How to buy Liquity (LQTY)

If you’re interested in purchasing Liquity (LQTY), this helpful step-by-step guide will show you how. We’ll walk you through the process so you can learn how to buy LQTY with ease. Whether you’re new to cryptocurrency or just looking to expand your portfolio, this guide can provide you with the information you need to get started. So why not give it a try and learn how to buy LQTY today?

Step 1: Create an account on an exchange that supports Liquity (LQTY)

First, you will need to open an account on a cryptocurrency exchange that supports Liquity (LQTY).

We recommend the following based on functionality, reputation, security, support and fees:

1

Binance

Fees (Maker/Taker) 0.075%*-0.1%*

Cryptocurrencies

Available for Trade 500+

Sign-up bonus

10% reduced trading fees*

Available in

Europe, Asia, Oceania, Africa

2

MEXC

Fees (Maker/Taker) 0.2%*-0.2%*

Cryptocurrencies

Available for Trade 1500+

Sign-up bonus

10% reduced trading fees & up to $170 in USDT vouchers*

Available in

North America, South America, Europe, Asia, Oceania, Africa

When you’re signing up for a cryptocurrency exchange, you’ll typically need to provide some basic information. This might include your email address, password, and full name. Depending on the exchange, you may also be asked for additional details like your phone number or address.

It’s worth noting that some exchanges have more stringent requirements, such as a “Know Your Customer” (KYC) procedure. This is typically the case with licensed and regulated exchanges. KYC procedures help ensure that exchanges comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. If you’re required to complete a KYC procedure, you’ll typically be asked to provide additional information, such as a government-issued ID or proof of address.

Step 2: Deposit funds into your account

When buying Liquity (LQTY) on a cryptocurrency exchange, many of them allow you to use fiat currencies like EUR, USD, and AUD to make your purchase directly. To do this, you’ll need to fund your account with one of several deposit methods, including credit and debit cards, e-wallets, and direct bank transfers. If this is not an option on the cryptocurrency exchange that you have chosen, then simply move onto the next step in this guide.

It’s important to note that different payment methods may have varying fees associated with them. For example, credit card payments may have higher fees than other options. To avoid paying unnecessary costs, it’s a good idea to research the fees for each payment method before funding your account.

Step 3: Buy Liquity (LQTY)

Buying Liquity (LQTY) on a cryptocurrency exchange is a simple process. Look for the search bar or navigation menu and search for Liquity (LQTY) or Liquity (LQTY) trading pairs. Next, find the section that allows you to buy Liquity (LQTY). Enter the amount of cryptocurrency you want to spend or the amount of fiat currency you want to use to buy Liquity (LQTY). The exchange will calculate the equivalent amount of Liquity (LQTY) based on the current market rate.

Before confirming your purchase, always double-check the transaction details, such as the amount of Liquity (LQTY) you’ll receive and the total cost of the purchase. Additionally, some exchanges offer a proprietary software wallet to store your Liquity (LQTY), but you can also create your own software wallet or purchase a hardware wallet for the highest level of protection.

How to create a Binance account

![]()

Show Detailed Instructions

Hide Detailed Instructions

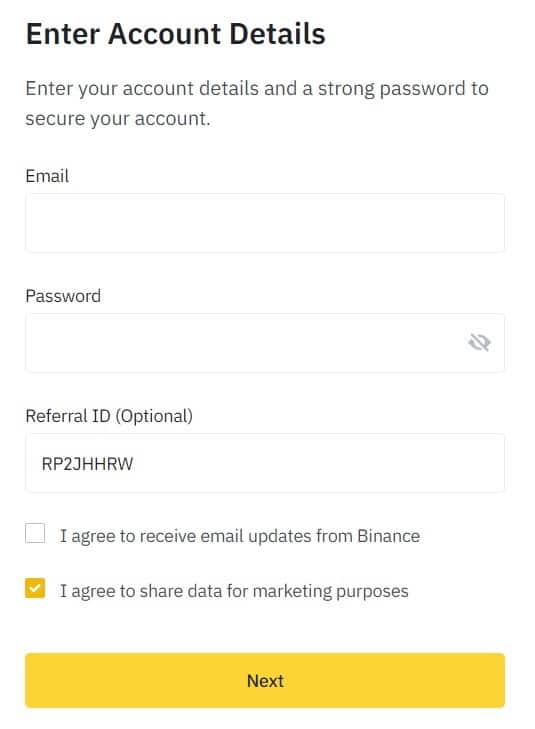

Step 1: Go to the Binance website.

Step 2: On the registration page, enter your email address, and create a password for your account.

Then, read and agree to the Terms of Service and click “Create Account”.

Note: Your password must be a combination of numbers and letters.

It should contain at least 8 characters, one UPPER CASE letter, and one number.

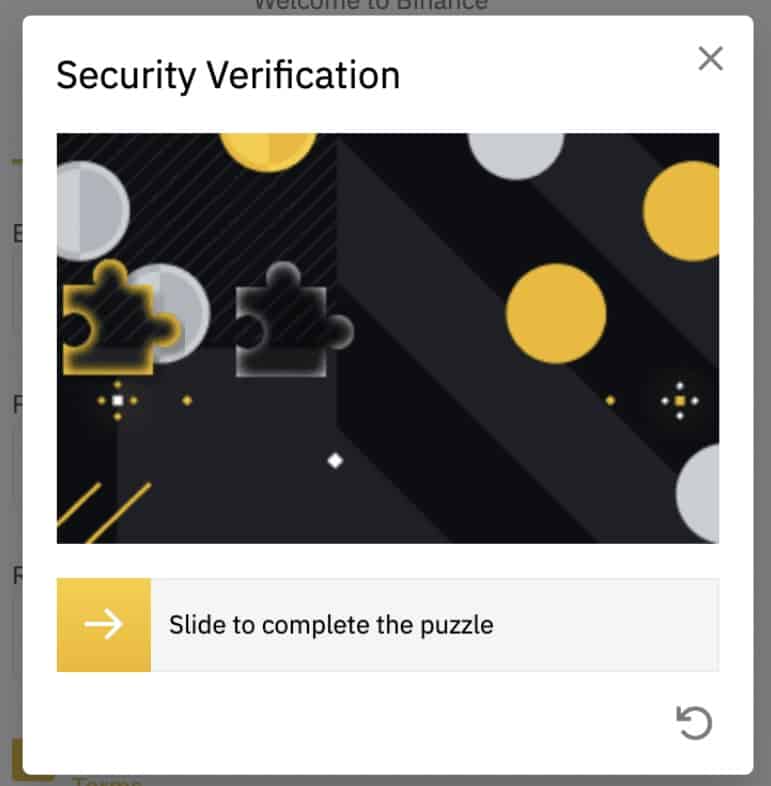

Step 3: Complete the Security Verification.

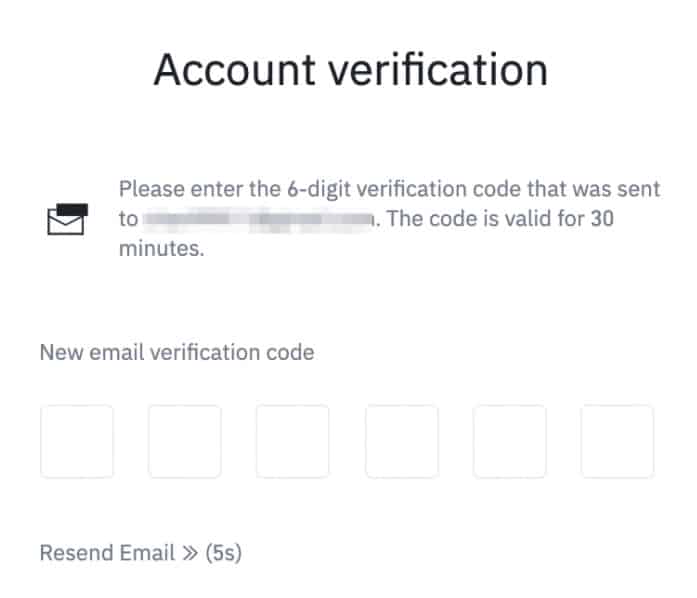

Step 4: The system will send a verification code to your email. The verification code is valid for 30 minutes. If you can’t find the email in your inbox, check your other mail folders as well, or click “Resend Email” to resend.

How to complete KYC (ID Verification) on Binance

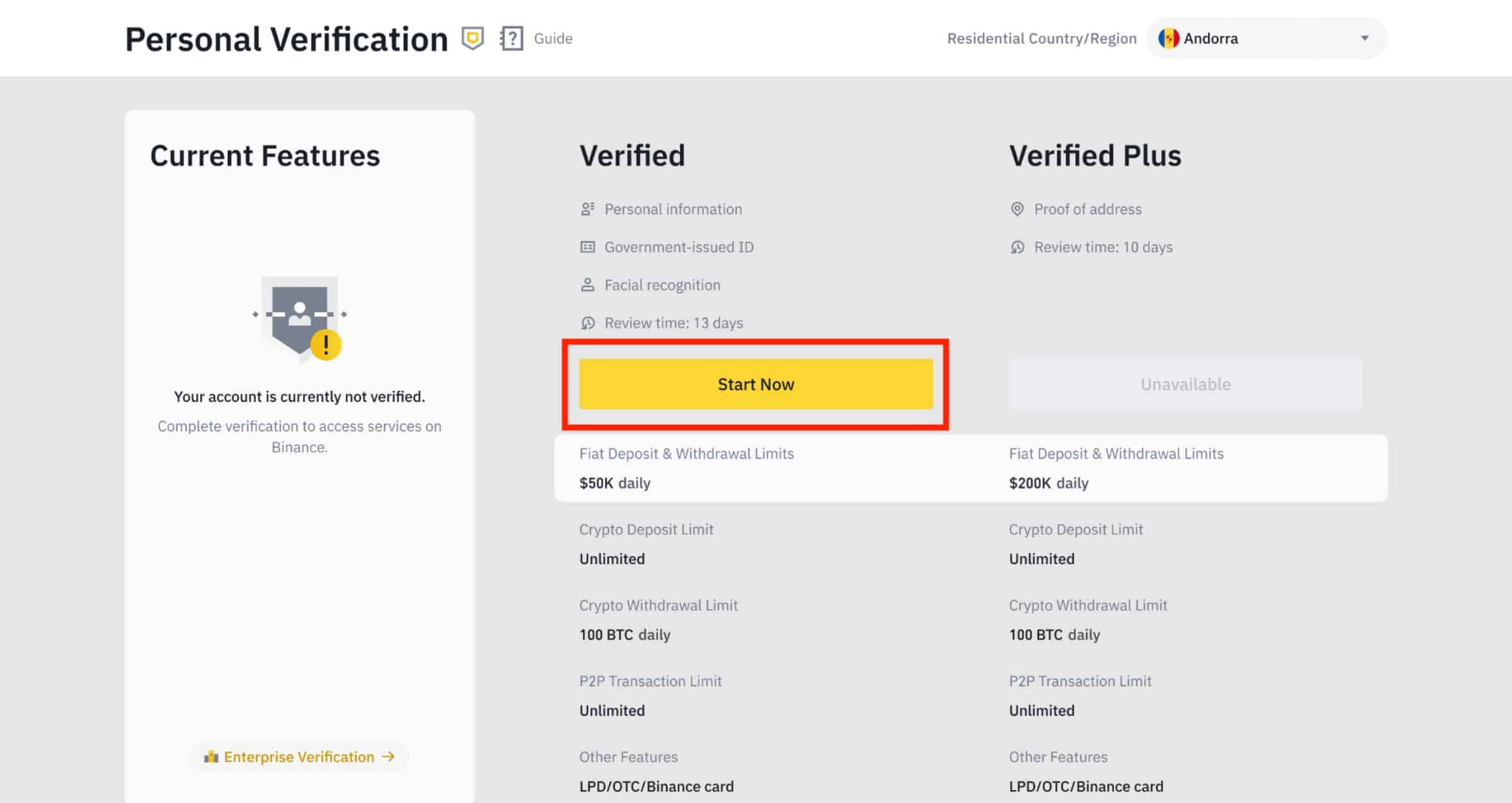

Step 1: Log in to your Binance account and click “User Center” and then “Identification”.

Step 2: click “Start Now” to verify your account.

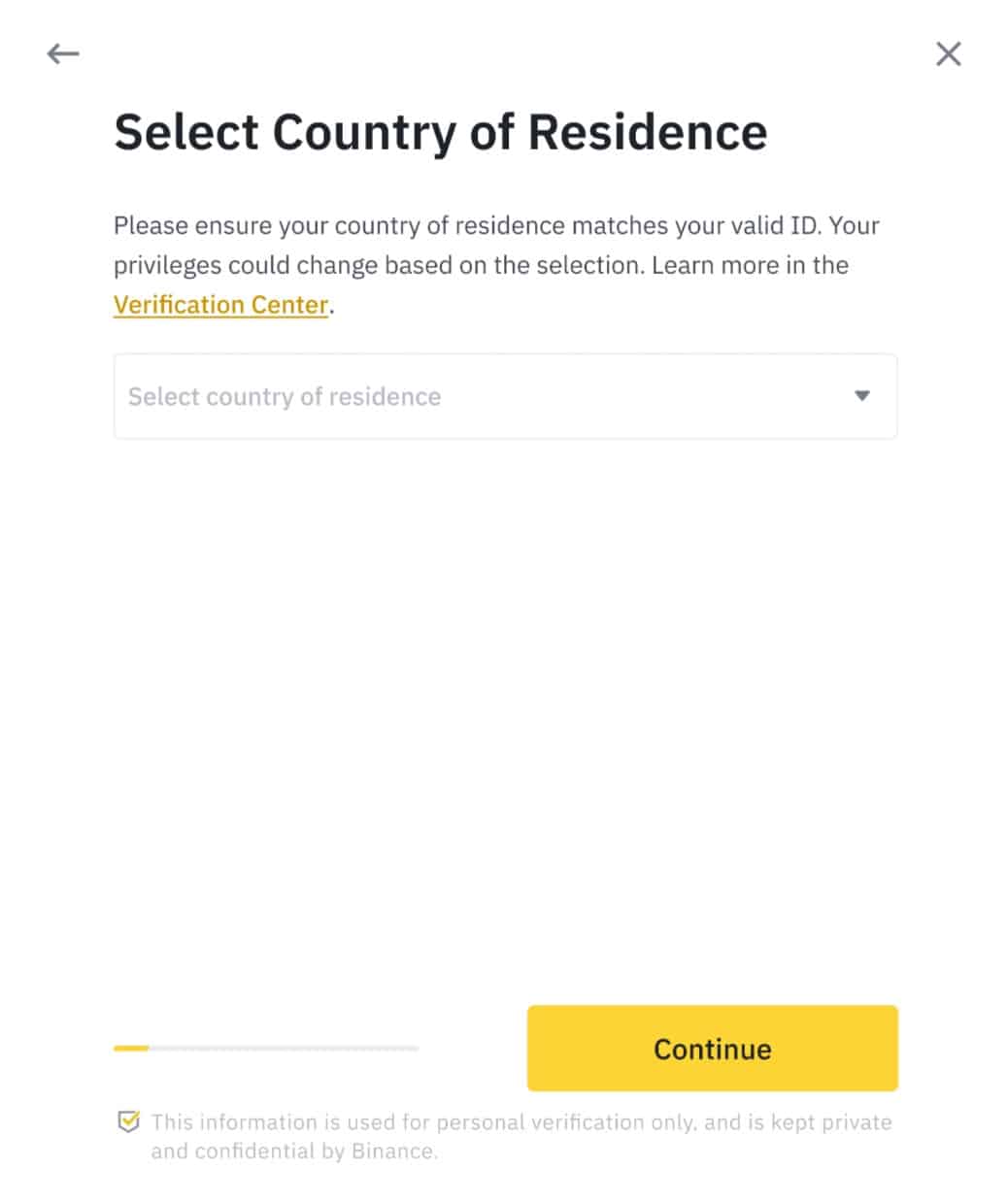

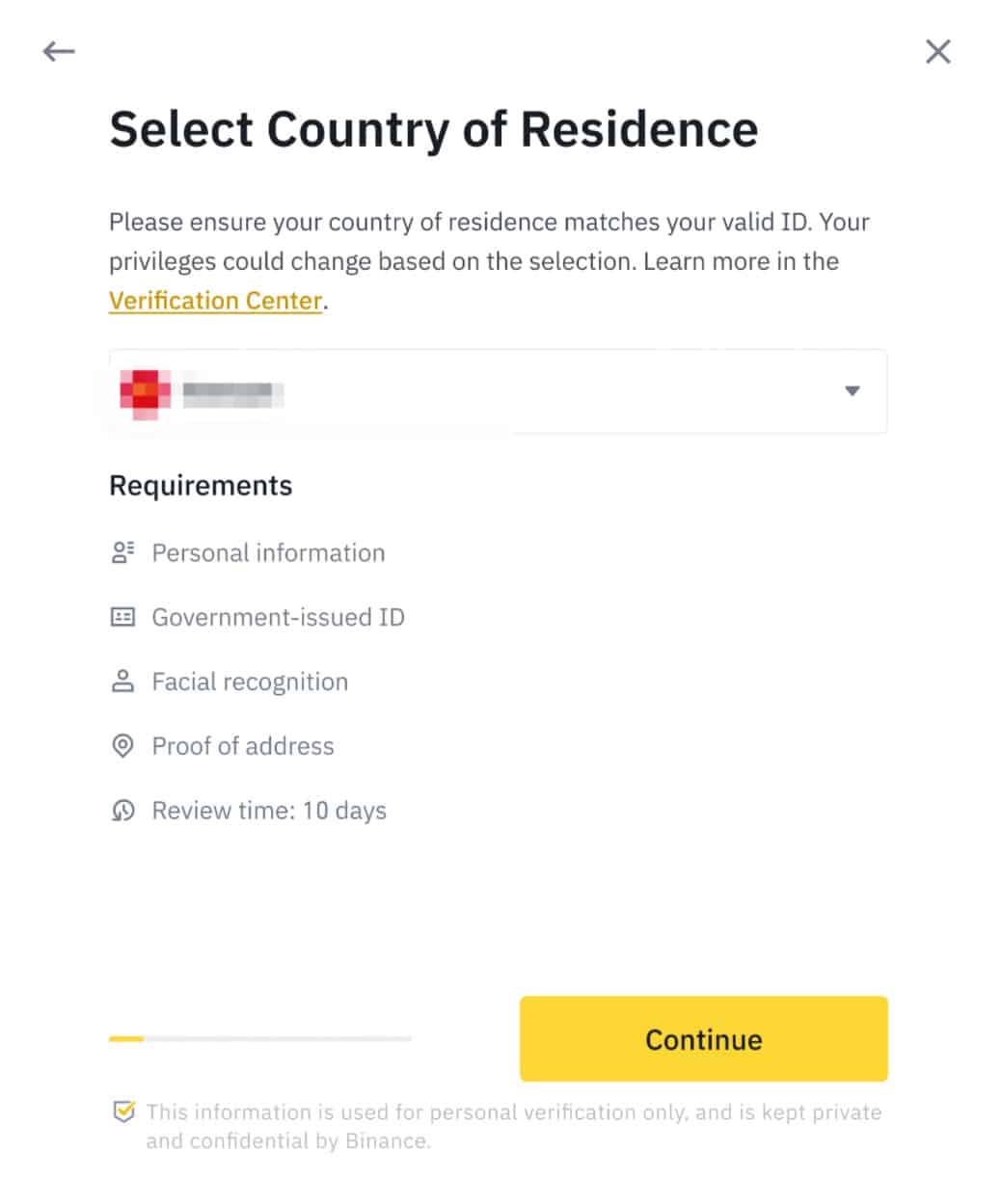

Step 3: Select your country of residence.

Ensure that your country of residence is consistent with your ID documents.

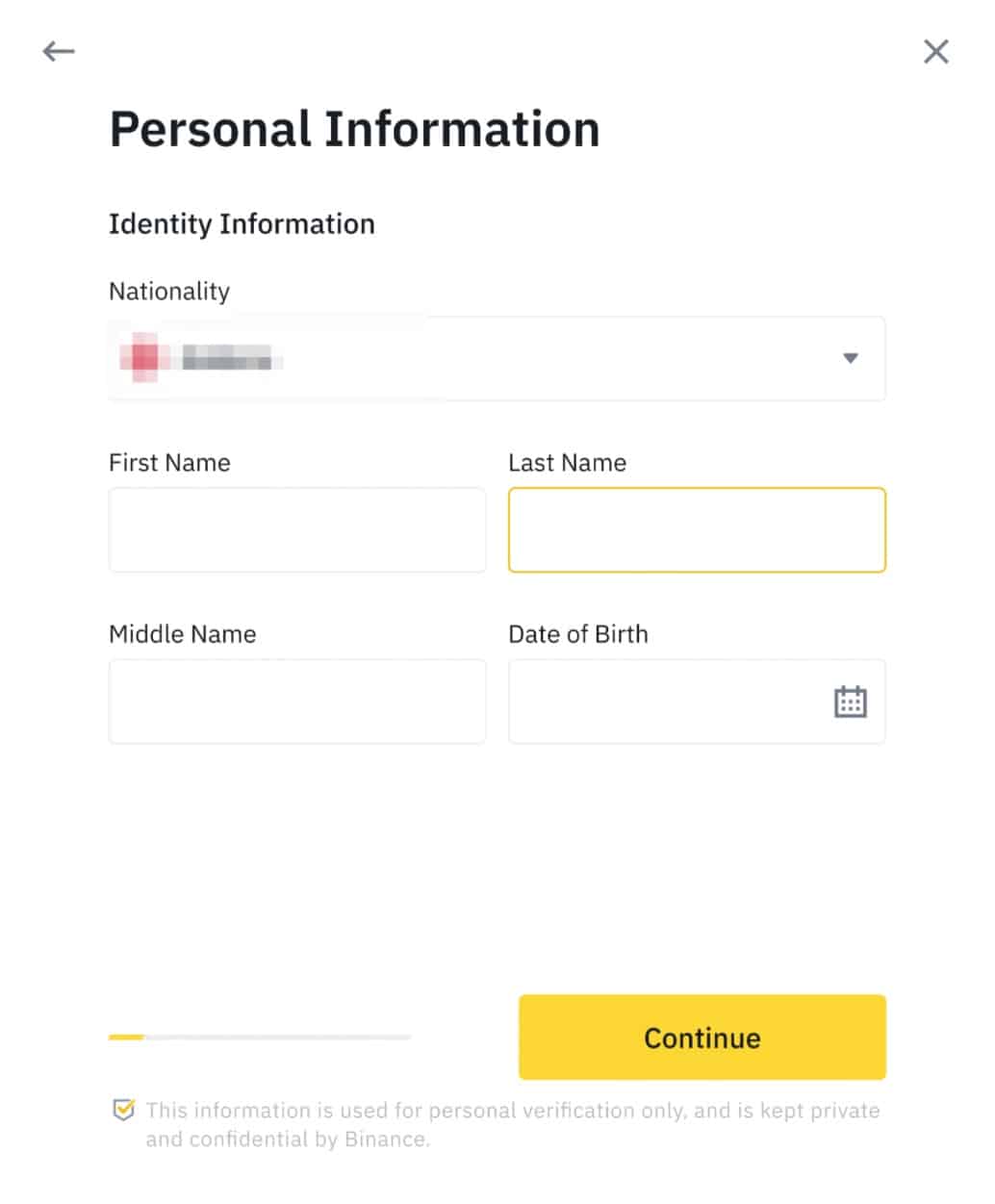

Step 5: Enter your personal information and click “Continue.”

You won’t be able to change it once confirmed.

Refer to the respective options offered for your country.

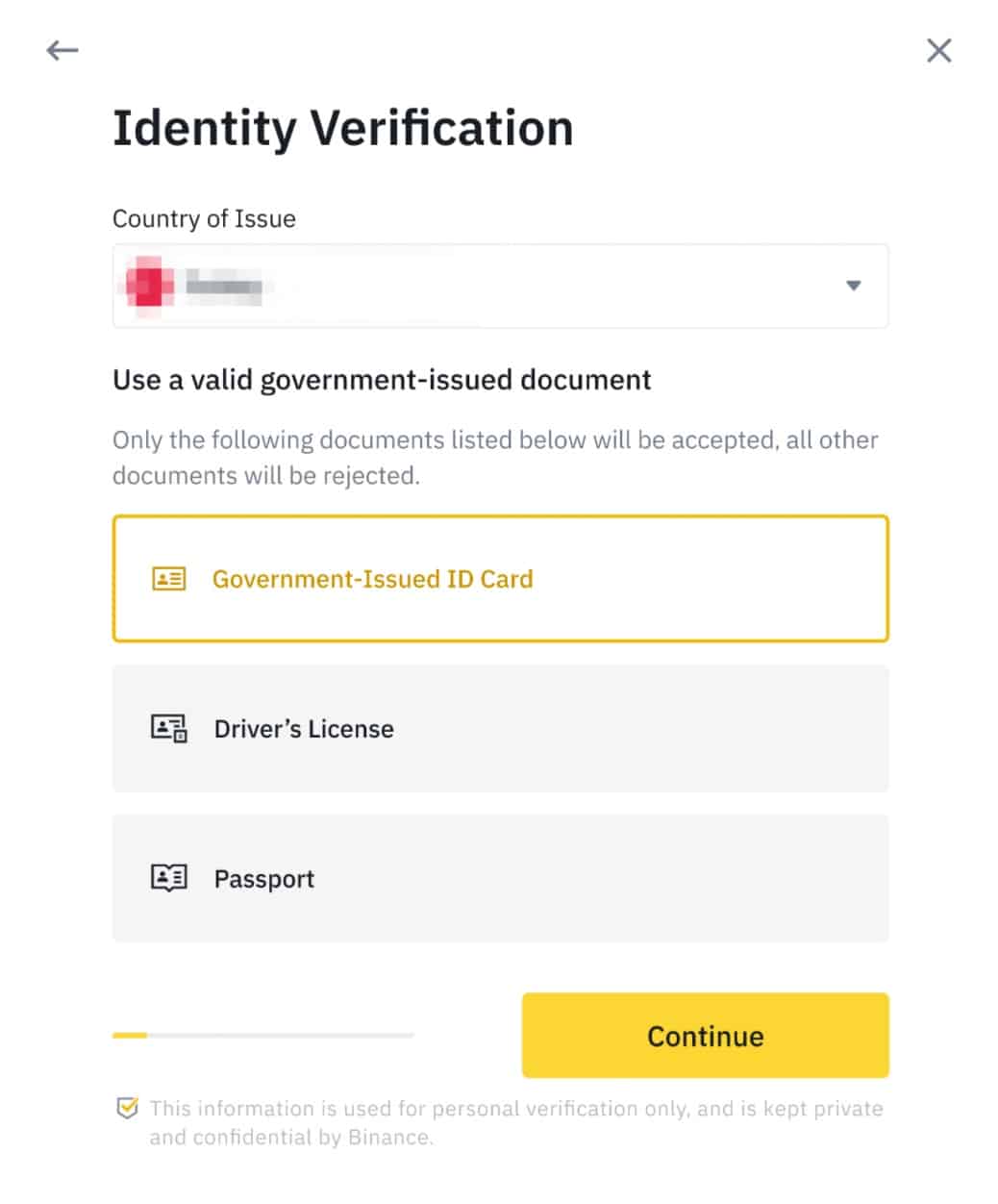

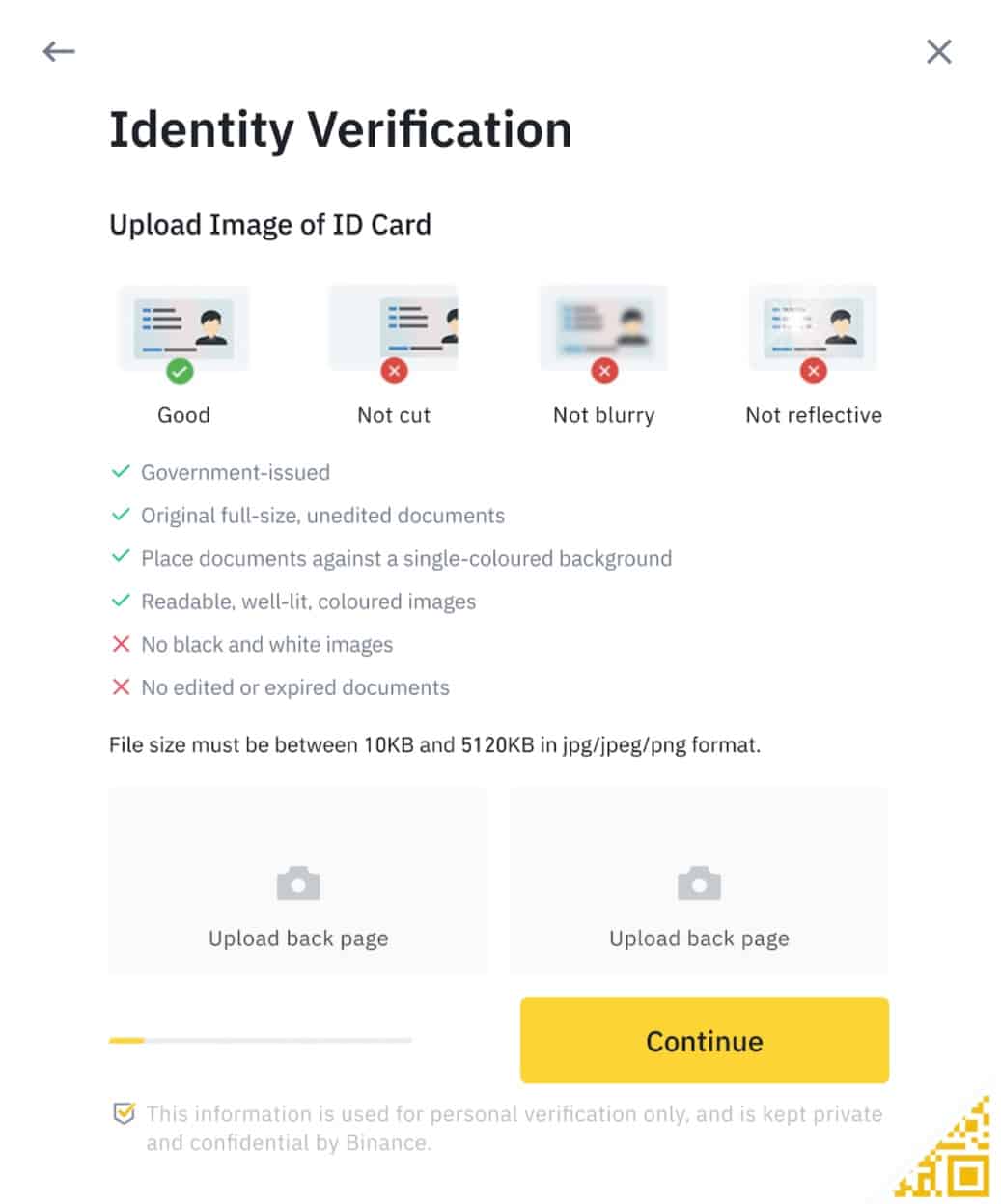

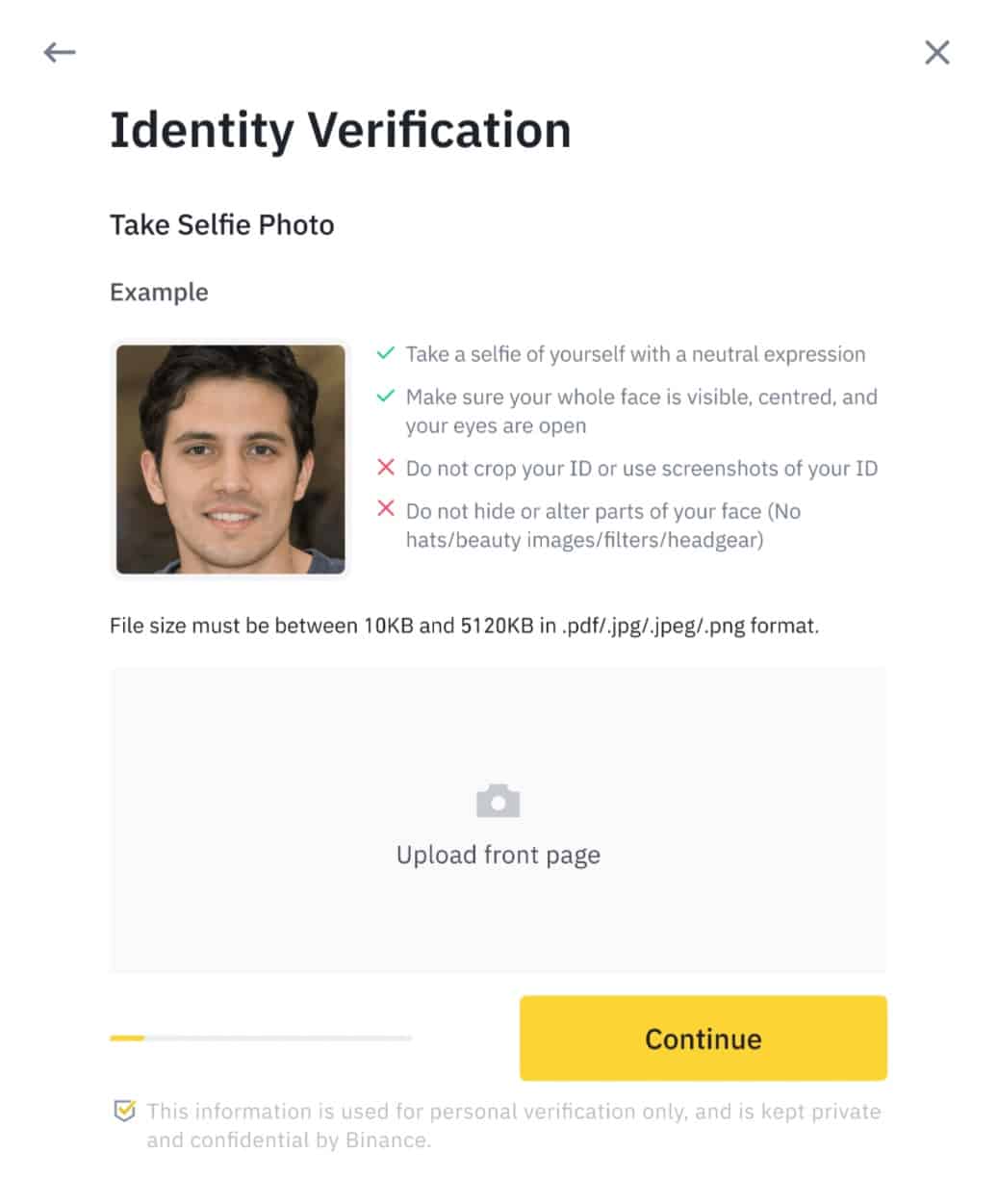

Step 7: Follow the instructions to upload photos of your document. Your photos should clearly show the full ID document.

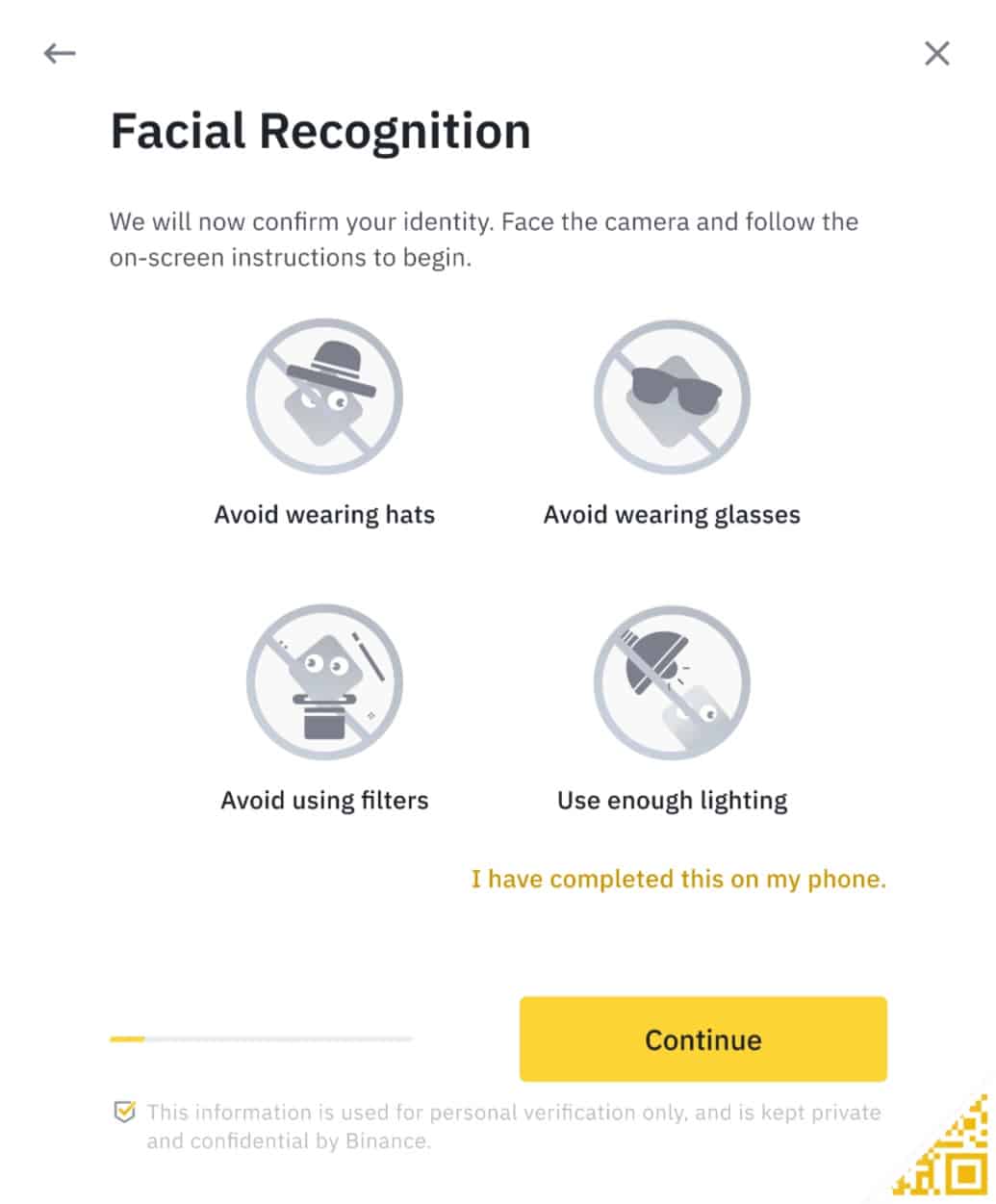

Do not wear hats, glasses, or use filters, and make sure that the lighting is sufficient.

Once your application has been verified, you will receive an email notification.

How to buy cryptocurrency on Binance

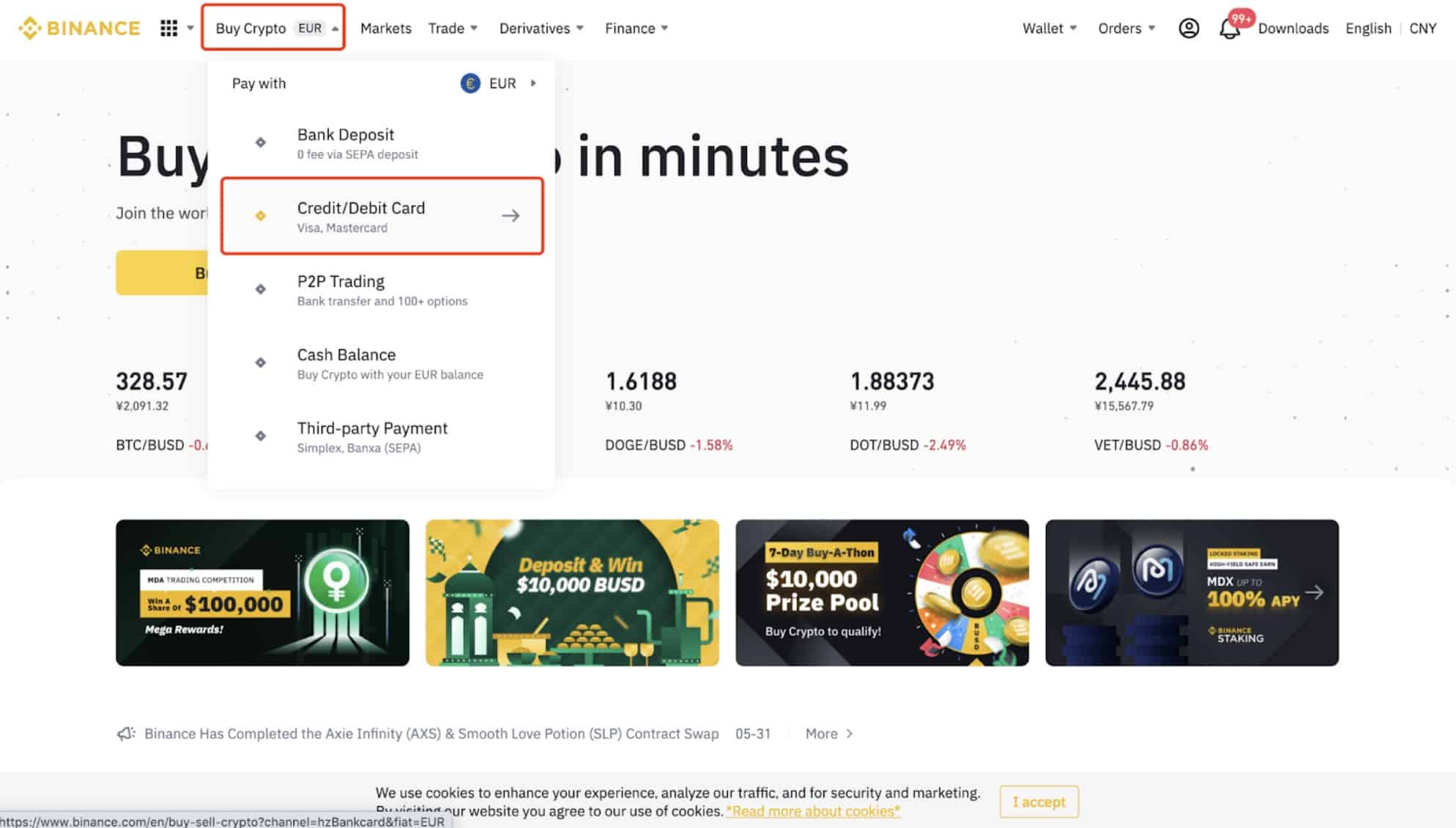

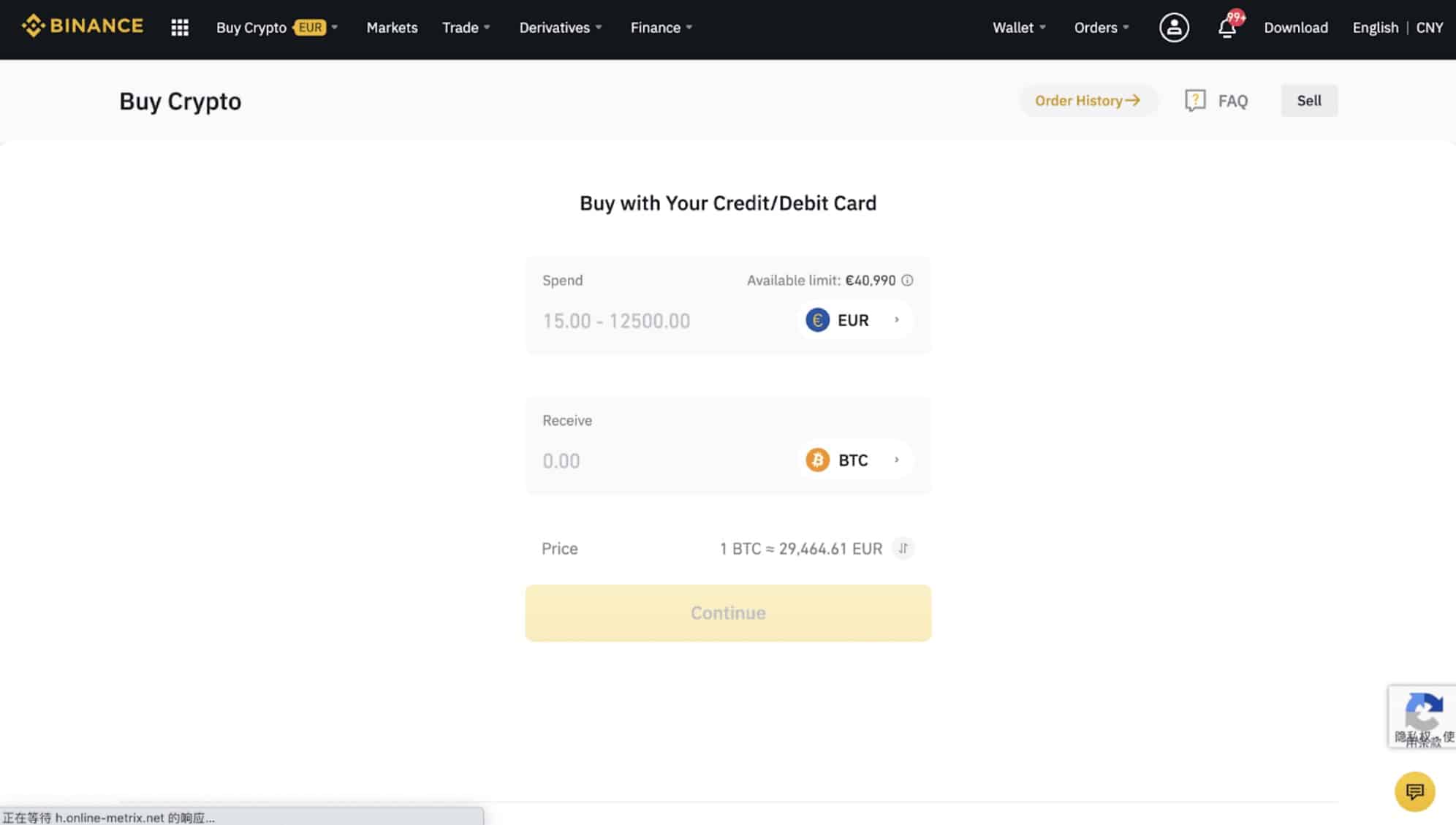

Step 1: Log in to your Binance account and click “Buy Crypto” and then “Credit/Debit Card”.

Step 2: Here you can choose to buy crypto with different fiat currencies. Enter the fiat amount you want to spend and the system will automatically display the amount of crypto you can get. When you have selected the amount you wish to spend then press “Continue”.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

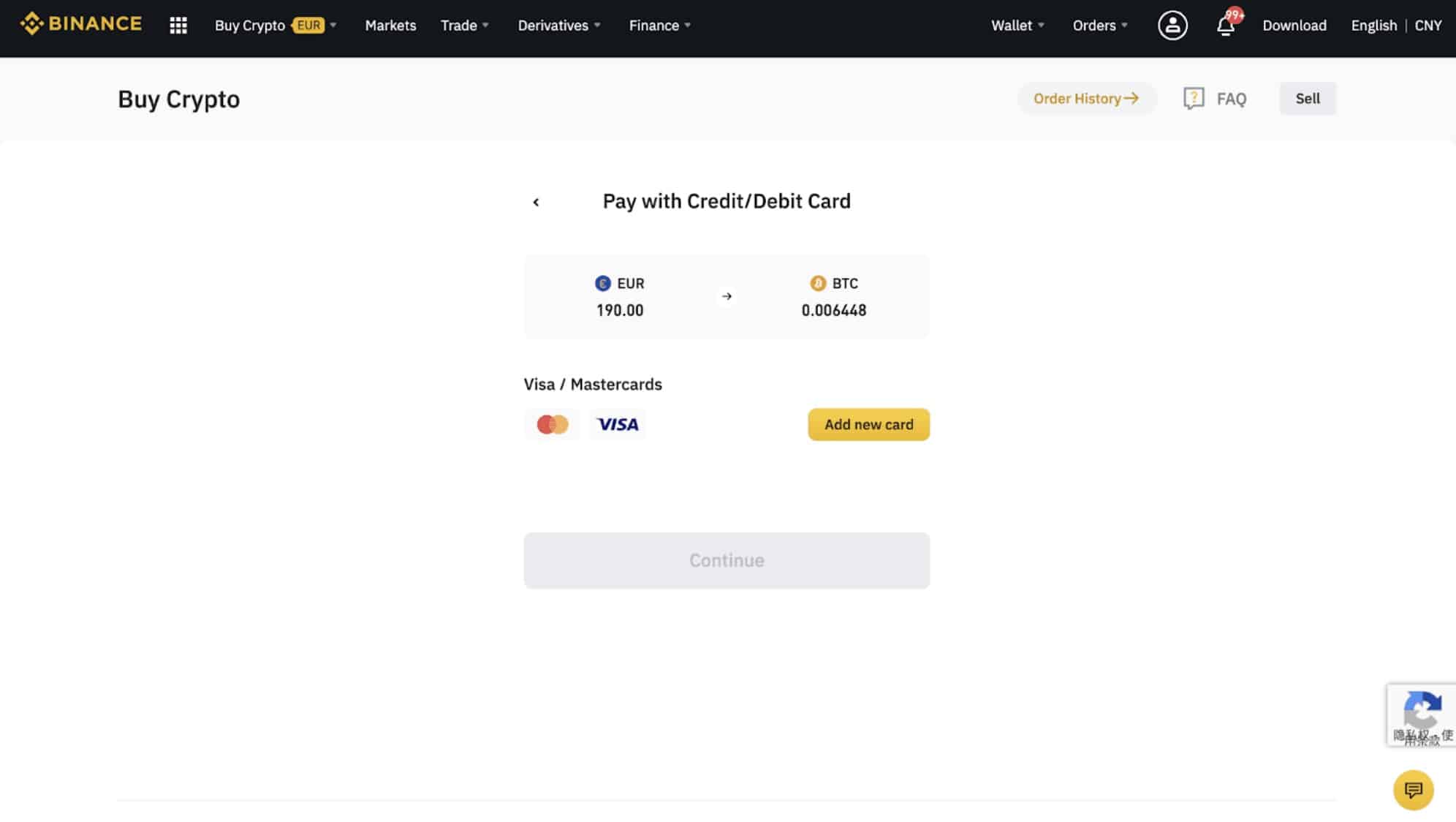

Step 3: Click “Add New Card”. Then enter your credit card details and your billing address.

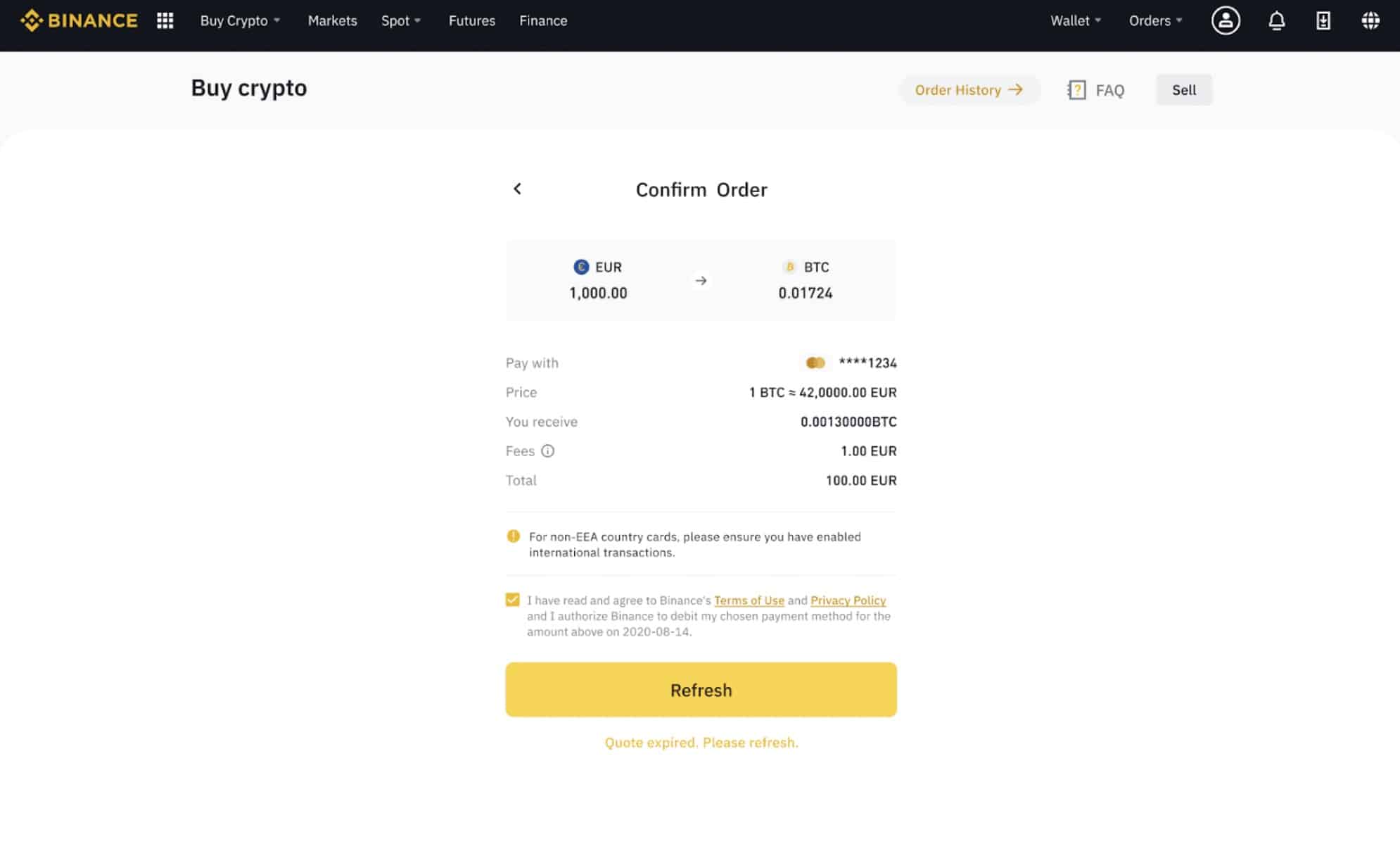

Step 4: Check the payment details and confirm your order within 1 minute. After 1 minute, the price and the amount of crypto you will get will be recalculated. You can click “Refresh” to see the latest market price. You will then be redirected to your bank’s OTP Transaction Page. Follow the on-screen instructions to verify the payment.

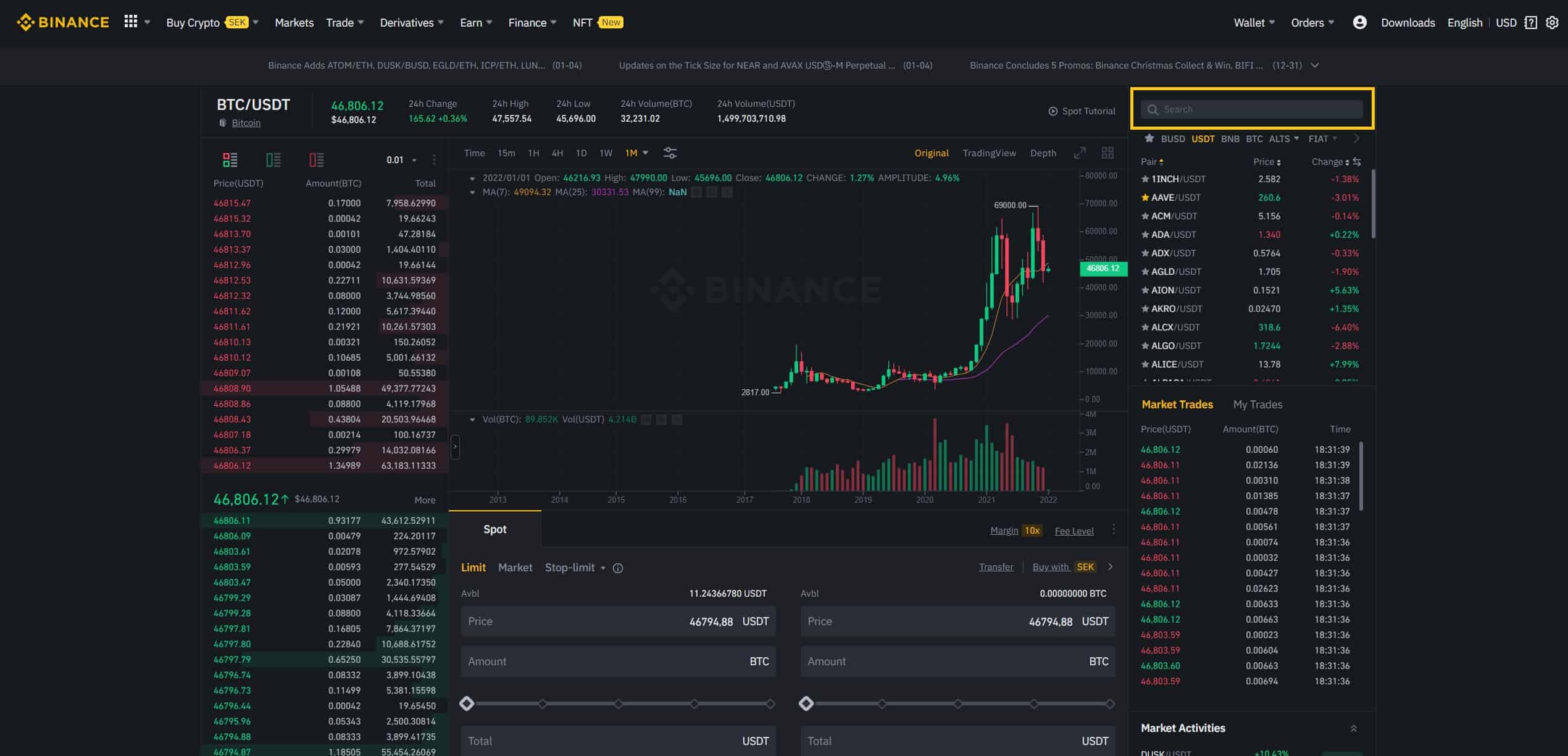

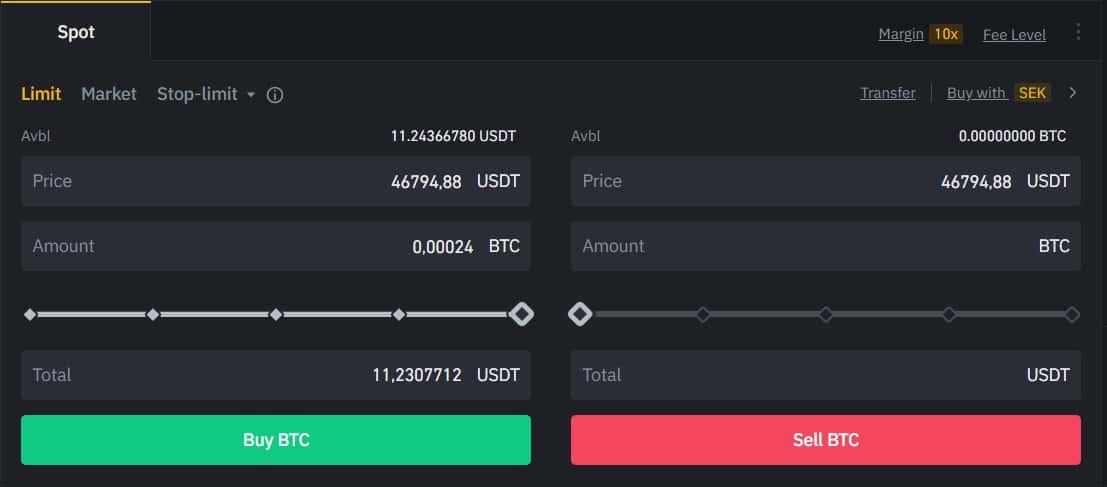

How to Conduct Spot Trading on Binance

Step 1: Log in to your Binance account.

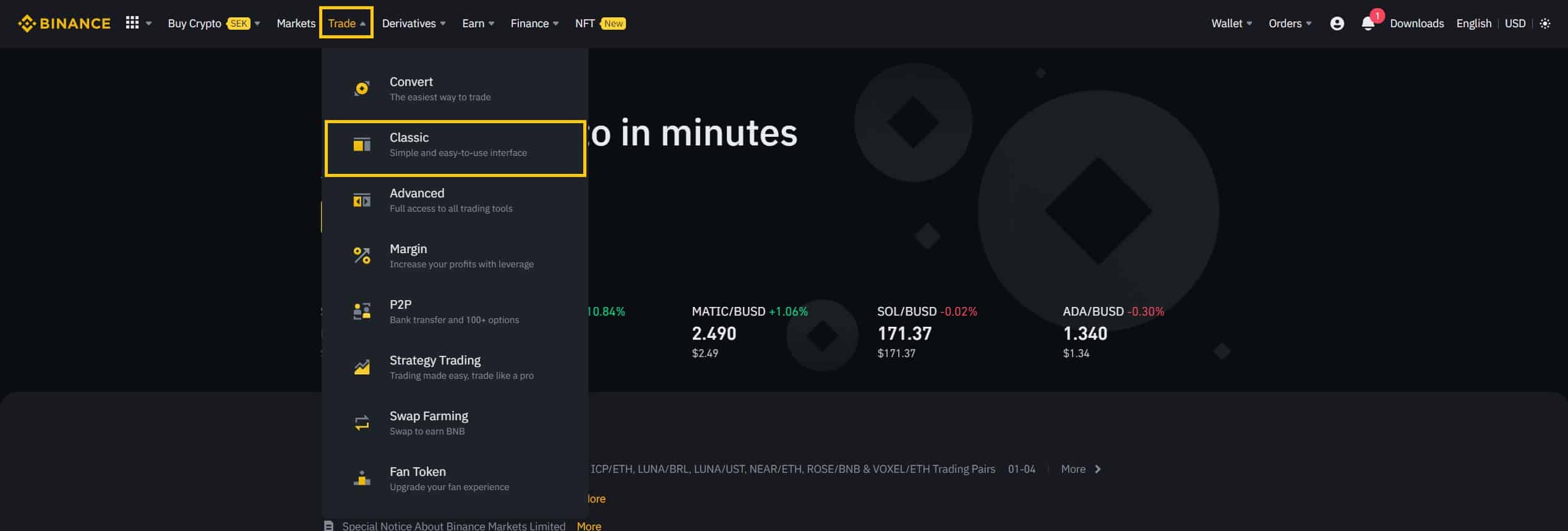

Click on “Classic” under “Trade” on the top navigation bar.

Step 2: Search and enter the cryptocurrency you want to trade.

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

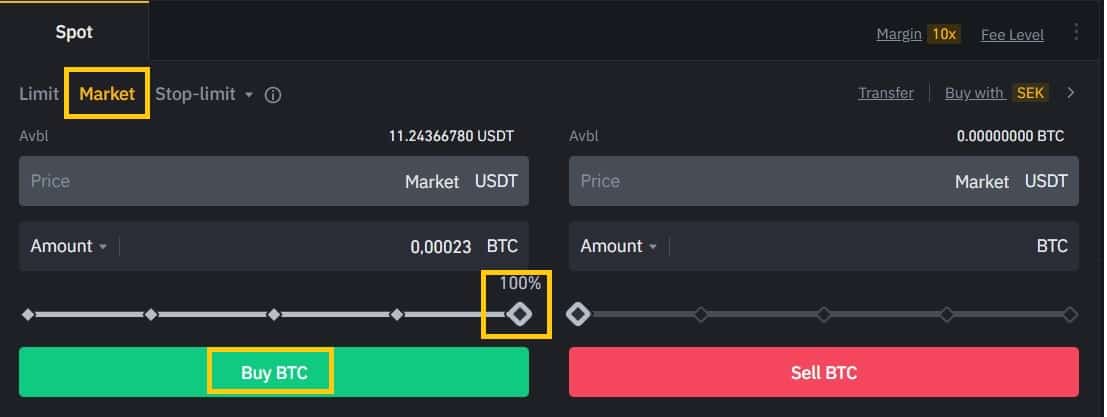

Step 4: If you don’t want to set a manual price, you can place a “Market Order” to set the buying/selling price automatically.

Hide Detailed Instructions

If you’re looking for more detailed instructions on buying cryptocurrency, our “Absolute Beginner’s Guide to Cryptocurrency Investing” can take you through the process step-by-step. This guide also covers how to send and receive cryptocurrency.

If you’re brand new to the world of cryptocurrency, don’t worry! We offer beginner, intermediate, and advanced level articles to help you get up to speed with everything you need to know. These articles cover a wide range of topics, so whether you’re just starting out or looking to expand your knowledge, we’ve got you covered. With our resources, you can confidently navigate the cryptocurrency space and make informed investment decisions.

What is Liquity (LQTY)?

Liquity is a revolutionary decentralized borrowing protocol that enables users to obtain interest-free loans using Ether (ETH) as collateral. Loans are disbursed in the form of LUSD, a stablecoin pegged to the US dollar, and borrowers must maintain a minimum collateral ratio of 110% at all times. The protocol is designed to be non-custodial, immutable, and devoid of governance, ensuring decentralization and security.

Liquity aims to address the prevalent issue of centralized stablecoins, such as Tether and USDC, that are currently dominating the stablecoin market. By providing a more capital-efficient and user-friendly method for borrowing stablecoins, Liquity promotes decentralization and reduces reliance on centralized assets.

Key Advantages of Liquity

Liquity offers several benefits to its users, including:

- 0% interest rate: Borrowers can enjoy loans without worrying about accumulating debt over time.

- Minimum collateral ratio of 110%: This allows for more efficient utilization of deposited ETH.

- Governance-free: The protocol is fully automated and algorithmic, with parameters set at the time of contract deployment.

- Directly redeemable: LUSD can be redeemed for the underlying collateral at face value whenever desired.

- Fully decentralized: The protocol is censorship-resistant, with no admin keys and accessible via multiple interfaces hosted by different Frontend Operators.

Using Liquity

To access Liquity, users must choose a web interface or frontend, which are operated by third-party applications and integration services. By interacting with these frontends, users can leverage the core functionalities of Liquity.

Main Use Cases of Liquity

The primary use cases for Liquity include:

- Borrowing LUSD against ETH by opening a Trove.

- Securing Liquity by providing LUSD to the Stability Pool in exchange for rewards.

- Staking LQTY to earn fee revenue from borrowing or redeeming LUSD.

- Redeeming 1 LUSD for 1 USD worth of ETH when the LUSD peg falls below $1.

Understanding LUSD and LQTY

LUSD is the USD-pegged stablecoin used to disburse loans on the Liquity protocol, and it can be redeemed against the underlying collateral at face value. LQTY, on the other hand, is a secondary token issued by Liquity that captures fee revenue generated by the system and incentivizes early adopters and frontends. The total LQTY supply is capped at 100,000,000 tokens.

Getting Started with Liquity

To borrow LUSD, all you need is a wallet (e.g., MetaMask) and sufficient Ether to open a Trove and pay the gas fees. To become a Stability Pool depositor or LQTY staker, you need to have LUSD and/or LQTY tokens. LUSD can be borrowed by opening a Trove, while LQTY can be earned as a Stability Pool depositor or purchased on decentralized exchanges like Uniswap.

Understanding Fees and Earnings in Liquity

Fees in the Liquity protocol play a crucial role in maintaining its stability and are applied to certain transactions. There are one-time fees associated with borrowing LUSD and redeeming LUSD. For borrowers, a borrowing fee is charged as a percentage of the loan amount (in LUSD). Conversely, redeemers are subject to a redemption fee on the amount they receive from the system (in ETH) when exchanging LUSD for ETH. It is important to note that repaying a loan as a borrower is free of charge, and redemption is a separate process.

Both fees depend on redemption volumes, meaning they increase with every redemption based on the redeemed amount, and decay over time as long as no redemptions occur. This design is intended to regulate large redemptions with higher fees and limit borrowing immediately after high redemption volumes. The fee decay ensures that fees for both borrowers and redeemers gradually decrease when redemption volumes are low.

The fees cannot drop below 0.5% (except in Recovery Mode), protecting the redemption facility from misuse by arbitrageurs front-running the price feed. The borrowing fee is capped at 5%, ensuring that the system remains attractive to borrowers even during phases of monetary contraction due to redemptions.

Earning Opportunities in Liquity

Liquity offers two primary methods for users to generate revenue:

- Depositing LUSD in the Stability Pool to earn liquidation gains (in ETH) and LQTY rewards.

- Staking LQTY tokens to earn LUSD and ETH revenue from borrowing and redemption fees.

Risk Considerations in Liquity

As a non-custodial system, all tokens sent to the protocol are managed algorithmically without interference from any person or legal entity. This means that user funds are subject only to the rules established in the smart contract code. Liquity’s code has been audited twice by Trail of Bits and once by Coinspect to ensure its security (find their reports here).

However, users should be aware of two scenarios where they might lose a portion of their funds:

- If a borrower’s (Trove owner) ETH collateral is liquidated, they will retain their borrowed LUSD, but their Trove will be closed, and the collateral will be used to compensate Stability Pool depositors.

- As a Stability Pool depositor, a user’s deposited LUSD may be used to repay debt from liquidated borrowers. Since liquidations are triggered when borrowers’ collateral drops below 110%, depositors are likely to receive more ETH in return. However, if ETH’s price decreases and they maintain exposure, the total value of their pool deposits may decline.

It’s essential to note that LUSD’s peg to the USD is not perfect, and deviations in both directions can occur under certain market conditions. Additionally, while the system has been carefully audited, the possibility of a hack or bug resulting in user losses cannot be completely ruled out.

Liquity development updates in 2023

In 2023, Liquity, a decentralized borrowing protocol, has undergone several key developments, reflecting its growing influence in the decentralized finance (DeFi) space. Here are the most significant updates:

Ecosystem Expansion into Layer 2 Networks: Liquity has extended its reach into Layer 2 networks like Optimism and Arbitrum. This expansion allows LUSD and LQTY tokens to be bridged to these networks, benefiting from the efficiencies of rollups. Notably, Liquity received a 75,000 ARB allocation from the Arbitrum Foundation, and its integration with Camelot Dex on Arbitrum has been particularly successful. This expansion into Layer 2 networks broadens the user base for Liquity’s tokens and opens up new use cases.

Integrations with Major DeFi Projects: Liquity’s stablecoin, LUSD, has been increasingly integrated into various DeFi projects. For instance, Aave has added LUSD on Ethereum, Optimism, and Arbitrum, and the community unanimously approved its addition as a collateral asset. Other significant integrations include Preon Finance and Polynomial Finance on Optimism, enhancing the utility and presence of LUSD in the DeFi ecosystem.

Improved Peg Stability and Key Metrics: Liquity has maintained the stability of its LUSD peg, with minimal deviations observed. This stability is a crucial aspect of its appeal in the DeFi space. Additionally, Liquity experienced growth in the number of troves and open loans, reaching new highs despite market fluctuations. The total value locked (TVL) in the protocol also showed resilience, underpinning the robustness of Liquity’s smart contracts.

DeFi Treasury Holdings and Chicken Bonds: Liquity has seen increased adoption by DeFi treasuries, with platforms like Olympus DAO, Synthetix, and Dopex adding LUSD to their holdings. Chicken Bonds, a unique DeFi primitive introduced by Liquity, also saw a resurgence in popularity, contributing to the growth of LUSD liquidity on Curve and enhancing the ecosystem’s overall liquidity.

Liquidity and Market Comparisons: In the competitive landscape of borrowing platforms, Liquity has remained a strong contender, offering low-cost loans with ETH collateral. Compared to other platforms like Aave and MakerDAO, Liquity’s borrowing costs are more favorable for users. Moreover, the circulating supply of LUSD has shown a positive growth trajectory, contrasting with the trends observed in other crypto asset-backed stablecoins like DAI and Frax.

These developments underscore Liquity’s commitment to expanding its footprint in the DeFi space, offering robust, decentralized financial services, and maintaining its position as a key player in the stablecoin and lending markets.

Official website: https://www.liquity.org/

Best cryptocurrency wallet for Liquity (LQTY)

Navigating the world of cryptocurrency wallets can be quite an adventure, as there are numerous options available to suit different needs. To find the perfect wallet for you, consider your trading habits and the level of security you require. Generally, there are two main categories of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical).

Each type of wallet comes with its own set of advantages and drawbacks, so there isn’t necessarily a one-size-fits-all solution. As you embark on your journey to find the best crypto wallet for your Liquity (LQTY) tokens, remember to keep an open mind and explore the features that align with your personal preferences and requirements.

When choosing the right wallet for your Liquity (LQTY) tokens, consider the following factors:

- Trading frequency: Hot wallets are generally more suitable for active traders due to their quick login capabilities, allowing for seamless buying and selling of crypto. Cold wallets, on the other hand, are better suited for those who make less frequent trades.

- Supported cryptocurrencies: Although not all wallets cater to every cryptocurrency, some of the best ones can trade a vast array of currencies, offering a versatile experience. Make sure the wallet you choose supports Liquity (LQTY).

- Security concerns: If you’re worried about potential hacking incidents, a physical cold wallet stored in a safe deposit box or a secure location at home provides the highest level of protection. However, if you’re confident in safeguarding your hot wallet, you might prefer its convenience.

- Associated costs: Investigate the costs of each wallet option. While many hot wallets are free to set up, cold wallets, being hardware devices, will require an upfront investment.

- Wallet features: While the basic functions of cryptocurrency wallets remain the same, additional features can distinguish one wallet from another. Hot wallets often come with advanced reporting tools, crypto market insights, and currency conversion capabilities. Security features can also be an essential factor when making your decision.

By considering all of these aspects, you’ll be better equipped to select the perfect cryptocurrency wallet for your Liquity (LQTY) tokens.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re planning to handle larger amounts of crypto, investing in cold storage can be a wise decision. Two of the most popular cold storage options are the Ledger Nano and the Trezor.

Ledger creates cold storage wallets designed for users who prioritize security. Their wallets are physical devices that connect to your computer, and you can only send cryptocurrency from them when they’re connected. Ledger offers a range of products, including the Ledger Nano S and the Ledger Nano X, which features Bluetooth connectivity.

Trezor, a trailblazer in the hardware wallet industry, combines top-notch security with an intuitive interface and compatibility with various desktop wallets. This blend makes it suitable for both beginners and experienced users. Trezor has earned a great deal of respect within the Bitcoin community over time. They offer two primary models – the Trezor One and the Trezor Model T, which comes with a built-in touchscreen.

Liquity (LQTY) Price & Charts

- Market Capitalization And Daily Trading Volume

- Current Market Price Of Every Cryptocurrency Relative To USD (And Some Local Currencies)

- Circulating And Total Supply

- Historical Charts With Prices Relative To USD, Bitcoin (BTC), And Ethereum (ETH).