidity providers and decentralized exchanges (DEXs), Marginfi ensures that its users have access to deeper liquidity pools, leading to better pricing and faster execution of trades.

- Diverse Financial Products and Services: Collaborations with other protocols allow Marginfi to offer a broader array of financial instruments and services, catering to a wider range of user needs.

- Improved Risk Management: Integrating with platforms that specialize in risk assessment and management tools can enhance the overall security and stability of Marginfi’s offerings.

- Increased Efficiency: Seamless integration with other protocols streamlines processes, reducing transaction times and costs, thus improving overall user experience.

Examples of Integration

Decentralized Exchanges (DEXs): Integration with DEXs on the Solana blockchain for better liquidity and trade execution.

Lending Platforms: Collaborations with other lending platforms to diversify borrowing and lending options.

Oracles: Utilizing third-party oracles for accurate and real-time price feeds, which are critical for maintaining the integrity of Marginfi’s financial operations.

The Role in Ecosystem Development

Marginfi’s integrations play a crucial role in the broader development of the Solana DeFi ecosystem. They encourage interoperability among different platforms, which is essential for the growth and maturation of the DeFi sector. This interconnectedness not only benefits Marginfi and its partners but also the end-users who gain access to a more comprehensive and efficient DeFi environment.

Challenges and Considerations

While beneficial, these integrations require careful consideration of security, compatibility, and regulatory compliance. Marginfi must ensure that its partnerships align with its standards and values, particularly concerning user security and data privacy.

Risk Management in Marginfi’s Lending Protocol

Risk management is a critical component of Marginfi’s lending protocol, ensuring the platform’s integrity and the security of its users’ assets. Given the inherent risks associated with decentralized finance (DeFi), particularly in lending and borrowing, Marginfi has implemented several strategies to mitigate these risks effectively.

Understanding the Risks

In DeFi lending, risks primarily arise from market volatility, liquidity issues, and the potential for smart contract vulnerabilities. Marginfi’s protocol, like any lending platform, must address these risks to maintain user trust and platform stability.

Key Strategies for Risk Management

Overcollateralization: As previously discussed, Marginfi requires borrowers to provide collateral exceeding the value of their loan. This overcollateralization is a buffer against market volatility and price fluctuations, ensuring that loans can be recovered even if asset values drop.

Dynamic Liquidation Mechanisms: Marginfi implements an automated liquidation process that is triggered if the value of the collateral falls below a certain threshold. This mechanism is designed to be quick and efficient, minimizing the potential for losses due to rapidly changing market conditions.

Diversification of Collateral Types: By allowing a variety of assets to be used as collateral, Marginfi spreads the risk. This diversification ensures that the platform’s exposure is not concentrated in a single asset type, which could be detrimental during market downturns.

Regular Audits and Security Measures: Marginfi conducts regular audits of its smart contracts and platform security. These audits, performed by independent security firms, help identify and rectify potential vulnerabilities, safeguarding against hacks and fraud.

Risk Assessment Algorithms: The platform employs advanced algorithms to assess the risk levels of various lending and borrowing activities continually. These algorithms take into account factors like asset volatility, borrower history, and market trends to adjust lending terms accordingly.

Insurance Funds: Marginfi can maintain an insurance fund to cover potential losses from unforeseen events. This fund acts as an additional layer of protection for lenders’ assets.

User Education and Transparency: Educating users about the risks involved in DeFi lending and borrowing is crucial. Marginfi ensures that its users are well-informed about the platform’s risk protocols and the inherent risks of DeFi transactions.

Impact of Effective Risk Management

Effective risk management in Marginfi’s lending protocol provides several benefits:

- Enhances User Trust: By demonstrating a commitment to security and stability, Marginfi builds trust among its users.

- Promotes Platform Longevity: A robust risk management framework ensures the platform can withstand market shocks and continue operating effectively.

- Attracts More Participation: A secure and stable platform is more likely to attract users, enhancing liquidity and overall platform activity.

Accessibility and User Experience on Marginfi

In the competitive landscape of decentralized finance (DeFi), the success of platforms like Marginfi is heavily influenced by their accessibility and user experience. Recognizing this, Marginfi has prioritized creating an intuitive and inclusive environment that caters to both seasoned DeFi enthusiasts and newcomers.

Focusing on User Interface (UI) and Design

- Intuitive Interface: Marginfi’s UI is designed to be clean and intuitive, making it easy for users to navigate through various features and services. This simplicity is key in reducing the learning curve for new users.

- Responsive Design: The platform is optimized for various devices, ensuring a seamless experience whether accessed via desktop or mobile.

Enhancing User Accessibility

- Multi-Language Support: To cater to a global audience, Marginfi provides support in multiple languages, breaking down barriers for non-English speaking users.

- User Guides and Educational Resources: Marginfi offers comprehensive guides and educational materials, helping users understand DeFi concepts, the platform’s features, and best practices for risk management.

Streamlining Transactions and Interactions

- Fast and Efficient Transactions: Leveraging the Solana blockchain’s high throughput, Marginfi ensures that transactions are fast and cost-effective.

- Integration with Wallets: Easy integration with popular crypto wallets enhances user convenience, allowing for quick and secure transactions.

Inclusive Community Engagement

- Active Community Support: Marginfi fosters a strong community through forums, social media, and direct support channels, where users can get assistance and engage with fellow members.

- Feedback Mechanisms: The platform incorporates user feedback into its development process, ensuring that the services evolve according to user needs and preferences.

User Experience Innovations

- Customizable Dashboards: Users can customize their dashboards to monitor their most relevant data, improving the personalization of the experience.

- Real-Time Analytics and Tools: Provision of real-time analytics and trading tools helps users make informed decisions.

Ensuring Accessibility for Diverse Users

Marginfi is committed to catering to a diverse user base, including:

- Novice Users: With simplified interfaces and educational content, Marginfi ensures that new users can navigate the platform without feeling overwhelmed.

- Experienced Traders: Advanced features and detailed analytics cater to the needs of experienced traders and users.

Future Outlook: Marginfi’s Role in the Evolving DeFi Landscape

As we look towards the future of decentralized finance (DeFi), Marginfi’s role is poised to be both influential and transformative. The platform’s innovative approach to DeFi services, underpinned by the Solana blockchain, positions it as a key player in shaping the trajectory of the DeFi sector.

Continued Innovation and Adaptation

Marginfi is expected to continue its path of innovation, adapting to emerging technologies and market trends. This could involve:

- Integrating New Blockchain Technologies: As blockchain technology evolves, Marginfi may integrate new features and protocols to enhance efficiency, security, and user experience.

- Expanding DeFi Offerings: Developing new financial products and services to meet the changing needs of users, such as more sophisticated trading tools or advanced lending options.

Strengthening the Solana Ecosystem

Marginfi’s growth is intricately linked with the development of the Solana blockchain. As Marginfi expands, it will likely contribute to and benefit from the ‘Solana Renaissance’, fostering a stronger and more vibrant Solana ecosystem.

Driving Mainstream Adoption of DeFi

Marginfi’s focus on user experience and accessibility can play a significant role in driving the mainstream adoption of DeFi. By making DeFi more approachable to a broader audience, Marginfi can help bridge the gap between traditional finance and decentralized finance.

Emphasizing Regulatory Compliance

As the DeFi sector matures, regulatory scrutiny is expected to increase. Marginfi’s future success will depend partly on its ability to navigate and comply with evolving regulations while maintaining its decentralized ethos.

Collaborating Across Industries

Marginfi might explore collaborations beyond the traditional crypto and DeFi space, potentially partnering with fintech firms, traditional financial institutions, or even other sectors, to create new intersections between DeFi and the wider economy.

Leveraging Community and Governance

The platform’s approach to community-driven governance and decision-making is likely to become even more significant. As users become more involved in governance, Marginfi can tap into a diverse range of insights and ideas, driving innovation and ensuring the platform remains aligned with its user base’s needs.

Focus on Sustainability

As environmental concerns become more prominent, Marginfi could adopt more energy-efficient practices or contribute to sustainability initiatives, aligning with a growing trend towards eco-consciousness in the tech industry.

Conclusion

Looking forward, Marginfi is set to play a pivotal role in the evolving landscape of DeFi. By continuing to innovate, focusing on user accessibility, complying with regulations, and actively participating in the Solana ecosystem, Marginfi is well-positioned to not only grow its platform but also to contribute significantly to the broader development and adoption of DeFi. As the sector matures, Marginfi’s adaptability, forward-thinking approach, and commitment to its community will be key factors in its ongoing success and influence.