How To Buy Anchor Protocol (ANC)?

A common question you often see on social media from crypto beginners is “Where can I buy Anchor Protocol?” Well, you’ll be happy to hear it is actually quite a simple and straightforward process.

Step 1: Create an account on an exchange that supports Anchor Protocol (ANC)

First, you will need to open an account on a cryptocurrency exchange that supports Anchor Protocol (ANC).

We recommend the following based on functionality, reputation, security, support and fees:

1

Binance

Fees (Maker/Taker) 0.075%*-0.1%*

Cryptocurrencies

Available for Trade 500+

Sign-up bonus

10% reduced trading fees*

Available in

Europe, Asia, Oceania, Africa

2

MEXC

Fees (Maker/Taker) 0.2%*-0.2%*

Cryptocurrencies

Available for Trade 1500+

Sign-up bonus

10% reduced trading fees & up to $170 in USDT vouchers*

Available in

North America, South America, Europe, Asia, Oceania, Africa

In order to sign up, you will need to enter some basic information, such as your email address, password, full name and, in some cases, you might also be asked for a phone number or address.

Note: On specific exchanges, you might need to complete a Know Your Customer (KYC) procedure in order to be able to purchase cryptocurrency. This is most commonly the case with licensed and regulated exchanges.

Step 2: Deposit funds into your account

Many cryptocurrency exchanges will allow you to purchase Anchor Protocol (ANC) with fiat currencies, such as EUR, USD, AUD and others. Furthermore, they will also provide you with multiple deposit methods through which you can fund your fiat account, such as credit and debit cards, ewallets or direct bank transfers.

Note: Some payment methods will have higher fees than others, such as credit card payments. Before funding your fiat account on your chosen exchange, make sure to do your due diligence to find out the fees involved with each payment method to avoid unnecessary costs.

Step 3: Buy Anchor Protocol (ANC)

This process is similar across almost every cryptocurrency exchange. All you have to do is find a navigation bar or a search bar, and search for Anchor Protocol (ANC) or Anchor Protocol (ANC) trading pairs. Look for the section that will allow you to buy Anchor Protocol (ANC), and enter the amount of the cryptocurrency that you want to spend for Anchor Protocol (ANC) or the amount of fiat currency that you want to spend towards buying Anchor Protocol (ANC). The exchange will then calculate the equivalent amount of Anchor Protocol (ANC) based on the current market rate.

Note: Make sure to always double-check your transaction details, such as the amount of Anchor Protocol (ANC) you will be buying as well as the total cost of the purchase before you end up confirming the transaction. Furthermore, many cryptocurrency exchanges will offer you their own proprietary software wallet where you will be storing your cryptocurrencies; however, you can create your own individual software wallet, or purchase a hardware wallet for the highest level of protection.

How to create a Binance account

![]()

Show Detailed Instructions

Hide Detailed Instructions

Step 1: Go to the Binance website.

Step 2: On the registration page, enter your email address, and create a password for your account.

Then, read and agree to the Terms of Service and click “Create Account”.

Note: Your password must be a combination of numbers and letters.

It should contain at least 8 characters, one UPPER CASE letter, and one number.

Step 3: Complete the Security Verification.

Step 4: The system will send a verification code to your email. The verification code is valid for 30 minutes. If you can’t find the email in your inbox, check your other mail folders as well, or click “Resend Email” to resend.

How to complete KYC (ID Verification) on Binance

Step 1: Log in to your Binance account and click “User Center” and then “Identification”.

Step 2: click “Start Now” to verify your account.

Step 3: Select your country of residence.

Ensure that your country of residence is consistent with your ID documents.

Step 5: Enter your personal information and click “Continue.”

You won’t be able to change it once confirmed.

Refer to the respective options offered for your country.

Step 7: Follow the instructions to upload photos of your document. Your photos should clearly show the full ID document.

Do not wear hats, glasses, or use filters, and make sure that the lighting is sufficient.

Once your application has been verified, you will receive an email notification.

How to buy cryptocurrency on Binance

Step 1: Log in to your Binance account and click “Buy Crypto” and then “Credit/Debit Card”.

Step 2: Here you can choose to buy crypto with different fiat currencies. Enter the fiat amount you want to spend and the system will automatically display the amount of crypto you can get. When you have selected the amount you wish to spend then press “Continue”.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

Step 3: Click “Add New Card”. Then enter your credit card details and your billing address.

Step 4: Check the payment details and confirm your order within 1 minute. After 1 minute, the price and the amount of crypto you will get will be recalculated. You can click “Refresh” to see the latest market price. You will then be redirected to your bank’s OTP Transaction Page. Follow the on-screen instructions to verify the payment.

How to Conduct Spot Trading on Binance

Step 1: Log in to your Binance account.

Click on “Classic” under “Trade” on the top navigation bar.

Step 2: Search and enter the cryptocurrency you want to trade.

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can place a “Market Order” to set the buying/selling price automatically.

Hide Detailed Instructions

How to create a Gate.io account

![]()

Show Detailed Instructions

Hide Detailed Instructions

Step 1: Go to the Gate.io website.

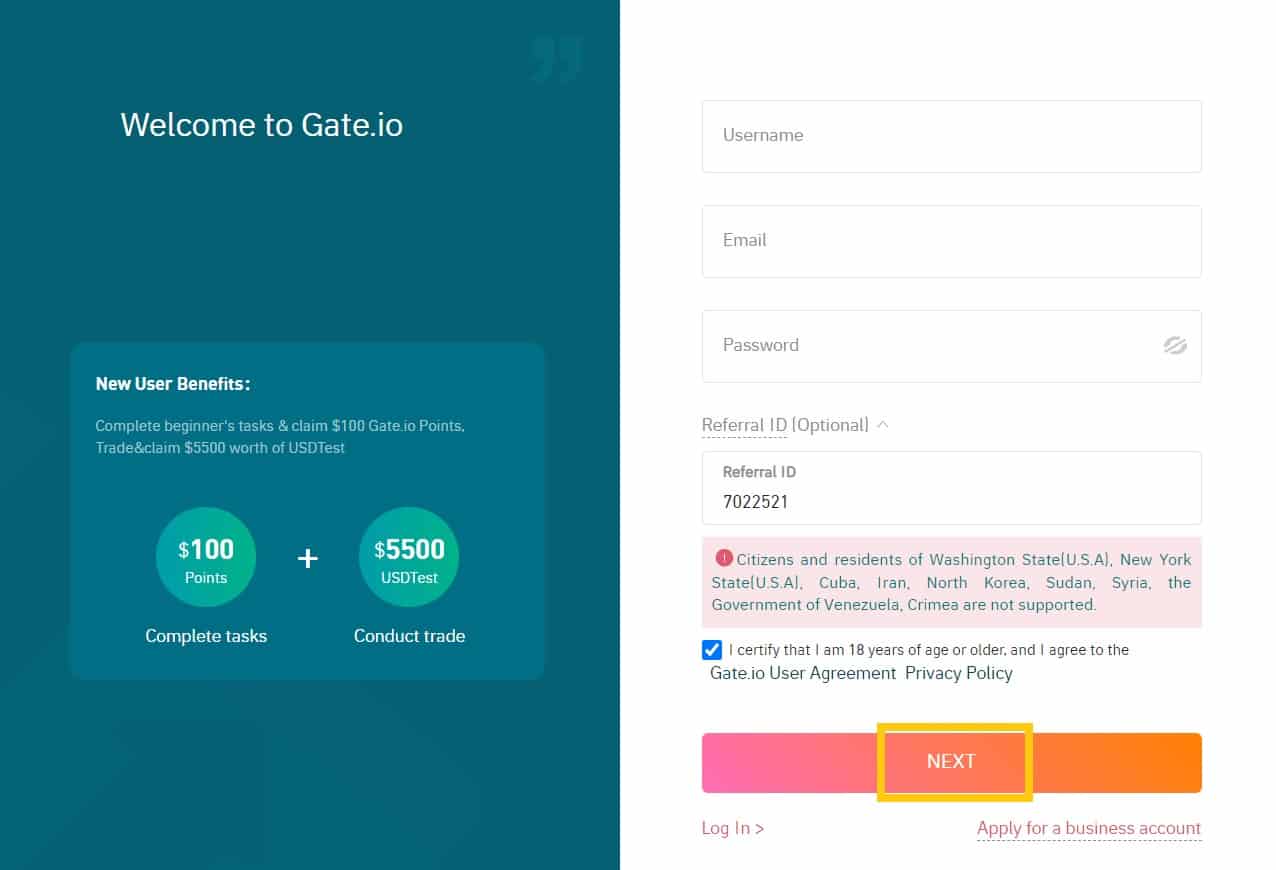

Step 2: Choose your username, your email address and your password. Then check “I certify that I am 18 years of age or older, and I agree to the Gate.io User Agreement Privacy Policy” and click “NEXT”.

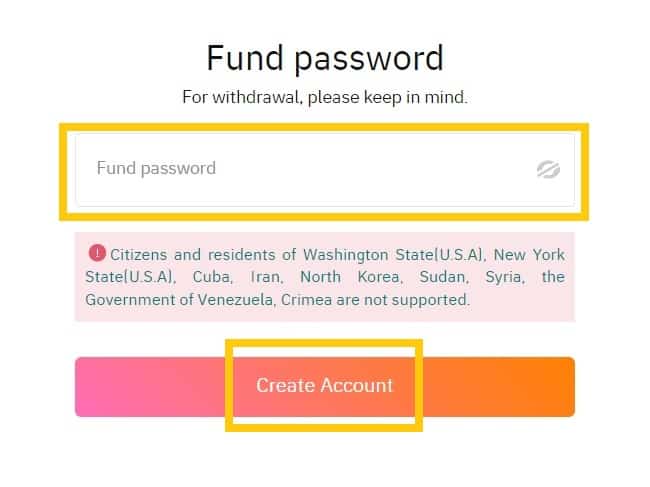

Step 3: Set your fund password and click “Create account”.

Note: Your fund password must contain at least 6 characters and can not be the same as your login password.

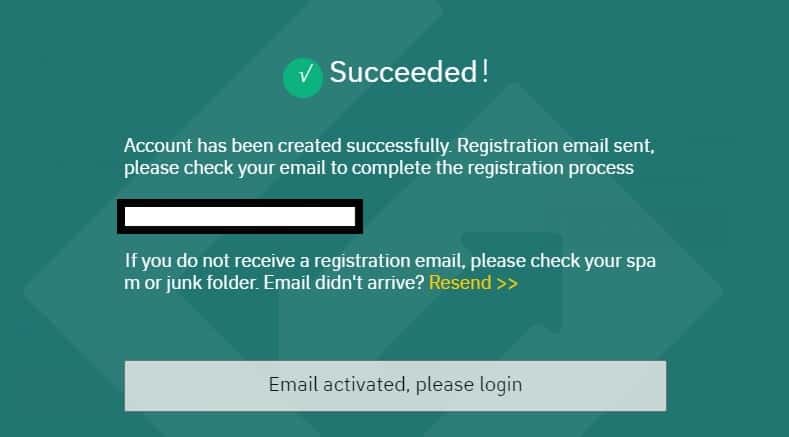

Step 4: An activation email will be sent to your email address. Complete the rest of the registration process by following the instructions in the email to activate your account. Once this is done done, click “Email activated, please log in”.

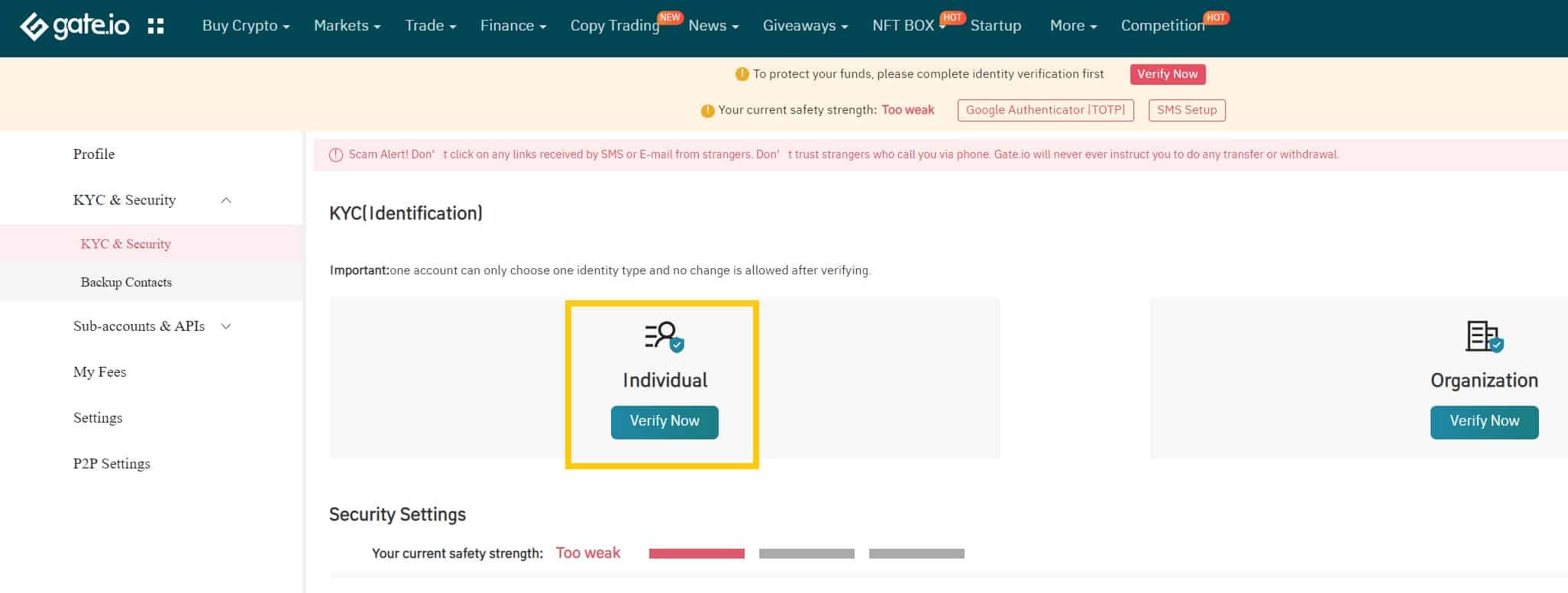

How to complete KYC (ID Verification) on Gate.io

In order to ensure the safety of your assets, and to reduce fraud, money laundering, blackmail, and other illegal activities, Gate.io makes it mandatory that all users obtain KYC ID Verification. Only after your account has obtained KYC ID verification, can you withdraw funds or use credit cards or debit cards to buy cryptocurrencies.

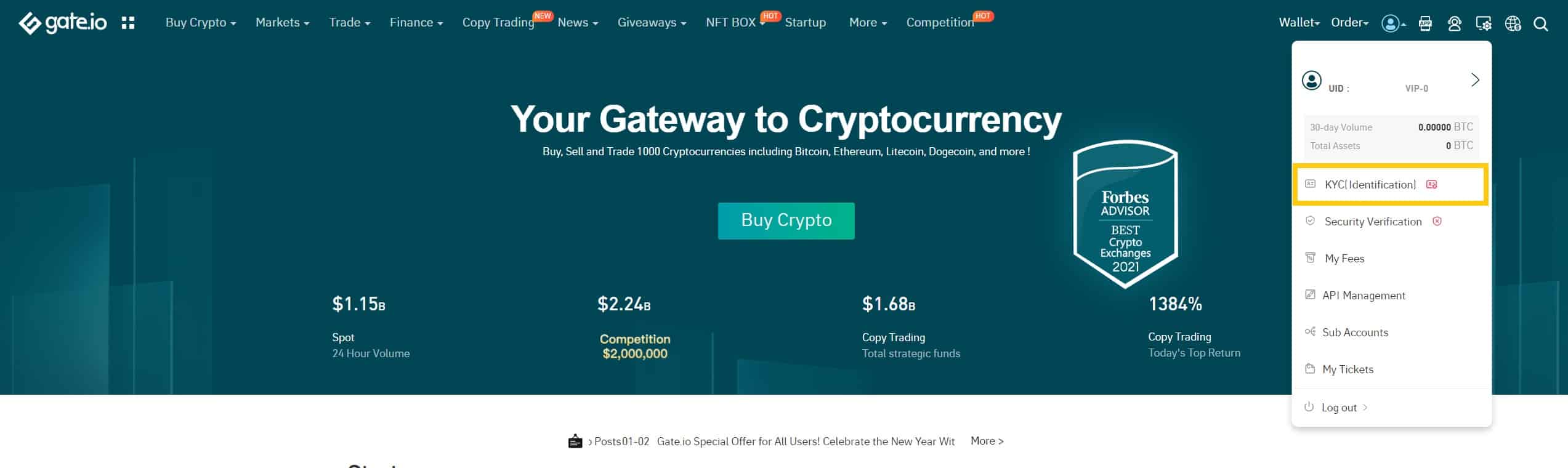

Step 1: Log in to your Gate.io account.

Place your cursor on the top-right profile icon and go to “KYC (ID Verification)”

Step 2: Click “Individual (Verify now)”

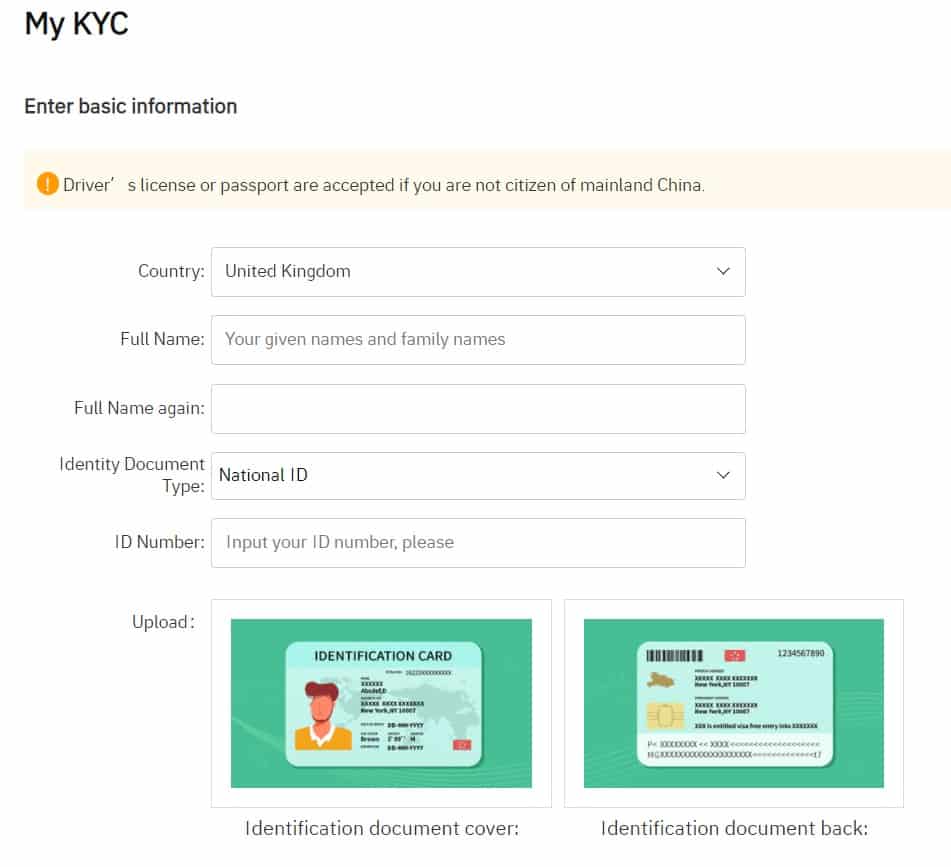

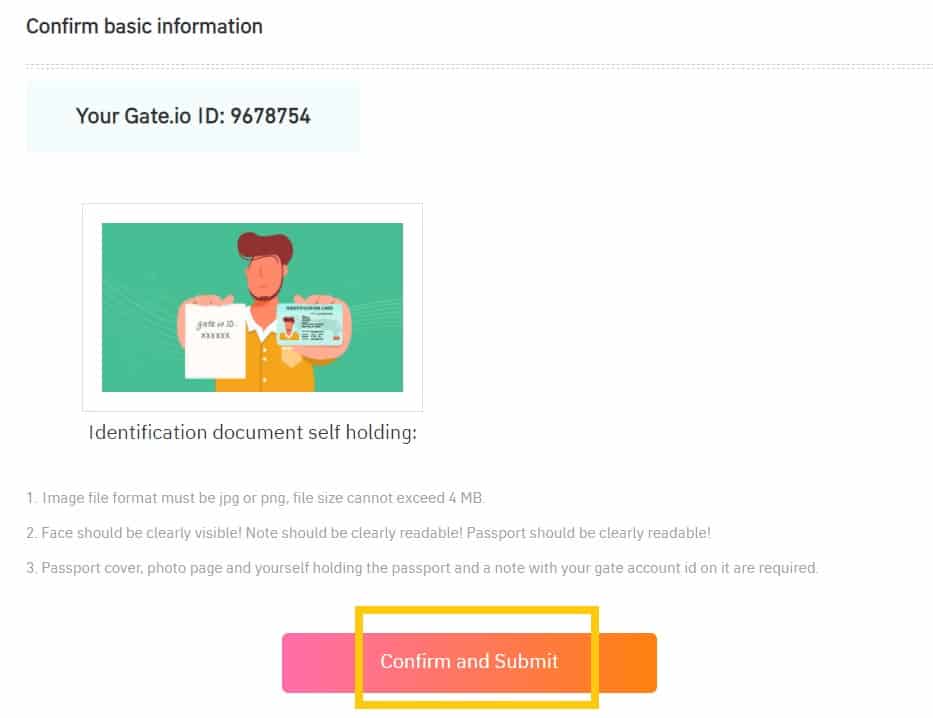

Step 3: Select your country, input your full legal name (twice), fill in your ID information, upload photos of both sides of your ID card, and a photo of you holding your ID together with your User ID (UID) for Gate.io. You will see your User ID by placing the cursor on the top-right profile icon on the main page. Make sure everything is filled in correctly and then click on “Confirm and Submit”.

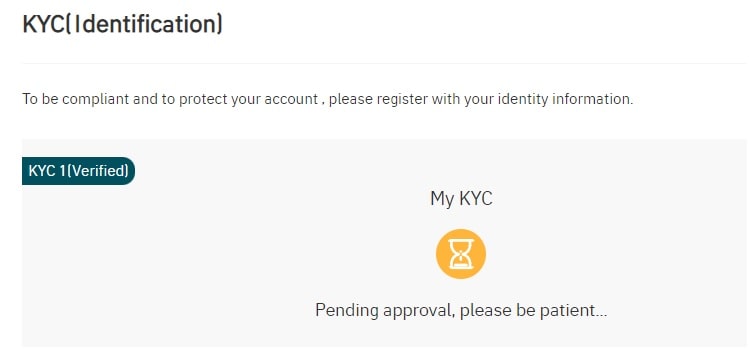

Step 4: After you have submitted all the requested information, you will see the pending approval.

Approval can take anywhere from a few hours to a few days to complete.

Once the KYC is approved, you’re ready to make your first cryptocurrency purchase.

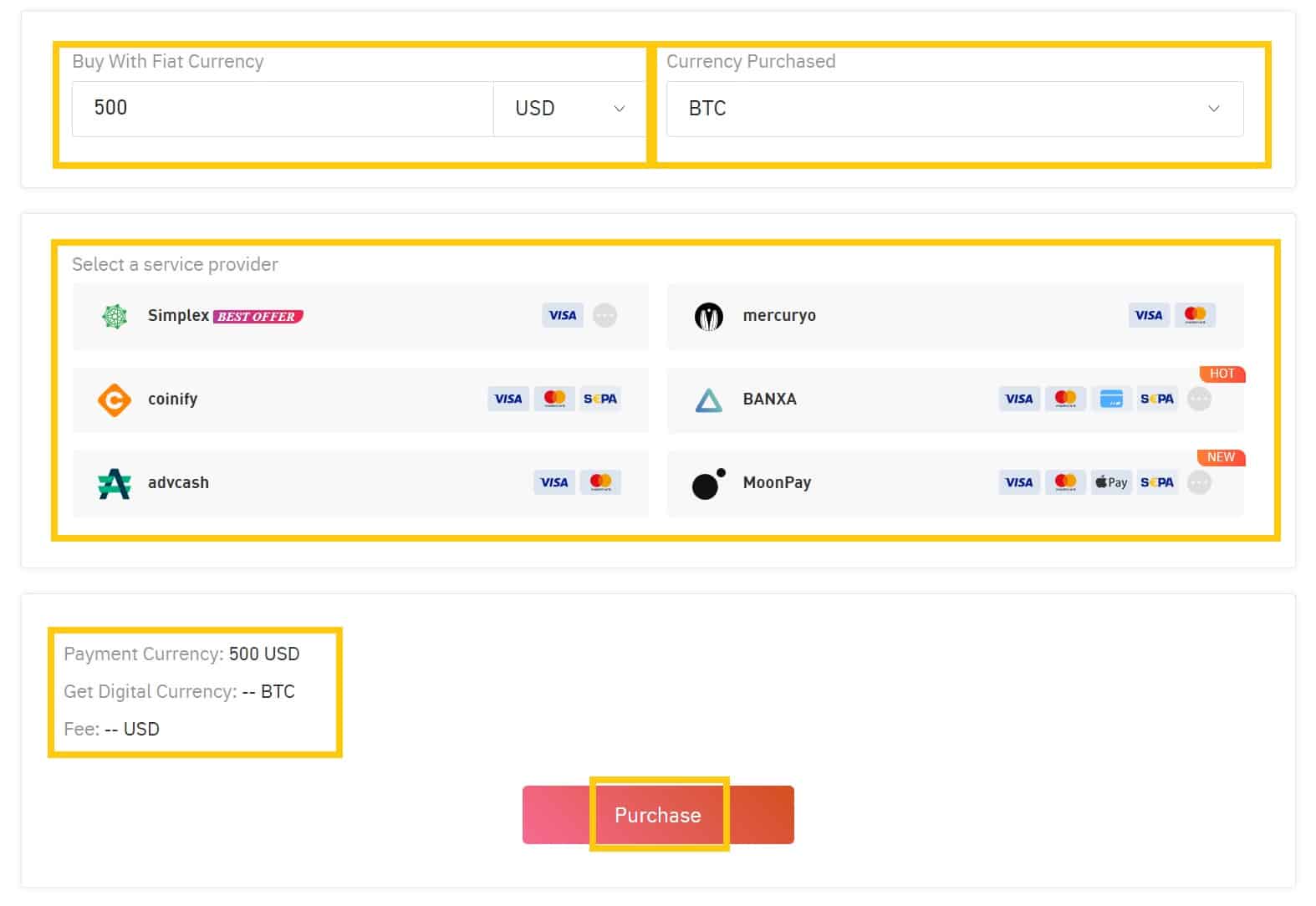

How to buy cryptocurrency on Gate.io

Step 1: Log in to your Gate.io account.

Then in the Menu Bar at the top of the page, click “Buy Crypto” and select “Credit Card”.

Step 2: Enter the amount you wish to spend in the “Buy with Fiat Currency” tab and select the cryptocurrency that you want to buy under the “Currency Purchased” field. Then select one of the “Service Providers” below and click the “Place Order” button to enter the confirmation page.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

Step 3: On the confirmation page, select “Buy Crypto” or the “Create Order” button to complete the payment.

Note: To ensure a quick and secure way of receiving the order, users might need to conduct an additional Identity Verification (KYC) with a third-party service provider. Once successfully verified, the service provider will immediately transfer the cryptocurrencies to your Gate.io account.

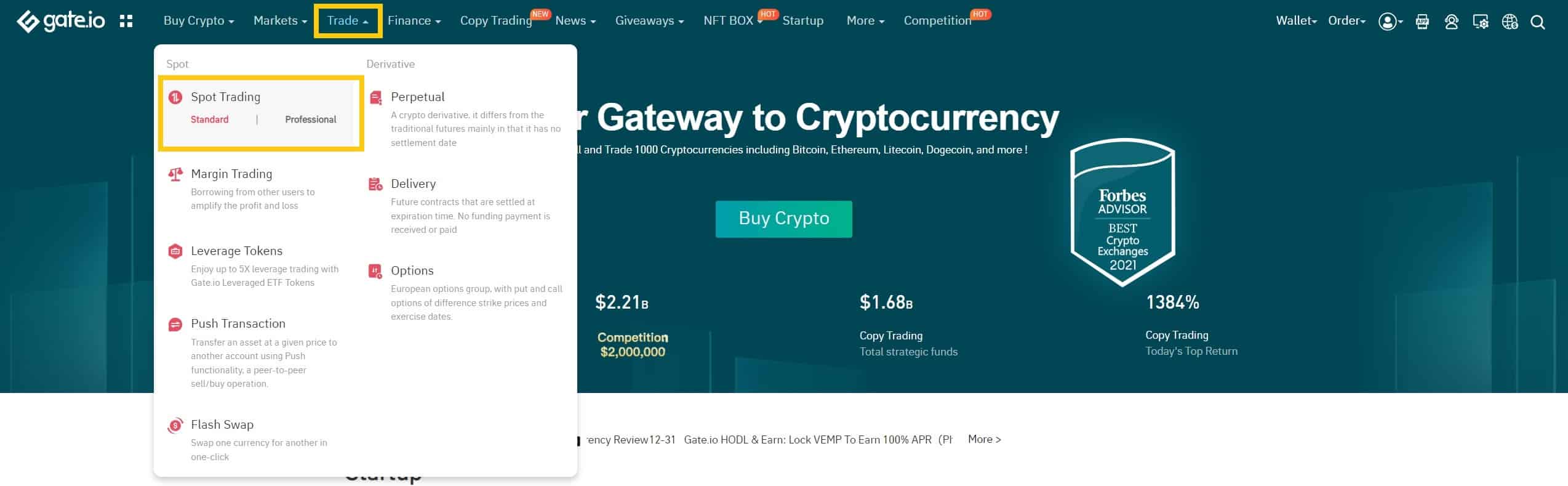

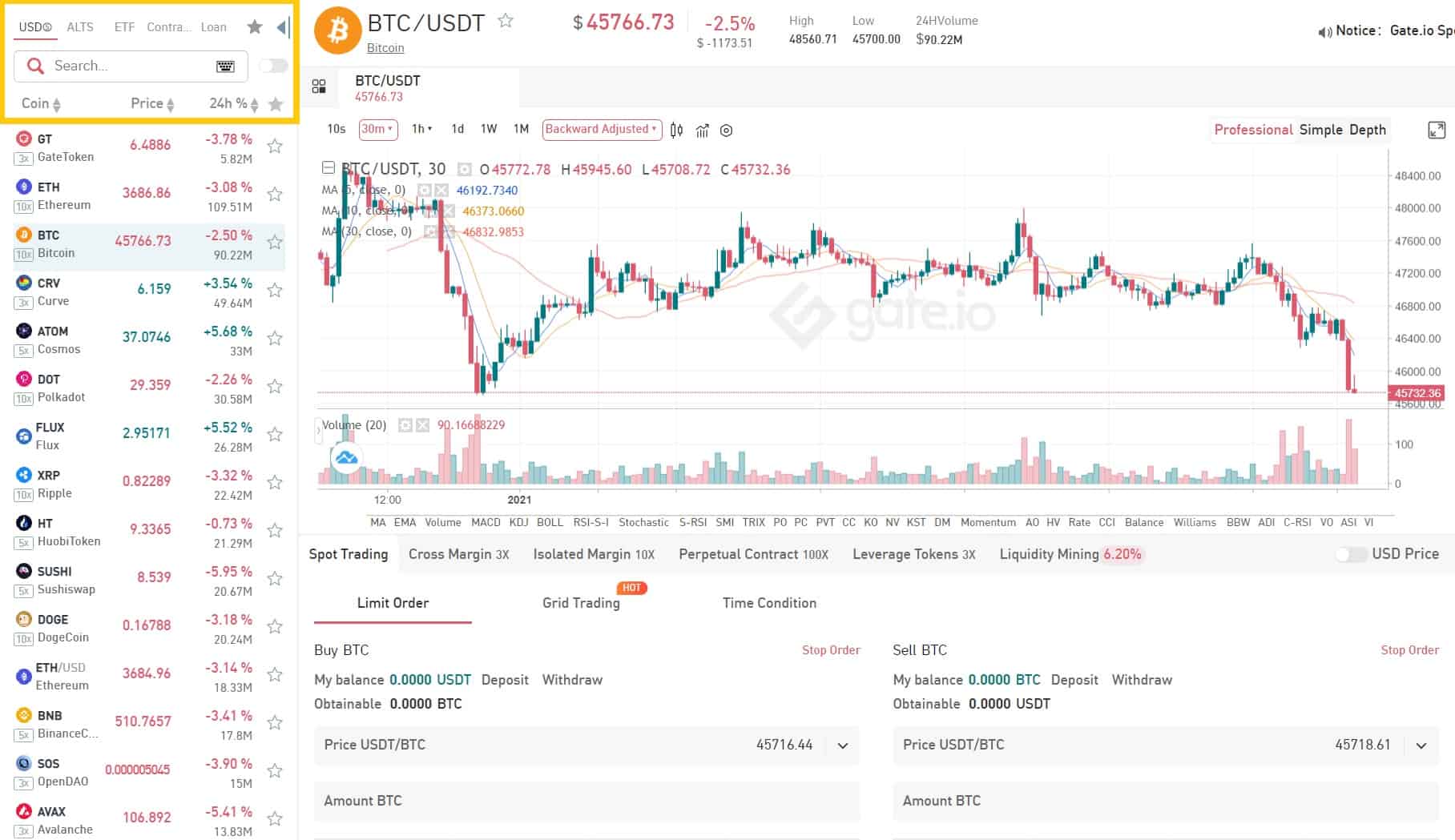

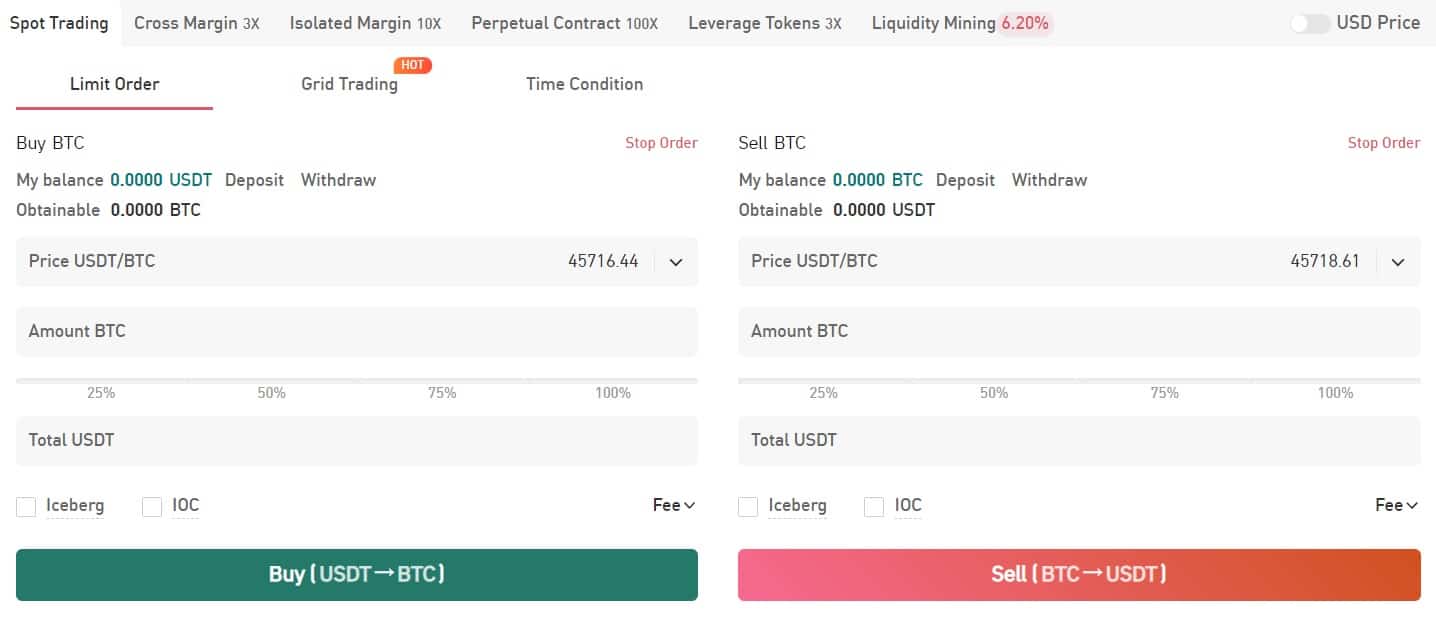

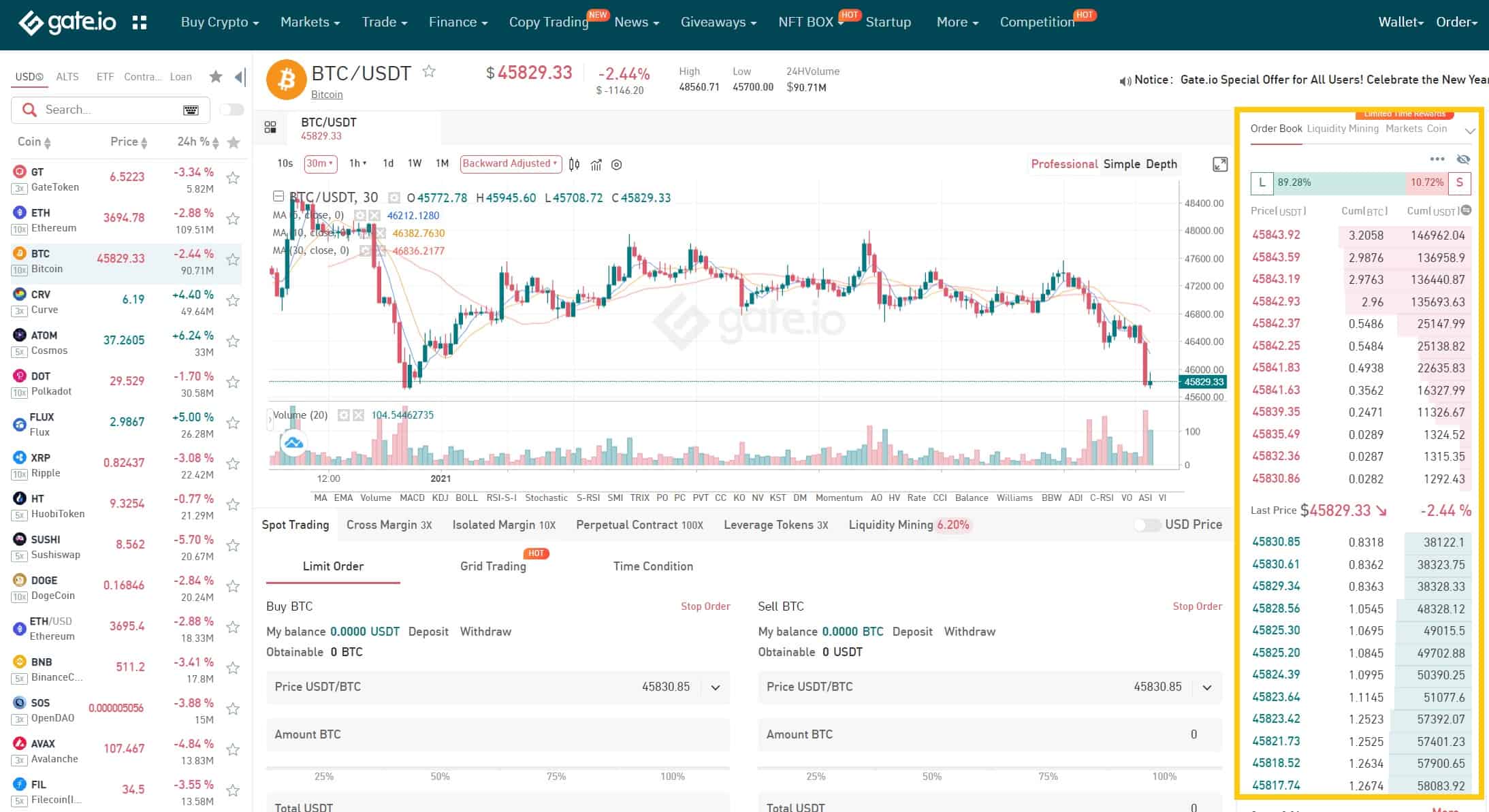

How to Conduct Spot Trading on Gate.io

Step 1: Log in to your Gate.io account.

Click on “Spot Trading” under “Trade” on the top navigation bar.

You can either choose “standard” or “professional” version. This tutorial uses the standard version.

Step 2: Search and enter the cryptocurrency you want to trade.

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can click on the last prices on the order book to set the buying/selling price automatically.

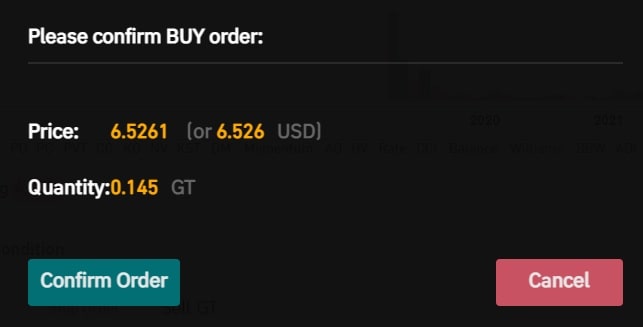

Step 5: Confirm the price and amount. Then click on “Place Order” to place the order, followed by “Confirm Order” to confirm it.

Hide Detailed Instructions

For more in-depth instructions, our ‘Absolute Beginner’s Guide To Cryptocurrency Investing‘ will take you through the process step-by step. In addition to providing instructions for sending and receiving your cryptocurrency.

And if you’re completely new to crypto our beginner, intermediate and advanced level articles will get you up to speed with everything you need to know about the cryptocurrency space starting out.

Simplecryptoguide.com

What Is Anchor Protocol (ANC)?

Anchor Protocol is a popular savings protocol that’s based around the Terra blockchain. The Anchor Protocol coin (ANC) provides users with low-volatility yields of just under 20% when taking the Anchor Rate into account.

Anchor Protocol was created by Terraform Labs and initially launched in March 2021. It was created in part to boost the overall demand for UST. Keep in mind that UST is the USD-pegged stablecoin from Terra. When the Anchor Protocol coin was first introduced, deposits could only be made in UST.

However, users are now able to deposit various stablecoins based on Ethereum, which include BUSD, USDC, Dai and USDT. Yields for UST typically range from 19.5–20.5%, and revolve around the Anchor Rate, which is maintained by the platform. If you deposit other stablecoins, your yields would be around 16.5%. Even though these yields are high, they’re consistent, which makes this a great investment if you need to diversify your crypto portfolio. Once you place your money into Anchor Protocol, you’ll be able to borrow and lend your assets while earning interest on any of the currency you’ve deposited. This ultimately opens up possibilities for even higher yield as you explore various liquidity pool options.

How Does Anchor Protocol Work?

Anchor Protocol runs on three primary mechanisms, which include loan liquidation, bonded asset (bAsset), and money market. A bAsset is a tokenized stake that’s situated on a Proof of Stake (PoS) blockchain. If you have a bAsset token, it effectively displays ownership of a PoS asset. Just like the underlying asset that you’ve staked, holding a bAsset will give you access to block rewards.

The main difference between a bAsset and a staked asset is that the bonded asset is fungible and transportable. What this means is that transactions can be completed with the bAsset in the same way that you would use the underlying asset to perform transactions.

Keep in mind that it’s possible for bAssets to be made on any PoS blockchain that’s equipped to handle smart contracts. In the time that Anchor Protocol has existed, bAssets have proven to be a key component of the platform because of how they are able to deliver consistent interest rates to any Terra deposits.

The money market that exists within Terra is a WebAssembly smart contract that’s present on the Terra blockchain. This market facilitates borrowing and depositing of Terra stablecoins. As mentioned previously, the Terra stablecoin is UST. It’s important to understand that the money market acts as the foundation for the Anchor Protocol. Terra deposits are brought together to form a pool, which generates interest from any loans.

If you want to borrow from this pool, you’ll be tasked with using some of your digital assets as a form of collateral. The interest rate that’s generated from the pool of Terra deposits is calculated based on the current demand and supply from borrowers. You can determine what this rate is by looking at the current utilization ratio for the pool.

It’s possible for someone to take out a loan via the Terra money market by securing the right amount of collateral that can be provided in return for the loan. The interest rates for the depositor and borrower are based on an algorithm that’s maintained by Anchor Protocol. With this algorithm, interest rates for a loan are generated based on the current availability and borrowing demand.

Anchor Protocol has an interest rate objective that’s known as the Anchor Rate. In order for the desired Anchor Rate objective to be reached, the smart contract will intuitively divide the block rewards from the bAssets that are serving as collateral. These rewards are divided between the depositor and the borrower.

Rewards are liquidated into UST, which provides depositors with the ability to obtain deposit yields that reach as high as 20%. Keep in mind that the two bAssets that are currently recognized by Anchor Protocol include bETH and bLUNA. These assets are liquid, and can be used to borrow UST.

Anchor Protocol Ecosystem

There are five types of participants in the Anchor ecosystem: depositors (lenders), borrowers, liquidators, ANC liquidity providers and, Oracle feeders.

- Depositor (lender)

Lends stable Terra currencies to the Anchor money market, which are pooled and lent to borrowers, and the accrued interest is distributed proportionally to all depositors. - Borrower

Entities that create bAsset collateralized lending positions to borrow Terra stable currencies from the Anchor money market. By borrowing, users can gain access to liquidity without losing exposure to the price of their bAsset collateral. Anchor Protocol distributes Anchor Tokens as incentives for borrowers. - Liquidator

Monitors the existence of risky loans and requests liquidation of loan collateral if necessary. Collateral is settled by executing bids in the Settlement Agreement. - ANC Liquidity Provider

Entities that provide liquidity to the Terraswap ANC-UST Pair. They manage the initial start-up of swap liquidity between ANC and UST tokens. - Oracle Feeder

Terra account that is responsible for providing accurate and up-to-date pricing feed for bAsset collateral. They fundamentally serve to provide the necessary infrastructure.

What is the ANC token?

The Anchor Token (ANC) is Anchor Protocol’s governance token. The ANC token is used as a means to propose how to spend the community pool, change parameters (e.g., LTV ratios for liquid staking derivatives), and vote to include new collateral on the supply side.

ANC also captures a portion of Anchor’s yield relative to the protocol’s assets under management. Anchor distributes 10% of protocol excess reserves (in UST, above the required 20% yield paid to depositors) and 1% of liquidated collateral to ANC stakers. The protocol takes UST earned and swaps it to ANC. Anchor distributes fees to ANC stakers pro-rata to their stake.

ANC is also used as an incentive to bootstrap borrow demand and initial deposit rate stability. The protocol distributes ANC tokens every block to stablecoin borrowers, proportional to the amount borrowed.

ANC, like LUNA and UST, is available on multiple chains including the Terra blockchain, Ethereum, and Binance Smart Chain (BSC). When transferred by the Shuttle bridge (a communication gateway between Terra and Ethereum), tokens will adopt the standard on the chain (e.g. ERC20 for Ethereum).

Anchor Protocol development updates in 2023

In 2023, Anchor Protocol (ANC), a prominent lending and borrowing protocol in the DeFi space, has seen several key developments that are shaping its ecosystem:

Price Performance: Anchor Protocol experienced notable price fluctuations throughout the year. The ANC token, which is integral to the protocol’s operation, saw its value increase significantly over a short period. For instance, there was a rise from $2.04 to $3.54 within a week, demonstrating a 73.53% increase, although it slightly decreased to $3.40 later on.

Governance Developments: Retrograde announced plans to build the governance master key for Terra, the blockchain ecosystem that Anchor Protocol is part of. This development is critical as it will allow those engaged in the governance of the project to decide the fate of the Terra ecosystem, thereby influencing Anchor Protocol’s trajectory.

Market Capitalization and Ranking: Anchor Protocol achieved a significant milestone by breaking into the top 100 token list on CoinMarketCap. It also witnessed a substantial increase in its total value locked (TVL), reaching $11.8 billion, indicating growing trust and utilization of the protocol.

Anchor Protocol V2: Looking towards future sustainability, the Anchor Protocol team is developing a version 2 of the platform. This update aims to address the long-term sustainability of the protocol, especially concerning the interest rates on UST (a stablecoin used within the protocol). Notable changes include allowing borrowers to keep all interest earned on staked assets used as collateral, integrating additional collateral options like staked $SOL, $AVAX, and $ATOM, and improving the borrowing interface.

Community Engagement: The protocol has maintained active community engagement, with AMA sessions discussing crucial topics like vote-escrowed economics. This level of interaction indicates a healthy and engaged user base, vital for the protocol’s growth and adaptation.

Fundamental and Technical Analysis: Both fundamental and technical analysis methods are used to predict the protocol’s future price movement. These analyses consider supply and demand dynamics, market capitalization, circulating supply, and other factors to provide a comprehensive overview of ANC’s potential future performance.

The developments in Anchor Protocol throughout 2023 highlight its growing prominence in the DeFi space and its commitment to evolving and adapting to meet the needs of its users.

Official website: https://app.anchorprotocol.com/

Best cryptocurrency wallet for Anchor Protocol (ANC)

There are plenty of different crypto wallets available. The best one for you depends on your general trading habits and which provides the most security in your situation. There are two main types of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical). Both have their pros and cons, and there is not necessarily a right or wrong answer when it comes to figuring out which crypto wallet is best for you.

HOW DO I DECIDE WHICH cryptocurrency WALLET TO USE for Anchor Protocol (ANC)?

Deciding which type of wallet to use depends on a variety of factors, including:

- How often you trade. In general, hot wallets are better for more active cryptocurrency traders. Quick login ability means you are only a few clicks and taps away from buying and selling crypto. Cold wallets are better suited for those looking to make less frequent trades.

- What you want to trade. As mentioned earlier, not all wallets support all types of cryptocurrencies. However, some of the best crypto wallets have the power to trade hundreds of different currencies, providing more of a one-size-fits-all experience.

- Your peace of mind. For those worried about hacking, having a physical cold wallet stored in a safe deposit box at the bank or somewhere at home, provides the safest, most secure option. Others might be confident in their ability to keep their hot wallets secure.

- How much it costs. It is important to investigate the costs associated with each wallet. Many hot wallets will be free to set up. Meanwhile, cold wallets, like any piece of hardware, will cost money to purchase.

- What it can do. While the basics of each cryptocurrency wallet are the same, additional features can help set them apart. This is especially true of hot wallets, many of which come with advanced reporting features, insights into the crypto market, the ability to convert cryptocurrencies and more. Security features can also be a good differentiator.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re going to be dealing in larger volumes of crypto, investing in cold storage might prove advantageous.

Most widespead examples of this being the Ledger Nano and the Trezor.

Ledger manufactures cold storage wallets designed for users who want increased security. Their wallets are a physical device that connects to your computer. Only when the device is connected can you send your cryptocurrency from it. Ledger offers a variety of products, such as the Ledger Nano S and the Ledger Nano X (a bluetooth connected hardware wallet).

Trezor is a pioneering hardware wallet company. The combination of world-class security with an intuitive interface and compatibility with other desktop wallets, makes it ideal for beginners and experts alike. The company has gained a lot of the Bitcoin community’s respect over the years. Trezor offers two main models – The Trezor One and Trezor Model T (which has a built in touch screen).

Market Overview

Coinmarketcap.com

Coinmarketcap will be your cryptocurrency go-to for just about everything. Here you can see the following: