How to buy Pendle (PENDLE): A Simple Guide

In this comprehensive guide to Pendle (PENDLE), we will delve deeper into the intricate workings of the project, and also offer practical advice on how to buy and securely store your Pendle (PENDLE) tokens. Understanding the context of Pendle’s creation, its underlying technology, and its mission are essential to appreciate the value it brings to the ecosystem, giving you the knowledge and confidence to join the Pendle (PENDLE) community.

Where to buy Pendle (PENDLE)?

Buying Pendle (PENDLE) involves a three-step process. First, set up an account on a reputable cryptocurrency exchange that supports Pendle (PENDLE). Next, deposit funds into your account, taking into consideration the different fee structures associated with various payment methods such as credit and debit cards, e-wallets, and direct bank transfers. Lastly, purchase Pendle (PENDLE) on the exchange by inputting the amount you wish to spend, with the platform calculating the equivalent amount of Pendle (PENDLE) based on the current market rate. We recommend buying Pendle (PENDLE) on any of the following cryptocurrency exchanges:

1

Binance

Fees (Maker/Taker) 0.075%*-0.1%*

Cryptocurrencies

Available for Trade 500+

Sign-up bonus

10% reduced trading fees*

Available in

Europe, Asia, Oceania, Africa

2

MEXC

Fees (Maker/Taker) 0.2%*-0.2%*

Cryptocurrencies

Available for Trade 1500+

Sign-up bonus

10% reduced trading fees & up to $170 in USDT vouchers*

Available in

North America, South America, Europe, Asia, Oceania, Africa

Understanding Pendle (PENDLE):

An In-depth Guide to Its Features and Use Cases

Website: https://www.pendle.finance/

Twitter: https://twitter.com/pendle_fi

Pendle is a novel DeFi protocol designed to optimize and manage yield through a permissionless yield-trading platform. In traditional finance, the yield from an asset is uncertain and fluctuates due to numerous factors such as market trends and other micro-economic factors. Similar fluctuations occur in DeFi yield, and it is this uncertainty that Pendle seeks to address.

Pendle operates by tokenizing yield, thereby allowing users to trade and manage their yield separately from their assets. To achieve this, Pendle employs the concept of Yield Tokenization. Initially, the protocol wraps yield-bearing tokens into Standardized Yield Tokens (SY), effectively making these tokens compatible with the Pendle Automated Market Maker (AMM). The SY token is then split into Principal Tokens (PT) and Yield Tokens (YT). This splitting process is what Pendle refers to as yield-tokenization, as it allows the yield from an asset to be tokenized into a separate entity.

Apart from yield tokenization, Pendle also employs a governance system called vePENDLE. vePENDLE allows users to lock their PENDLE tokens for a period and, in return, gain voting power in the Pendle ecosystem. The more PENDLE tokens locked and the longer the lock period, the more vePENDLE value and voting power a user gets. This governance system enables users to influence decisions in the ecosystem and earn from swap fees and YT fees.

In terms of tokenomics, Pendle uses its native token, PENDLE, which is used within its ecosystem for various functions. Users can earn PENDLE as rewards for providing liquidity and can also use it within the governance system. By locking their PENDLE tokens for vePENDLE, users can vote and earn from protocol revenue.

Pendle aims to bring traditional finance’s vast interest derivative market, worth over $400 trillion in notional value, to the DeFi space, making it accessible to all. It allows users to execute advanced yield strategies such as fixed yield, long yield, and earn more yield without additional risks. This functionality sets Pendle apart, enabling users to gain greater control over their yield while maximizing earning potential.

How does Pendle (PENDLE) work?

Pendle works by leveraging the concept of yield tokenization. It first wraps yield-bearing assets into standardized yield tokens (SY) that are compatible with the Pendle Automated Market Maker (AMM). These SY tokens are then split into Principal Tokens (PT) and Yield Tokens (YT). The PT represents the principal amount of the yield-bearing token, while the YT represents the future yield of the yield-bearing token. This separation is what is known as yield-tokenization, effectively allowing users to trade yield separately from their assets.

Both the PT and YT can be traded on the Pendle AMM. The PT and YT tokens also have a maturity date. For PT, holders can redeem the full underlying yield-bearing token after this date. For YT, the yield of the yield-bearing token is only accrued up until the maturity date, after which the YT has no value.

In addition to trading, Pendle users can also provide liquidity to the protocol. In return for providing liquidity, users receive swap fees generated by the pool, PENDLE incentives, and protocol incentives emitted by the underlying asset, such as COMP or AAVE.

The Pendle governance system, vePENDLE, allows users to lock PENDLE tokens for a period to gain vePENDLE, which gives them voting power within the Pendle ecosystem. The voting power enables them to vote for their preferred pool to incentivize liquidity, with voters receiving a portion of the swap fees collected by the pool. vePENDLE holders also receive a share of the protocol’s revenue, derived from swap fees and YT fees.

Security is also a key component of Pendle. Its codebase has been fully audited by reputable auditors, and all identified flaws have been addressed. However, users are still advised to exercise caution as Pendle interacts with third-party protocols and contracts, and there is inherent risk associated with the smart contracts and systems deployed by these third-party protocols.

By providing an innovative platform for tokenizing yield, Pendle aims to empower users with enhanced control over their assets’ yield, allowing them to devise and implement advanced yield strategies. Whether it’s hedging against yield downturns or maximizing yield exposure in bullish markets, Pendle provides the tools necessary for efficient yield management.

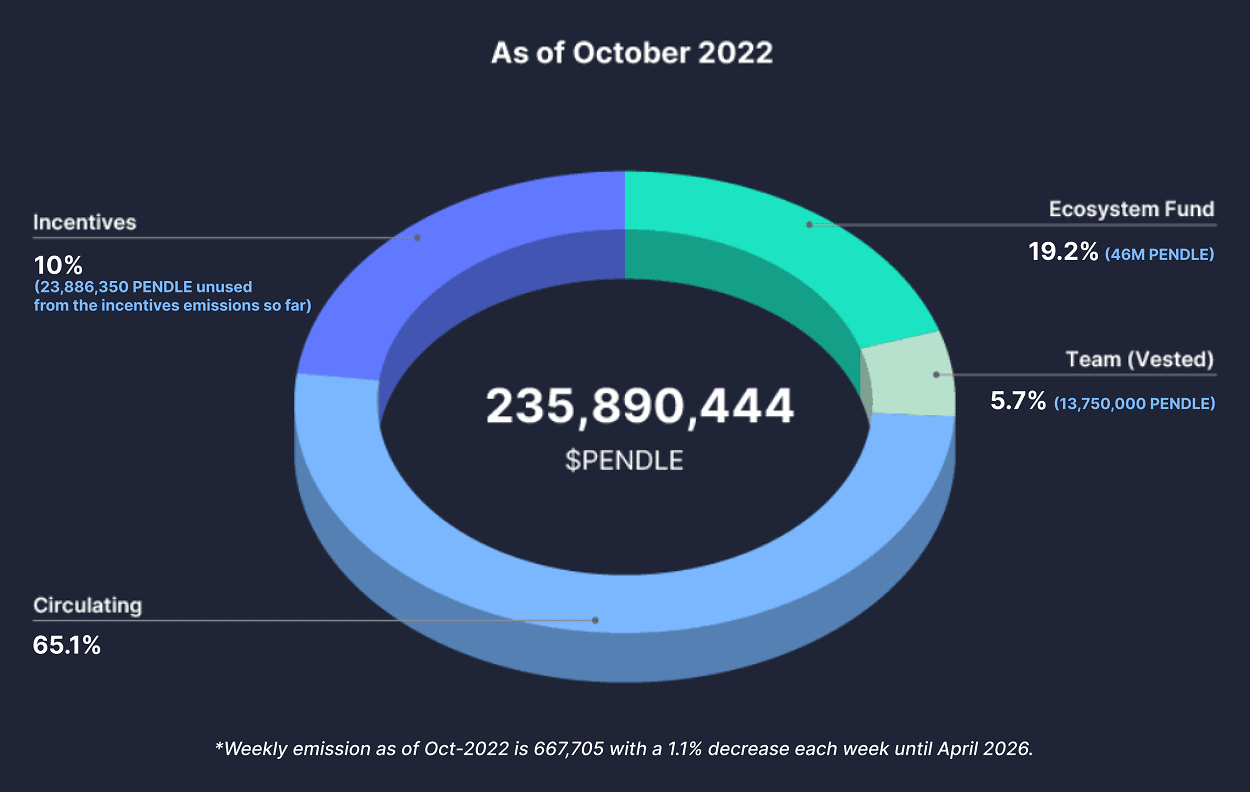

PENDLE Tokenomics

Pendle has implemented an innovative and dynamic tokenomic model aimed at supporting the sustainability and growth of the ecosystem. The PENDLE token, the native token of Pendle, forms the backbone of this model. As of October 2022, the PENDLE distribution mechanism allows for a weekly emission of 667,705 tokens, and this is expected to decrease by 1.1% each week until April 2026.

Team tokens have been programmed to vest up until April 2023. Beyond this period, any increase in the circulating supply will be a result of incentives and ecosystem development. The current tokenomics in place projects a terminal inflation rate of 2% per annum, specifically designed to encourage active participation in the network.

The flexibility of Pendle’s tokenomic structure lies in its capacity to adapt and evolve as the industry matures. This fluidity ensures that changes can be proposed and implemented based on the progressive evolution of ecosystem best practices. By this measure, PENDLE’s distribution aims to balance both the short-term incentives and the long-term health of the protocol.

However, it’s essential to note that the intrinsic value of PENDLE extends beyond mere transactional purposes. PENDLE serves as an instrumental tool for maintaining and reinforcing the robustness of the Pendle protocol, paving the way for a sustainable and decentralized finance ecosystem.

What is PENDLE / vePENDLE?

Pendle is a cutting-edge protocol designed to facilitate the trading of future yield via a decentralized platform. At the heart of Pendle’s governance model lies the Vote-Escrowed PENDLE, or vePENDLE. This unique feature enables an enhanced degree of decentralization within the protocol. PENDLE token holders can lock their tokens and in turn receive vePENDLE. The vePENDLE value is proportional to the amount and duration staked, with each wallet associated with a single vePENDLE expiry date.

Furthermore, vePENDLE serves as an additional sink to reduce the supply of PENDLE tokens, thus boosting the token’s stability and contributing significantly to the overall health and success of the Pendle ecosystem. This makes vePENDLE an integral tool in maintaining the long-term viability of the protocol.

One of the unique features of the vePENDLE system is the incentive channeling mechanism. vePENDLE holders have the power to vote for and direct the flow of rewards to different pools. This mechanism effectively incentivizes liquidity in the pool that the vePENDLE holders vote for. Therefore, the more vePENDLE a user holds, the more incentives they can channel.

The vePENDLE model also provides additional perks, including boosted rewards for liquidity providers and entitlements to a share of swap fees. All these features combine to create a robust, dynamic, and user-centric governance model, making vePENDLE a critical component of the Pendle ecosystem.

Pendle development updates in 2023

Pendle has made significant progress throughout 2023. Here’s an overview of the most important updates:

- Completed Milestones: Pendle has achieved several key milestones:

- Mainnet Launch on Ethereum: Successfully launched its mainnet on Ethereum.

- Partnerships: Forged strategic partnerships with Aura, Balancer, and Rocket Pool. It also collaborated with Camelot and participated in Stargate.

- Pendle v2 Achievements: Pendle v2 crossed $100 million in total value locked (TVL) and cumulative traded volume. Additionally, Pendle’s Principal Token (PT) began being used as collateral in a money market. The protocol also attained the #7 spot on DefiLlama’s list of DEXes across all chains based on volume and surpassed Uniswap and Curve in wstETH trading volume.

- Real-World Asset (RWA) Product: Pendle introduced a product that allows users to profit from real-world assets. This product utilizes MakerDao’s boosted Savings (sDAI) and Flux Finance’s fUSDC, marking a significant step in integrating DeFi with traditional financial assets.

- Growth in Total Locked Value: The protocol experienced a surge in the total locked value of assets on the platform, rising over 300% since the start of the year, attracting over $50 million amid renewed interest from traders.

- Crypto Market Performance: Pendle’s performance on the crypto market has been notable, especially after its listing on Binance’s Innovation Zone. The token experienced rapid price fluctuations following the listing, reflecting its speculative nature and the influence of market news on its price. Despite facing challenges in the past, 2023 has been a positive year for the token’s market performance, with a significant rise from the lows of late 2022.

- Current Roadmap and Future Developments: Pendle plans to expand its operations to the BNB Chain and introduce Pendle Earn, a new simplified UI offering decentralized fixed-rate products using PT tokens. Additionally, the protocol is working towards enabling permissionless listings on its app, allowing any protocols to set up a yield market.

These developments indicate Pendle’s commitment to innovation in the DeFi space, particularly in yield management and integration with real-world financial assets. The protocol’s growth in TVL and its dynamic performance in the crypto market underscore its potential and growing relevance in the DeFi ecosystem.

How to safely store your Pendle (PENDLE) Tokens

Best cryptocurrency wallet for Pendle (PENDLE)

Navigating the world of cryptocurrency wallets can be quite an adventure, as there are numerous options available to suit different needs. To find the perfect wallet for you, consider your trading habits and the level of security you require. Generally, there are two main categories of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical).

Each type of wallet comes with its own set of advantages and drawbacks, so there isn’t necessarily a one-size-fits-all solution. As you embark on your journey to find the best crypto wallet for your Pendle (PENDLE) tokens, remember to keep an open mind and explore the features that align with your personal preferences and requirements.

When choosing the right wallet for your Pendle (PENDLE) tokens, consider the following factors:

- Trading frequency: Hot wallets are generally more suitable for active traders due to their quick login capabilities, allowing for seamless buying and selling of crypto. Cold wallets, on the other hand, are better suited for those who make less frequent trades.

- Supported cryptocurrencies: Although not all wallets cater to every cryptocurrency, some of the best ones can trade a vast array of currencies, offering a versatile experience. Make sure the wallet you choose supports Pendle (PENDLE).

- Security concerns: If you’re worried about potential hacking incidents, a physical cold wallet stored in a safe deposit box or a secure location at home provides the highest level of protection. However, if you’re confident in safeguarding your hot wallet, you might prefer its convenience.

- Associated costs: Investigate the costs of each wallet option. While many hot wallets are free to set up, cold wallets, being hardware devices, will require an upfront investment.

- Wallet features: While the basic functions of cryptocurrency wallets remain the same, additional features can distinguish one wallet from another. Hot wallets often come with advanced reporting tools, crypto market insights, and currency conversion capabilities. Security features can also be an essential factor when making your decision.

By considering all of these aspects, you’ll be better equipped to select the perfect cryptocurrency wallet for your Pendle (PENDLE) tokens.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re planning to handle larger amounts of crypto, investing in cold storage can be a wise decision. Two of the most popular cold storage options are the Ledger Nano and the Trezor.

Ledger creates cold storage wallets designed for users who prioritize security. Their wallets are physical devices that connect to your computer, and you can only send cryptocurrency from them when they’re connected. Ledger offers a range of products, including the Ledger Nano S and the Ledger Nano X, which features Bluetooth connectivity.

Trezor, a trailblazer in the hardware wallet industry, combines top-notch security with an intuitive interface and compatibility with various desktop wallets. This blend makes it suitable for both beginners and experienced users. Trezor has earned a great deal of respect within the Bitcoin community over time. They offer two primary models – the Trezor One and the Trezor Model T, which comes with a built-in touchscreen.

Pendle (PENDLE) Price & Charts

- Market Capitalization And Daily Trading Volume

- Current Market Price Of Every Cryptocurrency Relative To USD (And Some Local Currencies)

- Circulating And Total Supply

- Historical Charts With Prices Relative To USD, Bitcoin (BTC), And Ethereum (ETH).

Frequently Asked Questions (FAQ)

Where is the best place to buy Pendle (PENDLE)?

We recommend either Bybit, MEXC or Gate.io as these platforms excel in functionality, reputation, security, customer support, and competitive fees.

How to buy Pendle (PENDLE) in Europe?

In Europe, acquiring Pendle (PENDLE) tokens is a seamless process, with numerous reputable cryptocurrency exchange platforms available to cater to your needs. Among the top choices, we recommend Bybit, MEXC, or Gate.io due to their outstanding performance in key areas such as functionality, reputation, security, customer support, and competitive fees.

These platforms have established a strong presence not only in Europe but also globally, offering an extensive range of cryptocurrencies, including Pendle (PENDLE).

How to buy Pendle (PENDLE) in the US?

For the United States, buying Pendle (PENDLE) tokens is also an effortless process, we particularly recommend MEXC, a top-tier exchange that excels in functionality, reputation, security, customer support, and competitive fees.

MEXC has established a strong presence in the US and across the globe, offering a wide range of cryptocurrencies, including Pendle (PENDLE). Catering to US-based customers, MEXC provides a user-friendly interface, responsive customer support, and multiple payment options, making it easy for users throughout the country to invest in digital currencies.

How much does Pendle (PENDLE) cost to buy?

Unlike traditional trading options, cryptocurrency allows for fractional purchases, so you don’t need to buy whole coins. This flexibility means you can begin investing in Pendle (PENDLE) and other digital currencies with an investment as low as $1!

Is it safe to buy Pendle (PENDLE)?

Safeguarding your investments is a joint effort, and adhering to recommended security practices is crucial. The first step to safely buying Pendle (PENDLE) is selecting a reputable exchange known for its reliability and strong security measures. Make sure to choose an exchange with a proven track record and positive reputation in the industry to minimize potential risks.

Is it Possible to Convert Pendle (PENDLE) to Cash?

Absolutely! After choosing your preferred cryptocurrency exchange platform, you can effortlessly convert your Pendle (PENDLE) tokens into cash at the current market rate using the exchange’s user-friendly trading interface.

What is the Pendle (PENDLE) Crypto Price Forecast?

Accurately predicting the Pendle (PENDLE) price for any time frame is challenging, but various fundamental factors offer insight into the token’s potential price fluctuations and volatility. Essential aspects to consider include:

- Adoption Rate – Increased on-chain activity, driven by the growing number of developers and users on the Pendle (PENDLE) platform, may lead to higher demand and value for it. This expansion could also boost investor confidence, prompting more people to buy and hold the tokens.

- Innovative Developments – The introduction of innovative features that improve Pendle (PENDLE)‘s capabilities can make the project more attractive for usage or investment, potentially driving up the token price. Furthermore, the Pendle (PENDLE) cryptocurrency value may experience a surge following announcements of new partnerships and investments in the project.

- Market Sentiment – The overall market outlook significantly impacts Pendle (PENDLE) crypto price trends. A risk-on attitude among global investors encourages buying activity in the crypto market, supporting Pendle (PENDLE)‘s price. On the other hand, bearish or risk-averse sentiment can trigger sell-offs that may negatively affect the price in the market.