What is Core (CORE)?

In this comprehensive guide to Core (CORE), we will delve deeper into the intricate workings of the project, and also offer practical advice on how to buy and securely store your Core (CORE) tokens. Understanding the context of Core’s creation, its underlying technology, and its mission are essential to appreciate the value it brings to the ecosystem, giving you the knowledge and confidence to join the Core (CORE) community.

Where to buy Core (CORE)?

First things first. Buying Core (CORE) involves a three-step process. First, set up an account on a reputable cryptocurrency exchange that supports Core (CORE). Next, deposit funds into your account, taking into consideration the different fee structures associated with various payment methods such as credit and debit cards, e-wallets, and direct bank transfers. Lastly, purchase Core (CORE) on the exchange by inputting the amount you wish to spend, with the platform calculating the equivalent amount of Core (CORE) based on the current market rate. We recommend buying Core (CORE) on any of the following cryptocurrency exchanges:

1

Bybit

Fees (Maker/Taker) 0.1%*-0.1%*

Cryptocurrencies

Available for Trade 400+

Sign-up bonus

$30,000 sign-up bonus*

Available in

Europe, Asia, Oceania, Africa

2

MEXC

Fees (Maker/Taker) 0.2%*-0.2%*

Cryptocurrencies

Available for Trade 1500+

Sign-up bonus

10% reduced trading fees & up to $170 in USDT vouchers*

Available in

North America, South America, Europe, Asia, Oceania, Africa

Understanding Core (CORE):

An In-depth Guide to Its Features and Use Cases

Website: https://www.coredao.org/

Twitter: https://twitter.com/Coredao_Org

Core (CORE) is a groundbreaking project designed to tackle the Blockchain Trilemma, a long-standing issue that all cryptocurrencies, including the likes of Bitcoin and Ethereum, must navigate. This trilemma asserts that there are inherent trade-offs to be made between optimal security, scalability, and decentralization, with two elements typically prioritized at the expense of the third. Core’s innovative solution to this challenge lies in its novel Satoshi Plus consensus mechanism, operating at the heart of the Core Network.

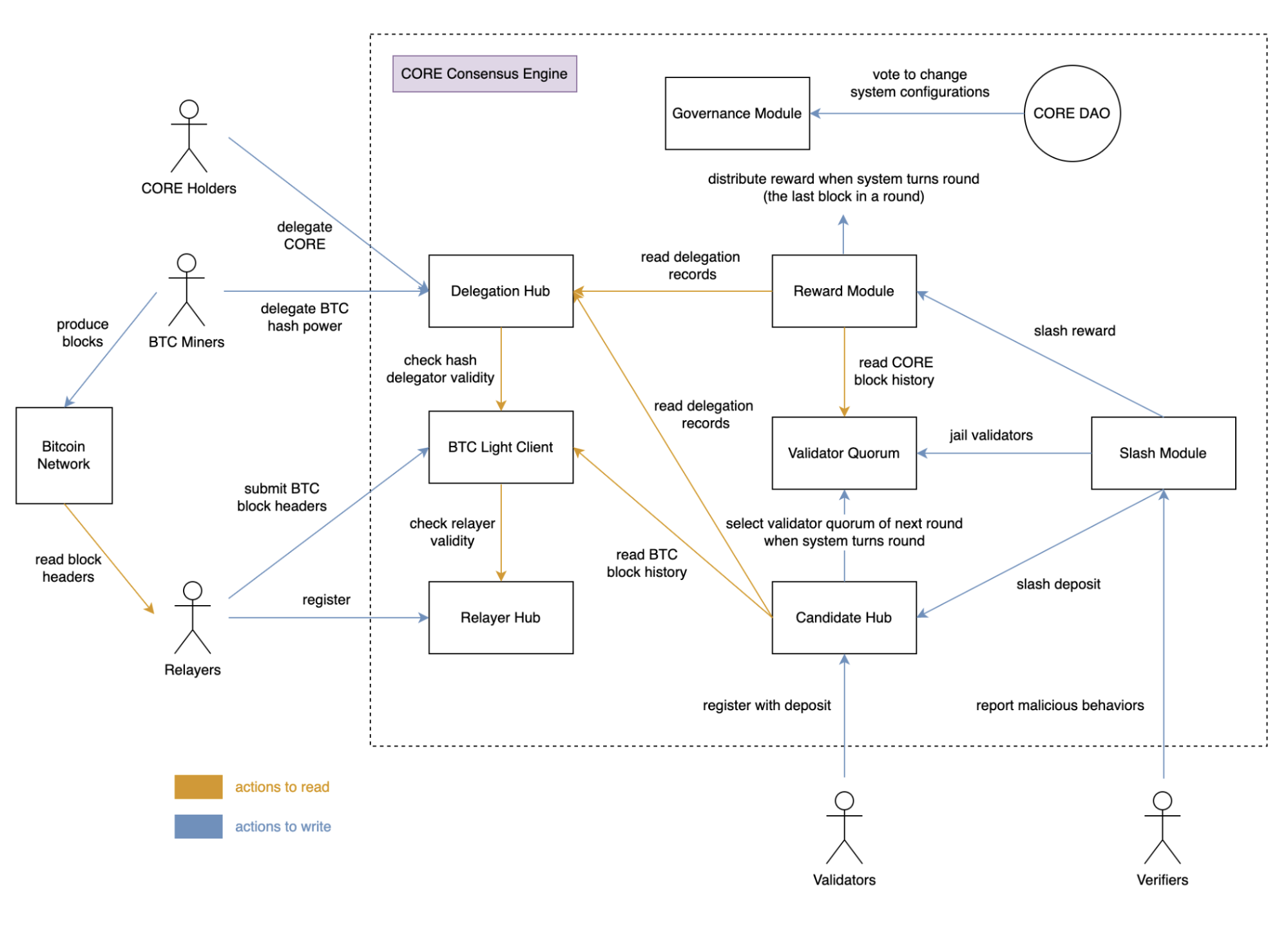

The Satoshi Plus consensus combines Proof of Work (PoW) and Delegated Proof of Stake (DPoS) to leverage the strengths of both, effectively mitigating their respective weaknesses. Bitcoin’s computing power underpins decentralization, while the DPoS and leadership election mechanisms bolster scalability. The entire network, working in harmony, maintains robust security measures. As the first chain to implement this novel consensus mechanism, Core sets the stage for a more balanced and optimized blockchain system.

Core features its native currency – CORE, the base layer currency of the chain, which is crucial to its operations. Core’s infrastructure includes a variety of key components and roles, such as validators responsible for block production and transaction validation, and relayers who transmit BTC block headers to the Core network. BTC Miners secure the Bitcoin network via PoW and CORE Holders, holders of the CORE currency, participate in staking by delegating their holdings to a validator. Verifiers play a vital role in maintaining network integrity by reporting malicious behaviors.

Core presents a distinctive approach to governance, facilitated by the Core DAO (Decentralized Autonomous Organization). This aspect of the network emphasizes the community’s role in decision-making and the overall operation of the Core Network. Despite its roots in the Geth codebase, Core sets itself apart with its unique Satoshi Plus Consensus and the creation of a fluid market for validators and rewards that encourages wide participation.

The Core project represents a significant stride towards achieving the elusive balance between security, scalability, and decentralization in the blockchain world. It serves as a testament to the continuous evolution and innovation that is the driving force behind the broader Web 3 adoption.

How does Core (CORE) work?

Core’s functionality hinges upon its innovative Satoshi Plus consensus mechanism. This new model merges the strengths of PoW and DPoS to address the shortcomings associated with each. Bitcoin’s computing power guarantees the network’s decentralization, while the DPoS and leadership election mechanisms enhance its scalability. The combined effect of these systems maintains Core’s overall security.

Key components contribute to Core’s operation. Validators, who produce blocks and validate transactions, become a part of the network by registering and locking up a refundable CORE deposit. Relayers, tasked with relaying BTC block headers to the Core network, also must register and lock up a CORE deposit. Bitcoin miners secure the Bitcoin network using PoW and can delegate their hash power to a validator to impact the Satoshi Plus consensus. Core token holders can participate in staking by delegating their holdings to a validator.

In order to ensure network integrity, Core employs verifiers who report any malicious behavior on the network. Successfully verified claims may lead to penalties for misbehaving validators, including slashing of rewards or stake, or jailing. The validator election mechanism also plays a critical role in the operation of Core, determining the top 21 validators who will be included in the validator set each round based on their hybrid score.

The hybrid score, a result of a protocol function used in validator election calculations, takes into account both the BTC hash power and CORE delegated to a validator. This introduces a more dynamic and democratic process of electing validators. Core’s operation is divided into rounds and slots. Each round, which currently lasts for a day, sees the election of 21 validators with the highest hybrid scores to form the validator set. These validators are then responsible for producing blocks on the Core network for the duration of the round. At the end of each round, the accumulated rewards are calculated and distributed, and the validator quorum for the next round is determined.

During the round, the operation is further divided into slots. Each slot is a brief period of 3 seconds in which an honest validator either produces a block or fails to do so. This round-robin approach to block production ensures continuous operation and minimizes potential downtime.

Epochs also play a crucial role in the operational cycle of the Core network. Currently set to 200 slots, or approximately 10 minutes, an epoch represents the cycle length for the system to check each validator’s status. Validators that have been jailed due to malicious activities are excluded from the quorum during this check, helping to maintain a more or less constant TPS within a given round. This mechanism further strengthens the security and reliability of the Core network.

The Core DAO (Decentralized Autonomous Organization) oversees the governance of the Core network. Through the DAO, network decisions are made in a truly democratic manner, giving a voice to the community and reinforcing the network’s decentralization.

All these components and mechanisms work together to create a dynamic, secure, and efficient blockchain network that robustly addresses the blockchain trilemma. In doing so, Core offers a unique, next-generation solution capable of serving as a springboard for broader adoption of Web 3 technologies.

Core (CORE) Tokenomics

Core (CORE) token operates on a “Sound Supply” model, drawing inspiration from Bitcoin’s sound money model. There is a hard cap of 2.1 billion tokens for the CORE supply, which means the production of these tokens will eventually cease. However, CORE adds an additional twist by implementing a mechanism similar to Ethereum’s “Ultra Sound Money” model. A portion of all block rewards and transaction fees will be burned. The exact percentage to be burned will be decided by the DAO. This burning mechanism ensures that while the total number of CORE tokens may asymptotically approach 2.1 billion, it will never fully reach this number, echoing Avalanche’s tokenomics model.

Core’s emission curve is designed to gradually distribute block rewards for CORE over an extended period of 81 years. This long payout period increases the likelihood of the chain’s success by ensuring that all network participants are fully incentivized before the transition to compensation purely through transaction fees. In essence, this additional block reward in the form of CORE can be perceived as a means for existing BTC miners to continue receiving subsidies after the cessation of Bitcoin block rewards around 2040. They can achieve this by becoming validators on the Core network and leveraging their existing hash power.

This tokenomics design is reflective of Core’s commitment to creating a sustainable, long-term network. By providing steady incentives for participants, Core ensures the longevity of its blockchain while also offering a compelling solution for BTC miners looking ahead to the end of Bitcoin block rewards.

How is the Core (CORE) network secured?

Core (CORE) network is secured through several comprehensive methods designed to fend off a broad range of potential threats. These threats can generally be divided into two categories: network attacks and consensus attacks.

To mitigate network attacks, such as Distributed Denial of Service (DDoS), Eclipse, and BGP Hijack, Core employs a combination of measures. These include transaction filtering, geographically spreading nodes, selecting nodes randomly for P2P communications, and maintaining an officially published seed list for public nodes. These strategies make it more challenging for potential attackers to target the network effectively.

Consensus attacks, however, have a broader range of threat vectors. To counter these, Core employs a unique combination of PoW, DPoS, and its validator election mechanism. These strategies confer various beneficial properties onto the Core network. Pre-computation and selfish mining are not feasible threats due to Core’s fixed validator set in a round-robin manner, which aims to manipulate a pseudorandom mechanism that doesn’t exist in Core’s system. Although censorship and transaction delays could potentially occur, they are mitigated as long as there are honest validators in the set.

Some other types of attacks, like the 51% and Sybil attacks, can’t be fully mitigated, but they are economically unwise to attempt and very difficult to achieve given Core’s ranking by the hybrid score of validators’ hash power and stake. Long-range attacks are mitigated by Core’s checkpointing scheme and reliance on PoW, which inherently doesn’t suffer from this category of attack.

Checkpointing also plays a role in mitigating potential short-range attacks, which become more relevant when combined with long-range attacks and checkpointing mechanisms. Through its innovative mechanisms, Core provides robust security measures to safeguard its network, offering a secure platform for its users and validators.

Core development updates in 2023

In 2023, Core (CORE) has made significant strides in its development, focusing on technological advancements and updates to its network. While details on the project itself are already covered extensively, here are the notable technological developments and network updates:

-

Mainnet Launch: Core’s mainnet was launched in January 2023, marking a pivotal step in the development of the Core blockchain. This launch represents the transition of Core from a conceptual framework to a functional blockchain network.

-

Consensus Mechanism Enhancement: Core employs the “Satoshi Plus” consensus mechanism, a blend of Bitcoin’s Proof-of-Work (PoW) and Ethereum’s Delegated Proof-of-Stake (DPoS). This hybrid model aims to solve the blockchain trilemma by balancing decentralization, scalability, and security.

-

Security Audits: The network’s security is a top priority for Core. In 2023, the blockchain underwent a security audit by CertiK, a leading firm in blockchain security. This audit helps in identifying and rectifying potential security vulnerabilities.

-

Governance Model: Core operates under a decentralized autonomous organization (DAO) model. This governance structure involves community participation in decision-making processes, such as transaction fee settings, protocol upgrades, and development proposals.

-

Tokenomics and Supply Distribution: The total supply of CORE tokens is capped at 2.1 billion, with a circulating supply of 855,761,890 CORE. The supply is distributed across various categories including node mining, user rewards, contributor rewards, reserves, relayer rewards, and a treasury fund.

-

Exchange Listings and Trading Pairs: CORE tokens are listed on multiple cryptocurrency exchanges, including prominent ones like Huobi and OKX. These listings increase the accessibility of CORE tokens for trading and investment.

-

Development of Ecosystem Applications: Core is focused on developing applications within its ecosystem, including tools and platforms for decentralized finance (DeFi). These applications are aimed at enhancing the utility and functionality of the Core blockchain.

-

Token Utility and Use Cases: The CORE token serves as both a utility and governance token within the Core network. Its use cases include transaction fee payments, participation in governance, and as rewards for network contributors.

These updates indicate Core’s commitment to building a scalable, secure, and user-centric blockchain ecosystem. However, it’s important to remember that the cryptocurrency market is highly volatile and unpredictable, and therefore, any investment should be made with caution and thorough research.

How to safely store your Core (CORE) Tokens

Best cryptocurrency wallet for Core (CORE)

Navigating the world of cryptocurrency wallets can be quite an adventure, as there are numerous options available to suit different needs. To find the perfect wallet for you, consider your trading habits and the level of security you require. Generally, there are two main categories of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical).

Each type of wallet comes with its own set of advantages and drawbacks, so there isn’t necessarily a one-size-fits-all solution. As you embark on your journey to find the best crypto wallet for your Core (CORE) tokens, remember to keep an open mind and explore the features that align with your personal preferences and requirements.

When choosing the right wallet for your Core (CORE) tokens, consider the following factors:

- Trading frequency: Hot wallets are generally more suitable for active traders due to their quick login capabilities, allowing for seamless buying and selling of crypto. Cold wallets, on the other hand, are better suited for those who make less frequent trades.

- Supported cryptocurrencies: Although not all wallets cater to every cryptocurrency, some of the best ones can trade a vast array of currencies, offering a versatile experience. Make sure the wallet you choose supports Core (CORE).

- Security concerns: If you’re worried about potential hacking incidents, a physical cold wallet stored in a safe deposit box or a secure location at home provides the highest level of protection. However, if you’re confident in safeguarding your hot wallet, you might prefer its convenience.

- Associated costs: Investigate the costs of each wallet option. While many hot wallets are free to set up, cold wallets, being hardware devices, will require an upfront investment.

- Wallet features: While the basic functions of cryptocurrency wallets remain the same, additional features can distinguish one wallet from another. Hot wallets often come with advanced reporting tools, crypto market insights, and currency conversion capabilities. Security features can also be an essential factor when making your decision.

By considering all of these aspects, you’ll be better equipped to select the perfect cryptocurrency wallet for your Core (CORE) tokens.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re planning to handle larger amounts of crypto, investing in cold storage can be a wise decision. Two of the most popular cold storage options are the Ledger Nano and the Trezor.

Ledger creates cold storage wallets designed for users who prioritize security. Their wallets are physical devices that connect to your computer, and you can only send cryptocurrency from them when they’re connected. Ledger offers a range of products, including the Ledger Nano S and the Ledger Nano X, which features Bluetooth connectivity.

Trezor, a trailblazer in the hardware wallet industry, combines top-notch security with an intuitive interface and compatibility with various desktop wallets. This blend makes it suitable for both beginners and experienced users. Trezor has earned a great deal of respect within the Bitcoin community over time. They offer two primary models – the Trezor One and the Trezor Model T, which comes with a built-in touchscreen.

Core (CORE) Price & Charts

- Market Capitalization And Daily Trading Volume

- Current Market Price Of Every Cryptocurrency Relative To USD (And Some Local Currencies)

- Circulating And Total Supply

- Historical Charts With Prices Relative To USD, Bitcoin (BTC), And Ethereum (ETH).

Frequently Asked Questions (FAQ)

Where is the best place to buy Core (CORE)?

We recommend either Bybit, MEXC or Gate.io as these platforms excel in functionality, reputation, security, customer support, and competitive fees.

How to buy Core (CORE) in Europe?

In Europe, acquiring Core (CORE) tokens is a seamless process, with numerous reputable cryptocurrency exchange platforms available to cater to your needs. Among the top choices, we recommend Bybit, MEXC, or Gate.io due to their outstanding performance in key areas such as functionality, reputation, security, customer support, and competitive fees.

These platforms have established a strong presence not only in Europe but also globally, offering an extensive range of cryptocurrencies, including Core (CORE).

How to buy Core (CORE) in the US?

For the United States, buying Core (CORE) tokens is also an effortless process, we particularly recommend MEXC, a top-tier exchange that excels in functionality, reputation, security, customer support, and competitive fees.

MEXC has established a strong presence in the US and across the globe, offering a wide range of cryptocurrencies, including Core (CORE). Catering to US-based customers, MEXC provides a user-friendly interface, responsive customer support, and multiple payment options, making it easy for users throughout the country to invest in digital currencies.

How much does Core (CORE) cost to buy?

Unlike traditional trading options, cryptocurrency allows for fractional purchases, so you don’t need to buy whole coins. This flexibility means you can begin investing in Core (CORE) and other digital currencies with an investment as low as $1!

Is it safe to buy Core (CORE)?

Safeguarding your investments is a joint effort, and adhering to recommended security practices is crucial. The first step to safely buying Core (CORE) is selecting a reputable exchange known for its reliability and strong security measures. Make sure to choose an exchange with a proven track record and positive reputation in the industry to minimize potential risks.

Is it Possible to Convert Core (CORE) to Cash?

Absolutely! After choosing your preferred cryptocurrency exchange platform, you can effortlessly convert your Core (CORE) tokens into cash at the current market rate using the exchange’s user-friendly trading interface.

What is the Core (CORE) Crypto Price Forecast?

Accurately predicting the Core (CORE) price for any time frame is challenging, but various fundamental factors offer insight into the token’s potential price fluctuations and volatility. Essential aspects to consider include:

- Adoption Rate – Increased on-chain activity, driven by the growing number of developers and users on the Core (CORE) platform, may lead to higher demand and value for it. This expansion could also boost investor confidence, prompting more people to buy and hold the tokens.

- Innovative Developments – The introduction of innovative features that improve Core (CORE)‘s capabilities can make the project more attractive for usage or investment, potentially driving up the token price. Furthermore, the Core (CORE) cryptocurrency value may experience a surge following announcements of new partnerships and investments in the project.

- Market Sentiment – The overall market outlook significantly impacts Core (CORE) crypto price trends. A risk-on attitude among global investors encourages buying activity in the crypto market, supporting Core (CORE)‘s price. On the other hand, bearish or risk-averse sentiment can trigger sell-offs that may negatively affect the price in the market.