How To Buy Waves (WAVES)?

A common question you often see on social media from crypto beginners is “Where can I buy Waves?” Well, you’ll be happy to hear it is actually quite a simple and straightforward process.

Step 1: Create an account on an exchange that supports Waves (WAVES)

First, you will need to open an account on a cryptocurrency exchange that supports Waves (WAVES).

We recommend the following based on functionality, reputation, security, support and fees:

1

Binance

Fees (Maker/Taker) 0.075%*-0.1%*

Cryptocurrencies

Available for Trade 500+

Sign-up bonus

10% reduced trading fees*

Available in

Europe, Asia, Oceania, Africa

2

Gate.io

Fees (Maker/Taker) 0.2%*-0.2%*

Cryptocurrencies

Available for Trade 1000+

Sign-up bonus

Up to $100 in USDT vouchers*

Available in

North America, South America, Europe, Asia, Oceania, Africa

In order to sign up, you will need to enter some basic information, such as your email address, password, full name and, in some cases, you might also be asked for a phone number or address.

Note: On specific exchanges, you might need to complete a Know Your Customer (KYC) procedure in order to be able to purchase cryptocurrency. This is most commonly the case with licensed and regulated exchanges.

Step 2: Deposit funds into your account

Many cryptocurrency exchanges will allow you to purchase Waves (WAVES) with fiat currencies, such as EUR, USD, AUD and others. Furthermore, they will also provide you with multiple deposit methods through which you can fund your fiat account, such as credit and debit cards, ewallets or direct bank transfers.

Note: Some payment methods will have higher fees than others, such as credit card payments. Before funding your fiat account on your chosen exchange, make sure to do your due diligence to find out the fees involved with each payment method to avoid unnecessary costs.

Step 3: Buy Waves (WAVES)

This process is similar across almost every cryptocurrency exchange. All you have to do is find a navigation bar or a search bar, and search for Waves (WAVES) or Waves (WAVES) trading pairs. Look for the section that will allow you to buy Waves (WAVES), and enter the amount of the cryptocurrency that you want to spend for Waves (WAVES) or the amount of fiat currency that you want to spend towards buying Waves (WAVES). The exchange will then calculate the equivalent amount of Waves (WAVES) based on the current market rate.

Note: Make sure to always double-check your transaction details, such as the amount of Waves (WAVES) you will be buying as well as the total cost of the purchase before you end up confirming the transaction. Furthermore, many cryptocurrency exchanges will offer you their own proprietary software wallet where you will be storing your cryptocurrencies; however, you can create your own individual software wallet, or purchase a hardware wallet for the highest level of protection.

How to create a Binance account

Show Detailed Instructions

Hide Detailed Instructions

Step 1: Go to the Binance website.

Step 2: On the registration page, enter your email address, and create a password for your account.

Then, read and agree to the Terms of Service and click “Create Account”.

Note: Your password must be a combination of numbers and letters.

It should contain at least 8 characters, one UPPER CASE letter, and one number.

Step 3: Complete the Security Verification.

Step 4: The system will send a verification code to your email. The verification code is valid for 30 minutes. If you can’t find the email in your inbox, check your other mail folders as well, or click “Resend Email” to resend.

How to complete KYC (ID Verification) on Binance

Step 1: Log in to your Binance account and click “User Center” and then “Identification”.

Step 2: click “Start Now” to verify your account.

Step 3: Select your country of residence.

Ensure that your country of residence is consistent with your ID documents.

Step 5: Enter your personal information and click “Continue.”

You won’t be able to change it once confirmed.

Refer to the respective options offered for your country.

Step 7: Follow the instructions to upload photos of your document. Your photos should clearly show the full ID document.

Do not wear hats, glasses, or use filters, and make sure that the lighting is sufficient.

Once your application has been verified, you will receive an email notification.

How to buy cryptocurrency on Binance

Step 1: Log in to your Binance account and click “Buy Crypto” and then “Credit/Debit Card”.

Step 2: Here you can choose to buy crypto with different fiat currencies. Enter the fiat amount you want to spend and the system will automatically display the amount of crypto you can get. When you have selected the amount you wish to spend then press “Continue”.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

Step 3: Click “Add New Card”. Then enter your credit card details and your billing address.

Step 4: Check the payment details and confirm your order within 1 minute. After 1 minute, the price and the amount of crypto you will get will be recalculated. You can click “Refresh” to see the latest market price. You will then be redirected to your bank’s OTP Transaction Page. Follow the on-screen instructions to verify the payment.

How to Conduct Spot Trading on Binance

Step 1: Log in to your Binance account.

Click on “Classic” under “Trade” on the top navigation bar.

Step 2: Search and enter the cryptocurrency you want to trade.

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can place a “Market Order” to set the buying/selling price automatically.

Hide Detailed Instructions

How to create a Gate.io account

Show Detailed Instructions

Hide Detailed Instructions

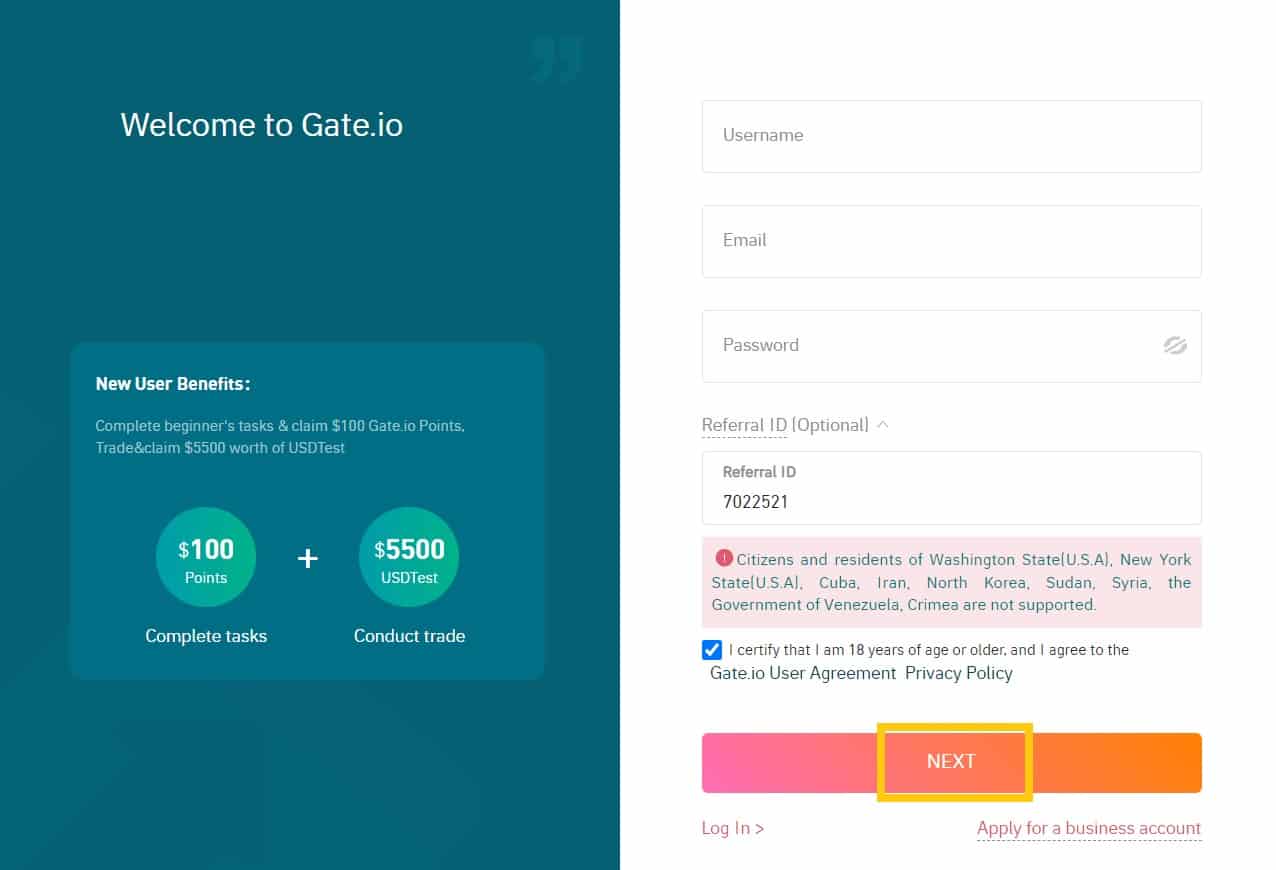

Step 1: Go to the Gate.io website.

Step 2: Choose your username, your email address and your password. Then check “I certify that I am 18 years of age or older, and I agree to the Gate.io User Agreement Privacy Policy” and click “NEXT”.

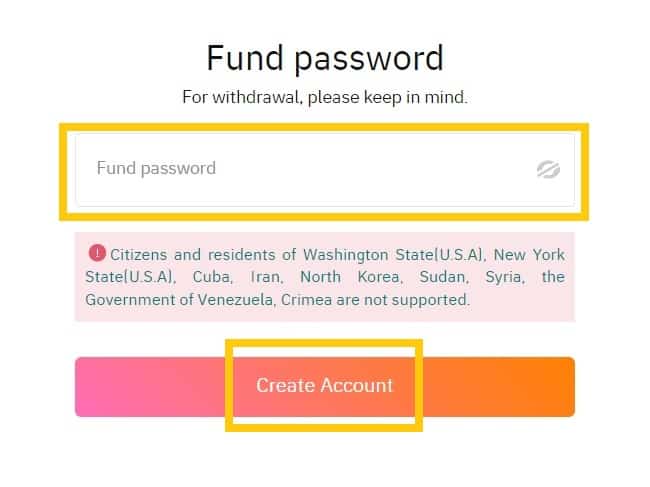

Step 3: Set your fund password and click “Create account”.

Note: Your fund password must contain at least 6 characters and can not be the same as your login password.

Step 4: An activation email will be sent to your email address. Complete the rest of the registration process by following the instructions in the email to activate your account. Once this is done done, click “Email activated, please log in”.

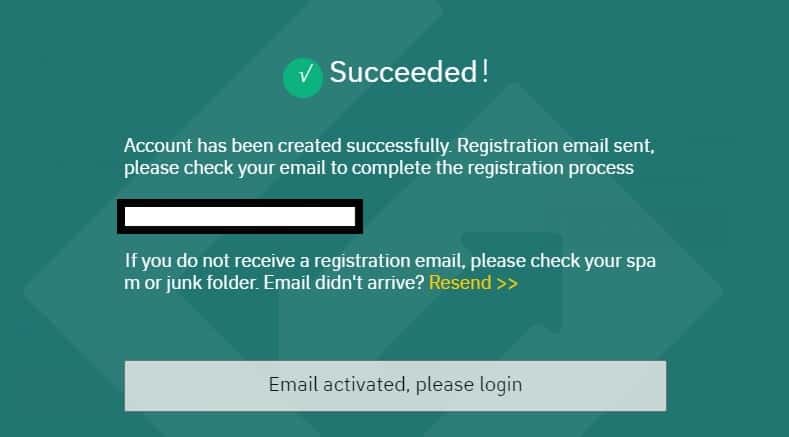

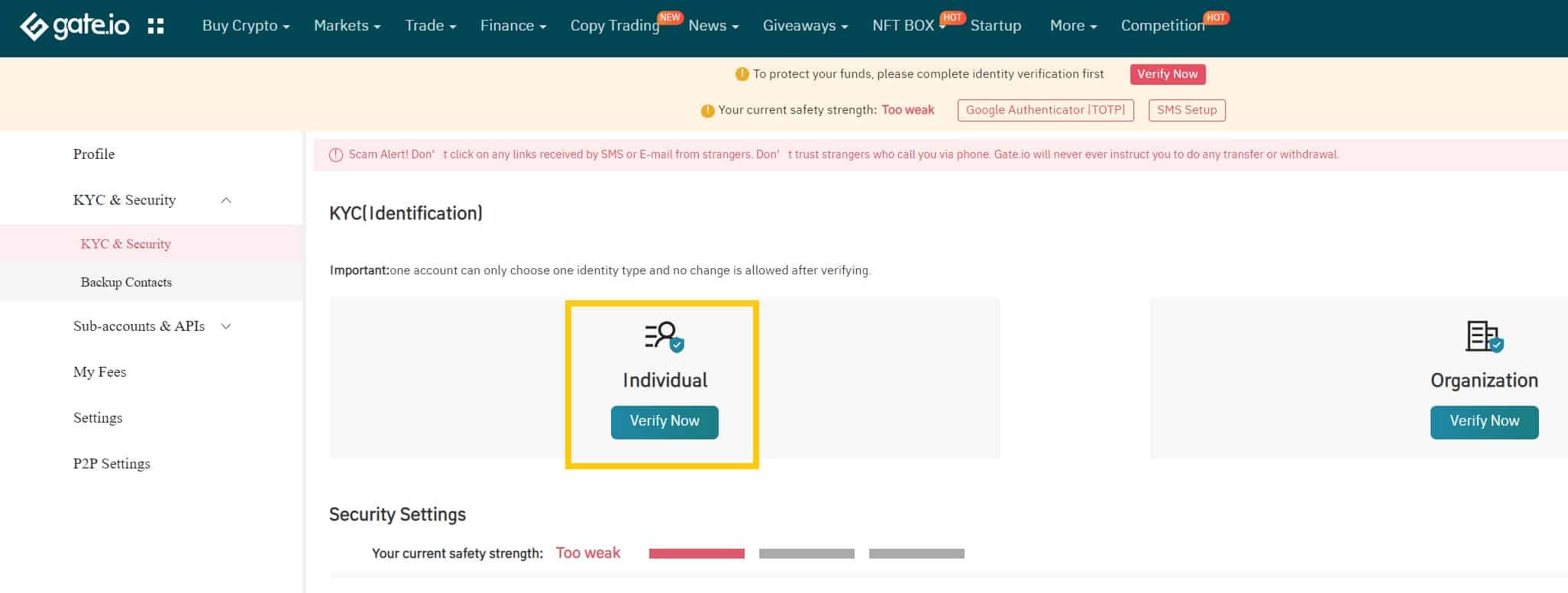

How to complete KYC (ID Verification) on Gate.io

In order to ensure the safety of your assets, and to reduce fraud, money laundering, blackmail, and other illegal activities, Gate.io makes it mandatory that all users obtain KYC ID Verification. Only after your account has obtained KYC ID verification, can you withdraw funds or use credit cards or debit cards to buy cryptocurrencies.

Step 1: Log in to your Gate.io account.

Place your cursor on the top-right profile icon and go to “KYC (ID Verification)”

Step 2: Click “Individual (Verify now)”

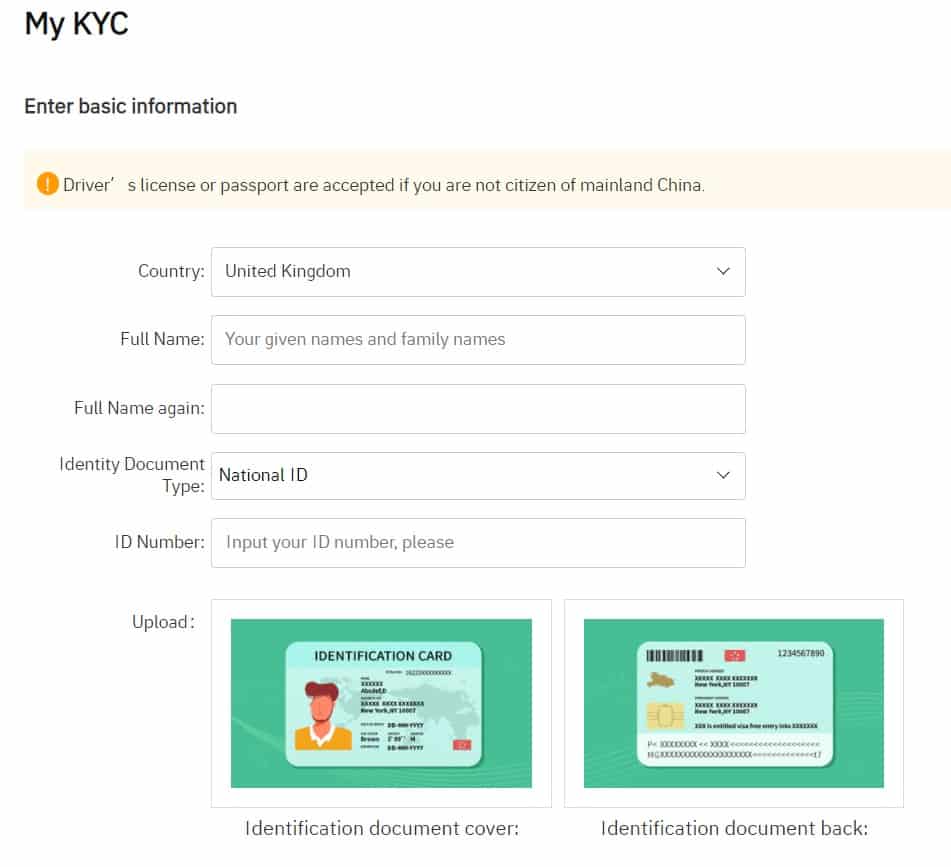

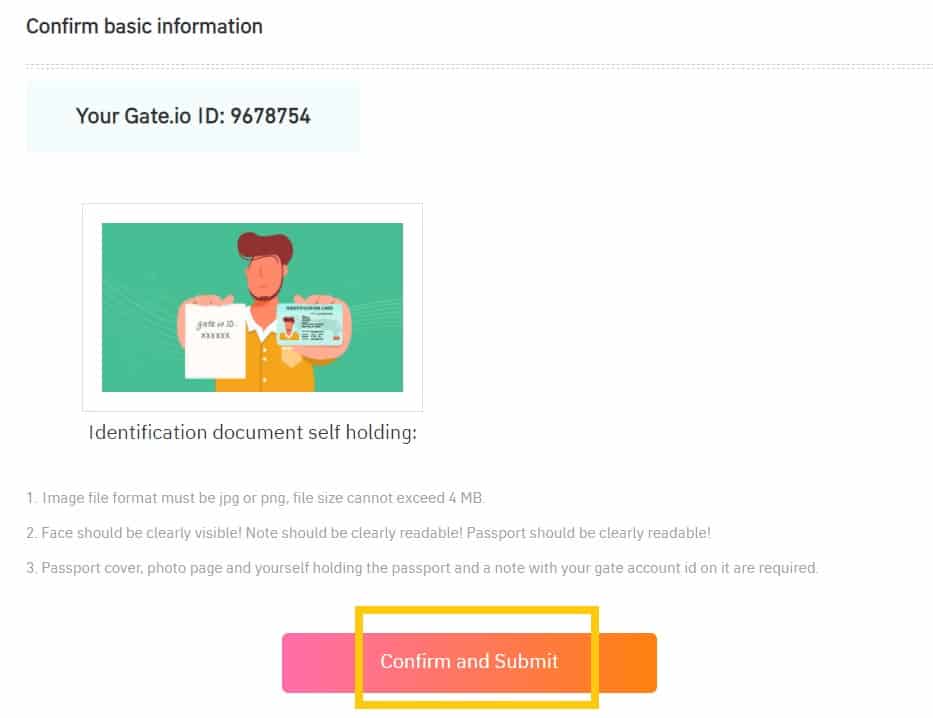

Step 3: Select your country, input your full legal name (twice), fill in your ID information, upload photos of both sides of your ID card, and a photo of you holding your ID together with your User ID (UID) for Gate.io. You will see your User ID by placing the cursor on the top-right profile icon on the main page. Make sure everything is filled in correctly and then click on “Confirm and Submit”.

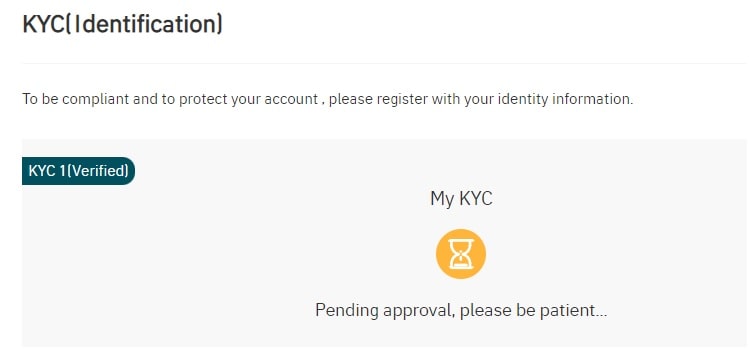

Step 4: After you have submitted all the requested information, you will see the pending approval.

Approval can take anywhere from a few hours to a few days to complete.

Once the KYC is approved, you’re ready to make your first cryptocurrency purchase.

How to buy cryptocurrency on Gate.io

Step 1: Log in to your Gate.io account.

Then in the Menu Bar at the top of the page, click “Buy Crypto” and select “Credit Card”.

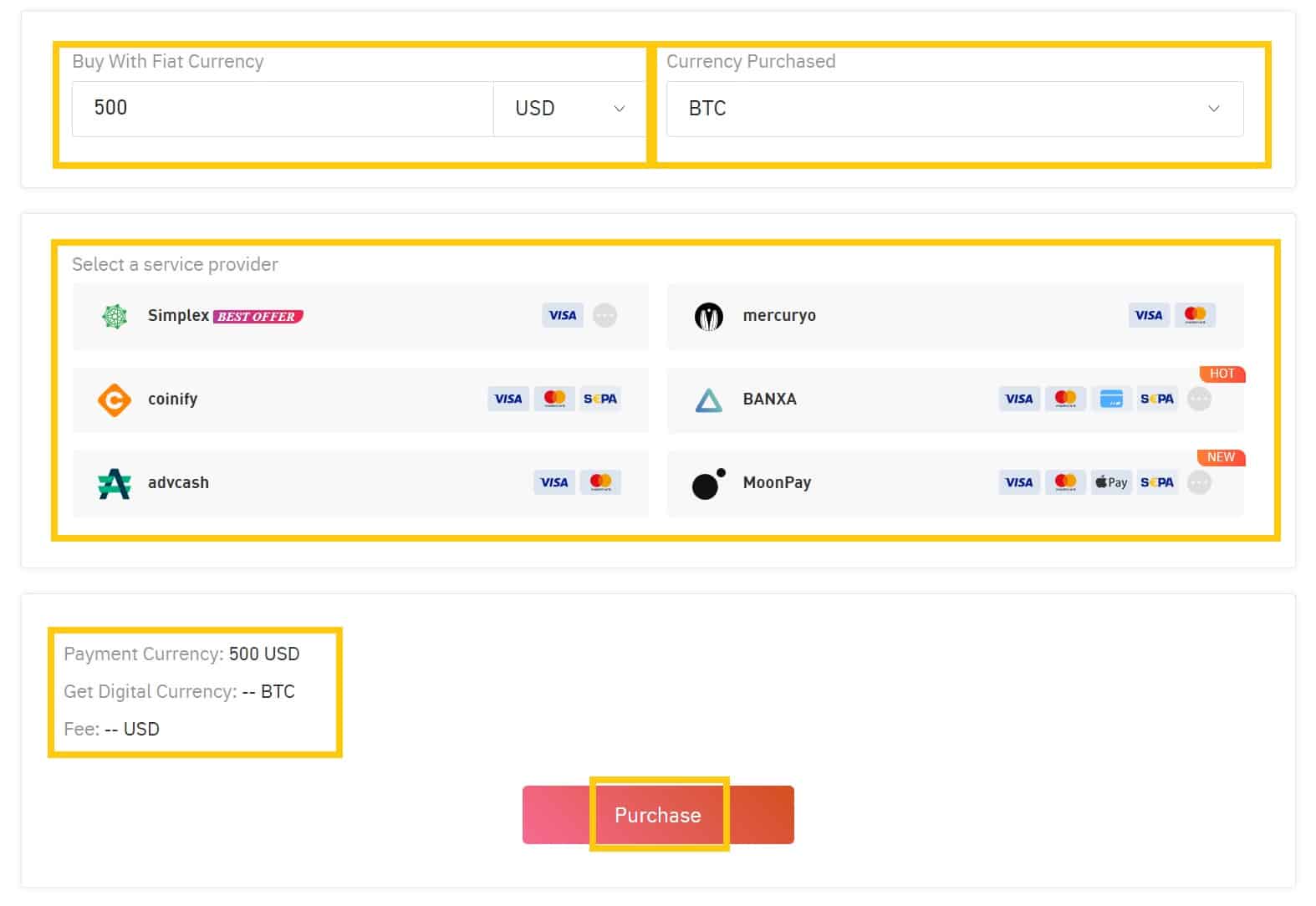

Step 2: Enter the amount you wish to spend in the “Buy with Fiat Currency” tab and select the cryptocurrency that you want to buy under the “Currency Purchased” field. Then select one of the “Service Providers” below and click the “Place Order” button to enter the confirmation page.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

Step 3: On the confirmation page, select “Buy Crypto” or the “Create Order” button to complete the payment.

Note: To ensure a quick and secure way of receiving the order, users might need to conduct an additional Identity Verification (KYC) with a third-party service provider. Once successfully verified, the service provider will immediately transfer the cryptocurrencies to your Gate.io account.

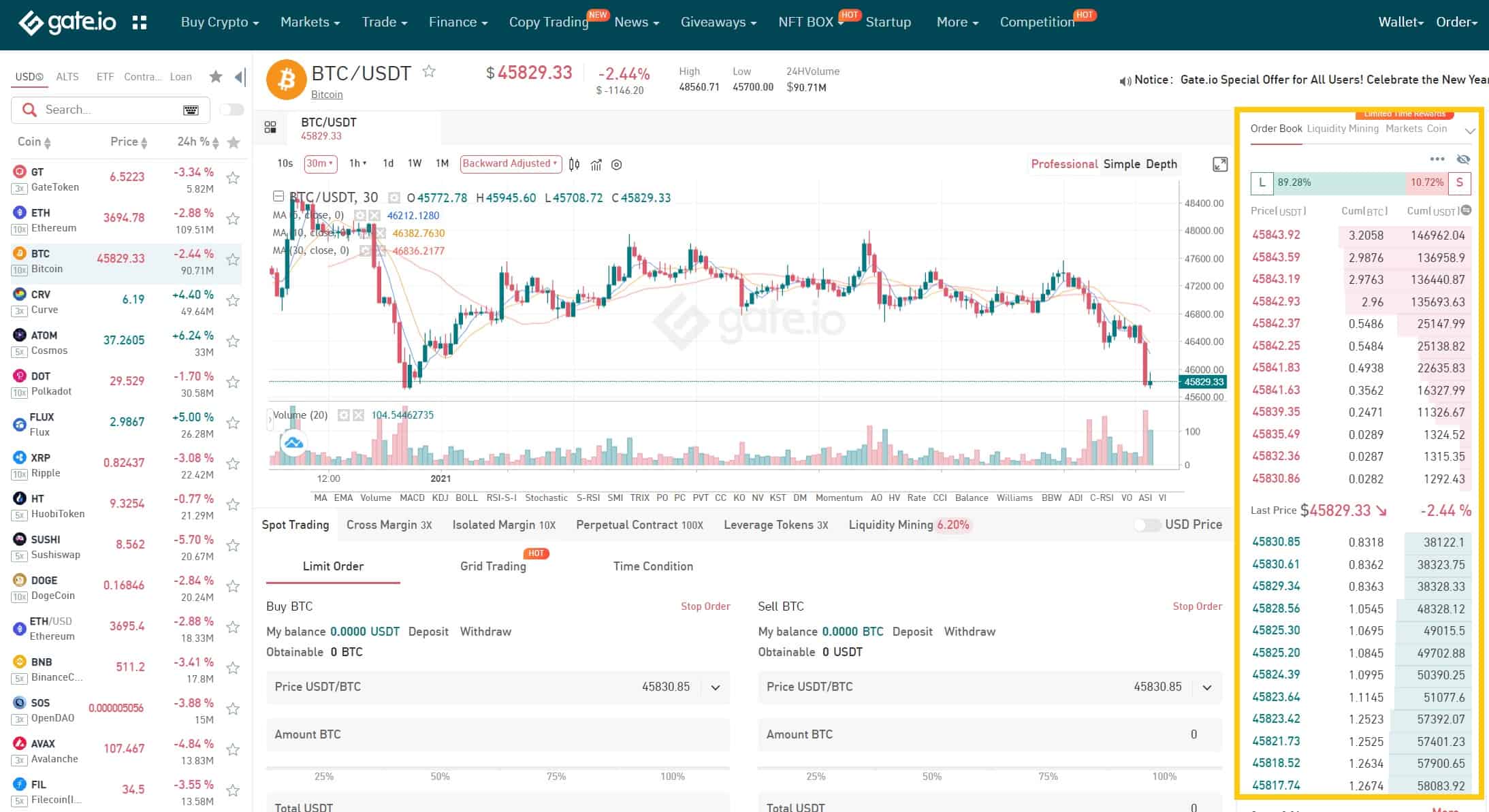

How to Conduct Spot Trading on Gate.io

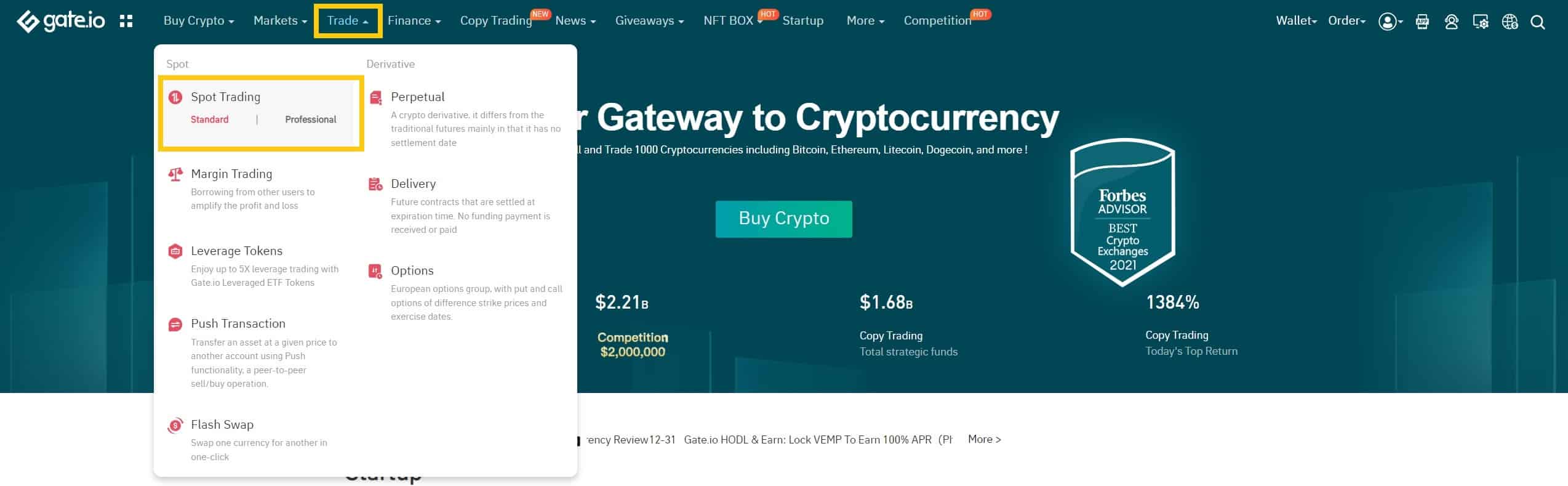

Step 1: Log in to your Gate.io account.

Click on “Spot Trading” under “Trade” on the top navigation bar.

You can either choose “standard” or “professional” version. This tutorial uses the standard version.

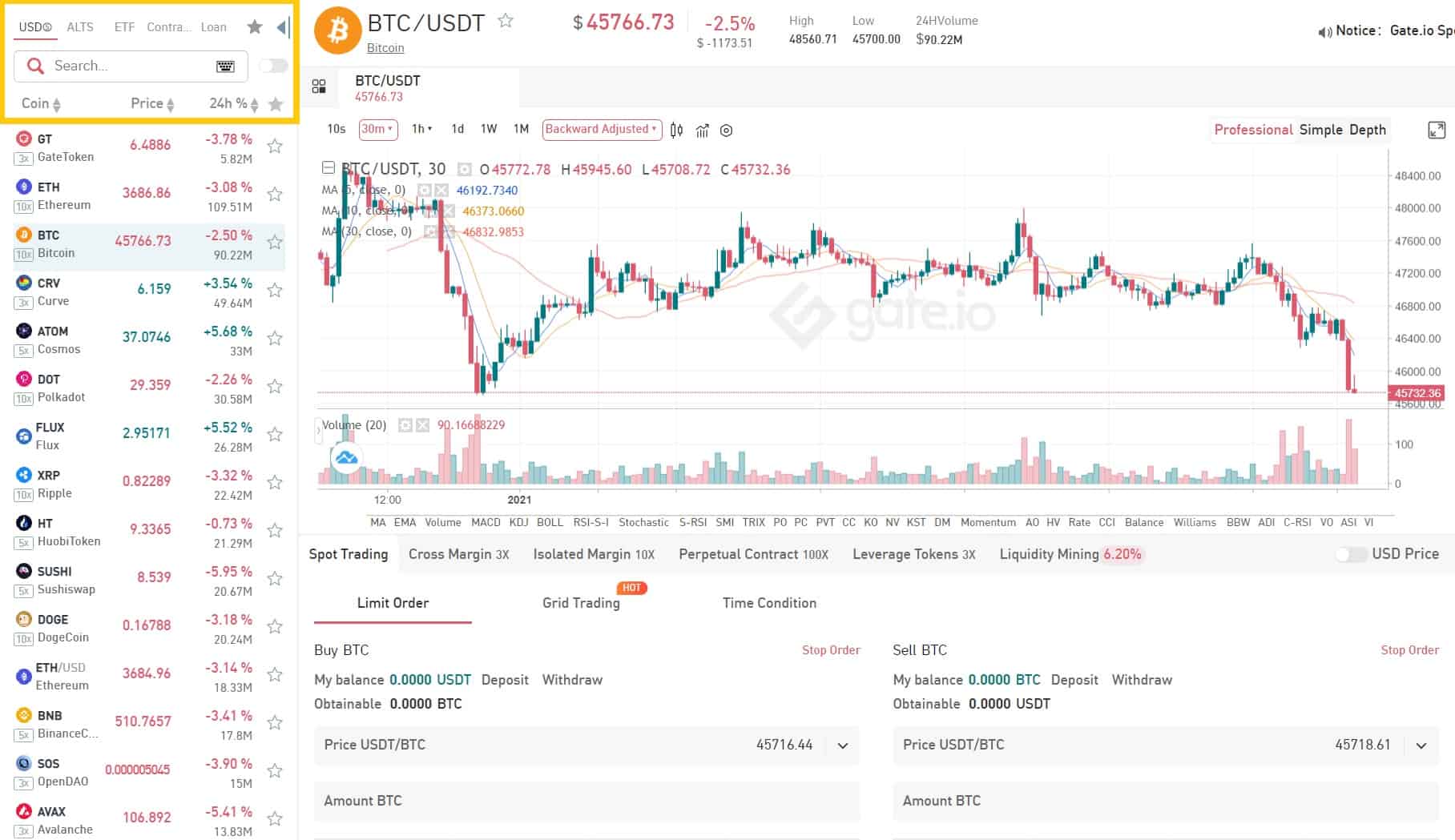

Step 2: Search and enter the cryptocurrency you want to trade.

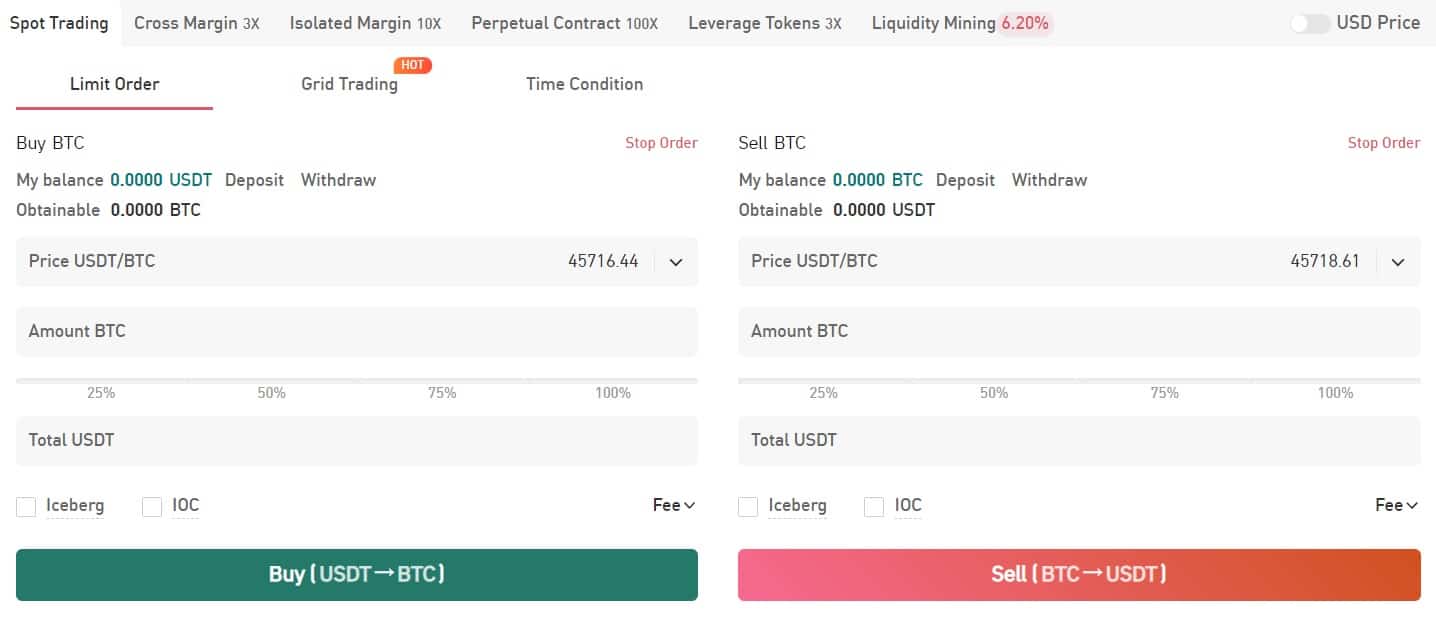

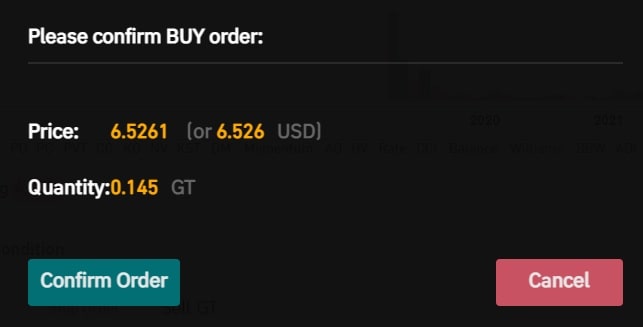

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can click on the last prices on the order book to set the buying/selling price automatically.

Step 5: Confirm the price and amount. Then click on “Place Order” to place the order, followed by “Confirm Order” to confirm it.

Hide Detailed Instructions

For more in-depth instructions, our ‘Absolute Beginner’s Guide To Cryptocurrency Investing‘ will take you through the process step-by step. In addition to providing instructions for sending and receiving your cryptocurrency.

And if you’re completely new to crypto our beginner, intermediate and advanced level articles will get you up to speed with everything you need to know about the cryptocurrency space starting out.

Simplecryptoguide.com

What Is Waves (WAVES)?

The Waves blockchain is designed to enable users to create and launch custom crypto tokens.

Waves allows for the creation and trade of crypto tokens without the need for extensive smart contract programming. Rather, tokens can be created and managed via scripts that run in user accounts on the Waves blockchain. The idea is that the development of new tokens (and the applications that govern them) should not substantially differ from launching a traditional web application.

Toward this goal, programs and applications run as attachments to these transactions, and new assets are given a unique identifier. Scripts can only be attached at the creation of the asset. These assets are designed to trade within the Waves ecosystem, which includes its own built-in decentralized exchange (Waves.Exchange), made to facilitate trade between tokens created on the Waves blockchain with other WAVES tokens.

In 2018, the Waves team added smart contract functionality to the Waves MainNet, enabling third-parties to build decentralized applications (dapps). Further, in 2019, the team behind the platform began to market Waves Enterprise, a version of the network designed for institutions.

How does Waves work?

The Waves blockchain allows two different types of nodes to run its software: full nodes and the lightweight nodes.

Full nodes keep a complete history of the transactions, while lightweight nodes depend on full nodes for transaction confirmation and interactions within the network. To keep its distributed network in sync, Waves uses a variation of the proof-of-stake (PoS) consensus mechanism called leased proof-of-stake (LPoS).

The Waves LPoS Blockchain

In a traditional proof-of-stake model, any node that chooses to lock up tokens can be eligible to add blocks to the blockchain. The chances that a node will be able to add a block generally increase or decrease depending on the amount of coins a node has locked in a special contract.

With the LPoS, nodes also have the option to lease their balance to full nodes. This means that when a full node is selected to produce the next block and is compensated, nodes that lease tokens to that selected node earn a certain percentage of the payout.

Waves-NG

The protocol that determines which node gets the right to produce the next block is called Waves-NG, and it is a modification of an idea first proposed (but rejected) for Bitcoin (BTC).

Waves-NG breaks up the Waves blockchain into two kinds of blocks –” key blocks” and “micro blocks.” Key blocks are created by a randomly chosen proof-of-stake miner. A public key in this block is then used by other nodes to create many microblocks which include transactions.

Smart Assets

Central to the Waves blockchain is the ability to create ‘Smart Assets,’ tokens with an attached script written in Ride, a programming language native to Waves. Any token can be given functionalities by attaching a script. The execution of the scripts costs 0.004 WAVES.

Since Waves enables users to issue tokens without any programming experience, the tokens and subsequent transfers are done as attachments added to transactions. Different transaction types are introduced through plug-ins that are installed as extensions on top of the blockchain.

What is the Waves token?

The WAVES cryptocurrency plays a key role in maintaining and operating the Waves network.

WAVES is used to create custom tokens and to pay for transaction fees. Further, the supply of WAVES tokens is limited – there will only ever be 100 million WAVES. Ownership of the WAVES cryptocurrency determines who gets to add new blocks to the Waves blockchain and who earns a share of fees paid for transactions.

Any user wanting to become a full node will need a minimum balance of 1,000 WAVES. Waves enables users who do not have as many tokens to participate in mining by leasing their nodes, but leasing does cost 0.002 WAVES.

Who are the founders of Waves?

Waves is synonymous with its founder, Ukrainian-born scientist Alexander Ivanov (also known as Sasha Ivanov). Prior to creating Waves, Ivanov was already active in the cryptocurrency space, having released the now-defunct instant exchange Coinomat and indexing site Cooleindex. He also created an early version of a stablecoin, CoinoUSD, tied to the U.S. dollar.

Ivanov is publicly active in his promotion of Waves, giving frequent interviews on the platform and trends in the wider blockchain industry.

According to Waves’ marketing literature, the company now employs over 180 people at locations including Moscow and Switzerland.

Waves development updates in 2023

Waves, a notable player in the blockchain and cryptocurrency space, has seen a range of developments and updates in 2023, reflecting its commitment to innovation and community engagement. Here’s an overview of the most important updates:

-

DAO Launch and Governance: Waves has launched a Decentralized Autonomous Organization (DAO), comprising Waves Enterprises, Waves Labs, and Tokenomika. This DAO is designed to manage and execute decisions made by community members, enhancing community engagement and decision-making processes.

-

Algorithmic Stablecoin and Market Recovery: Waves faced challenges with its algorithmic stablecoin, Neutrino USD (NUSD), which lost its peg to the U.S. dollar. However, the NUSD has been restored to a 1:1 peg with the dollar. Measures have been implemented to avoid similar incidents in the future, including setting thresholds and maximum APR borrowing limits for tokens, as well as imposing daily withdrawal limits for USDT and USDC across DeFi protocols on the Waves ecosystem.

-

Development and Library Updates: To facilitate developer onboarding and build on the protocol, Waves is updating its Java and Go libraries. These updates aim to support all features of the Waves blockchain and are anticipated to be released soon.

-

Layer 2 EVM (Ethereum Virtual Machine) Introduction: Waves is working towards rolling out a new layer 2 EVM. This development is expected to enhance transactions with layer 2 networks while also tapping into scalability and other efficiencies. The EVM will also facilitate easier connectivity to the Ethereum network through smart contract-enabled transactions.

-

On-Chain Metrics and NFT Trade Volume: There has been a noticeable increase in Waves’ development activity since mid-March 2023. The total NFT trade volume on the network has surged, indicating heightened network activity. On-chain volumes have shown improvement, though they still have some way to go to reach peak monthly levels.

-

Market Performance and Predictions: Despite the volatility in the crypto market, Waves (WAVES) has shown resilience. Market analysts predict bullish scenarios for WAVES, with price predictions ranging between $10.04 and $18.97 by 2030, and a possible reach of $7.81 by 2025. However, a bearish market price prediction for 2023 is around $1.79.

-

Community Support: Waves enjoys strong community support, evident in the recent launch of its DAO and the positive reception of its DeFi ecosystem developments. The project is recognized for its potential and pace of development within the crypto community.

These updates mark significant milestones in Waves’ journey, showcasing its dedication to stability, community-driven governance, and technological advancement. The focus on enhancing scalability, developer support, and network efficiency positions Waves as a dynamic and evolving platform in the blockchain and cryptocurrency landscape.

Official website: https://waves.tech/

Best cryptocurrency wallet for Waves (WAVES)

There are plenty of different crypto wallets available. The best one for you depends on your general trading habits and which provides the most security in your situation. There are two main types of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical). Both have their pros and cons, and there is not necessarily a right or wrong answer when it comes to figuring out which crypto wallet is best for you.

HOW DO I DECIDE WHICH cryptocurrency WALLET TO USE for Waves (WAVES)?

Deciding which type of wallet to use depends on a variety of factors, including:

- How often you trade. In general, hot wallets are better for more active cryptocurrency traders. Quick login ability means you are only a few clicks and taps away from buying and selling crypto. Cold wallets are better suited for those looking to make less frequent trades.

- What you want to trade. As mentioned earlier, not all wallets support all types of cryptocurrencies. However, some of the best crypto wallets have the power to trade hundreds of different currencies, providing more of a one-size-fits-all experience.

- Your peace of mind. For those worried about hacking, having a physical cold wallet stored in a safe deposit box at the bank or somewhere at home, provides the safest, most secure option. Others might be confident in their ability to keep their hot wallets secure.

- How much it costs. It is important to investigate the costs associated with each wallet. Many hot wallets will be free to set up. Meanwhile, cold wallets, like any piece of hardware, will cost money to purchase.

- What it can do. While the basics of each cryptocurrency wallet are the same, additional features can help set them apart. This is especially true of hot wallets, many of which come with advanced reporting features, insights into the crypto market, the ability to convert cryptocurrencies and more. Security features can also be a good differentiator.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re going to be dealing in larger volumes of crypto, investing in cold storage might prove advantageous.

Most widespead examples of this being the Ledger Nano and the Trezor.

Ledger manufactures cold storage wallets designed for users who want increased security. Their wallets are a physical device that connects to your computer. Only when the device is connected can you send your cryptocurrency from it. Ledger offers a variety of products, such as the Ledger Nano S and the Ledger Nano X (a bluetooth connected hardware wallet).

Trezor is a pioneering hardware wallet company. The combination of world-class security with an intuitive interface and compatibility with other desktop wallets, makes it ideal for beginners and experts alike. The company has gained a lot of the Bitcoin community’s respect over the years. Trezor offers two main models – The Trezor One and Trezor Model T (which has a built in touch screen).

Market Overview

Coinmarketcap.com

Coinmarketcap will be your cryptocurrency go-to for just about everything. Here you can see the following: