How To Buy RAMP (RAMP)?

A common question you often see on social media from crypto beginners is “Where can I buy RAMP?” Well, you’ll be happy to hear it is actually quite a simple and straightforward process.

Step 1: Create an account on an exchange that supports RAMP (RAMP)

First, you will need to open an account on a cryptocurrency exchange that supports RAMP (RAMP).

We recommend the following based on functionality, reputation, security, support and fees:

1

Binance

Fees (Maker/Taker) 0.075%*-0.1%*

Cryptocurrencies

Available for Trade 500+

Sign-up bonus

10% reduced trading fees*

Available in

Europe, Asia, Oceania, Africa

2

MEXC

Fees (Maker/Taker) 0.2%*-0.2%*

Cryptocurrencies

Available for Trade 1500+

Sign-up bonus

10% reduced trading fees & up to $170 in USDT vouchers*

Available in

North America, South America, Europe, Asia, Oceania, Africa

In order to sign up, you will need to enter some basic information, such as your email address, password, full name and, in some cases, you might also be asked for a phone number or address.

Note: On specific exchanges, you might need to complete a Know Your Customer (KYC) procedure in order to be able to purchase cryptocurrency. This is most commonly the case with licensed and regulated exchanges.

Step 2: Deposit funds into your account

Many cryptocurrency exchanges will allow you to purchase RAMP (RAMP) with fiat currencies, such as EUR, USD, AUD and others. Furthermore, they will also provide you with multiple deposit methods through which you can fund your fiat account, such as credit and debit cards, ewallets or direct bank transfers.

Note: Some payment methods will have higher fees than others, such as credit card payments. Before funding your fiat account on your chosen exchange, make sure to do your due diligence to find out the fees involved with each payment method to avoid unnecessary costs.

Step 3: Buy RAMP (RAMP)

This process is similar across almost every cryptocurrency exchange. All you have to do is find a navigation bar or a search bar, and search for RAMP (RAMP) or RAMP (RAMP) trading pairs. Look for the section that will allow you to buy RAMP (RAMP), and enter the amount of the cryptocurrency that you want to spend for RAMP (RAMP) or the amount of fiat currency that you want to spend towards buying RAMP (RAMP). The exchange will then calculate the equivalent amount of RAMP (RAMP) based on the current market rate.

Note: Make sure to always double-check your transaction details, such as the amount of RAMP (RAMP) you will be buying as well as the total cost of the purchase before you end up confirming the transaction. Furthermore, many cryptocurrency exchanges will offer you their own proprietary software wallet where you will be storing your cryptocurrencies; however, you can create your own individual software wallet, or purchase a hardware wallet for the highest level of protection.

How to create a Binance account

![]()

Show Detailed Instructions

Hide Detailed Instructions

Step 1: Go to the Binance website.

Step 2: On the registration page, enter your email address, and create a password for your account.

Then, read and agree to the Terms of Service and click “Create Account”.

Note: Your password must be a combination of numbers and letters.

It should contain at least 8 characters, one UPPER CASE letter, and one number.

Step 3: Complete the Security Verification.

Step 4: The system will send a verification code to your email. The verification code is valid for 30 minutes. If you can’t find the email in your inbox, check your other mail folders as well, or click “Resend Email” to resend.

How to complete KYC (ID Verification) on Binance

Step 1: Log in to your Binance account and click “User Center” and then “Identification”.

Step 2: click “Start Now” to verify your account.

Step 3: Select your country of residence.

Ensure that your country of residence is consistent with your ID documents.

Step 5: Enter your personal information and click “Continue.”

You won’t be able to change it once confirmed.

Refer to the respective options offered for your country.

Step 7: Follow the instructions to upload photos of your document. Your photos should clearly show the full ID document.

Do not wear hats, glasses, or use filters, and make sure that the lighting is sufficient.

Once your application has been verified, you will receive an email notification.

How to buy cryptocurrency on Binance

Step 1: Log in to your Binance account and click “Buy Crypto” and then “Credit/Debit Card”.

Step 2: Here you can choose to buy crypto with different fiat currencies. Enter the fiat amount you want to spend and the system will automatically display the amount of crypto you can get. When you have selected the amount you wish to spend then press “Continue”.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

Step 3: Click “Add New Card”. Then enter your credit card details and your billing address.

Step 4: Check the payment details and confirm your order within 1 minute. After 1 minute, the price and the amount of crypto you will get will be recalculated. You can click “Refresh” to see the latest market price. You will then be redirected to your bank’s OTP Transaction Page. Follow the on-screen instructions to verify the payment.

How to Conduct Spot Trading on Binance

Step 1: Log in to your Binance account.

Click on “Classic” under “Trade” on the top navigation bar.

Step 2: Search and enter the cryptocurrency you want to trade.

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can place a “Market Order” to set the buying/selling price automatically.

Hide Detailed Instructions

How to create a Gate.io account

![]()

Show Detailed Instructions

Hide Detailed Instructions

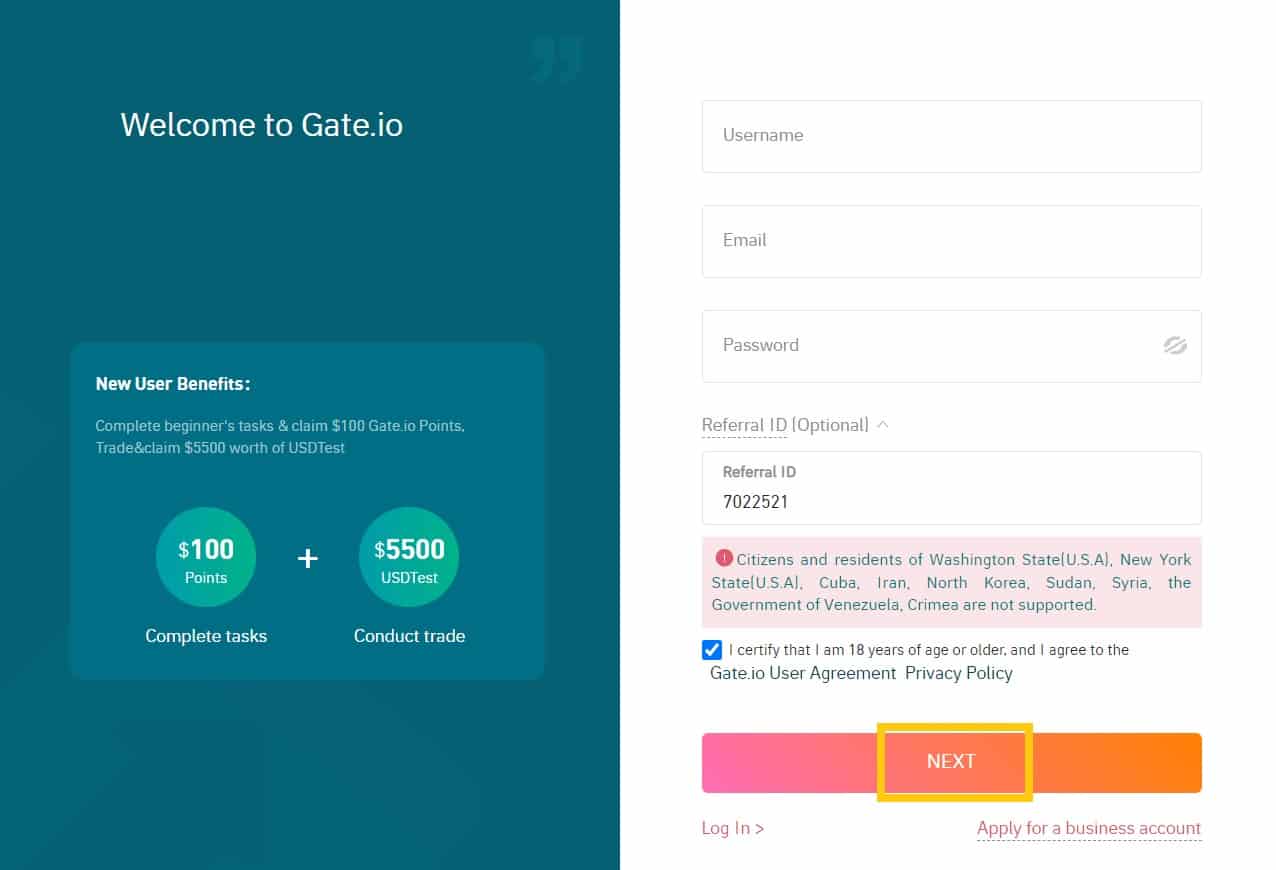

Step 1: Go to the Gate.io website.

Step 2: Choose your username, your email address and your password. Then check “I certify that I am 18 years of age or older, and I agree to the Gate.io User Agreement Privacy Policy” and click “NEXT”.

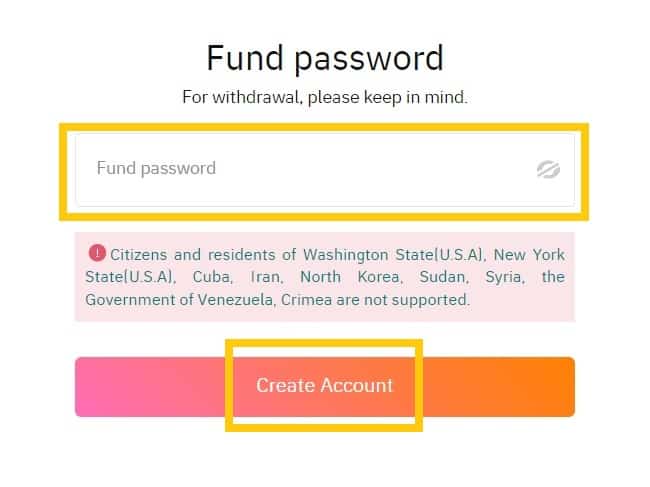

Step 3: Set your fund password and click “Create account”.

Note: Your fund password must contain at least 6 characters and can not be the same as your login password.

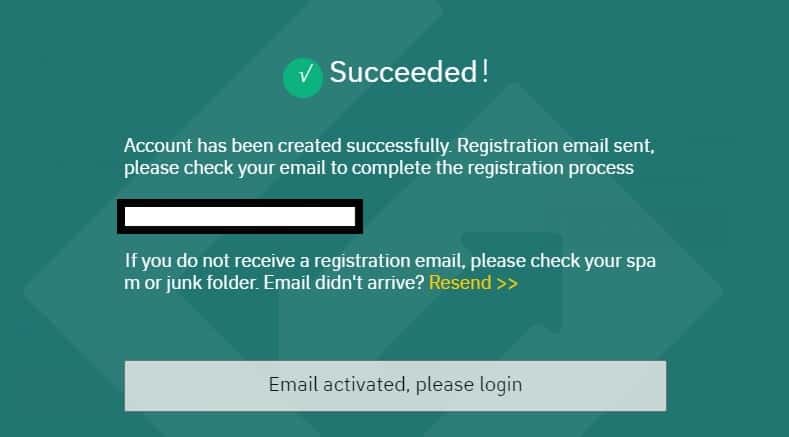

Step 4: An activation email will be sent to your email address. Complete the rest of the registration process by following the instructions in the email to activate your account. Once this is done done, click “Email activated, please log in”.

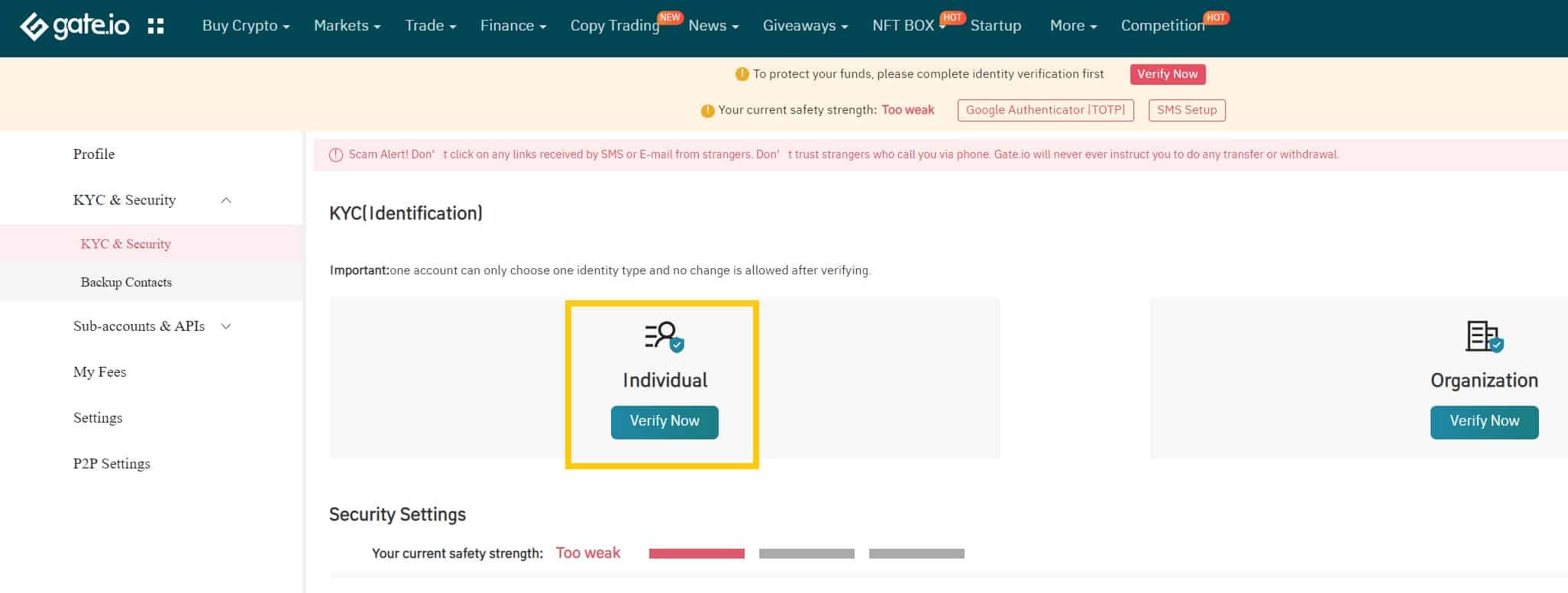

How to complete KYC (ID Verification) on Gate.io

In order to ensure the safety of your assets, and to reduce fraud, money laundering, blackmail, and other illegal activities, Gate.io makes it mandatory that all users obtain KYC ID Verification. Only after your account has obtained KYC ID verification, can you withdraw funds or use credit cards or debit cards to buy cryptocurrencies.

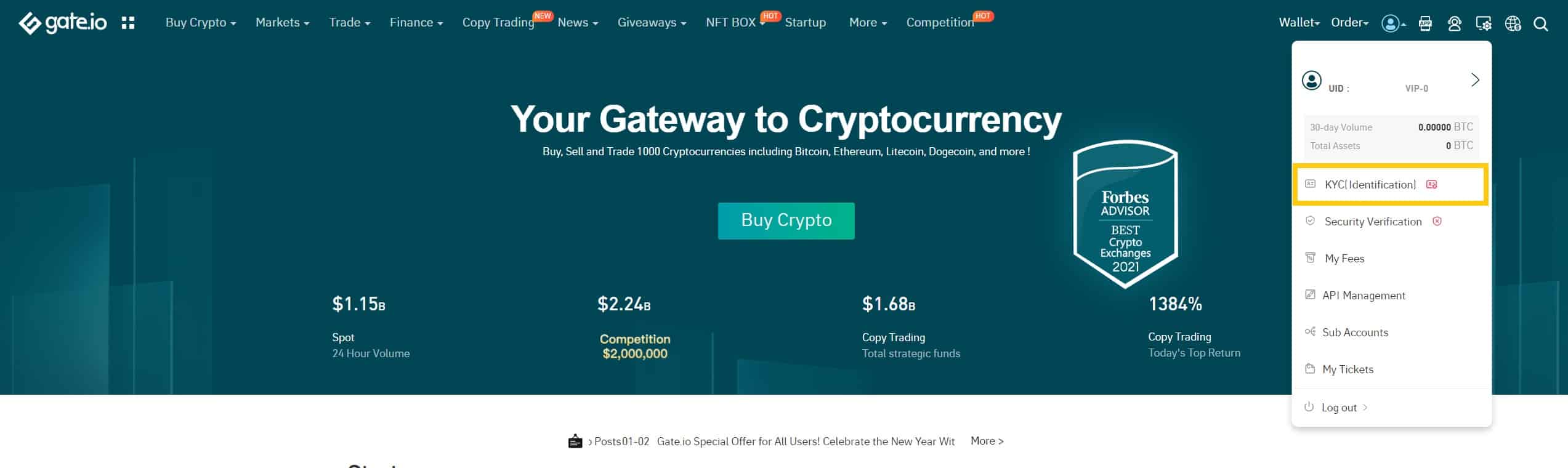

Step 1: Log in to your Gate.io account.

Place your cursor on the top-right profile icon and go to “KYC (ID Verification)”

Step 2: Click “Individual (Verify now)”

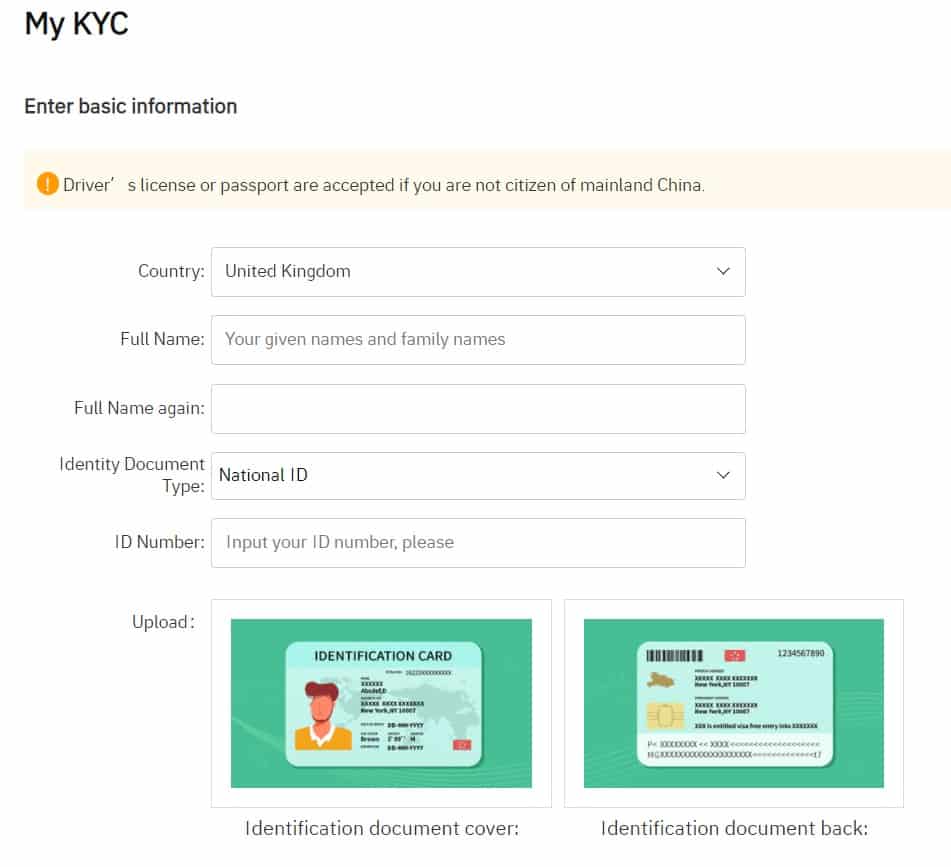

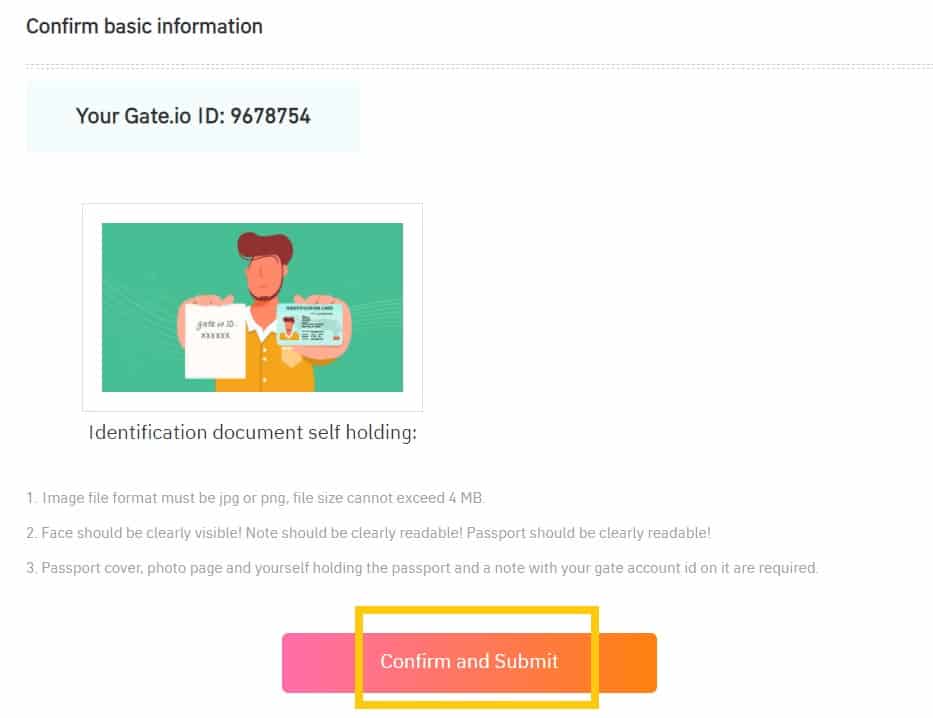

Step 3: Select your country, input your full legal name (twice), fill in your ID information, upload photos of both sides of your ID card, and a photo of you holding your ID together with your User ID (UID) for Gate.io. You will see your User ID by placing the cursor on the top-right profile icon on the main page. Make sure everything is filled in correctly and then click on “Confirm and Submit”.

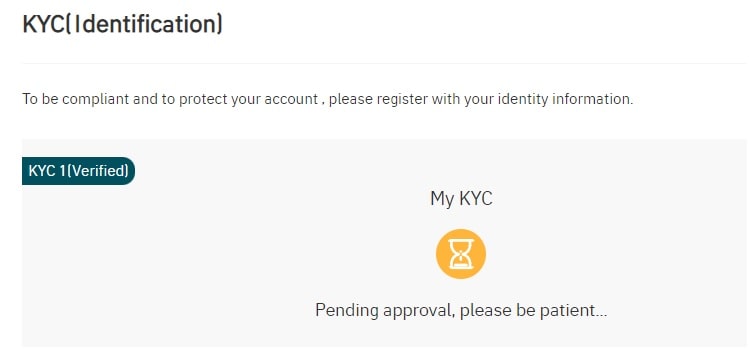

Step 4: After you have submitted all the requested information, you will see the pending approval.

Approval can take anywhere from a few hours to a few days to complete.

Once the KYC is approved, you’re ready to make your first cryptocurrency purchase.

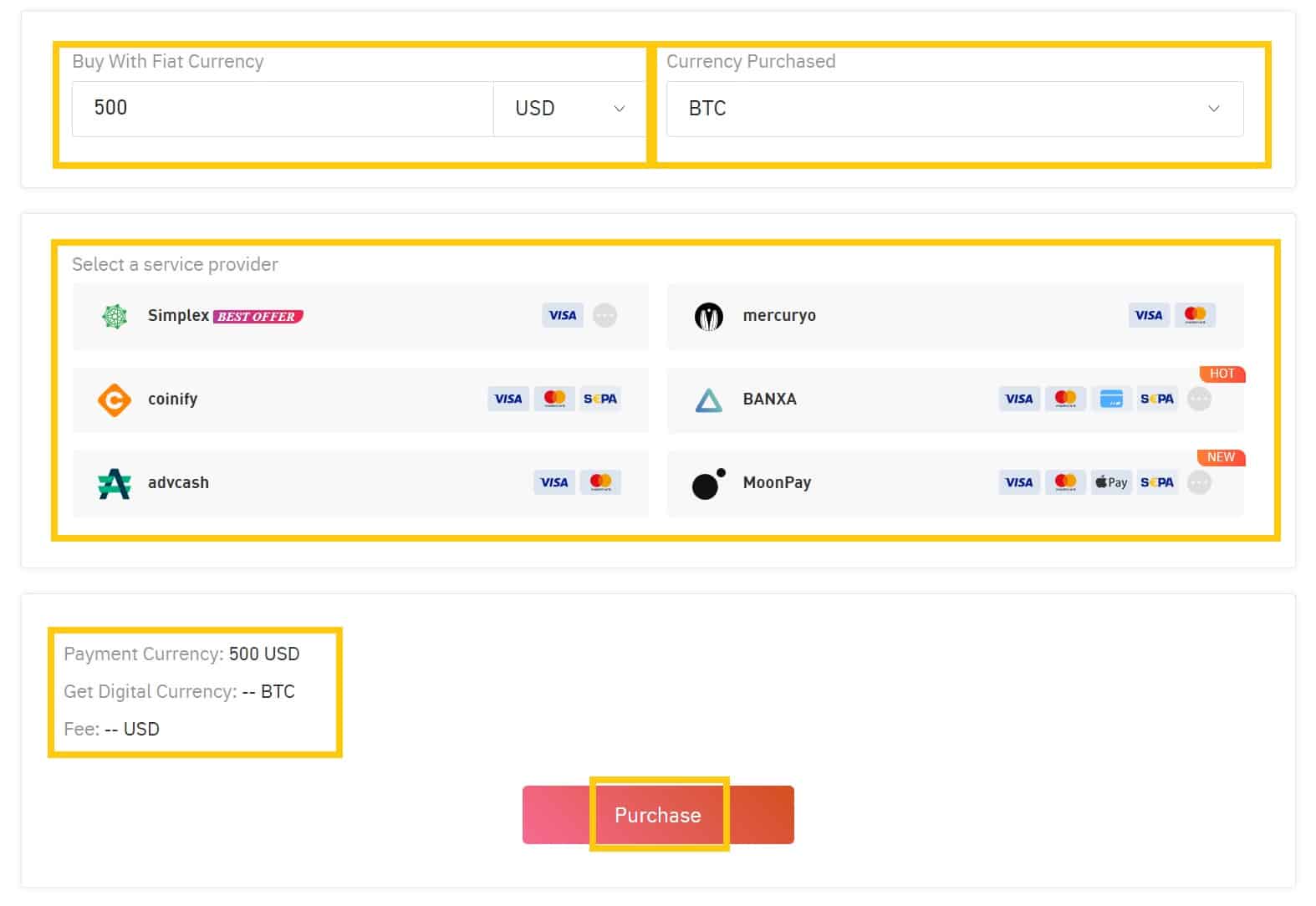

How to buy cryptocurrency on Gate.io

Step 1: Log in to your Gate.io account.

Then in the Menu Bar at the top of the page, click “Buy Crypto” and select “Credit Card”.

Step 2: Enter the amount you wish to spend in the “Buy with Fiat Currency” tab and select the cryptocurrency that you want to buy under the “Currency Purchased” field. Then select one of the “Service Providers” below and click the “Place Order” button to enter the confirmation page.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

Step 3: On the confirmation page, select “Buy Crypto” or the “Create Order” button to complete the payment.

Note: To ensure a quick and secure way of receiving the order, users might need to conduct an additional Identity Verification (KYC) with a third-party service provider. Once successfully verified, the service provider will immediately transfer the cryptocurrencies to your Gate.io account.

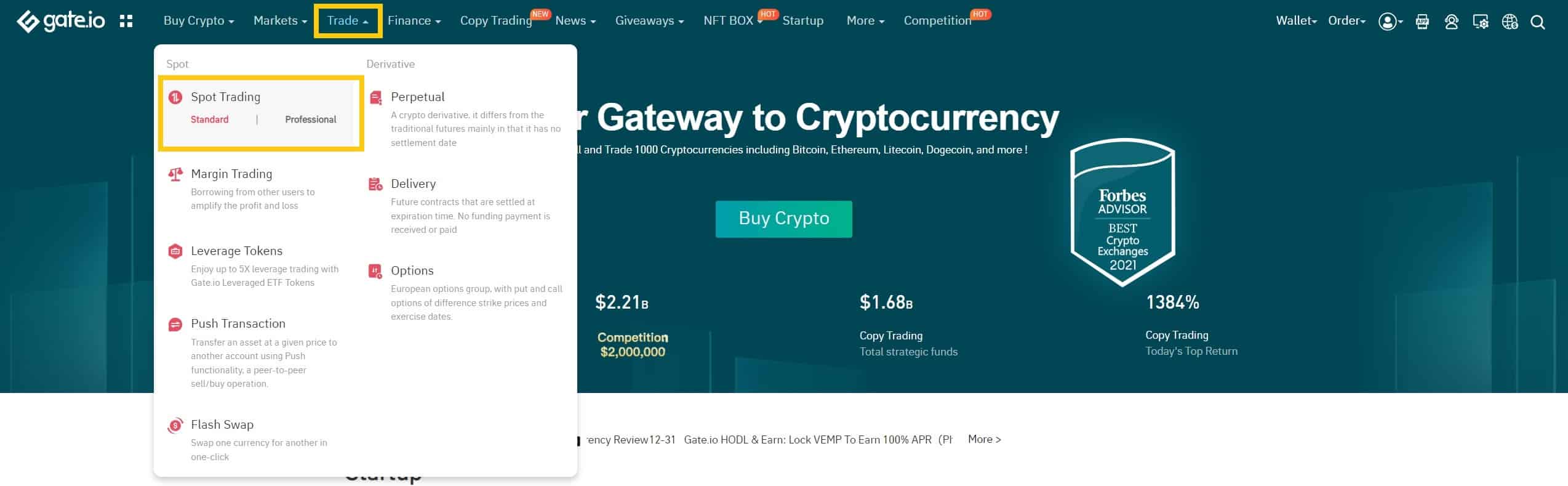

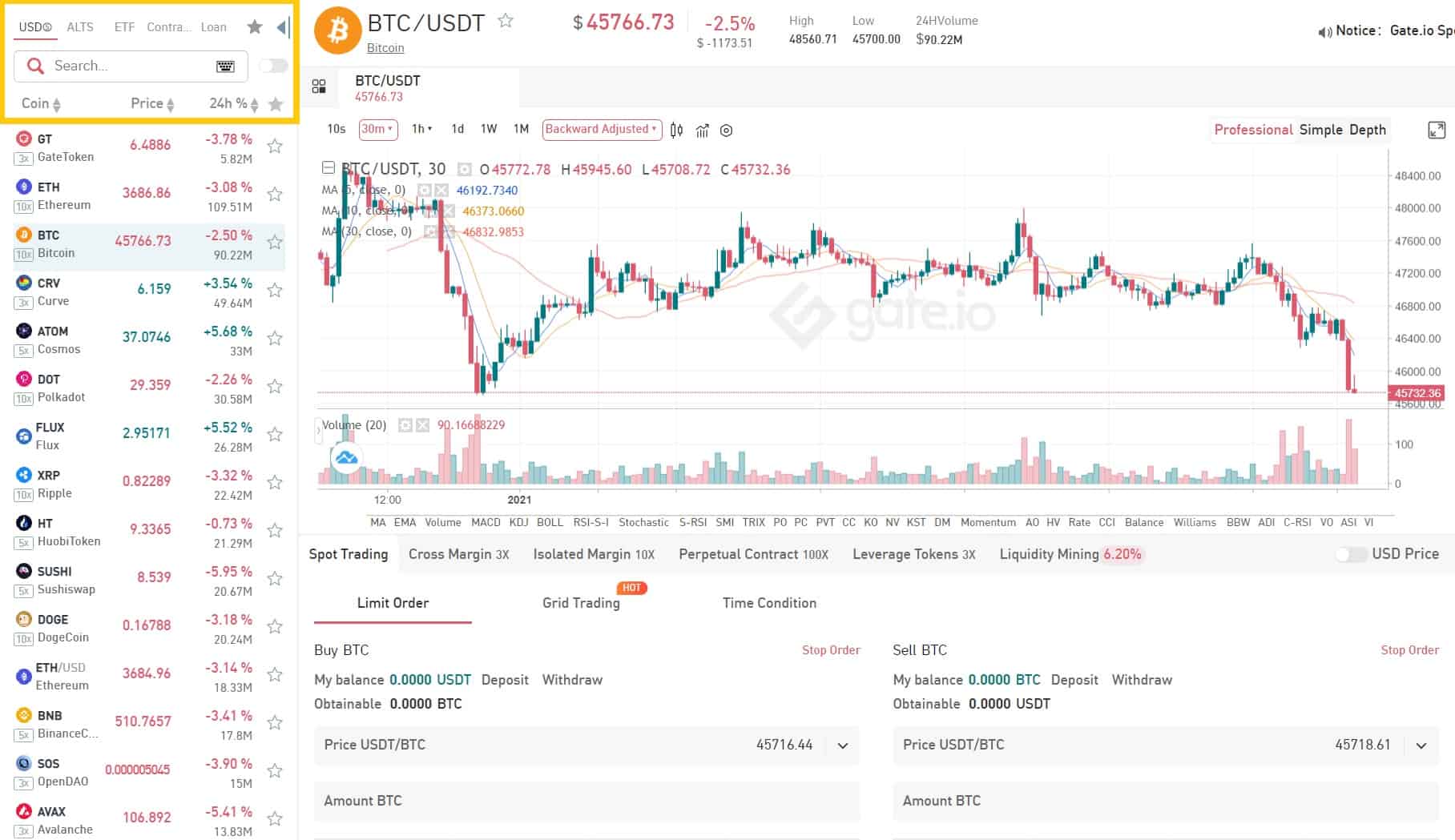

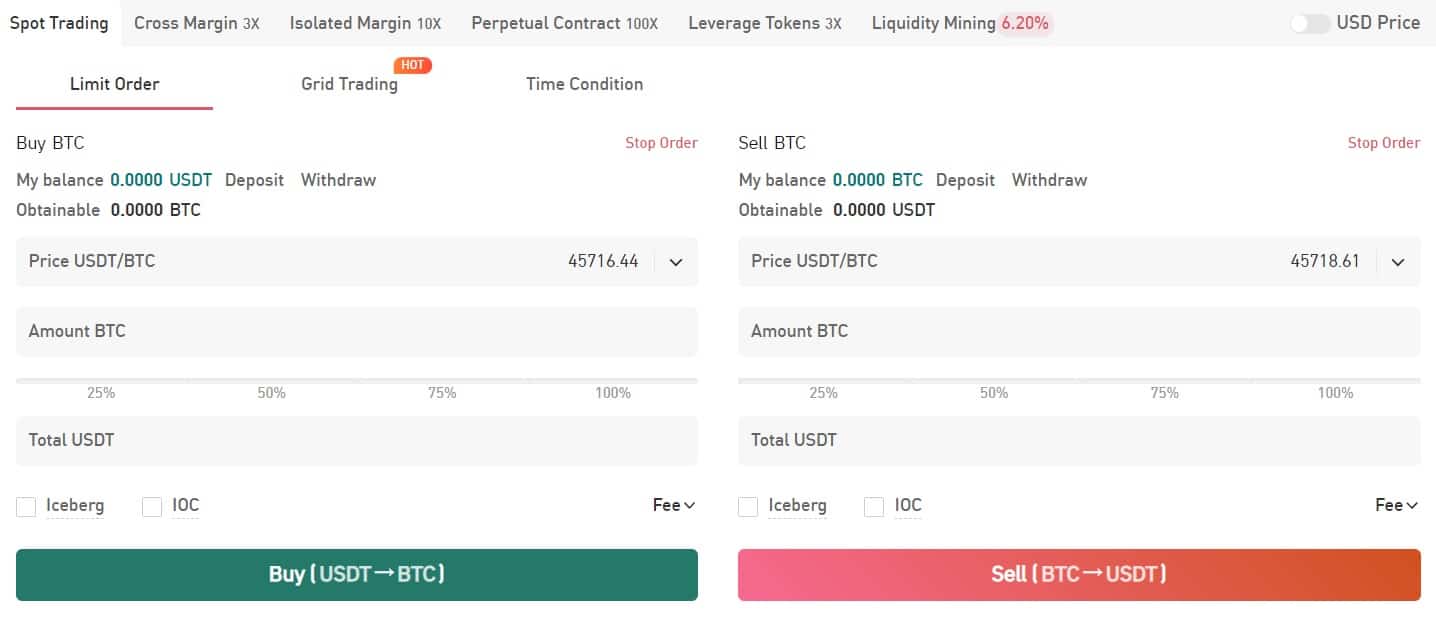

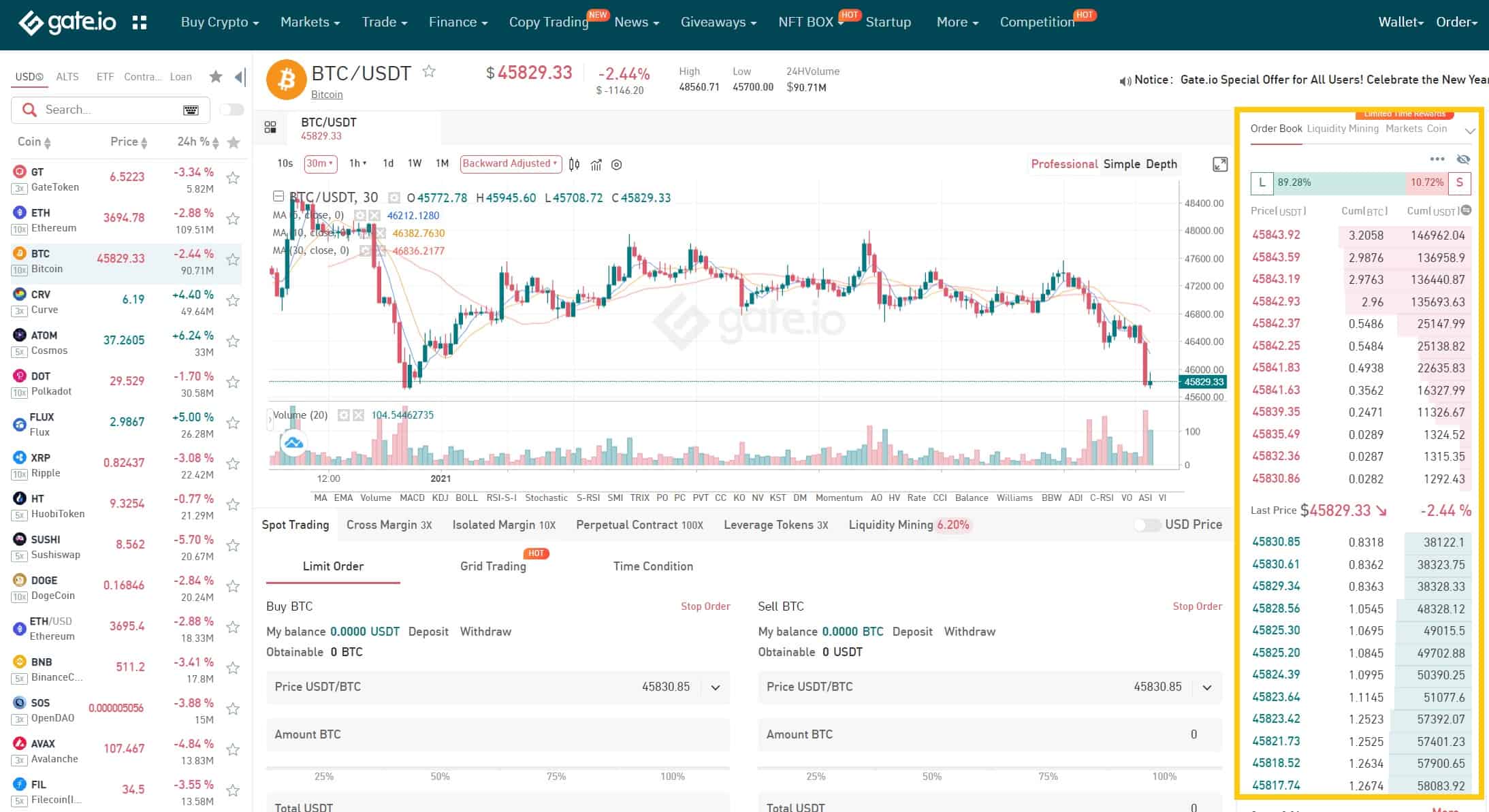

How to Conduct Spot Trading on Gate.io

Step 1: Log in to your Gate.io account.

Click on “Spot Trading” under “Trade” on the top navigation bar.

You can either choose “standard” or “professional” version. This tutorial uses the standard version.

Step 2: Search and enter the cryptocurrency you want to trade.

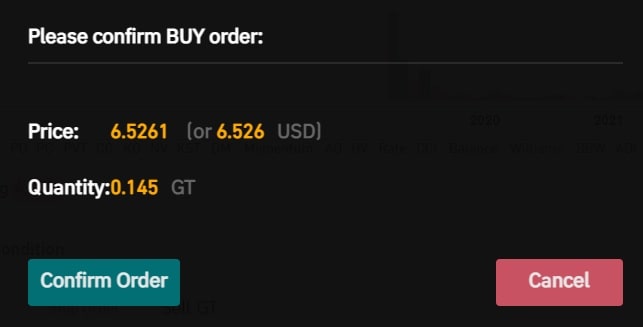

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can click on the last prices on the order book to set the buying/selling price automatically.

Step 5: Confirm the price and amount. Then click on “Place Order” to place the order, followed by “Confirm Order” to confirm it.

Hide Detailed Instructions

For more in-depth instructions, our ‘Absolute Beginner’s Guide To Cryptocurrency Investing‘ will take you through the process step-by step. In addition to providing instructions for sending and receiving your cryptocurrency.

And if you’re completely new to crypto our beginner, intermediate and advanced level articles will get you up to speed with everything you need to know about the cryptocurrency space starting out.

Simplecryptoguide.com

What Is RAMP (RAMP)?

RAMP is a decentralized protocol that intends to boost DeFi adoption by allowing non-Ethereum (ETH) users to stake tokens on ETH platforms; at the same time, Ethereum users can interact with the RAMP protocol and increase their yields.

RAMP DeFi allows the staked capital of non-ERC-20 staking blockchains to be collateralized into a stablecoin known as rUSD that is issued on the Ethereum blockchain. The main result of this is the maximization of capital efficiency on stacked digital assets, where users earn staking rewards, unlock liquidity from staked assets and stack multiple yield streams at the same time.

Users who are already on the Ethereum blockchain can mint eUSD by depositing their ERC20 stablecoins into RAMP’s eUSD liquidity pool. This means that rUSD and eUSD holders can exchange, lend, or borrow both tokens freely and in turn create liquidity for users with capital locked into staking arrangements.

What is the RAMP token?

The RAMP token is issued as a utility token powering platform value and aligning the interests of all platform participants.

The RAMP platform allows users to deposit a wide range of digital assets such as RAMP, BNB, CAKE, Pancake LP tokens and mint rUSD, a stablecoin, by collateralizing these asset deposits.

This puts users in a unique position where their assets continue to produce high yields for them, and they get to unlock liquidity at the same time. In most of the vaults, yield generated exceed any fees or interest paid, which means that users get to grow their earnings faster than their interest fees.

The platform charges utility fees, and this accrues positive value back to the RAMP token through token burns.

The RAMP token has a fixed total supply and can no longer be minted. This means that any RAMP burned is removed from circulation, forever.

To summarize, RAMP allows you to:

- Borrow rUSD liquidity while you retain ownership of your favorite staking / farming assets for further growth potential.

- Generate high yields on deposited collateral with as low as 1% interest for rUSD borrowing.

- Transfer rUSD liquidity across different blockchain networks to access tokens directly on decentralized exchanges.

Who Are the Founders of RAMP?

RAMP was co-founded by Lawrence Lim and Loh Zheng Rong. Before RAMP, Lim was the head of international growth at IOST and handled global sales at TradeGecko. He was also responsible for mergers and acquisitions at KPMG Corporate Finance LLC and asset management at JP Morgan Chase & Co.

Lim studied at the Nanyang Technological University and got a Bachelor of Business degree in banking and finance with First Class Honors.

Loh Zheng Rong co-founded NOX Pte Ltd and was a blockchain consulting partner at Merkle Ventures LLP. He was also the chief innovation officer at 2359 media, as well as the senior advisor of ICONIC Partners. He was also the chief operating officer and co-founder of Toucanapp Pte Ltd. He has a Bachelor of Business Administration (B.B.A) degree in finance wealth management from the Singapore Management University.

What Makes RAMP Unique?

To efficiently power token exchanges between blockchain systems, the network takes advantage of liquidity on/off-ramp designs. Within this framework, the tokens that use a non-Ethereum standard are first converted into stablecoins called rUSD for use on the Ethereum blockchain.

ERC-20-based stablecoins can also be converted into eUSD for use in Ramp DeFi’s liquidity pool. rUSD holders get the ability to use funds locked in non-Ethereum blockchains as well as the ability to use fully-collateralized stablecoins and earn staking incentives after the conversion. eUSD holders earn interest from lending their digital wealth as well as a chance to provide liquidity within DeFi protocols.

How Many RAMP (RAMP) Coins Are There in Circulation?

RAMP’s circulating supply is around 425 million coins as of February 2022, with a maximum supply of 1,000,000,000 RAMP coins.

How Is the RAMP Network Secured?

RAMP network collaborates with the Crust Network for secure on-chain decentralized data storage. As such, RAMP DeFi is an open finance project and has the potential to unlock liquidity from staked digital assets, allowing all users to collateralize their digital assets while locked in staking into liquid capital.

Crust implements the incentive layer protocol for decentralized storage. It is adaptable to multiple storage layer protocols, including IPFS, and even supports the application layer. The architecture it is based on has the capability to support a decentralized computing layer and build an entire cloud ecosystem.

RAMP development updates in 2023

In 2023, RAMP, a significant player in the decentralized finance (DeFi) sector, has made notable strides in product development and technological advancements. Here are the key updates:

Support for zkSync Era: In April 2023, RAMP became the first platform to support direct purchases into the zkSync Era network, a major development in the blockchain space. This integration allows users to benefit from lower gas fees and faster transaction times on the zkSync Era network, which is a “zero-knowledge Ethereum Virtual Machine” (zkEVM).

Expanded Payment Options in the UK and Germany: RAMP has extended USD payment support to users in the UK and Germany, enabling transactions in USD alongside local currencies. This update was part of RAMP’s ongoing efforts to cater to the diverse needs of its global user base.

Integration with Worldcoin: RAMP was selected as the first and only global off-ramp provider for Worldcoin (WLD), offering WLD-to-fiat conversions. This service is a testament to RAMP’s capabilities in providing fast, secure, and global financial transactions.

Streamlined Access via Google Account Sign-In: RAMP introduced Google Social Login, making it easier and quicker for users to access its services. This enhancement is aimed at simplifying the user’s entry into the crypto world.

Global Availability of Off-Ramp Services: In February 2023, RAMP announced the global availability of its off-ramp product. This service enables users to sell cryptocurrencies and transfer digital assets back into fiat currency. The launch of this service was a significant step in bridging the gap between cryptocurrencies and the traditional financial system. The off-ramp service is approved by the UK’s Financial Conduct Authority (FCA), ensuring compliance with strict anti-money laundering and counter-terrorist financing standards.

Price Prediction and Market Performance: According to forecasts, RAMP DEFI (RAMP) is expected to see price increases in the coming years, with predictions for reaching $0.067305 in 2023, and possibly reaching $1 in January 2025. However, these predictions should be taken with caution due to the inherent volatility of the cryptocurrency market.

These developments highlight RAMP’s commitment to innovation and its role in enhancing the accessibility and efficiency of DeFi services.

Official website: https://rampdefi.com/

Best cryptocurrency wallet for RAMP (RAMP)

There are plenty of different crypto wallets available. The best one for you depends on your general trading habits and which provides the most security in your situation. There are two main types of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical). Both have their pros and cons, and there is not necessarily a right or wrong answer when it comes to figuring out which crypto wallet is best for you.

HOW DO I DECIDE WHICH cryptocurrency WALLET TO USE for RAMP (RAMP)?

Deciding which type of wallet to use depends on a variety of factors, including:

- How often you trade. In general, hot wallets are better for more active cryptocurrency traders. Quick login ability means you are only a few clicks and taps away from buying and selling crypto. Cold wallets are better suited for those looking to make less frequent trades.

- What you want to trade. As mentioned earlier, not all wallets support all types of cryptocurrencies. However, some of the best crypto wallets have the power to trade hundreds of different currencies, providing more of a one-size-fits-all experience.

- Your peace of mind. For those worried about hacking, having a physical cold wallet stored in a safe deposit box at the bank or somewhere at home, provides the safest, most secure option. Others might be confident in their ability to keep their hot wallets secure.

- How much it costs. It is important to investigate the costs associated with each wallet. Many hot wallets will be free to set up. Meanwhile, cold wallets, like any piece of hardware, will cost money to purchase.

- What it can do. While the basics of each cryptocurrency wallet are the same, additional features can help set them apart. This is especially true of hot wallets, many of which come with advanced reporting features, insights into the crypto market, the ability to convert cryptocurrencies and more. Security features can also be a good differentiator.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re going to be dealing in larger volumes of crypto, investing in cold storage might prove advantageous.

Most widespead examples of this being the Ledger Nano and the Trezor.

Ledger manufactures cold storage wallets designed for users who want increased security. Their wallets are a physical device that connects to your computer. Only when the device is connected can you send your cryptocurrency from it. Ledger offers a variety of products, such as the Ledger Nano S and the Ledger Nano X (a bluetooth connected hardware wallet).

Trezor is a pioneering hardware wallet company. The combination of world-class security with an intuitive interface and compatibility with other desktop wallets, makes it ideal for beginners and experts alike. The company has gained a lot of the Bitcoin community’s respect over the years. Trezor offers two main models – The Trezor One and Trezor Model T (which has a built in touch screen).

Market Overview

Coinmarketcap.com

Coinmarketcap will be your cryptocurrency go-to for just about everything. Here you can see the following: