How To Buy Serum (SRM)?

A common question you often see on social media from crypto beginners is “Where can I buy Serum?” Well, you’ll be happy to hear it is actually quite a simple and straightforward process.

Step 1: Create an account on an exchange that supports Serum (SRM)

First, you will need to open an account on a cryptocurrency exchange that supports Serum (SRM).

We recommend the following based on functionality, reputation, security, support and fees:

1

Binance

Fees (Maker/Taker) 0.075%*-0.1%*

Cryptocurrencies

Available for Trade 500+

Sign-up bonus

10% reduced trading fees*

Available in

Europe, Asia, Oceania, Africa

2

MEXC

Fees (Maker/Taker) 0.2%*-0.2%*

Cryptocurrencies

Available for Trade 1500+

Sign-up bonus

10% reduced trading fees & up to $170 in USDT vouchers*

Available in

North America, South America, Europe, Asia, Oceania, Africa

In order to sign up, you will need to enter some basic information, such as your email address, password, full name and, in some cases, you might also be asked for a phone number or address.

Note: On specific exchanges, you might need to complete a Know Your Customer (KYC) procedure in order to be able to purchase cryptocurrency. This is most commonly the case with licensed and regulated exchanges.

Step 2: Deposit funds into your account

Many cryptocurrency exchanges will allow you to purchase Serum (SRM) with fiat currencies, such as EUR, USD, AUD and others. Furthermore, they will also provide you with multiple deposit methods through which you can fund your fiat account, such as credit and debit cards, ewallets or direct bank transfers.

Note: Some payment methods will have higher fees than others, such as credit card payments. Before funding your fiat account on your chosen exchange, make sure to do your due diligence to find out the fees involved with each payment method to avoid unnecessary costs.

Step 3: Buy Serum (SRM)

This process is similar across almost every cryptocurrency exchange. All you have to do is find a navigation bar or a search bar, and search for Serum (SRM) or Serum (SRM) trading pairs. Look for the section that will allow you to buy Serum (SRM), and enter the amount of the cryptocurrency that you want to spend for Serum (SRM) or the amount of fiat currency that you want to spend towards buying Serum (SRM). The exchange will then calculate the equivalent amount of Serum (SRM) based on the current market rate.

Note: Make sure to always double-check your transaction details, such as the amount of Serum (SRM) you will be buying as well as the total cost of the purchase before you end up confirming the transaction. Furthermore, many cryptocurrency exchanges will offer you their own proprietary software wallet where you will be storing your cryptocurrencies; however, you can create your own individual software wallet, or purchase a hardware wallet for the highest level of protection.

How to create a Binance account

![]()

Show Detailed Instructions

Hide Detailed Instructions

Step 1: Go to the Binance website.

Step 2: On the registration page, enter your email address, and create a password for your account.

Then, read and agree to the Terms of Service and click “Create Account”.

Note: Your password must be a combination of numbers and letters.

It should contain at least 8 characters, one UPPER CASE letter, and one number.

Step 3: Complete the Security Verification.

Step 4: The system will send a verification code to your email. The verification code is valid for 30 minutes. If you can’t find the email in your inbox, check your other mail folders as well, or click “Resend Email” to resend.

How to complete KYC (ID Verification) on Binance

Step 1: Log in to your Binance account and click “User Center” and then “Identification”.

Step 2: click “Start Now” to verify your account.

Step 3: Select your country of residence.

Ensure that your country of residence is consistent with your ID documents.

Step 5: Enter your personal information and click “Continue.”

You won’t be able to change it once confirmed.

Refer to the respective options offered for your country.

Step 7: Follow the instructions to upload photos of your document. Your photos should clearly show the full ID document.

Do not wear hats, glasses, or use filters, and make sure that the lighting is sufficient.

Once your application has been verified, you will receive an email notification.

How to buy cryptocurrency on Binance

Step 1: Log in to your Binance account and click “Buy Crypto” and then “Credit/Debit Card”.

Step 2: Here you can choose to buy crypto with different fiat currencies. Enter the fiat amount you want to spend and the system will automatically display the amount of crypto you can get. When you have selected the amount you wish to spend then press “Continue”.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

Step 3: Click “Add New Card”. Then enter your credit card details and your billing address.

Step 4: Check the payment details and confirm your order within 1 minute. After 1 minute, the price and the amount of crypto you will get will be recalculated. You can click “Refresh” to see the latest market price. You will then be redirected to your bank’s OTP Transaction Page. Follow the on-screen instructions to verify the payment.

How to Conduct Spot Trading on Binance

Step 1: Log in to your Binance account.

Click on “Classic” under “Trade” on the top navigation bar.

Step 2: Search and enter the cryptocurrency you want to trade.

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can place a “Market Order” to set the buying/selling price automatically.

Hide Detailed Instructions

How to create a Gate.io account

![]()

Show Detailed Instructions

Hide Detailed Instructions

Step 1: Go to the Gate.io website.

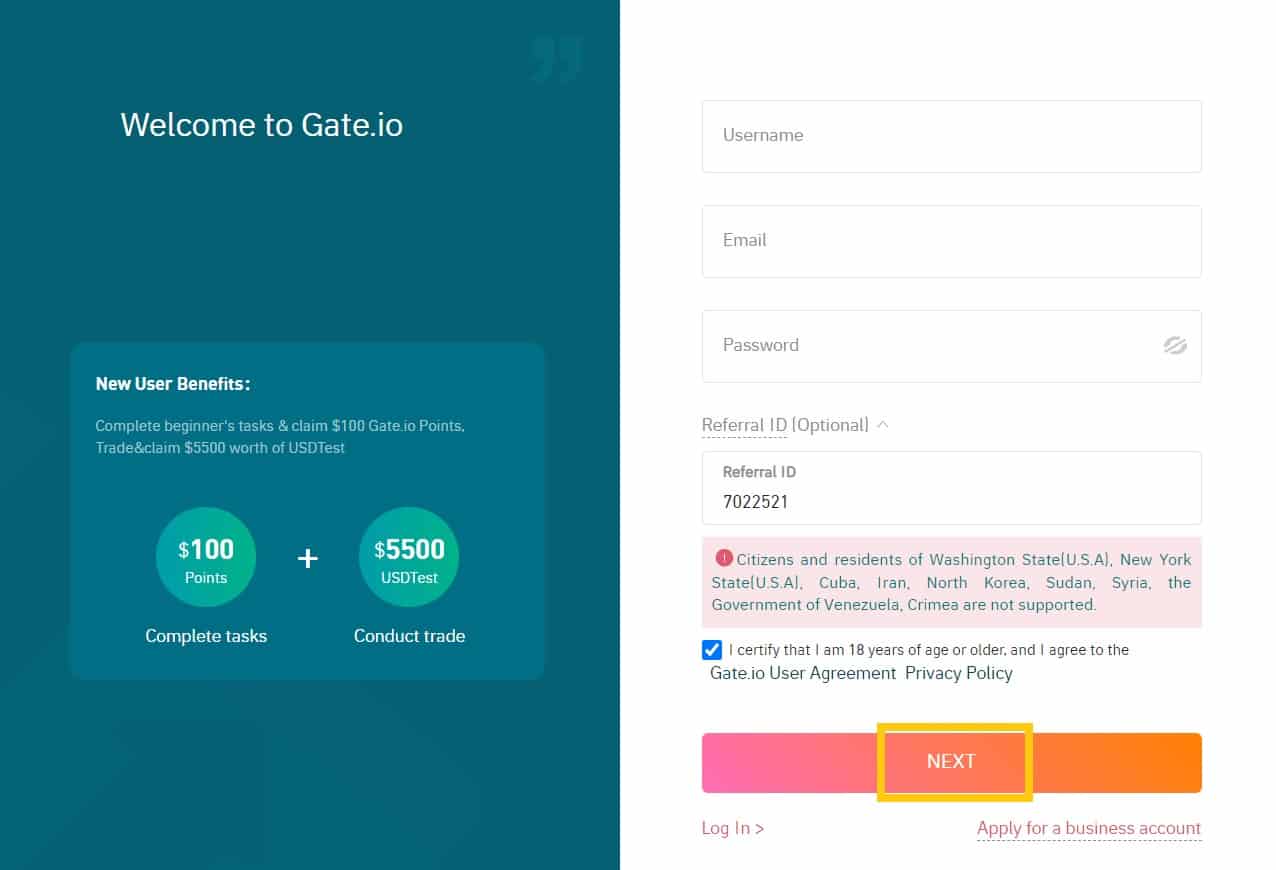

Step 2: Choose your username, your email address and your password. Then check “I certify that I am 18 years of age or older, and I agree to the Gate.io User Agreement Privacy Policy” and click “NEXT”.

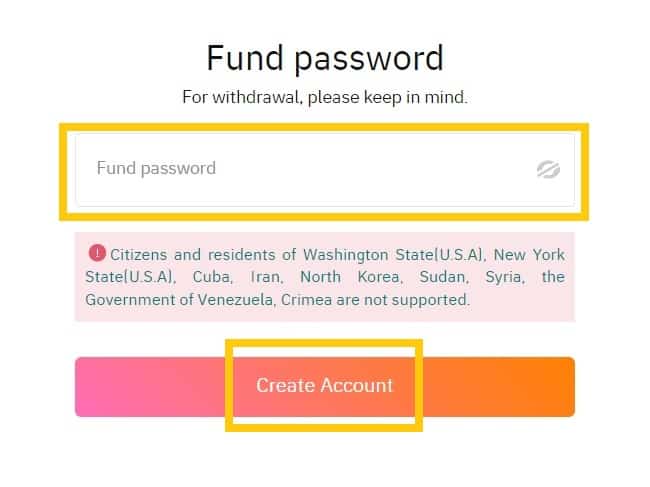

Step 3: Set your fund password and click “Create account”.

Note: Your fund password must contain at least 6 characters and can not be the same as your login password.

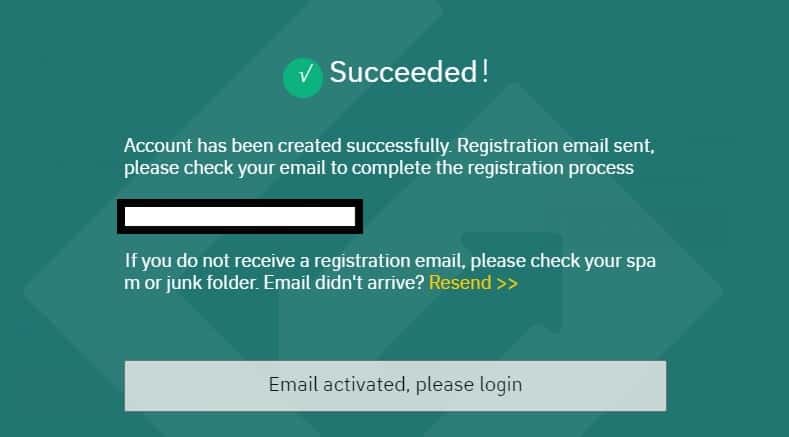

Step 4: An activation email will be sent to your email address. Complete the rest of the registration process by following the instructions in the email to activate your account. Once this is done done, click “Email activated, please log in”.

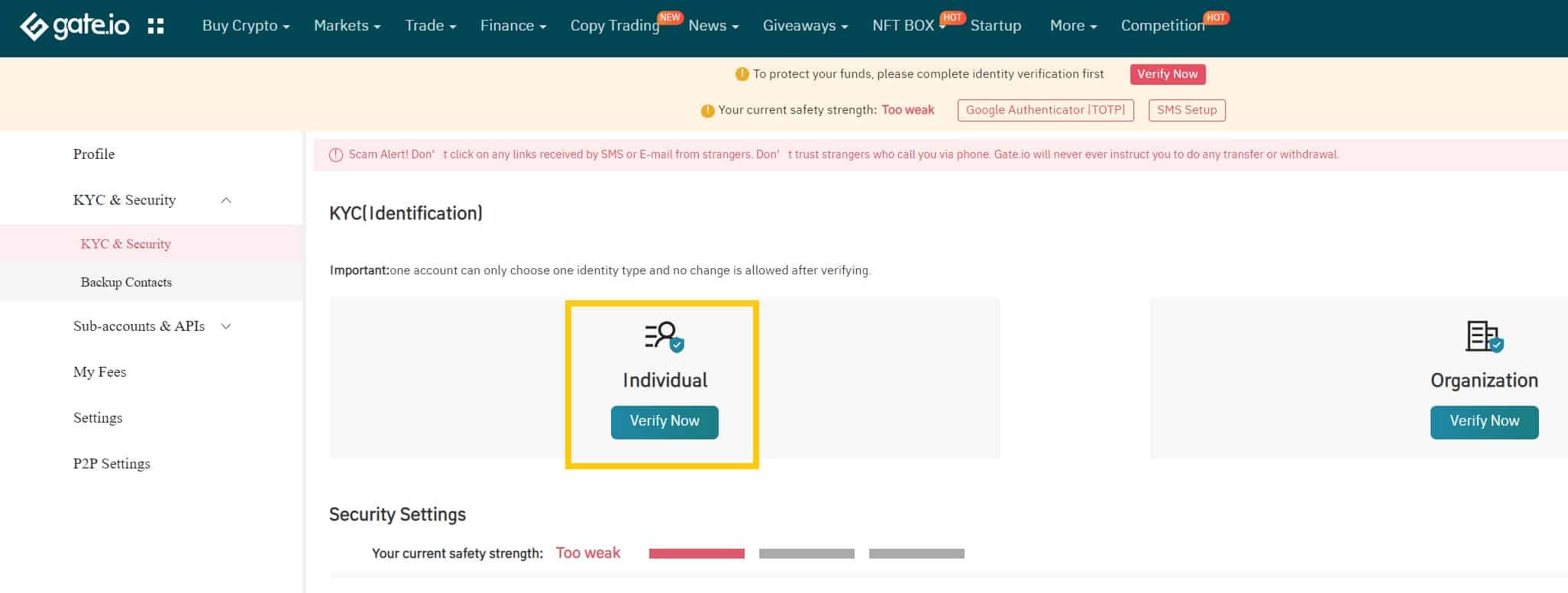

How to complete KYC (ID Verification) on Gate.io

In order to ensure the safety of your assets, and to reduce fraud, money laundering, blackmail, and other illegal activities, Gate.io makes it mandatory that all users obtain KYC ID Verification. Only after your account has obtained KYC ID verification, can you withdraw funds or use credit cards or debit cards to buy cryptocurrencies.

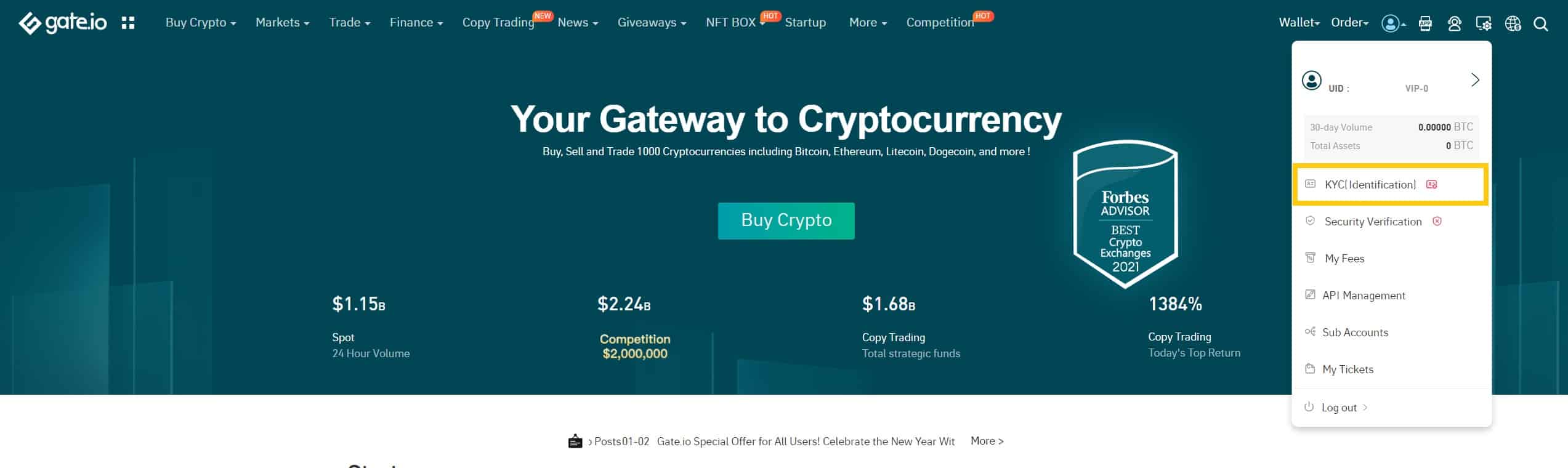

Step 1: Log in to your Gate.io account.

Place your cursor on the top-right profile icon and go to “KYC (ID Verification)”

Step 2: Click “Individual (Verify now)”

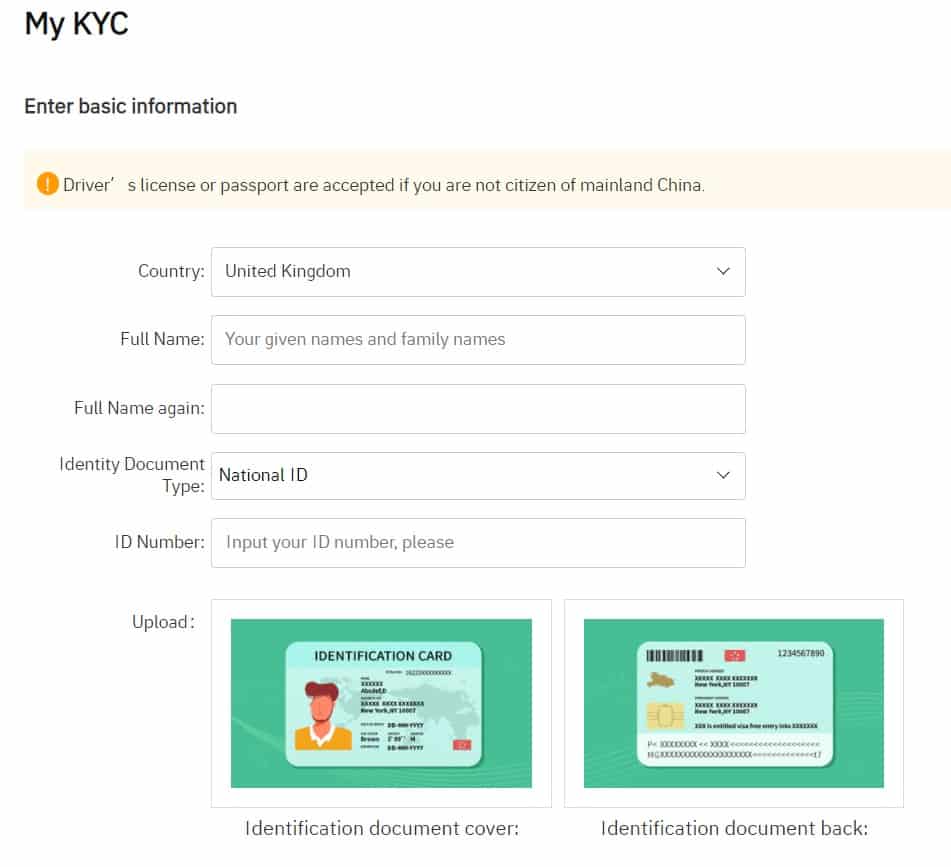

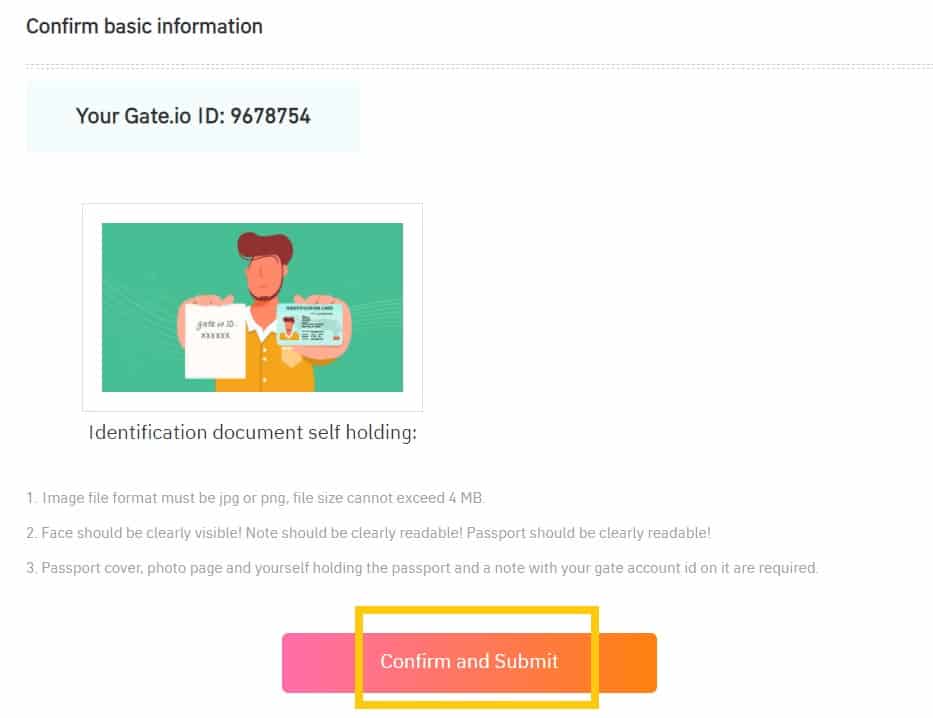

Step 3: Select your country, input your full legal name (twice), fill in your ID information, upload photos of both sides of your ID card, and a photo of you holding your ID together with your User ID (UID) for Gate.io. You will see your User ID by placing the cursor on the top-right profile icon on the main page. Make sure everything is filled in correctly and then click on “Confirm and Submit”.

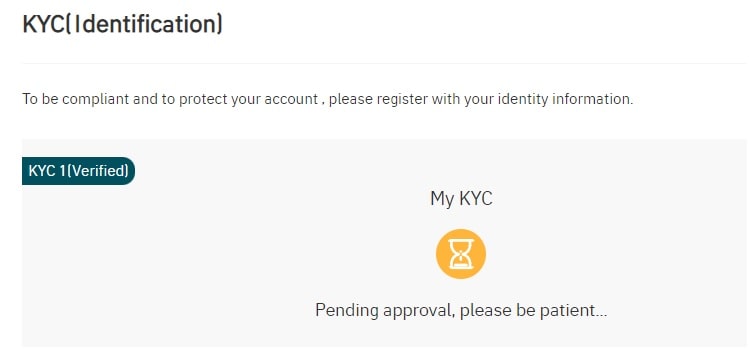

Step 4: After you have submitted all the requested information, you will see the pending approval.

Approval can take anywhere from a few hours to a few days to complete.

Once the KYC is approved, you’re ready to make your first cryptocurrency purchase.

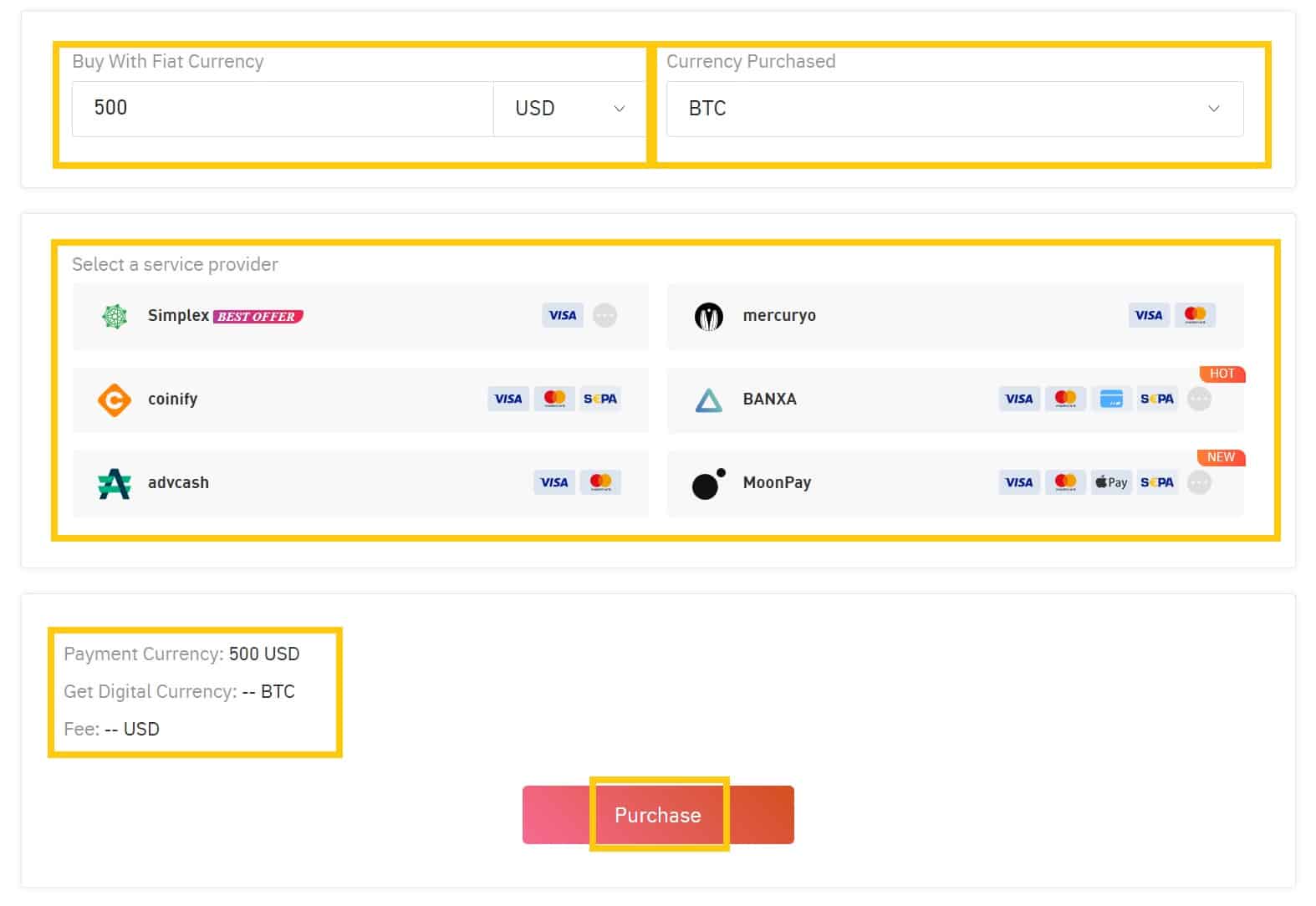

How to buy cryptocurrency on Gate.io

Step 1: Log in to your Gate.io account.

Then in the Menu Bar at the top of the page, click “Buy Crypto” and select “Credit Card”.

Step 2: Enter the amount you wish to spend in the “Buy with Fiat Currency” tab and select the cryptocurrency that you want to buy under the “Currency Purchased” field. Then select one of the “Service Providers” below and click the “Place Order” button to enter the confirmation page.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

Step 3: On the confirmation page, select “Buy Crypto” or the “Create Order” button to complete the payment.

Note: To ensure a quick and secure way of receiving the order, users might need to conduct an additional Identity Verification (KYC) with a third-party service provider. Once successfully verified, the service provider will immediately transfer the cryptocurrencies to your Gate.io account.

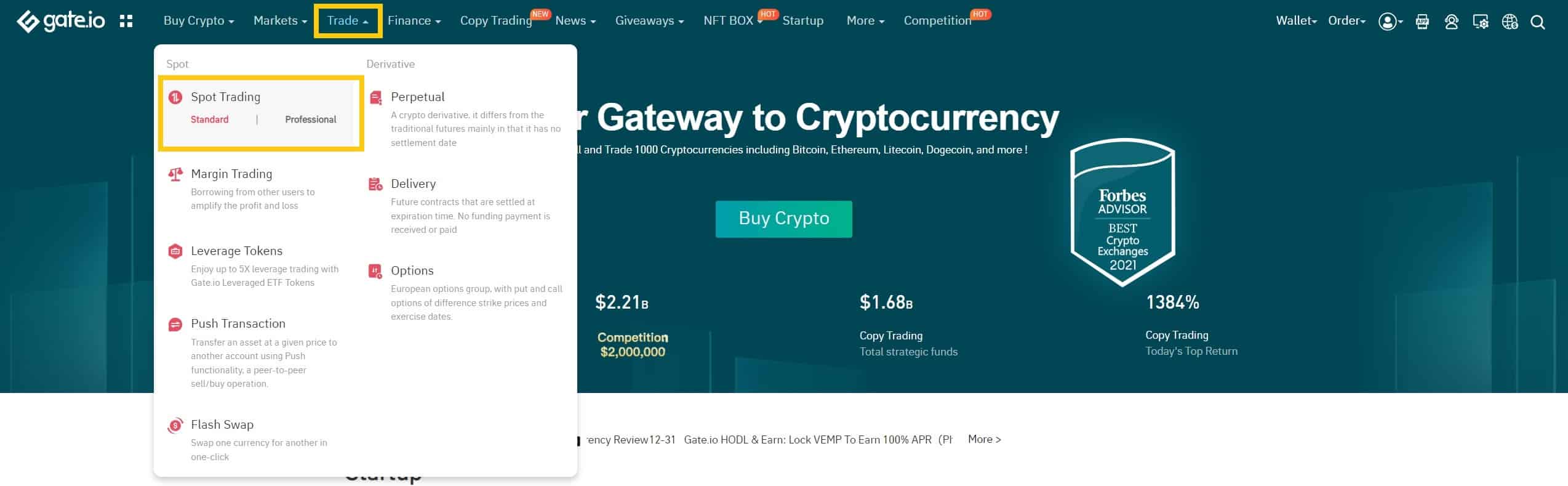

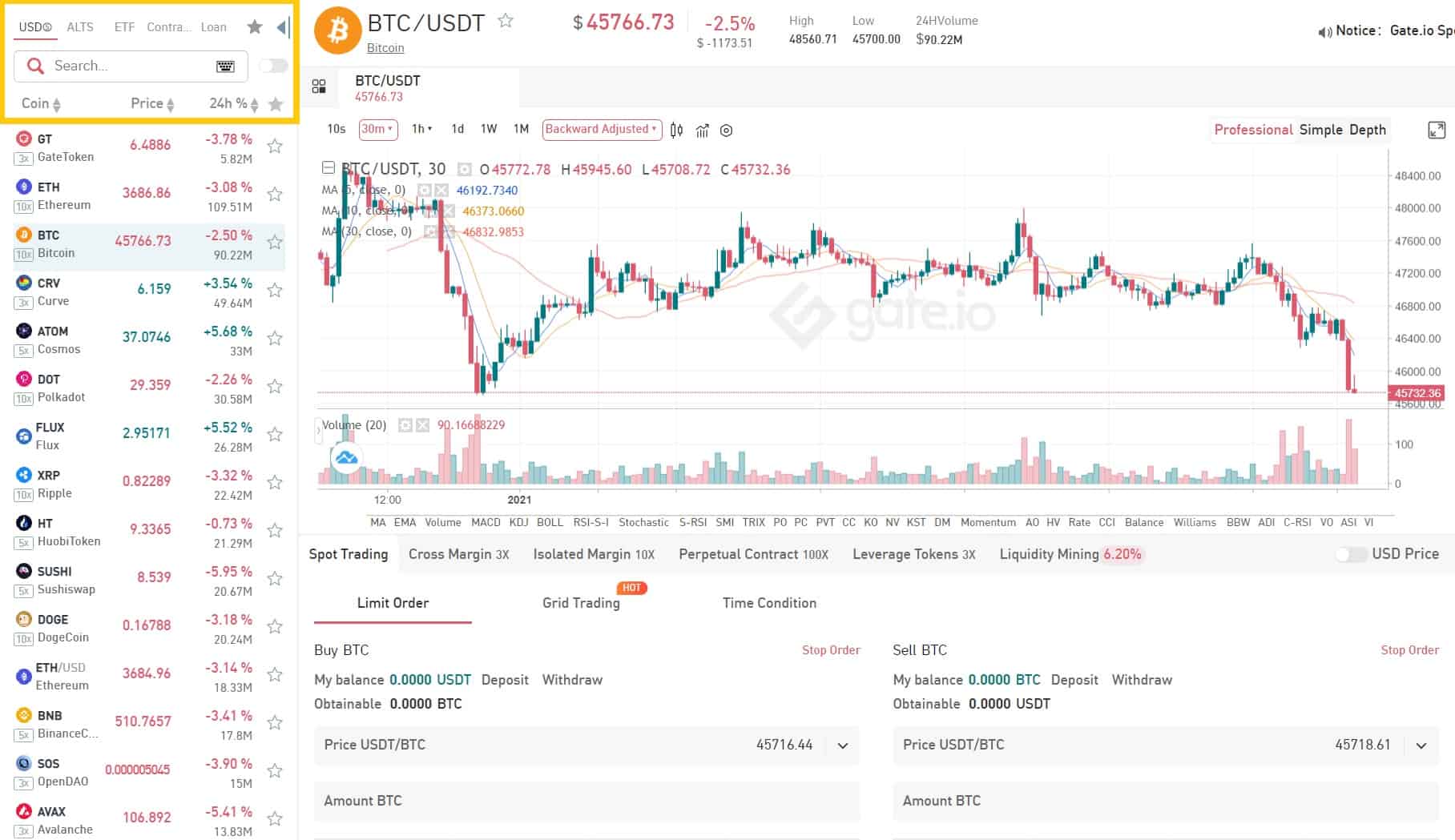

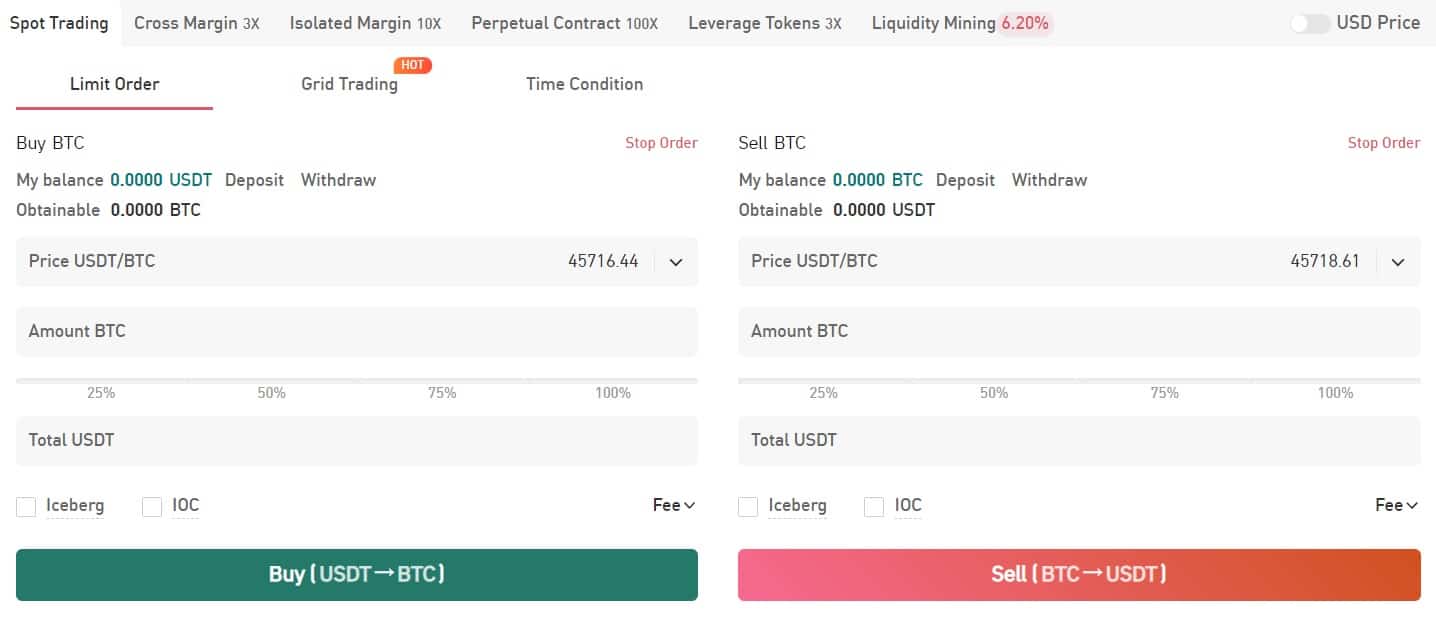

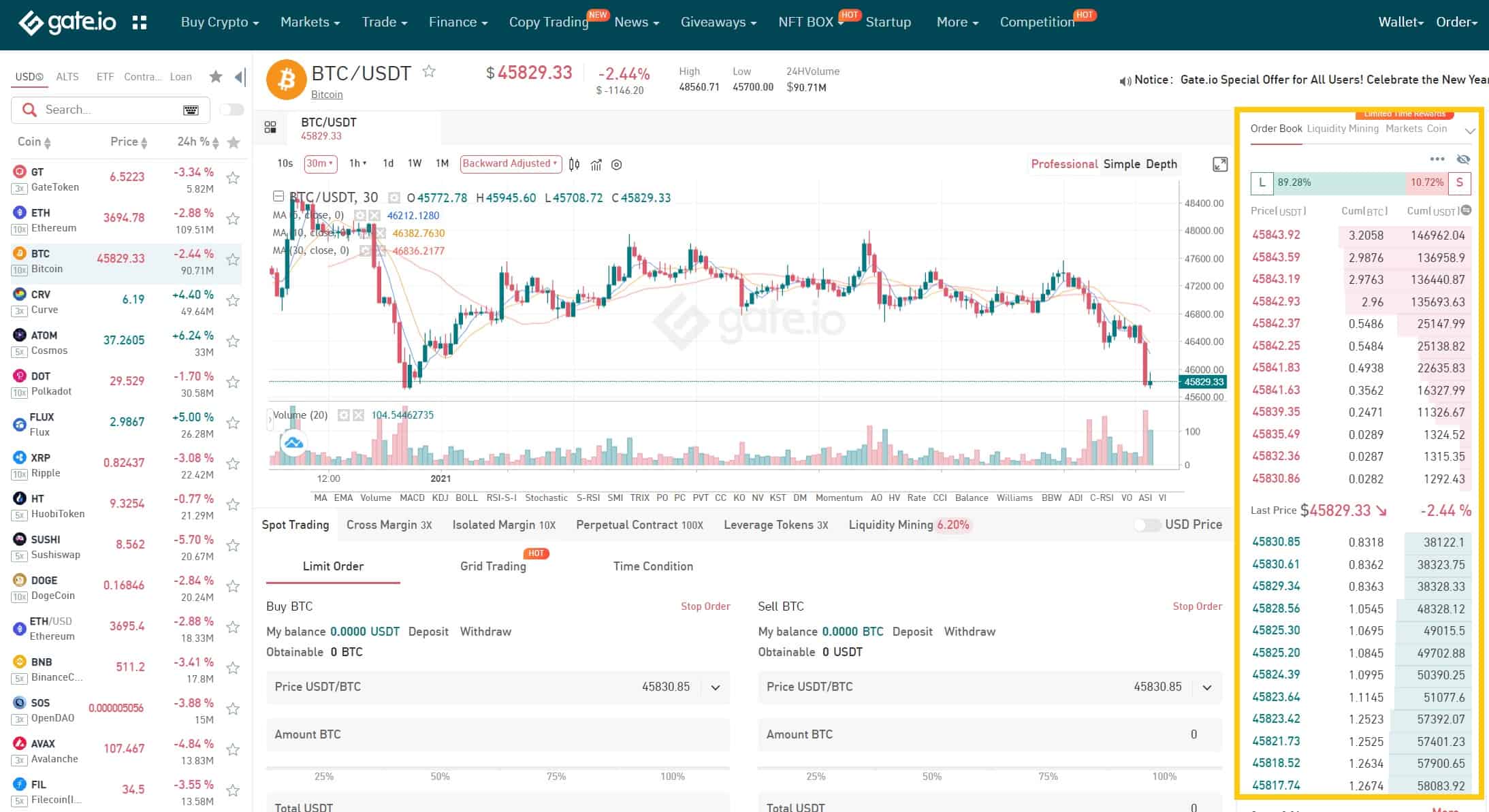

How to Conduct Spot Trading on Gate.io

Step 1: Log in to your Gate.io account.

Click on “Spot Trading” under “Trade” on the top navigation bar.

You can either choose “standard” or “professional” version. This tutorial uses the standard version.

Step 2: Search and enter the cryptocurrency you want to trade.

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can click on the last prices on the order book to set the buying/selling price automatically.

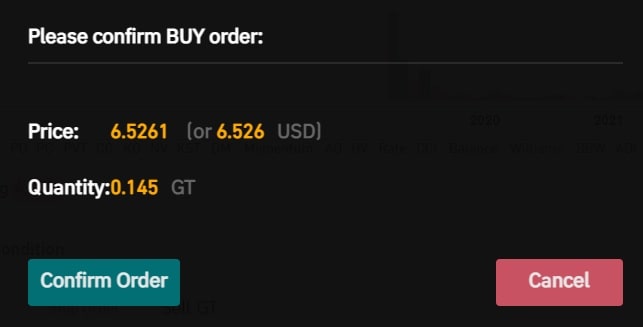

Step 5: Confirm the price and amount. Then click on “Place Order” to place the order, followed by “Confirm Order” to confirm it.

Hide Detailed Instructions

For more in-depth instructions, our ‘Absolute Beginner’s Guide To Cryptocurrency Investing‘ will take you through the process step-by step. In addition to providing instructions for sending and receiving your cryptocurrency.

And if you’re completely new to crypto our beginner, intermediate and advanced level articles will get you up to speed with everything you need to know about the cryptocurrency space starting out.

Simplecryptoguide.com

What Is Serum (SRM)?

Serum is a fully decentralized ecosystem based on Solana. Its main focus is interoperability, and the highlight of its ecosystem is decentralibility. Serum offers an easy-to-use platform from which any crypto token can be exchanged for another without the need to go through any KYC procedures. Serum’s DEX uses the traditional swap system, allowing users to add any trading pairs they like.

Since Serum is built on Solana’s blockchain, its DEX benefits from capabilities worthy of a centralized exchange while users retain full control of their funds. Thanks to its cross-chain features, you can trade BTC, ETH, ERC20 tokens and SPL tokens (Solana’s token standard), among others. These features allow DeFi users to find in Serum a truly decentralized platform, which has all the convenience offered by centralized platforms and more.

How Does Serum Work?

Like any blockchain, Solana comes with a consensus mechanism, with the main innovation behind the Solana network being proof of history (PoH). As the name suggests, it’s a form of consensus based on evidence of past events.

Note that for the Solana network, PoH presents itself as an overlay to proof of stake (PoS), the well-known consensus that implements the concept of masternodes and staking.

Before getting into the specifics of how PoH works, it’s necessary to go back to the basics. Let’s take Bitcoin and its consensus, proof of work (PoW), as an example. On the Bitcoin network, all of the network nodes work in parallel to validate the next block. This implies that the majority of nodes must validate any block before it can be anchored forever in the chain. This process is relatively lengthy, and requires most of the network to agree that “such and such block has been validated at such and such time.”

To maximize its technical capabilities and meet the requirements of its users, the Solana blockchain implements PoH. This method obviates the need for all validators in the network to agree on creating a block. The PoH algorithm will cryptographically prove that one transaction was created before another, making its immediate implementation in the chain possible. In this way, blocks are created approximately every 400 milliseconds on the Solana blockchain, with the network theoretically approaching 50,000 to 65,000 transactions per second (TPS).

In addition, the costs incurred by a transaction on the Solana network are negligible, on the order of $0.00001 per transaction — or about $10 in fees for 1 million transactions.

As Serum is entirely built on Solana, it takes advantage of this blockchain’s capabilities, which are necessary for its ecosystem to function optimally.

Who Is the Founder of Serum?

The Serum Foundation was launched in August 2020. It’s the brainchild of Sam Bankman-Fried, a math and computer science graduate of MIT. Bankman-Fried is also the founder of Alameda Research (2017), a successful cryptocurrency trading company, and the popular crypto derivatives exchange FTX (2019). Along with his FTX colleagues, Bankman-Fried came up with a DeFi protocol to implement in which the DEX was autonomous.

Serum is supported by many centralized exchanges. To date, it has also entered into numerous collaborations, including one with Chainlink (LINK), providing pricing oracles for its DEX within the ecosystem. The leading advisors for the project include Robert Leshner, the founder of Compound Labs, and Long Vuong, founder and CEO of TomoChain.

What is the SRM token?

SRM is the native token of the Serum ecosystem. Serum’s cross-chain swap protocol allows users to reliably swap assets between blockchains. Serum offers investors a decentralized, automated full-limit order book that gives them full control over each order. The integration between Ethereum and Solana makes Serum faster, more efficient and interoperable with ERC20 tokens.

The regulated cross-chain contracts allow easy margin positions in DeFi on synthetic assets. SRMBTC is a model for creating ERC20 or Solana-based tokens for BTC, while SRMUSD is a model for creating a decentralized USD fixed constant currency.

Stake rewards are distributed based on the performance of nodes that take into account important in-chain actions, such as providing blockchain histories for cross-chain placement verification.

The SRM token also has a classic mechanism that is recognized by the tokens of exchange platforms. This system of redemption and destruction rarefies the total amount of SRM.

Apart from the utility of the SRM token in the ecosystem, all fees paid in SRM are automatically burned every week. This mechanism gradually reduces the number of SRM tokens in circulation, further increasing its rarity. That’s why SRM continues to remain valuable.

Currently, Serum is the most preferred decentralized exchange on the Solana ecosystem. The Solana ecosystem offers users a fast trading experience, and as the ecosystem expands, the number of projects on Serum DEX will increase.

What Are the Use Cases of SRM?

The Serum project is fueled by its governance token, SRM. It’s the native utility token of the Serum ecosystem built on the Solana blockchain. It confers several advantages on its holders, including:

- A 50% reduction of the costs incurred for an exchange on any Serum DEX. In addition, up to 80% of the brokerage commissions from transactions made on Serum’s DEX return to users who also have SRM cryptocurrencies. This way, the Serum ecosystem distributes revenue to crypto owners and paves the way for continuous revenue generation.

- The possibility of staking with your SRM token. Currently, this is reserved only for users with 1 million SRM in holdings and the technical capacity to operate masternodes.

Note that the Serum ecosystem chooses to burn these fees and contribute to the ecosystem. The rest of the fees, 20%, are distributed to users (stakers) who lock SRM tokens.

- The right to vote on the ecosystem’s governance. Users thus get to decide if any update is needed within the ecosystem, such as adjusting network charges.

Serum development updates in 2023

Serum, operating on the Solana blockchain, has experienced significant developments in 2023. These advancements highlight Serum’s ongoing efforts to enhance its platform and maintain security in the dynamic world of cryptocurrency.

Emergency Fork Following FTX Hack: In response to security concerns triggered by the hack of Sam Bankman-Fried’s FTX exchange, Serum underwent an emergency fork. This decision was crucial to ensure the security of the Serum protocol and its users. The community forked the project, copying the underlying software code and starting afresh, to safeguard against any potential compromises in security.

Substantial Growth in SRM Token Price: Serum’s SRM tokens saw remarkable growth, with the price nearly doubling from a weekly low. This growth was a rebound from the significant drops in the crypto market, reflecting the resilience and adaptability of the Serum ecosystem. The price increase was likely driven by the community’s support for the fork and the renewed confidence in the platform’s security and future.

SRM Fork and Community Response: The SRM token was forked by its community, providing protection from the FTX exchange cyberattack. This fork was a critical move, ensuring that SRM holders were shielded from the hack’s impact. By creating a new start from the original code, the Serum community effectively restored the token’s security and boosted investor confidence, as evidenced by the subsequent increase in the SRM token’s value.

These updates represent significant steps in Serum’s journey, particularly in terms of enhancing security and building investor confidence. The platform’s quick response to potential threats and its ability to recover and grow from market downturns underscore its commitment to maintaining a secure and robust ecosystem in the ever-evolving cryptocurrency market.

Official website: https://www.projectserum.com/

Best cryptocurrency wallet for Serum (SRM)

There are plenty of different crypto wallets available. The best one for you depends on your general trading habits and which provides the most security in your situation. There are two main types of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical). Both have their pros and cons, and there is not necessarily a right or wrong answer when it comes to figuring out which crypto wallet is best for you.

HOW DO I DECIDE WHICH cryptocurrency WALLET TO USE for Serum (SRM)?

Deciding which type of wallet to use depends on a variety of factors, including:

- How often you trade. In general, hot wallets are better for more active cryptocurrency traders. Quick login ability means you are only a few clicks and taps away from buying and selling crypto. Cold wallets are better suited for those looking to make less frequent trades.

- What you want to trade. As mentioned earlier, not all wallets support all types of cryptocurrencies. However, some of the best crypto wallets have the power to trade hundreds of different currencies, providing more of a one-size-fits-all experience.

- Your peace of mind. For those worried about hacking, having a physical cold wallet stored in a safe deposit box at the bank or somewhere at home, provides the safest, most secure option. Others might be confident in their ability to keep their hot wallets secure.

- How much it costs. It is important to investigate the costs associated with each wallet. Many hot wallets will be free to set up. Meanwhile, cold wallets, like any piece of hardware, will cost money to purchase.

- What it can do. While the basics of each cryptocurrency wallet are the same, additional features can help set them apart. This is especially true of hot wallets, many of which come with advanced reporting features, insights into the crypto market, the ability to convert cryptocurrencies and more. Security features can also be a good differentiator.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re going to be dealing in larger volumes of crypto, investing in cold storage might prove advantageous.

Most widespead examples of this being the Ledger Nano and the Trezor.

Ledger manufactures cold storage wallets designed for users who want increased security. Their wallets are a physical device that connects to your computer. Only when the device is connected can you send your cryptocurrency from it. Ledger offers a variety of products, such as the Ledger Nano S and the Ledger Nano X (a bluetooth connected hardware wallet).

Trezor is a pioneering hardware wallet company. The combination of world-class security with an intuitive interface and compatibility with other desktop wallets, makes it ideal for beginners and experts alike. The company has gained a lot of the Bitcoin community’s respect over the years. Trezor offers two main models – The Trezor One and Trezor Model T (which has a built in touch screen).

Market Overview

Coinmarketcap.com

Coinmarketcap will be your cryptocurrency go-to for just about everything. Here you can see the following: