How To Buy Synapse (SYN)?

A common question you often see on social media from crypto beginners is “Where can I buy Synapse?” Well, you’ll be happy to hear it is actually quite a simple and straightforward process.

Step 1: Create an account on an exchange that supports Synapse (SYN)

First, you will need to open an account on a cryptocurrency exchange that supports Synapse (SYN).

We recommend the following based on functionality, reputation, security, support and fees:

1

MEXC

Fees (Maker/Taker) 0.2%*-0.2%*

Cryptocurrencies

Available for Trade 1500+

Sign-up bonus

10% reduced trading fees & up to $170 in USDT vouchers*

Available in

North America, South America, Europe, Asia, Oceania, Africa

In order to sign up, you will need to enter some basic information, such as your email address, password, full name and, in some cases, you might also be asked for a phone number or address.

Note: On specific exchanges, you might need to complete a Know Your Customer (KYC) procedure in order to be able to purchase cryptocurrency. This is most commonly the case with licensed and regulated exchanges.

Step 2: Deposit funds into your account

Many cryptocurrency exchanges will allow you to purchase Synapse (SYN) with fiat currencies, such as EUR, USD, AUD and others. Furthermore, they will also provide you with multiple deposit methods through which you can fund your fiat account, such as credit and debit cards, ewallets or direct bank transfers.

Note: Some payment methods will have higher fees than others, such as credit card payments. Before funding your fiat account on your chosen exchange, make sure to do your due diligence to find out the fees involved with each payment method to avoid unnecessary costs.

Step 3: Buy Synapse (SYN)

This process is similar across almost every cryptocurrency exchange. All you have to do is find a navigation bar or a search bar, and search for Synapse (SYN) or Synapse (SYN) trading pairs. Look for the section that will allow you to buy Synapse (SYN), and enter the amount of the cryptocurrency that you want to spend for Synapse (SYN) or the amount of fiat currency that you want to spend towards buying Synapse (SYN). The exchange will then calculate the equivalent amount of Synapse (SYN) based on the current market rate.

Note: Make sure to always double-check your transaction details, such as the amount of Synapse (SYN) you will be buying as well as the total cost of the purchase before you end up confirming the transaction. Furthermore, many cryptocurrency exchanges will offer you their own proprietary software wallet where you will be storing your cryptocurrencies; however, you can create your own individual software wallet, or purchase a hardware wallet for the highest level of protection.

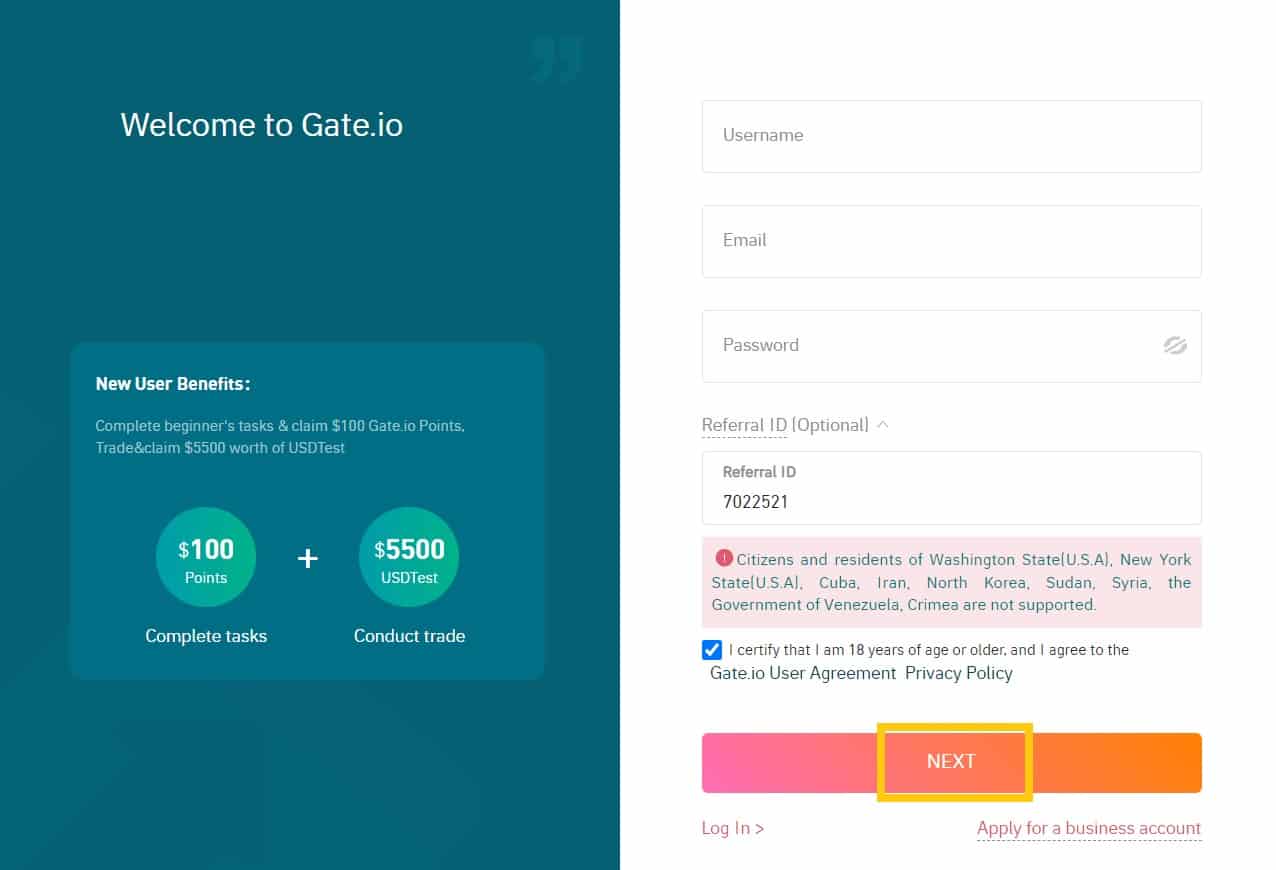

How to create a Gate.io account

![]()

Show Detailed Instructions

Hide Detailed Instructions

Step 1: Go to the Gate.io website.

Step 2: Choose your username, your email address and your password. Then check “I certify that I am 18 years of age or older, and I agree to the Gate.io User Agreement Privacy Policy” and click “NEXT”.

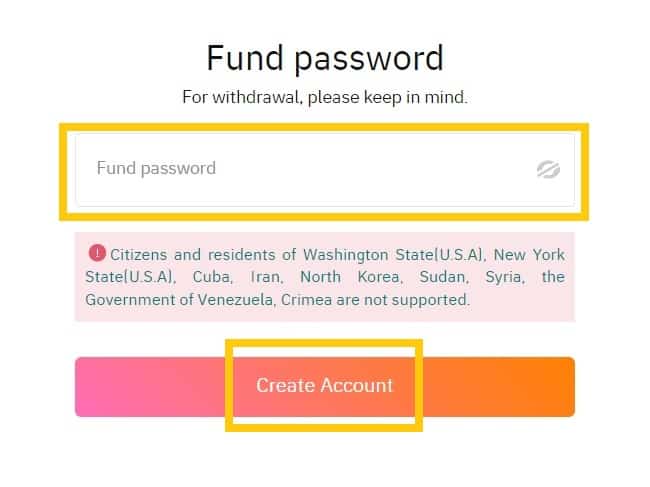

Step 3: Set your fund password and click “Create account”.

Note: Your fund password must contain at least 6 characters and can not be the same as your login password.

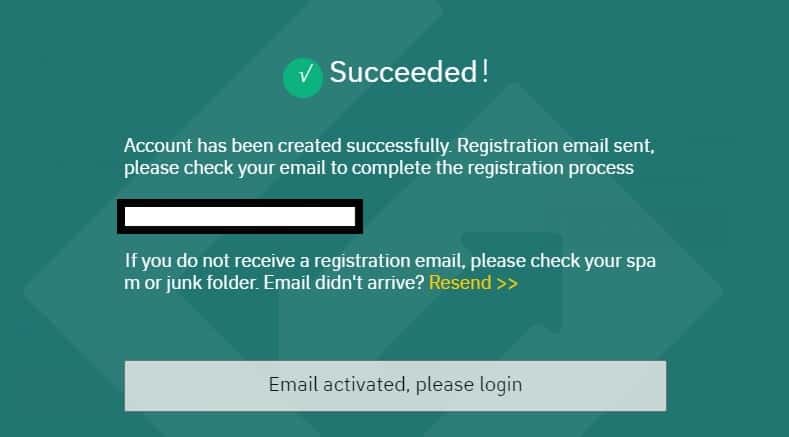

Step 4: An activation email will be sent to your email address. Complete the rest of the registration process by following the instructions in the email to activate your account. Once this is done done, click “Email activated, please log in”.

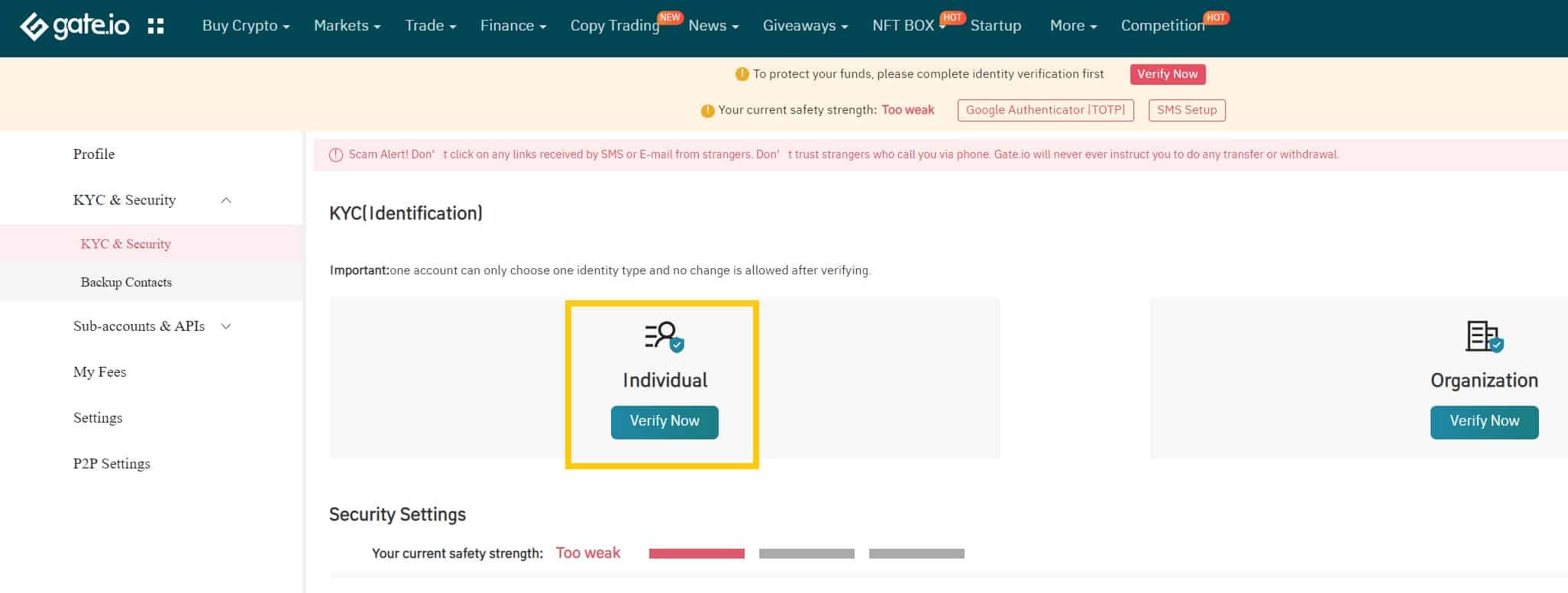

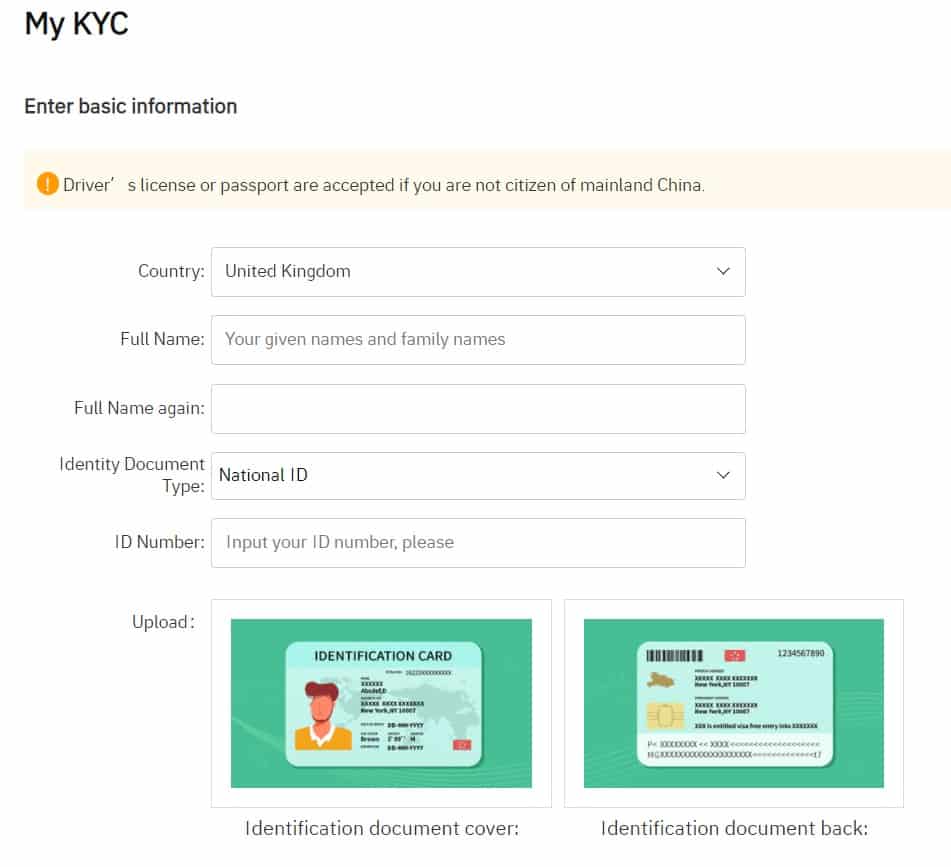

How to complete KYC (ID Verification) on Gate.io

In order to ensure the safety of your assets, and to reduce fraud, money laundering, blackmail, and other illegal activities, Gate.io makes it mandatory that all users obtain KYC ID Verification. Only after your account has obtained KYC ID verification, can you withdraw funds or use credit cards or debit cards to buy cryptocurrencies.

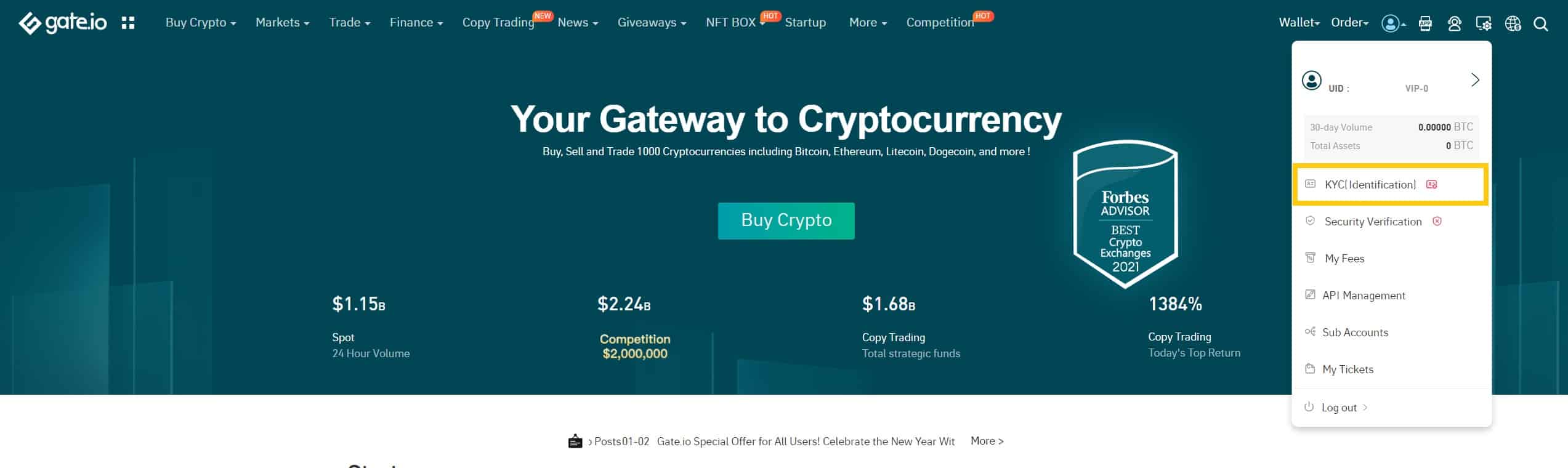

Step 1: Log in to your Gate.io account.

Place your cursor on the top-right profile icon and go to “KYC (ID Verification)”

Step 2: Click “Individual (Verify now)”

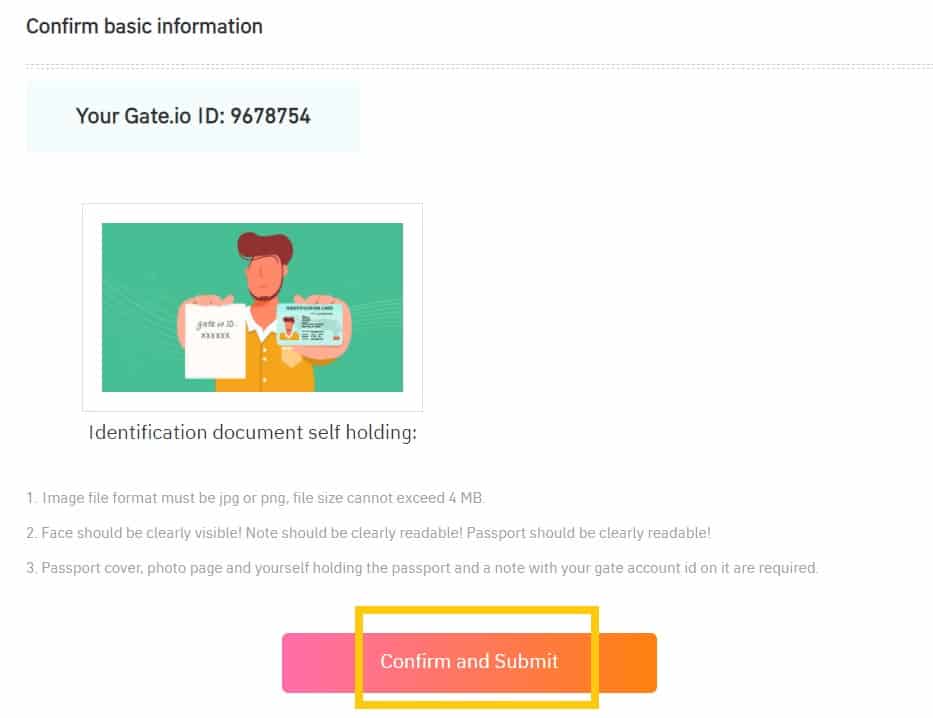

Step 3: Select your country, input your full legal name (twice), fill in your ID information, upload photos of both sides of your ID card, and a photo of you holding your ID together with your User ID (UID) for Gate.io. You will see your User ID by placing the cursor on the top-right profile icon on the main page. Make sure everything is filled in correctly and then click on “Confirm and Submit”.

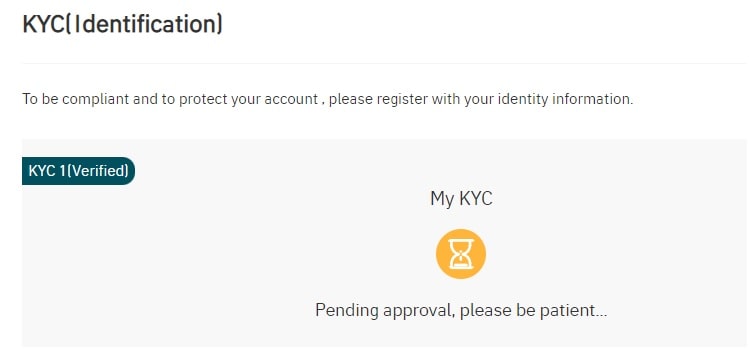

Step 4: After you have submitted all the requested information, you will see the pending approval.

Approval can take anywhere from a few hours to a few days to complete.

Once the KYC is approved, you’re ready to make your first cryptocurrency purchase.

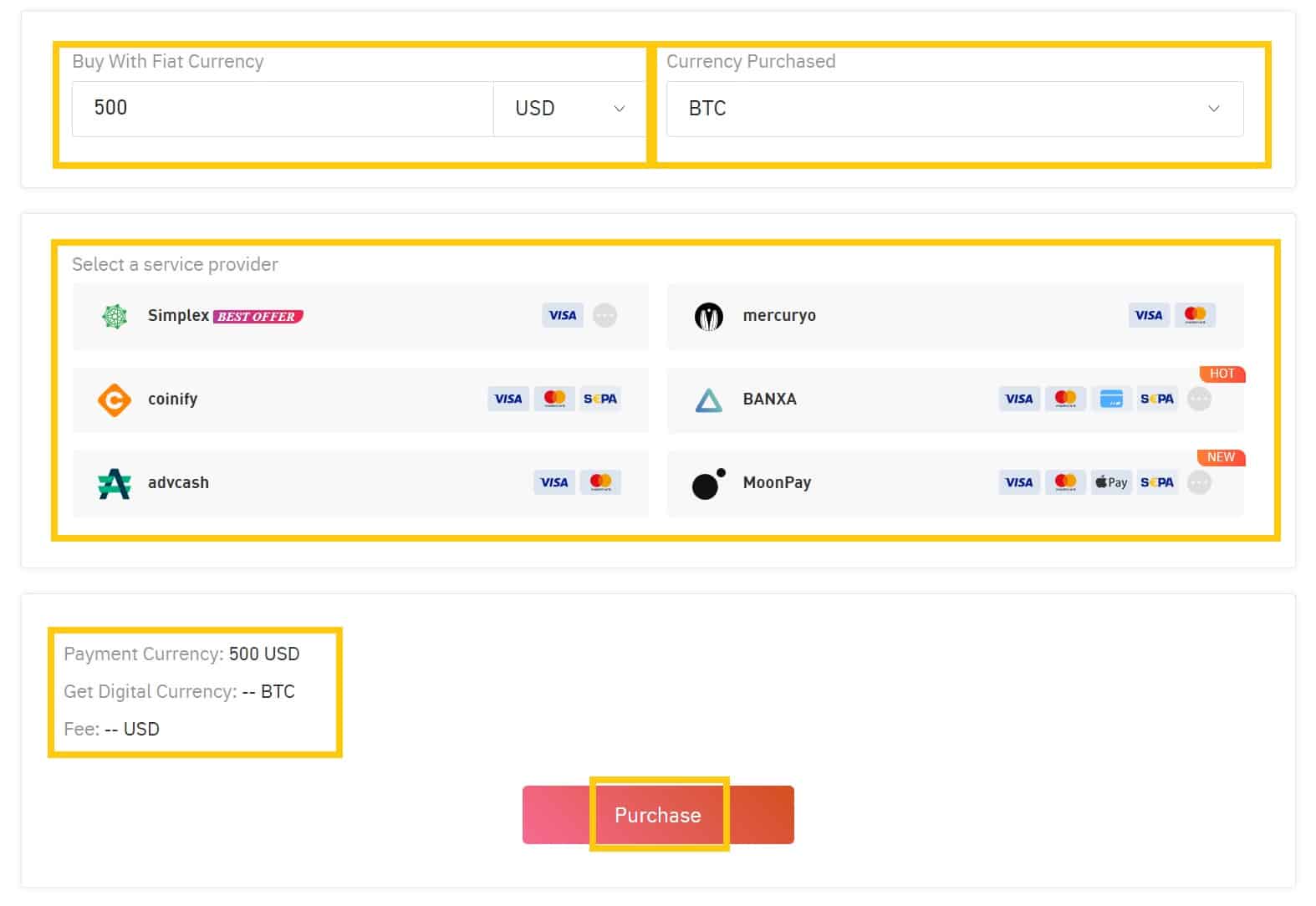

How to buy cryptocurrency on Gate.io

Step 1: Log in to your Gate.io account.

Then in the Menu Bar at the top of the page, click “Buy Crypto” and select “Credit Card”.

Step 2: Enter the amount you wish to spend in the “Buy with Fiat Currency” tab and select the cryptocurrency that you want to buy under the “Currency Purchased” field. Then select one of the “Service Providers” below and click the “Place Order” button to enter the confirmation page.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

Step 3: On the confirmation page, select “Buy Crypto” or the “Create Order” button to complete the payment.

Note: To ensure a quick and secure way of receiving the order, users might need to conduct an additional Identity Verification (KYC) with a third-party service provider. Once successfully verified, the service provider will immediately transfer the cryptocurrencies to your Gate.io account.

How to Conduct Spot Trading on Gate.io

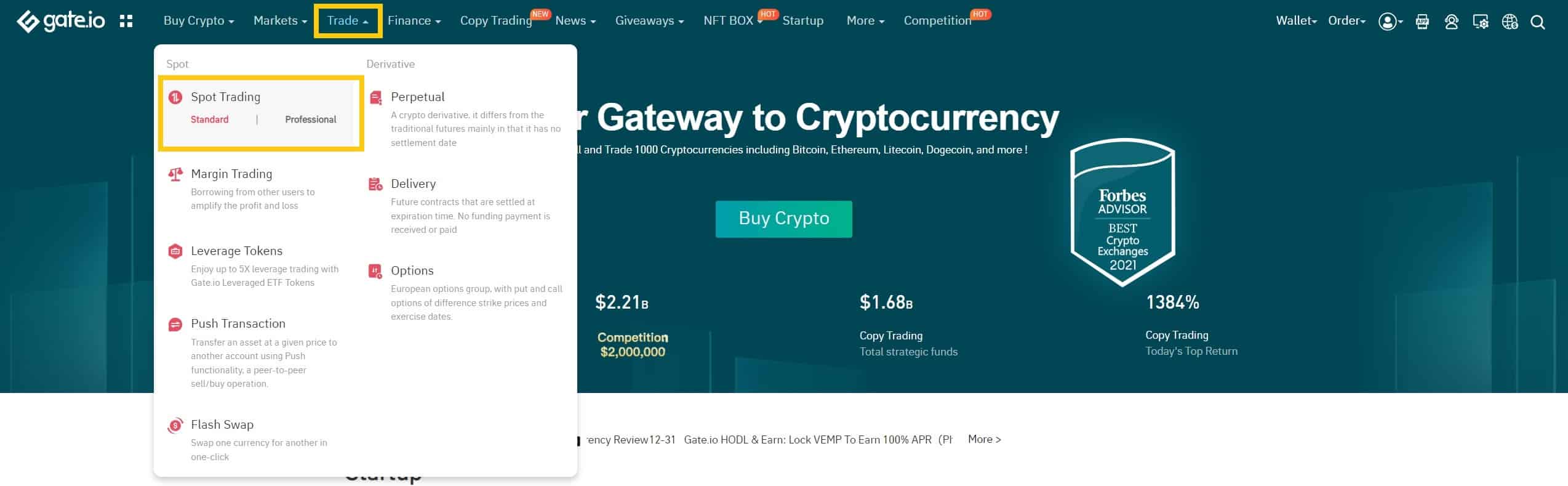

Step 1: Log in to your Gate.io account.

Click on “Spot Trading” under “Trade” on the top navigation bar.

You can either choose “standard” or “professional” version. This tutorial uses the standard version.

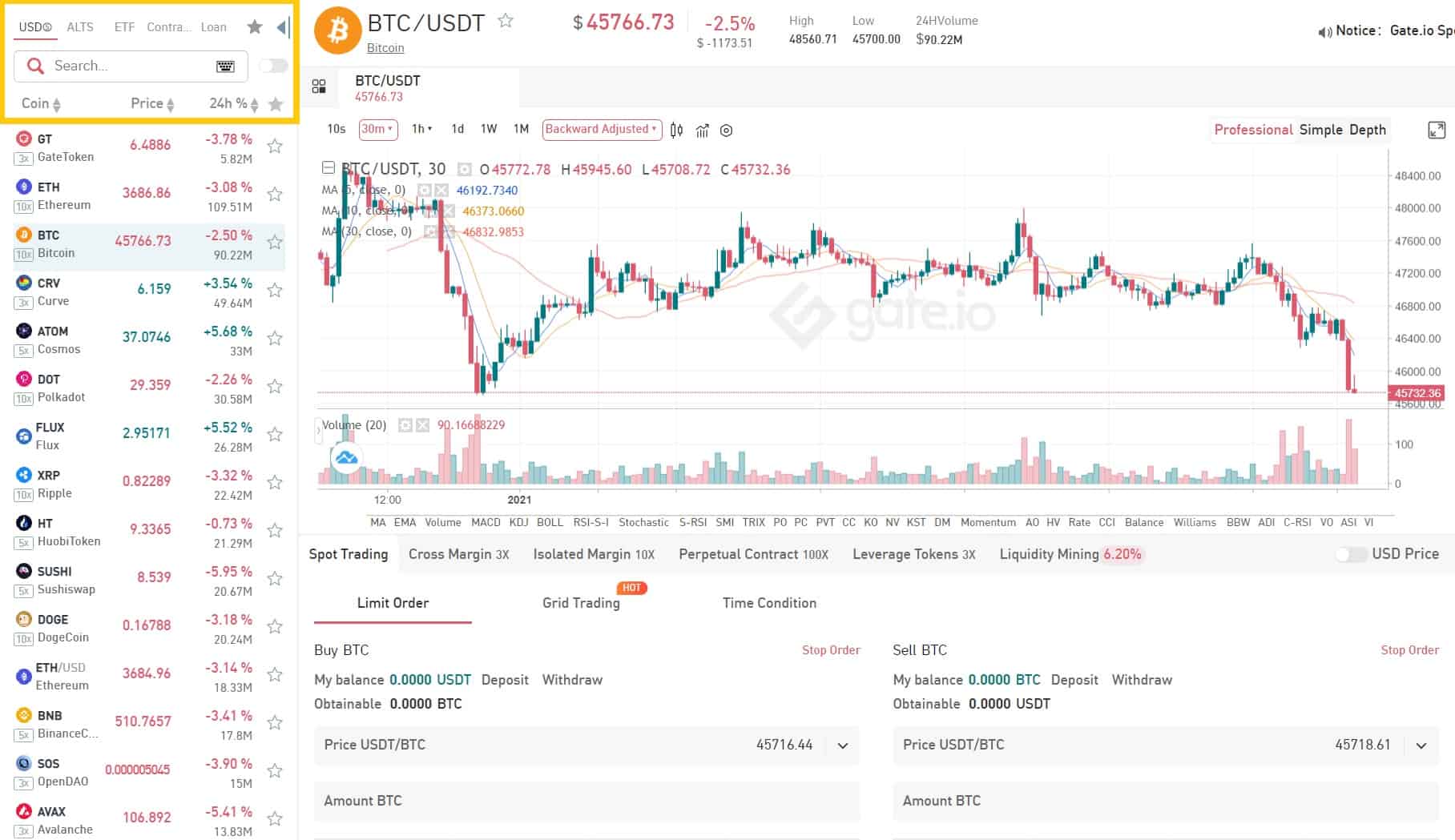

Step 2: Search and enter the cryptocurrency you want to trade.

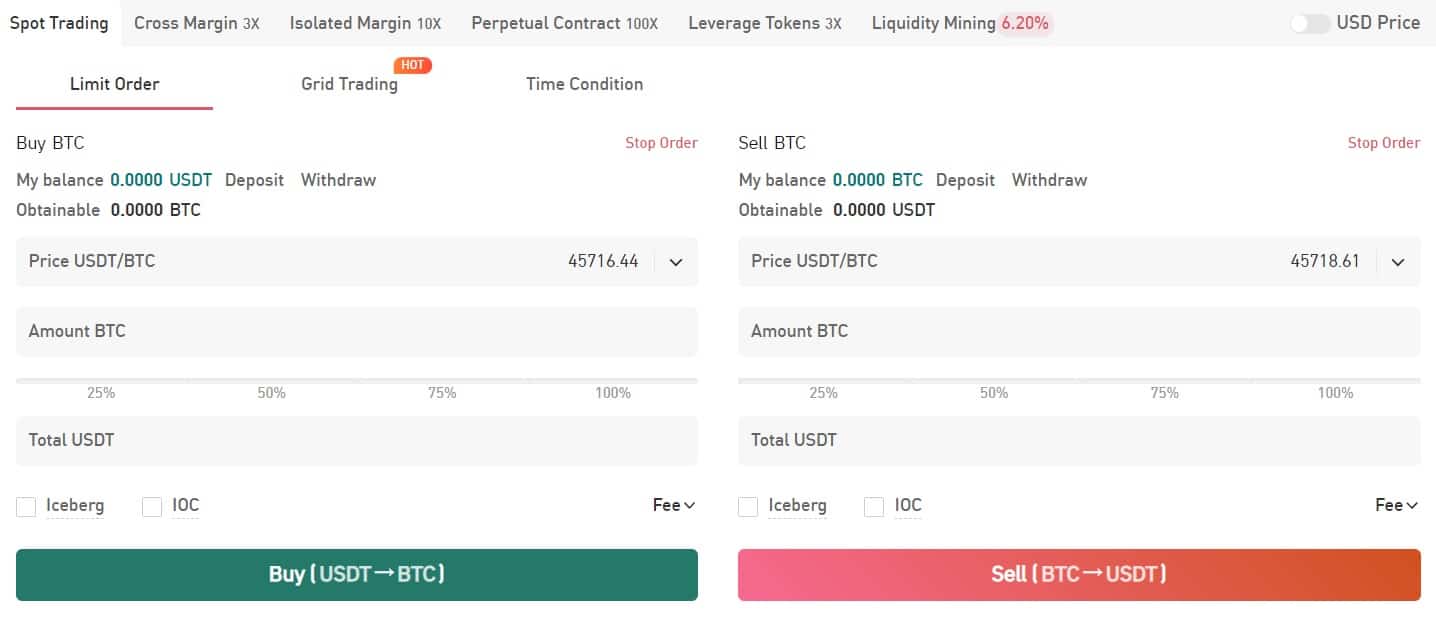

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

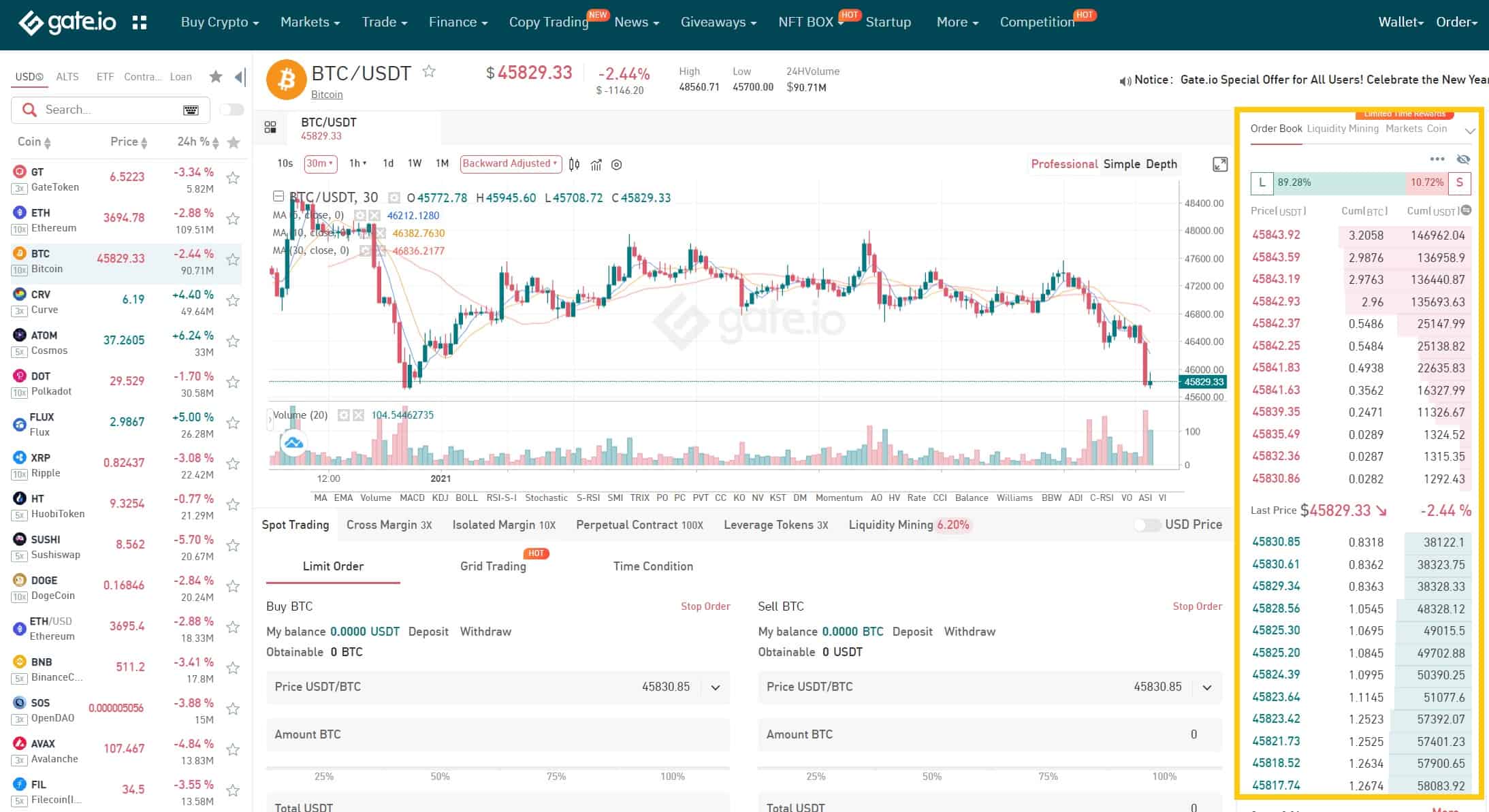

Step 4: If you don’t want to set a manual price, you can click on the last prices on the order book to set the buying/selling price automatically.

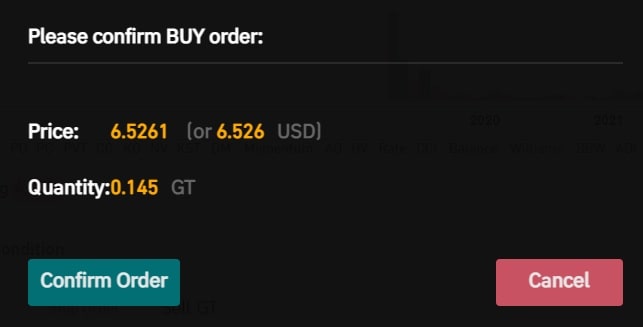

Step 5: Confirm the price and amount. Then click on “Place Order” to place the order, followed by “Confirm Order” to confirm it.

Hide Detailed Instructions

Alternative ways to buy Synapse (SYN)

Because the project is very new, it is only offered directly on a select number of exchanges. If you’re not comfortable connecting your bank account to any of these smaller exchanges, or if you cannot connect your bank account to them for geographical reasons. Then you can instead create an account on any of the major exchanges and simply transfer the funds from there.

Out of the major exchanges we recommend the following based on functionality, reputation, security, support and fees:

1

Binance

Fees (Maker/Taker) 0.075%*-0.1%*

Cryptocurrencies

Available for Trade 500+

Sign-up bonus

10% reduced trading fees*

Available in

Europe, Asia, Oceania, Africa

2

Bybit

Fees (Maker/Taker) 0.1%*-0.1%*

Cryptocurrencies

Available for Trade 400+

Sign-up bonus

$30,000 sign-up bonus*

Available in

Europe, Asia, Oceania, Africa

How to create a Binance account

![]()

Show Detailed Instructions

Hide Detailed Instructions

Step 1: Go to the Binance website.

Step 2: On the registration page, enter your email address, and create a password for your account.

Then, read and agree to the Terms of Service and click “Create Account”.

Note: Your password must be a combination of numbers and letters.

It should contain at least 8 characters, one UPPER CASE letter, and one number.

Step 3: Complete the Security Verification.

Step 4: The system will send a verification code to your email. The verification code is valid for 30 minutes. If you can’t find the email in your inbox, check your other mail folders as well, or click “Resend Email” to resend.

How to complete KYC (ID Verification) on Binance

Step 1: Log in to your Binance account and click “User Center” and then “Identification”.

Step 2: click “Start Now” to verify your account.

Step 3: Select your country of residence.

Ensure that your country of residence is consistent with your ID documents.

Step 5: Enter your personal information and click “Continue.”

You won’t be able to change it once confirmed.

Refer to the respective options offered for your country.

Step 7: Follow the instructions to upload photos of your document. Your photos should clearly show the full ID document.

Do not wear hats, glasses, or use filters, and make sure that the lighting is sufficient.

Once your application has been verified, you will receive an email notification.

How to buy cryptocurrency on Binance

Step 1: Log in to your Binance account and click “Buy Crypto” and then “Credit/Debit Card”.

Step 2: Here you can choose to buy crypto with different fiat currencies. Enter the fiat amount you want to spend and the system will automatically display the amount of crypto you can get. When you have selected the amount you wish to spend then press “Continue”.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

Step 3: Click “Add New Card”. Then enter your credit card details and your billing address.

Step 4: Check the payment details and confirm your order within 1 minute. After 1 minute, the price and the amount of crypto you will get will be recalculated. You can click “Refresh” to see the latest market price. You will then be redirected to your bank’s OTP Transaction Page. Follow the on-screen instructions to verify the payment.

How to Conduct Spot Trading on Binance

Step 1: Log in to your Binance account.

Click on “Classic” under “Trade” on the top navigation bar.

Step 2: Search and enter the cryptocurrency you want to trade.

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can place a “Market Order” to set the buying/selling price automatically.

Hide Detailed Instructions

For more in-depth instructions, our ‘Absolute Beginner’s Guide To Cryptocurrency Investing‘ will take you through the process step-by step. In addition to providing instructions for sending and receiving your cryptocurrency.

And if you’re completely new to crypto our beginner, intermediate and advanced level articles will get you up to speed with everything you need to know about the cryptocurrency space starting out.

Simplecryptoguide.com

What Is Synapse (SYN)?

Synapse stands out as a universal cross-chain liquidity network, designed to connect various blockchains through an extensible cross-chain communication protocol. This innovative protocol supports an array of features, including assets, smart contract calls, and more. By harnessing the power of Synapse, blockchains can securely and effortlessly interoperate, paving the way for developers to create groundbreaking cross-chain applications. These applications span a wide range of financial services, such as cross-chain decentralized exchanges (DEXs), lending platforms, margining systems, derivatives markets, and yield aggregators.

The Synapse Bridge, the first application built using this revolutionary cross-chain protocol, employs automated market makers (AMMs) deployed across more than 15 EVM and non-EVM blockchains. The primary function of the Synapse Bridge is to facilitate the seamless transfer of assets between all participating chains. As a result, users can now capitalize on Synapse to move assets between the most popular EVM-compatible blockchains, enjoying the deepest liquidity among all interoperability solutions.

Security and Consensus Mechanisms

The robust security of the Synapse network is upheld by cross-chain multi-party computation (MPC) validators, which operate using threshold signature schemes (TSS). This leaderless network maintains its security through a decentralized approach, in which each validator runs the same process upon receiving on-chain events across the various chains tracked by the MPC validator group. Consensus is achieved when at least two-thirds of all validators have collectively signed the same transaction using their individual keys. Once this consensus is reached, a transaction is issued to the destination chain.

Benefits and Future Implications

The advent of Synapse has far-reaching implications for the world of decentralized finance (DeFi) and the broader blockchain ecosystem. By enabling seamless and secure cross-chain communication, Synapse empowers developers to build applications that were previously considered unattainable. Additionally, users can access a wider range of financial services and products, creating a more inclusive and interconnected DeFi landscape. Moreover, by providing the deepest liquidity among interoperability solutions, Synapse has the potential to establish itself as the go-to platform for cross-chain asset transfers.

As the adoption of blockchain technology and DeFi continues to accelerate, the demand for efficient and secure cross-chain communication will grow in tandem. Synapse’s universal cross-chain liquidity network is well-positioned to address this demand, fostering a more interconnected and efficient blockchain ecosystem. As more developers harness the power of Synapse to create novel cross-chain applications, it is expected that the platform will continue to evolve, offering even more advanced features and functionality to its users.

Secure Multi-Party Computation (MPC)

Secure multi-party computation (MPC) is a cryptographic technique that allows a group of validators to work together on a shared function without compromising the privacy of each validator’s input data. In an MPC network, validators collaborate to solve a function and share the information gained from the solution, while none of them can identify the input data used by other validators. This innovative approach to computation enables secure collaboration and information sharing among participants without requiring them to reveal sensitive information. One widely-known method for achieving MPC is Shamir secret sharing, which employs polynomial interpolation to create shares of a secret that can be securely distributed among participants.

Threshold Signature Schemes (TSS)

Threshold signature schemes (TSS) are cryptographic techniques that enable secure digital signatures in a decentralized manner. In a traditional digital signature system, a public-private key pair is generated by a single entity. The private key is used to authenticate transactions with a signature, while the public key is used to verify the existence of the signature. TSS, however, takes a different approach by dividing the private key among a group of “m-out-of-n” validators on the network.

Under TSS, the private/public key pair is not generated by a single entity. Instead, any subset of validators smaller than “m” (the threshold, or quorum) cannot reconstruct the private key or generate a signature using it. This setup ensures that the validators can collaborate to sign and authenticate transactions without compromising their privacy or needing to trust other validators in the quorum.

Synapse Network and its Security Mechanisms

In the context of the Synapse network, secure multi-party computation (MPC) and threshold signature schemes (TSS) play crucial roles in maintaining robust security. The Synapse network is secured by cross-chain MPC validators that operate using TSS. This leaderless network ensures its security by having each validator run the same process upon receiving on-chain events across various chains tracked by the MPC validator group. When at least two-thirds of all validators have collectively signed the same transaction using their individual keys, the network achieves consensus and issues a transaction to the destination chain.

The use of MPC and TSS in Synapse enables a high level of security, which is essential for a cross-chain liquidity network. These cryptographic techniques allow validators to collaborate on the network without sacrificing their privacy or needing to trust other validators. This decentralized approach to security is vital for ensuring the integrity of the Synapse network and its ability to facilitate seamless and secure cross-chain communication.

Implications and Applications

The implementation of secure multi-party computation (MPC) and threshold signature schemes (TSS) in the Synapse network has far-reaching implications for the world of decentralized finance (DeFi) and the broader blockchain ecosystem. By providing a secure and decentralized method for cross-chain communication, Synapse empowers developers to build applications that were previously considered unattainable.

These applications span a wide range of financial services, such as cross-chain decentralized exchanges (DEXs), lending platforms, margining systems, derivatives markets, and yield aggregators. Furthermore, by employing MPC and TSS, the Synapse network ensures that validators can work together without compromising their privacy or having to trust other participants on the network.

As the adoption of blockchain technology and DeFi continues to accelerate, the demand for efficient and secure cross-chain communication will grow in tandem. Synapse’s universal cross-chain liquidity network, built on the foundations of MPC and TSS, is well-positioned to address this demand, fostering a more interconnected and efficient blockchain ecosystem.

Synapse and the SYN Token: Revolutionizing DeFi Community-Building

Synapse Protocol is a trailblazer in the world of decentralized finance (DeFi), addressing the need for a dynamic utility token that can adapt to the fast-changing environment of interchain activities across blockchains. While protocols like Synthetix and Compound have established best practices for protocol growth through their liquidity mining incentive programs, many protocols have failed to experiment with these parameters systematically. Synapse aims to change this, breaking from the norm and taking a different approach to building a community of early adopters committed to the protocol’s continuous growth.

Traditional infrastructure protocols have often overpaid for liquidity for their native coins, leading to negative ramifications, particularly early in a project’s life cycle when emissions are at their highest. These practices run counter to the long-term goals of liquidity mining initiatives. In contrast, Synapse views utility tokens as community-bootstrapping devices capable of adjusting supply and emissions to meet the community’s needs as it progresses through stages of growth.

Key Functions of the SYN Token

The SYN Token, the governance token of Synapse Protocol, serves various crucial functions within the ecosystem, including governance, protocol fees, validator economics, Synapse Chain, and providing liquidity to SYN.

- Governance – SYN Token enables early adopters and future investors to have a say in the protocol’s development, ensuring active community involvement. SYN token holders with more than 50,000 tokens can submit snapshot proposals to the Synapse DAO, empowering them to influence the protocol’s direction.

- Protocol Fees – Protocol fees are divided between liquidity providers and the DAO treasury, allowing actions supporting SYN via community governance. This setup enables the treasury to accumulate non-SYN assets (primarily stablecoins) and allows the protocol to provide demand when needed to develop the price floor required for flexible control of SYN emissions and supply.

- Validator Economics – In the Synapse network, validators play a vital role in securing the network, and it’s essential to incentivize them accordingly. To help validators operate within the Synapse network, SYN may be used as a subsidy to compensate them for gas expended on Ethereum, ensuring that they are rewarded for their critical contributions to the network’s security and functionality.

- Synapse Chain – As the protocol reaches its Archean and Proterozoic phases and launches the Synapse Chain, validators will be required to stake SYN and earn network fees. With the Synapse Chain secured by Proof of Stake consensus, anyone can contribute to the security of the chain by delegating SYN to validators and earning a portion of block rewards. As the native token of the Synapse Chain, SYN may be used to pay for transactions within the network and bridging to other chains.

- Providing Liquidity to SYN – Synapse holders can provide liquidity to SYN on Sushiswap, incentivized with SYN emissions or SUSHI emissions. Additionally, third-party decentralized exchanges have listed SYN on their platforms, encouraging holders to provide liquidity and capture a share of SYN trading volume. This process ensures that SYN remains accessible and liquid, further promoting the growth and adoption of the Synapse Protocol.

Synapse development updates in 2023

Synapse (SYN), a decentralized finance (DeFi) protocol, has seen significant developments in 2023, mainly in its cross-chain capabilities and market performance. Here are the key updates:

Surge in Token Value and Trading Volume: Synapse’s native token SYN experienced a notable surge in its value, increasing by 44.74% over a 24-hour period and reaching a five-month high. This increase in value coincided with a remarkable 600% rise in trading volume, signaling a growing interest and confidence in the protocol.

Recovery from Selling Pressure: The SYN token demonstrated resilience by recovering more than 17% from a low point after a significant sell-off by a liquidity provider. This recovery reflects the robustness of the token and the protocol’s ability to withstand market fluctuations.

Interoperability Protocol Enhancements: Synapse continued to focus on its role as an interoperability protocol, enabling the safe and secure transfer of arbitrary data across different blockchain layers, including layer 1, layer 2, and sidechain ecosystems. These developments aim to improve inter-blockchain compatibility, making asset transfer across networks more efficient.

Optimistic Security Approaches and Synapse Chain: Synapse Chain, an Ethereum-based optimistic rollup, has been developed to serve as a sovereign execution environment for cross-chain use cases. This approach combines the security and decentralization of Ethereum’s base layer with increased throughput and scalability, enhancing the user experience.

Governance and Tokenomics: The Synapse community governs the protocol through the Synapse DAO, where SYN holders vote and participate in governance activities. The tokenomics of SYN focus on rewarding users who actively participate within the ecosystem, including incentives for liquidity providers and rewards for validators.

These developments in 2023 have positioned Synapse as a significant player in the DeFi space, with its enhanced cross-chain capabilities and robust market performance highlighting its potential for growth and innovation in the blockchain sector.

Official website: https://synapseprotocol.com/

Best cryptocurrency wallet for Synapse (SYN)

There are plenty of different crypto wallets available. The best one for you depends on your general trading habits and which provides the most security in your situation. There are two main types of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical). Both have their pros and cons, and there is not necessarily a right or wrong answer when it comes to figuring out which crypto wallet is best for you.

HOW DO I DECIDE WHICH cryptocurrency WALLET TO USE for Synapse (SYN)?

Deciding which type of wallet to use depends on a variety of factors, including:

- How often you trade. In general, hot wallets are better for more active cryptocurrency traders. Quick login ability means you are only a few clicks and taps away from buying and selling crypto. Cold wallets are better suited for those looking to make less frequent trades.

- What you want to trade. As mentioned earlier, not all wallets support all types of cryptocurrencies. However, some of the best crypto wallets have the power to trade hundreds of different currencies, providing more of a one-size-fits-all experience.

- Your peace of mind. For those worried about hacking, having a physical cold wallet stored in a safe deposit box at the bank or somewhere at home, provides the safest, most secure option. Others might be confident in their ability to keep their hot wallets secure.

- How much it costs. It is important to investigate the costs associated with each wallet. Many hot wallets will be free to set up. Meanwhile, cold wallets, like any piece of hardware, will cost money to purchase.

- What it can do. While the basics of each cryptocurrency wallet are the same, additional features can help set them apart. This is especially true of hot wallets, many of which come with advanced reporting features, insights into the crypto market, the ability to convert cryptocurrencies and more. Security features can also be a good differentiator.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re going to be dealing in larger volumes of crypto, investing in cold storage might prove advantageous.

Most widespead examples of this being the Ledger Nano and the Trezor.

Ledger manufactures cold storage wallets designed for users who want increased security. Their wallets are a physical device that connects to your computer. Only when the device is connected can you send your cryptocurrency from it. Ledger offers a variety of products, such as the Ledger Nano S and the Ledger Nano X (a bluetooth connected hardware wallet).

Trezor is a pioneering hardware wallet company. The combination of world-class security with an intuitive interface and compatibility with other desktop wallets, makes it ideal for beginners and experts alike. The company has gained a lot of the Bitcoin community’s respect over the years. Trezor offers two main models – The Trezor One and Trezor Model T (which has a built in touch screen).

Market Overview

Coinmarketcap.com

Coinmarketcap will be your cryptocurrency go-to for just about everything. Here you can see the following: