How To Buy Acala (ACA)?

A common question you often see on social media from crypto beginners is “Where can I buy Acala?” Well, you’ll be happy to hear it is actually quite a simple and straightforward process.

Step 1: Create an account on an exchange that supports Acala (ACA)

First, you will need to open an account on a cryptocurrency exchange that supports Acala (ACA).

We recommend the following based on functionality, reputation, security, support and fees:

1

Binance

Fees (Maker/Taker) 0.075%*-0.1%*

Cryptocurrencies

Available for Trade 500+

Sign-up bonus

10% reduced trading fees*

Available in

Europe, Asia, Oceania, Africa

2

MEXC

Fees (Maker/Taker) 0.2%*-0.2%*

Cryptocurrencies

Available for Trade 1500+

Sign-up bonus

10% reduced trading fees & up to $170 in USDT vouchers*

Available in

North America, South America, Europe, Asia, Oceania, Africa

In order to sign up, you will need to enter some basic information, such as your email address, password, full name and, in some cases, you might also be asked for a phone number or address.

Note: On specific exchanges, you might need to complete a Know Your Customer (KYC) procedure in order to be able to purchase cryptocurrency. This is most commonly the case with licensed and regulated exchanges.

Step 2: Deposit funds into your account

Many cryptocurrency exchanges will allow you to purchase Acala (ACA) with fiat currencies, such as EUR, USD, AUD and others. Furthermore, they will also provide you with multiple deposit methods through which you can fund your fiat account, such as credit and debit cards, ewallets or direct bank transfers.

Note: Some payment methods will have higher fees than others, such as credit card payments. Before funding your fiat account on your chosen exchange, make sure to do your due diligence to find out the fees involved with each payment method to avoid unnecessary costs.

Step 3: Buy Acala (ACA)

This process is similar across almost every cryptocurrency exchange. All you have to do is find a navigation bar or a search bar, and search for Acala (ACA) or Acala (ACA) trading pairs. Look for the section that will allow you to buy Acala (ACA), and enter the amount of the cryptocurrency that you want to spend for Acala (ACA) or the amount of fiat currency that you want to spend towards buying Acala (ACA). The exchange will then calculate the equivalent amount of Acala (ACA) based on the current market rate.

Note: Make sure to always double-check your transaction details, such as the amount of Acala (ACA) you will be buying as well as the total cost of the purchase before you end up confirming the transaction. Furthermore, many cryptocurrency exchanges will offer you their own proprietary software wallet where you will be storing your cryptocurrencies; however, you can create your own individual software wallet, or purchase a hardware wallet for the highest level of protection.

How to create a Binance account

![]()

Show Detailed Instructions

Hide Detailed Instructions

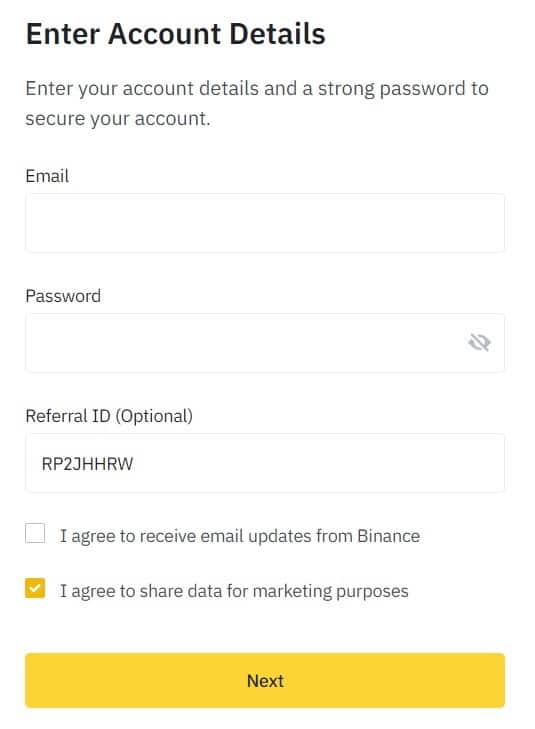

Step 1: Go to the Binance website.

Step 2: On the registration page, enter your email address, and create a password for your account.

Then, read and agree to the Terms of Service and click “Create Account”.

Note: Your password must be a combination of numbers and letters.

It should contain at least 8 characters, one UPPER CASE letter, and one number.

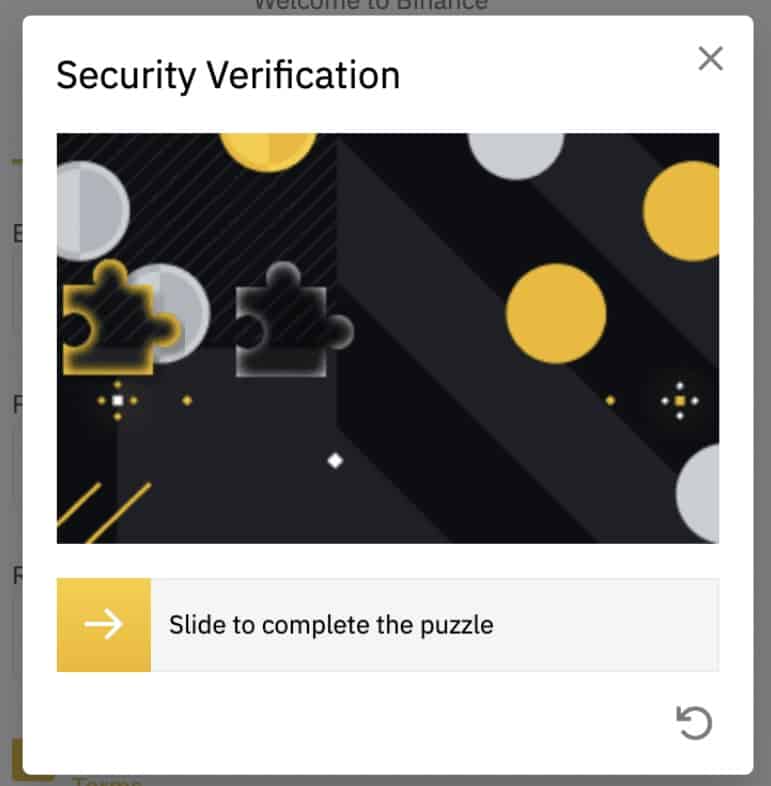

Step 3: Complete the Security Verification.

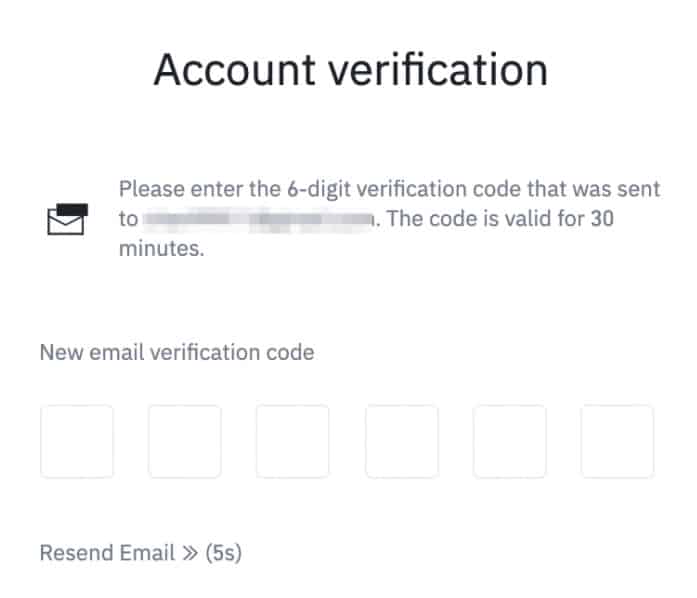

Step 4: The system will send a verification code to your email. The verification code is valid for 30 minutes. If you can’t find the email in your inbox, check your other mail folders as well, or click “Resend Email” to resend.

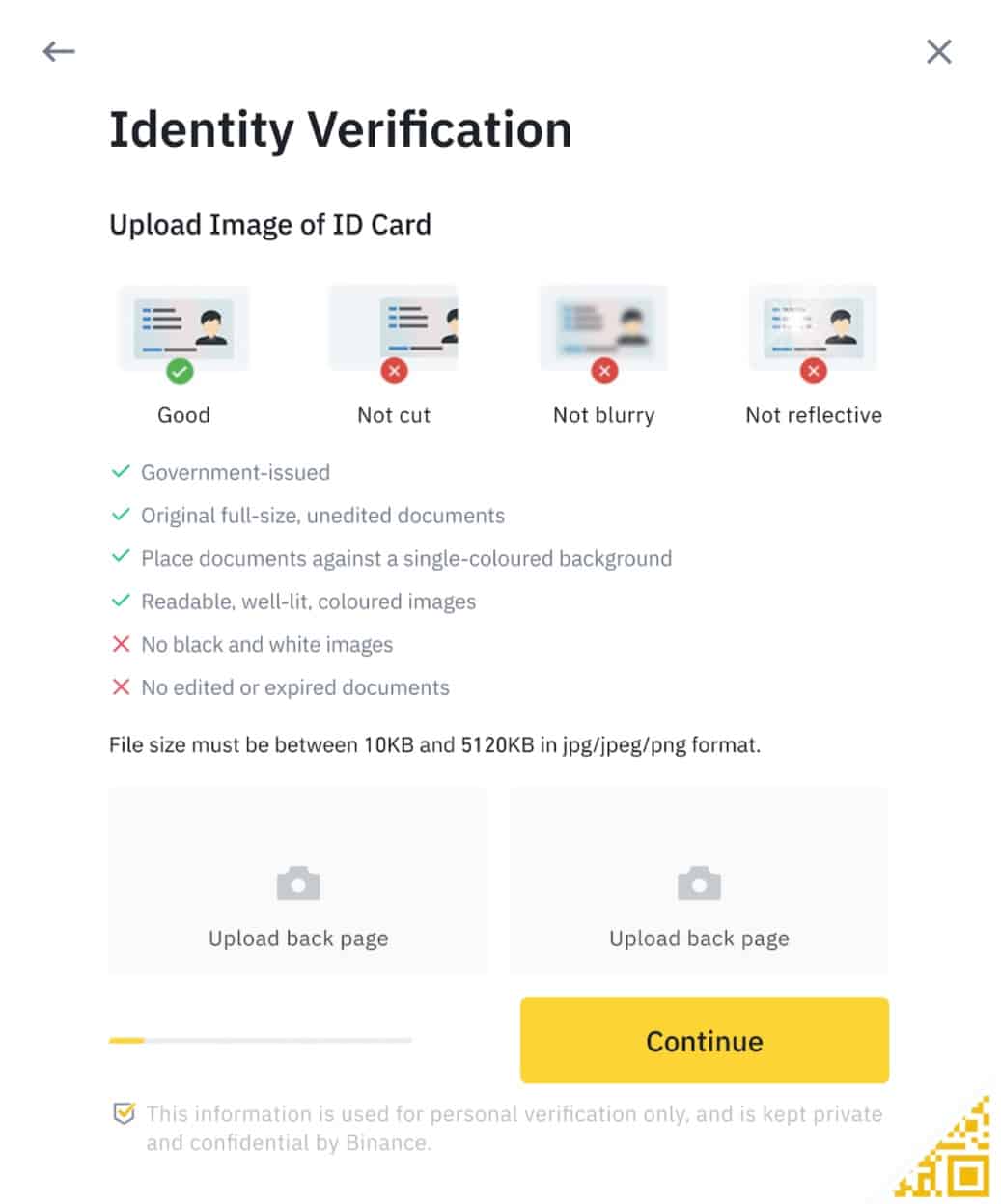

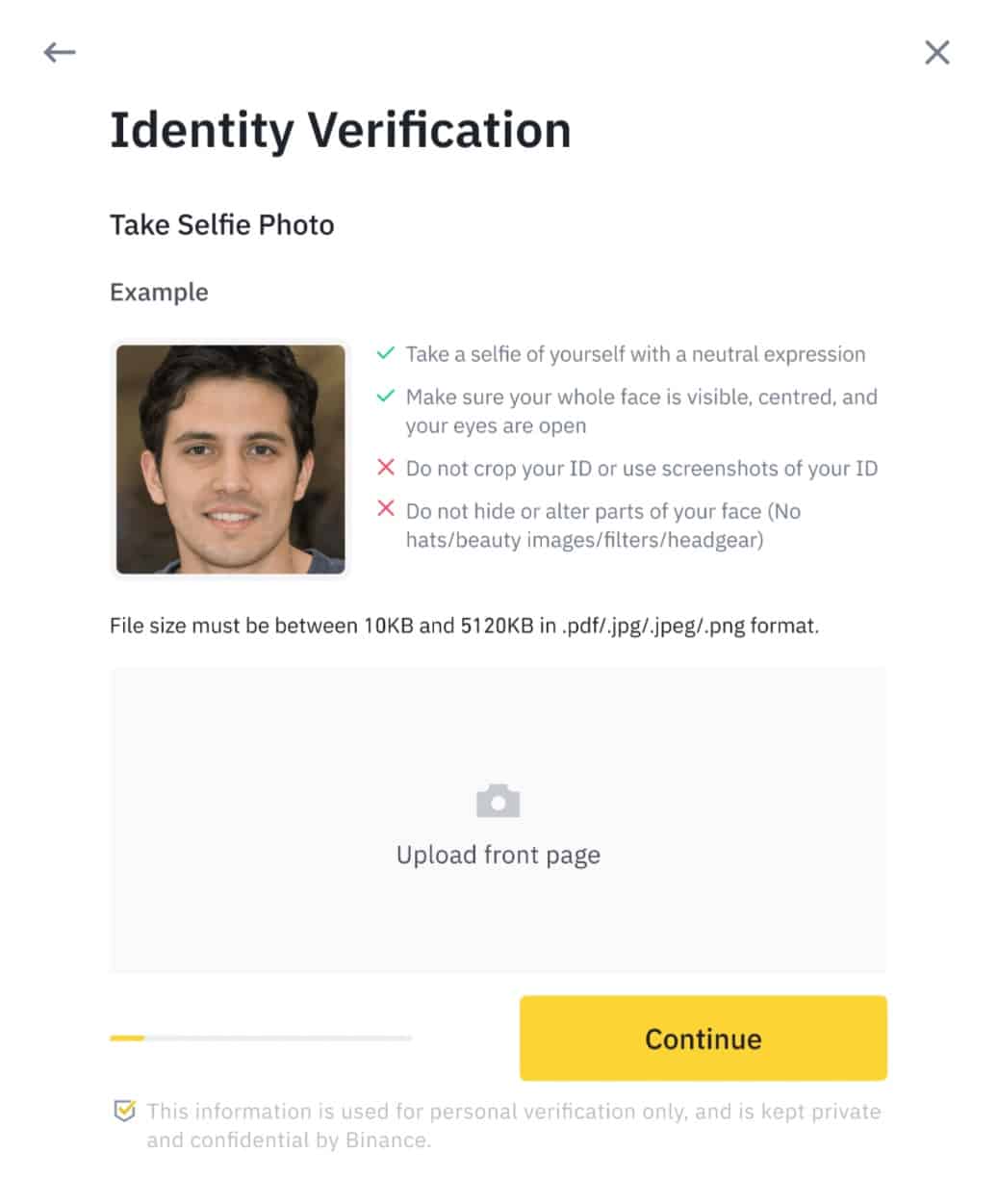

How to complete KYC (ID Verification) on Binance

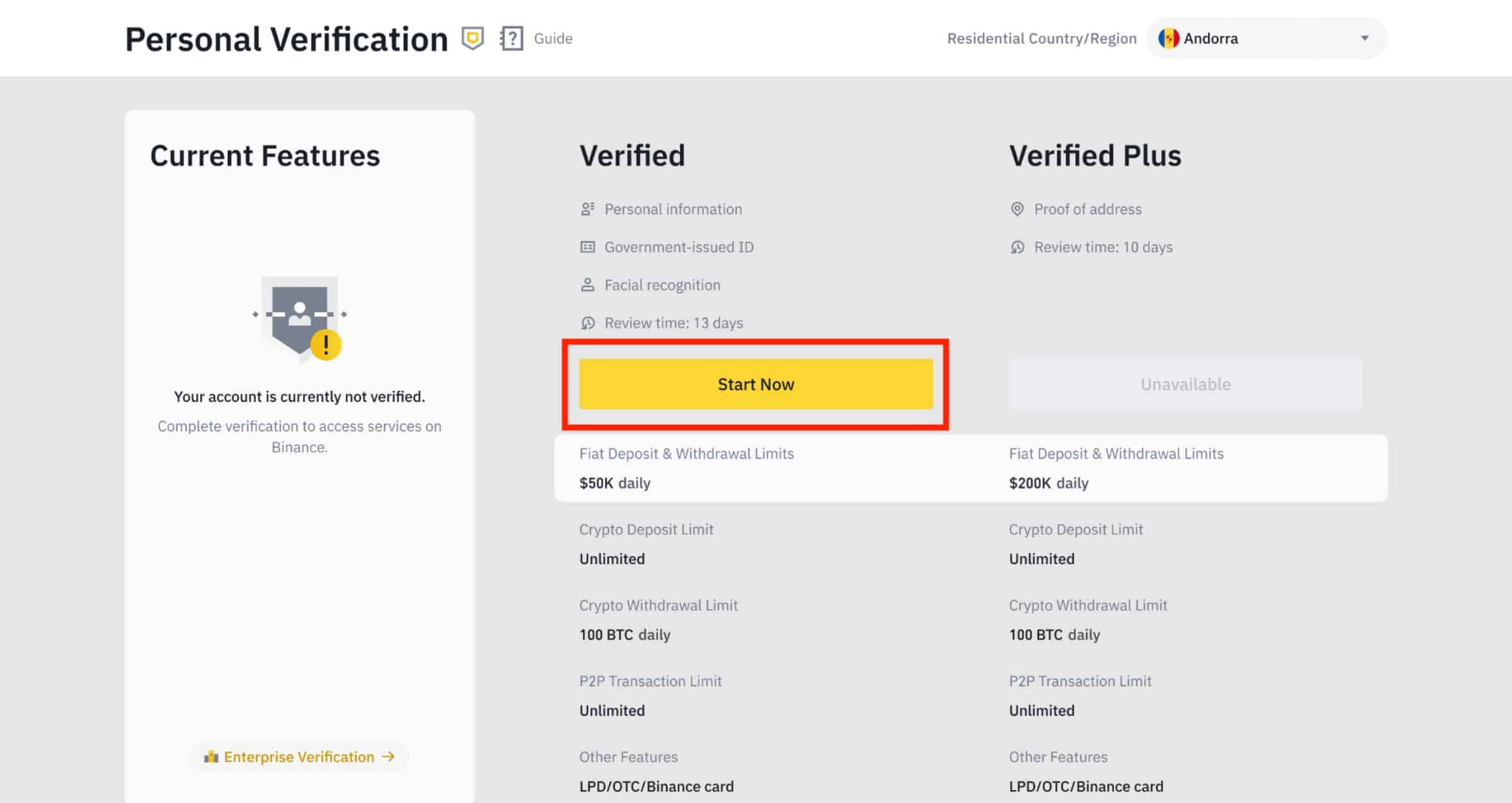

Step 1: Log in to your Binance account and click “User Center” and then “Identification”.

Step 2: click “Start Now” to verify your account.

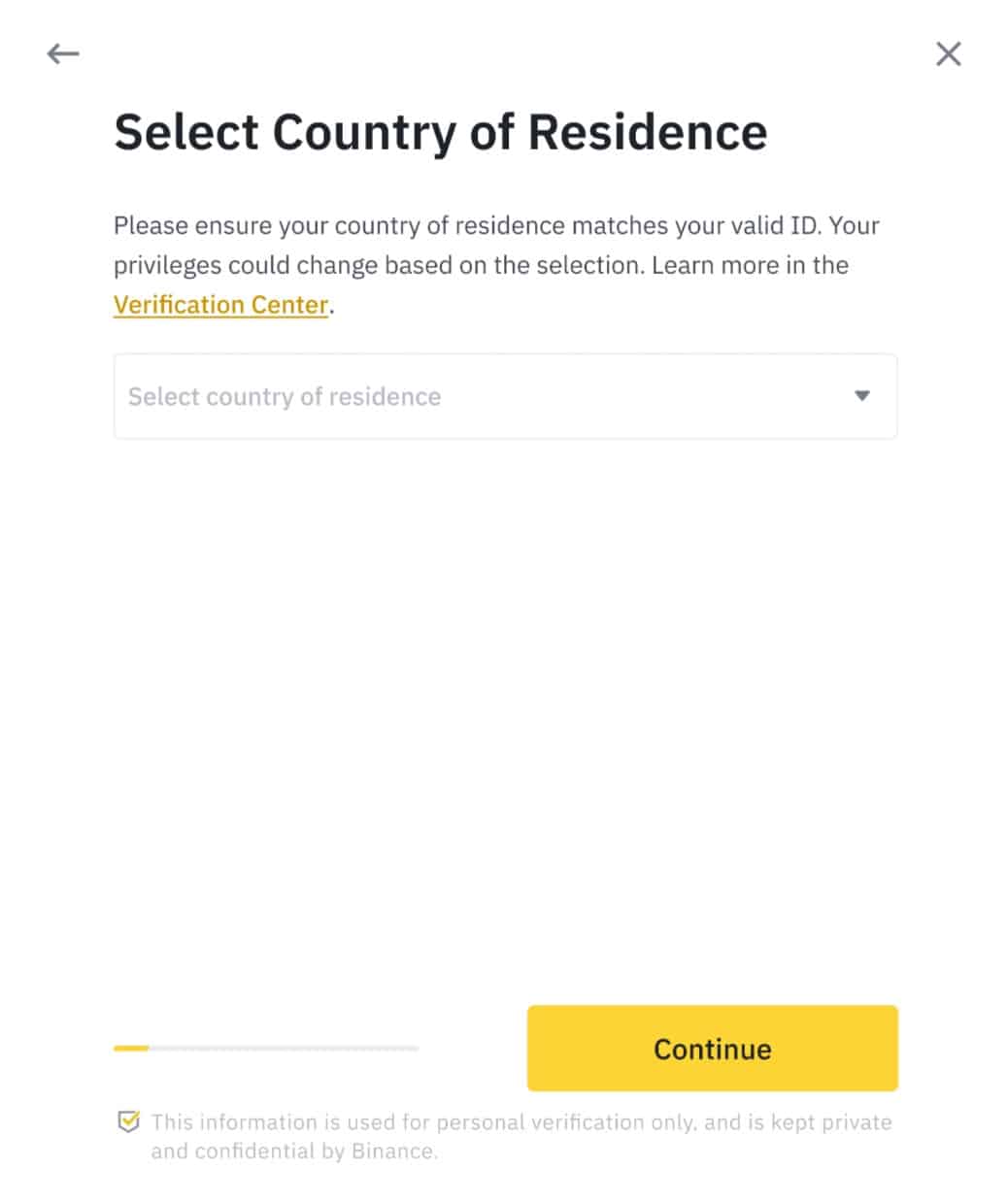

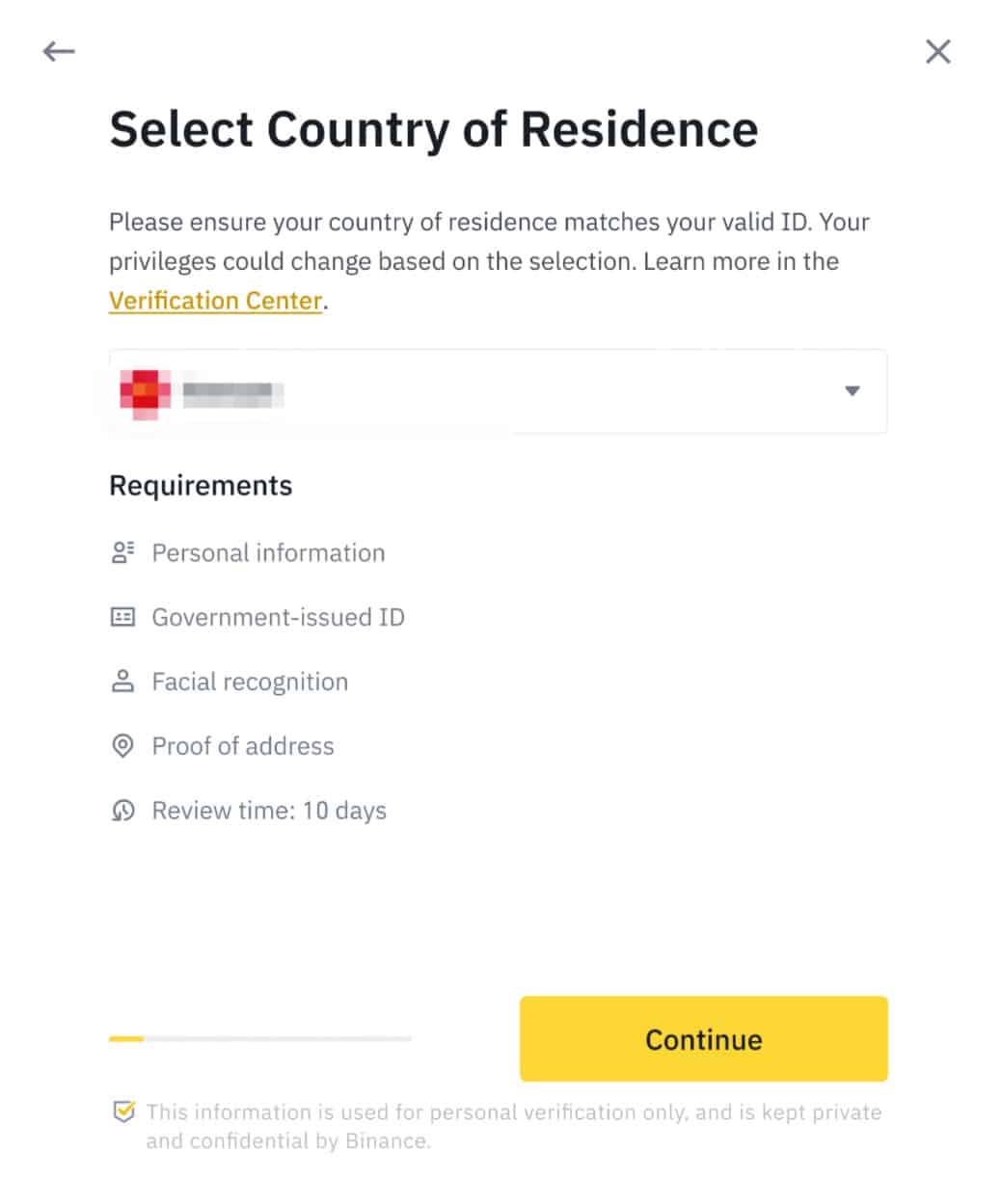

Step 3: Select your country of residence.

Ensure that your country of residence is consistent with your ID documents.

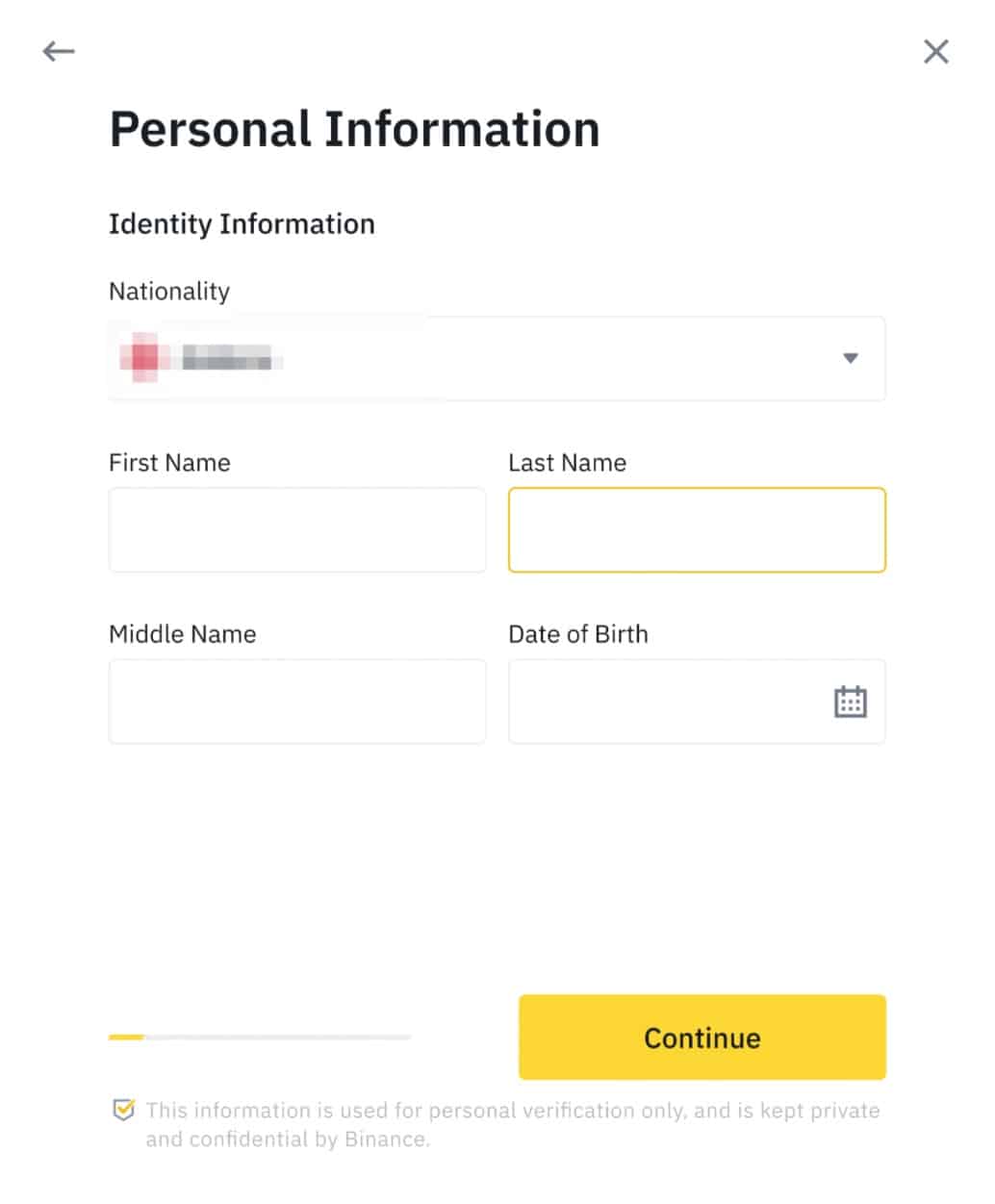

Step 5: Enter your personal information and click “Continue.”

You won’t be able to change it once confirmed.

Refer to the respective options offered for your country.

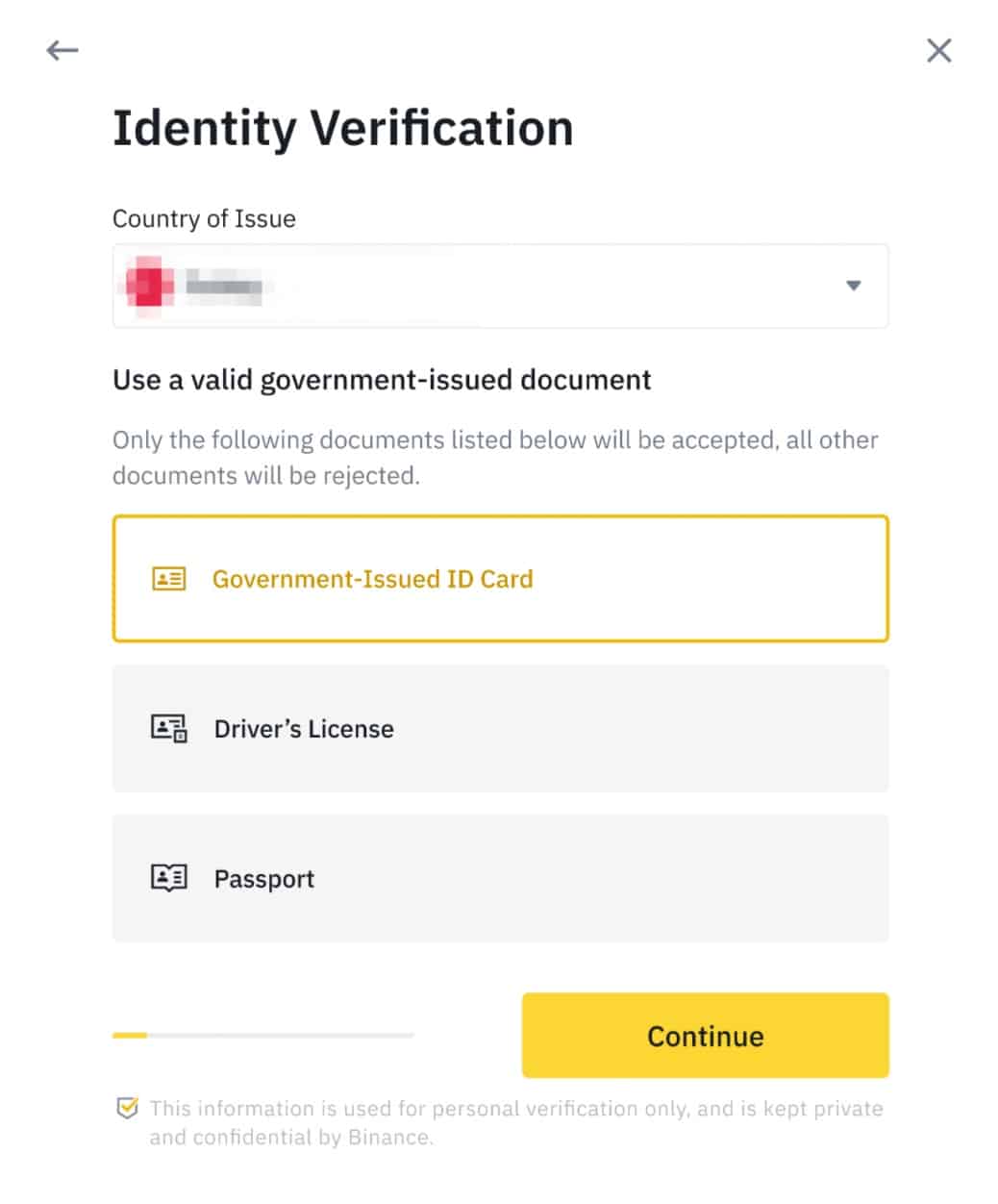

Step 7: Follow the instructions to upload photos of your document. Your photos should clearly show the full ID document.

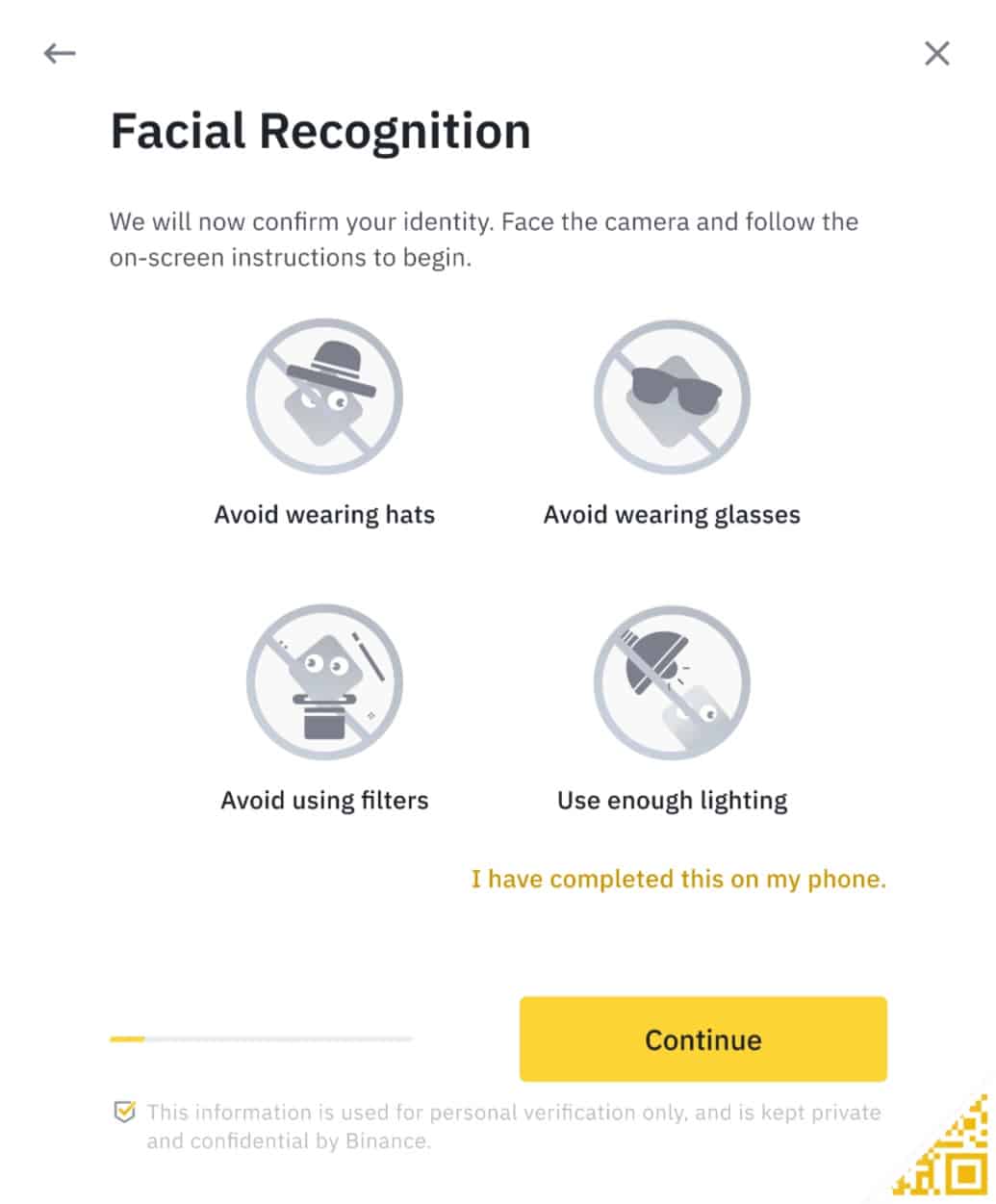

Do not wear hats, glasses, or use filters, and make sure that the lighting is sufficient.

Once your application has been verified, you will receive an email notification.

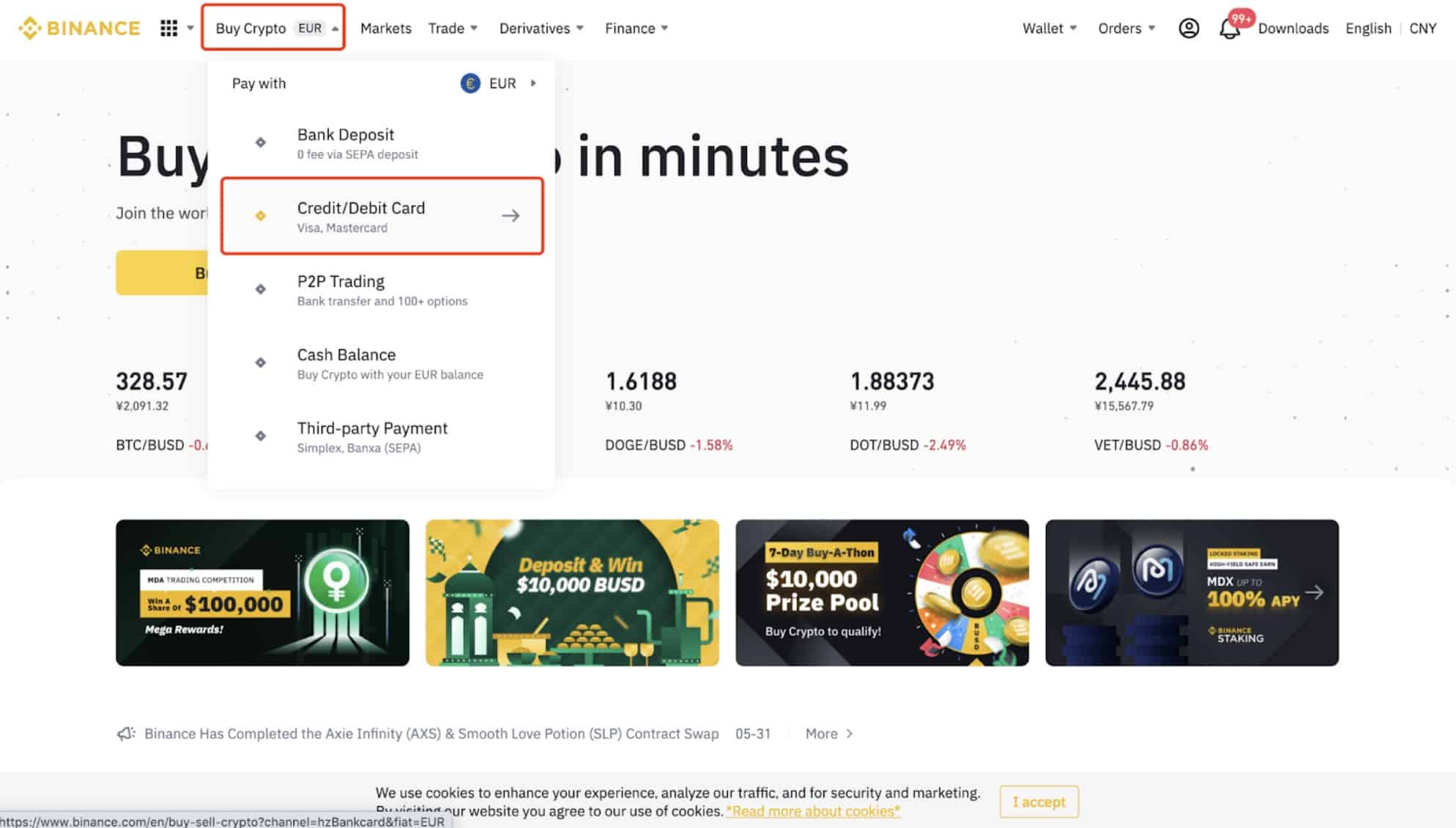

How to buy cryptocurrency on Binance

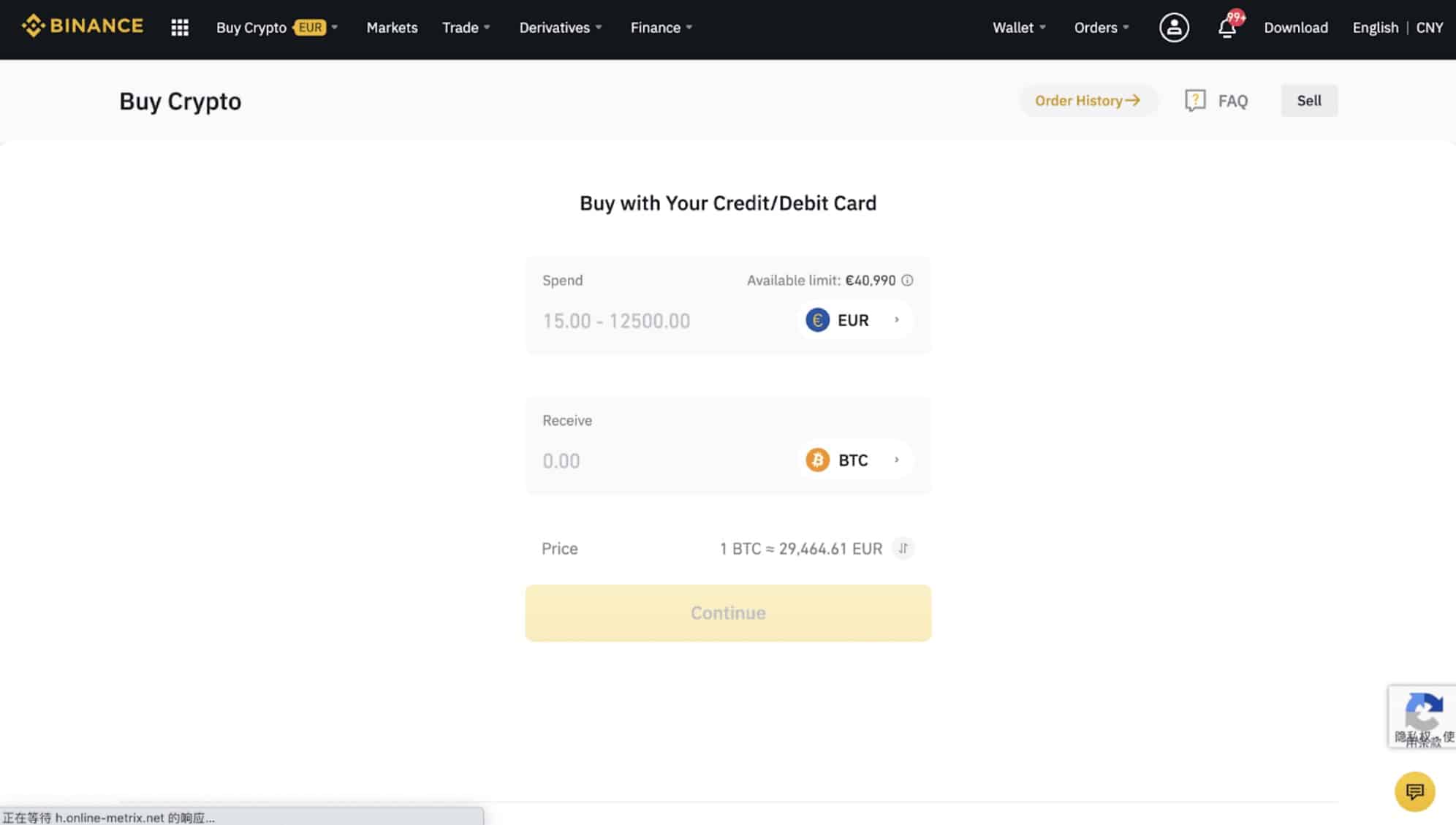

Step 1: Log in to your Binance account and click “Buy Crypto” and then “Credit/Debit Card”.

Step 2: Here you can choose to buy crypto with different fiat currencies. Enter the fiat amount you want to spend and the system will automatically display the amount of crypto you can get. When you have selected the amount you wish to spend then press “Continue”.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

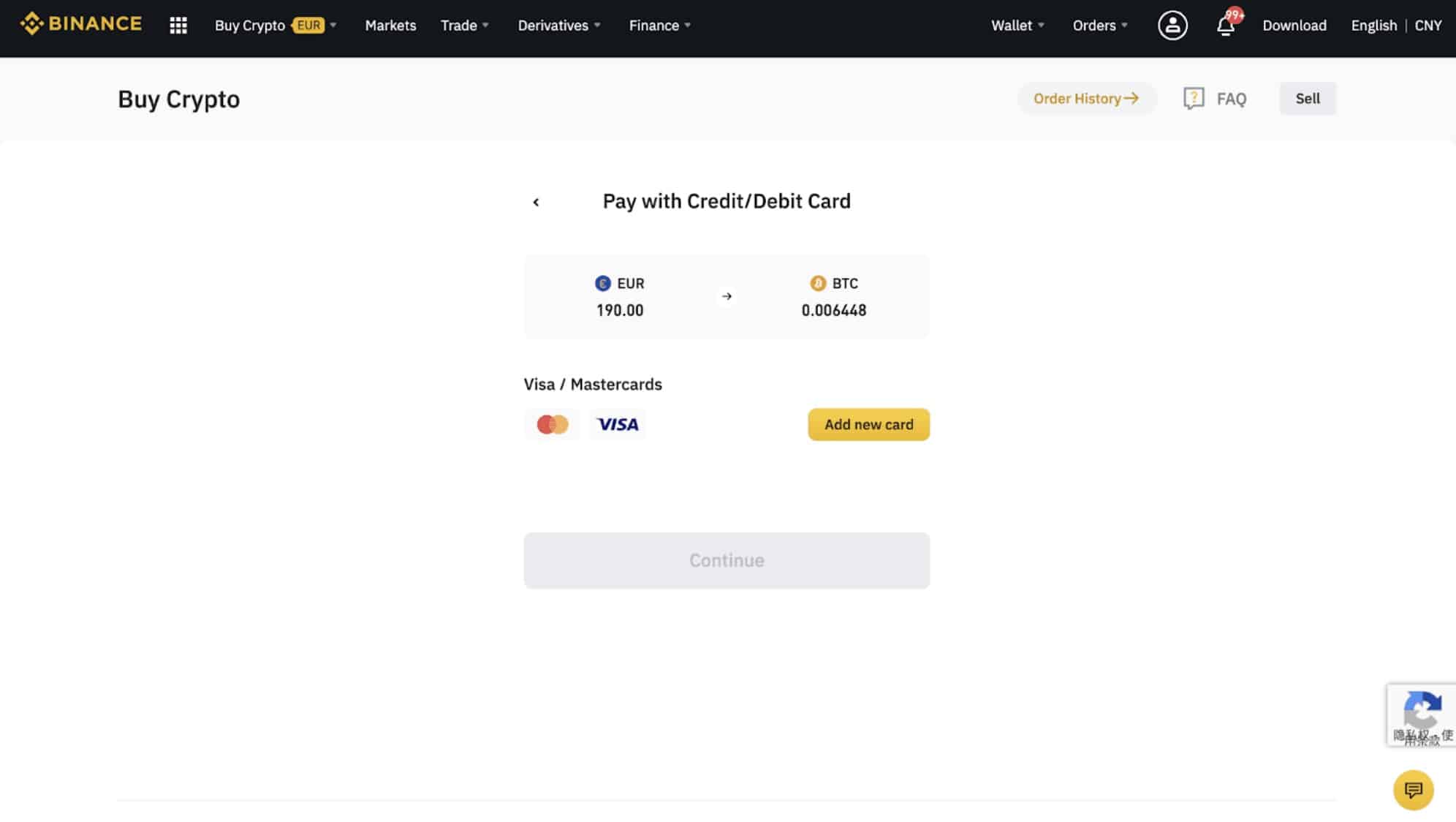

Step 3: Click “Add New Card”. Then enter your credit card details and your billing address.

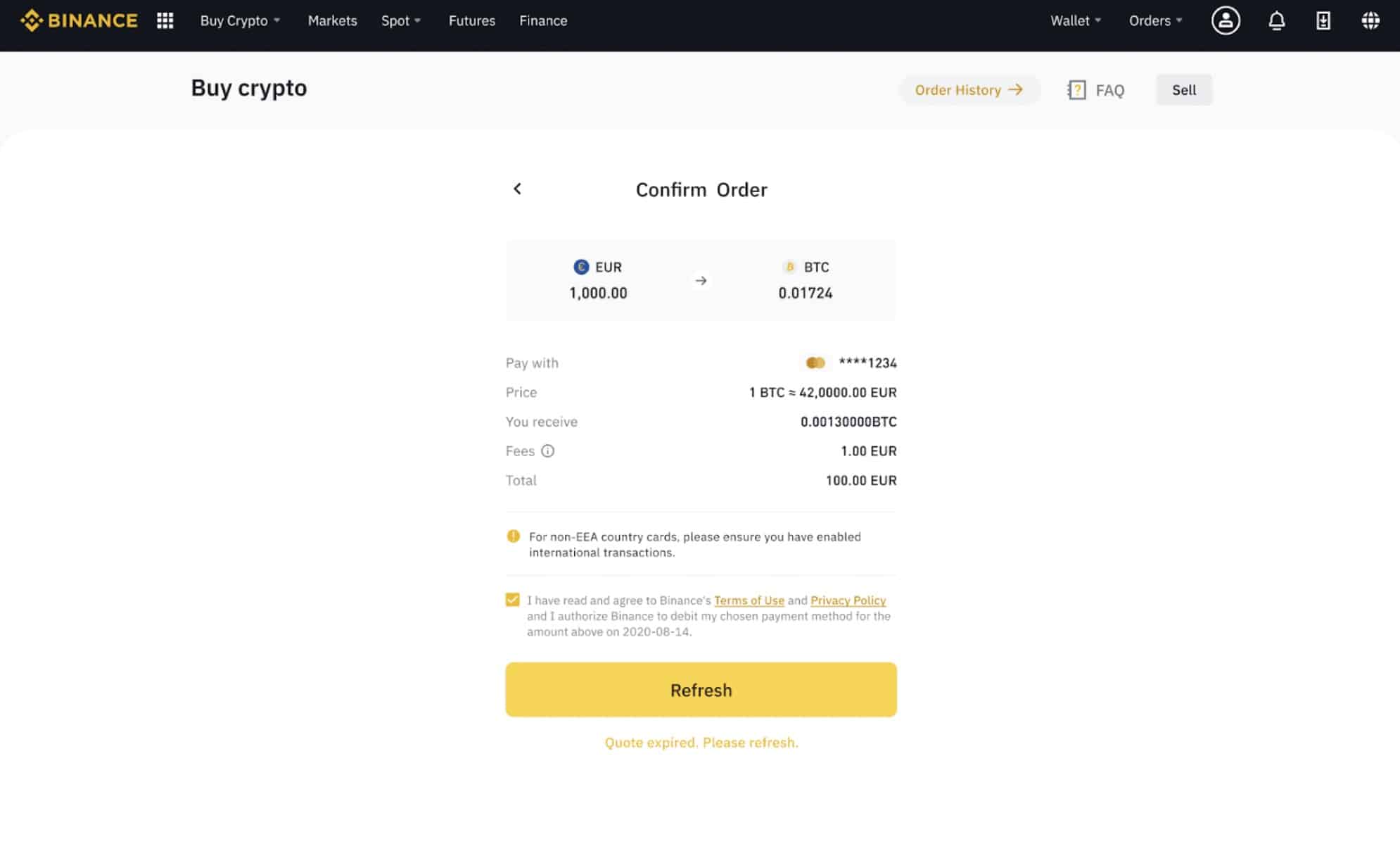

Step 4: Check the payment details and confirm your order within 1 minute. After 1 minute, the price and the amount of crypto you will get will be recalculated. You can click “Refresh” to see the latest market price. You will then be redirected to your bank’s OTP Transaction Page. Follow the on-screen instructions to verify the payment.

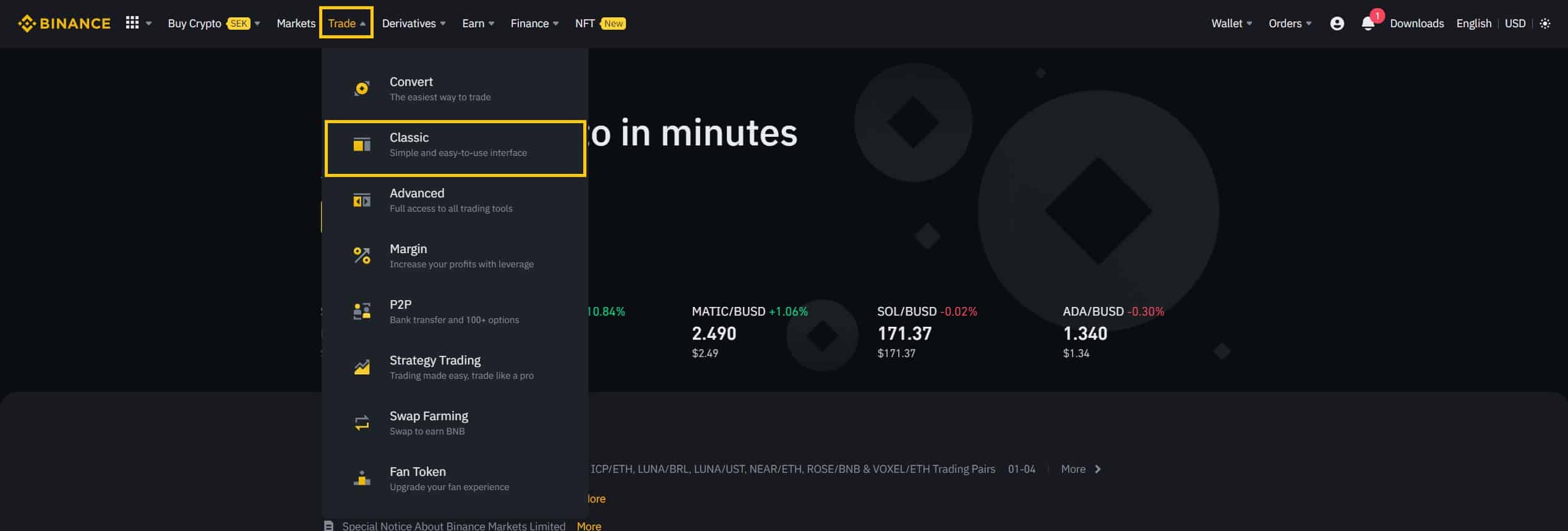

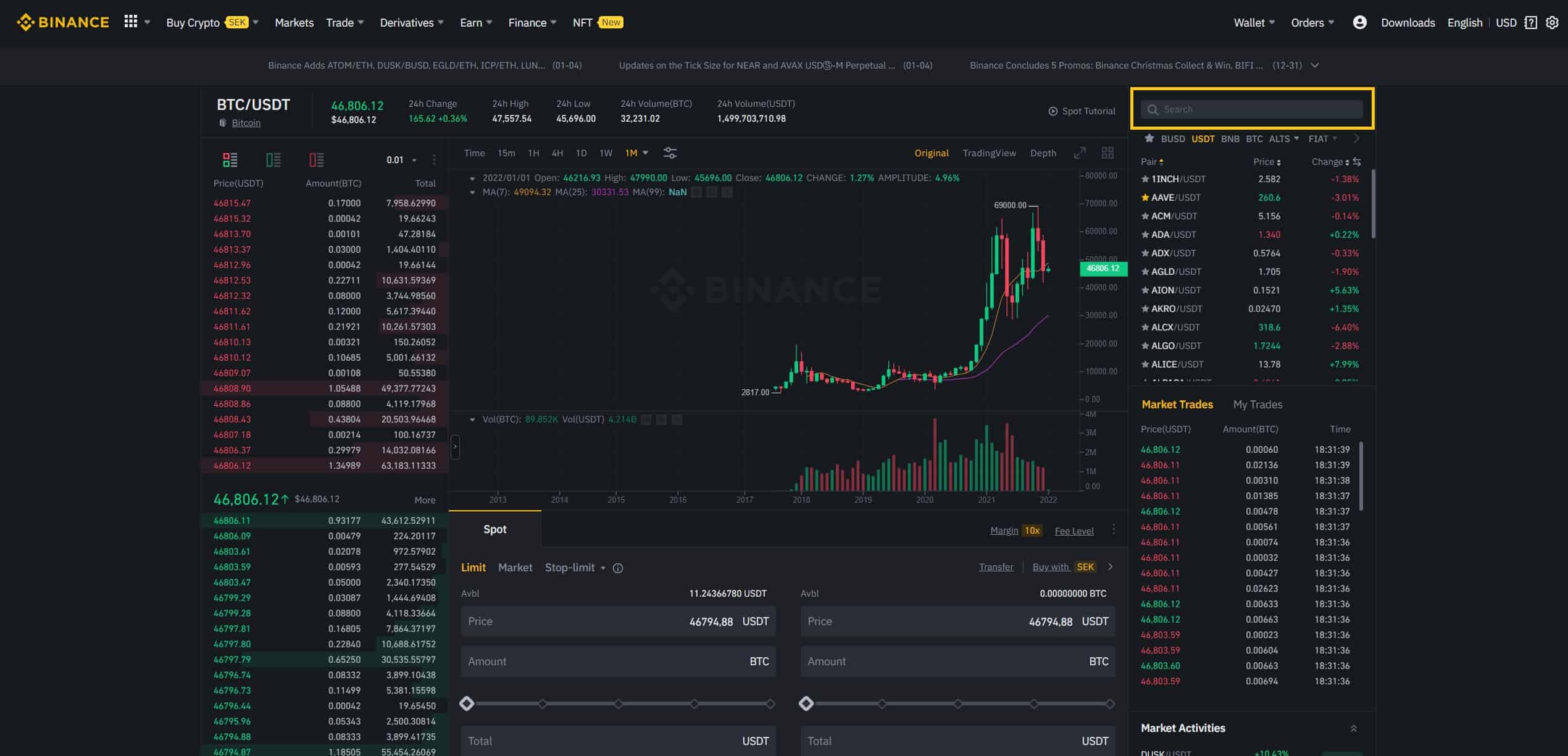

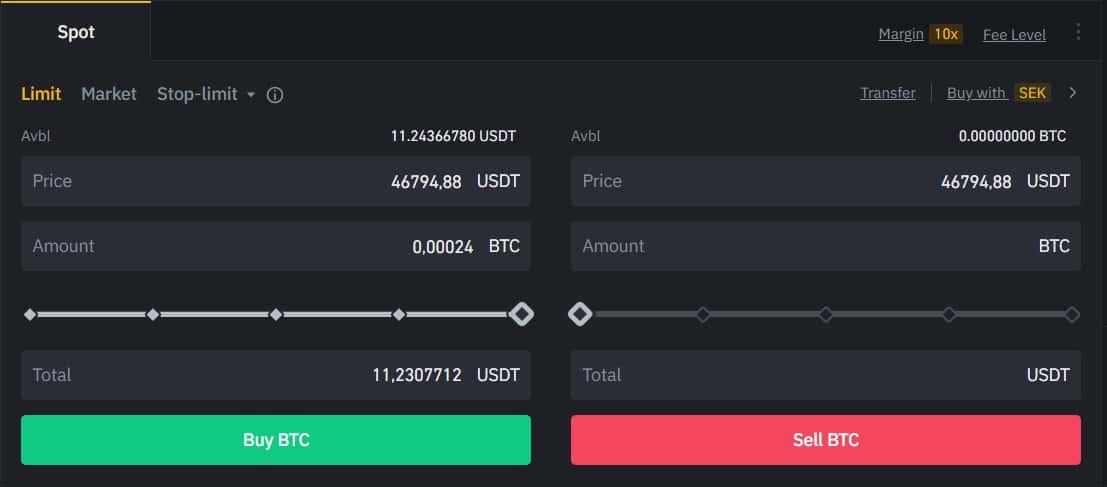

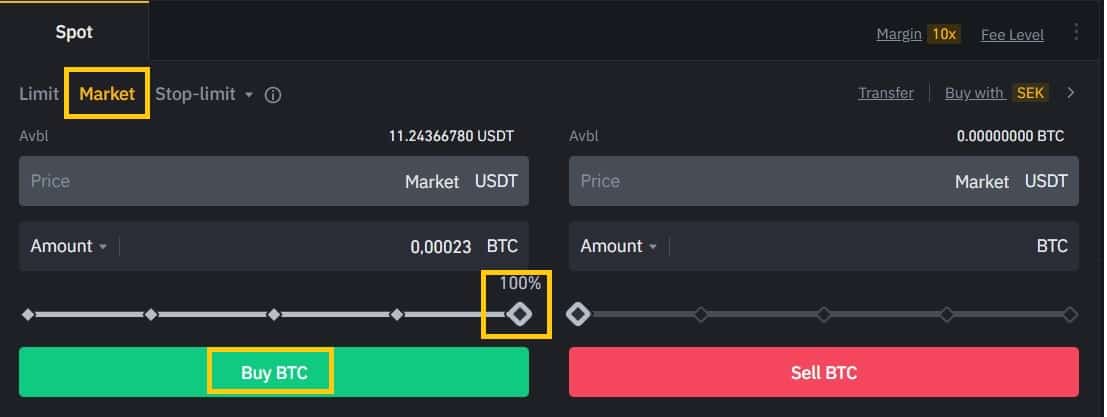

How to Conduct Spot Trading on Binance

Step 1: Log in to your Binance account.

Click on “Classic” under “Trade” on the top navigation bar.

Step 2: Search and enter the cryptocurrency you want to trade.

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can place a “Market Order” to set the buying/selling price automatically.

Hide Detailed Instructions

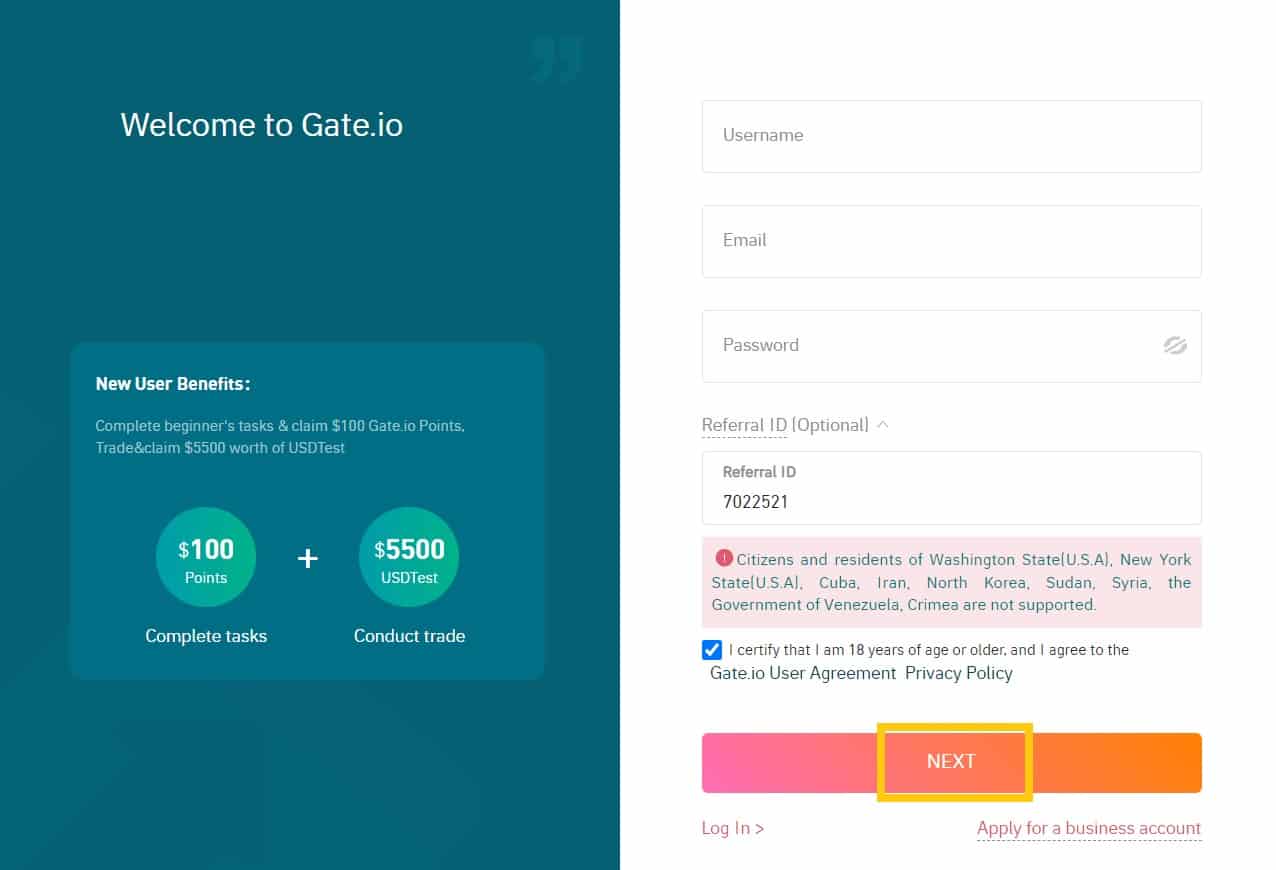

How to create a Gate.io account

![]()

Show Detailed Instructions

Hide Detailed Instructions

Step 1: Go to the Gate.io website.

Step 2: Choose your username, your email address and your password. Then check “I certify that I am 18 years of age or older, and I agree to the Gate.io User Agreement Privacy Policy” and click “NEXT”.

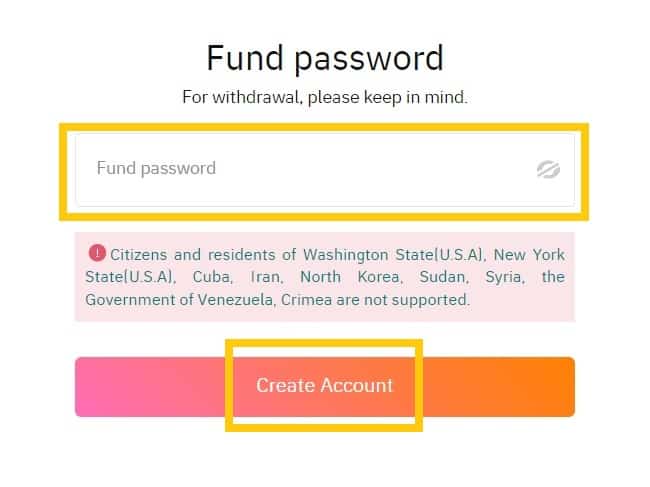

Step 3: Set your fund password and click “Create account”.

Note: Your fund password must contain at least 6 characters and can not be the same as your login password.

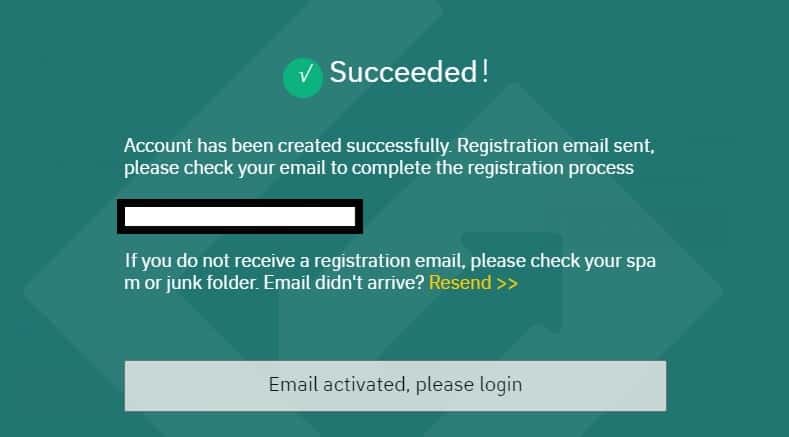

Step 4: An activation email will be sent to your email address. Complete the rest of the registration process by following the instructions in the email to activate your account. Once this is done done, click “Email activated, please log in”.

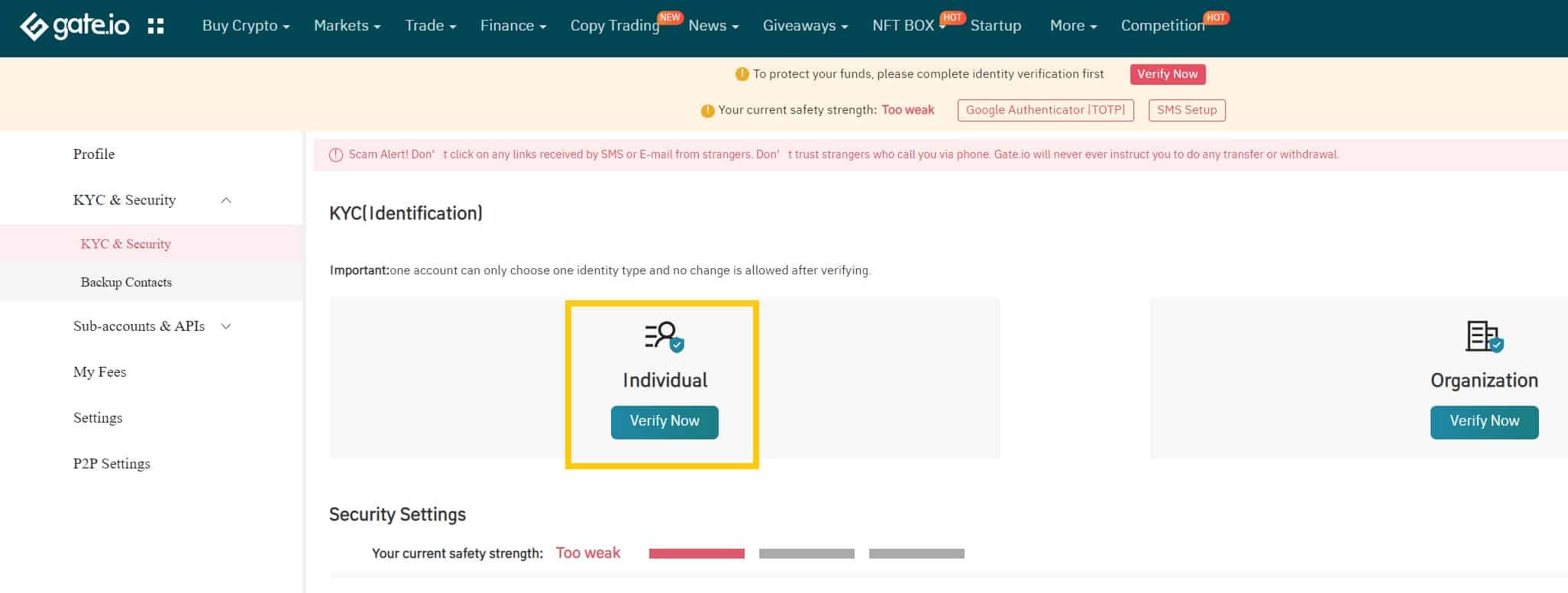

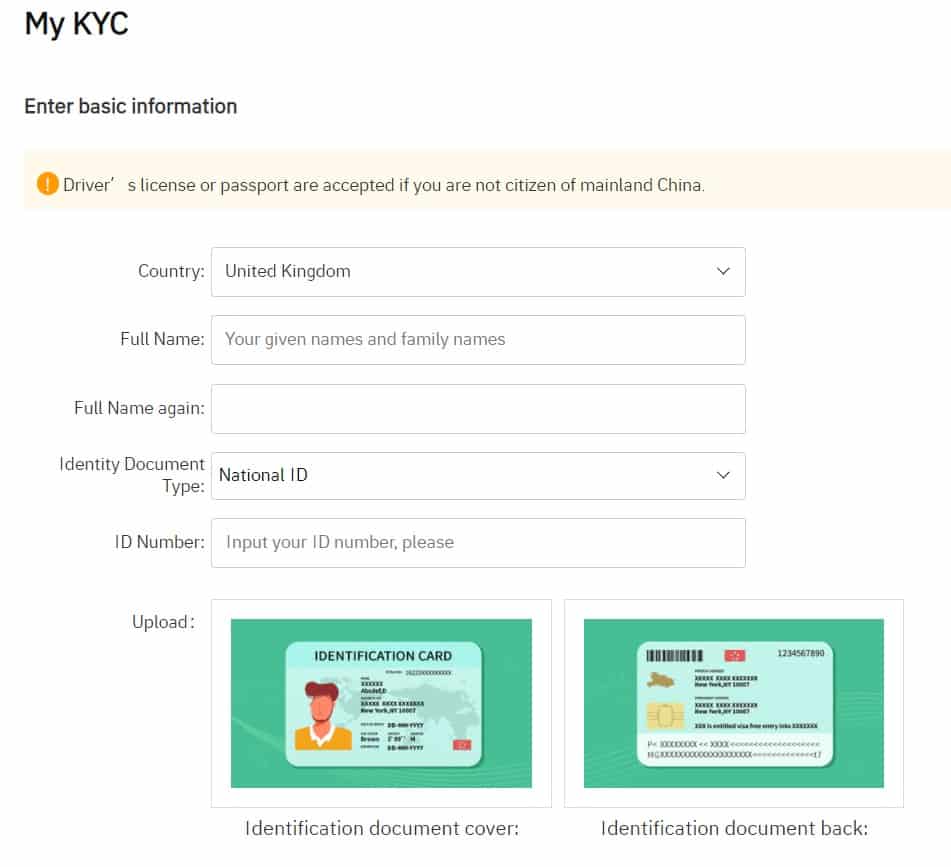

How to complete KYC (ID Verification) on Gate.io

In order to ensure the safety of your assets, and to reduce fraud, money laundering, blackmail, and other illegal activities, Gate.io makes it mandatory that all users obtain KYC ID Verification. Only after your account has obtained KYC ID verification, can you withdraw funds or use credit cards or debit cards to buy cryptocurrencies.

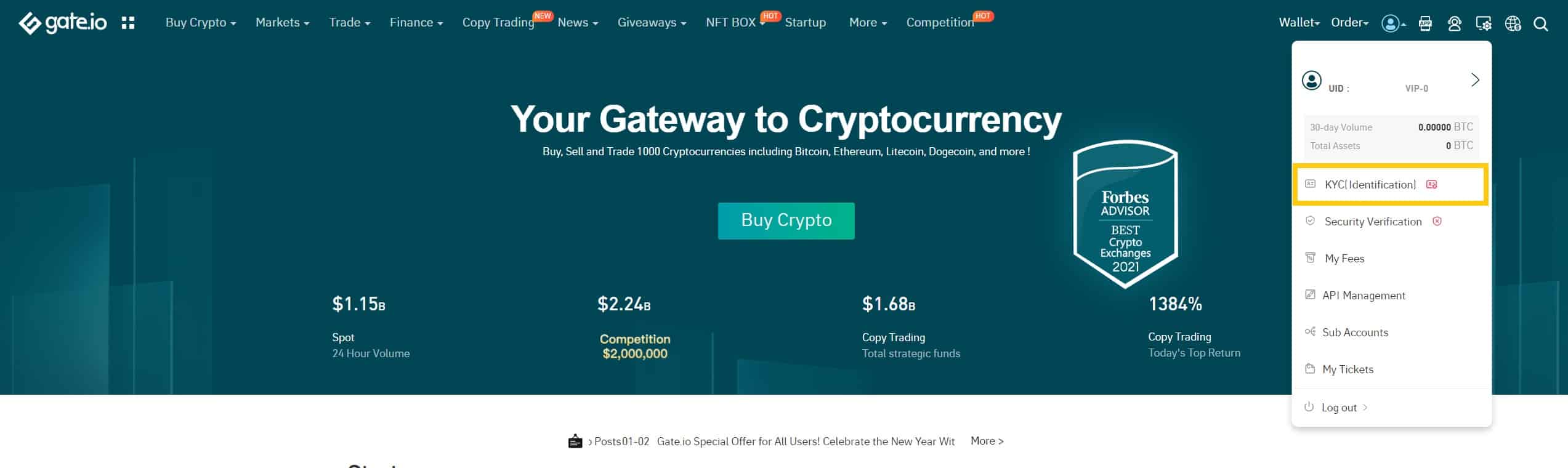

Step 1: Log in to your Gate.io account.

Place your cursor on the top-right profile icon and go to “KYC (ID Verification)”

Step 2: Click “Individual (Verify now)”

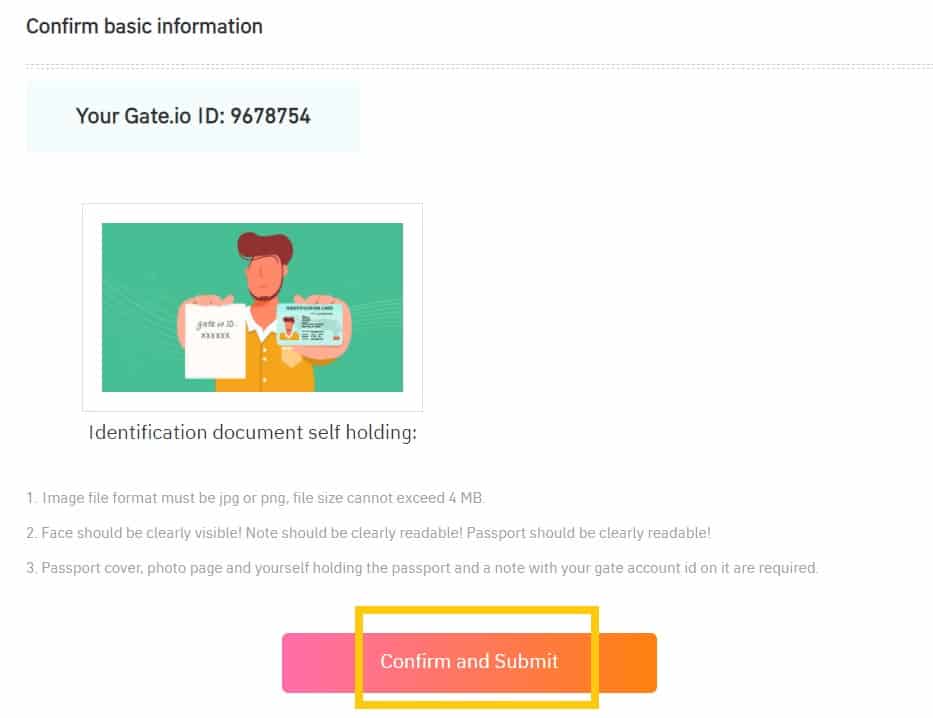

Step 3: Select your country, input your full legal name (twice), fill in your ID information, upload photos of both sides of your ID card, and a photo of you holding your ID together with your User ID (UID) for Gate.io. You will see your User ID by placing the cursor on the top-right profile icon on the main page. Make sure everything is filled in correctly and then click on “Confirm and Submit”.

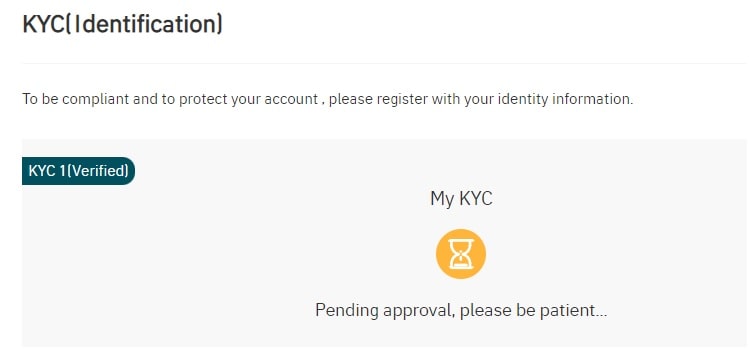

Step 4: After you have submitted all the requested information, you will see the pending approval.

Approval can take anywhere from a few hours to a few days to complete.

Once the KYC is approved, you’re ready to make your first cryptocurrency purchase.

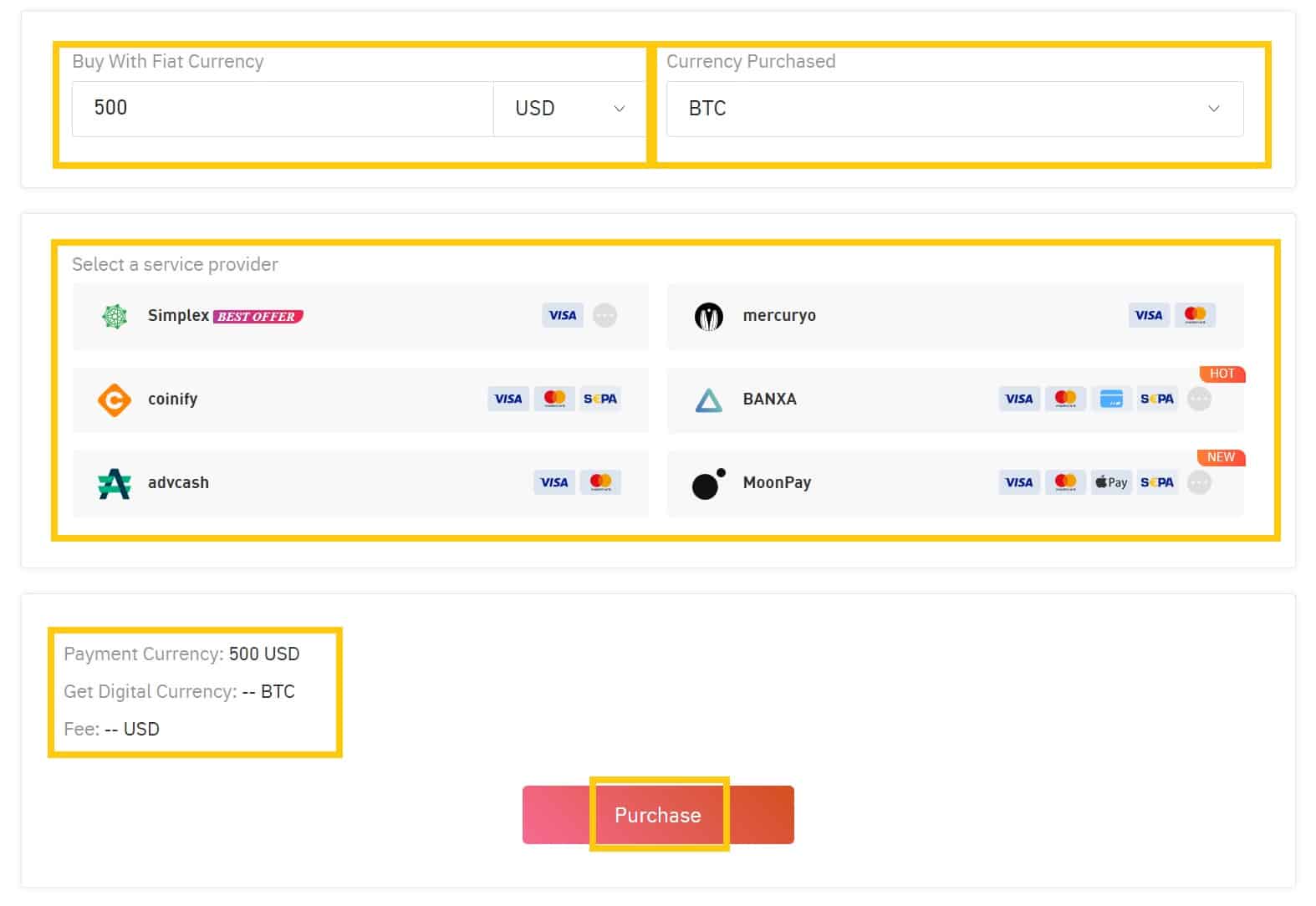

How to buy cryptocurrency on Gate.io

Step 1: Log in to your Gate.io account.

Then in the Menu Bar at the top of the page, click “Buy Crypto” and select “Credit Card”.

Step 2: Enter the amount you wish to spend in the “Buy with Fiat Currency” tab and select the cryptocurrency that you want to buy under the “Currency Purchased” field. Then select one of the “Service Providers” below and click the “Place Order” button to enter the confirmation page.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

Step 3: On the confirmation page, select “Buy Crypto” or the “Create Order” button to complete the payment.

Note: To ensure a quick and secure way of receiving the order, users might need to conduct an additional Identity Verification (KYC) with a third-party service provider. Once successfully verified, the service provider will immediately transfer the cryptocurrencies to your Gate.io account.

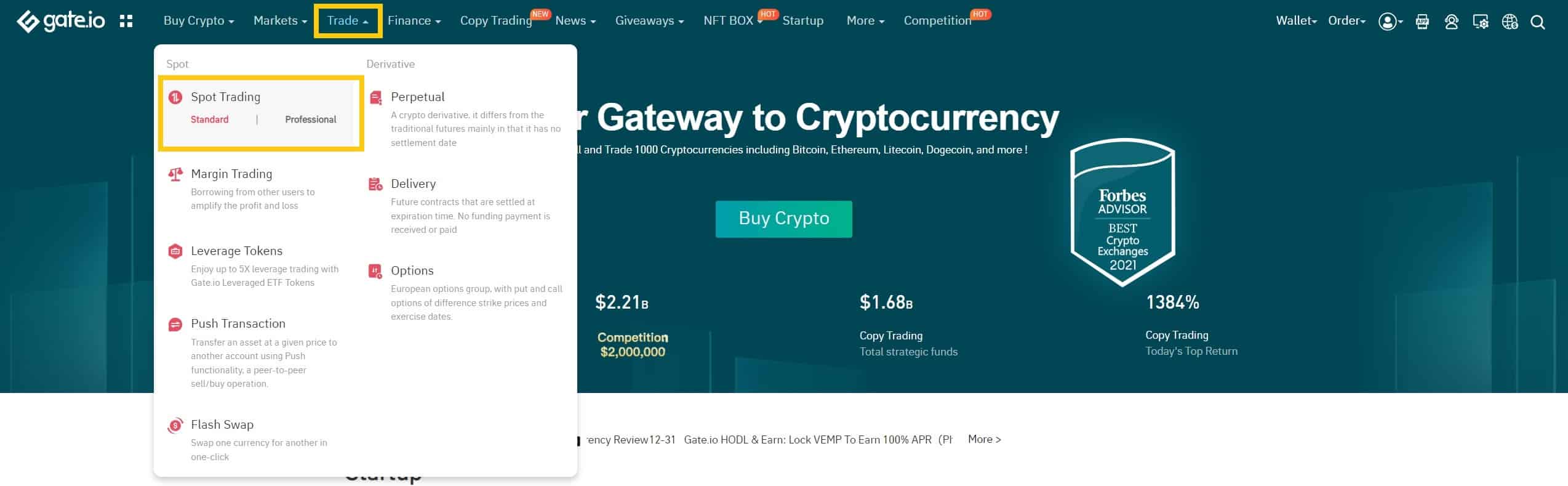

How to Conduct Spot Trading on Gate.io

Step 1: Log in to your Gate.io account.

Click on “Spot Trading” under “Trade” on the top navigation bar.

You can either choose “standard” or “professional” version. This tutorial uses the standard version.

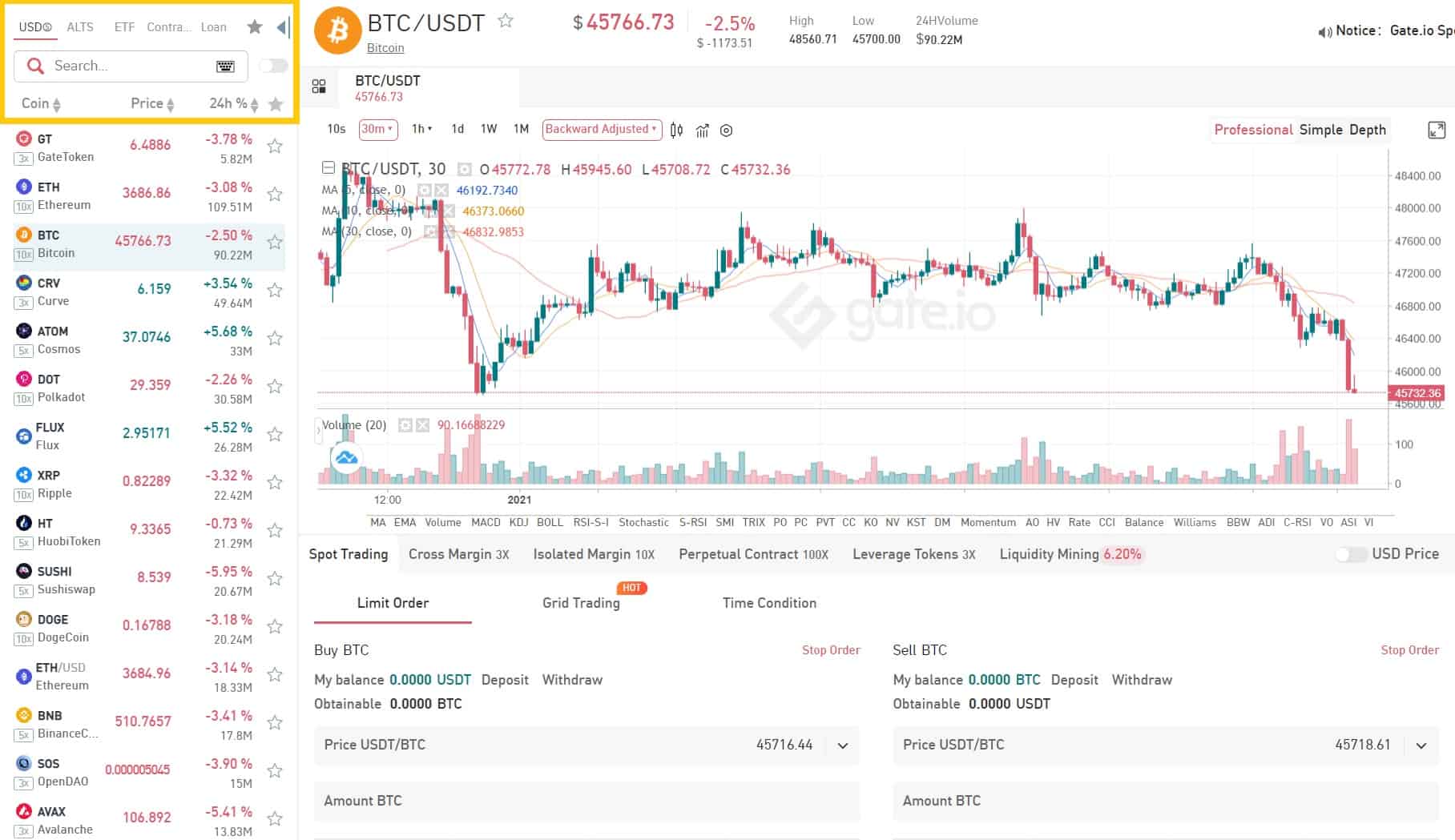

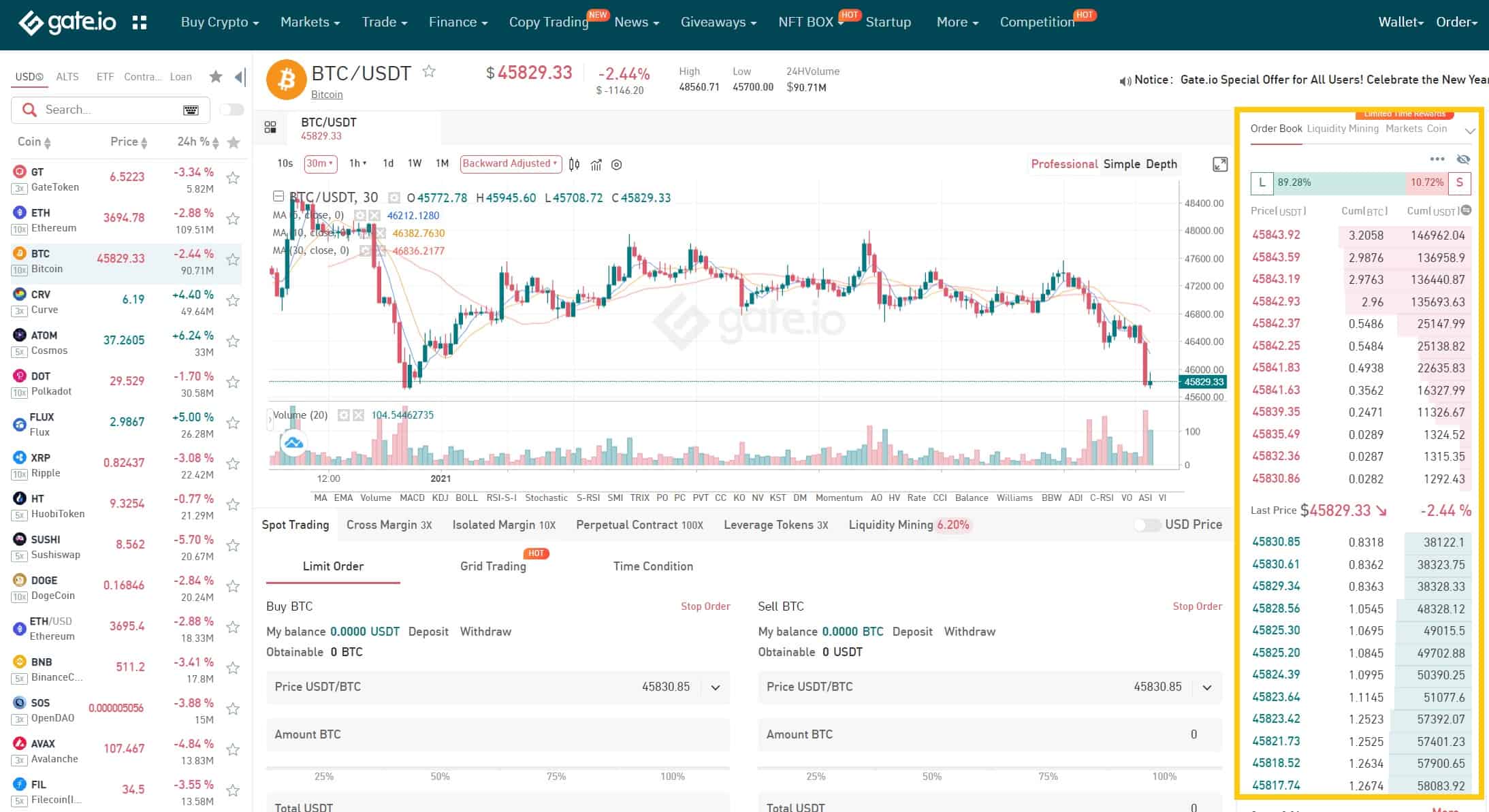

Step 2: Search and enter the cryptocurrency you want to trade.

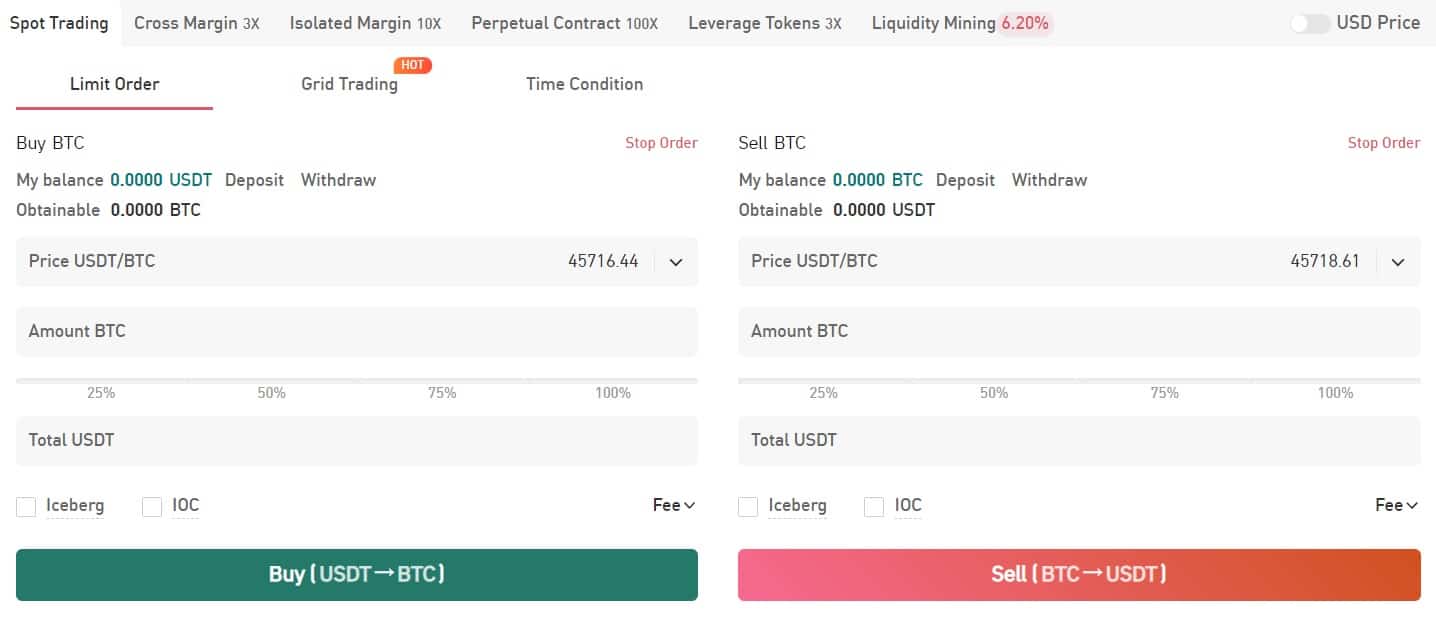

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can click on the last prices on the order book to set the buying/selling price automatically.

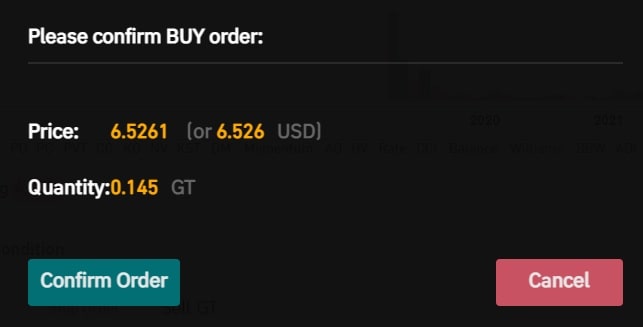

Step 5: Confirm the price and amount. Then click on “Place Order” to place the order, followed by “Confirm Order” to confirm it.

Hide Detailed Instructions

For more in-depth instructions, our ‘Absolute Beginner’s Guide To Cryptocurrency Investing‘ will take you through the process step-by step. In addition to providing instructions for sending and receiving your cryptocurrency.

And if you’re completely new to crypto our beginner, intermediate and advanced level articles will get you up to speed with everything you need to know about the cryptocurrency space starting out.

Simplecryptoguide.com

What Is Acala (ACA)?

Acala Network is a foundational player for decentralized finance (DeFi) in the Polkadot ecosystem. The protocol offers various DeFi products and services — including lending, borrowing, and staking — that provide Polkadot’s user experience, minimized gas fees, and overall scalability features. These financial applications make use of two main protocols: Homa and Honzon. Homa is a tokenized staking liquidity protocol, and Honzon is a cross-chain stablecoin protocol. Acala has also designed its own automated market maker (AMM) decentralized exchange (DEX) and decentralized governance structure that relies on a native governance and utility asset, ACA token.

What is Polkadot?

Polkadot is a blockchain network that allows not just tokens but also arbitrary information to be transferred across it. Unlike Ethereum, which only allows DApps to create tokens within the bounds set by the parent chain, Polkadot allows developers to create their own parallel blockchains or “parachains.”

While they might seem like sidechains to the uninformed, parachains are much more advanced. Instead of creating a new set of validators and nodes for each new parachain, Polkadot’s relay chain maintains the entire network’s security. This lets developers focus directly on development without needing to worry about incentivizing users and validators to secure each new parachain.

Polkadot users can currently stake DOT tokens for all kinds of rewards. While staked validators receive incentives for approving transactions, “nominators” can select up to 16 validator candidates to trust their stake with and receive rewards in the process.

To launch on Polkadot, a parachain team must gain a “slot” in the network. Currently, Polkadot has a limit of approximately 100 parachain slots. Each parachain can define its own parameters for attributes like block times, transaction fees and even mining rewards. Parachains are customized blockchains that are optimized for specific use cases such as DeFi, identity or gaming.

The amount paid to lease a parachain varies based on the auction and requires teams to lock the amount away in DOT tokens. These tokens cannot be staked and are returned to the team on the lease’s expiry. Further, teams can crowdfund the DOT needed to start the chain, significantly lowering the initial capital required to create practically useful blockchain applications. The DOT gained in a crowdloan is similarly locked in the Polkadot Relay Chain and never touched by the parachain team. The funds are returned to contributors at the end of the lease term (estimated at a maximum two years for Polkadot).

How does Acala work?

Acala defines itself as a high-performance decentralized finance platform built as a Polkadot parachain. Founded by members of two Polkadot ecosystem teams, Laminar and Polkawallet, Acala brings a slew of decentralized financial services to Polkadot, including a decentralized exchange (DEX), staking liquidity (Liquid DOT (LDOT)) and even an algorithmic stablecoin, aUSD. Acala is both a parachain platform on which other teams can build, as well as an application layer providing a suite of applications offering the aforementioned financial products.

Current DeFi applications face many problems concerning adoption from a mainstream audience, and much of these issues stem from the platform they’re built on. Unlike Ethereum, which requires gas fees to be denominated in ETH, Acala allows any blockchain platform to participate and pay for computation in any currency in what the team calls “Bring Your Own Gas.”

Along with its micro-gas fees system, Acala is slowly but surely solving the gas fee inflation and network congestion problems faced by decentralized applications built on Ethereum. Additionally, since the platform used to design Polkadot, Substrate, is capable of parsing any language that compiles to WebAssembly, it’s much easier for developers to try their hand at creating an app.

Ethereum may be the most popular DeFi platform right now, but not all developers are willing to learn Solidity, and Acala’s open approach to development could be crucial in the long run. Further, its engineering team has also deployed a custom-built Acala EVM, a novel contribution to the Polkadot ecosystem that gives a seamless, full-stack experience for Solidity, Substrate and Web3 developers. This way, developers on Acala get the benefit of the EVM environment, without sacrificing the power of Substrate.

The Acala EVM also brings protocol composability between EVM and Substrate runtime environments, giving Acala developers outstanding tooling support. Smart contracts deployed within the Acala EVM can directly access both native and cross-chain assets like DOT, aUSD, PolkaBTC and XBTC, but even ERC-20 tokens can be made available at the runtime level. These can be listed on the DEX or used as gas fee tokens through governance approval. Composability is vital to a sustainable development environment because it allows developers to use existing resources as building blocks to create higher-order DApps.

The blockchain’s trustless, permissionless and stateful nature allows computers to truly unlock the power of composability, enabling developers to build on top of shared infrastructure without worrying about dependencies and other development resources being taken away. Just like how Ethereum pushed the limits of what blockchain could achieve, Polkadot and Substrate are redefining DLT as a whole and could lead to many new on-chain innovations outside of the Ethereum ecosystem.

Acala runs on a fundamentally different model than Ethereum, which is more inclusive and beneficial to developers and end-users alike. Their goal isn’t to redeploy Ethereum on Polkadot but create an environment conducive to cross-chain innovation and interactions between distributed applications on top of interoperable blockchains.

What is the ACA token?

The native ACA token has two primary functions within the Acala network. Firstly, ACA serves as a utility token across the Acala platform. ACA is used for transaction fees and smart contract-based applications that operate across the Acala ecosystem. Furthermore, the ACA token is used in staking and other fundamental network activities.

Secondly, the Acala token (ACA) is used for the governance of the Acala network. Holders of the ACA token are granted voting rights. This allows token holders to vote on proposals regarding Acala Treasury governance, the election of council members, risk management, and upgrades to the network. Moreover, Acala token holders can vote on adjustments to key risk parameters of the Acala network and the decentralized applications (dApps) that make up the Acala ecosystem. These parameters include collateral type proposals, stability fees, and liquidation ratios.

What is the Acala Dollar (aUSD)?

The Acala Dollar (aUSD) is a multi-collateralized stablecoin that powers the native Acala decentralized applications (dApps) and decentralized finance (DeFi) experiences. These include lending, borrowing, interest-earning, and synthetic asset trading. The aUSD token is equal to one US dollar. This makes it a useful trading pair and a reliable store of value. Acala network offers multiple ways to leverage returns with aUSD using the Acala Mandala DeFi suite.

Acala development updates in 2023

Acala has seen significant developments in 2023. These updates showcase Acala’s continuous evolution in the DeFi space, emphasizing its commitment to enhancing its infrastructure, security, and overall ecosystem. Here’s a detailed overview of the key updates:

Technological Advancements and Network Updates

DeFi Platform Expansion: Acala continues to strengthen its position as a liquidity hub for Web3 finance, focusing on HyFi (DeFi+CeFi) solutions. It integrates multichain liquid staking token protocols, an AMM decentralized exchange, and an app platform that’s EVM-compatible and highly customizable. This strategic expansion has been instrumental in consolidating Acala’s role in the Polkadot ecosystem, offering a range of financial products and services.

Focus on Cross-Chain Innovation: The platform’s dedication to optimizing DeFi situations and integrating its DEX, stablecoin, and liquid staking protocol positions Acala uniquely in the blockchain space. Its current focus remains on its DeFi applications and compatibility with Ethereum, but it’s also opening the gates to a more open development ecosystem, inviting innovation and interoperability.

EVM and Substrate Runtime Environments: Acala’s deployment of a custom-built EVM is a significant contribution to the Polkadot ecosystem. This environment allows developers to use Solidity, Substrate, and Web3 for a seamless, full-stack experience. It brings protocol composability between EVM and Substrate, enhancing tooling support for Acala developers and broadening the spectrum of potential applications and use-cases.

Significant Changes to the Platform

Liquidity Pool Exploit: In 2022, Acala experienced a significant exploit involving its iBTC/aUSD liquidity pool, leading to the unauthorized minting of $3 billion worth of aUSD stablecoins. This incident highlighted vulnerabilities in decentralized finance platforms and prompted Acala to undertake comprehensive measures to improve its security protocols and address potential risks.

Recovery and Security Measures: Following the exploit, Acala recovered a significant portion of the erroneously minted aUSD and took decisive steps to prevent future incidents. The community played a critical role in the recovery process, voting to burn the remaining minted aUSD. This incident underscored the importance of robust security measures and community involvement in governance decisions.

Price Predictions and Market Performance: Various financial analysts have offered predictions about Acala’s future price, suggesting a potential increase in the coming years. These predictions reflect confidence in the Acala Token (ACA) and its growth prospects. However, as with all cryptocurrencies, the market is volatile, and these predictions should be considered with caution.

These updates mark a significant milestone in Acala’s journey, showcasing its resilience and adaptability in the face of challenges. The continuous development and expansion of its platform, coupled with its innovative approach to DeFi and cross-chain interoperability, position Acala as a noteworthy player in the cryptocurrency landscape. The Acala community and investors alike are keenly watching these developments, anticipating their impact on the platform’s performance and utility.

Official website: https://acala.network/

Best cryptocurrency wallet for Acala (ACA)

There are plenty of different crypto wallets available. The best one for you depends on your general trading habits and which provides the most security in your situation. There are two main types of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical). Both have their pros and cons, and there is not necessarily a right or wrong answer when it comes to figuring out which crypto wallet is best for you.

HOW DO I DECIDE WHICH cryptocurrency WALLET TO USE for Acala (ACA)?

Deciding which type of wallet to use depends on a variety of factors, including:

- How often you trade. In general, hot wallets are better for more active cryptocurrency traders. Quick login ability means you are only a few clicks and taps away from buying and selling crypto. Cold wallets are better suited for those looking to make less frequent trades.

- What you want to trade. As mentioned earlier, not all wallets support all types of cryptocurrencies. However, some of the best crypto wallets have the power to trade hundreds of different currencies, providing more of a one-size-fits-all experience.

- Your peace of mind. For those worried about hacking, having a physical cold wallet stored in a safe deposit box at the bank or somewhere at home, provides the safest, most secure option. Others might be confident in their ability to keep their hot wallets secure.

- How much it costs. It is important to investigate the costs associated with each wallet. Many hot wallets will be free to set up. Meanwhile, cold wallets, like any piece of hardware, will cost money to purchase.

- What it can do. While the basics of each cryptocurrency wallet are the same, additional features can help set them apart. This is especially true of hot wallets, many of which come with advanced reporting features, insights into the crypto market, the ability to convert cryptocurrencies and more. Security features can also be a good differentiator.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re going to be dealing in larger volumes of crypto, investing in cold storage might prove advantageous.

Most widespead examples of this being the Ledger Nano and the Trezor.

Ledger manufactures cold storage wallets designed for users who want increased security. Their wallets are a physical device that connects to your computer. Only when the device is connected can you send your cryptocurrency from it. Ledger offers a variety of products, such as the Ledger Nano S and the Ledger Nano X (a bluetooth connected hardware wallet).

Trezor is a pioneering hardware wallet company. The combination of world-class security with an intuitive interface and compatibility with other desktop wallets, makes it ideal for beginners and experts alike. The company has gained a lot of the Bitcoin community’s respect over the years. Trezor offers two main models – The Trezor One and Trezor Model T (which has a built in touch screen).

Market Overview

Coinmarketcap.com

Coinmarketcap will be your cryptocurrency go-to for just about everything. Here you can see the following: