How To Buy Terra (LUNA)?

A common question you often see on social media from crypto beginners is “Where can I buy Terra?” Well, you’ll be happy to hear it is actually quite a simple and straightforward process.

Step 1: Create an account on an exchange that supports Terra (LUNA)

First, you will need to open an account on a cryptocurrency exchange that supports Terra (LUNA).

We recommend the following based on functionality, reputation, security, support and fees:

1

Binance

Fees (Maker/Taker) 0.075%*-0.1%*

Cryptocurrencies

Available for Trade 500+

Sign-up bonus

10% reduced trading fees*

Available in

Europe, Asia, Oceania, Africa

2

MEXC

Fees (Maker/Taker) 0.2%*-0.2%*

Cryptocurrencies

Available for Trade 1500+

Sign-up bonus

10% reduced trading fees & up to $170 in USDT vouchers*

Available in

North America, South America, Europe, Asia, Oceania, Africa

In order to sign up, you will need to enter some basic information, such as your email address, password, full name and, in some cases, you might also be asked for a phone number or address.

Note: On specific exchanges, you might need to complete a Know Your Customer (KYC) procedure in order to be able to purchase cryptocurrency. This is most commonly the case with licensed and regulated exchanges.

Step 2: Deposit funds into your account

Many cryptocurrency exchanges will allow you to purchase Terra (LUNA) with fiat currencies, such as EUR, USD, AUD and others. Furthermore, they will also provide you with multiple deposit methods through which you can fund your fiat account, such as credit and debit cards, ewallets or direct bank transfers.

Note: Some payment methods will have higher fees than others, such as credit card payments. Before funding your fiat account on your chosen exchange, make sure to do your due diligence to find out the fees involved with each payment method to avoid unnecessary costs.

Step 3: Buy Terra (LUNA)

This process is similar across almost every cryptocurrency exchange. All you have to do is find a navigation bar or a search bar, and search for Terra (LUNA) or Terra (LUNA) trading pairs. Look for the section that will allow you to buy Terra (LUNA), and enter the amount of the cryptocurrency that you want to spend for Terra (LUNA) or the amount of fiat currency that you want to spend towards buying Terra (LUNA). The exchange will then calculate the equivalent amount of Terra (LUNA) based on the current market rate.

Note: Make sure to always double-check your transaction details, such as the amount of Terra (LUNA) you will be buying as well as the total cost of the purchase before you end up confirming the transaction. Furthermore, many cryptocurrency exchanges will offer you their own proprietary software wallet where you will be storing your cryptocurrencies; however, you can create your own individual software wallet, or purchase a hardware wallet for the highest level of protection.

How to create a Binance account

Show Detailed Instructions

Hide Detailed Instructions

Step 1: Go to the Binance website.

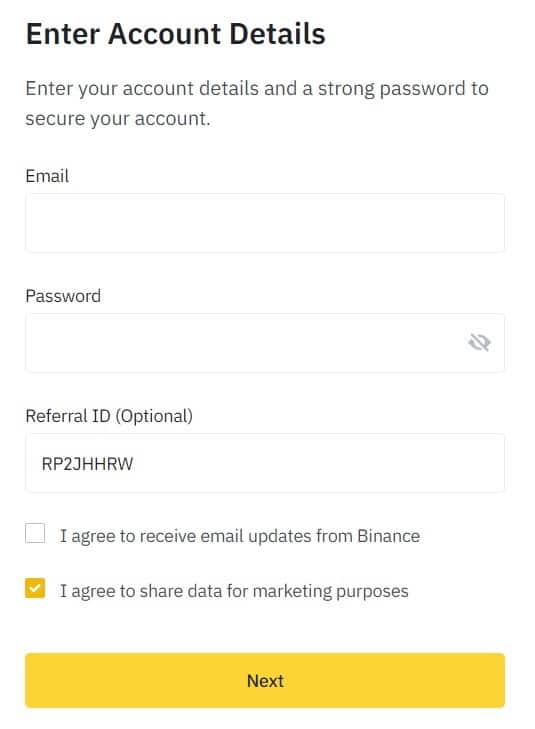

Step 2: On the registration page, enter your email address, and create a password for your account.

Then, read and agree to the Terms of Service and click “Create Account”.

Note: Your password must be a combination of numbers and letters.

It should contain at least 8 characters, one UPPER CASE letter, and one number.

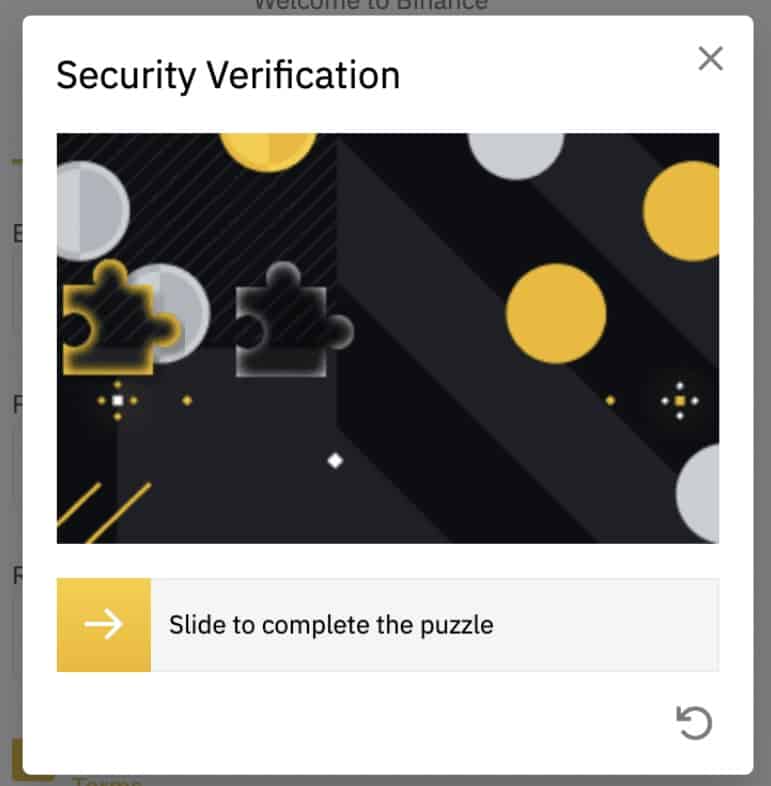

Step 3: Complete the Security Verification.

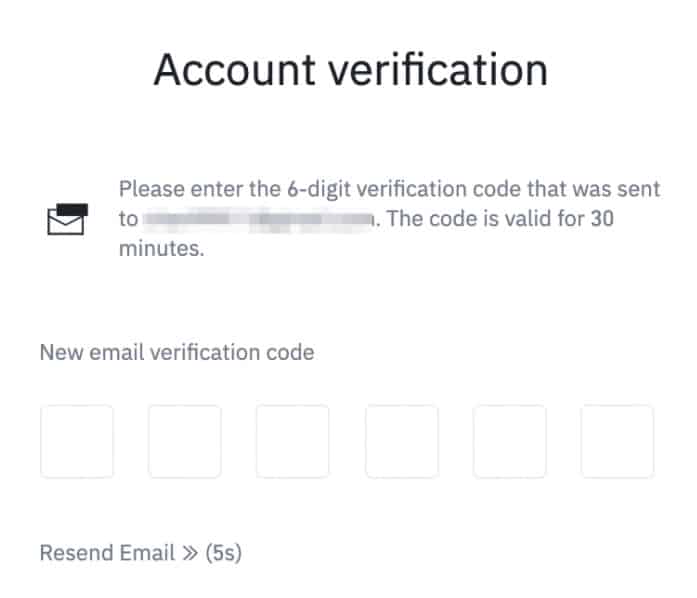

Step 4: The system will send a verification code to your email. The verification code is valid for 30 minutes. If you can’t find the email in your inbox, check your other mail folders as well, or click “Resend Email” to resend.

How to complete KYC (ID Verification) on Binance

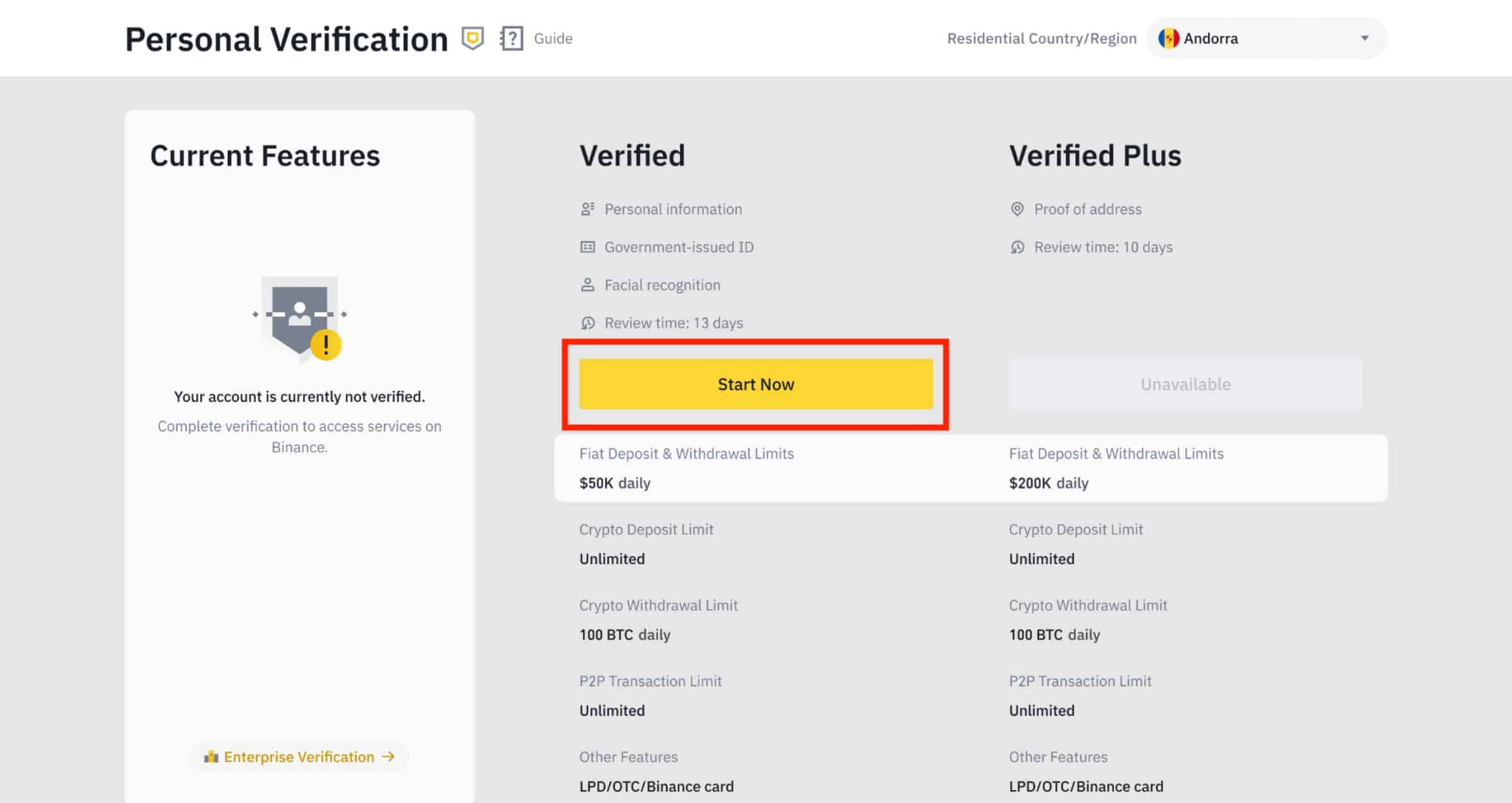

Step 1: Log in to your Binance account and click “User Center” and then “Identification”.

Step 2: click “Start Now” to verify your account.

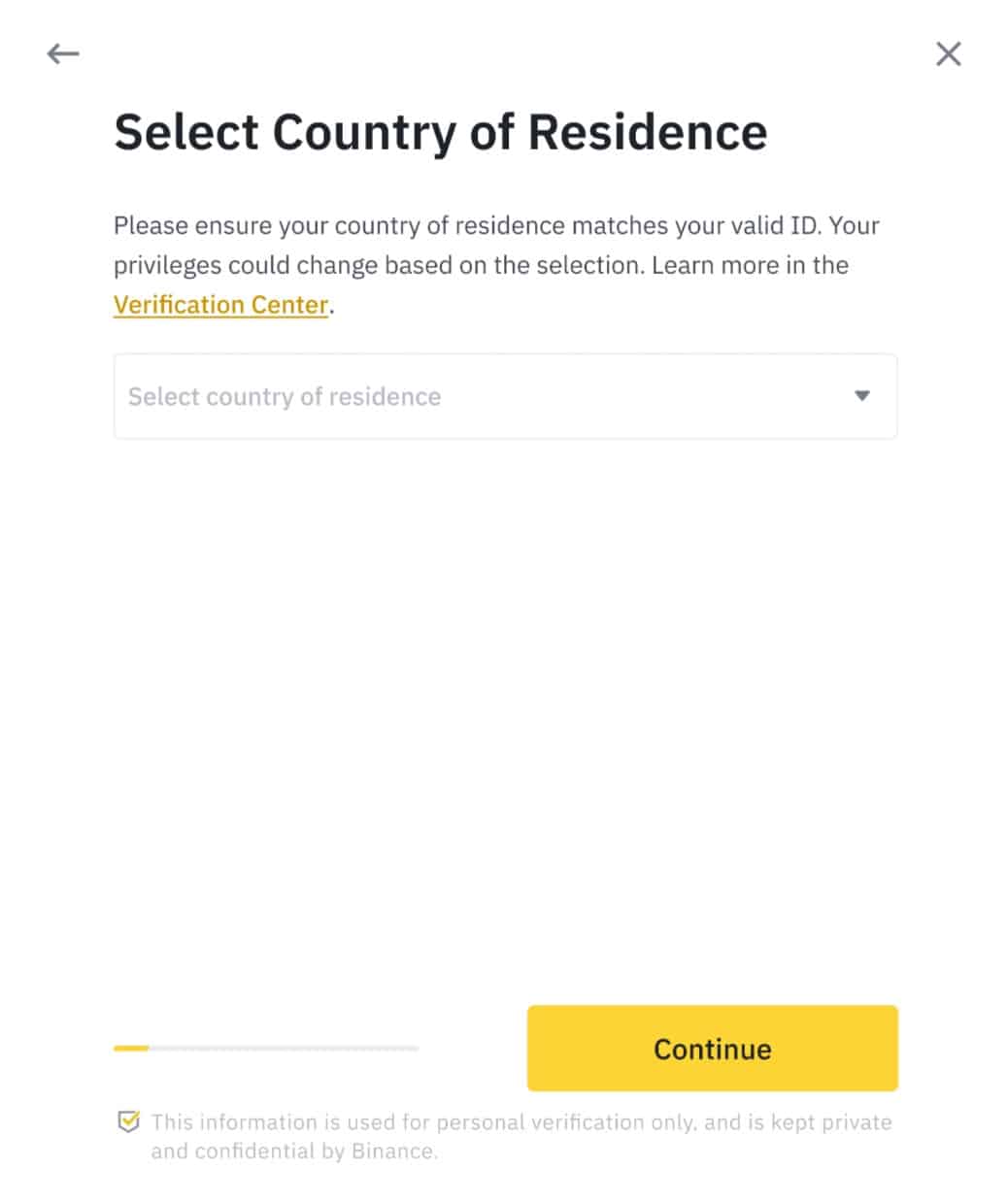

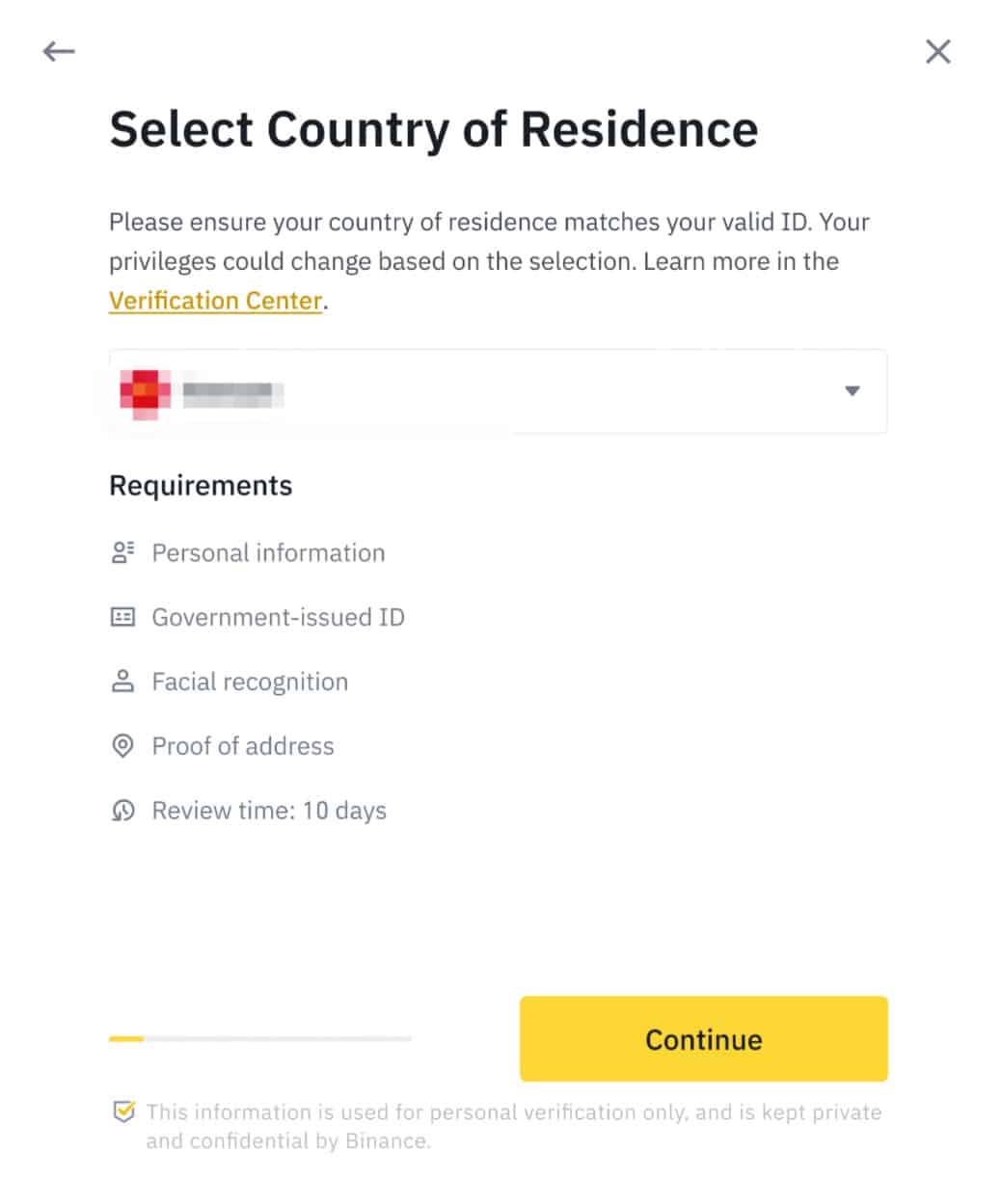

Step 3: Select your country of residence.

Ensure that your country of residence is consistent with your ID documents.

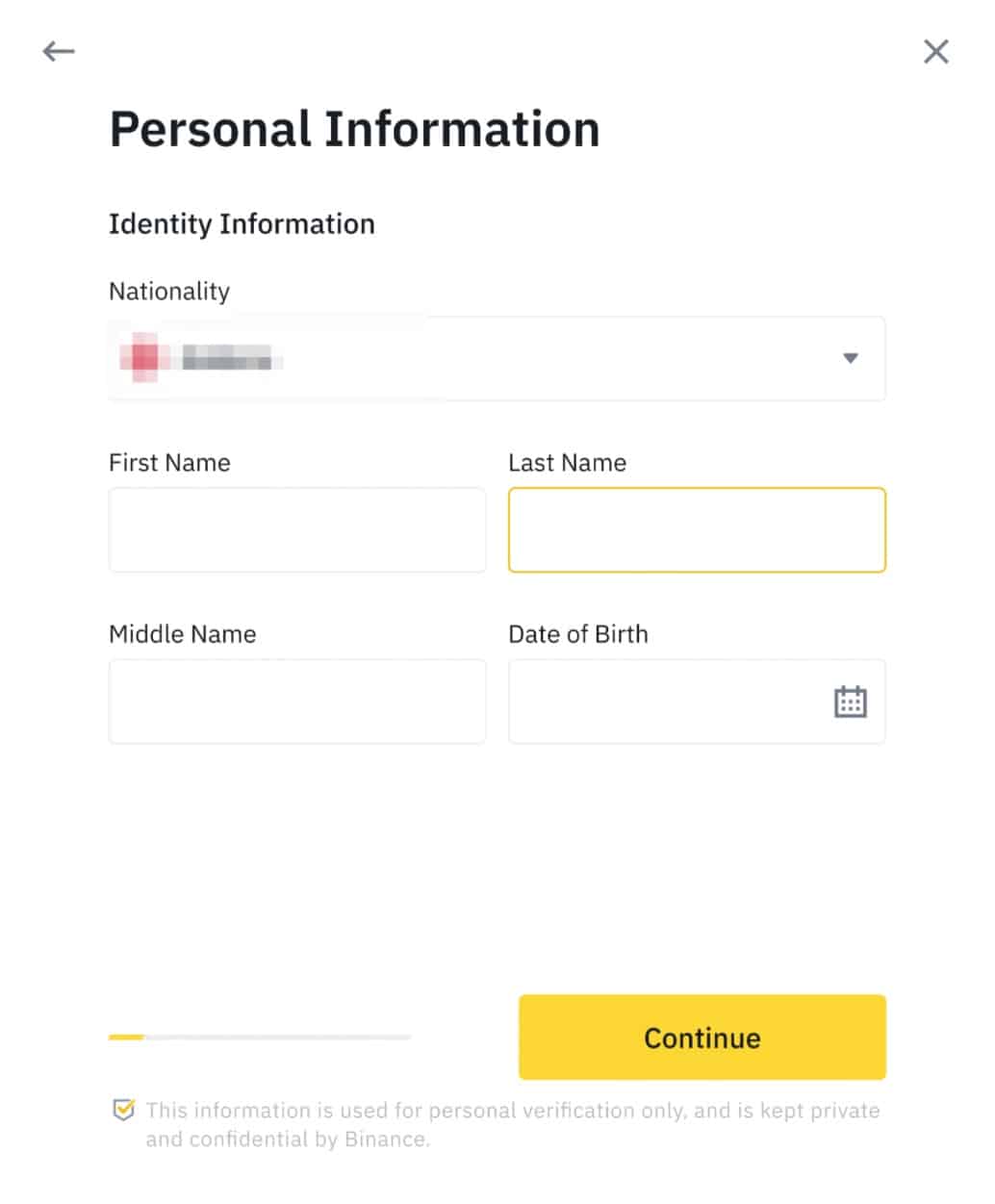

Step 5: Enter your personal information and click “Continue.”

You won’t be able to change it once confirmed.

Refer to the respective options offered for your country.

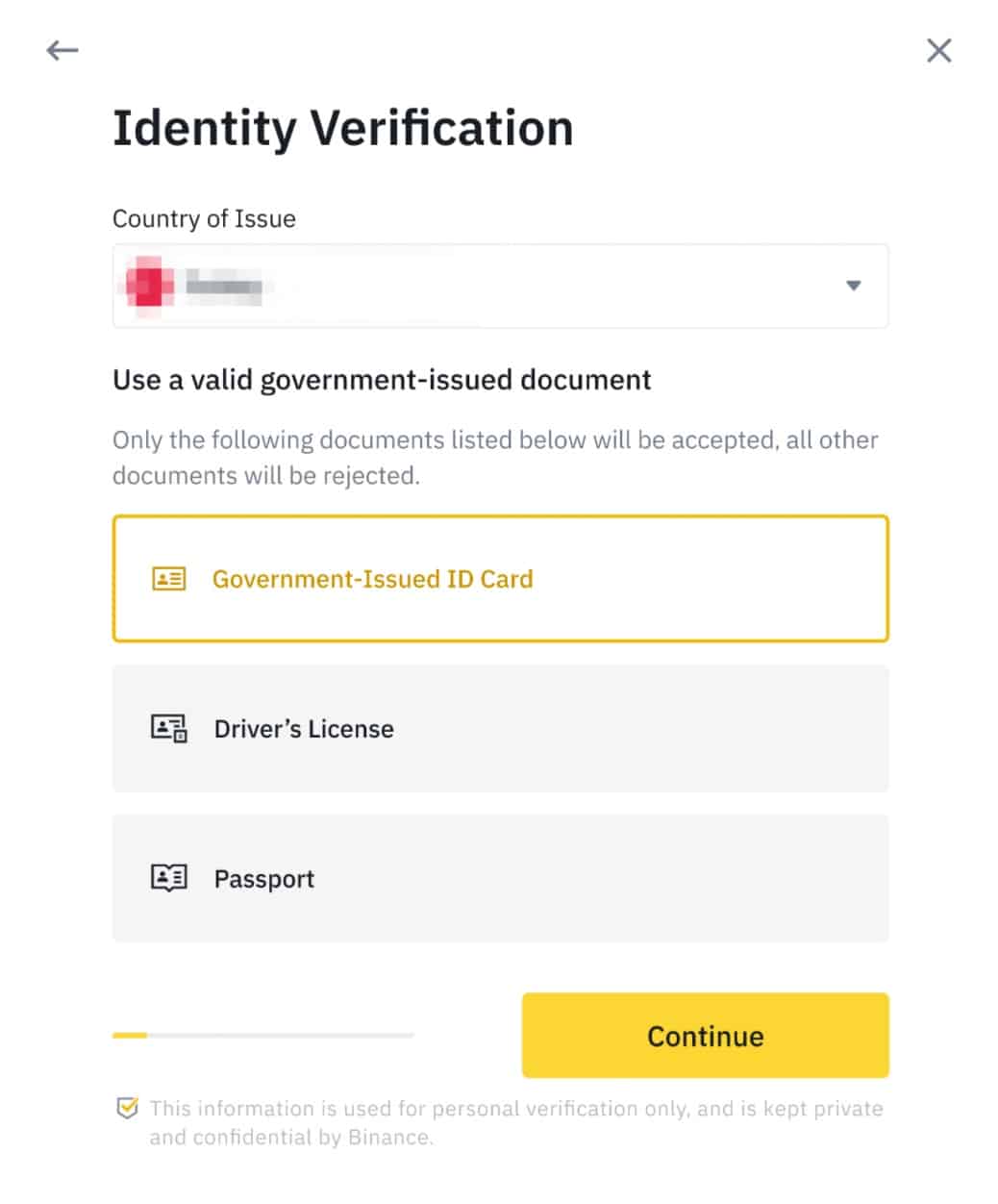

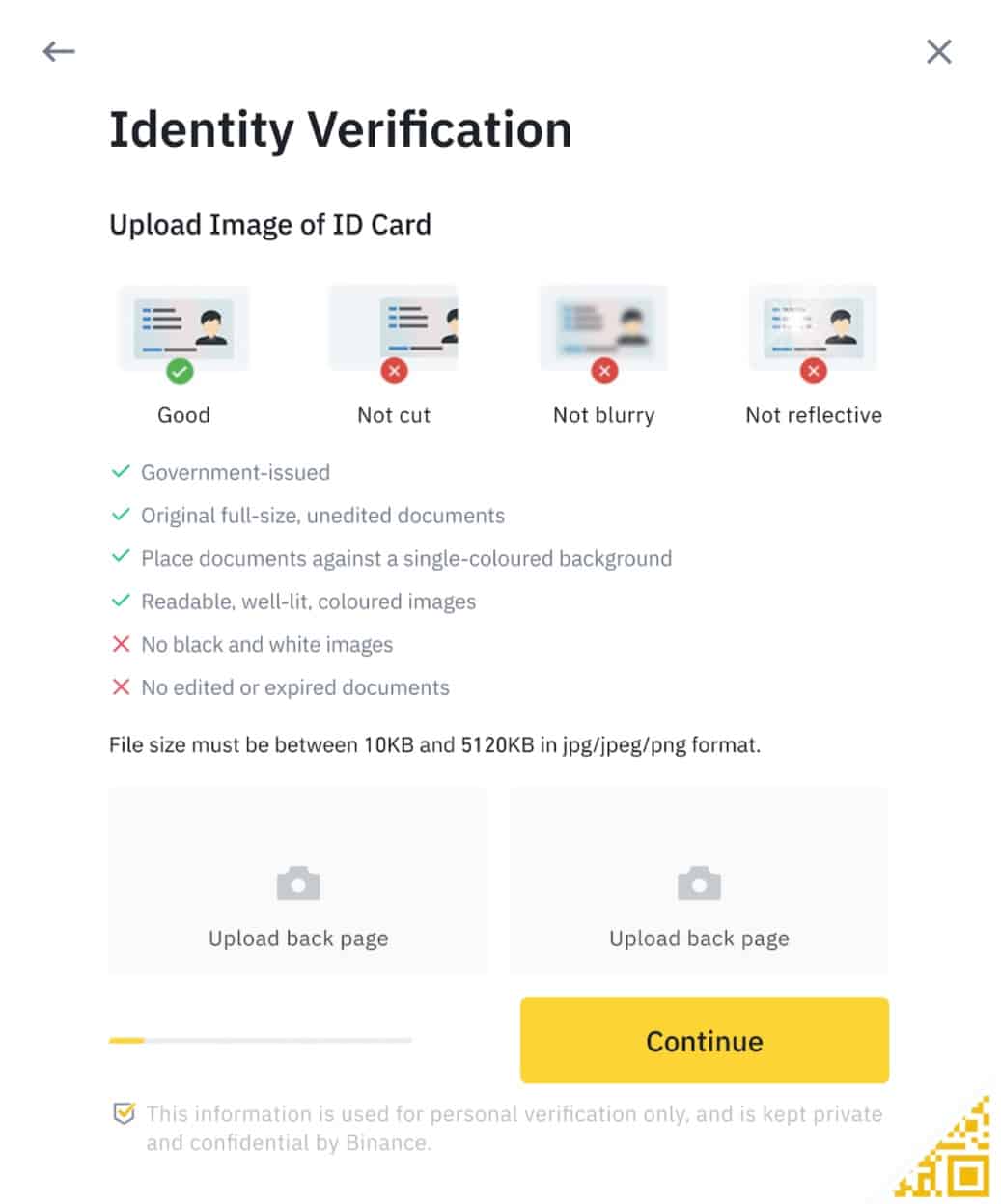

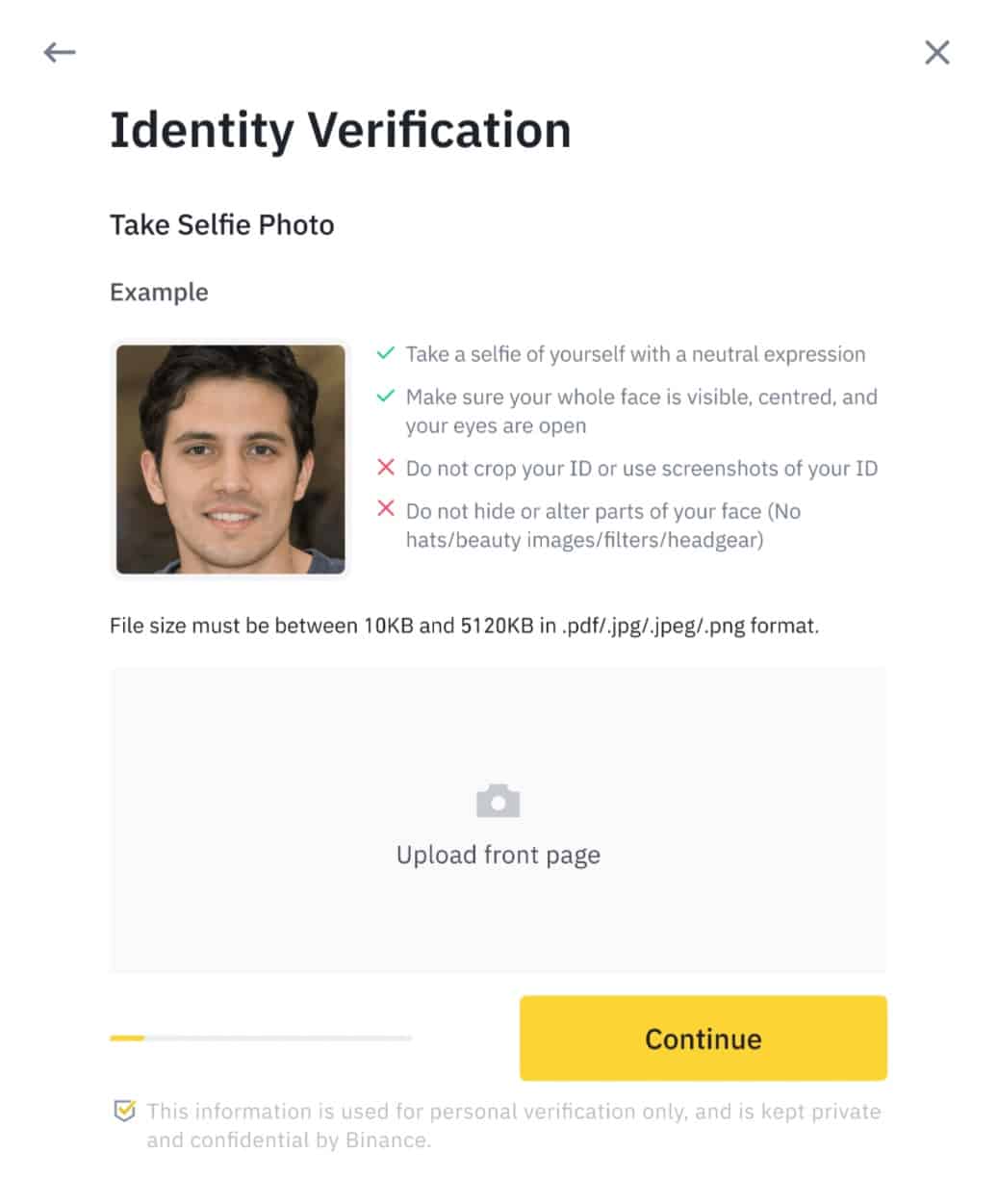

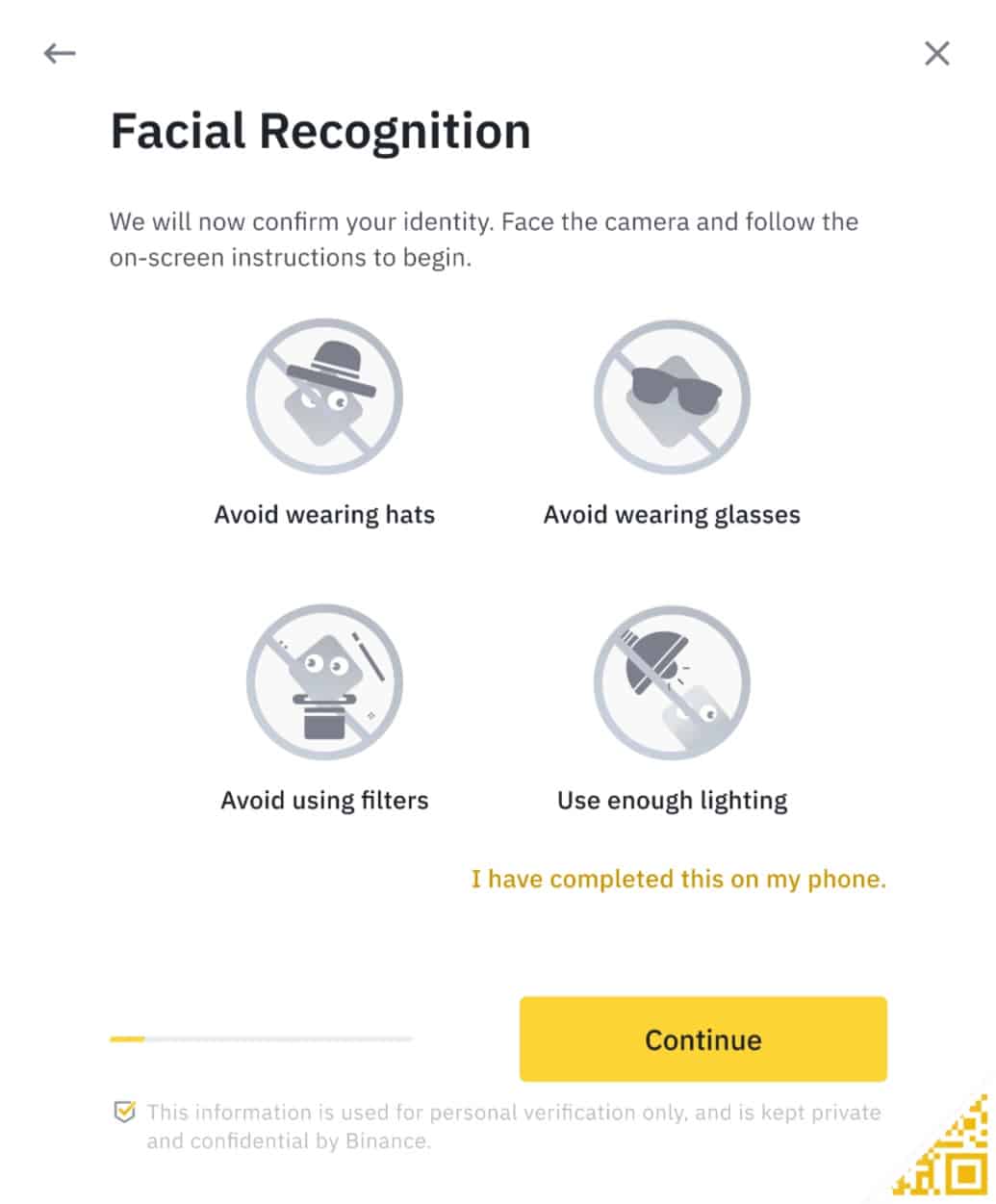

Step 7: Follow the instructions to upload photos of your document. Your photos should clearly show the full ID document.

Do not wear hats, glasses, or use filters, and make sure that the lighting is sufficient.

Once your application has been verified, you will receive an email notification.

How to buy cryptocurrency on Binance

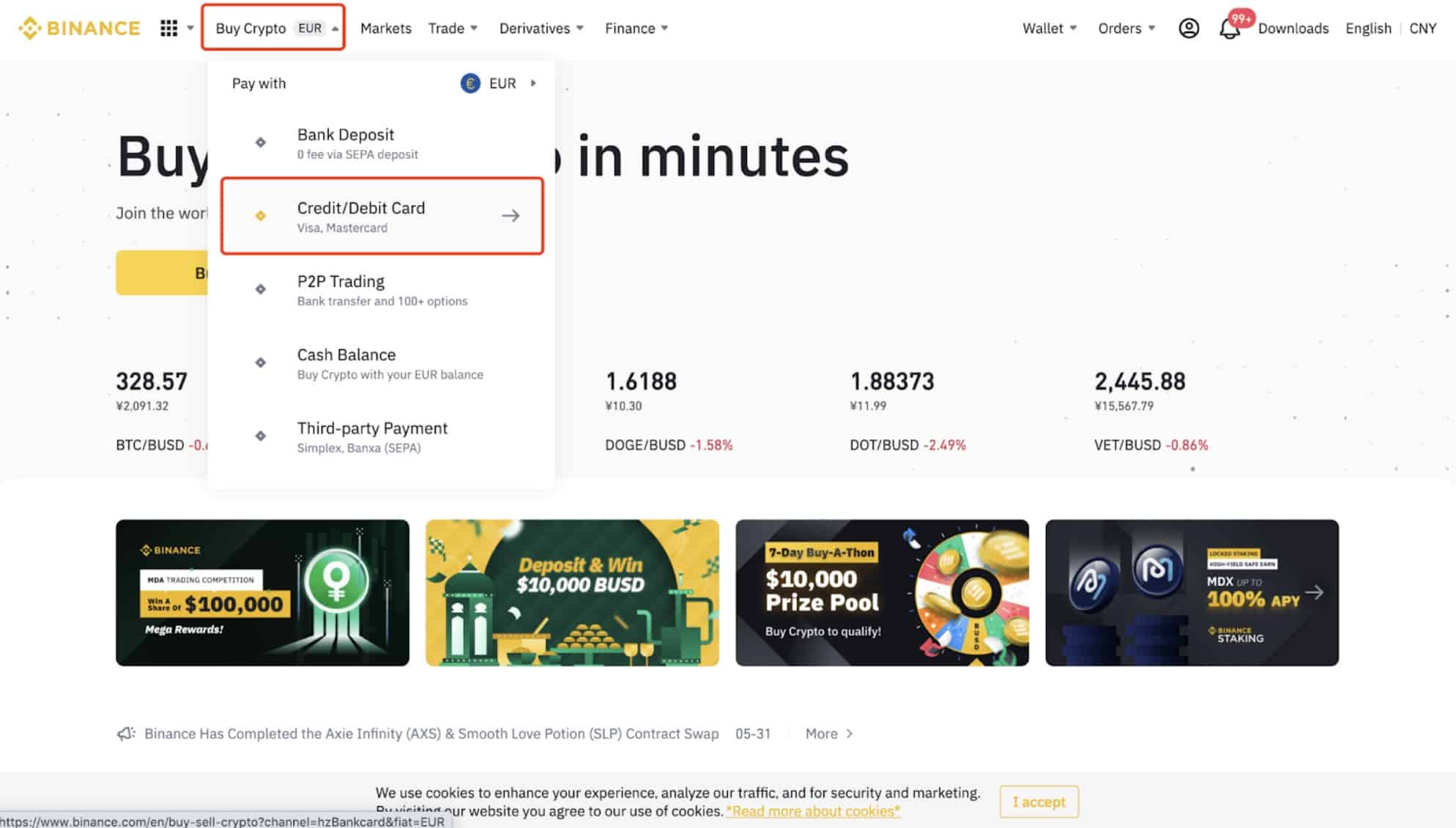

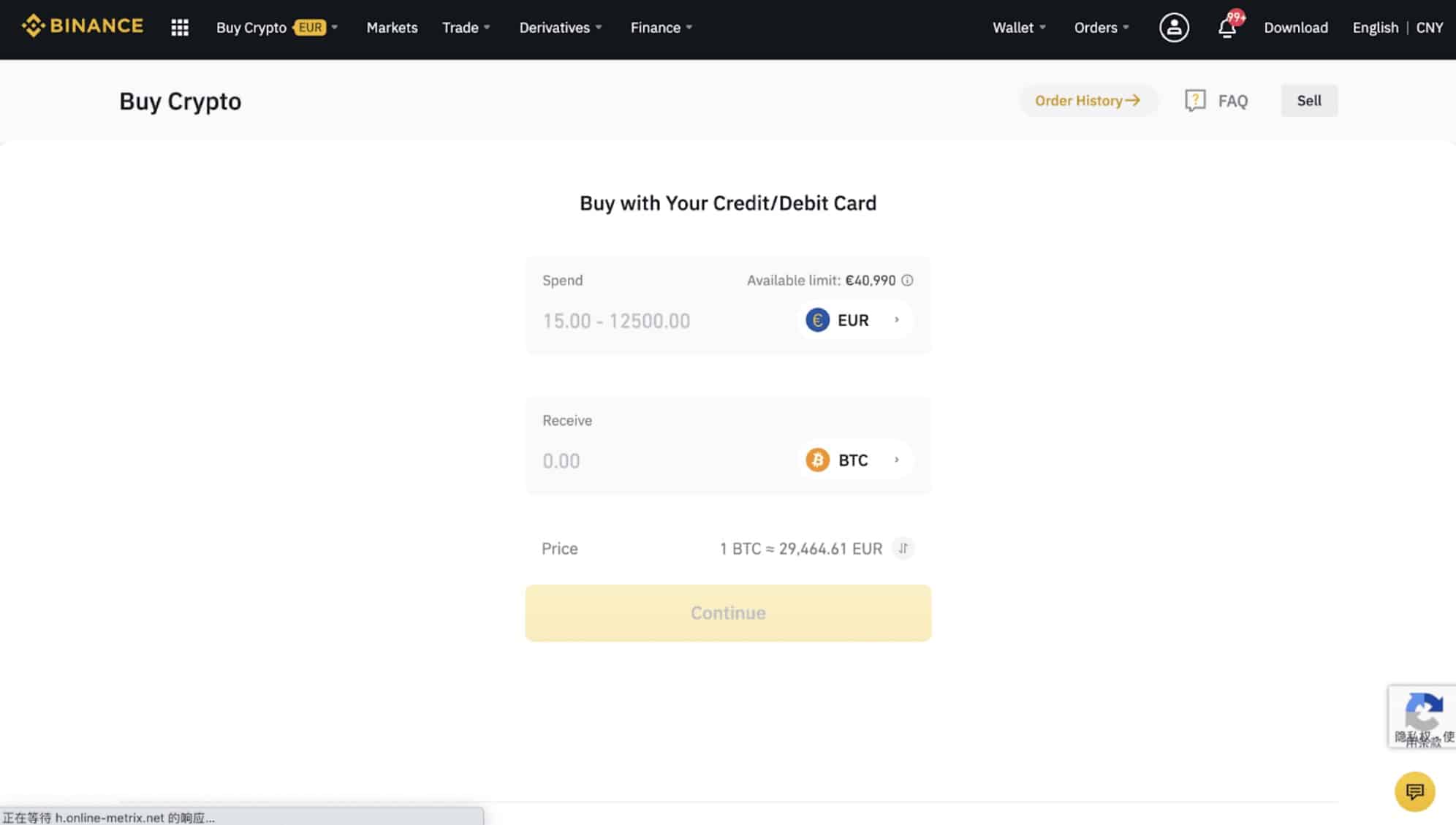

Step 1: Log in to your Binance account and click “Buy Crypto” and then “Credit/Debit Card”.

Step 2: Here you can choose to buy crypto with different fiat currencies. Enter the fiat amount you want to spend and the system will automatically display the amount of crypto you can get. When you have selected the amount you wish to spend then press “Continue”.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

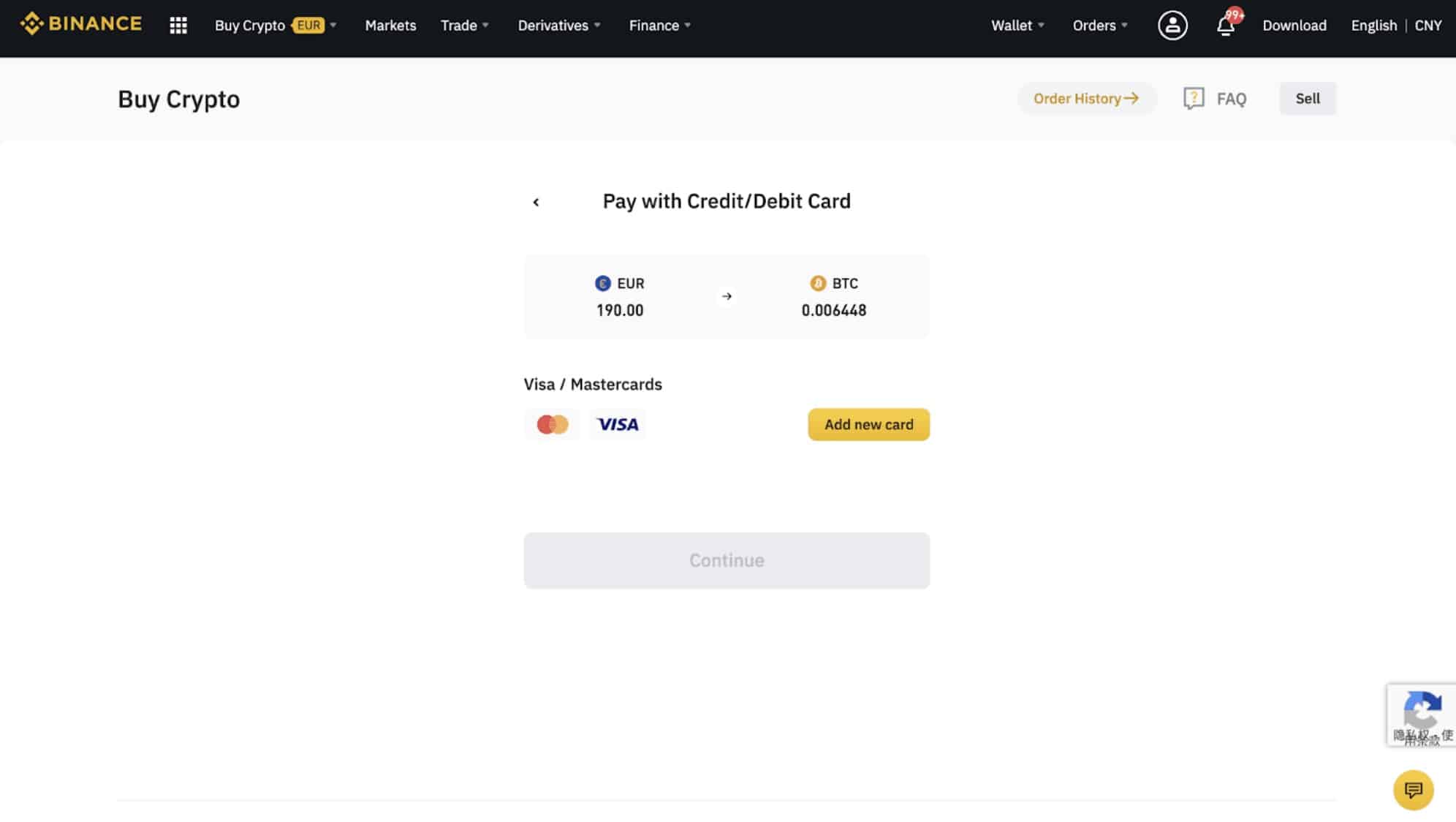

Step 3: Click “Add New Card”. Then enter your credit card details and your billing address.

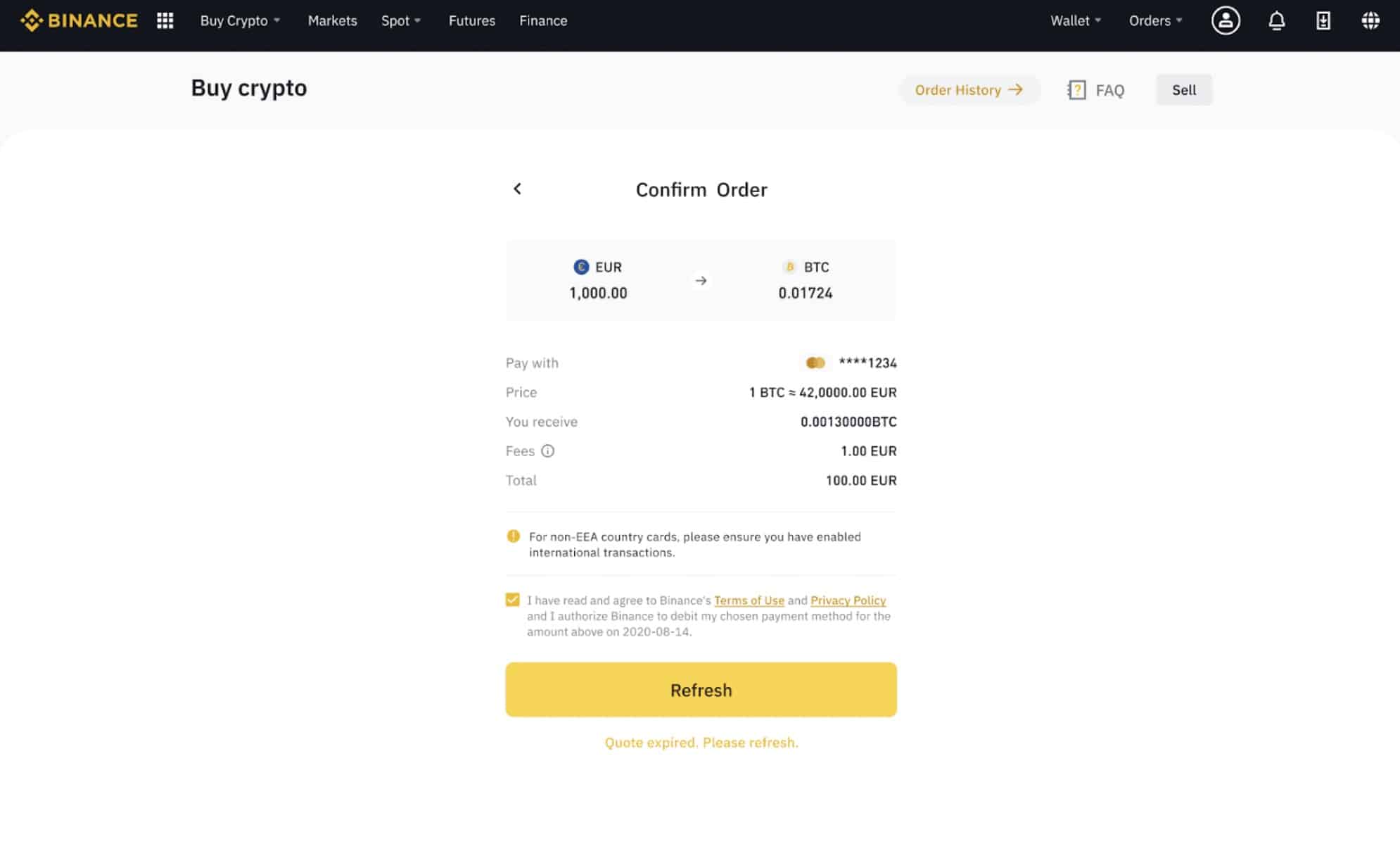

Step 4: Check the payment details and confirm your order within 1 minute. After 1 minute, the price and the amount of crypto you will get will be recalculated. You can click “Refresh” to see the latest market price. You will then be redirected to your bank’s OTP Transaction Page. Follow the on-screen instructions to verify the payment.

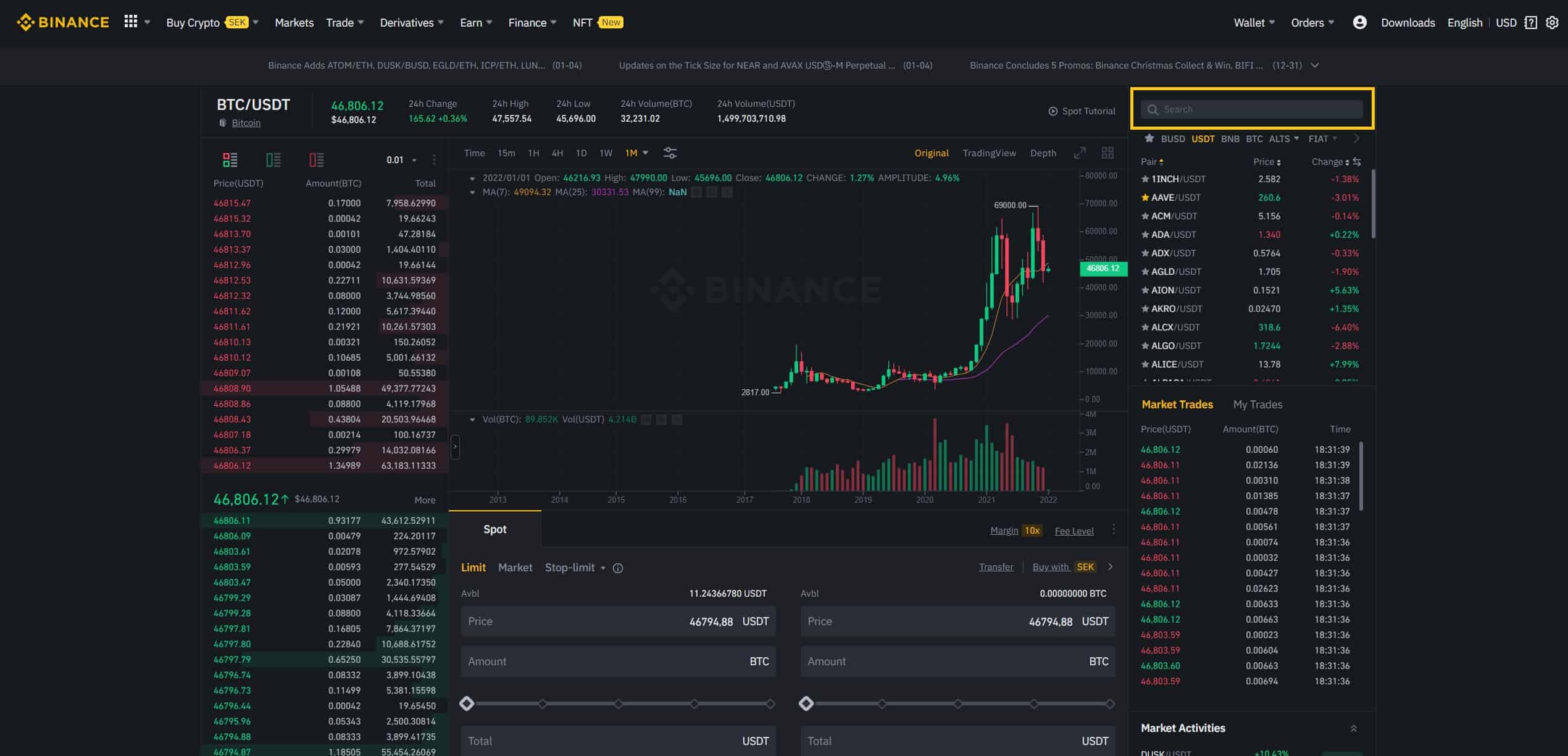

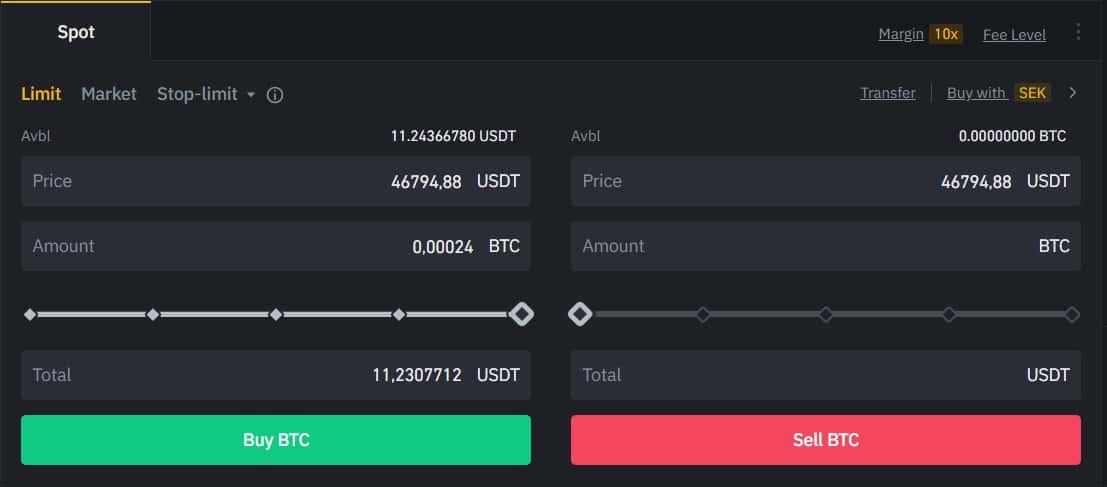

How to Conduct Spot Trading on Binance

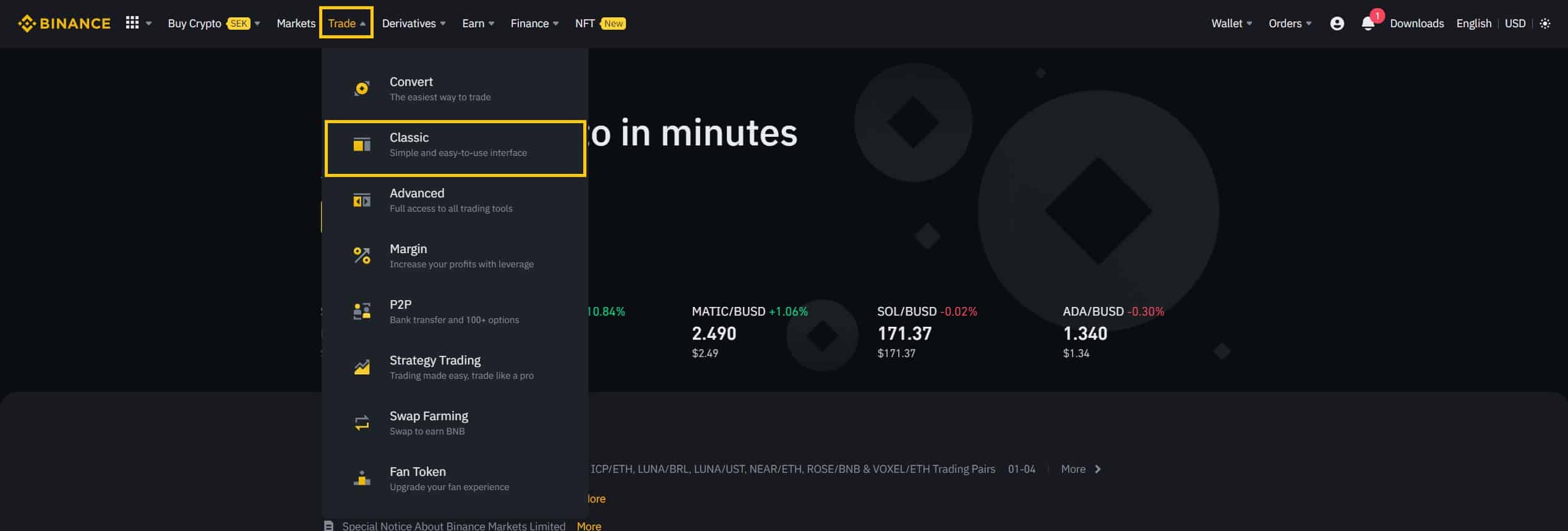

Step 1: Log in to your Binance account.

Click on “Classic” under “Trade” on the top navigation bar.

Step 2: Search and enter the cryptocurrency you want to trade.

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

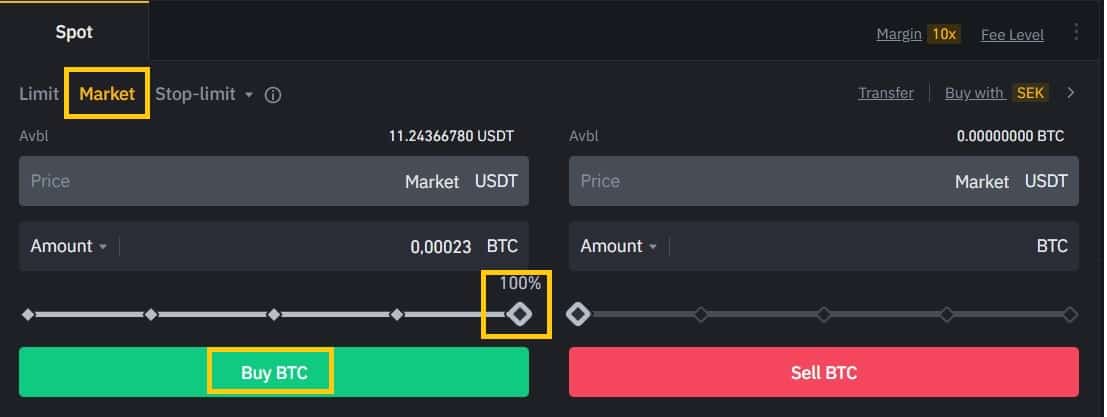

Step 4: If you don’t want to set a manual price, you can place a “Market Order” to set the buying/selling price automatically.

Hide Detailed Instructions

How to create a Gate.io account

Show Detailed Instructions

Hide Detailed Instructions

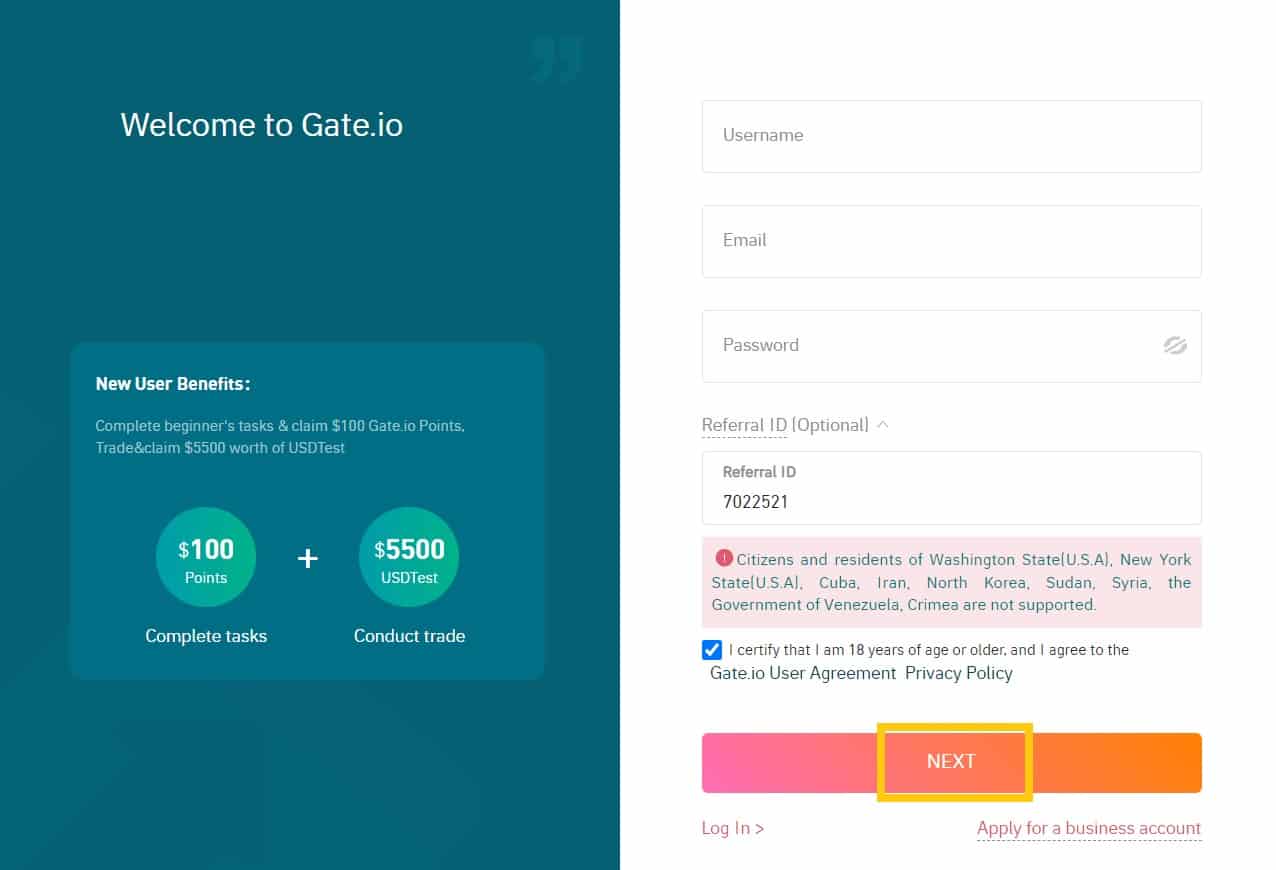

Step 1: Go to the Gate.io website.

Step 2: Choose your username, your email address and your password. Then check “I certify that I am 18 years of age or older, and I agree to the Gate.io User Agreement Privacy Policy” and click “NEXT”.

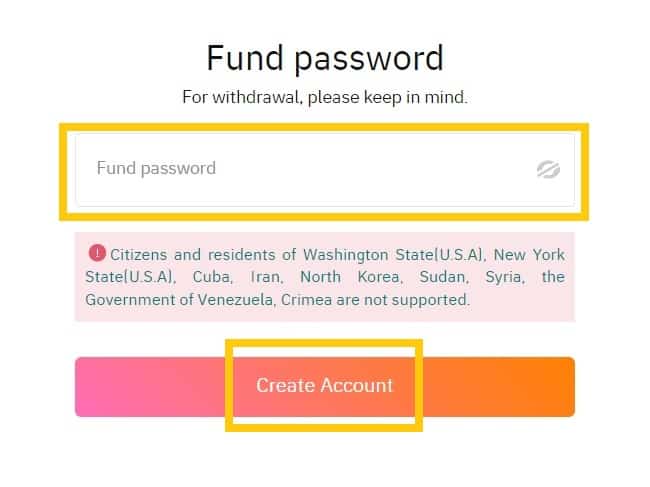

Step 3: Set your fund password and click “Create account”.

Note: Your fund password must contain at least 6 characters and can not be the same as your login password.

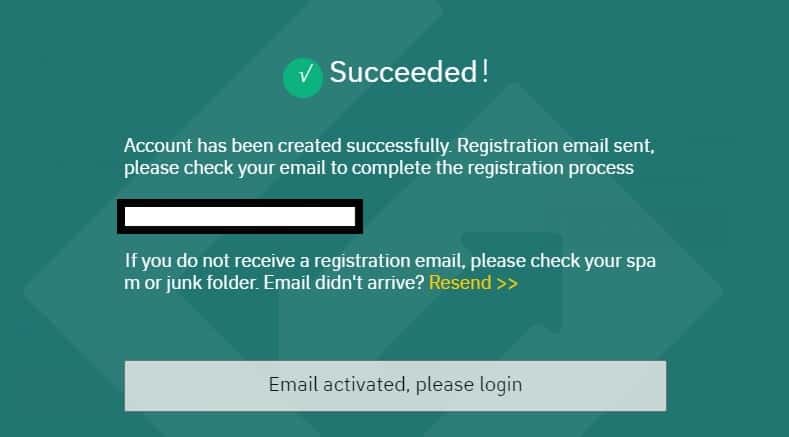

Step 4: An activation email will be sent to your email address. Complete the rest of the registration process by following the instructions in the email to activate your account. Once this is done done, click “Email activated, please log in”.

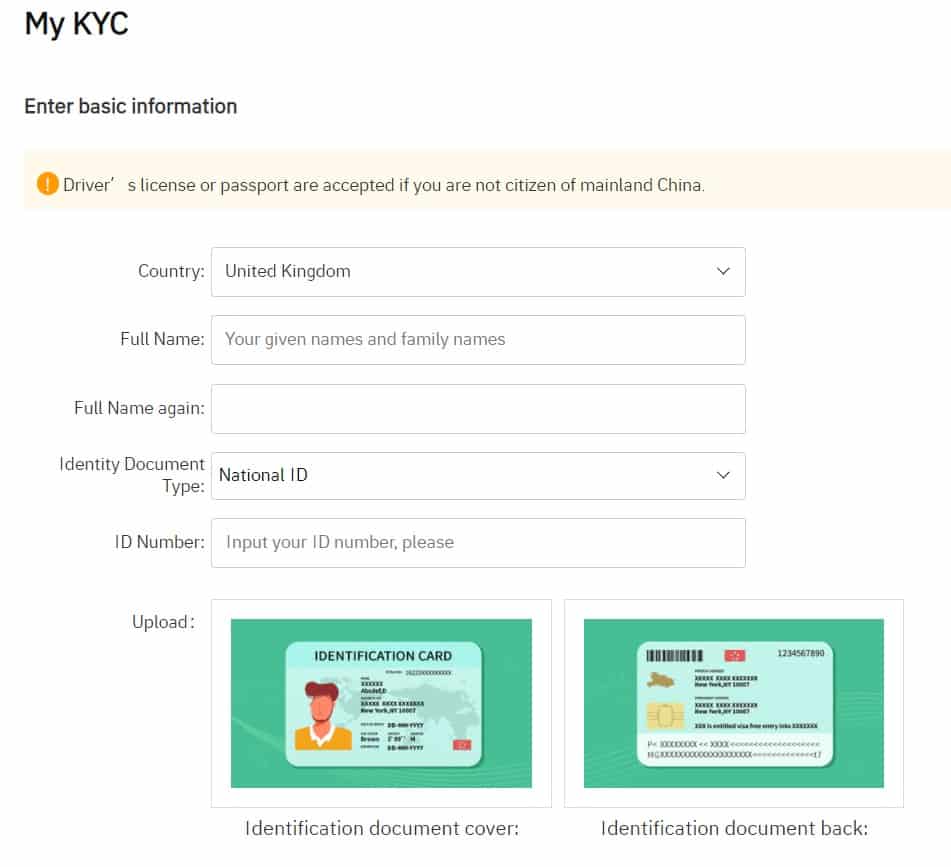

How to complete KYC (ID Verification) on Gate.io

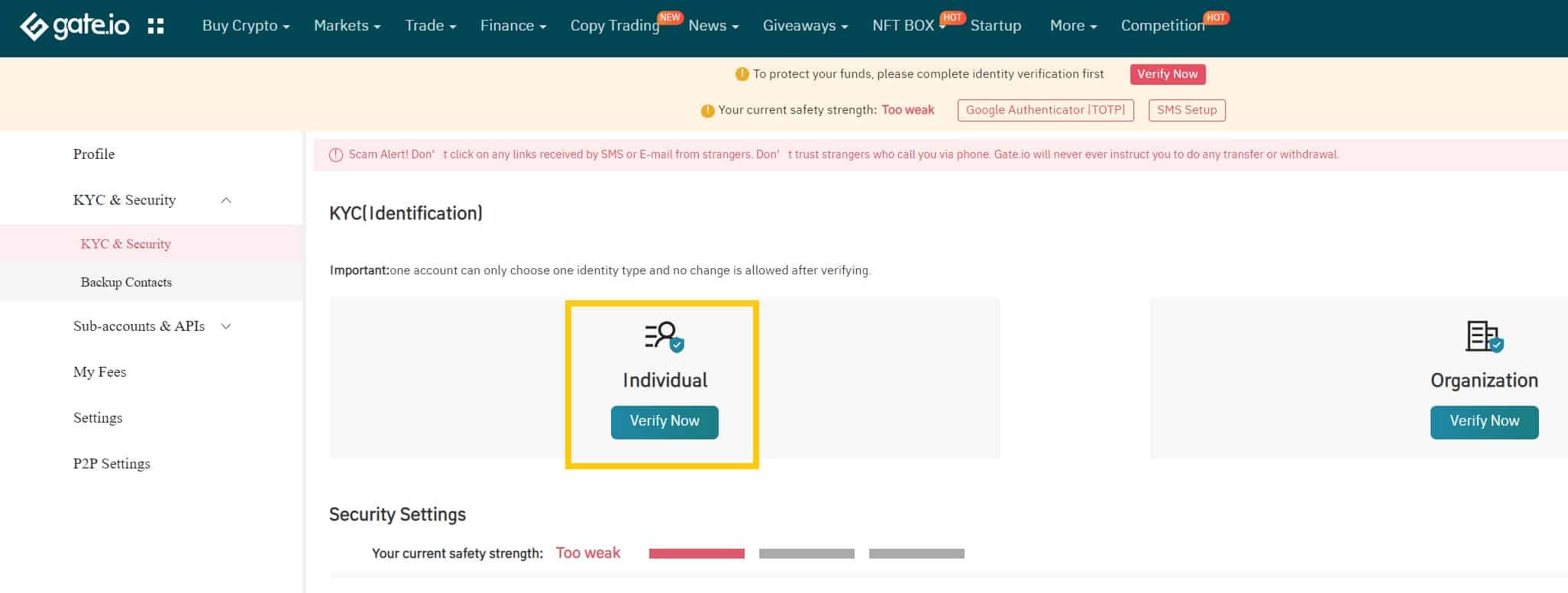

In order to ensure the safety of your assets, and to reduce fraud, money laundering, blackmail, and other illegal activities, Gate.io makes it mandatory that all users obtain KYC ID Verification. Only after your account has obtained KYC ID verification, can you withdraw funds or use credit cards or debit cards to buy cryptocurrencies.

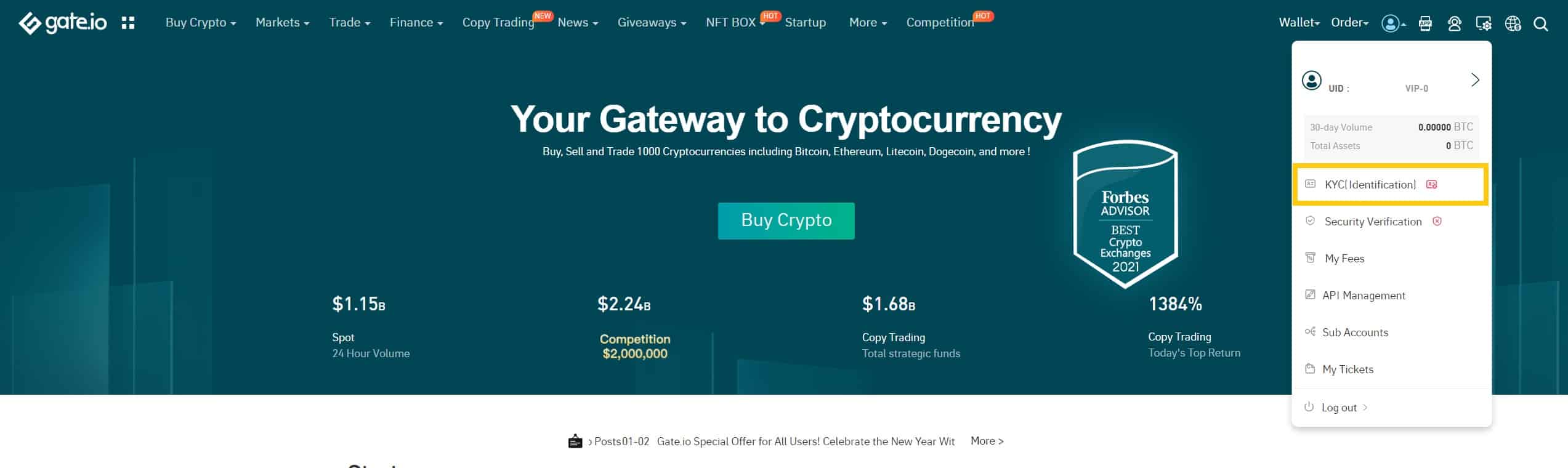

Step 1: Log in to your Gate.io account.

Place your cursor on the top-right profile icon and go to “KYC (ID Verification)”

Step 2: Click “Individual (Verify now)”

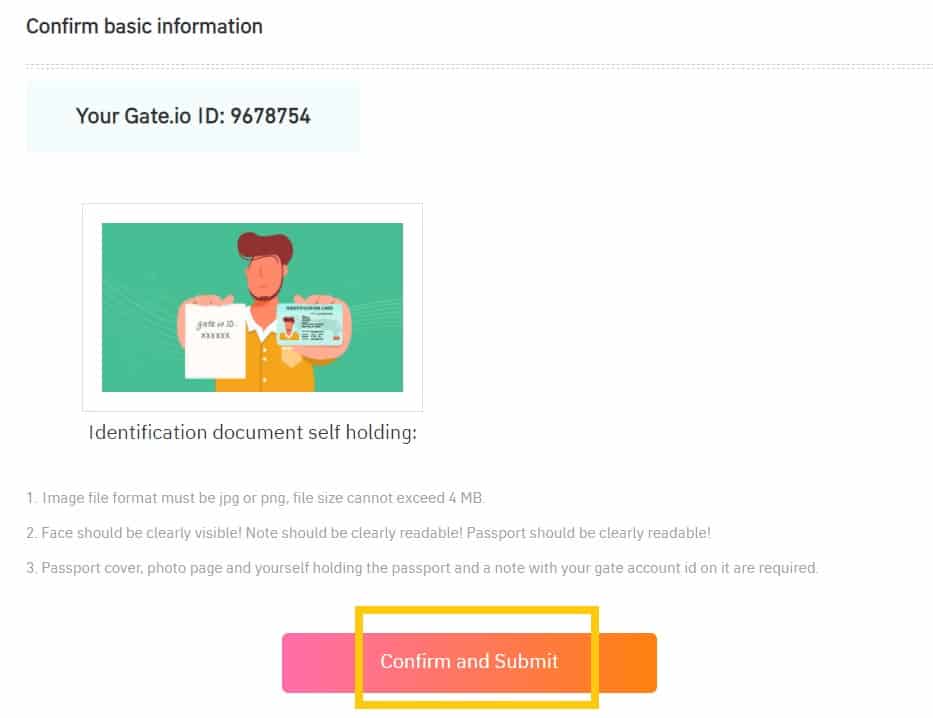

Step 3: Select your country, input your full legal name (twice), fill in your ID information, upload photos of both sides of your ID card, and a photo of you holding your ID together with your User ID (UID) for Gate.io. You will see your User ID by placing the cursor on the top-right profile icon on the main page. Make sure everything is filled in correctly and then click on “Confirm and Submit”.

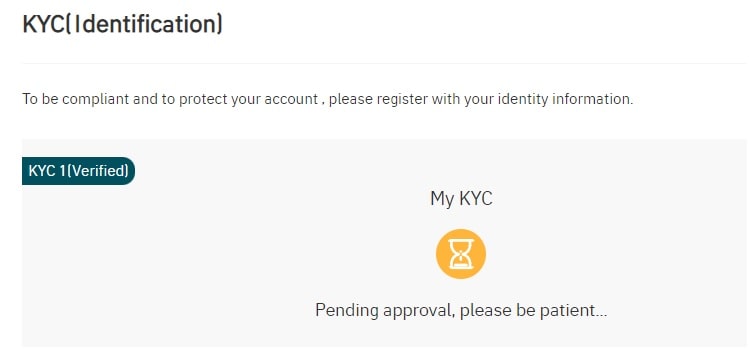

Step 4: After you have submitted all the requested information, you will see the pending approval.

Approval can take anywhere from a few hours to a few days to complete.

Once the KYC is approved, you’re ready to make your first cryptocurrency purchase.

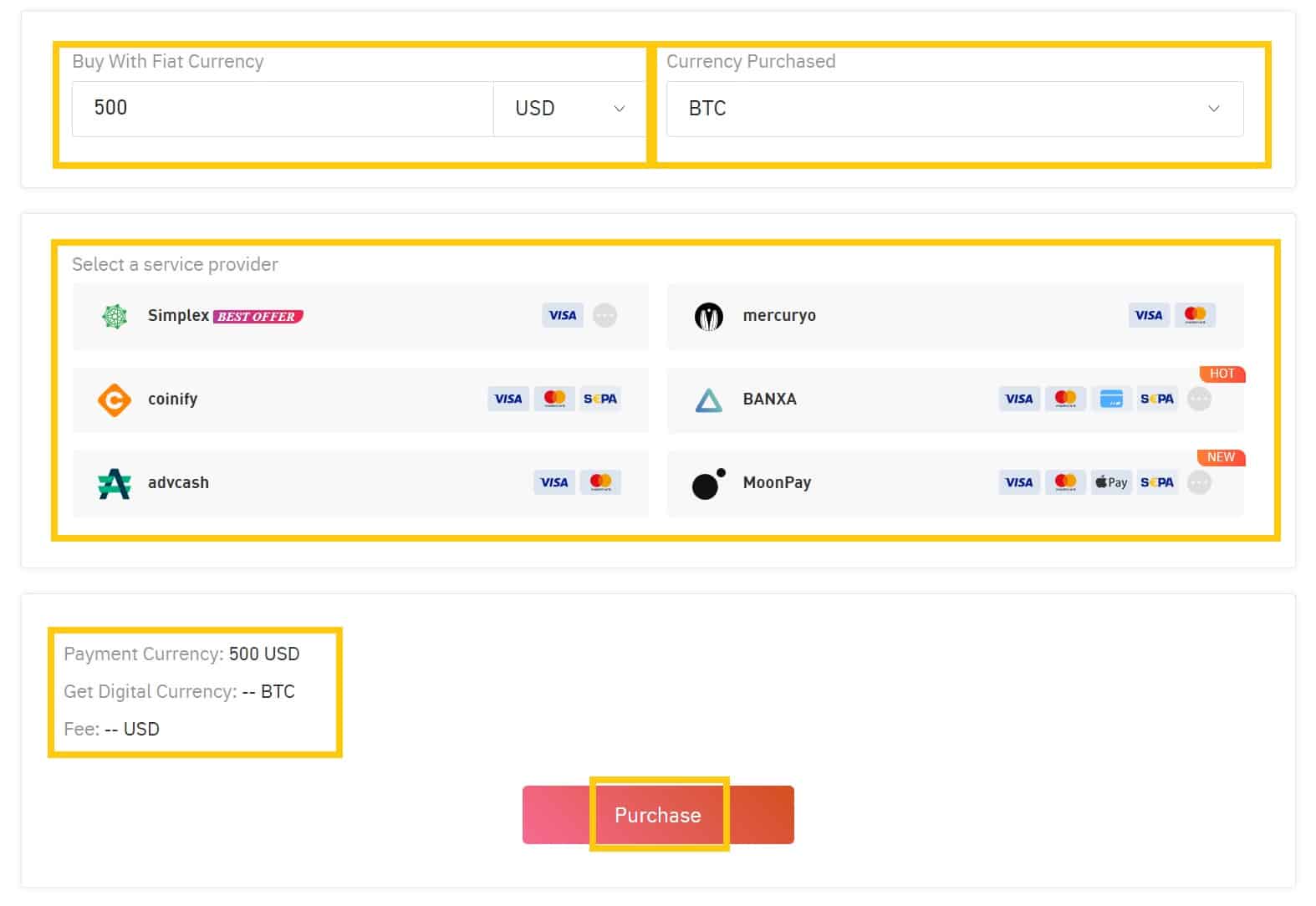

How to buy cryptocurrency on Gate.io

Step 1: Log in to your Gate.io account.

Then in the Menu Bar at the top of the page, click “Buy Crypto” and select “Credit Card”.

Step 2: Enter the amount you wish to spend in the “Buy with Fiat Currency” tab and select the cryptocurrency that you want to buy under the “Currency Purchased” field. Then select one of the “Service Providers” below and click the “Place Order” button to enter the confirmation page.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

Step 3: On the confirmation page, select “Buy Crypto” or the “Create Order” button to complete the payment.

Note: To ensure a quick and secure way of receiving the order, users might need to conduct an additional Identity Verification (KYC) with a third-party service provider. Once successfully verified, the service provider will immediately transfer the cryptocurrencies to your Gate.io account.

How to Conduct Spot Trading on Gate.io

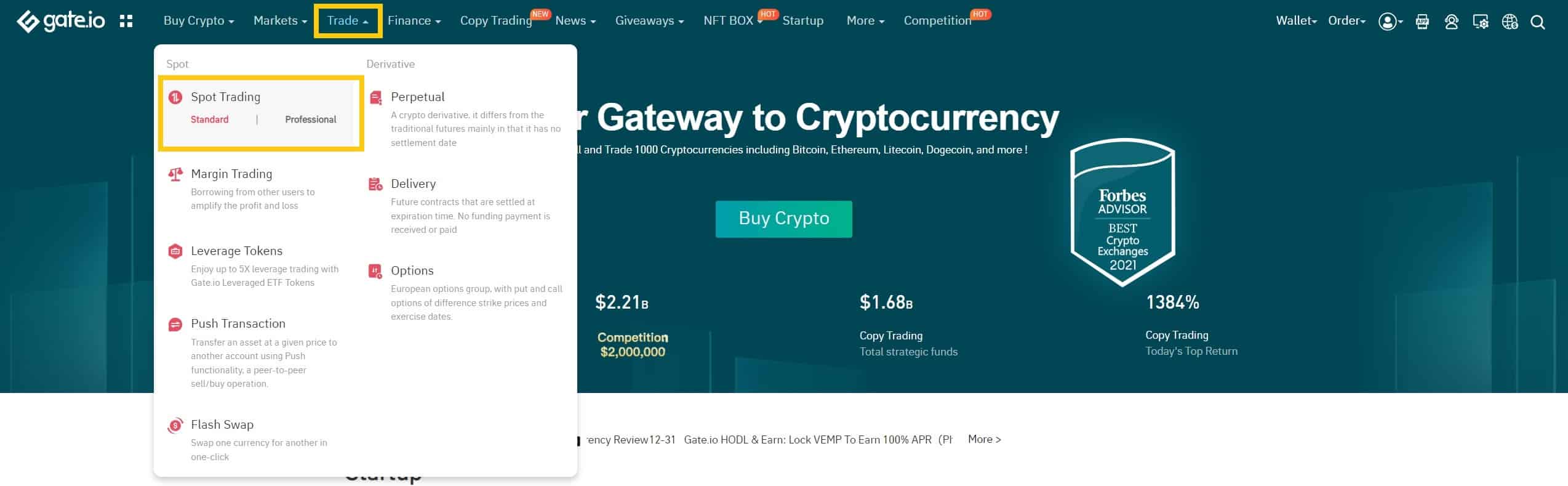

Step 1: Log in to your Gate.io account.

Click on “Spot Trading” under “Trade” on the top navigation bar.

You can either choose “standard” or “professional” version. This tutorial uses the standard version.

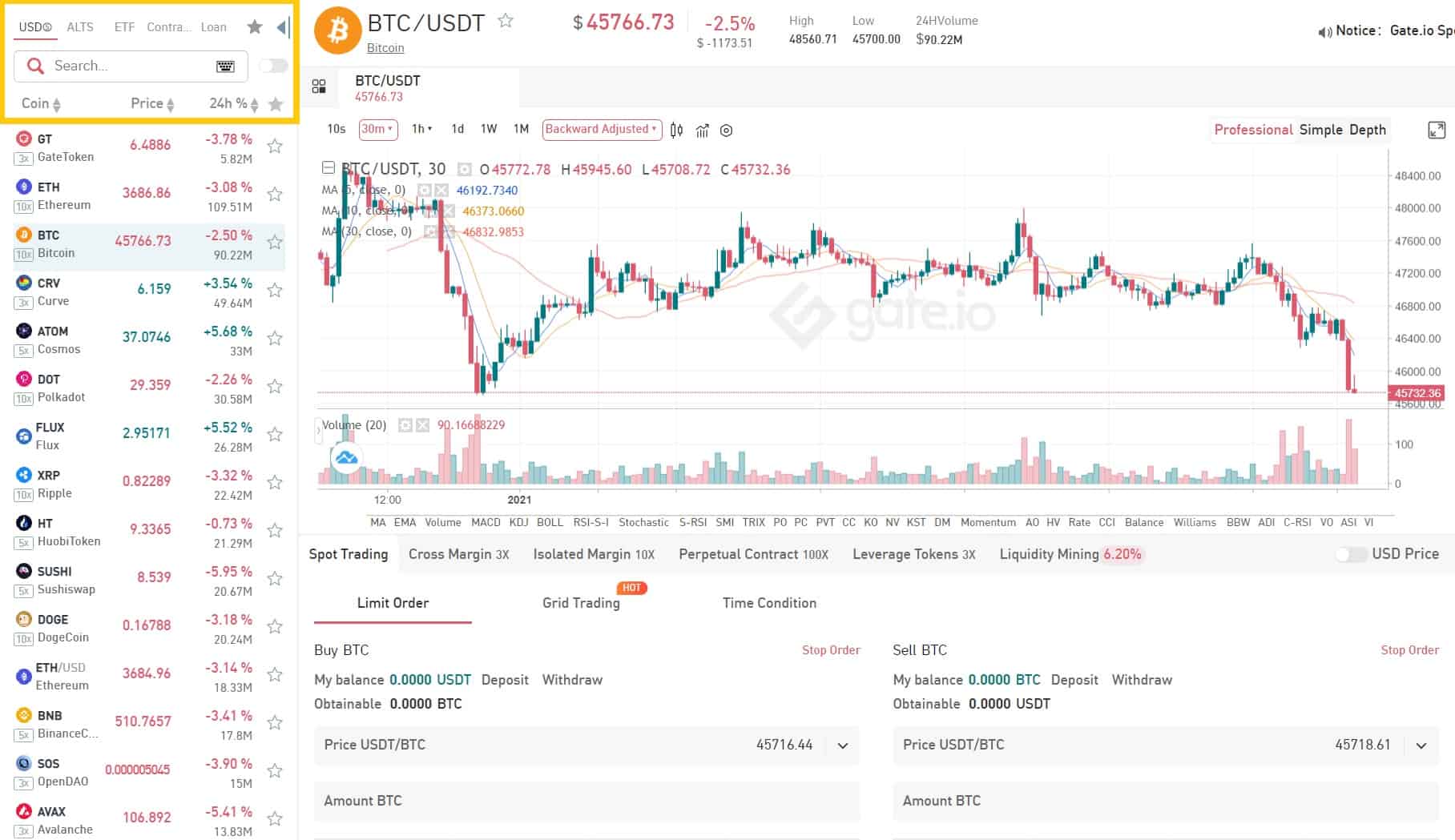

Step 2: Search and enter the cryptocurrency you want to trade.

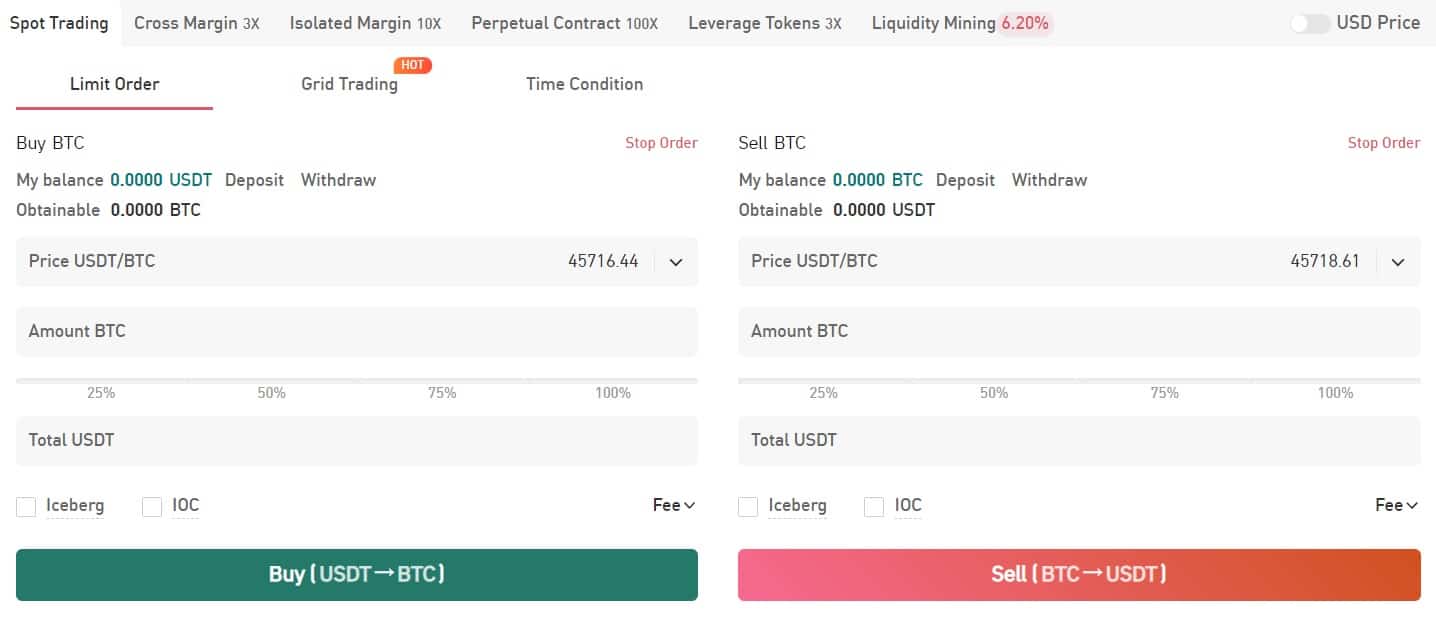

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

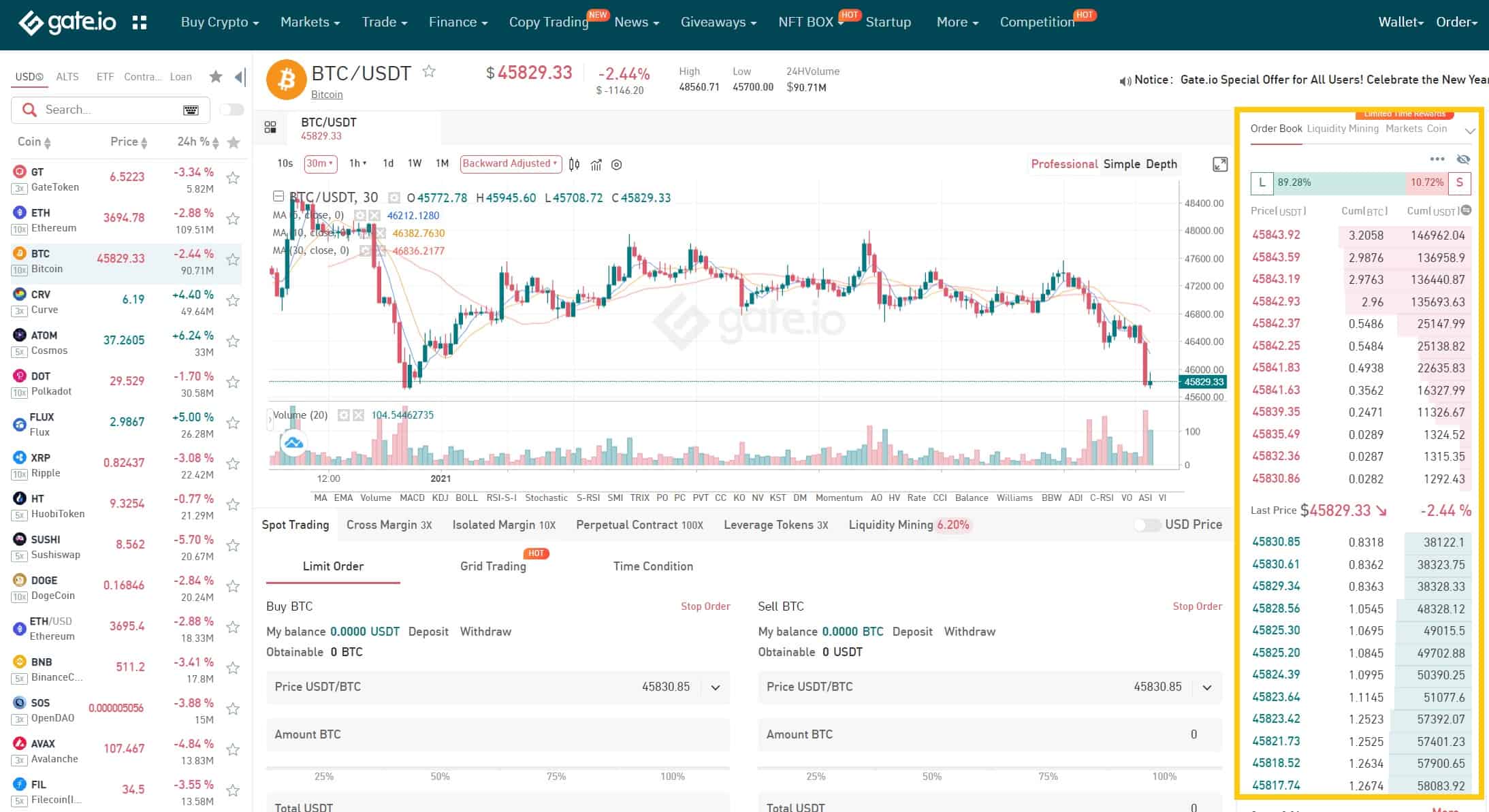

Step 4: If you don’t want to set a manual price, you can click on the last prices on the order book to set the buying/selling price automatically.

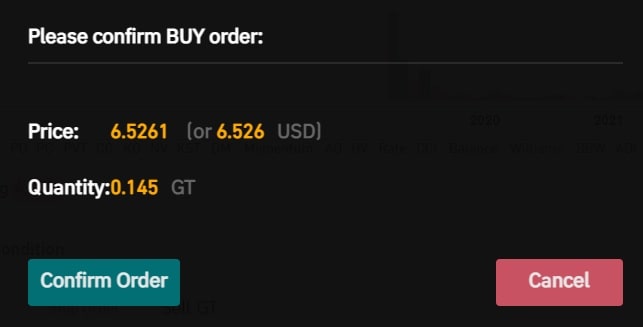

Step 5: Confirm the price and amount. Then click on “Place Order” to place the order, followed by “Confirm Order” to confirm it.

Hide Detailed Instructions

For more in-depth instructions, our ‘Absolute Beginner’s Guide To Cryptocurrency Investing‘ will take you through the process step-by step. In addition to providing instructions for sending and receiving your cryptocurrency.

And if you’re completely new to crypto our beginner, intermediate and advanced level articles will get you up to speed with everything you need to know about the cryptocurrency space starting out.

Simplecryptoguide.com

What Is Terra (LUNA)?

Terra is a blockchain protocol that uses fiat-pegged stablecoins to power price-stable global payments systems. According to its white paper, Terra combines the price stability and wide adoption of fiat currencies with the censorship-resistance of Bitcoin (BTC) and offers fast and affordable settlements.

Development on Terra began in January 2018, and its mainnet officially launched in April 2019. As of September 2020, it offers stablecoins pegged to the U.S. dollar, South Korean won, Mongolian tugrik and the International Monetary Fund’s Special Drawing Rights basket of currencies — and it intends to roll out additional options.

Terra’s native token, LUNA, is used to stabilize the price of the protocol’s stablecoins. LUNA holders are also able to submit and vote on governance proposals.

Who Are the Founders of Terra?

Terra was founded in January 2018 by Daniel Shin and Do Kwon. The two conceived of the project as a way to drive the rapid adoption of blockchain technology and cryptocurrency through a focus on price stability and usability. Kwon took on the position of CEO of Terraform Labs, the company behind Terra.

Prior to developing Terra, Shin co-founded and headed Ticket Monster, otherwise known as TMON — a major South Korean e-commerce platform. He later co-founded Fast Track Asia, a startup incubator working with entrepreneurs to build fully functional companies.

Kwon previously founded and served as CEO of Anyfi, a startup providing decentralized wireless mesh networking solutions. He has also worked as a software engineer for Microsoft and Apple.

What Makes Terra Unique?

Terra seeks to set itself apart through its use of fiat-pegged stablecoins, stating that it combines the borderless benefits of cryptocurrencies with the day-to-day price stability of fiat currencies. It keeps its one-to-one peg through an algorithm that automatically adjusts stablecoin supply based on its demand. It does so by incentivizing LUNA holders to swap LUNA and stablecoins at profitable exchange rates, as needed, to either expand or contract the stablecoin supply to match demand.

Terra has established a number of partnerships with payments platforms, particularly in the Asia-Pacific region. In July 2019, Terra announced a partnership with Chai, a South Korea-based mobile payments application, in which purchases made using the application on e-commerce platforms are processed via the Terra blockchain network. Each transaction is subject to (on average) a 2%–3% fee charged to the merchant.

In addition, Terra is supported by the Terra Alliance, a group of businesses and platforms advocating for the adoption of Terra. In February 2019, the company announced that e-commerce platforms from 10 different countries, representing a user base of 45 million and a gross merchandise value of $25 billion, were members of the alliance.

How Is the Terra Network Secured?

The Terra blockchain is secured using a proof-of-stake consensus algorithm based on Tendermint, in which LUNA token holders stake their tokens as collateral to validate transactions, receiving rewards in proportion to the amount of LUNA staked. Tokenholders may also delegate others to validate transactions on their behalf, sharing in any revenue generated. Terra also offers additional guidance to validator nodes on the best practices for helping to keep the network secure.

What Is Terra 2.0 (LUNA)?

The development of Terra Classic launched in January 2018 and the blockchain launched in April 2019. It attempted to combine the price stability and wide adoption of fiat currencies with the censorship-resistance of Bitcoin (BTC) and offer fast and affordable settlements through its UST stablecoin. Terra Classic offered stablecoins pegged to the U.S. dollar, South Korean won, Mongolian tugrik, and the International Monetary Fund’s Special Drawing Rights basket of currencies.

The new Terra blockchain continues the legacy of Terra Classic without the UST stablecoin. It will keep building with the help of the LUNA community dubbed “LUNAtics” and evolve the world-class UX and UI that brought Terra Classic up to second place in total value locked (TVL) at its peak. Many DApps have agreed to migrate to Terra to continue their functionality.

Terra 2.0 will continue without its algorithmic stablecoin UST and aims to preserve the Terra ecosystem with hundreds of developers working on different decentralized applications. The LUNA token will be airdropped across Luna Classic stakers, holders, residual UST holders and essential Terra Classic app developers. Terra removed the wallet of Terra Foundation Labs for the airdrop event, making Terra a fully community-owned chain.

The airdrop will be carried out according to two snapshots taken, one before the Terra Classic crash (May 7) and one after it (May 27). The eligibility for the airdrop is as follows:

Holding the following assets on the May 7 snapshot:

- Luna Classic (LUNC) (including staking derivatives)

- Less than 500k aUST (UST deposited in Anchor)

Holding the following assets on the May 27 snapshot:

- Luna Classic (LUNC) (including staking derivatives)

- UST

At Genesis, 30% of the LUNA airdrop will be immediately available to pre-attack users with wallets that had less than 10k LUNA (including staking derivatives) or deposited UST in Anchor, and post-attack users with any quantity of LUNA (including staking derivatives), UST, or both.

Furthermore, vested LUNA distributed during the airdrop will be automatically staked to Terra validators. Users can change their delegator and will earn staking rewards on their vested LUNA but are subject to a six-month cliff. You can read the full details of the Terra (LUNA) airdrop in this explainer article by Terra.

Terra development updates in 2023

Terra (LUNA) has undergone several key developments in 2023, marking significant progress in the blockchain’s evolution. Here are the main highlights:

-

Major Network Upgrade (v.2.4): Terra (LUNA) blockchain implemented a strategic upgrade to version 2.4, which brought several new updates to the chain. This upgrade aimed to enhance the adoption of its native token LUNA and improve the overall functionality of the blockchain. The Terra mainnet, dubbed Phoenix-1, went offline briefly to facilitate this upgrade but resumed normal operation shortly after.

-

Approval of Proposal 11766: The Terra Luna Classic community unanimously endorsed Proposal 11766, leading to a major blockchain upgrade known as version 2.2.1. This upgrade, spearheaded by the L1 Terra Classic Task Force (L1TF), was a significant step in enhancing the blockchain’s robustness and aligning it with the long-term vision of Terra Luna Classic.

-

Second Airdrop and Rebranding: Terra recently passed a proposal to conduct a second airdrop of over 19 million LUNA tokens. Alongside this, the project underwent a rebranding, including the launch of Terra Docs, which provides official documentation for the project, as well as basic developer tutorials on building on the blockchain. This initiative aims to make it easier for developers to engage with the Terra ecosystem.

-

NFT Marketplace and Stablecoin Launch: Terra launched Random Earth Version 2, an NFT marketplace for the Terra ecosystem, and introduced a new stablecoin, $SOLID, developed by Capapult. These developments highlight Terra’s ongoing exploration into NFTs and its efforts to expand its range of offerings within the decentralized finance (DeFi) space.

-

Price Performance: September 2023 saw Terra (LUNA) enjoy one of its best months since the hard fork, with the price rallying from $1.8 to a high of $7.06. Despite facing challenges like the arrest warrant for founder Do Kwon and market fluctuations, LUNA managed to trade better than at the start of the month, showcasing the resilience of the token in a volatile market.

These updates indicate Terra’s commitment to rebuilding and enhancing its platform, reflecting the project’s resilience and adaptability in the face of previous challenges. The Terra community, known as “Lunatics,” remains actively engaged and supportive of these developments, demonstrating ongoing trust in the project’s future.

Official website: https://www.terra.money/

Best cryptocurrency wallet for Terra (LUNA)

There are plenty of different crypto wallets available. The best one for you depends on your general trading habits and which provides the most security in your situation. There are two main types of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical). Both have their pros and cons, and there is not necessarily a right or wrong answer when it comes to figuring out which crypto wallet is best for you.

HOW DO I DECIDE WHICH cryptocurrency WALLET TO USE for Terra (LUNA)?

Deciding which type of wallet to use depends on a variety of factors, including:

- How often you trade. In general, hot wallets are better for more active cryptocurrency traders. Quick login ability means you are only a few clicks and taps away from buying and selling crypto. Cold wallets are better suited for those looking to make less frequent trades.

- What you want to trade. As mentioned earlier, not all wallets support all types of cryptocurrencies. However, some of the best crypto wallets have the power to trade hundreds of different currencies, providing more of a one-size-fits-all experience.

- Your peace of mind. For those worried about hacking, having a physical cold wallet stored in a safe deposit box at the bank or somewhere at home, provides the safest, most secure option. Others might be confident in their ability to keep their hot wallets secure.

- How much it costs. It is important to investigate the costs associated with each wallet. Many hot wallets will be free to set up. Meanwhile, cold wallets, like any piece of hardware, will cost money to purchase.

- What it can do. While the basics of each cryptocurrency wallet are the same, additional features can help set them apart. This is especially true of hot wallets, many of which come with advanced reporting features, insights into the crypto market, the ability to convert cryptocurrencies and more. Security features can also be a good differentiator.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re going to be dealing in larger volumes of crypto, investing in cold storage might prove advantageous.

Most widespead examples of this being the Ledger Nano and the Trezor.

Ledger manufactures cold storage wallets designed for users who want increased security. Their wallets are a physical device that connects to your computer. Only when the device is connected can you send your cryptocurrency from it. Ledger offers a variety of products, such as the Ledger Nano S and the Ledger Nano X (a bluetooth connected hardware wallet).

Trezor is a pioneering hardware wallet company. The combination of world-class security with an intuitive interface and compatibility with other desktop wallets, makes it ideal for beginners and experts alike. The company has gained a lot of the Bitcoin community’s respect over the years. Trezor offers two main models – The Trezor One and Trezor Model T (which has a built in touch screen).

Market Overview

Coinmarketcap.com

Coinmarketcap will be your cryptocurrency go-to for just about everything. Here you can see the following: