How to buy Linear Finance (LINA)

If you’re interested in purchasing Linear Finance (LINA), this helpful step-by-step guide will show you how. We’ll walk you through the process so you can learn how to buy Linear Finance (LINA) with ease. Whether you’re new to cryptocurrency or just looking to expand your portfolio, this guide can provide you with the information you need to get started. So why not give it a try and learn how to buy Linear Finance (LINA) today?

Step 1: Create an account on an exchange that supports Linear Finance (LINA)

First, you will need to open an account on a cryptocurrency exchange that supports Linear Finance (LINA).

We recommend the following based on functionality, reputation, security, support and fees:

1

Binance

Fees (Maker/Taker) 0.075%*-0.1%*

Cryptocurrencies

Available for Trade 500+

Sign-up bonus

10% reduced trading fees*

Available in

Europe, Asia, Oceania, Africa

2

MEXC

Fees (Maker/Taker) 0.2%*-0.2%*

Cryptocurrencies

Available for Trade 1500+

Sign-up bonus

10% reduced trading fees & up to $170 in USDT vouchers*

Available in

North America, South America, Europe, Asia, Oceania, Africa

When you’re signing up for a cryptocurrency exchange, you’ll typically need to provide some basic information. This might include your email address, password, and full name. Depending on the exchange, you may also be asked for additional details like your phone number or address.

It’s worth noting that some exchanges have more stringent requirements, such as a “Know Your Customer” (KYC) procedure. This is typically the case with licensed and regulated exchanges. KYC procedures help ensure that exchanges comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. If you’re required to complete a KYC procedure, you’ll typically be asked to provide additional information, such as a government-issued ID or proof of address.

Step 2: Deposit funds into your account

When buying Linear Finance (LINA) on a cryptocurrency exchange, many of them allow you to use fiat currencies like EUR, USD, and AUD to make your purchase directly. To do this, you’ll need to fund your account with one of several deposit methods, including credit and debit cards, e-wallets, and direct bank transfers. If this is not an option on the cryptocurrency exchange that you have chosen, then simply move onto the next step in this guide.

It’s important to note that different payment methods may have varying fees associated with them. For example, credit card payments may have higher fees than other options. To avoid paying unnecessary costs, it’s a good idea to research the fees for each payment method before funding your account.

Step 3: Buy Linear Finance (LINA)

Buying Linear Finance (LINA) on a cryptocurrency exchange is a simple process. Look for the search bar or navigation menu and search for Linear Finance (LINA) or Linear Finance (LINA) trading pairs. Next, find the section that allows you to buy Linear Finance (LINA). Enter the amount of cryptocurrency you want to spend or the amount of fiat currency you want to use to buy Linear Finance (LINA). The exchange will calculate the equivalent amount of Linear Finance (LINA) based on the current market rate.

Before confirming your purchase, always double-check the transaction details, such as the amount of Linear Finance (LINA) you’ll receive and the total cost of the purchase. Additionally, some exchanges offer a proprietary software wallet to store your Linear Finance (LINA), but you can also create your own software wallet or purchase a hardware wallet for the highest level of protection.

How to create a Binance account

![]()

Show Detailed Instructions

Hide Detailed Instructions

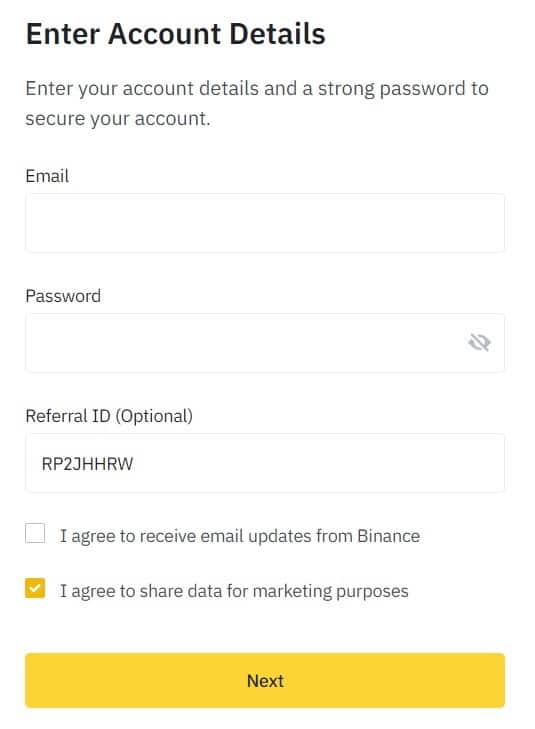

Step 1: Go to the Binance website.

Step 2: On the registration page, enter your email address, and create a password for your account.

Then, read and agree to the Terms of Service and click “Create Account”.

Note: Your password must be a combination of numbers and letters.

It should contain at least 8 characters, one UPPER CASE letter, and one number.

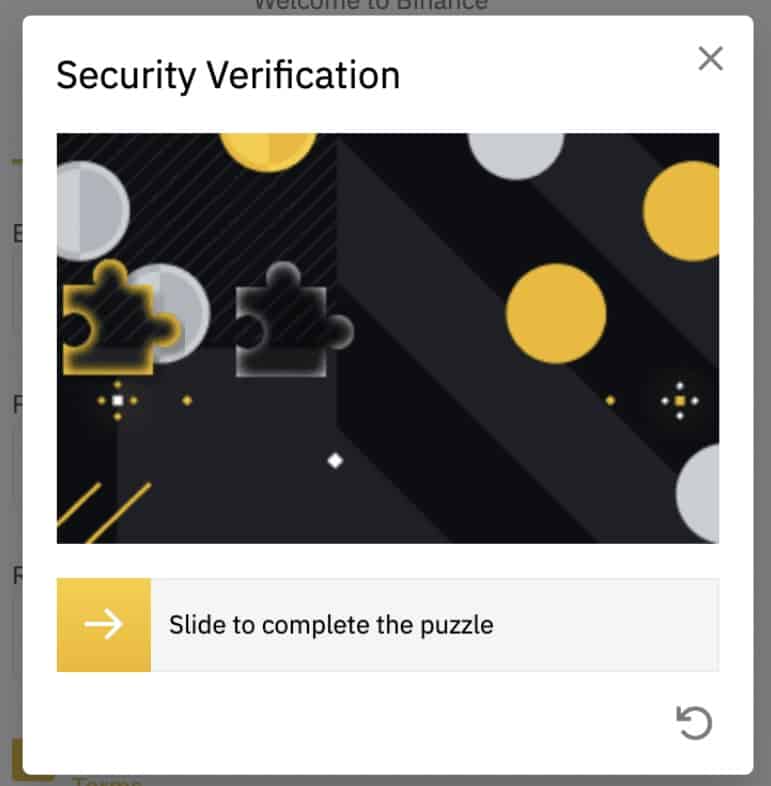

Step 3: Complete the Security Verification.

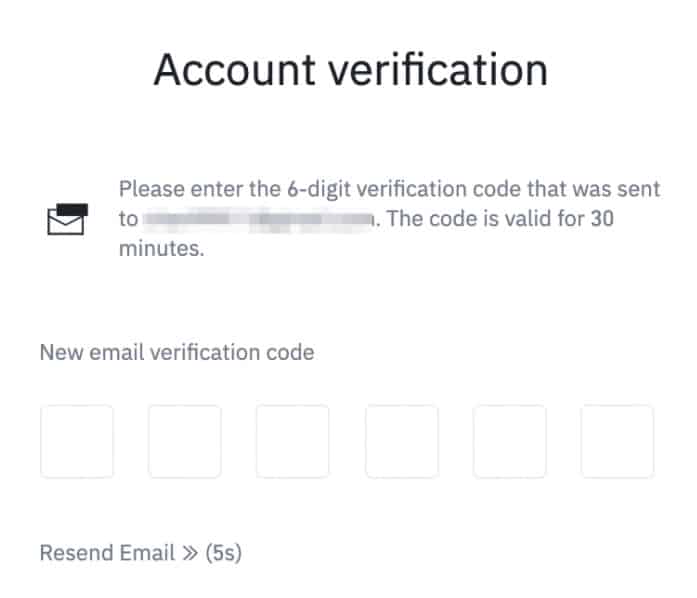

Step 4: The system will send a verification code to your email. The verification code is valid for 30 minutes. If you can’t find the email in your inbox, check your other mail folders as well, or click “Resend Email” to resend.

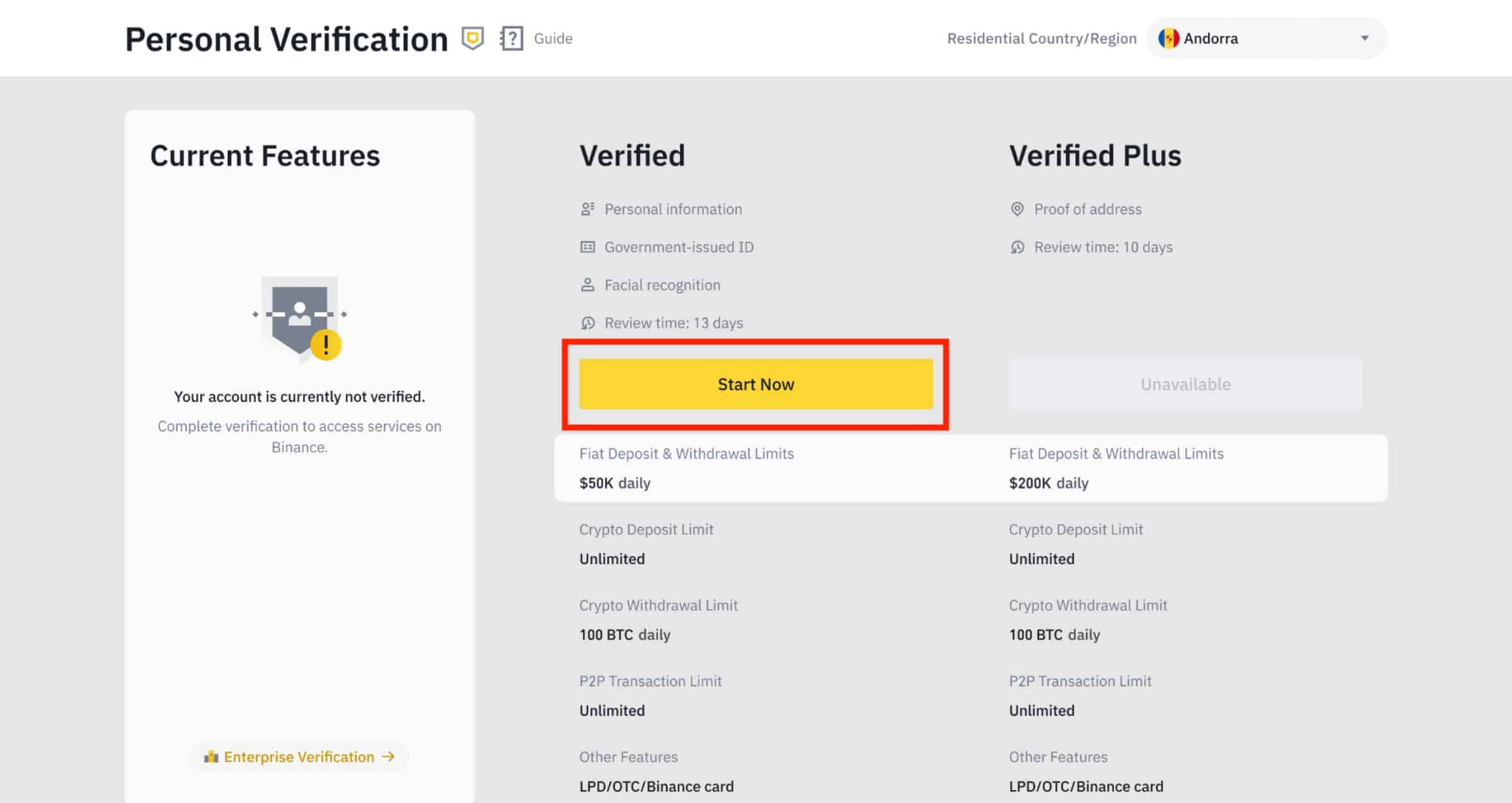

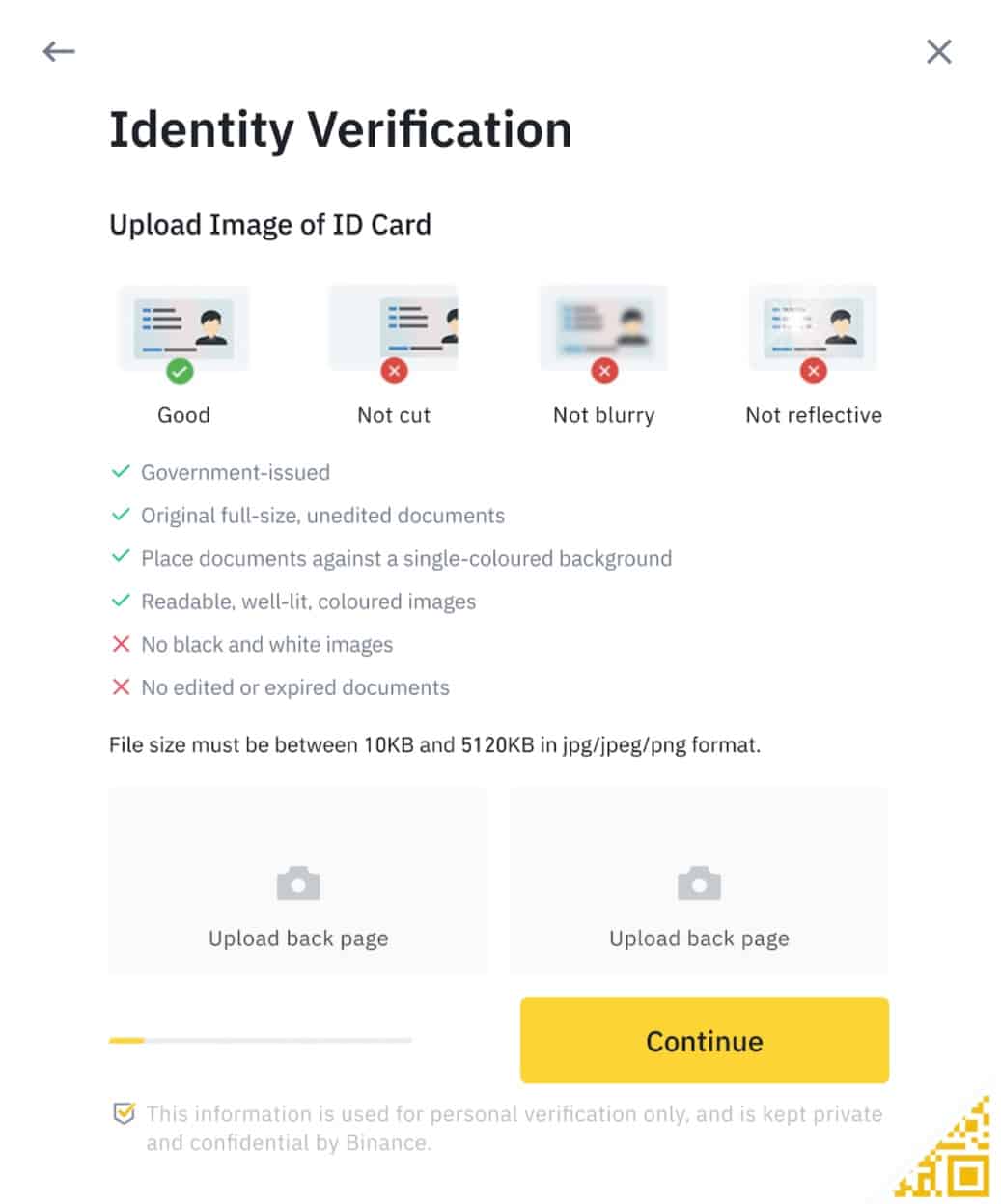

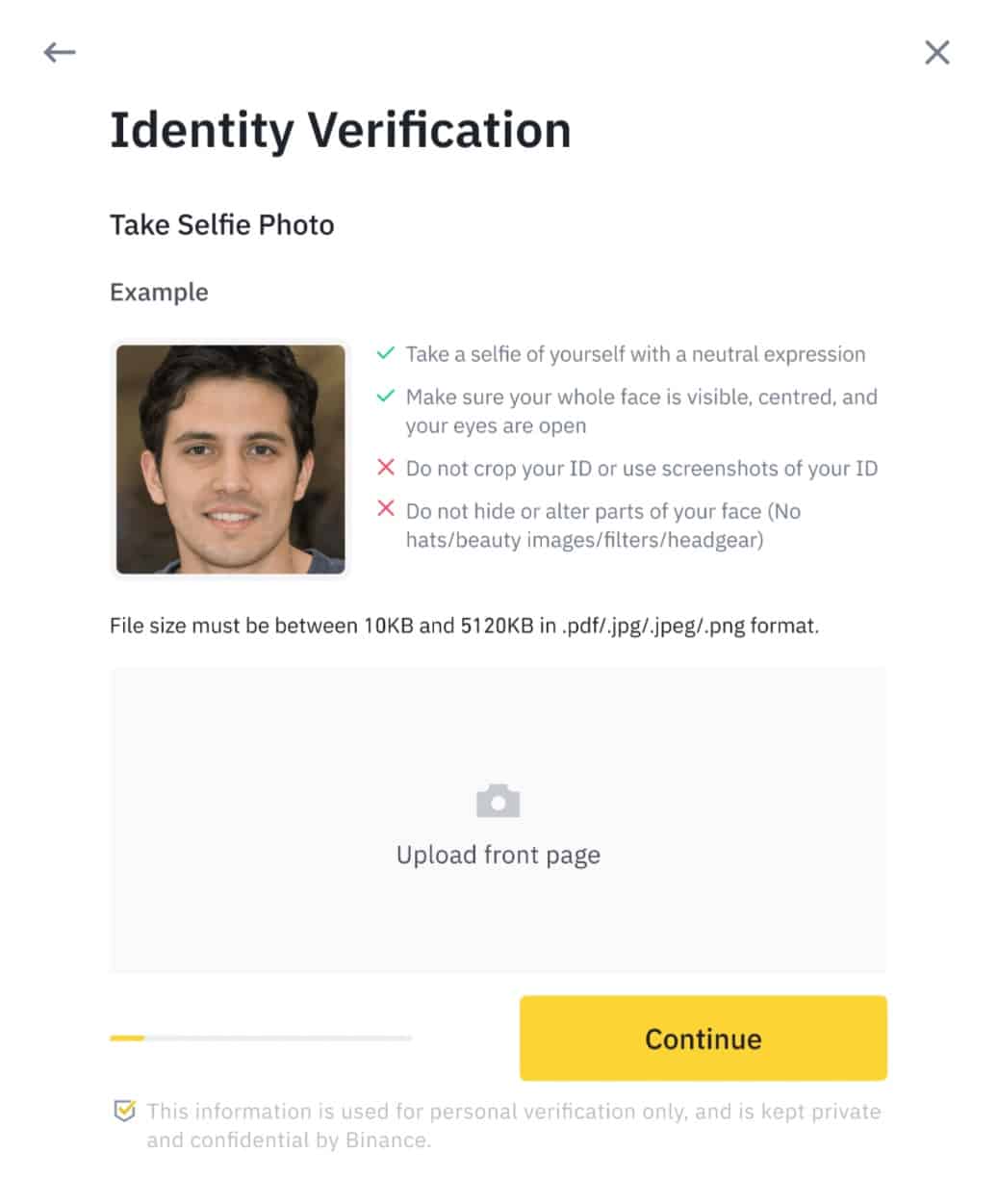

How to complete KYC (ID Verification) on Binance

Step 1: Log in to your Binance account and click “User Center” and then “Identification”.

Step 2: click “Start Now” to verify your account.

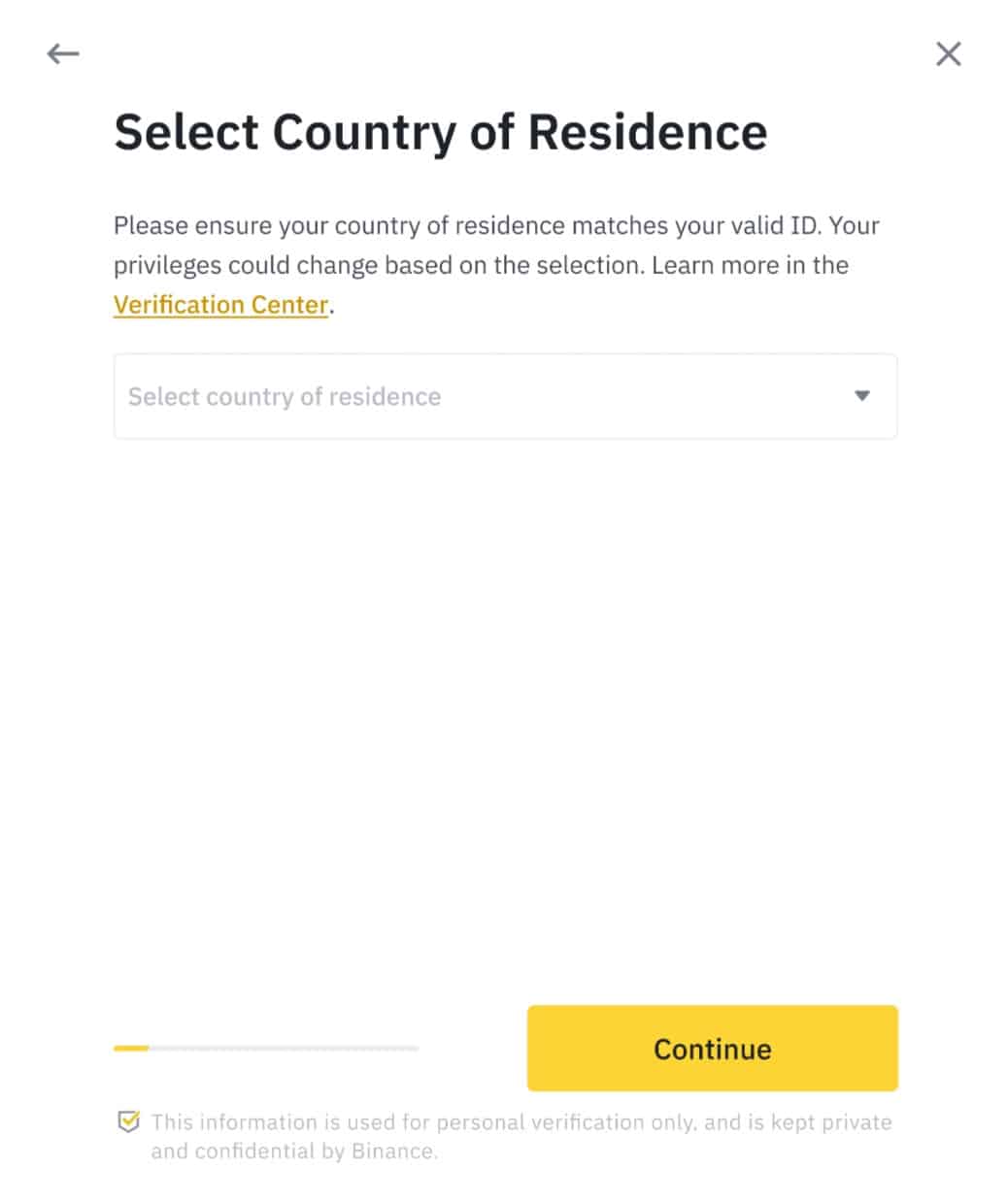

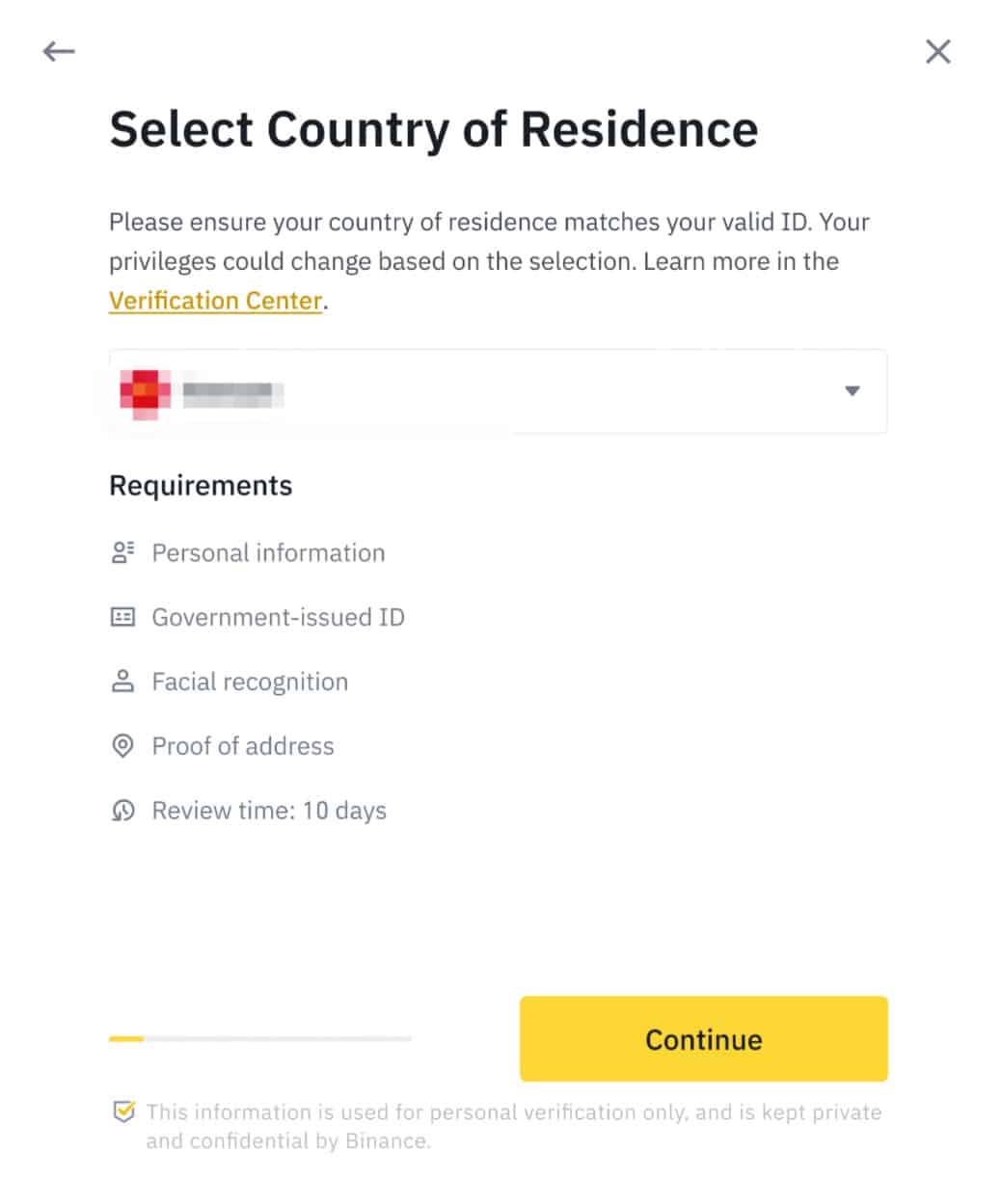

Step 3: Select your country of residence.

Ensure that your country of residence is consistent with your ID documents.

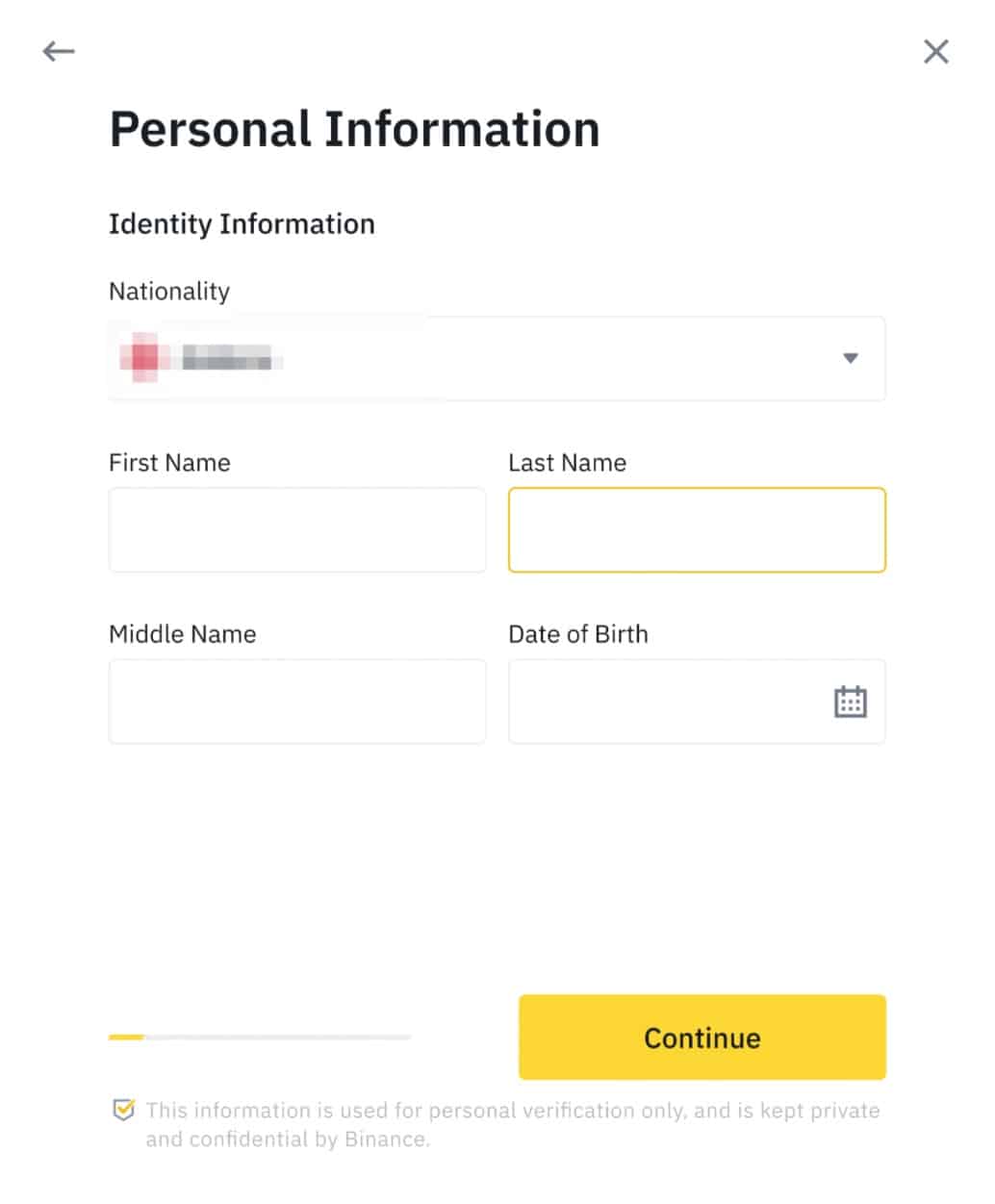

Step 5: Enter your personal information and click “Continue.”

You won’t be able to change it once confirmed.

Refer to the respective options offered for your country.

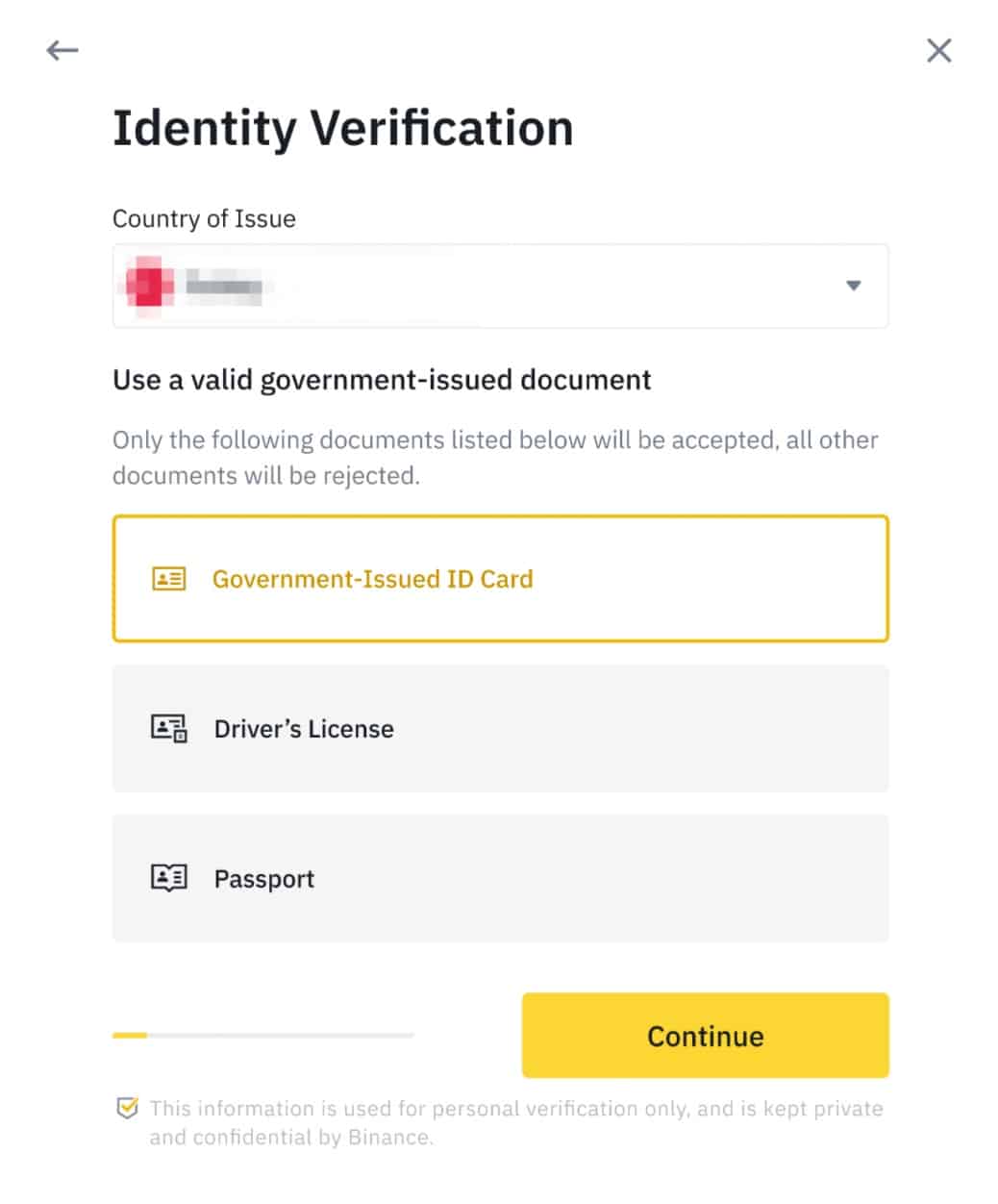

Step 7: Follow the instructions to upload photos of your document. Your photos should clearly show the full ID document.

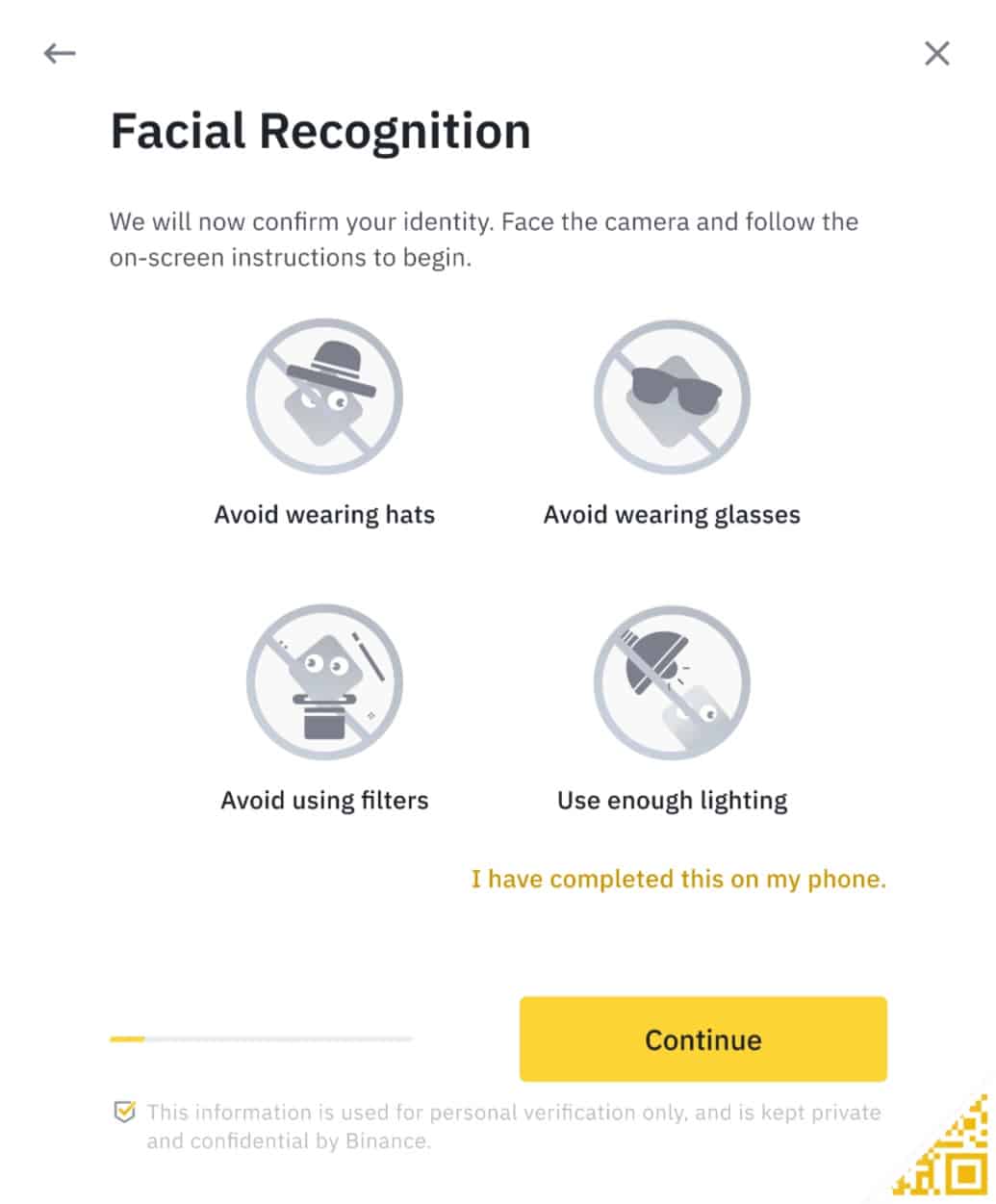

Do not wear hats, glasses, or use filters, and make sure that the lighting is sufficient.

Once your application has been verified, you will receive an email notification.

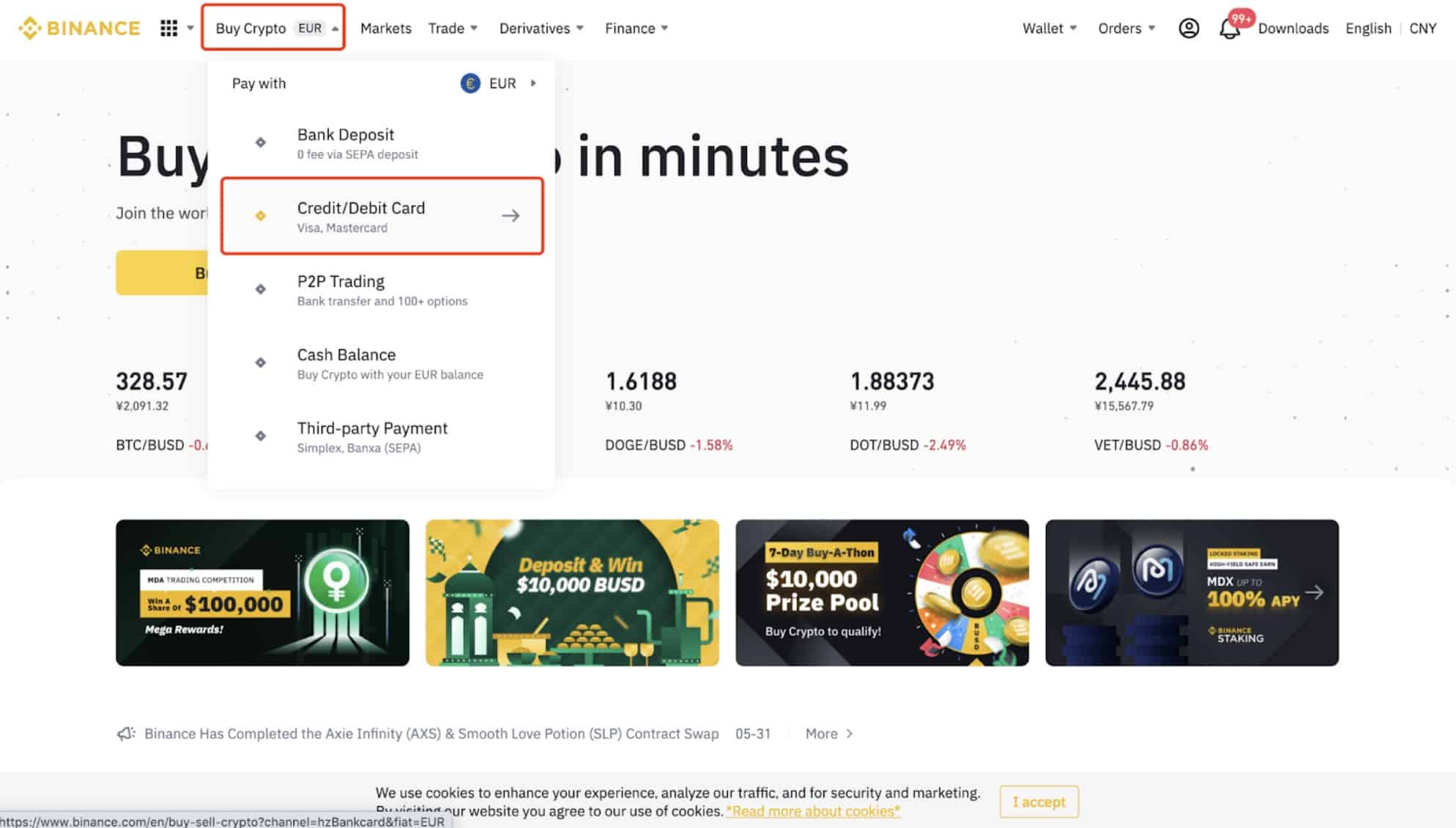

How to buy cryptocurrency on Binance

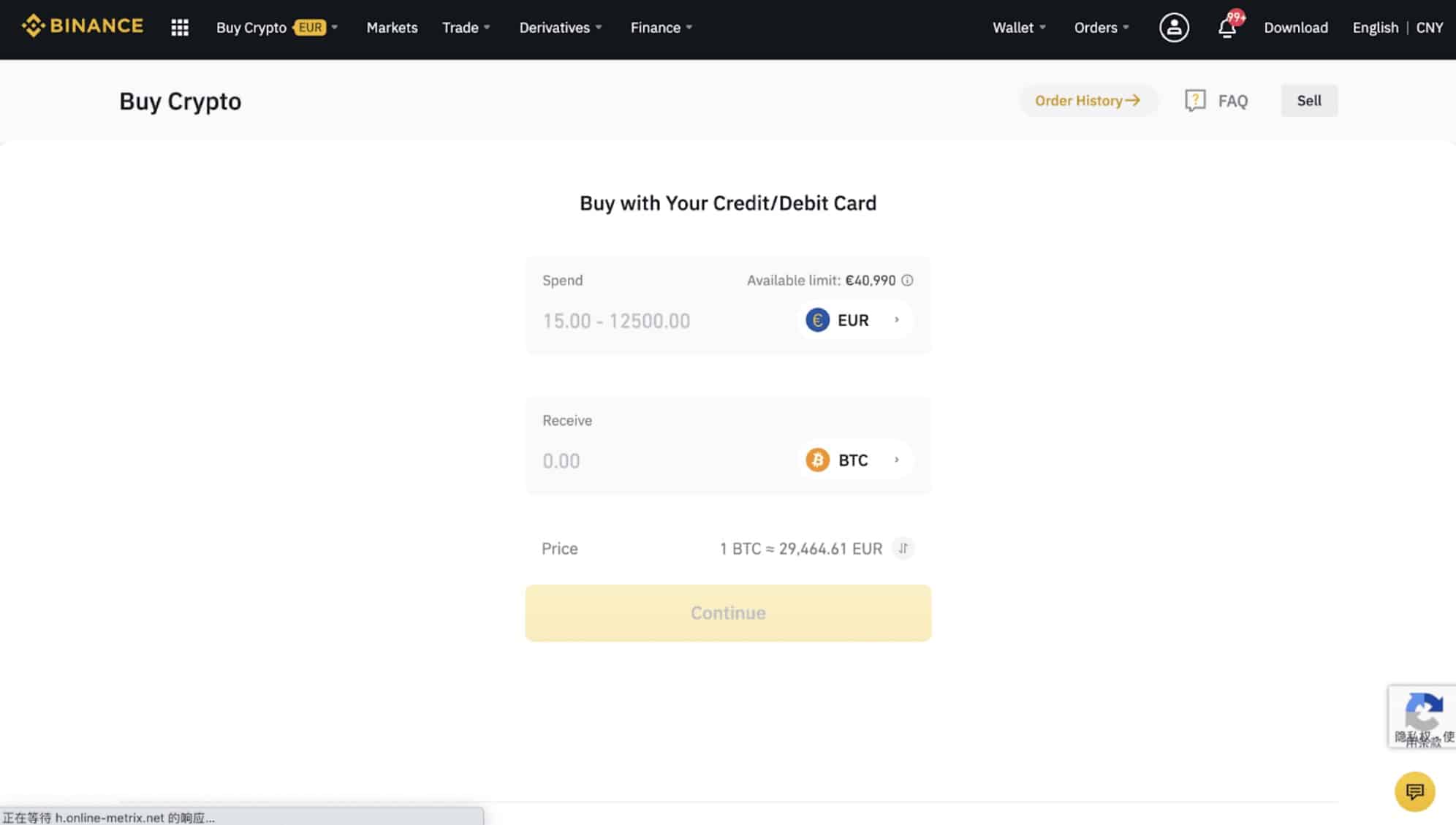

Step 1: Log in to your Binance account and click “Buy Crypto” and then “Credit/Debit Card”.

Step 2: Here you can choose to buy crypto with different fiat currencies. Enter the fiat amount you want to spend and the system will automatically display the amount of crypto you can get. When you have selected the amount you wish to spend then press “Continue”.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

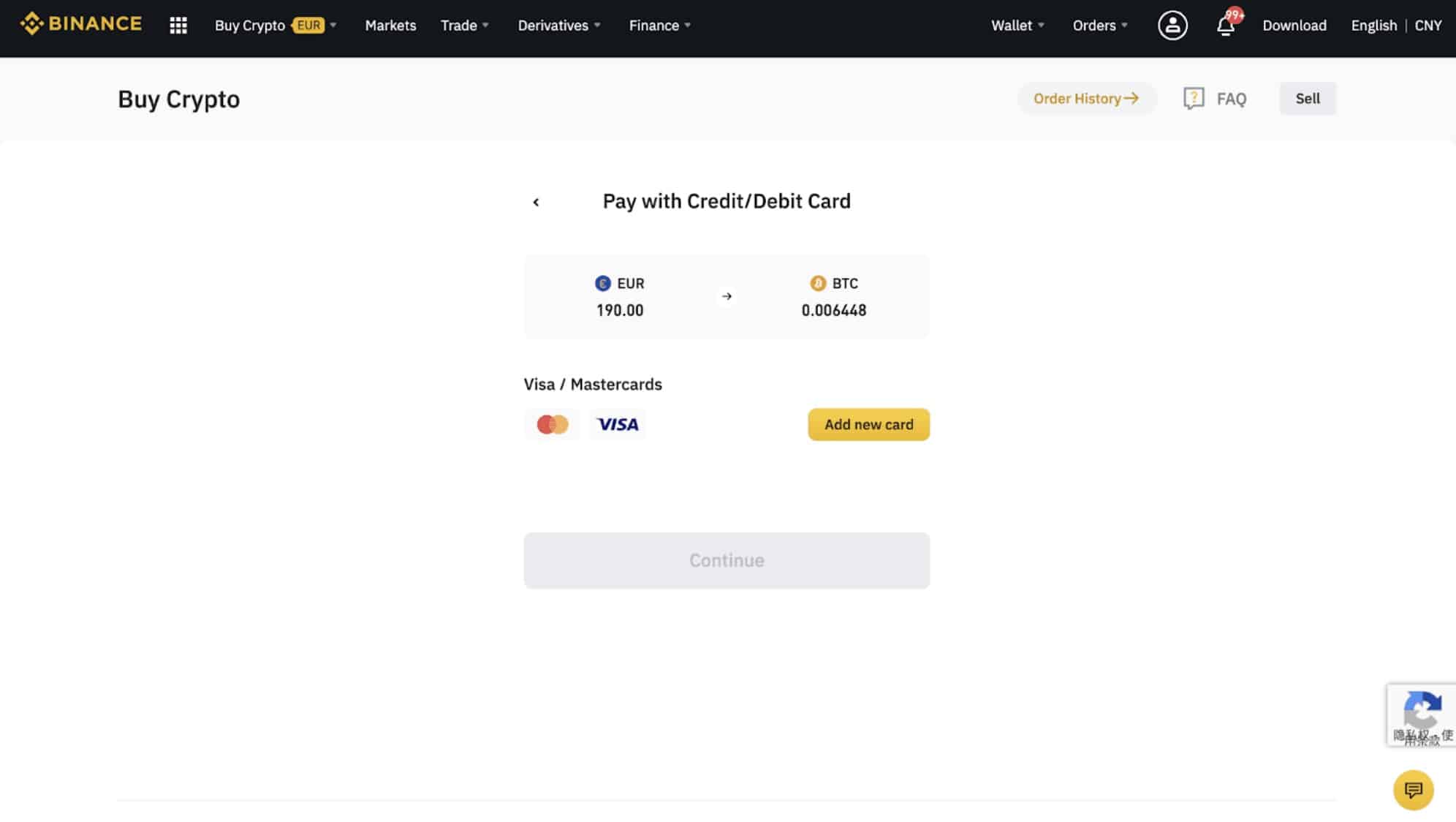

Step 3: Click “Add New Card”. Then enter your credit card details and your billing address.

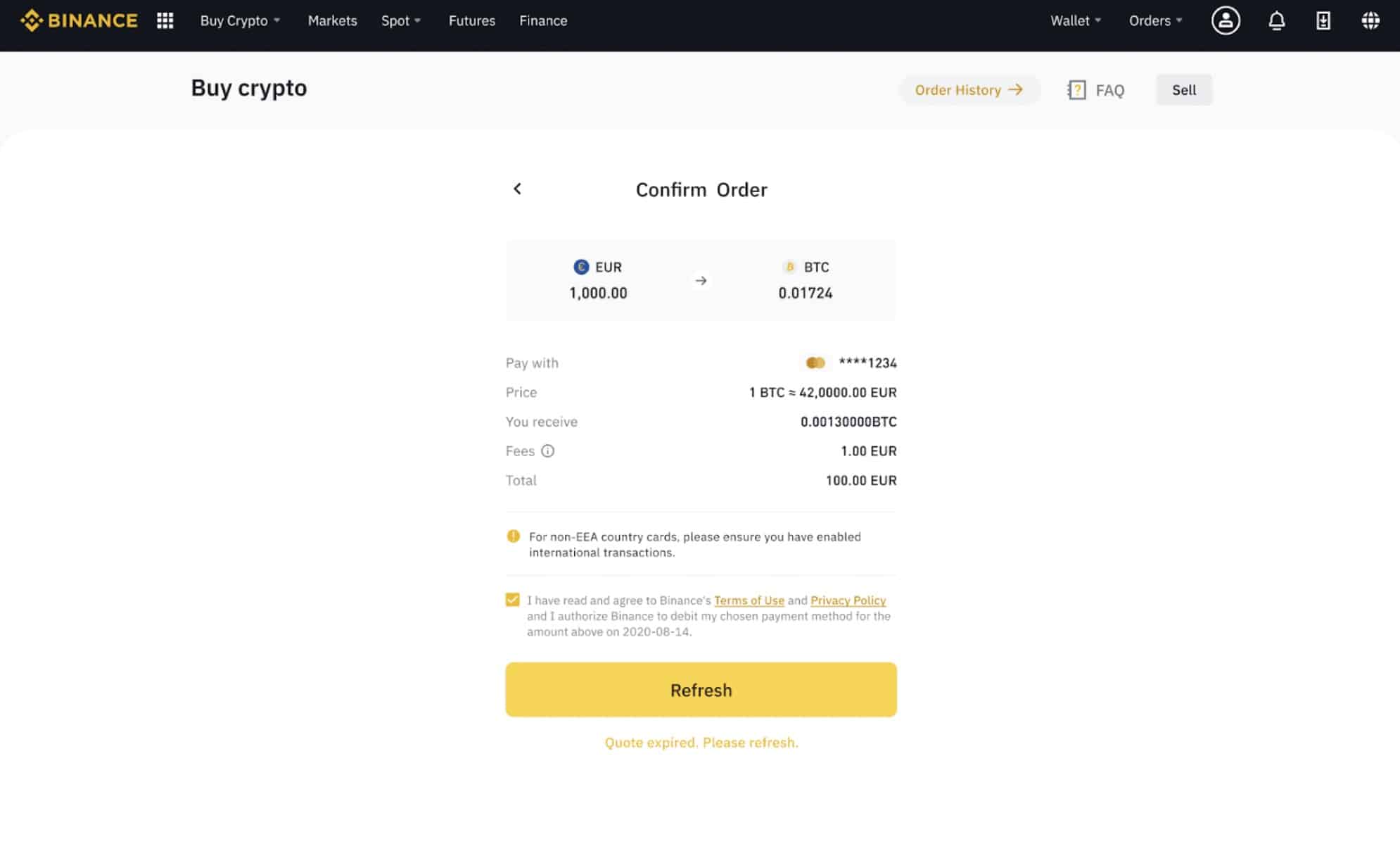

Step 4: Check the payment details and confirm your order within 1 minute. After 1 minute, the price and the amount of crypto you will get will be recalculated. You can click “Refresh” to see the latest market price. You will then be redirected to your bank’s OTP Transaction Page. Follow the on-screen instructions to verify the payment.

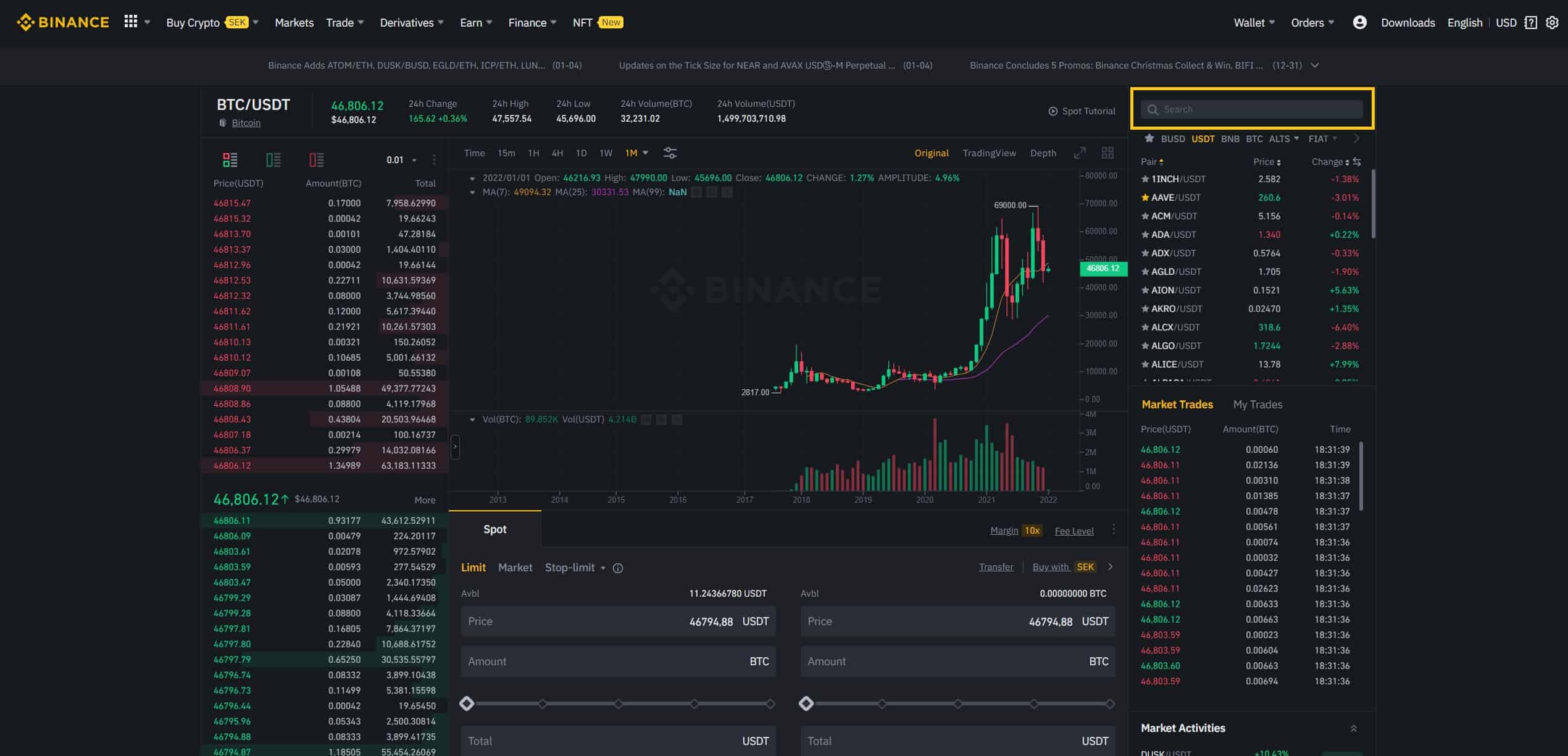

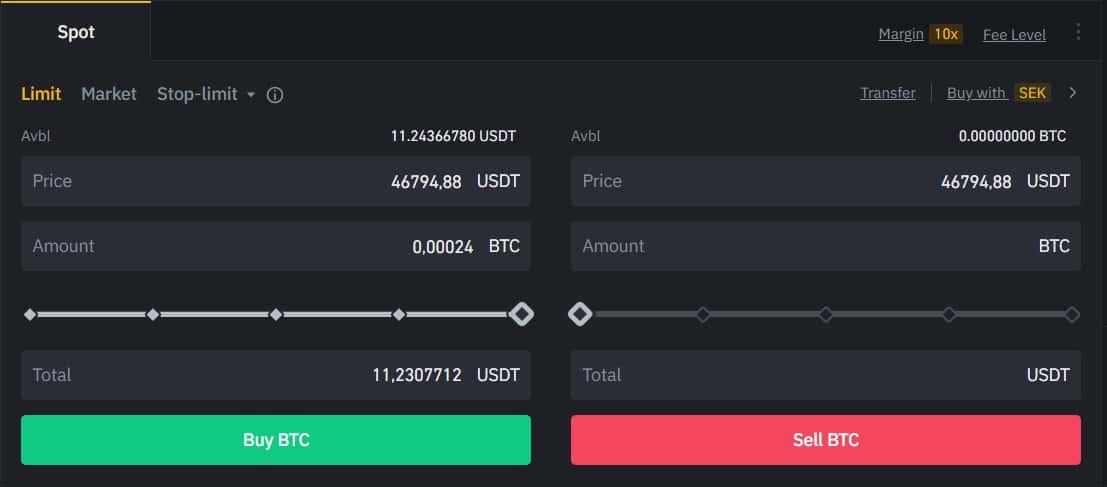

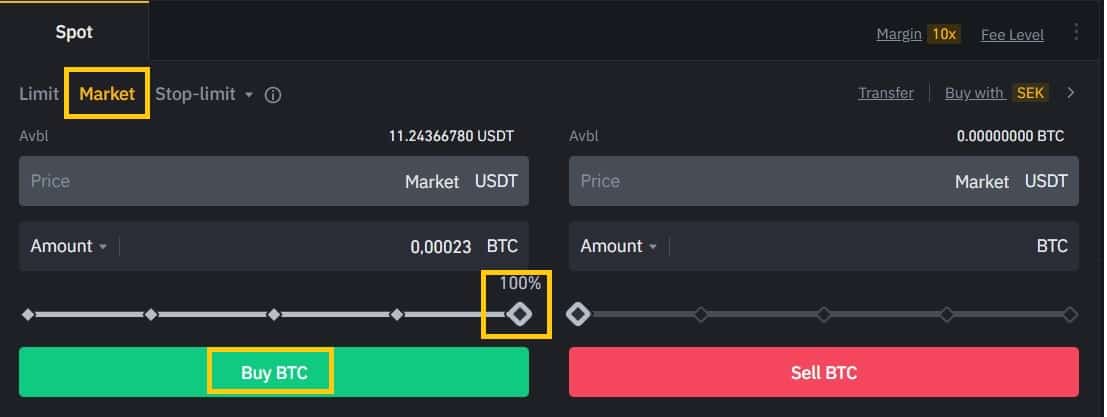

How to Conduct Spot Trading on Binance

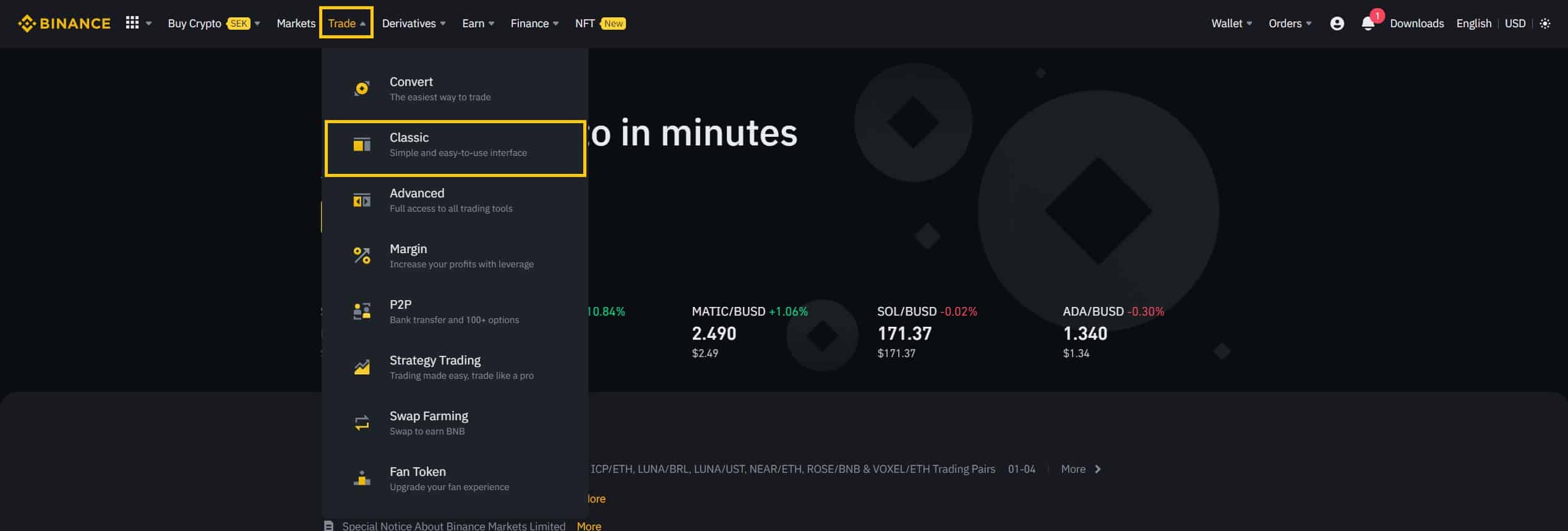

Step 1: Log in to your Binance account.

Click on “Classic” under “Trade” on the top navigation bar.

Step 2: Search and enter the cryptocurrency you want to trade.

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can place a “Market Order” to set the buying/selling price automatically.

Hide Detailed Instructions

If you’re looking for more detailed instructions on buying cryptocurrency, our “Absolute Beginner’s Guide to Cryptocurrency Investing” can take you through the process step-by-step. This guide also covers how to send and receive cryptocurrency.

If you’re brand new to the world of cryptocurrency, don’t worry! We offer beginner, intermediate, and advanced level articles to help you get up to speed with everything you need to know. These articles cover a wide range of topics, so whether you’re just starting out or looking to expand your knowledge, we’ve got you covered. With our resources, you can confidently navigate the cryptocurrency space and make informed investment decisions.

What is Linear Finance (LINA)?

Linear Finance, also known as “Linear,” is an innovative, non-custodial, cross-chain compatible, delta-one asset protocol designed to revolutionize the DeFi (Decentralized Finance) landscape. The primary objective of Linear Finance is to foster inclusiveness and democratize access to a wide variety of investment assets, both digital and traditional. This groundbreaking platform offers immense value to investors by simplifying the investment process, reducing fees, and ensuring asset security at fair market value.

Combining Expertise for a Unique DeFi Solution

Linear Finance stands out in the DeFi space, thanks to the exceptional union of technical expertise from leading cryptocurrency projects and financial acumen gleaned from the realm of traditional global asset management firms. This potent combination equips Linear Finance with the necessary skills, experience, and insights to revolutionize the world of decentralized finance and create a truly unique DeFi solution.

The seamless integration of these distinct areas of expertise has given rise to one of the first DeFi projects built on the Ethereum blockchain with cross-chain compatibility. This groundbreaking feature significantly enhances the functionality and versatility of the platform, enabling users to tap into the benefits of multiple blockchain networks without the typical hurdles associated with cross-chain transactions.

Linear Finance’s robust foundation, born from the fusion of technical and financial mastery, empowers users to effortlessly build and manage their spot or portfolio exposures. The platform offers an extensive range of innovative digital and traditional financial products, providing users with unparalleled flexibility to tailor their investment strategies according to their unique needs and preferences. This diverse selection of financial instruments positions Linear Finance as a trailblazer in the DeFi landscape, offering a one-stop solution for investors seeking cutting-edge opportunities in both the digital and traditional finance worlds.

The Power of the Linear Token (LINA)

Central to Linear Finance’s robust infrastructure is the Ethereum-based Linear Token (LINA). LINA plays a pivotal role in supporting synthetic assets built on various EVM-compatible chains, with plans to extend compatibility to other prominent blockchains in the long run. By leveraging the capabilities of LINA, Linear Finance revolutionizes the way users interact with the DeFi ecosystem, providing a seamless, cost-effective, and efficient solution for staking, investing, and redemption processes.

LINA’s versatile nature simplifies the complex processes associated with staking, investing, and redemption within the DeFi landscape. By offering a faster and more cost-effective solution, LINA reduces barriers to entry for users, empowering them to make the most of the thriving Ethereum DeFi ecosystem. This streamlined approach not only enhances the user experience but also fosters broader adoption of decentralized finance solutions.

Despite its cross-chain compatibility, LINA maintains strong ties to the Ethereum DeFi ecosystem, ensuring users can tap into the extensive opportunities available on this leading blockchain network. The strategic decision to base LINA on the Ethereum blockchain allows Linear Finance to leverage the network’s established infrastructure, security, and liquidity, while still offering the benefits of a more versatile and efficient token for users. Ultimately, the power of the Linear Token (LINA) lies in its ability to bridge the gap between the Ethereum DeFi ecosystem and other blockchain networks, setting the stage for a more interconnected and accessible future for decentralized finance.

Non-Custodial Cross-Chain Protocol for Synthetic Assets

Linear Finance establishes itself as a game-changing platform for the creation of synthetic assets, also known as Liquids, by offering a non-custodial, cross-chain protocol that eliminates slippage. This innovative approach provides users with a secure and flexible environment for creating and managing their synthetic assets, while also ensuring a seamless and frictionless trading experience.

At the heart of Linear Finance’s synthetic asset creation process lies a collateralized debt pool. This pool, which is initially backed by the Linear token (LINA), is designed to support a diverse range of digital and real-world assets in the future. By contributing collateralized assets to the debt pool, users can “build” Linear USD (ℓUSD), a versatile currency that can be used to purchase synthetic assets (Liquids) on the Linear exchange.

The innovative design of Linear Finance’s collateralized debt pool allows for the pooling of collateralized assets, ensuring instantaneous liquidity and serving as a reliable counterparty for users. This unique structure not only guarantees a smooth and efficient trading experience but also provides users with enhanced security and peace of mind when engaging with the platform.

Governance and Fee Distribution with LINA Token

In addition to its primary role as the backbone of Linear Finance’s infrastructure, the LINA token serves a critical function as a governance token. This feature empowers LINA holders with the ability to participate in the decision-making process, ensuring that the platform’s development and growth are guided by the collective wisdom of its users. By facilitating decentralized governance, LINA fosters a sense of ownership and collaboration within the Linear Finance community.

LINA holders have the unique opportunity to influence crucial aspects of the platform, including distribution models, assets to be listed, oracle selection, and pledge ratios. This inclusive approach to governance not only promotes transparency and fairness but also ensures that the platform remains agile and responsive to the evolving needs and preferences of its users.

As a token of appreciation for their involvement in the debt pool, LINA holders receive pro-rata fees generated from the creation of Liquids. This incentive mechanism not only rewards active participants for their contributions but also encourages further engagement with the platform, fostering a vibrant and committed community of users.

Inflationary Model and Liquidity Mining Programs

The LINA token employs an inflationary model as a strategic approach to encourage user engagement and enhance staking incentives. By gradually increasing the token supply, Linear Finance creates an environment that rewards long-term commitment and active participation within the platform. This approach helps drive user growth, ultimately contributing to the overall success and sustainability of the DeFi ecosystem.

To further stimulate platform engagement and ensure stability, Linear Finance implements liquidity mining programs. These programs incentivize users to contribute liquidity to the platform by offering rewards in the form of LINA tokens. As a result, exchange usage is promoted, and the stability of the collateralized debt pool is maintained, fostering a reliable and robust environment for all users.

Linear Finance places a strong emphasis on the synthetization of a wide range of assets, encompassing cryptocurrencies, commodities, and, most notably, traditional assets such as market indices and thematic theme exposures. This comprehensive approach ensures that users have access to a diverse array of investment opportunities, enabling them to create well-balanced and versatile portfolios that cater to their specific needs and preferences.

Linear Finance’s Long-Term Vision

Linear Finance envisions a future where users can gain exposure to a diverse range of assets without facing slippage or settlement time constraints. Furthermore, Linear Finance aims to serve as a reliable gateway in the ever-growing intersection between Decentralized Finance (DeFi) and Centralized Finance (CeFi). This convergence was fueled by the rapid adoption of cryptocurrency in 2020 and the ongoing collaboration between DeFi and CeFi. By providing a solid foundation, Linear Finance enables the development of applications that leverage CeFi/DeFi composability, unlocking new possibilities in the financial ecosystem.

Linear Finance is strategically positioned to facilitate the integration of traditional financial markets and the emerging digital asset space. By providing easy access to both digital and traditional assets, Linear Finance empowers users to diversify their investments, manage risks more effectively, and capitalize on the unique opportunities present in both worlds. This fusion of old and new finance is a testament to Linear Finance’s dedication to financial inclusivity and democratization.

As a pioneering DeFi platform, Linear Finance encourages the development of innovative applications and financial products that build upon its robust infrastructure. This open-ended approach fosters creativity and collaboration, paving the way for novel solutions that address real-world challenges and drive the evolution of finance. By serving as a launchpad for financial innovation, Linear Finance is poised to become an essential hub for the CeFi and DeFi communities.

In Conclusion: A Bright Future for Linear Finance

Linear Finance, with its non-custodial, cross-chain compatible, and delta-one asset protocol, is set to transform the DeFi landscape by bridging the gap between traditional and digital finance. By combining substantial technical expertise, extensive financial experience, and a powerful Ethereum-based token (LINA), Linear Finance is uniquely equipped to democratize access to investment assets and foster financial innovation. As Linear Finance continues to evolve and expand, it will undoubtedly play a pivotal role in shaping the future of finance, making the world of investment more inclusive, accessible, and efficient for all.

Linear Finance development updates in 2023

In 2023, Linear Finance (LINA) introduced several technological advancements and updates to its network:

Improved Protocol Functionality: Linear Finance has worked on enhancing its protocol’s functionality. This includes optimizing the efficiency of its delta-one asset protocol, which maintains a one-to-one relationship with the price movement of underlying assets, thereby offering true value in its derivative products.

Cross-Chain Compatibility Enhancements: The platform focused on improving its cross-chain compatibility features. By supporting a wider range of blockchains, Linear Finance aims to provide faster transaction speeds and lower fees. This development is essential in facilitating efficient and cost-effective trading on the platform.

Governance Token Development: The LINA token, used for governance, has seen developments in its utility and application within the ecosystem. The governance model was likely enhanced to allow for greater community participation in decision-making processes related to the protocol.

Expansion of Staking and Exchange Services: Linear Finance likely expanded its staking services and synthetic asset exchange, enhancing the overall user experience and utility of the LINA token within its ecosystem.

Community Growth Initiatives: There were focused efforts on community growth and engagement. This might include initiatives like educational series, ambassador programs, and enhanced social media interaction to increase community involvement and support for the platform.

Advancements in Tokenomics: Adjustments and reviews of the tokenomics of LINA, including its inflation rate and distribution, might have been made to align with the platform’s growth and the evolving needs of its users.

These updates indicate Linear Finance’s dedication to improving its platform, focusing on technological enhancements, governance, community engagement, and efficient asset trading.

Official website: https://linear.finance/

Best cryptocurrency wallet for Linear Finance (LINA)

Navigating the world of cryptocurrency wallets can be quite an adventure, as there are numerous options available to suit different needs. To find the perfect wallet for you, consider your trading habits and the level of security you require. Generally, there are two main categories of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical).

Each type of wallet comes with its own set of advantages and drawbacks, so there isn’t necessarily a one-size-fits-all solution. As you embark on your journey to find the best crypto wallet for your Linear Finance (LINA) tokens, remember to keep an open mind and explore the features that align with your personal preferences and requirements.

When choosing the right wallet for your Linear Finance (LINA) tokens, consider the following factors:

- Trading frequency: Hot wallets are generally more suitable for active traders due to their quick login capabilities, allowing for seamless buying and selling of crypto. Cold wallets, on the other hand, are better suited for those who make less frequent trades.

- Supported cryptocurrencies: Although not all wallets cater to every cryptocurrency, some of the best ones can trade a vast array of currencies, offering a versatile experience. Make sure the wallet you choose supports Linear Finance (LINA).

- Security concerns: If you’re worried about potential hacking incidents, a physical cold wallet stored in a safe deposit box or a secure location at home provides the highest level of protection. However, if you’re confident in safeguarding your hot wallet, you might prefer its convenience.

- Associated costs: Investigate the costs of each wallet option. While many hot wallets are free to set up, cold wallets, being hardware devices, will require an upfront investment.

- Wallet features: While the basic functions of cryptocurrency wallets remain the same, additional features can distinguish one wallet from another. Hot wallets often come with advanced reporting tools, crypto market insights, and currency conversion capabilities. Security features can also be an essential factor when making your decision.

By considering all of these aspects, you’ll be better equipped to select the perfect cryptocurrency wallet for your Linear Finance (LINA) tokens.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re planning to handle larger amounts of crypto, investing in cold storage can be a wise decision. Two of the most popular cold storage options are the Ledger Nano and the Trezor.

Ledger creates cold storage wallets designed for users who prioritize security. Their wallets are physical devices that connect to your computer, and you can only send cryptocurrency from them when they’re connected. Ledger offers a range of products, including the Ledger Nano S and the Ledger Nano X, which features Bluetooth connectivity.

Trezor, a trailblazer in the hardware wallet industry, combines top-notch security with an intuitive interface and compatibility with various desktop wallets. This blend makes it suitable for both beginners and experienced users. Trezor has earned a great deal of respect within the Bitcoin community over time. They offer two primary models – the Trezor One and the Trezor Model T, which comes with a built-in touchscreen.

Linear Finance (LINA) Price & Charts

- Market Capitalization And Daily Trading Volume

- Current Market Price Of Every Cryptocurrency Relative To USD (And Some Local Currencies)

- Circulating And Total Supply

- Historical Charts With Prices Relative To USD, Bitcoin (BTC), And Ethereum (ETH).