How To Buy Hegic (HEGIC)?

A common question you often see on social media from crypto beginners is “Where can I buy Hegic?” Well, you’ll be happy to hear it is actually quite a simple and straightforward process.

Step 1: Create an account on an exchange that supports Hegic (HEGIC)

First, you will need to open an account on a cryptocurrency exchange that supports Hegic (HEGIC).

We recommend the following based on functionality, reputation, security, support and fees:

1

Binance

Fees (Maker/Taker) 0.075%*-0.1%*

Cryptocurrencies

Available for Trade 500+

Sign-up bonus

10% reduced trading fees*

Available in

Europe, Asia, Oceania, Africa

2

MEXC

Fees (Maker/Taker) 0.2%*-0.2%*

Cryptocurrencies

Available for Trade 1500+

Sign-up bonus

10% reduced trading fees & up to $170 in USDT vouchers*

Available in

North America, South America, Europe, Asia, Oceania, Africa

In order to sign up, you will need to enter some basic information, such as your email address, password, full name and, in some cases, you might also be asked for a phone number or address.

Note: On specific exchanges, you might need to complete a Know Your Customer (KYC) procedure in order to be able to purchase cryptocurrency. This is most commonly the case with licensed and regulated exchanges.

Step 2: Deposit funds into your account

Many cryptocurrency exchanges will allow you to purchase Hegic (HEGIC) with fiat currencies, such as EUR, USD, AUD and others. Furthermore, they will also provide you with multiple deposit methods through which you can fund your fiat account, such as credit and debit cards, ewallets or direct bank transfers.

Note: Some payment methods will have higher fees than others, such as credit card payments. Before funding your fiat account on your chosen exchange, make sure to do your due diligence to find out the fees involved with each payment method to avoid unnecessary costs.

Step 3: Buy Hegic (HEGIC)

This process is similar across almost every cryptocurrency exchange. All you have to do is find a navigation bar or a search bar, and search for Hegic (HEGIC) or Hegic (HEGIC) trading pairs. Look for the section that will allow you to buy Hegic (HEGIC), and enter the amount of the cryptocurrency that you want to spend for Hegic (HEGIC) or the amount of fiat currency that you want to spend towards buying Hegic (HEGIC). The exchange will then calculate the equivalent amount of Hegic (HEGIC) based on the current market rate.

Note: Make sure to always double-check your transaction details, such as the amount of Hegic (HEGIC) you will be buying as well as the total cost of the purchase before you end up confirming the transaction. Furthermore, many cryptocurrency exchanges will offer you their own proprietary software wallet where you will be storing your cryptocurrencies; however, you can create your own individual software wallet, or purchase a hardware wallet for the highest level of protection.

How to create a Binance account

![]()

Show Detailed Instructions

Hide Detailed Instructions

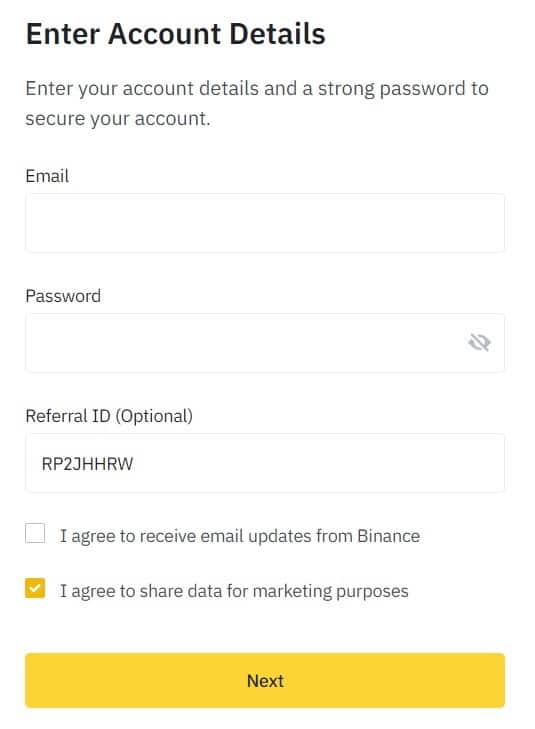

Step 1: Go to the Binance website.

Step 2: On the registration page, enter your email address, and create a password for your account.

Then, read and agree to the Terms of Service and click “Create Account”.

Note: Your password must be a combination of numbers and letters.

It should contain at least 8 characters, one UPPER CASE letter, and one number.

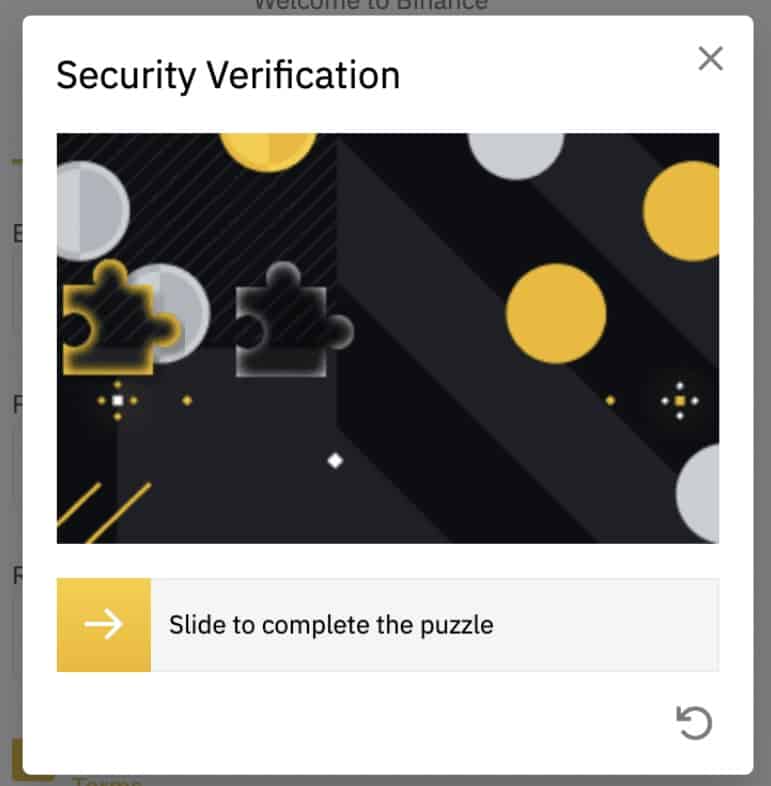

Step 3: Complete the Security Verification.

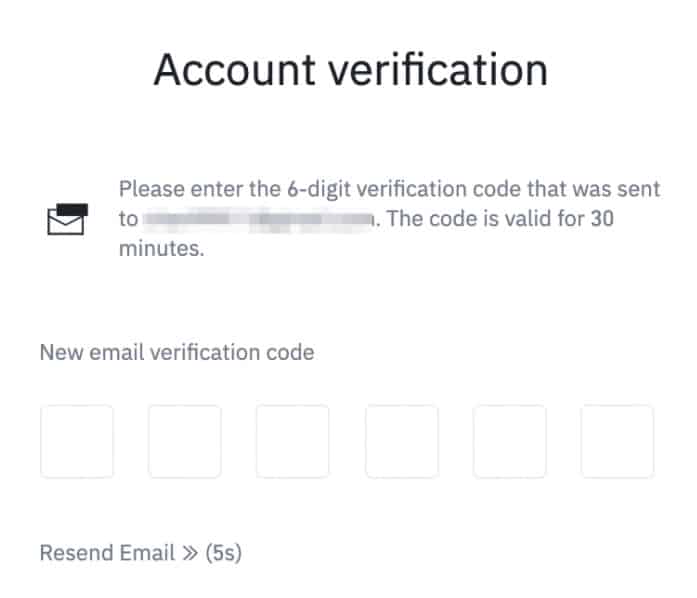

Step 4: The system will send a verification code to your email. The verification code is valid for 30 minutes. If you can’t find the email in your inbox, check your other mail folders as well, or click “Resend Email” to resend.

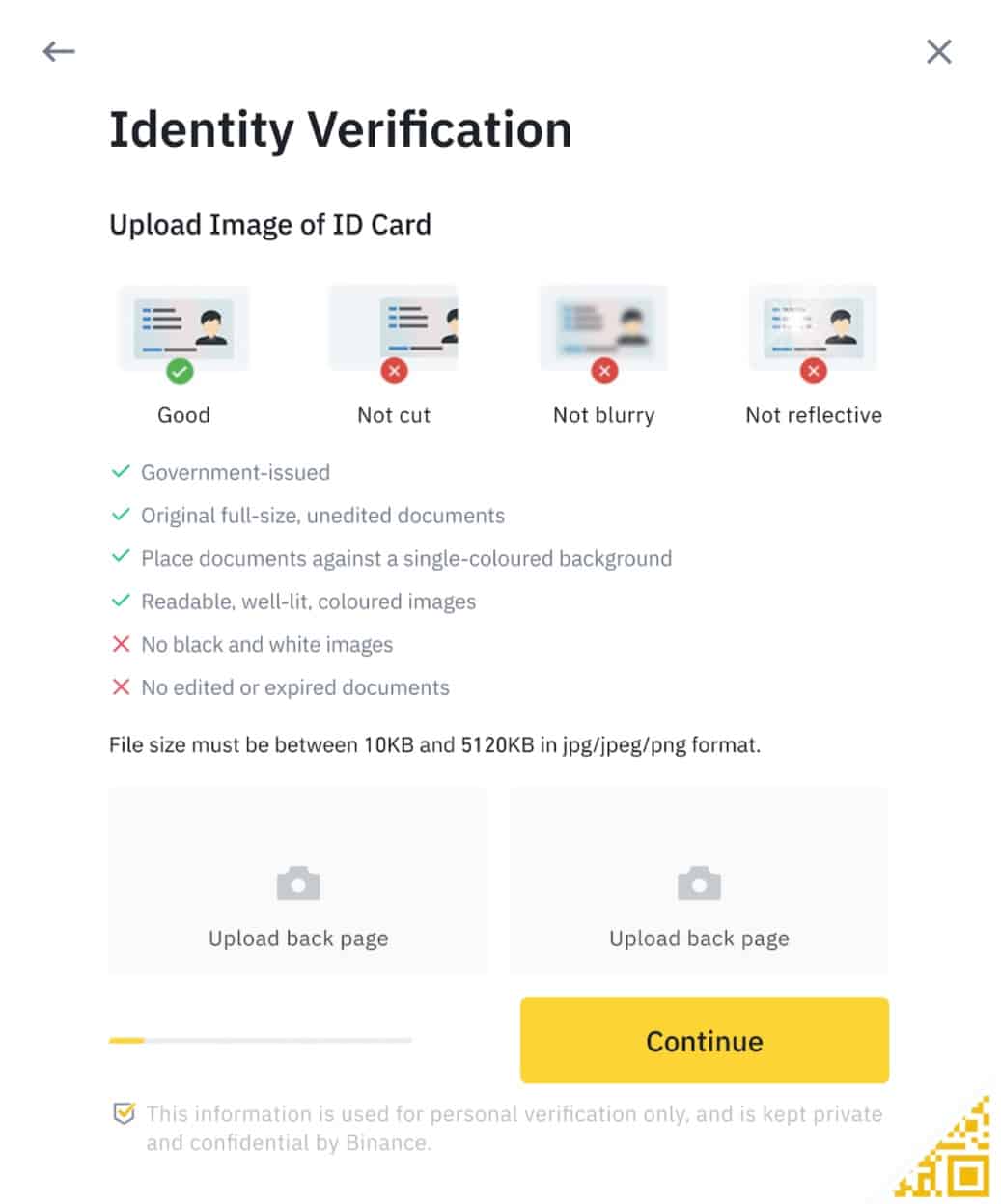

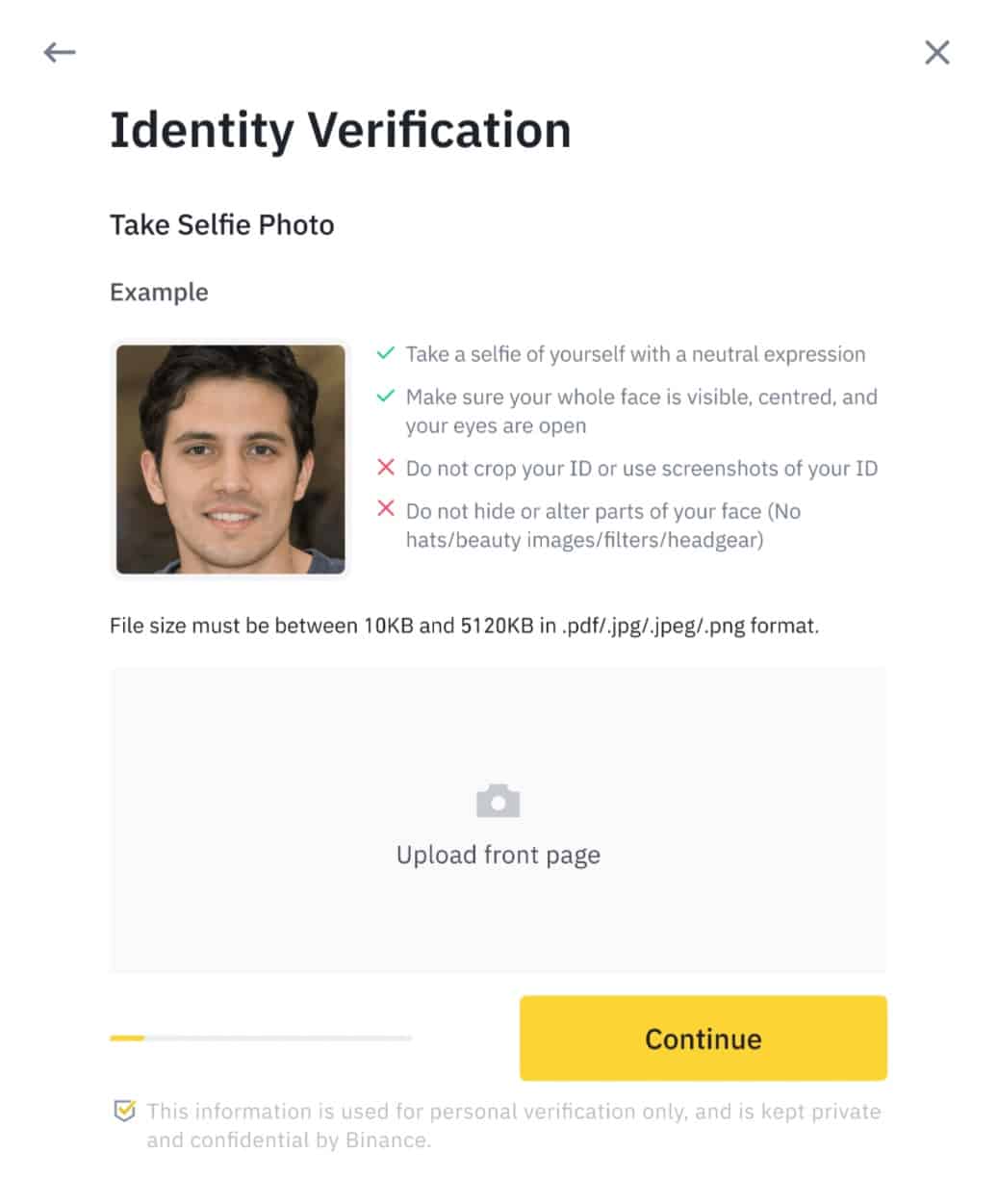

How to complete KYC (ID Verification) on Binance

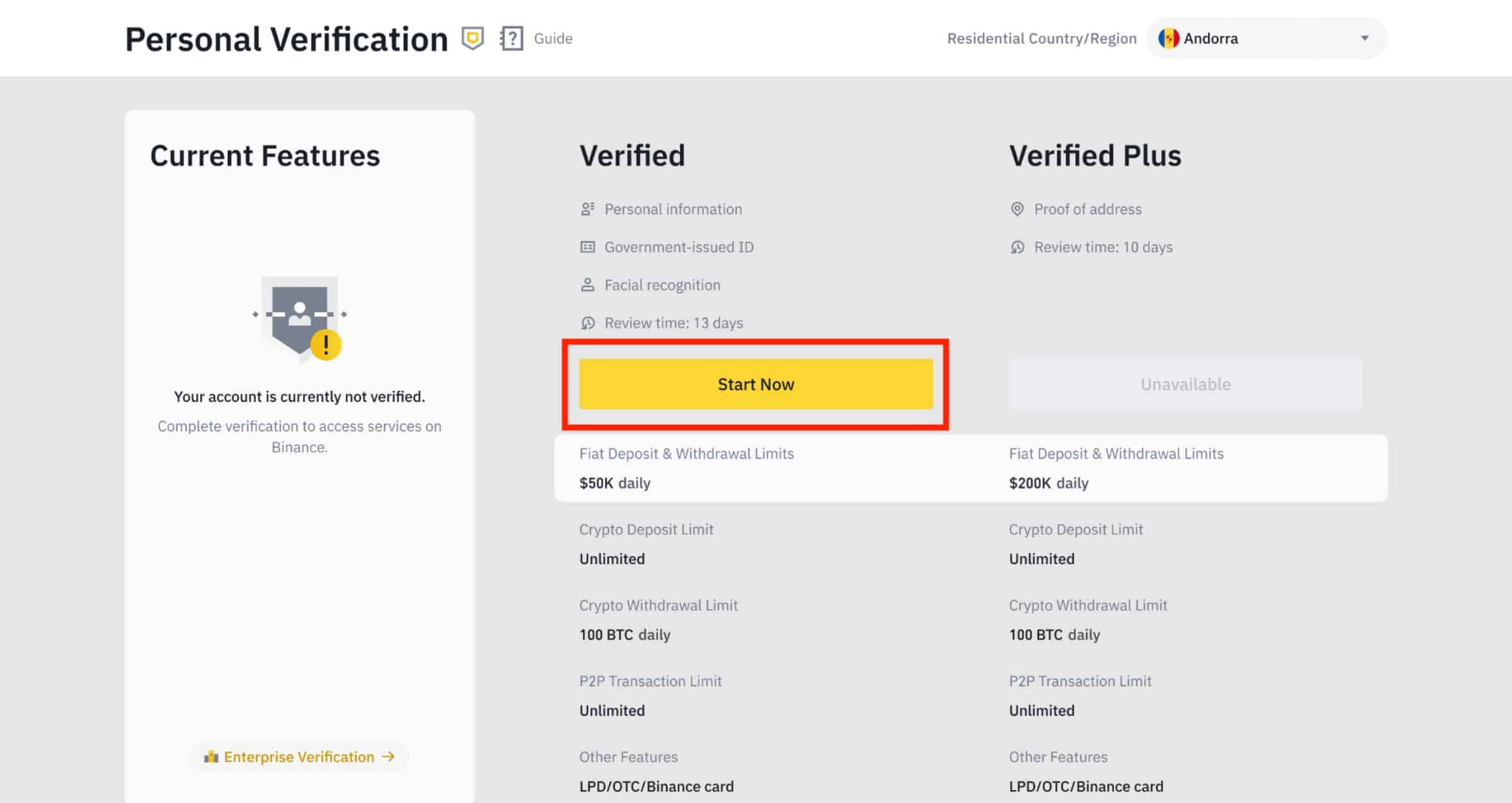

Step 1: Log in to your Binance account and click “User Center” and then “Identification”.

Step 2: click “Start Now” to verify your account.

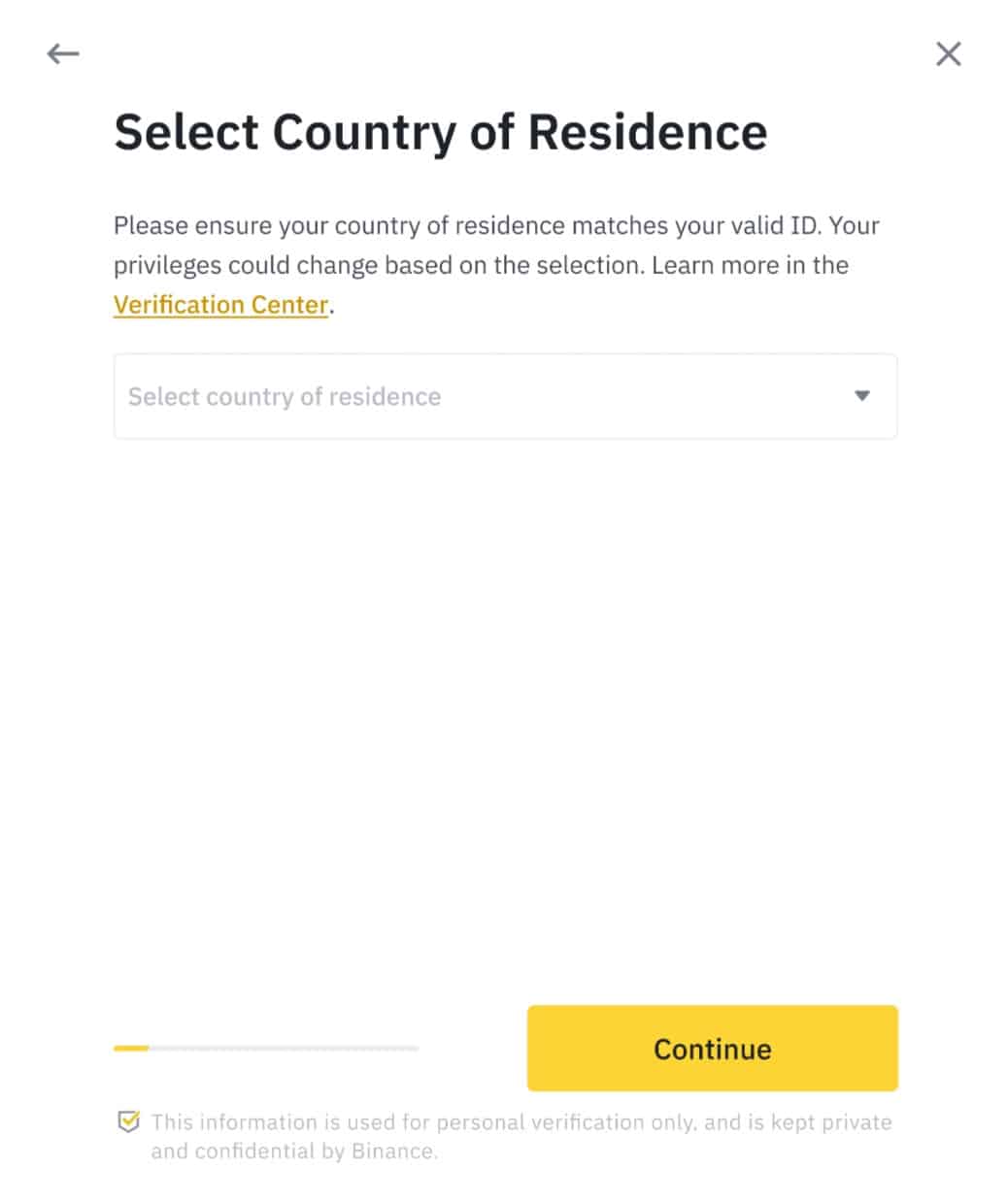

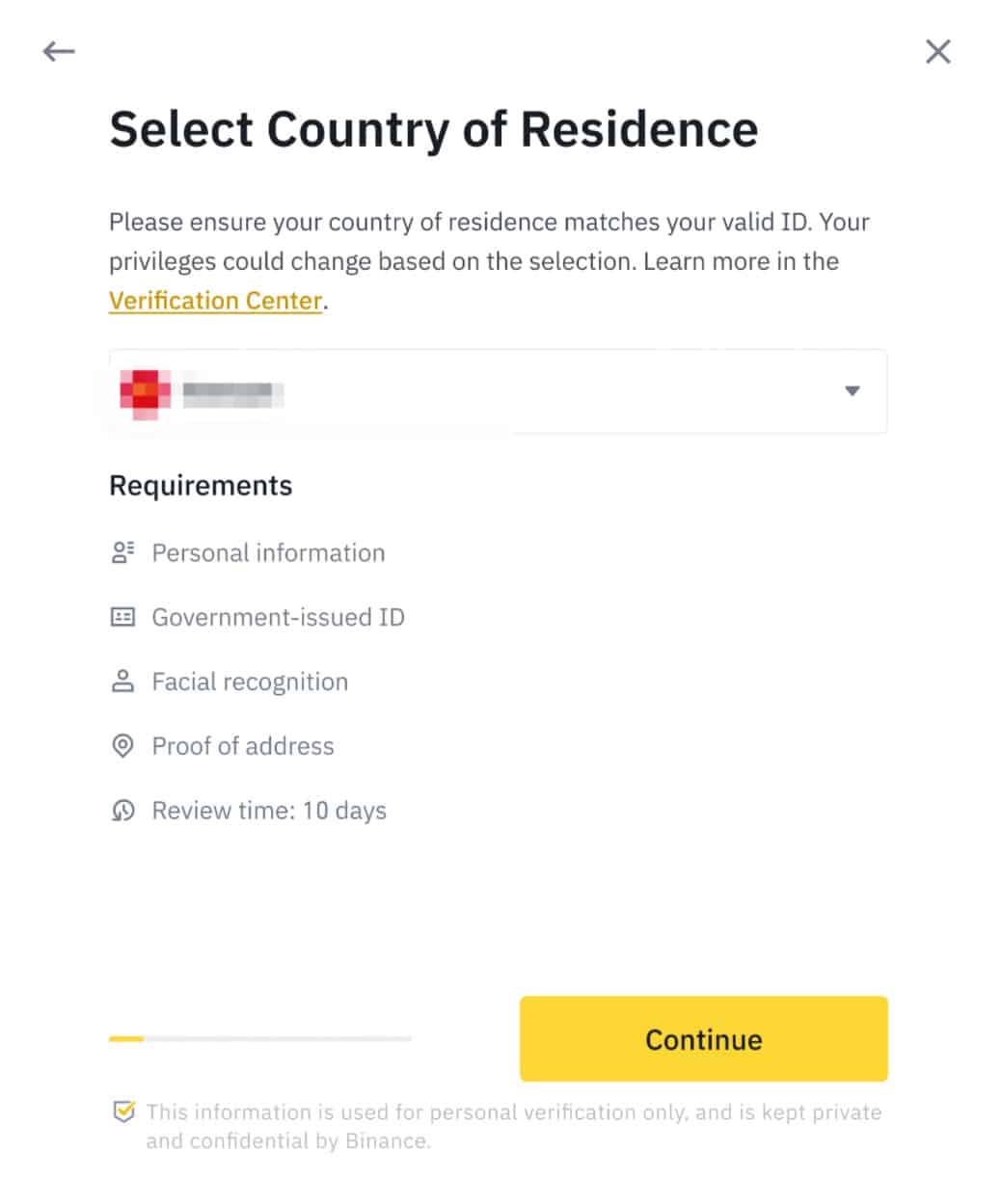

Step 3: Select your country of residence.

Ensure that your country of residence is consistent with your ID documents.

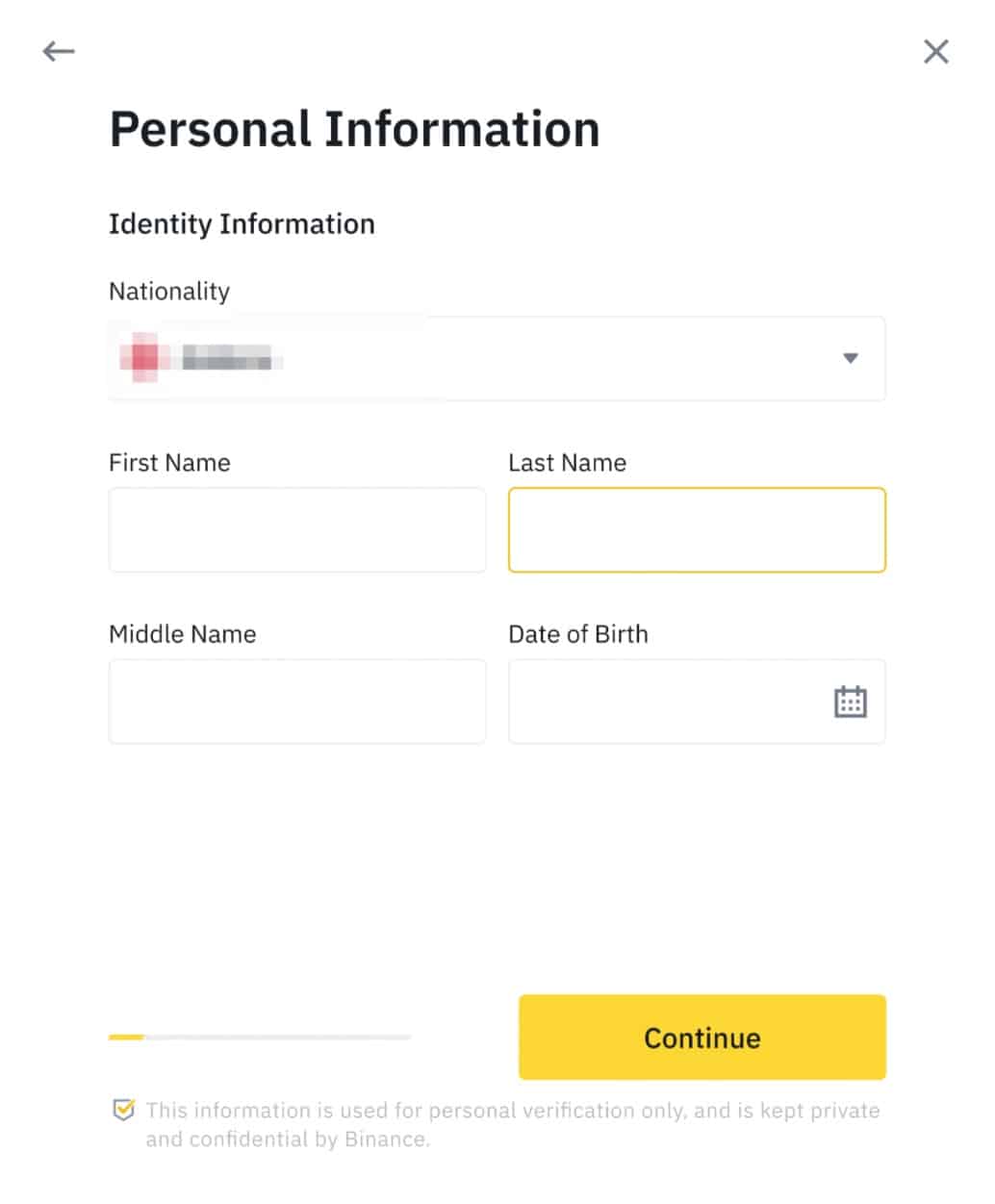

Step 5: Enter your personal information and click “Continue.”

You won’t be able to change it once confirmed.

Refer to the respective options offered for your country.

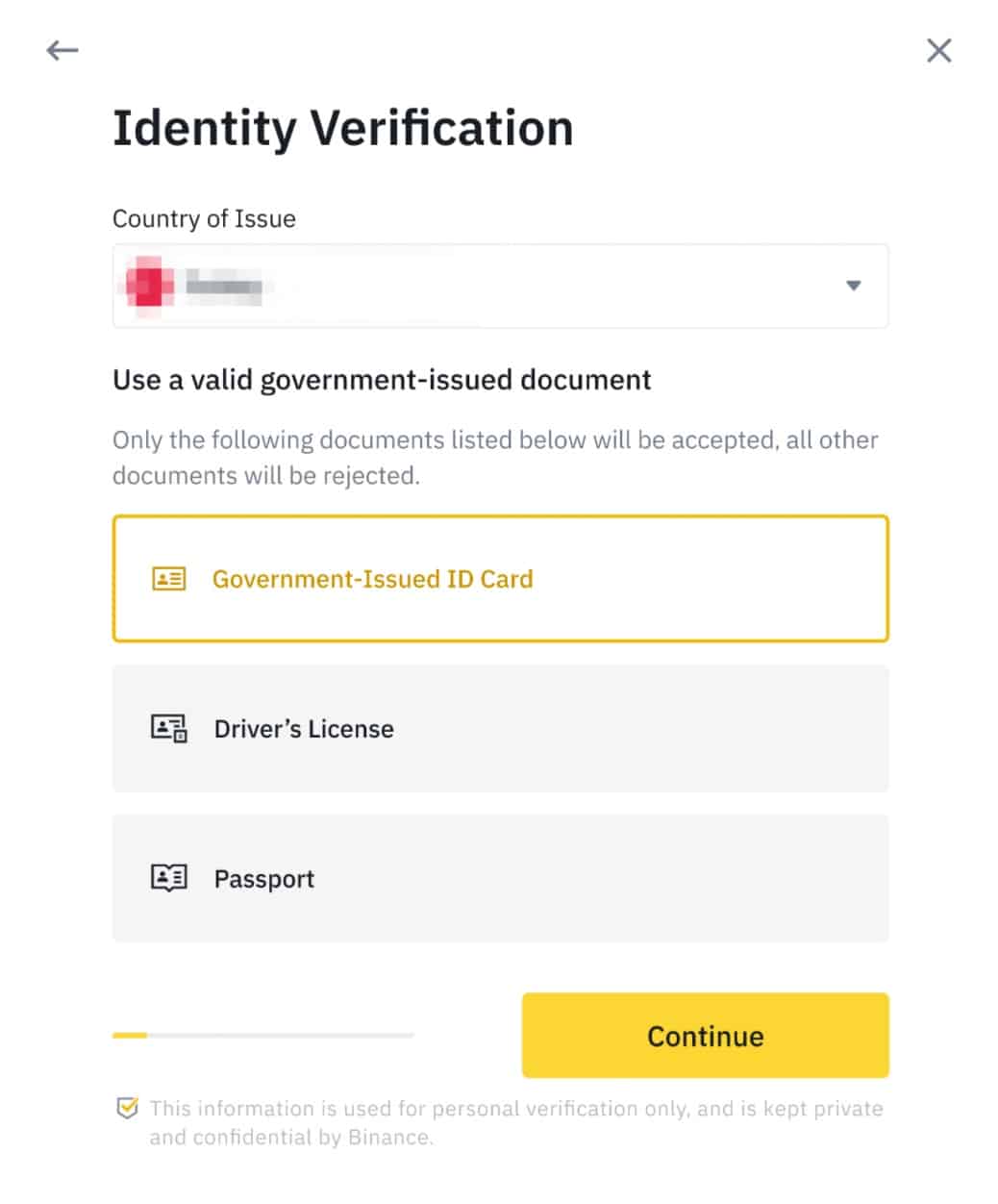

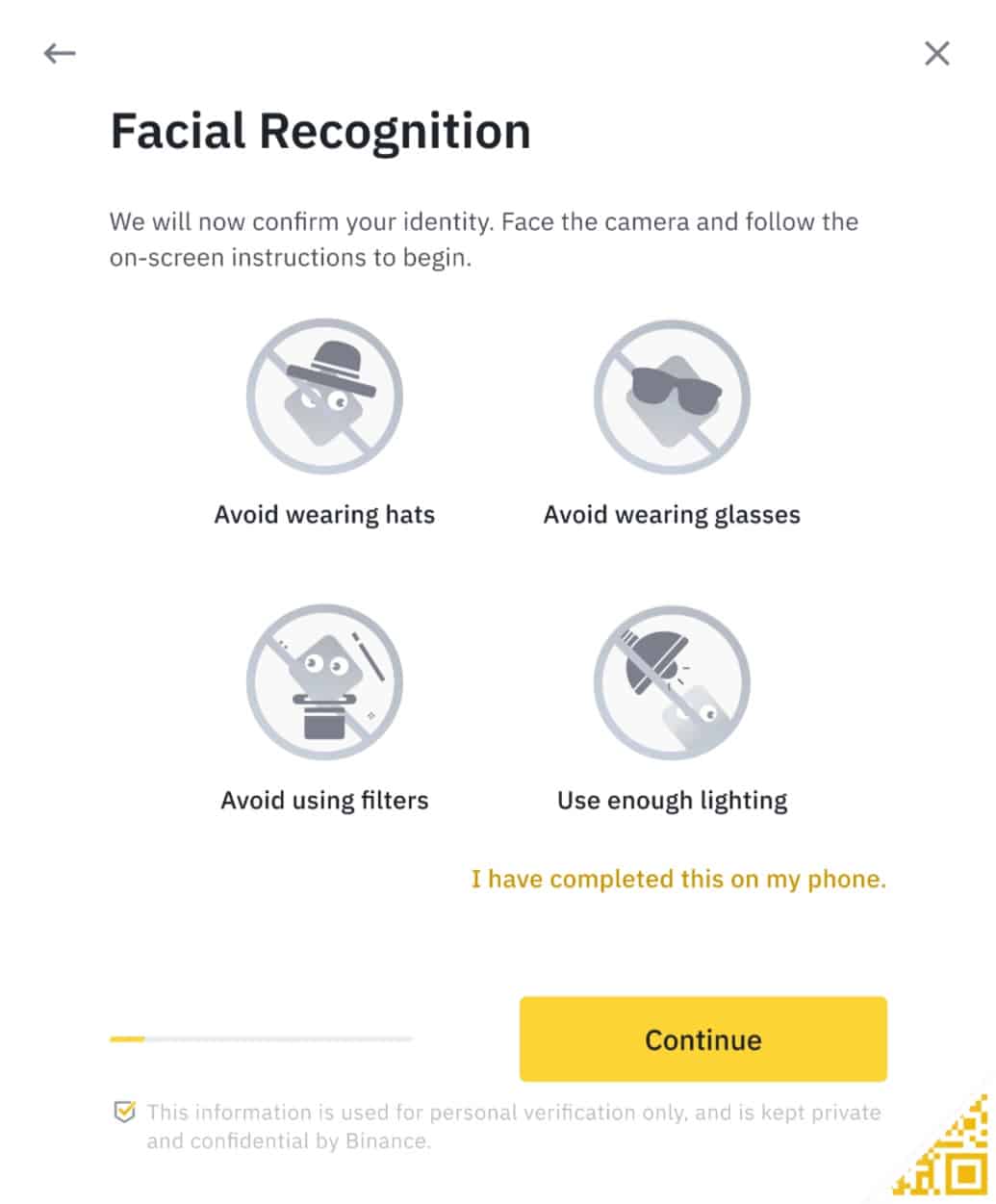

Step 7: Follow the instructions to upload photos of your document. Your photos should clearly show the full ID document.

Do not wear hats, glasses, or use filters, and make sure that the lighting is sufficient.

Once your application has been verified, you will receive an email notification.

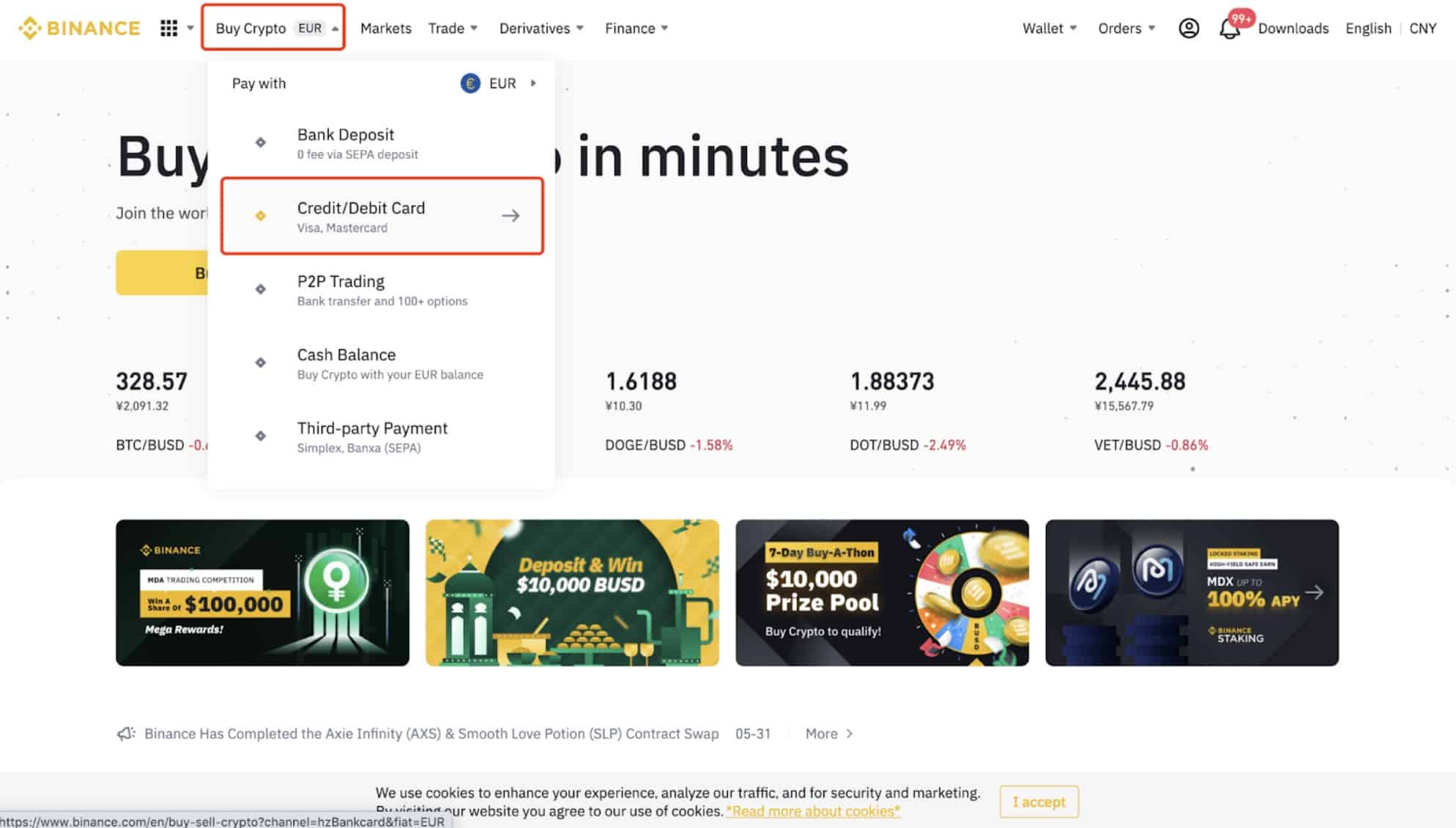

How to buy cryptocurrency on Binance

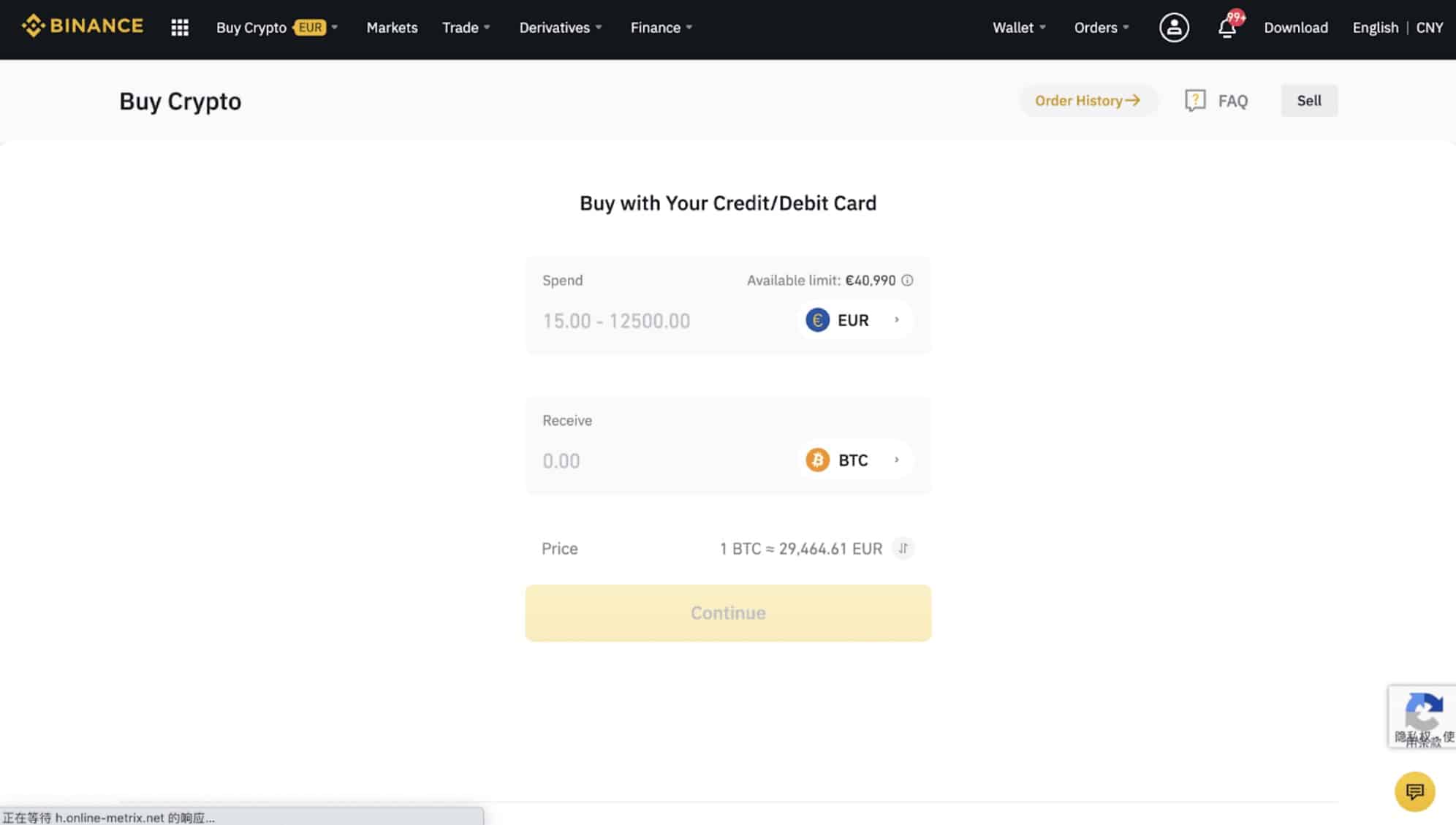

Step 1: Log in to your Binance account and click “Buy Crypto” and then “Credit/Debit Card”.

Step 2: Here you can choose to buy crypto with different fiat currencies. Enter the fiat amount you want to spend and the system will automatically display the amount of crypto you can get. When you have selected the amount you wish to spend then press “Continue”.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

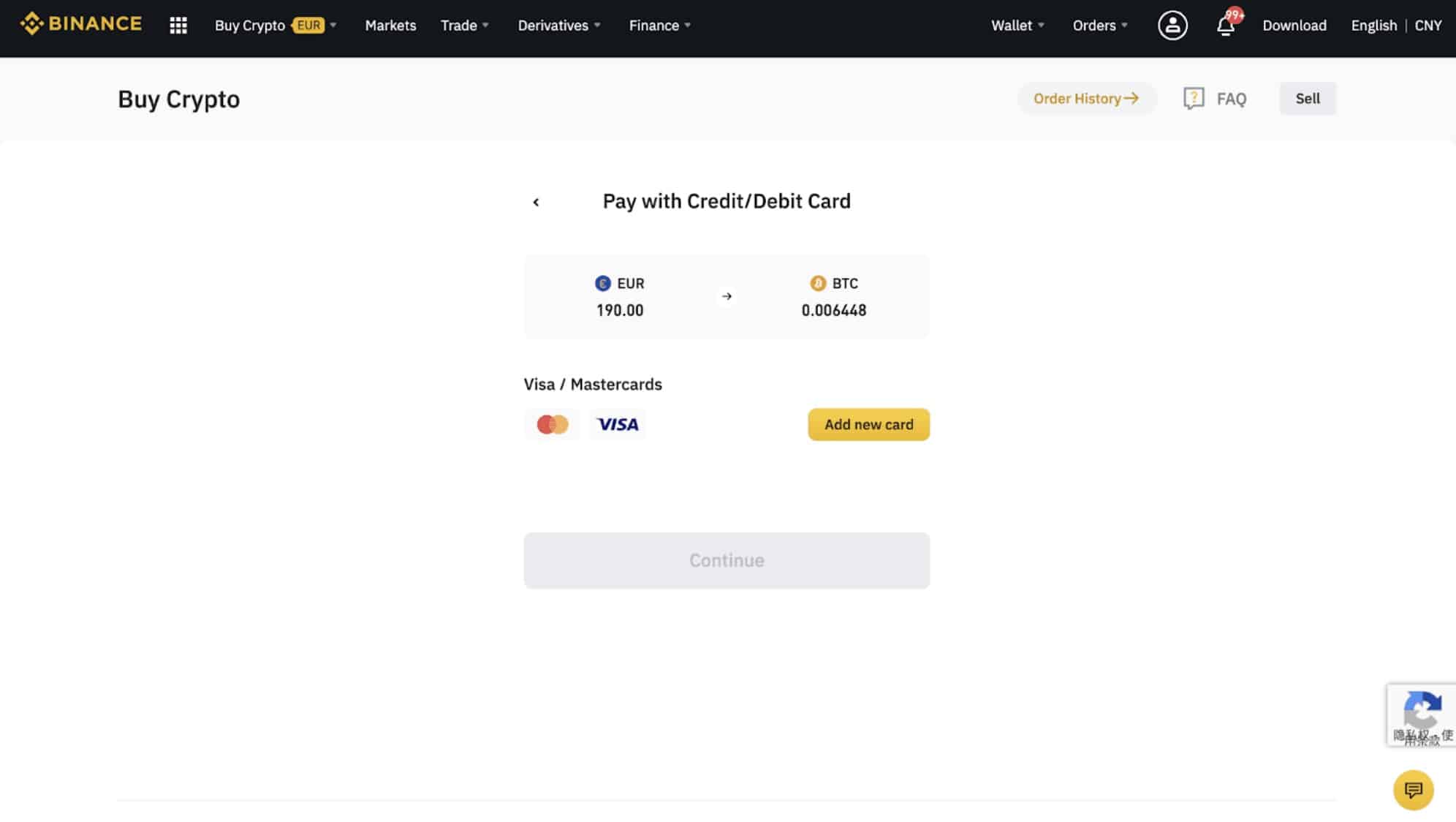

Step 3: Click “Add New Card”. Then enter your credit card details and your billing address.

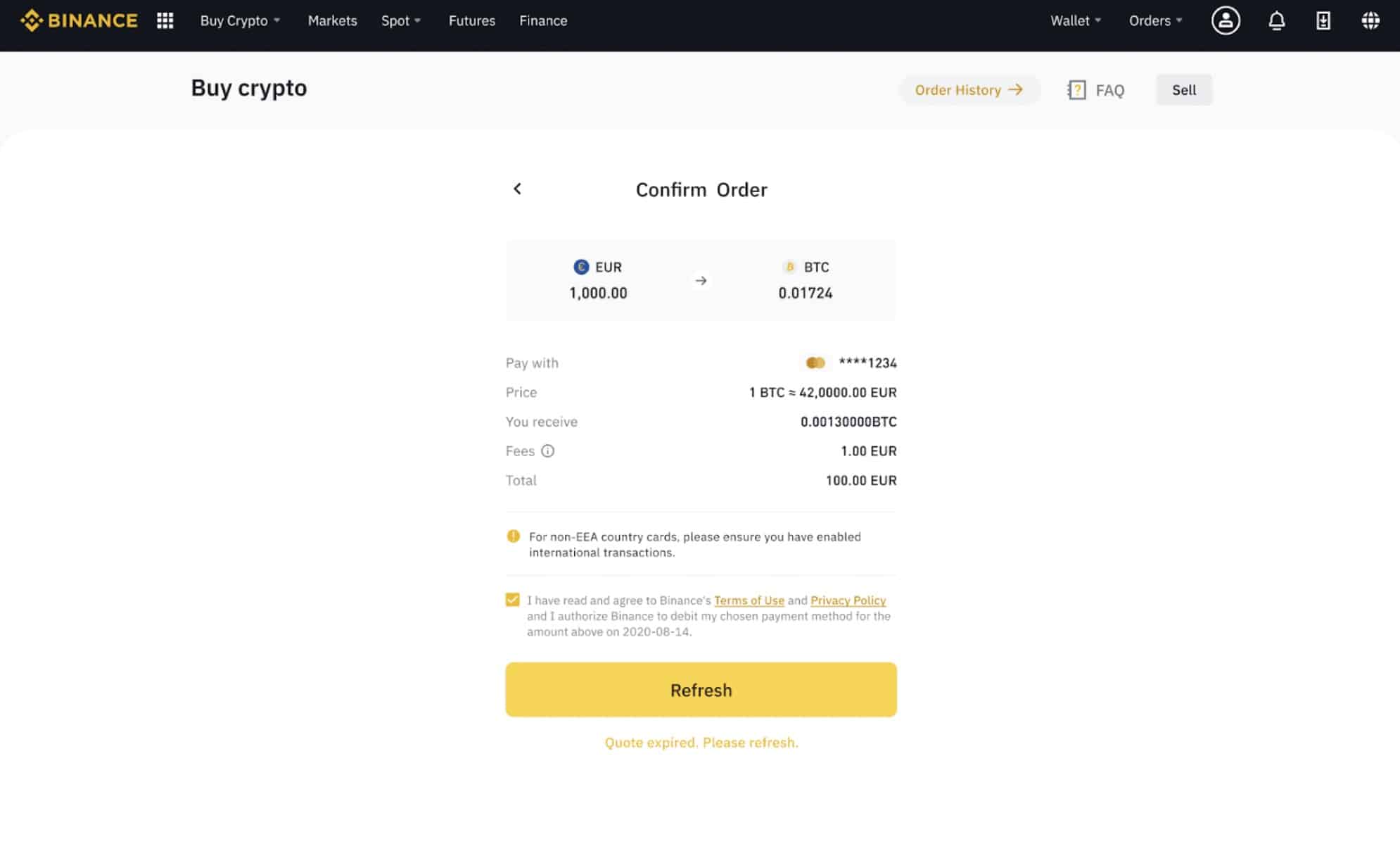

Step 4: Check the payment details and confirm your order within 1 minute. After 1 minute, the price and the amount of crypto you will get will be recalculated. You can click “Refresh” to see the latest market price. You will then be redirected to your bank’s OTP Transaction Page. Follow the on-screen instructions to verify the payment.

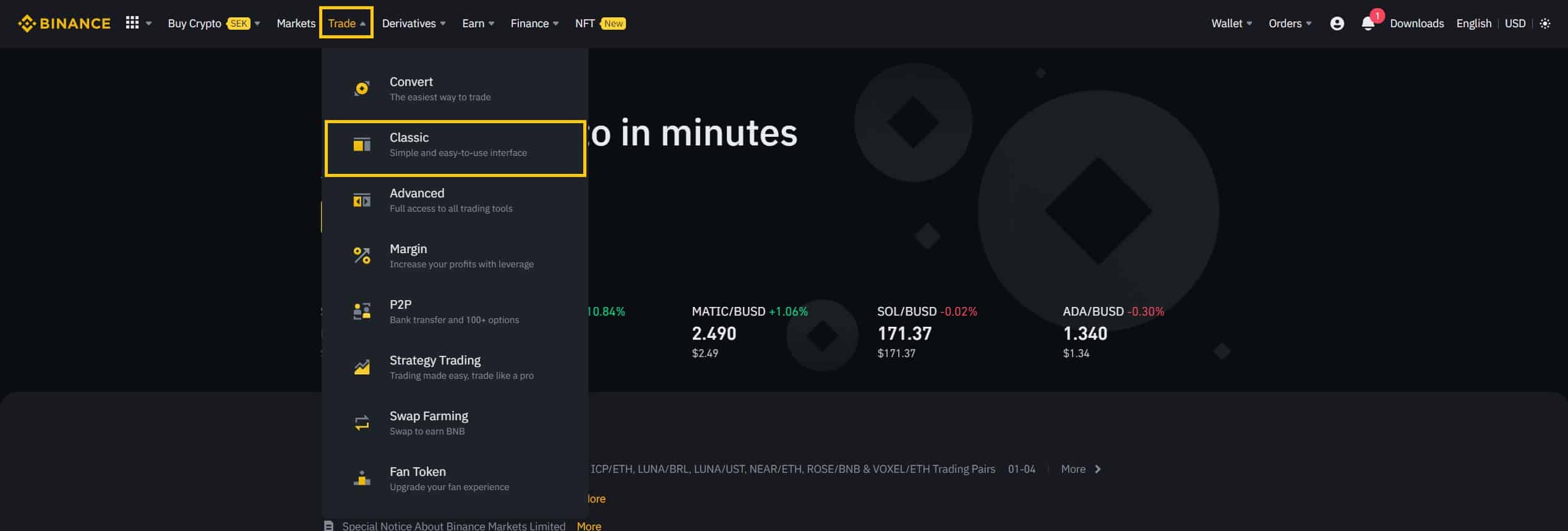

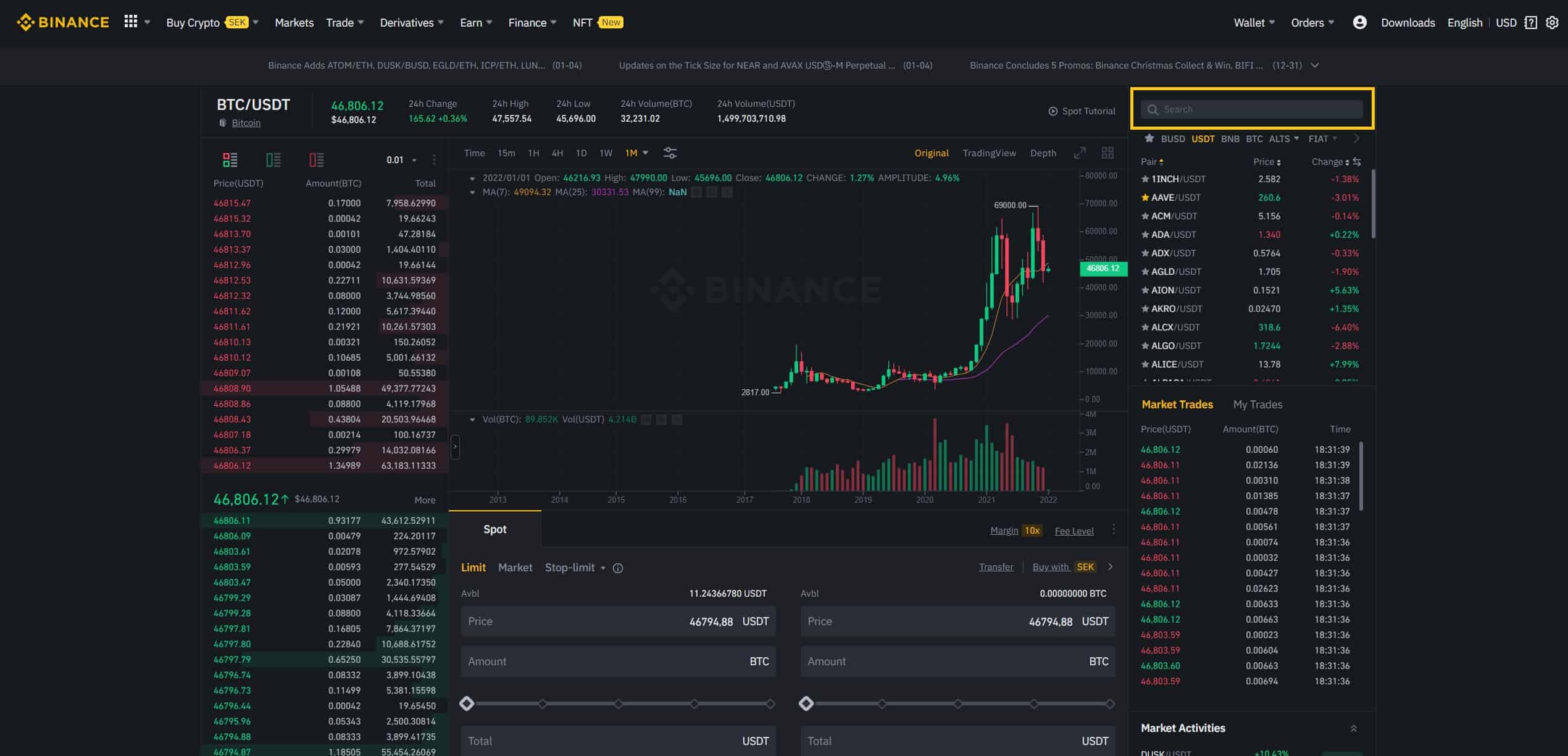

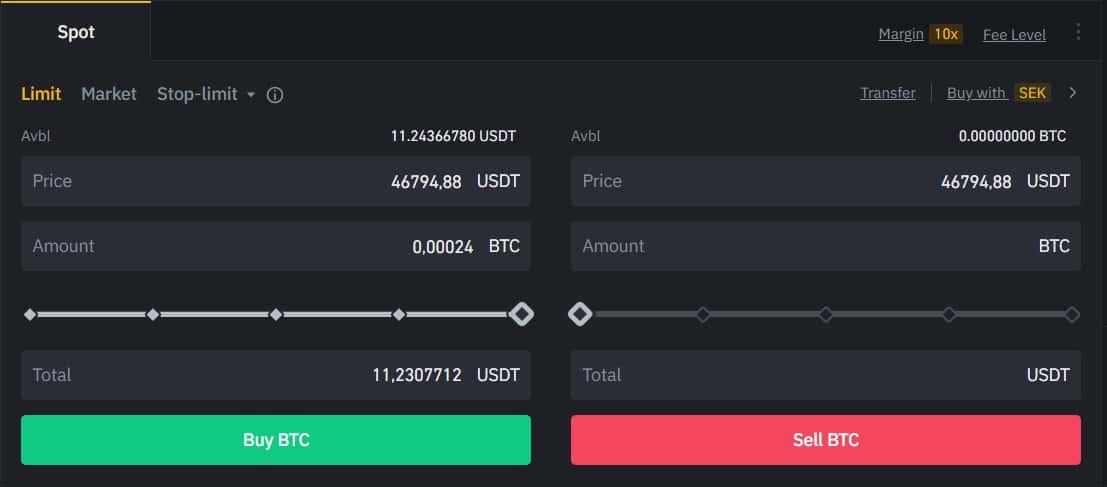

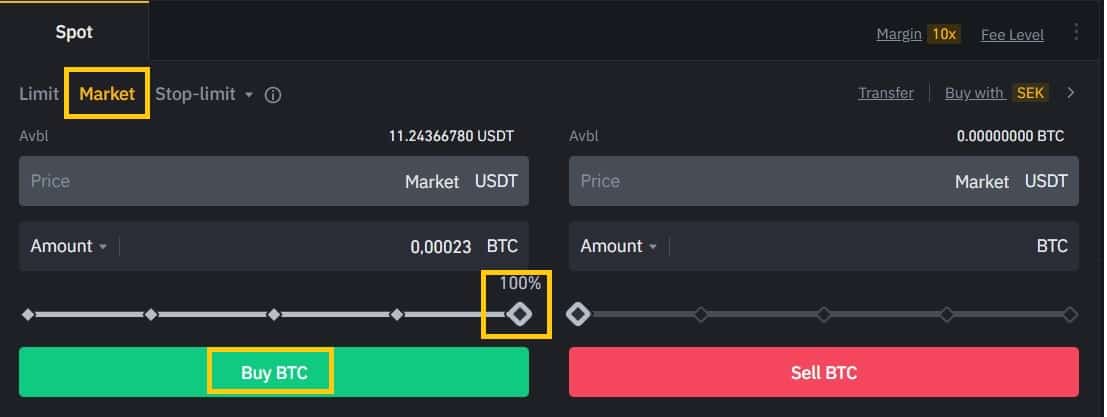

How to Conduct Spot Trading on Binance

Step 1: Log in to your Binance account.

Click on “Classic” under “Trade” on the top navigation bar.

Step 2: Search and enter the cryptocurrency you want to trade.

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can place a “Market Order” to set the buying/selling price automatically.

Hide Detailed Instructions

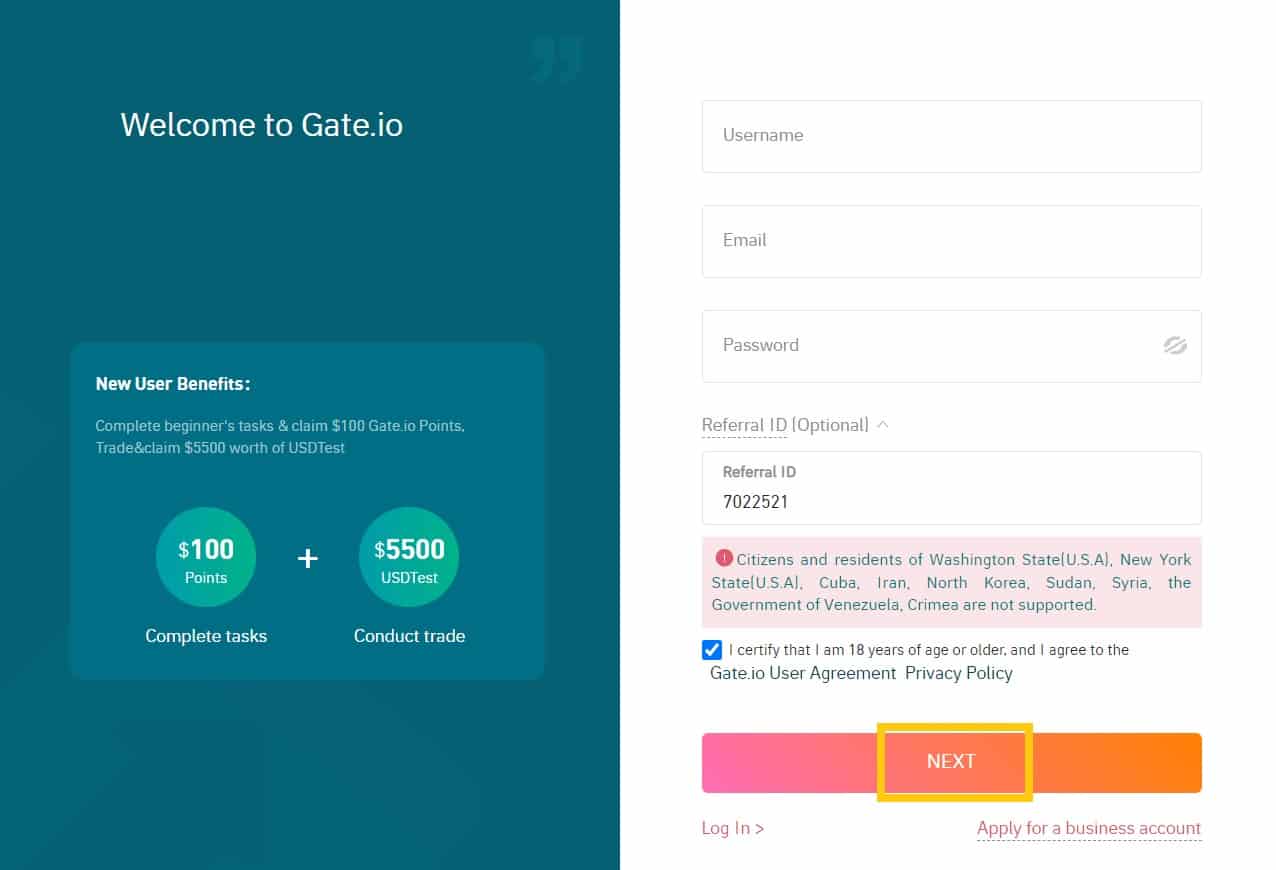

How to create a Gate.io account

![]()

Show Detailed Instructions

Hide Detailed Instructions

Step 1: Go to the Gate.io website.

Step 2: Choose your username, your email address and your password. Then check “I certify that I am 18 years of age or older, and I agree to the Gate.io User Agreement Privacy Policy” and click “NEXT”.

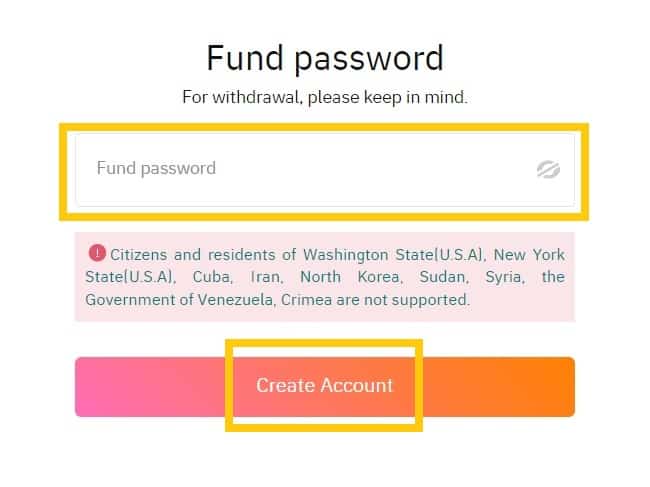

Step 3: Set your fund password and click “Create account”.

Note: Your fund password must contain at least 6 characters and can not be the same as your login password.

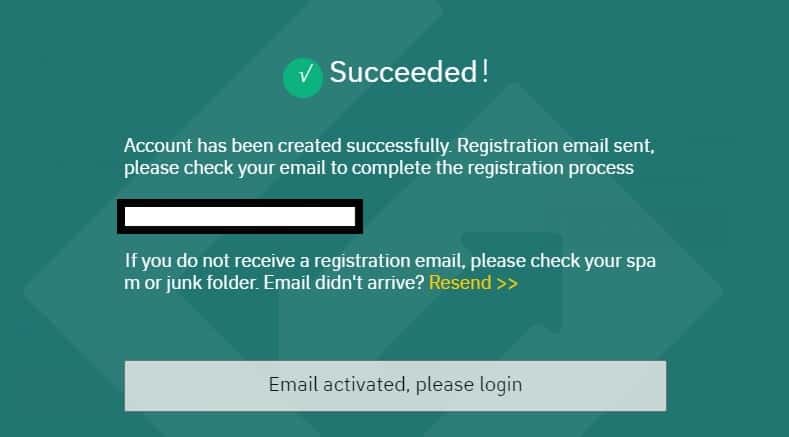

Step 4: An activation email will be sent to your email address. Complete the rest of the registration process by following the instructions in the email to activate your account. Once this is done done, click “Email activated, please log in”.

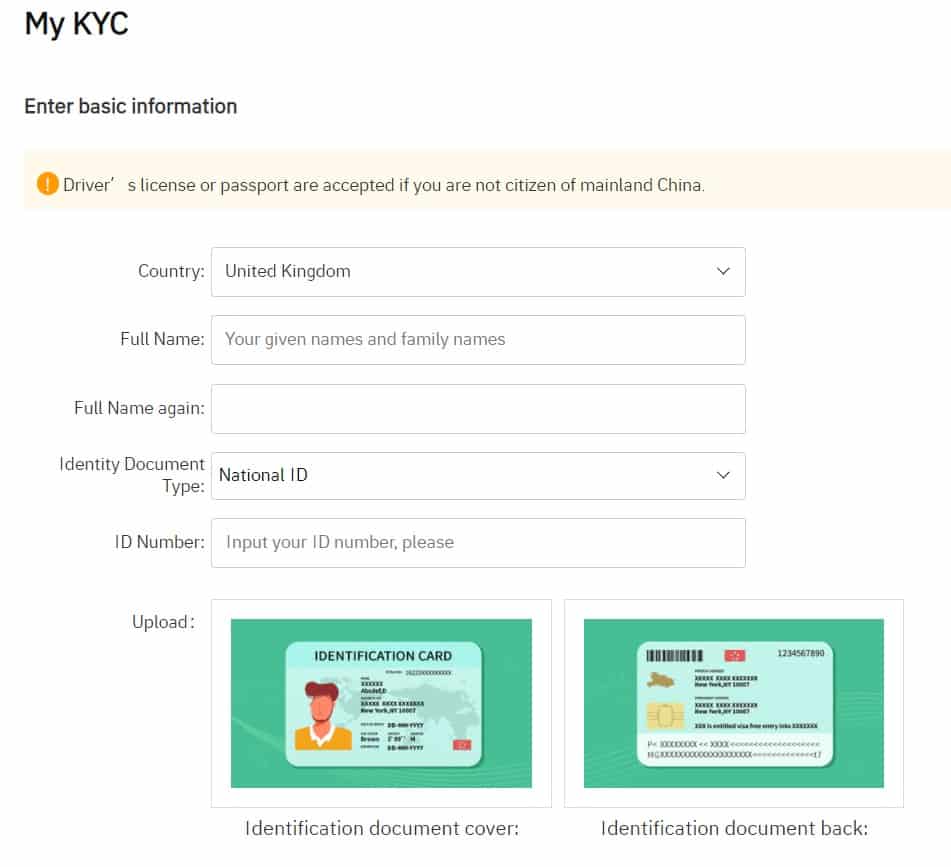

How to complete KYC (ID Verification) on Gate.io

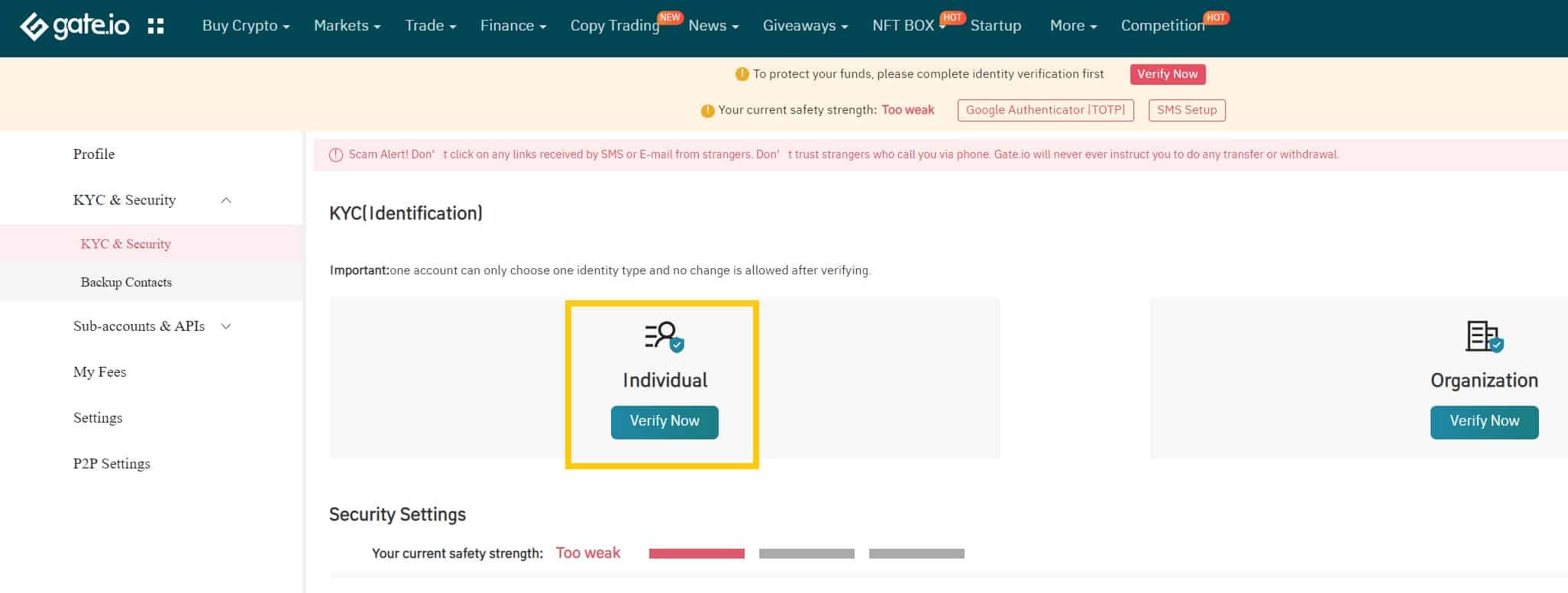

In order to ensure the safety of your assets, and to reduce fraud, money laundering, blackmail, and other illegal activities, Gate.io makes it mandatory that all users obtain KYC ID Verification. Only after your account has obtained KYC ID verification, can you withdraw funds or use credit cards or debit cards to buy cryptocurrencies.

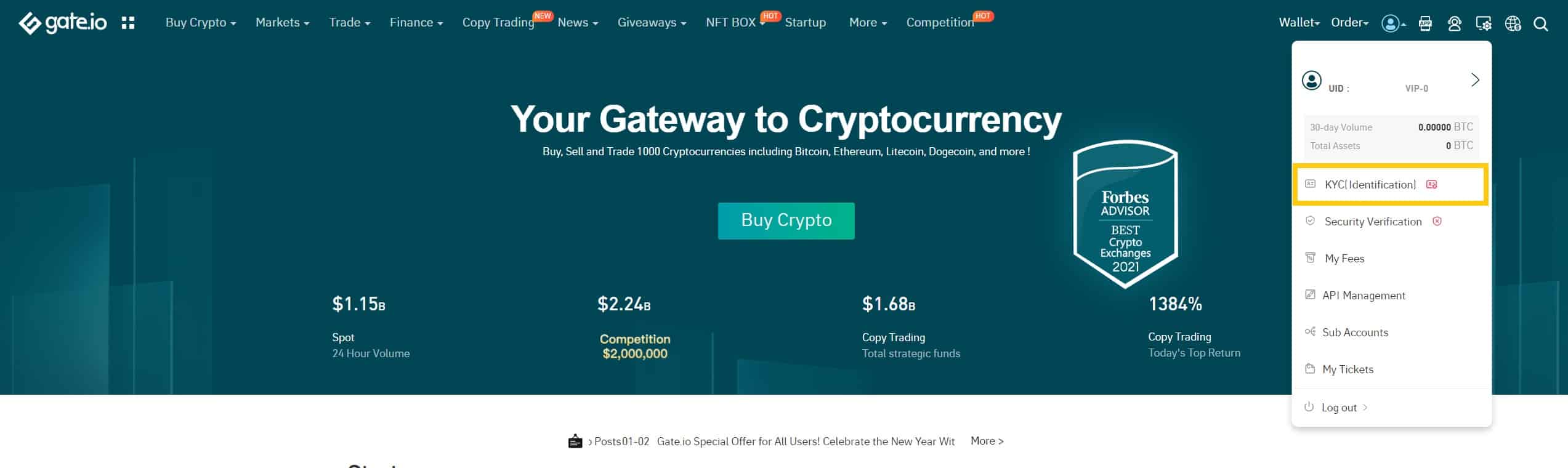

Step 1: Log in to your Gate.io account.

Place your cursor on the top-right profile icon and go to “KYC (ID Verification)”

Step 2: Click “Individual (Verify now)”

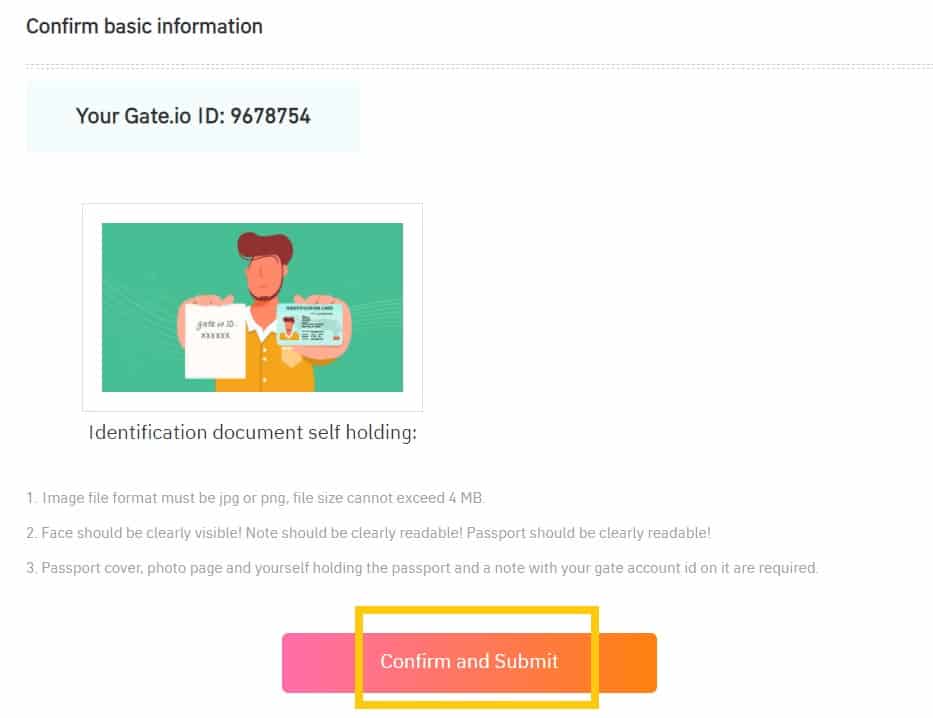

Step 3: Select your country, input your full legal name (twice), fill in your ID information, upload photos of both sides of your ID card, and a photo of you holding your ID together with your User ID (UID) for Gate.io. You will see your User ID by placing the cursor on the top-right profile icon on the main page. Make sure everything is filled in correctly and then click on “Confirm and Submit”.

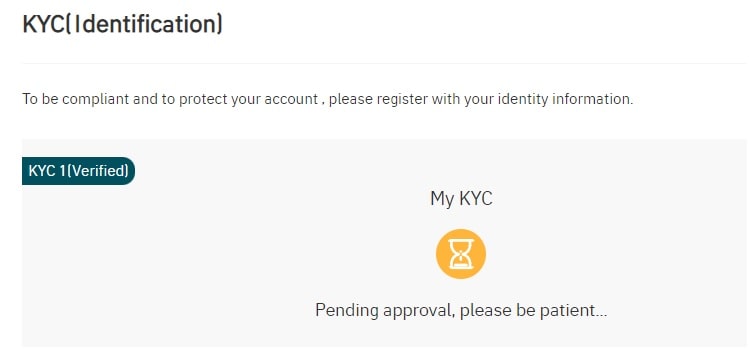

Step 4: After you have submitted all the requested information, you will see the pending approval.

Approval can take anywhere from a few hours to a few days to complete.

Once the KYC is approved, you’re ready to make your first cryptocurrency purchase.

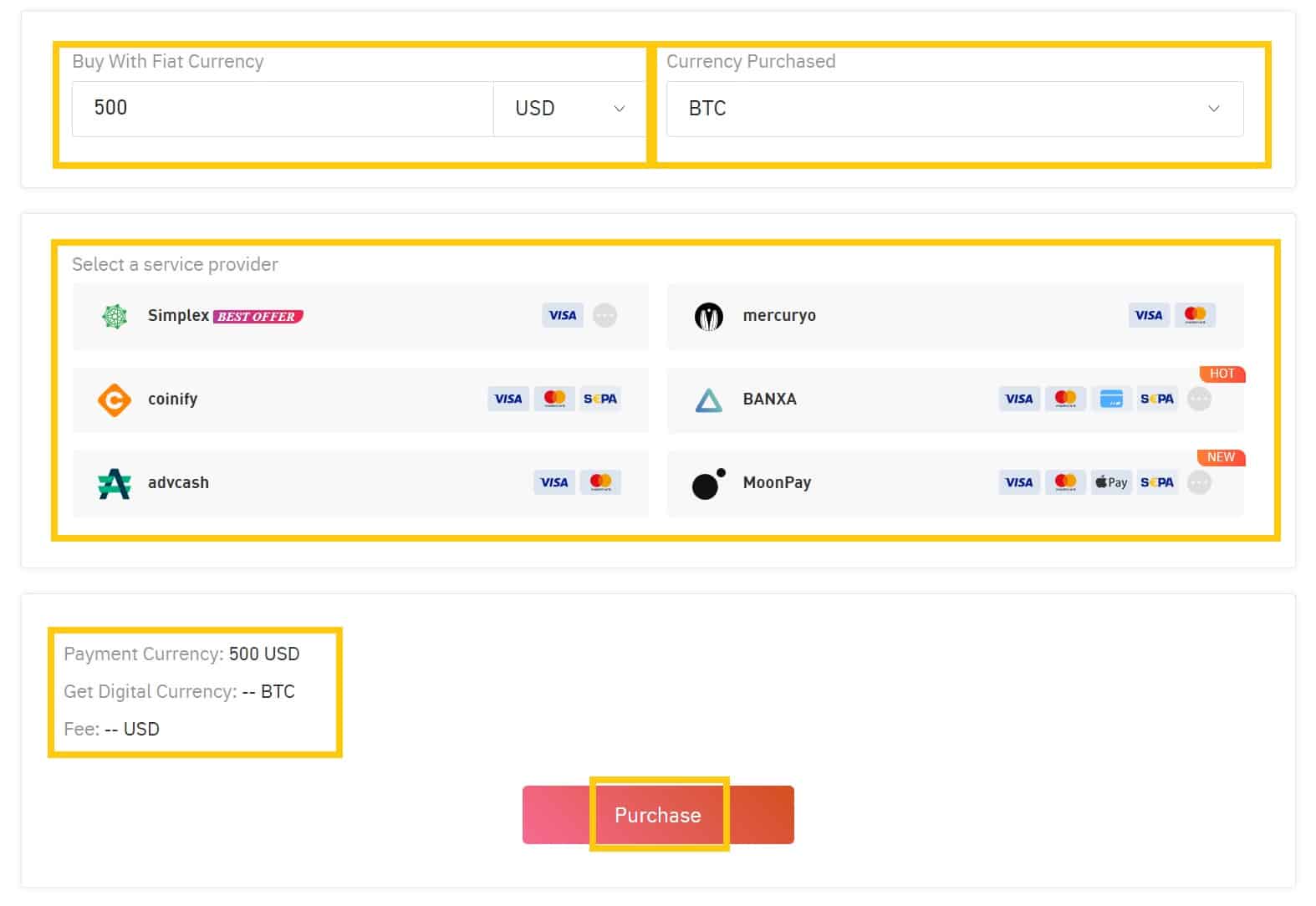

How to buy cryptocurrency on Gate.io

Step 1: Log in to your Gate.io account.

Then in the Menu Bar at the top of the page, click “Buy Crypto” and select “Credit Card”.

Step 2: Enter the amount you wish to spend in the “Buy with Fiat Currency” tab and select the cryptocurrency that you want to buy under the “Currency Purchased” field. Then select one of the “Service Providers” below and click the “Place Order” button to enter the confirmation page.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

Step 3: On the confirmation page, select “Buy Crypto” or the “Create Order” button to complete the payment.

Note: To ensure a quick and secure way of receiving the order, users might need to conduct an additional Identity Verification (KYC) with a third-party service provider. Once successfully verified, the service provider will immediately transfer the cryptocurrencies to your Gate.io account.

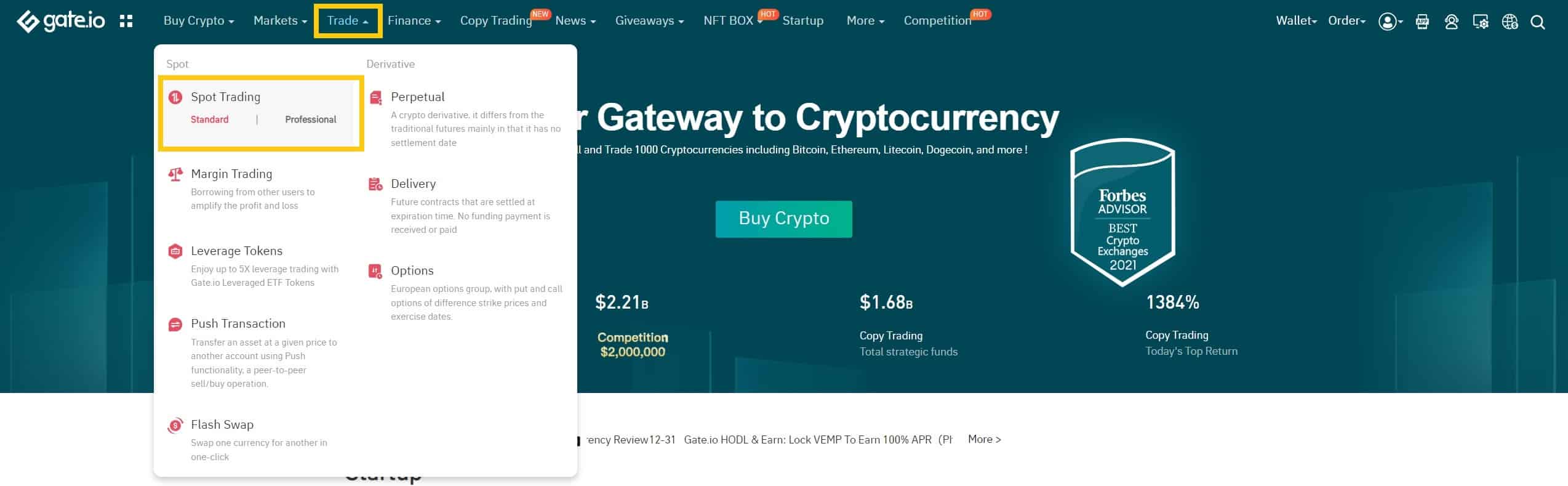

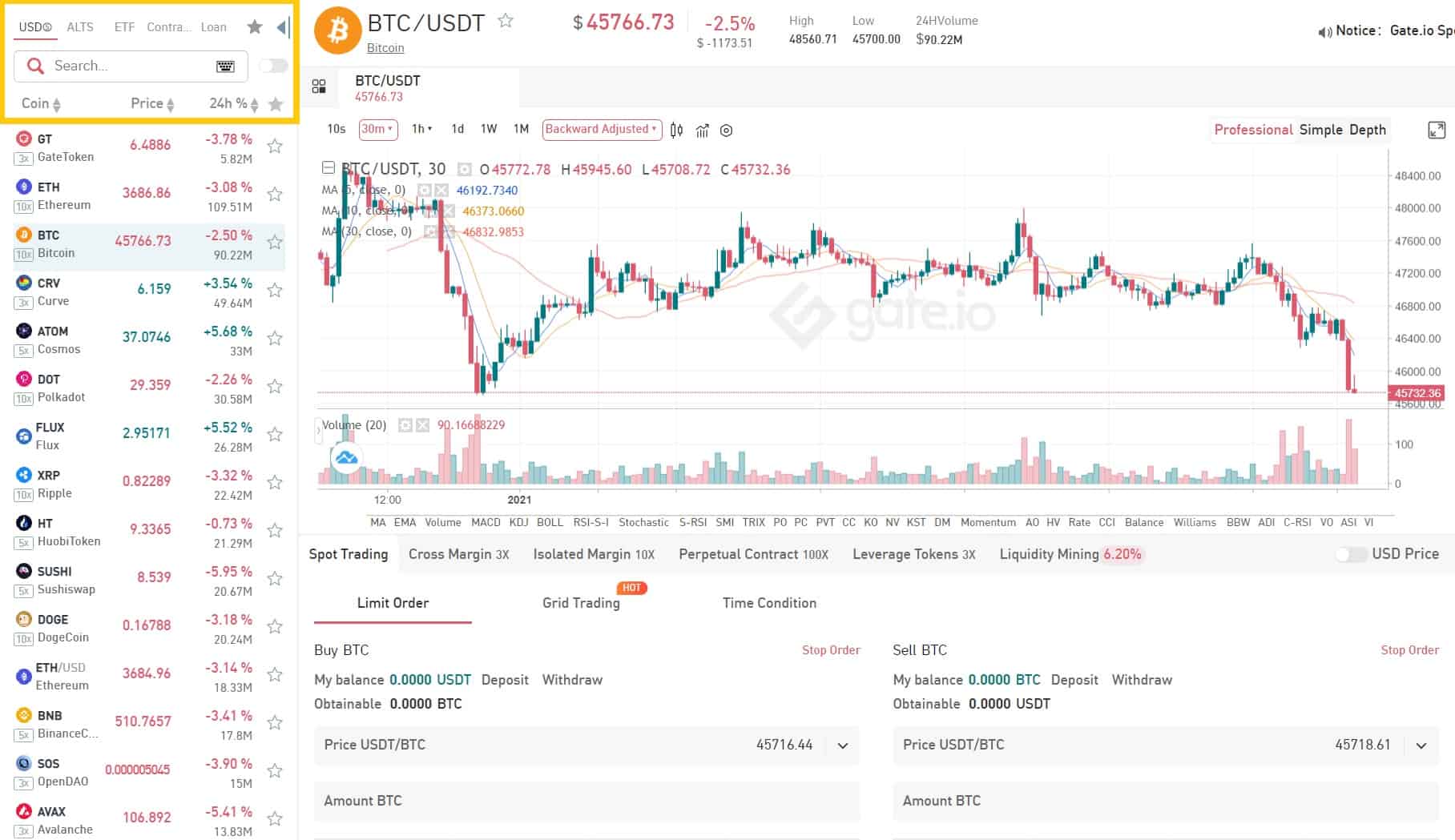

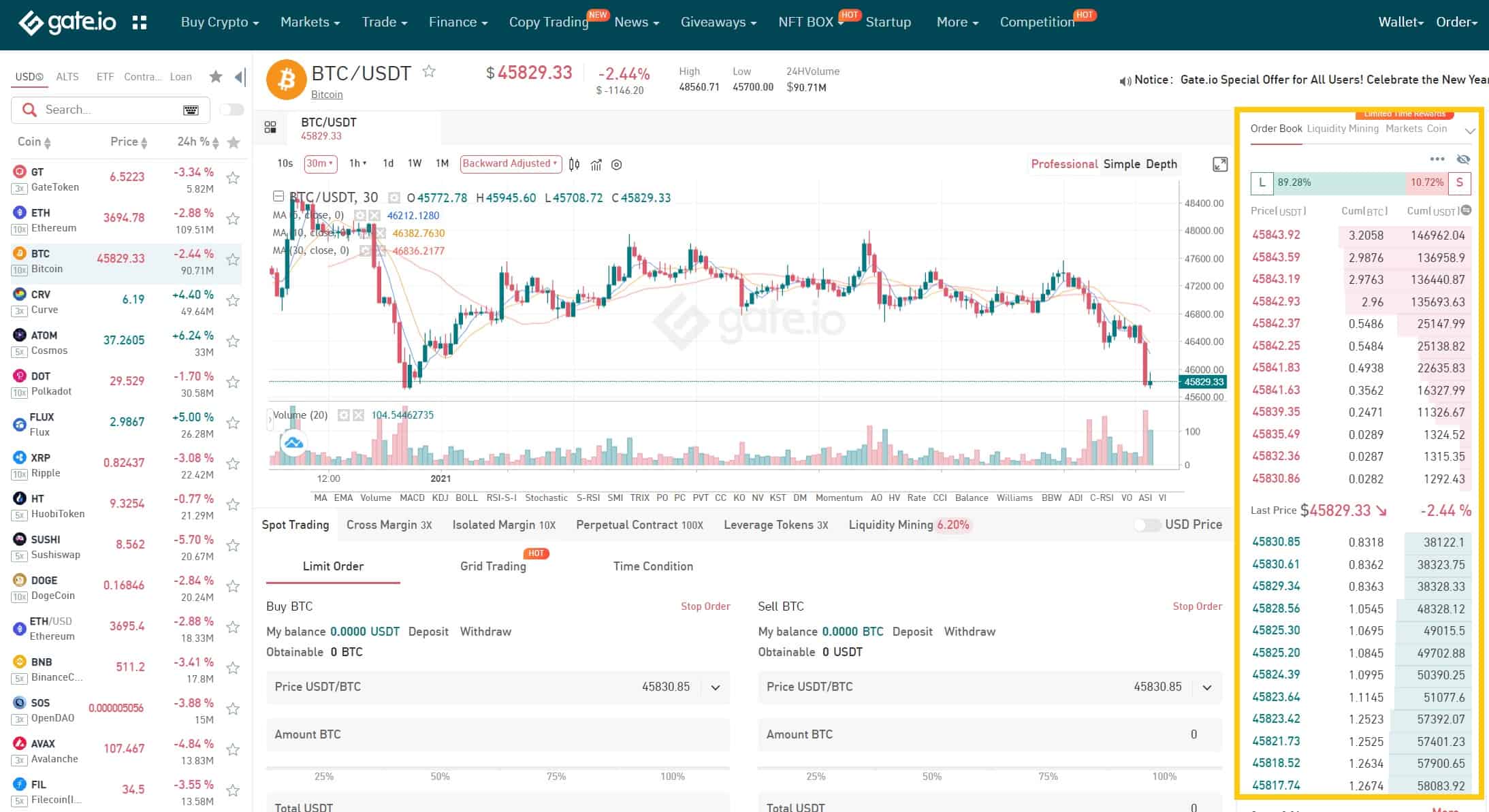

How to Conduct Spot Trading on Gate.io

Step 1: Log in to your Gate.io account.

Click on “Spot Trading” under “Trade” on the top navigation bar.

You can either choose “standard” or “professional” version. This tutorial uses the standard version.

Step 2: Search and enter the cryptocurrency you want to trade.

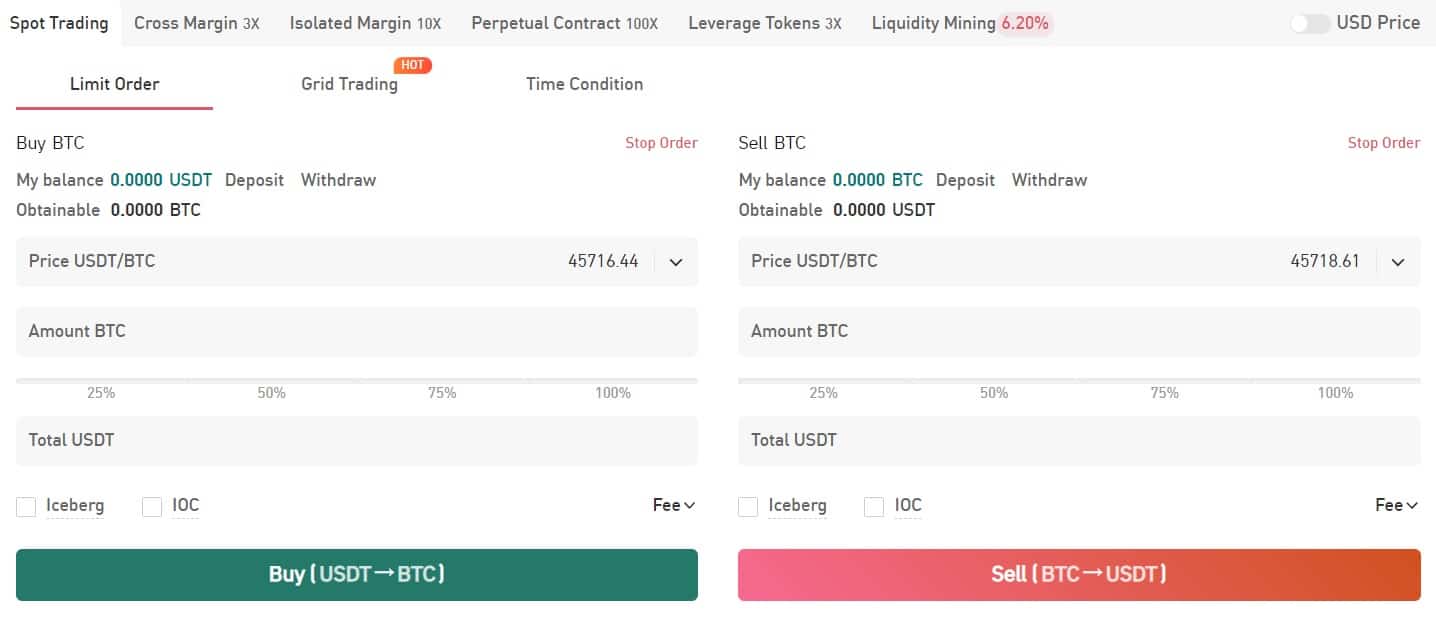

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can click on the last prices on the order book to set the buying/selling price automatically.

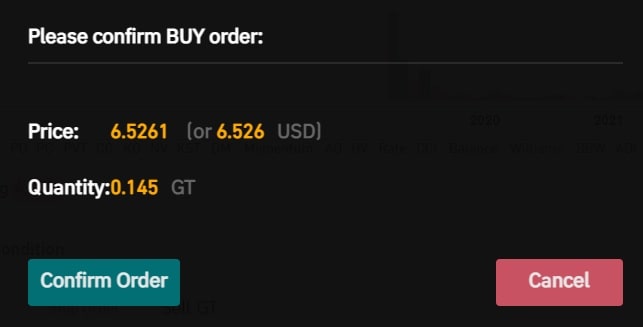

Step 5: Confirm the price and amount. Then click on “Place Order” to place the order, followed by “Confirm Order” to confirm it.

Hide Detailed Instructions

For more in-depth instructions, our ‘Absolute Beginner’s Guide To Cryptocurrency Investing‘ will take you through the process step-by step. In addition to providing instructions for sending and receiving your cryptocurrency.

And if you’re completely new to crypto our beginner, intermediate and advanced level articles will get you up to speed with everything you need to know about the cryptocurrency space starting out.

Simplecryptoguide.com

What Is Hegic (HEGIC)?

Hegic is an on-chain options trading protocol that is powered by hedge contracts and liquidity pools on Ethereum (ETH). A hedge contract is an options-like, on-chain contract that gives the holder or buyer a right to buy or sell an asset at a certain price (strike) as well as imposes an obligation on the writer or seller to buy or sell an asset at a certain time period.

These hedge contracts are non-custodial, trustless and censorship-resistant. The hedge contracts are guaranteed by the liquidity locked into them and the Ethereum Virtual Machine (EVM) that executes the code autonomously.

Hegic introduces a mechanism that integrates a pool model for liquidity providers that want to enhance trustless options trading. This Ethereum-based platform is an options trading portal where traders are able to engage for profit, or directly participate as a liquidity provider for a share of the transaction fees. Each of the contracts is fully created, maintained and settled in a decentralized way without any involvement of third-party processors.

The HEGIC token is an ERC-20 utility token that is used for the distribution of 100% of the settlement fees between all of the token holders. The transaction fees that are accumulated are distributed to all HEIGC holders throughout each quarter. The holders can then participate in governance by determining the rates, the settlement fee sizes, the strike price multipliers and the types of assets supported.

HEGIC token holders get a 30% discount when purchasing contracts.

How does Hegic work?

Users can participate in the Hegic platform primarily as buyers of hedge contracts or as writers of hedge contracts.

First, Hegic users can purchase call and put options for certain Ethereum-based assets. This can be advantageous for many reasons. For example, a decision to participate in an option call may benefit your overall investment strategy, or mitigate some form of risk. Most traditional and crypto options trades are predicated on there being individual holders and individual writers in a transaction. Hegic’s liquidity pools, however, are designed to accumulate liquidity from many liquidity providers, or writers, which reduces downside risk and offers deep liquidity.

Second, those who find the potential returns of writing hedge contracts to be attractive enough may “write” both call and put options on the Hegic platform by allocating various assets like wBTC or ETH to their respective liquidity pool contracts in order to generate yield. Hegic’s liquidity pools are non-custodial, which means that nobody is meant to have access to the writer’s funds except for the holders who have purchased the hedge contract.

Hegic’s liquidity pool mechanism means that hedge contract writers’ assets are pooled. Therefore, the downside risk is distributed amongst all the liquidity providers. Similarly, the monetary rewards for writing a hedge contract are split between all of the liquidity providers as well. Liquidity providers earn the HEGIC LP token in proportion to their contribution to the liquidity pool, as well as a share of the pool’s premiums, which are paid in ETH or wBTC.

Another unique feature of Hegic’s liquidity pool mechanism is that, as opposed to traditional models that rely on individual writers, a Hegic liquidity provider may allocate funds to many hedge contracts simultaneously in order to diversify their liquidity allocation. This model is designed so that, over the long-run, a liquidity provider’s returns on the Hegic platform might exceed the returns of a traditional individual writer.

When hedge contracts expire, both a premium and a settlement fee are generated in ETH or wBTC. The premium is paid back to liquidity providers, while 100% of the platform’s settlement fees are distributed proportionately among all HEGIC token holders. These fees are accumulated and distributed quarterly. Both premiums and settlement fee rewards are paid out in ETH and wBTC, though Hegic also relies heavily on its own native token, which provides some unique benefits to holders.

What is the HEGIC token?

HEGIC is an ERC-20 token that is primarily used for distributing rewards and as the platform’s general utility token. Though users can earn rewards in the form of ETH and wBTC (wrapped Bitcoin), liquidity providers and platform users can also earn HEGIC and get special benefits by holding the token. Some of these benefits include:

- By staking at least 880,000 HEGIC, token holders can claim one of the 3,000 available staking lots, which can make them eligible to receive an equal proportion of Hegic’s settlement fees denominated in ETH and wBTC and distributed quarterly.

- Owners of a staking lot also receive rewards in HEGIC from bonding curve fees.

- HEGIC token holders are eligible for a 30% discount when purchasing hedge contracts on the Hegic platform.

- Hedge contract writers who also hold a sufficient amount of HEGIC tokens are eligible for priority unlocks of their liquidity.

- Liquidity providers earn HEGIC in addition to premiums paid in ETH and wBTC.

HEGIC has a fixed maximum supply of approximately three billion HEGIC, which is released according to a curated schedule through a bonding curve smart contract. Users can either purchase HEGIC on an exchange, or directly through the bonding curve. The total HEGIC supply is set to be distributed as follows:

- 3% distributed in an Initial Coin Offering (ICO) with a bonding curve schedule

- 22% to provide liquidity to the bonding curve contract

- 20% to reward early project contributors

- 10% to the Hegic Development Fund

- 40% to distribute as rewards to liquidity providers and options holders

- 5% to provide liquidity to a decentralized exchange (DEX) liquidity pool for public availability.

Who are the founders of Hegic?

Hegic was created by an anonymous developer going by the name of Molly Wintermute. The protocol was first released on February 20, 2020, with the goal of abstracting away the complexities of options trading, allowing users to seamlessly use it on a daily basis.

What Makes Hegic Unique?

Some of Hegic’s key features are its ETH and DAI pools.

The Hegic ETH pool is non-custodial, and the liquidity providers can earn a premium in ETH. All of the deposited ETH in this pool is used for selling ETH call options, and holders of these options can swap their DAI for ETH at the strike price after they expire. In exchange, the one who purchases the option pays a premium. This premium is distributed to liquidity providers on a pro-rata basis when the option expires within two days or up to four weeks.

The DAI pool is for DAI liquidity providers and is typically used for selling ETH put options. This pool is meant for traders that want to purchase puts where providers supply their share of DAI for writeDAI tokens.

Hegic development updates in 2023

Hegic, a notable player in the crypto derivatives market, has experienced a year of significant developments and challenges in 2023. Here’s an overview of the most crucial updates:

SEC Scrutiny Over Insider Trading Allegations: Hegic drew attention due to possible insider trading concerns, particularly related to its WHITE token. This situation arose after Hegic’s pseudonymous founder, Molly Wintermute, announced the sunsetting of Whiteheart, Hegic’s sister platform, and the return of its $28 million treasury to investors. This move led to a surge in demand for Whiteheart’s token, WHITE, before official payouts, with Hegic purchasing a significant portion of WHITE’s supply just days before the closure announcement.

Hegic’s Price Movements and Predictions: Throughout the year, Hegic’s price movements have been closely monitored using various indicators like RSI, Moving Averages, and MACD. These tools help predict the long-term trend of Hegic’s price movements. In 2023, Hegic showed a neutral trend with its 50-day Moving Average crossing below the 200-day MA, while its price traded above both, indicating a balancing act between bullish and bearish trends.

Trading Options on Hegic Platform: Hegic offers on-chain trading options, allowing users to engage in strategies for speculation or hedging while also providing opportunities to earn as liquidity providers. The platform supports trading options with two assets, WBTC and ETH. Hegic’s ETH call and put options allow traders to speculate on ETH’s price movements over various time frames. The value of these options is influenced by factors like the underlying asset’s volatility and the time until the contract expires.

These developments reflect the dynamic and evolving nature of Hegic’s role in the cryptocurrency market. The platform’s adaptations and responses to market trends and regulatory scrutiny highlight its commitment to maintaining a significant presence in the crypto derivatives sector. As the year progresses, further developments and updates can be expected, potentially shaping Hegic’s trajectory in the competitive cryptocurrency landscape.

Official website: https://www.hegic.co/

Best cryptocurrency wallet for Hegic (HEGIC)

There are plenty of different crypto wallets available. The best one for you depends on your general trading habits and which provides the most security in your situation. There are two main types of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical). Both have their pros and cons, and there is not necessarily a right or wrong answer when it comes to figuring out which crypto wallet is best for you.

HOW DO I DECIDE WHICH cryptocurrency WALLET TO USE for Hegic (HEGIC)?

Deciding which type of wallet to use depends on a variety of factors, including:

- How often you trade. In general, hot wallets are better for more active cryptocurrency traders. Quick login ability means you are only a few clicks and taps away from buying and selling crypto. Cold wallets are better suited for those looking to make less frequent trades.

- What you want to trade. As mentioned earlier, not all wallets support all types of cryptocurrencies. However, some of the best crypto wallets have the power to trade hundreds of different currencies, providing more of a one-size-fits-all experience.

- Your peace of mind. For those worried about hacking, having a physical cold wallet stored in a safe deposit box at the bank or somewhere at home, provides the safest, most secure option. Others might be confident in their ability to keep their hot wallets secure.

- How much it costs. It is important to investigate the costs associated with each wallet. Many hot wallets will be free to set up. Meanwhile, cold wallets, like any piece of hardware, will cost money to purchase.

- What it can do. While the basics of each cryptocurrency wallet are the same, additional features can help set them apart. This is especially true of hot wallets, many of which come with advanced reporting features, insights into the crypto market, the ability to convert cryptocurrencies and more. Security features can also be a good differentiator.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re going to be dealing in larger volumes of crypto, investing in cold storage might prove advantageous.

Most widespead examples of this being the Ledger Nano and the Trezor.

Ledger manufactures cold storage wallets designed for users who want increased security. Their wallets are a physical device that connects to your computer. Only when the device is connected can you send your cryptocurrency from it. Ledger offers a variety of products, such as the Ledger Nano S and the Ledger Nano X (a bluetooth connected hardware wallet).

Trezor is a pioneering hardware wallet company. The combination of world-class security with an intuitive interface and compatibility with other desktop wallets, makes it ideal for beginners and experts alike. The company has gained a lot of the Bitcoin community’s respect over the years. Trezor offers two main models – The Trezor One and Trezor Model T (which has a built in touch screen).

Market Overview

Coinmarketcap.com

Coinmarketcap will be your cryptocurrency go-to for just about everything. Here you can see the following: