How To Buy Celsius (CEL)?

A common question you often see on social media from crypto beginners is “Where can I buy Celsius?” Well, you’ll be happy to hear it is actually quite a simple and straightforward process.

Step 1: Create an account on an exchange that supports Celsius (CEL)

First, you will need to open an account on a cryptocurrency exchange that supports Celsius (CEL).

We recommend the following based on functionality, reputation, security, support and fees:

1

Binance

Fees (Maker/Taker) 0.075%*-0.1%*

Cryptocurrencies

Available for Trade 500+

Sign-up bonus

10% reduced trading fees*

Available in

Europe, Asia, Oceania, Africa

2

Bybit

Fees (Maker/Taker) 0.1%*-0.1%*

Cryptocurrencies

Available for Trade 400+

Sign-up bonus

$30,000 sign-up bonus*

Available in

Europe, Asia, Oceania, Africa

In order to sign up, you will need to enter some basic information, such as your email address, password, full name and, in some cases, you might also be asked for a phone number or address.

Note: On specific exchanges, you might need to complete a Know Your Customer (KYC) procedure in order to be able to purchase cryptocurrency. This is most commonly the case with licensed and regulated exchanges.

Step 2: Deposit funds into your account

Many cryptocurrency exchanges will allow you to purchase Celsius (CEL) with fiat currencies, such as EUR, USD, AUD and others. Furthermore, they will also provide you with multiple deposit methods through which you can fund your fiat account, such as credit and debit cards, ewallets or direct bank transfers.

Note: Some payment methods will have higher fees than others, such as credit card payments. Before funding your fiat account on your chosen exchange, make sure to do your due diligence to find out the fees involved with each payment method to avoid unnecessary costs.

Step 3: Buy Celsius (CEL)

This process is similar across almost every cryptocurrency exchange. All you have to do is find a navigation bar or a search bar, and search for Celsius (CEL) or Celsius (CEL) trading pairs. Look for the section that will allow you to buy Celsius (CEL), and enter the amount of the cryptocurrency that you want to spend for Celsius (CEL) or the amount of fiat currency that you want to spend towards buying Celsius (CEL). The exchange will then calculate the equivalent amount of Celsius (CEL) based on the current market rate.

Note: Make sure to always double-check your transaction details, such as the amount of Celsius (CEL) you will be buying as well as the total cost of the purchase before you end up confirming the transaction. Furthermore, many cryptocurrency exchanges will offer you their own proprietary software wallet where you will be storing your cryptocurrencies; however, you can create your own individual software wallet, or purchase a hardware wallet for the highest level of protection.

How to create a Gate.io account

![]()

Show Detailed Instructions

Hide Detailed Instructions

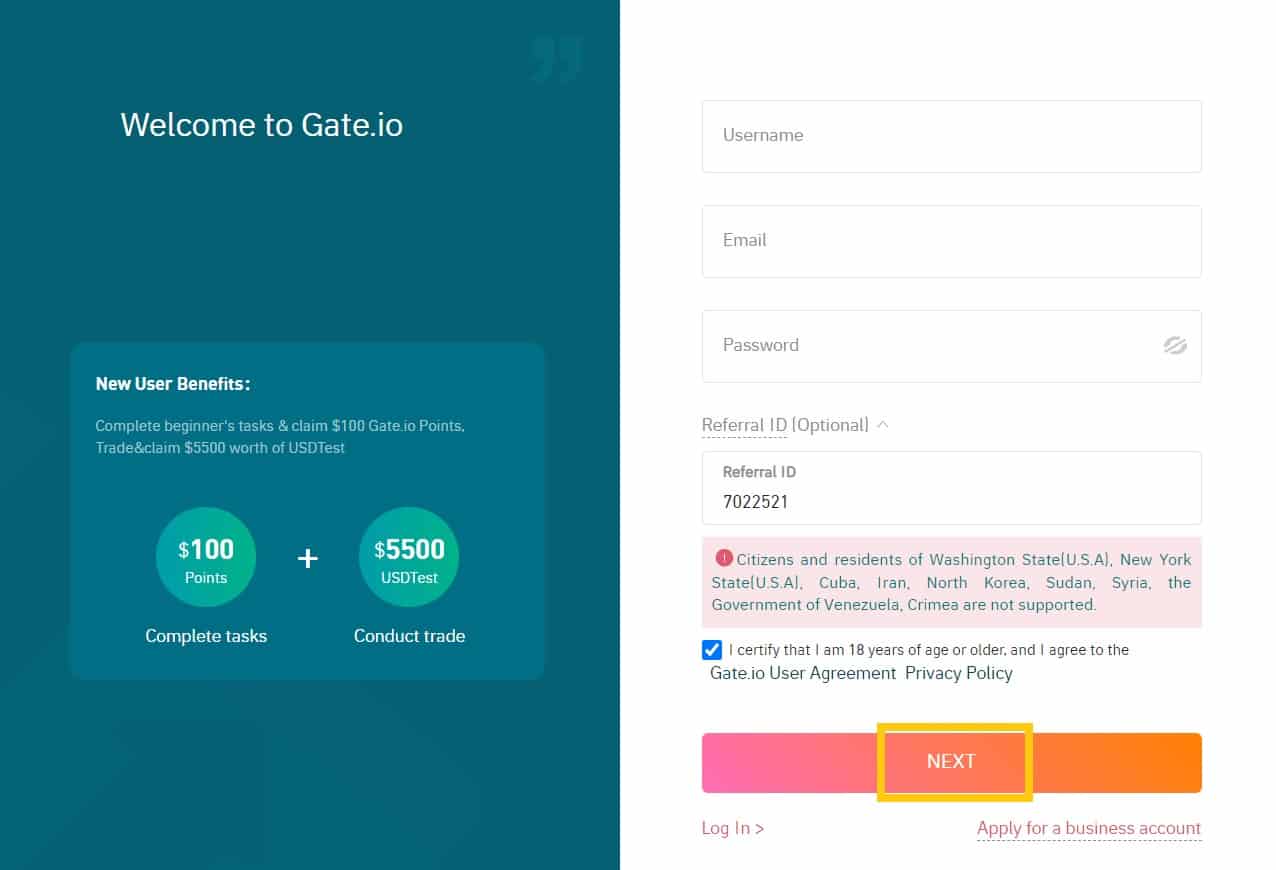

Step 1: Go to the Gate.io website.

Step 2: Choose your username, your email address and your password. Then check “I certify that I am 18 years of age or older, and I agree to the Gate.io User Agreement Privacy Policy” and click “NEXT”.

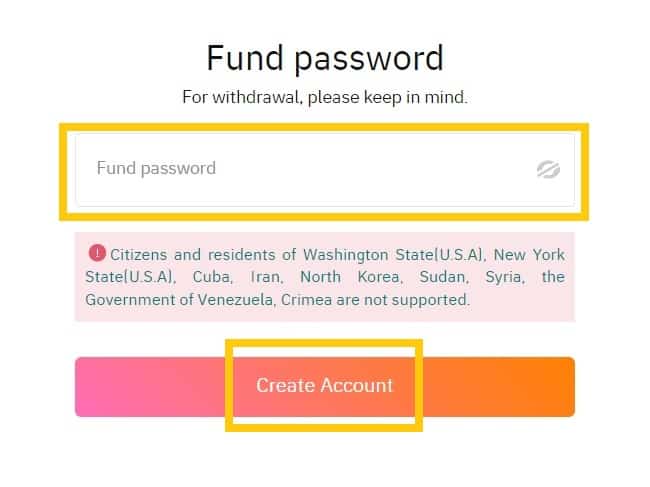

Step 3: Set your fund password and click “Create account”.

Note: Your fund password must contain at least 6 characters and can not be the same as your login password.

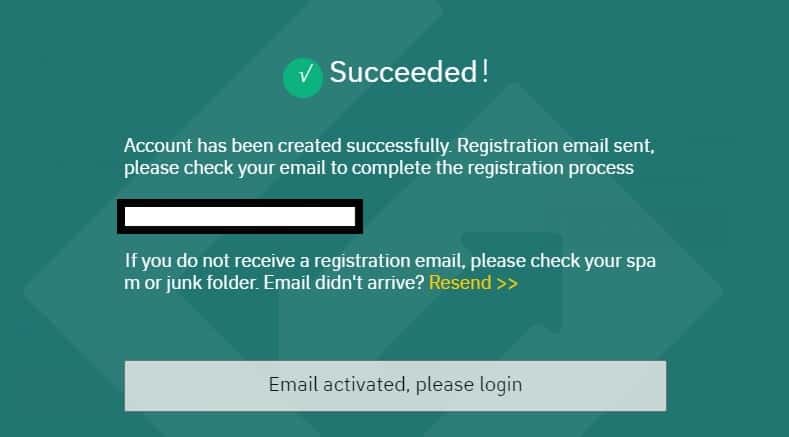

Step 4: An activation email will be sent to your email address. Complete the rest of the registration process by following the instructions in the email to activate your account. Once this is done done, click “Email activated, please log in”.

How to complete KYC (ID Verification) on Gate.io

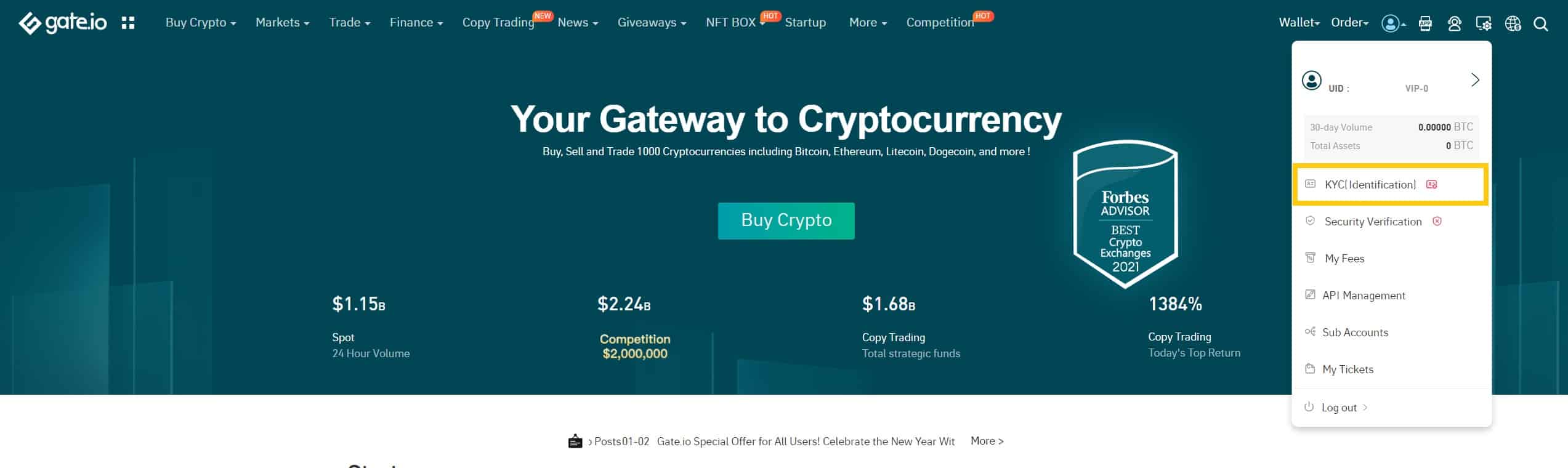

In order to ensure the safety of your assets, and to reduce fraud, money laundering, blackmail, and other illegal activities, Gate.io makes it mandatory that all users obtain KYC ID Verification. Only after your account has obtained KYC ID verification, can you withdraw funds or use credit cards or debit cards to buy cryptocurrencies.

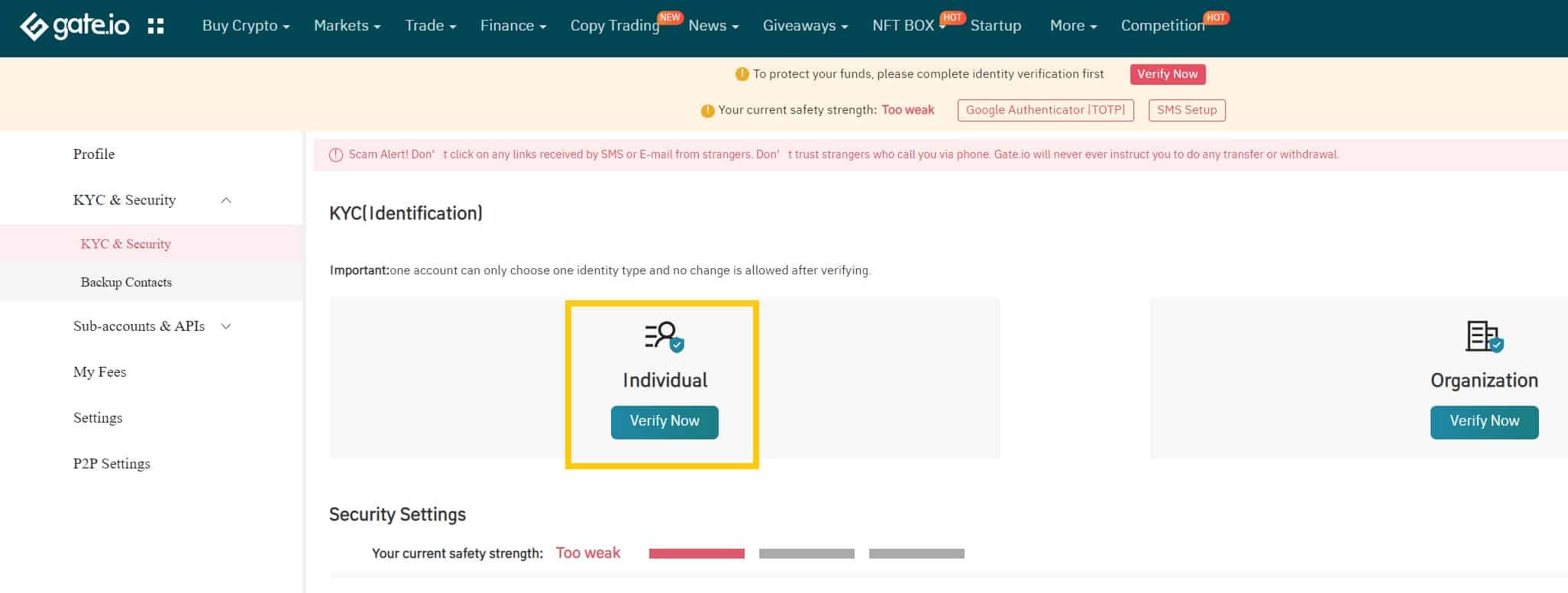

Step 1: Log in to your Gate.io account.

Place your cursor on the top-right profile icon and go to “KYC (ID Verification)”

Step 2: Click “Individual (Verify now)”

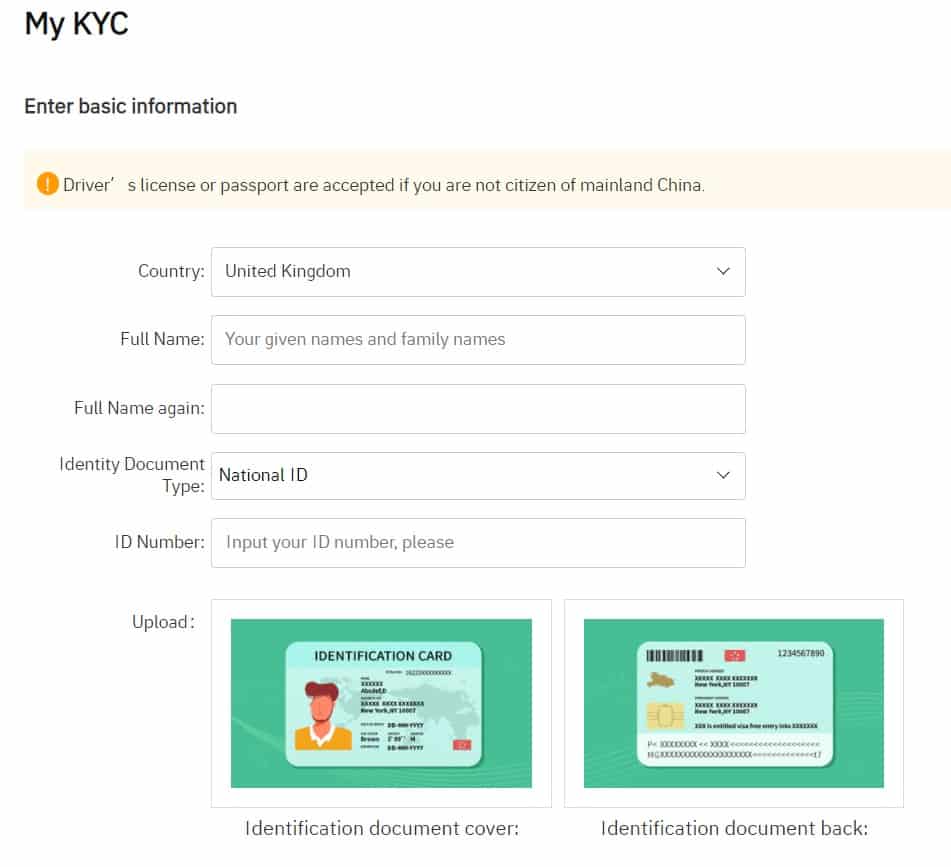

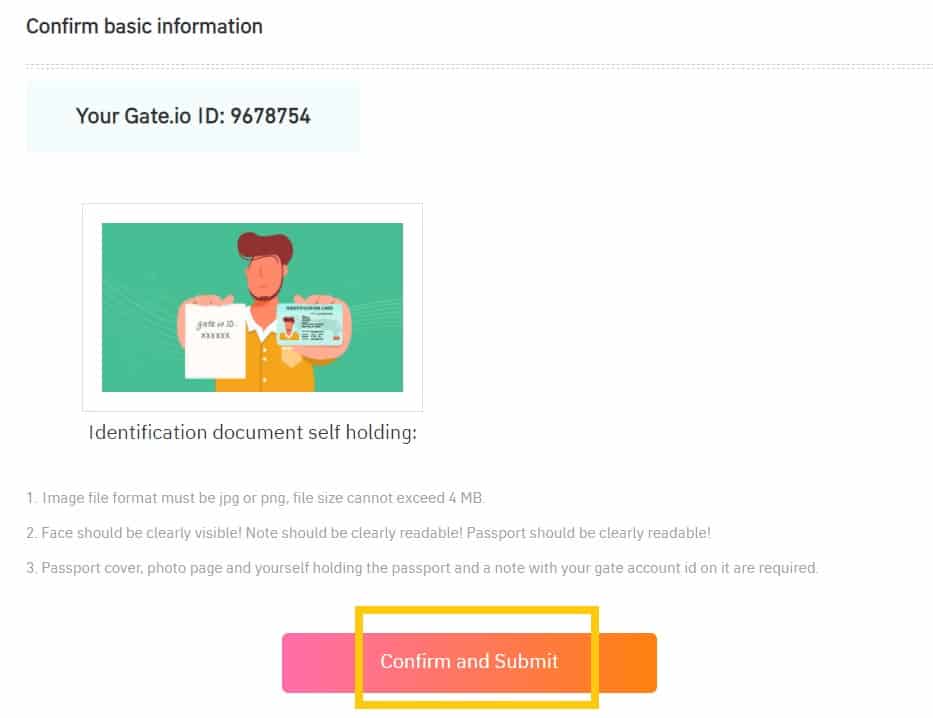

Step 3: Select your country, input your full legal name (twice), fill in your ID information, upload photos of both sides of your ID card, and a photo of you holding your ID together with your User ID (UID) for Gate.io. You will see your User ID by placing the cursor on the top-right profile icon on the main page. Make sure everything is filled in correctly and then click on “Confirm and Submit”.

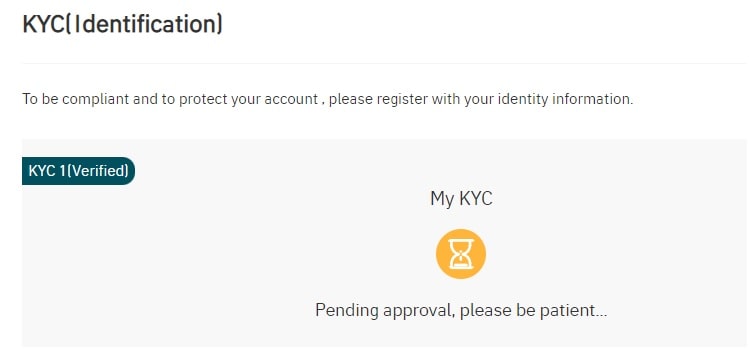

Step 4: After you have submitted all the requested information, you will see the pending approval.

Approval can take anywhere from a few hours to a few days to complete.

Once the KYC is approved, you’re ready to make your first cryptocurrency purchase.

How to buy cryptocurrency on Gate.io

Step 1: Log in to your Gate.io account.

Then in the Menu Bar at the top of the page, click “Buy Crypto” and select “Credit Card”.

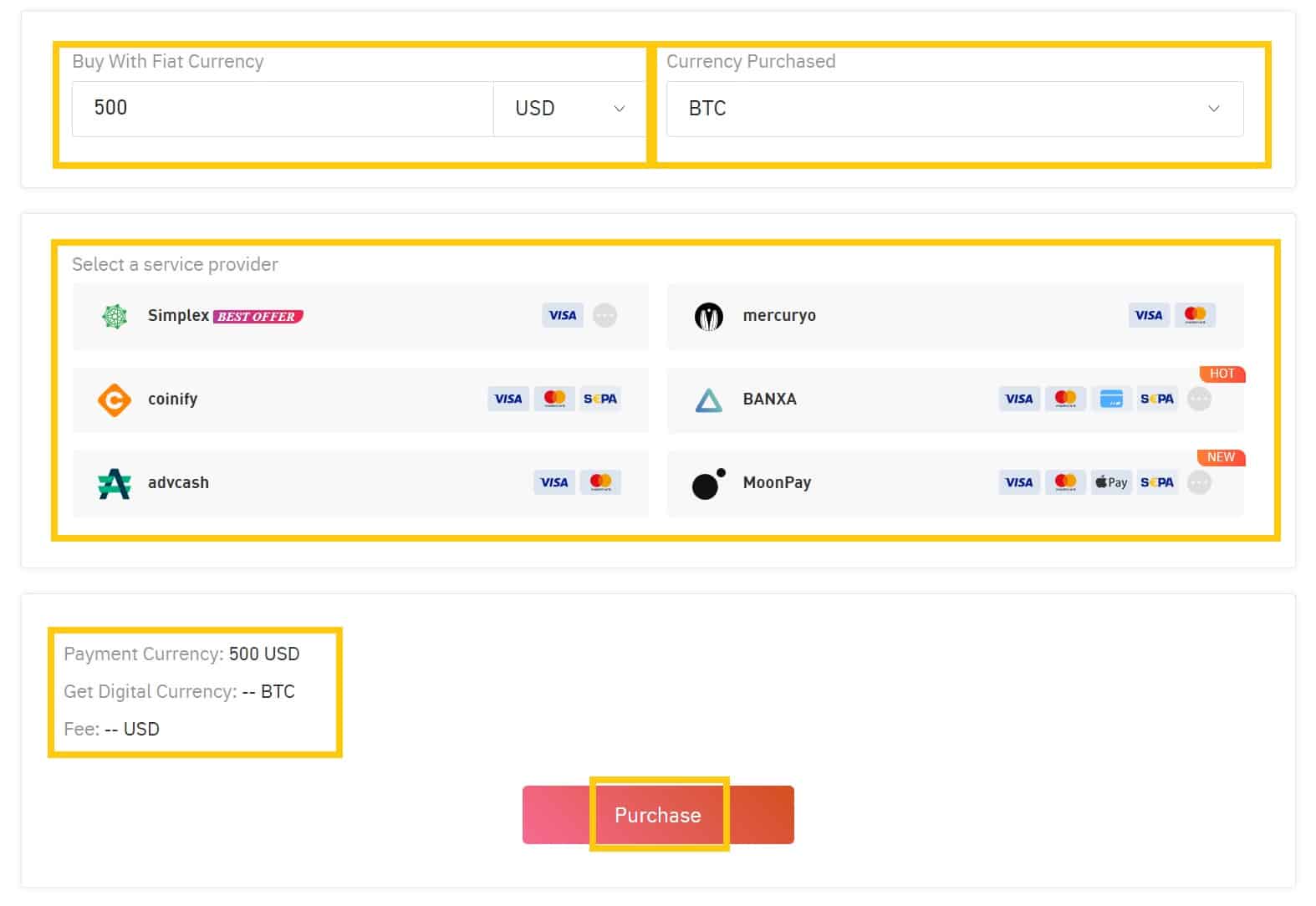

Step 2: Enter the amount you wish to spend in the “Buy with Fiat Currency” tab and select the cryptocurrency that you want to buy under the “Currency Purchased” field. Then select one of the “Service Providers” below and click the “Place Order” button to enter the confirmation page.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

Step 3: On the confirmation page, select “Buy Crypto” or the “Create Order” button to complete the payment.

Note: To ensure a quick and secure way of receiving the order, users might need to conduct an additional Identity Verification (KYC) with a third-party service provider. Once successfully verified, the service provider will immediately transfer the cryptocurrencies to your Gate.io account.

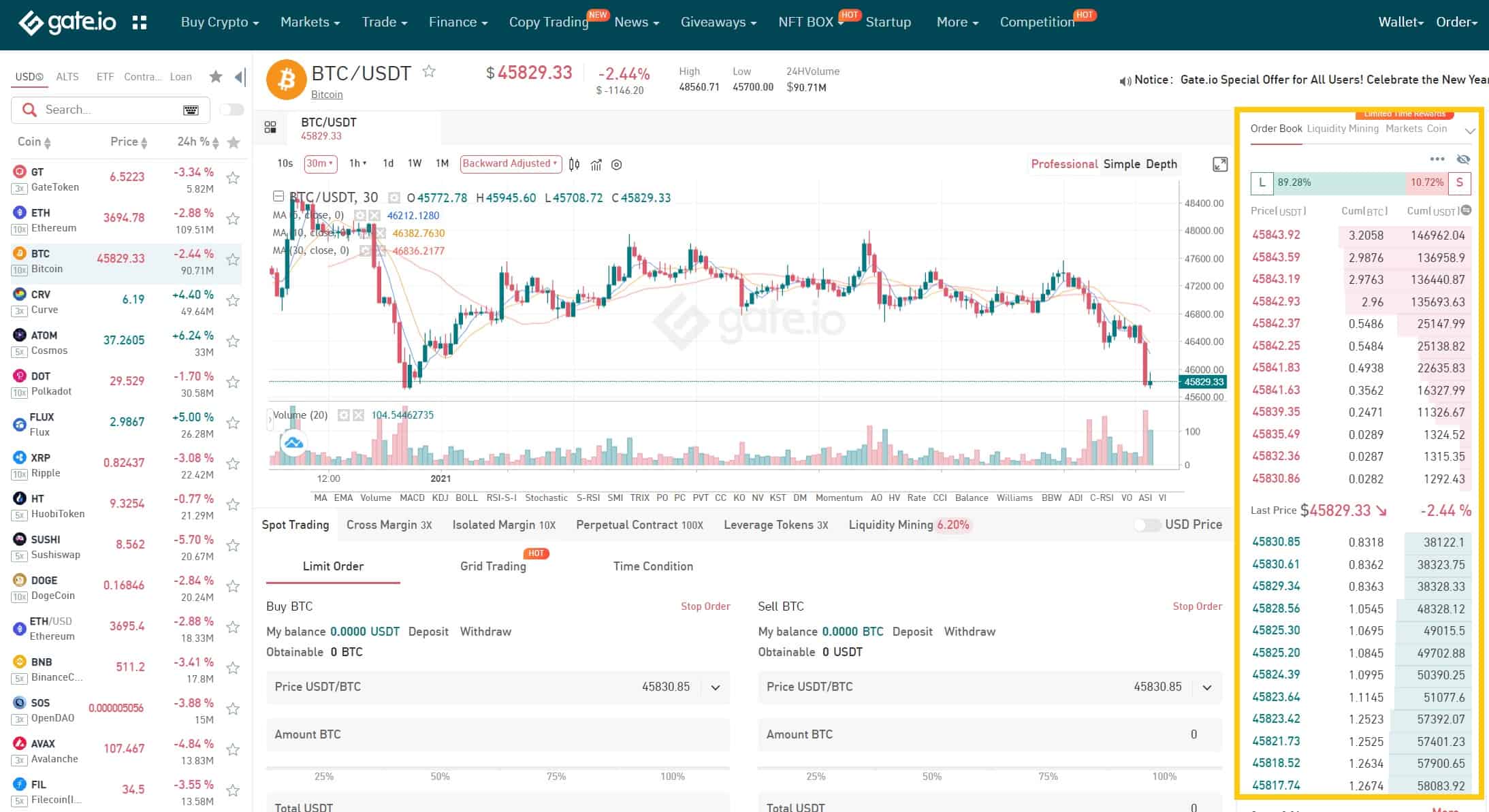

How to Conduct Spot Trading on Gate.io

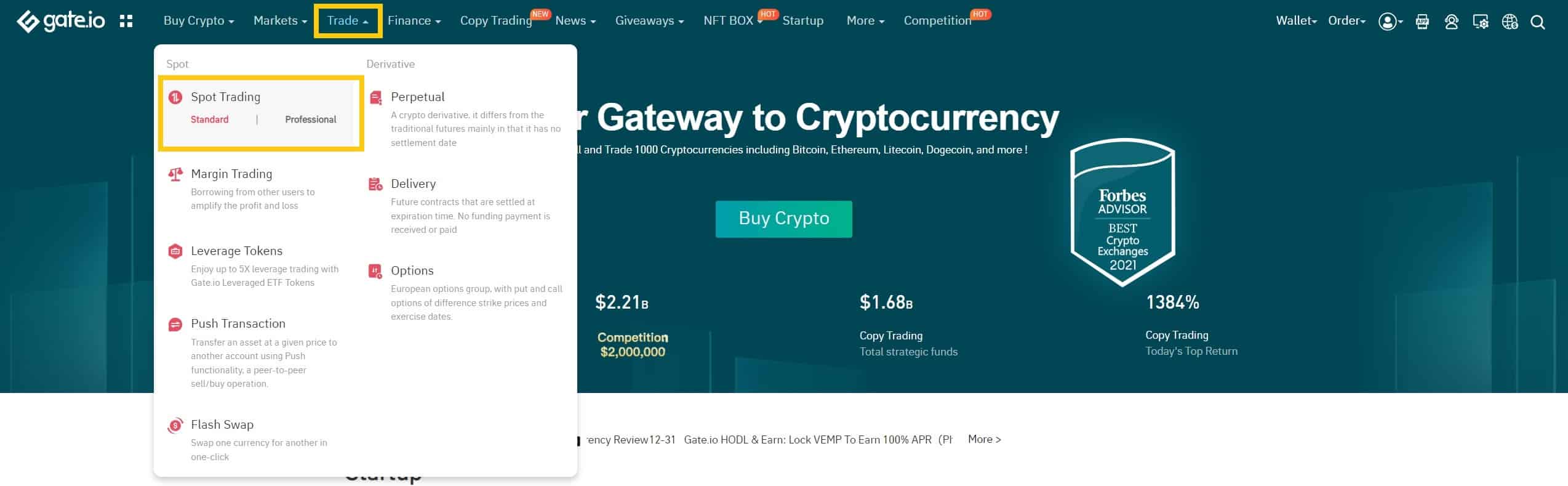

Step 1: Log in to your Gate.io account.

Click on “Spot Trading” under “Trade” on the top navigation bar.

You can either choose “standard” or “professional” version. This tutorial uses the standard version.

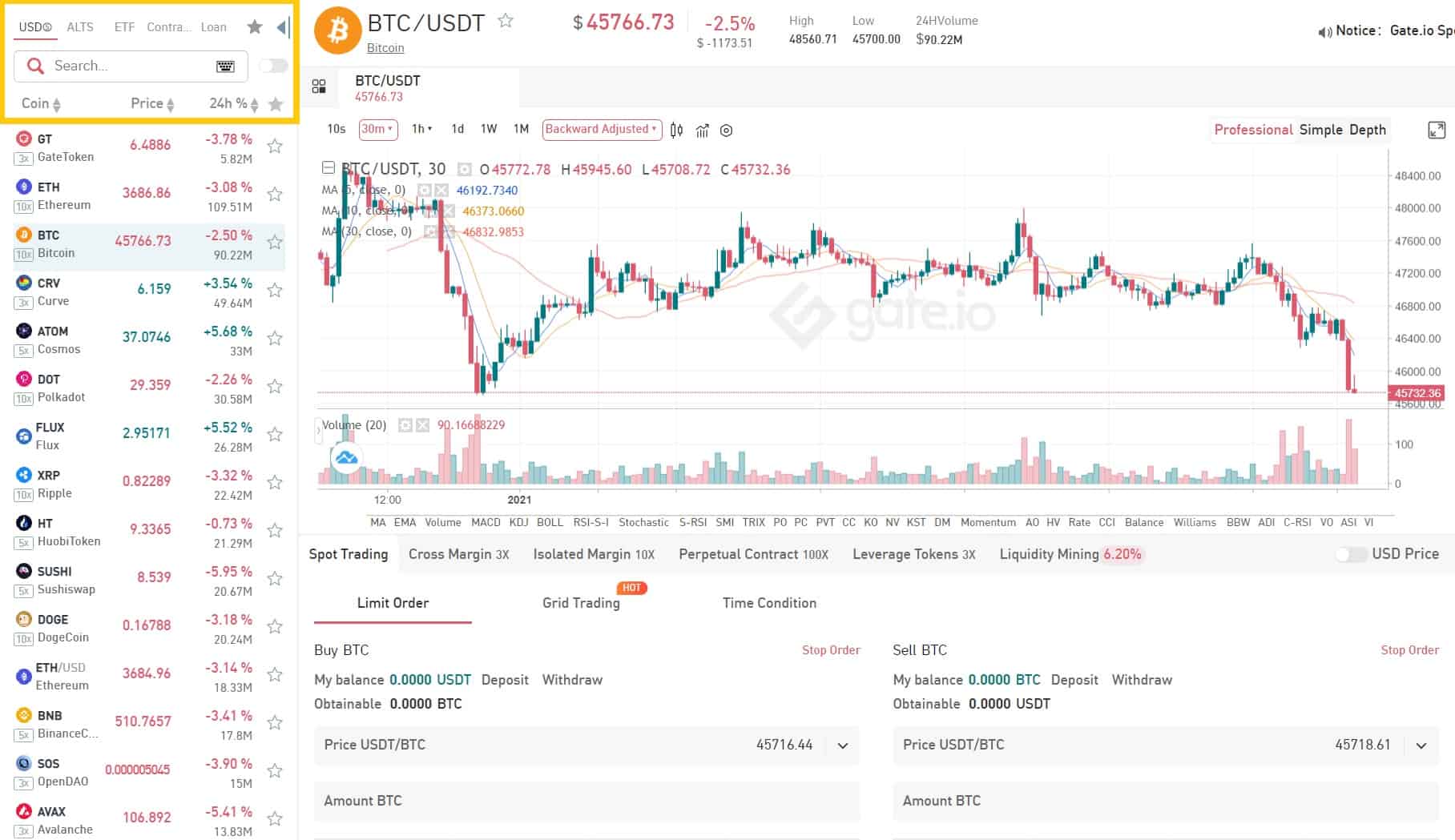

Step 2: Search and enter the cryptocurrency you want to trade.

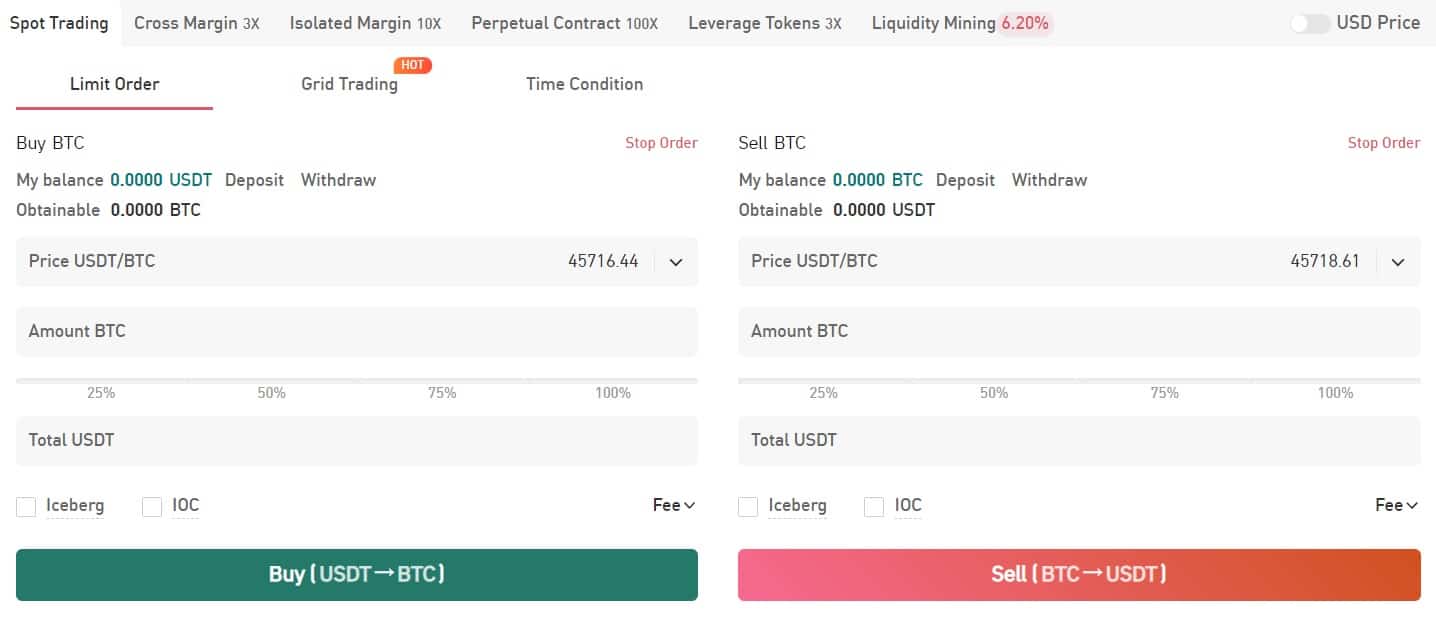

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can click on the last prices on the order book to set the buying/selling price automatically.

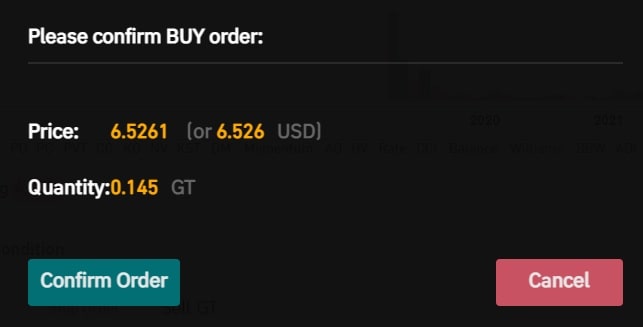

Step 5: Confirm the price and amount. Then click on “Place Order” to place the order, followed by “Confirm Order” to confirm it.

Hide Detailed Instructions

For more in-depth instructions, our ‘Absolute Beginner’s Guide To Cryptocurrency Investing‘ will take you through the process step-by step. In addition to providing instructions for sending and receiving your cryptocurrency.

And if you’re completely new to crypto our beginner, intermediate and advanced level articles will get you up to speed with everything you need to know about the cryptocurrency space starting out.

Simplecryptoguide.com

What Is Celsius (CEL)?

The Celsius Network is a financial technology (fintech) platform that offers interest-bearing savings accounts, borrowing, and payments with digital and fiat assets. It operates on an economic model that challenges conventional banking models while prioritizing the Celsius community.

Launched in June 2018, the Celsius Network is a blockchain-integrated fintech platform that’s accessible to anyone with a smartphone. With its suite of lending, yield creation, and payments solutions, the Celsius Network provides access to financial services and conditions not available through conventional institutions. At its core, the Celsius mandate is simple: ensure financial services while doing what’s best for the community, not intermediaries.

The Celsius Network’s community-first mandate flips the traditional approach taken in financial services, and allows for a radical alternative. Celsius returns 80% of all its earning to users in the form of rewards and attractive interest rates on savings. But how does Celsius afford to do this? The key lies in the over-collateralization of crypto loans and rehypothecation, a process by which crypto funds held as collateral on the Celsius Network are lent to another party — in this case, large investors looking for reliable inroads into cryptocurrency.

Rather than borrow crypto from disjointed sources, investors such as hedge funds can borrow crypto from a proven source: the Celsius Network. Celsius presents an attractive opportunity for large institutional investors looking for a secure onramp to the crypto market by aggregating cryptocurrency into one large pool. The interest Celsius earns from these investors is fed back into the community. 80% of profits are rewarded to Celsius Network users, while 20% is used to fund development on the platform. A closer look at each segment of the Celsius Network highlights a robust ecosystem of incentivized interactions.

How does Celsius work?

The Celsius Network is a blockchain-integrated fintech platform that’s accessible to anyone with a smartphone. With its suite of lending, yield creation, and payments solutions, the Celsius Network provides access to financial services and conditions not available through conventional institutions. At its core, the Celsius mandate is simple: ensure financial services while doing what’s best for the community, not intermediaries.

The Celsius Network’s community-first mandate flips the traditional approach taken in financial services, and allows for a radical alternative. Celsius returns 80% of all its earning to users in the form of rewards and attractive interest rates on savings. But how does Celsius afford to do this? The key lies in the over-collateralization of crypto loans and rehypothecation, a process by which crypto funds held as collateral on the Celsius Network are lent to another party — in this case, large investors looking for reliable inroads into cryptocurrency.

Rather than borrow crypto from disjointed sources, investors such as hedge funds can borrow crypto from a proven source: the Celsius Network. Celsius presents an attractive opportunity for large institutional investors looking for a secure onramp to the crypto market by aggregating cryptocurrency into one large pool. The interest Celsius earns from these investors is fed back into the community. 80% of profits are rewarded to Celsius Network users, while 20% is used to fund development on the platform. A closer look at each segment of the Celsius Network highlights a robust ecosystem of incentivized interactions.

How to earn interest with Celsius?

Celsius’s earning network allows users to stake their cryptocurrency for borrowing and earn interest in return. The platform accepts more than 50 tokens, including BTC, LTC, ETH, and stablecoins like USDT, GUSD, and DAI. The Annual Percentage Yield (APR) of each staked cryptocurrency reflects the market demand for that particular coin. As of February 2022, some of these tokens were earning 17% a year, dwarfing yield offers by banks — often less than 1%. If users opt to receive their interest earnings in CEL, the platform’s native token, payouts are 30% higher.

In contrast to fiat-denominated banks, Celsius doesn’t require a minimum deposit to start earning interest. Also, there’s no lockup period or penalty for failing to maintain a minimum or withdrawing your funds. With fewer restrictions and higher yields, the Celsius Network offers a radically different value proposition in the way you manage and hold your assets.

How to borrow with Celsius?

On the Celsius Network’s lending platform, you can borrow USD against crypto collateral. There are several benefits to taking out a crypto-collateralized loan. Perhaps most notably, these loans allow you to maintain your crypto assets while accessing fiat liquidity. Normally, if you sell your crypto in exchange for cash, there are tax implications in the form of capital gains and a risk of missing out on market appreciation. Celsius allows you to avoid this eventuality. Celsius Network loans are always over-collateralized to protect against losses that may arise from market volatility. As such, you can only obtain a loan that equates to 25%, 33%, or 50% of the collateral value.

The remaining untapped collateral acts as a buffer against crypto price fluctuations. To access Celsius Network loans, you need only select the type and amount of collateral you wish to deploy, the loan term, and the desired USD loan amount through the Celsius app. Compared to the conventional loan process that takes days or weeks, Celsius loans execute in minutes or seconds. Because all loans are collateralized, there’s no need to check credit or perform alternative verification protocols.

What is the CEL token?

The CEL token underpins the Celsius Network’s earning and reward systems. Utilization of the CEL token affords each Celsius user group unique benefits:

- Earners: By accepting rewards in the form of CEL tokens, earners receive up to 30% more rewards on all deposits of non-CEL tokens.

- Borrowers: By paying interest with CEL tokens, borrowers receive up to a 30% discount on interest payments.

- Institutions: By paying interest with CEL tokens, institutions borrowing tokens from Celsius receive a 30% discount on their interest payments.

The reward percentages originate from the Celsius loyalty program, which refers to each user’s CEL holdings. For instance, the Bronze reward level requires 5-10% of your portfolio to reside in CEL, Silver requires 10-15%, Gold requires 15-20%, and Platinum requires 20-100%. CEL’s most beneficial use is for earning compound interest, especially if you can maximize rewards through a substantial allocation of CEL in your portfolio.

Who Are the Founders of Celsius?

Celsius originally came into being as the product of creators Alex Mashinsky and Daniel Leon in 2017.

Mashinsky has a long-running history in the internet development sphere, having worked on the Voice Over Internet Protocol (VOIP) in the 1990s and other technologies since. Celsius is far from Mashinsky’s first corporate venture, with seven startups and 35 patents to his name, the project’s official website states.

Co-founder and COO Daniel Leon meanwhile has experience focusing on growing early-stage startups. His previous roles include being CEO of Atlis Labs, a social recommendation and discovery app which used real-time user referrals.

Celsius now has a large team of core employees, technical developers and advisors with experience in various spheres.

Celsius development updates in 2023

Celsius Network, a prominent crypto lender, has experienced significant developments and changes in 2023. These updates are crucial for understanding the direction and future of the platform. Here’s a detailed overview of the most important advancements:

Exit from Bankruptcy and Restructuring Plan: Celsius Network received U.S. bankruptcy court approval for a restructuring plan in November 2023. This plan involves returning cryptocurrency to customers and creating a new company managed by Fahrenheit LLC, a consortium including hedge fund Arrington Capital. The reorganized business will focus on mining new bitcoin and earning staking fees by validating blockchain transactions. This move is a significant step forward for Celsius, which had filed for Chapter 11 protection in July 2022 after freezing customer accounts to prevent withdrawals.

Management of the Successor Company: The potential successor to Celsius, temporarily named NewCo, aims to restart operations without any funded debt, with an initial funding of up to $450 million in cryptocurrency, subject to court approval. NewCo announced plans to commence reimbursements to clients whose assets were locked following Celsius’s downfall. This development was seen as the most favorable recovery strategy for affected clients. The operations of NewCo will be overseen by the investment group Fahrenheit.

Challenges with the Securities and Exchange Commission (SEC): Celsius’s revamp plan encountered a speed bump with the SEC. While specific details of the SEC’s concerns were not disclosed, regulatory challenges are not uncommon in the crypto industry, especially for platforms undergoing significant restructuring like Celsius.

Financial Distribution to Creditors: As part of the restructuring process, approximately $2 billion in Bitcoin and Ethereum will be distributed promptly to creditors. This distribution is a key element of the restructuring plan, aiming to resolve the financial concerns of Celsius’s clients and creditors.

Legal and Regulatory Developments: The restructuring plan also includes a settlement that values Celsius’s proprietary crypto token, CEL, at 25 cents. Furthermore, the reorganized company will pursue litigation against Celsius founder Alex Mashinsky, who faces U.S. criminal charges and a New York civil lawsuit for allegedly misleading customers and artificially inflating the value of CEL.

In summary, the developments at Celsius in 2023 reflect a challenging yet progressive path towards restructuring and reviving the platform. The approval of the bankruptcy exit plan, the establishment of NewCo, and the intended financial distributions to creditors mark critical steps in addressing the issues faced by the platform and its users. However, the ongoing regulatory challenges and legal proceedings indicate that the journey towards complete recovery and stability is still in progress.

Official website: https://celsius.network/

Best cryptocurrency wallet for Celsius (CEL)

There are plenty of different crypto wallets available. The best one for you depends on your general trading habits and which provides the most security in your situation. There are two main types of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical). Both have their pros and cons, and there is not necessarily a right or wrong answer when it comes to figuring out which crypto wallet is best for you.

HOW DO I DECIDE WHICH cryptocurrency WALLET TO USE for Celsius (CEL)?

Deciding which type of wallet to use depends on a variety of factors, including:

- How often you trade. In general, hot wallets are better for more active cryptocurrency traders. Quick login ability means you are only a few clicks and taps away from buying and selling crypto. Cold wallets are better suited for those looking to make less frequent trades.

- What you want to trade. As mentioned earlier, not all wallets support all types of cryptocurrencies. However, some of the best crypto wallets have the power to trade hundreds of different currencies, providing more of a one-size-fits-all experience.

- Your peace of mind. For those worried about hacking, having a physical cold wallet stored in a safe deposit box at the bank or somewhere at home, provides the safest, most secure option. Others might be confident in their ability to keep their hot wallets secure.

- How much it costs. It is important to investigate the costs associated with each wallet. Many hot wallets will be free to set up. Meanwhile, cold wallets, like any piece of hardware, will cost money to purchase.

- What it can do. While the basics of each cryptocurrency wallet are the same, additional features can help set them apart. This is especially true of hot wallets, many of which come with advanced reporting features, insights into the crypto market, the ability to convert cryptocurrencies and more. Security features can also be a good differentiator.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re going to be dealing in larger volumes of crypto, investing in cold storage might prove advantageous.

Most widespead examples of this being the Ledger Nano and the Trezor.

Ledger manufactures cold storage wallets designed for users who want increased security. Their wallets are a physical device that connects to your computer. Only when the device is connected can you send your cryptocurrency from it. Ledger offers a variety of products, such as the Ledger Nano S and the Ledger Nano X (a bluetooth connected hardware wallet).

Trezor is a pioneering hardware wallet company. The combination of world-class security with an intuitive interface and compatibility with other desktop wallets, makes it ideal for beginners and experts alike. The company has gained a lot of the Bitcoin community’s respect over the years. Trezor offers two main models – The Trezor One and Trezor Model T (which has a built in touch screen).

Market Overview

Coinmarketcap.com

Coinmarketcap will be your cryptocurrency go-to for just about everything. Here you can see the following: