How To Buy Monero (XMR)?

A common question you often see on social media from crypto beginners is “Where can I buy Monero?” Well, you’ll be happy to hear it is actually quite a simple and straightforward process.

Step 1: Create an account on an exchange that supports Monero (XMR)

First, you will need to open an account on a cryptocurrency exchange that supports Monero (XMR).

We recommend the following based on functionality, reputation, security, support and fees:

1

Binance

Fees (Maker/Taker) 0.075%*-0.1%*

Cryptocurrencies

Available for Trade 500+

Sign-up bonus

10% reduced trading fees*

Available in

Europe, Asia, Oceania, Africa

2

MEXC

Fees (Maker/Taker) 0.2%*-0.2%*

Cryptocurrencies

Available for Trade 1500+

Sign-up bonus

10% reduced trading fees & up to $170 in USDT vouchers*

Available in

North America, South America, Europe, Asia, Oceania, Africa

In order to sign up, you will need to enter some basic information, such as your email address, password, full name and, in some cases, you might also be asked for a phone number or address.

Note: On specific exchanges, you might need to complete a Know Your Customer (KYC) procedure in order to be able to purchase cryptocurrency. This is most commonly the case with licensed and regulated exchanges.

Step 2: Deposit funds into your account

Many cryptocurrency exchanges will allow you to purchase Monero (XMR) with fiat currencies, such as EUR, USD, AUD and others. Furthermore, they will also provide you with multiple deposit methods through which you can fund your fiat account, such as credit and debit cards, ewallets or direct bank transfers.

Note: Some payment methods will have higher fees than others, such as credit card payments. Before funding your fiat account on your chosen exchange, make sure to do your due diligence to find out the fees involved with each payment method to avoid unnecessary costs.

Step 3: Buy Monero (XMR)

This process is similar across almost every cryptocurrency exchange. All you have to do is find a navigation bar or a search bar, and search for Monero (XMR) or Monero (XMR) trading pairs. Look for the section that will allow you to buy Monero (XMR), and enter the amount of the cryptocurrency that you want to spend for Monero (XMR) or the amount of fiat currency that you want to spend towards buying Monero (XMR). The exchange will then calculate the equivalent amount of Monero (XMR) based on the current market rate.

Note: Make sure to always double-check your transaction details, such as the amount of Monero (XMR) you will be buying as well as the total cost of the purchase before you end up confirming the transaction. Furthermore, many cryptocurrency exchanges will offer you their own proprietary software wallet where you will be storing your cryptocurrencies; however, you can create your own individual software wallet, or purchase a hardware wallet for the highest level of protection.

How to create a Binance account

Show Detailed Instructions

Hide Detailed Instructions

Step 1: Go to the Binance website.

Step 2: On the registration page, enter your email address, and create a password for your account.

Then, read and agree to the Terms of Service and click “Create Account”.

Note: Your password must be a combination of numbers and letters.

It should contain at least 8 characters, one UPPER CASE letter, and one number.

Step 3: Complete the Security Verification.

Step 4: The system will send a verification code to your email. The verification code is valid for 30 minutes. If you can’t find the email in your inbox, check your other mail folders as well, or click “Resend Email” to resend.

How to complete KYC (ID Verification) on Binance

Step 1: Log in to your Binance account and click “User Center” and then “Identification”.

Step 2: click “Start Now” to verify your account.

Step 3: Select your country of residence.

Ensure that your country of residence is consistent with your ID documents.

Step 5: Enter your personal information and click “Continue.”

You won’t be able to change it once confirmed.

Refer to the respective options offered for your country.

Step 7: Follow the instructions to upload photos of your document. Your photos should clearly show the full ID document.

Do not wear hats, glasses, or use filters, and make sure that the lighting is sufficient.

Once your application has been verified, you will receive an email notification.

How to buy cryptocurrency on Binance

Step 1: Log in to your Binance account and click “Buy Crypto” and then “Credit/Debit Card”.

Step 2: Here you can choose to buy crypto with different fiat currencies. Enter the fiat amount you want to spend and the system will automatically display the amount of crypto you can get. When you have selected the amount you wish to spend then press “Continue”.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

Step 3: Click “Add New Card”. Then enter your credit card details and your billing address.

Step 4: Check the payment details and confirm your order within 1 minute. After 1 minute, the price and the amount of crypto you will get will be recalculated. You can click “Refresh” to see the latest market price. You will then be redirected to your bank’s OTP Transaction Page. Follow the on-screen instructions to verify the payment.

How to Conduct Spot Trading on Binance

Step 1: Log in to your Binance account.

Click on “Classic” under “Trade” on the top navigation bar.

Step 2: Search and enter the cryptocurrency you want to trade.

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can place a “Market Order” to set the buying/selling price automatically.

Hide Detailed Instructions

How to create a Gate.io account

Show Detailed Instructions

Hide Detailed Instructions

Step 1: Go to the Gate.io website.

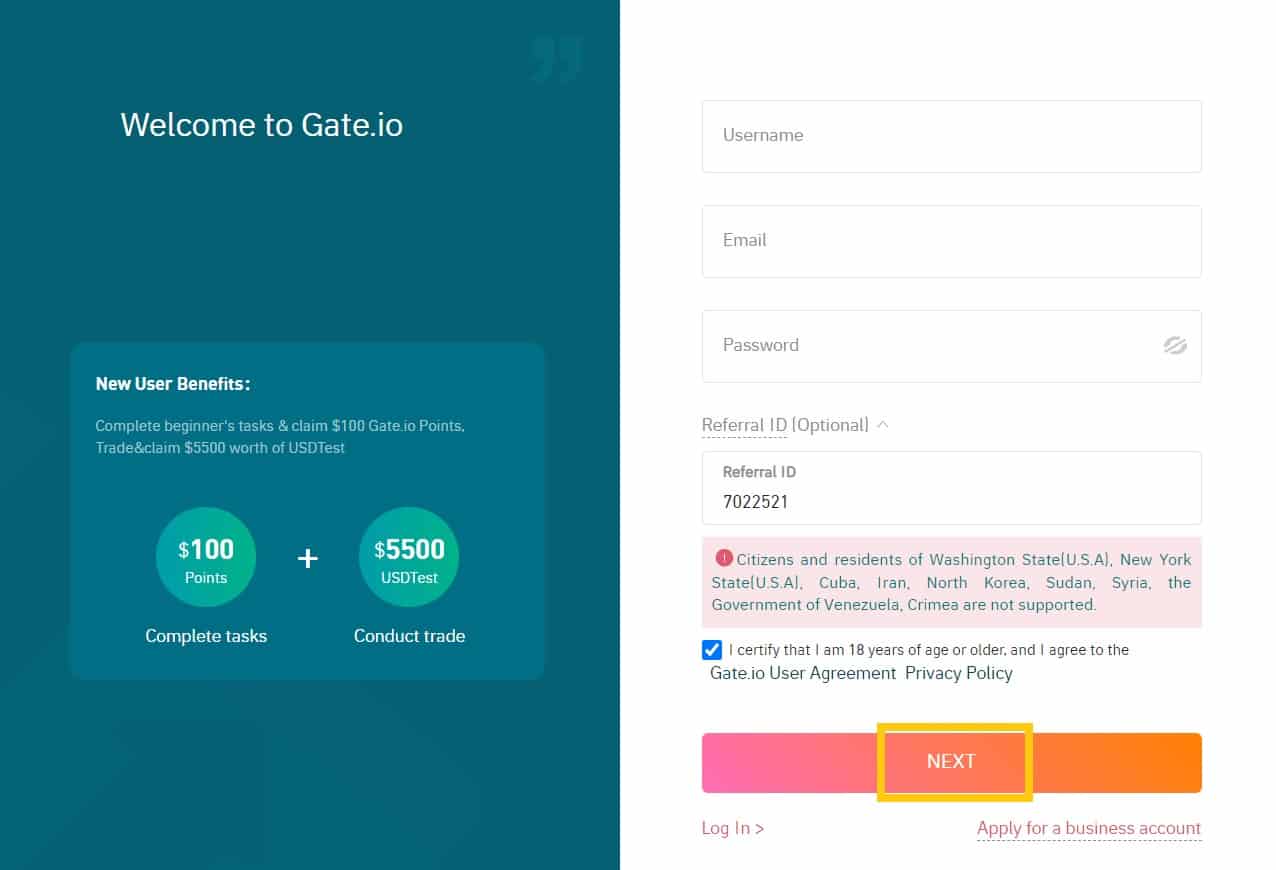

Step 2: Choose your username, your email address and your password. Then check “I certify that I am 18 years of age or older, and I agree to the Gate.io User Agreement Privacy Policy” and click “NEXT”.

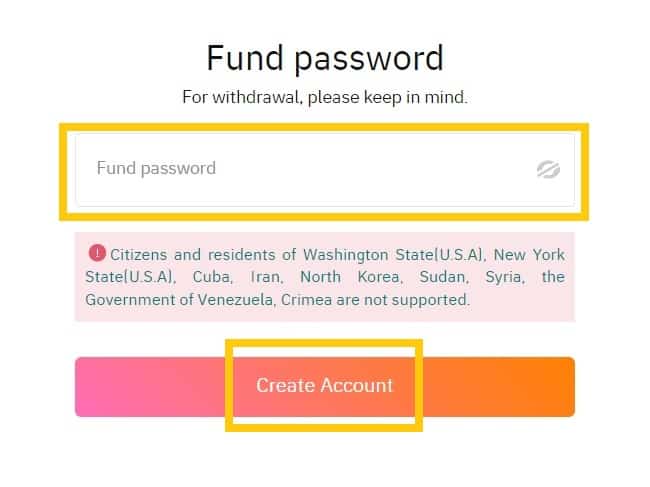

Step 3: Set your fund password and click “Create account”.

Note: Your fund password must contain at least 6 characters and can not be the same as your login password.

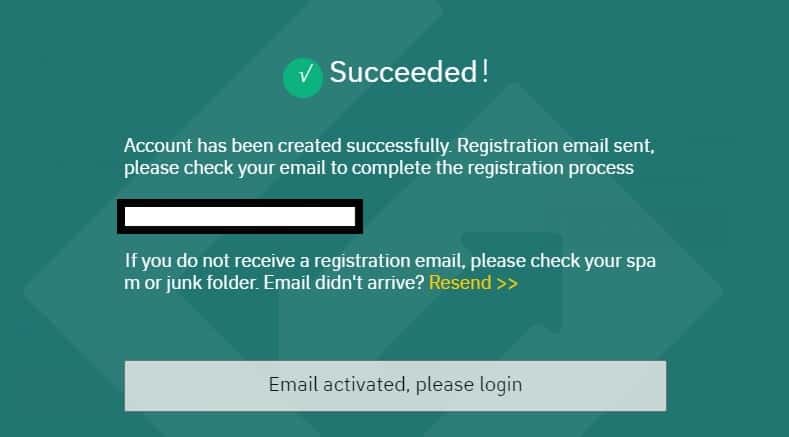

Step 4: An activation email will be sent to your email address. Complete the rest of the registration process by following the instructions in the email to activate your account. Once this is done done, click “Email activated, please log in”.

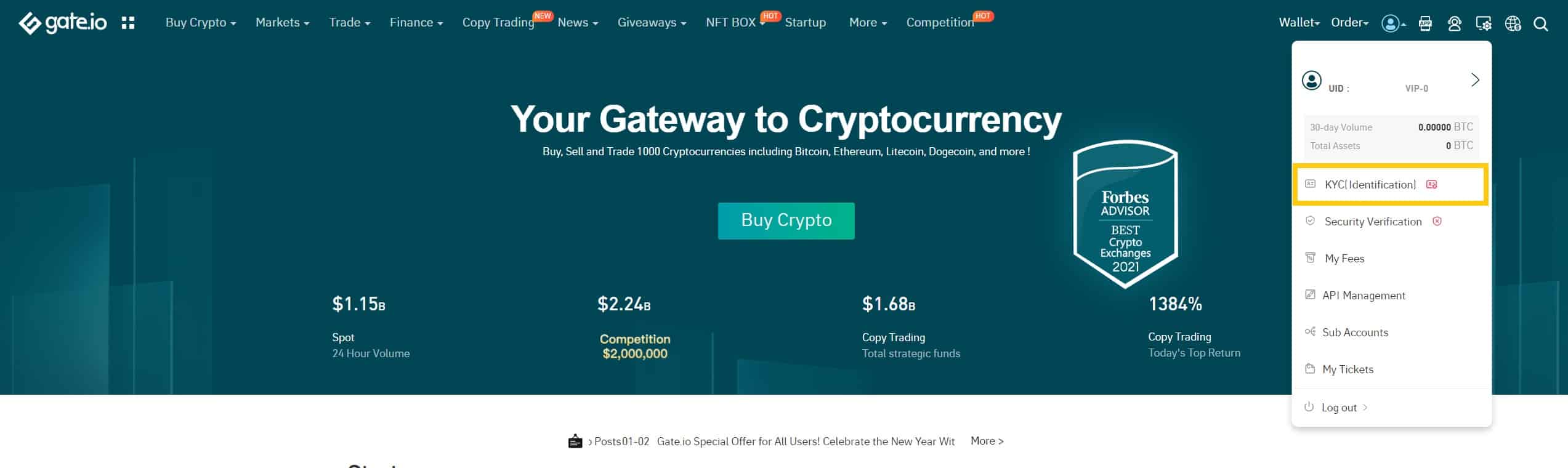

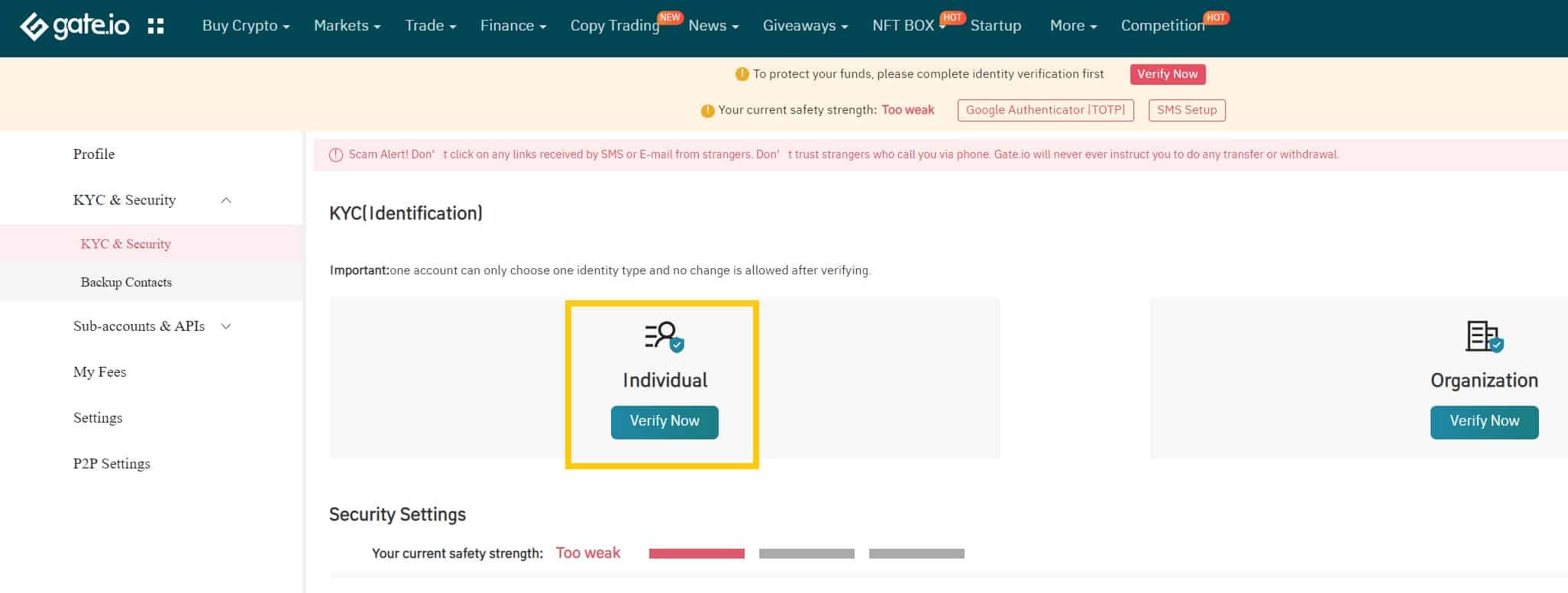

How to complete KYC (ID Verification) on Gate.io

In order to ensure the safety of your assets, and to reduce fraud, money laundering, blackmail, and other illegal activities, Gate.io makes it mandatory that all users obtain KYC ID Verification. Only after your account has obtained KYC ID verification, can you withdraw funds or use credit cards or debit cards to buy cryptocurrencies.

Step 1: Log in to your Gate.io account.

Place your cursor on the top-right profile icon and go to “KYC (ID Verification)”

Step 2: Click “Individual (Verify now)”

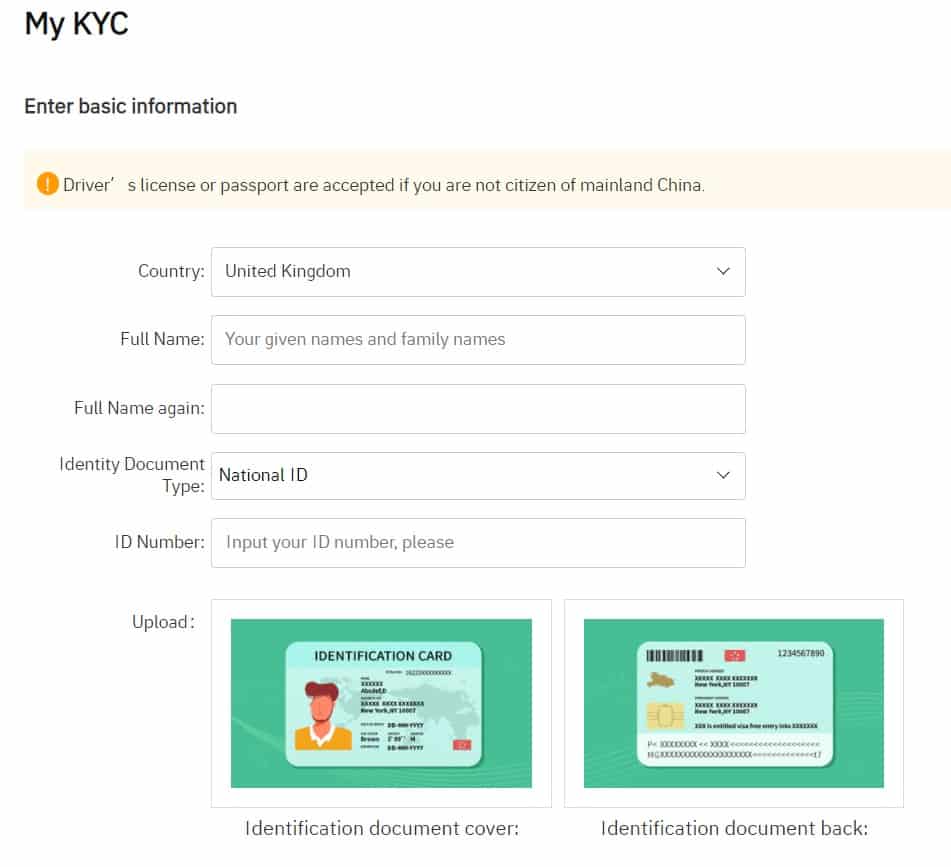

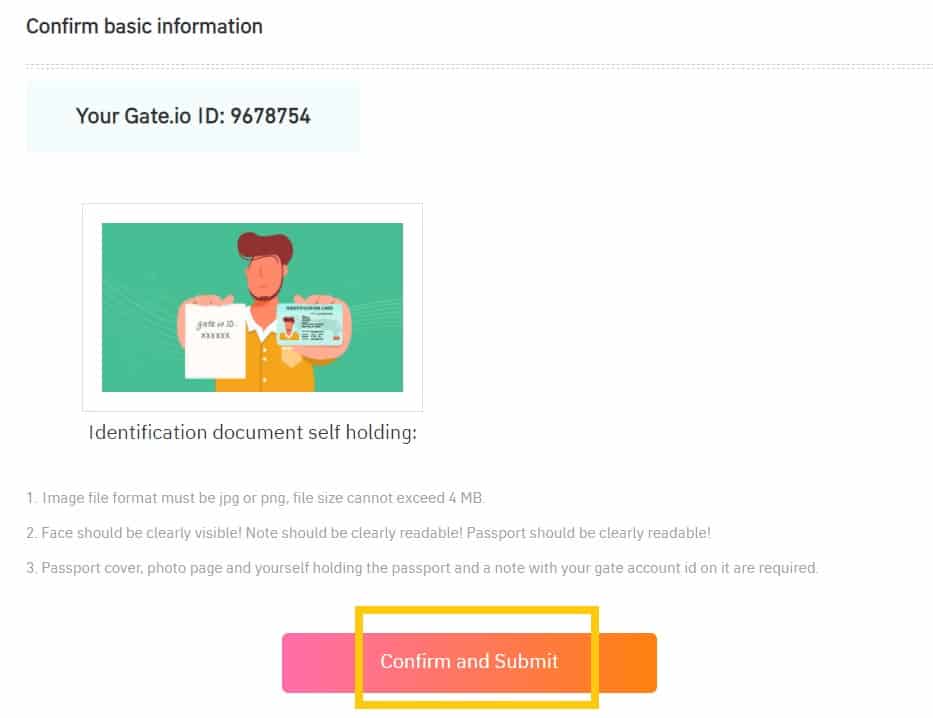

Step 3: Select your country, input your full legal name (twice), fill in your ID information, upload photos of both sides of your ID card, and a photo of you holding your ID together with your User ID (UID) for Gate.io. You will see your User ID by placing the cursor on the top-right profile icon on the main page. Make sure everything is filled in correctly and then click on “Confirm and Submit”.

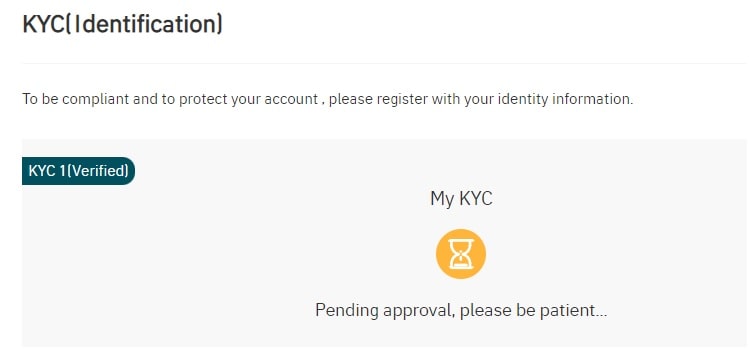

Step 4: After you have submitted all the requested information, you will see the pending approval.

Approval can take anywhere from a few hours to a few days to complete.

Once the KYC is approved, you’re ready to make your first cryptocurrency purchase.

How to buy cryptocurrency on Gate.io

Step 1: Log in to your Gate.io account.

Then in the Menu Bar at the top of the page, click “Buy Crypto” and select “Credit Card”.

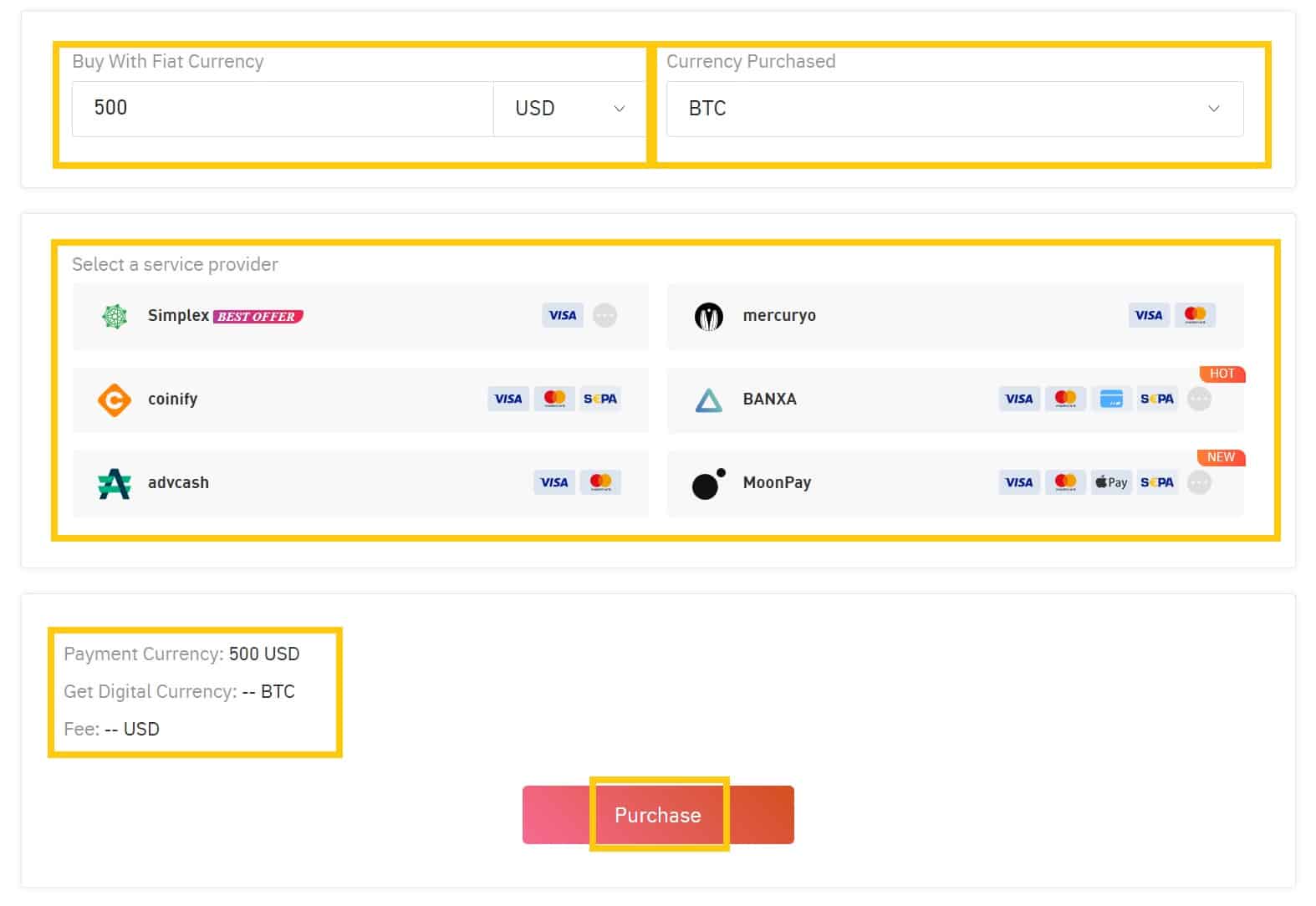

Step 2: Enter the amount you wish to spend in the “Buy with Fiat Currency” tab and select the cryptocurrency that you want to buy under the “Currency Purchased” field. Then select one of the “Service Providers” below and click the “Place Order” button to enter the confirmation page.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

Step 3: On the confirmation page, select “Buy Crypto” or the “Create Order” button to complete the payment.

Note: To ensure a quick and secure way of receiving the order, users might need to conduct an additional Identity Verification (KYC) with a third-party service provider. Once successfully verified, the service provider will immediately transfer the cryptocurrencies to your Gate.io account.

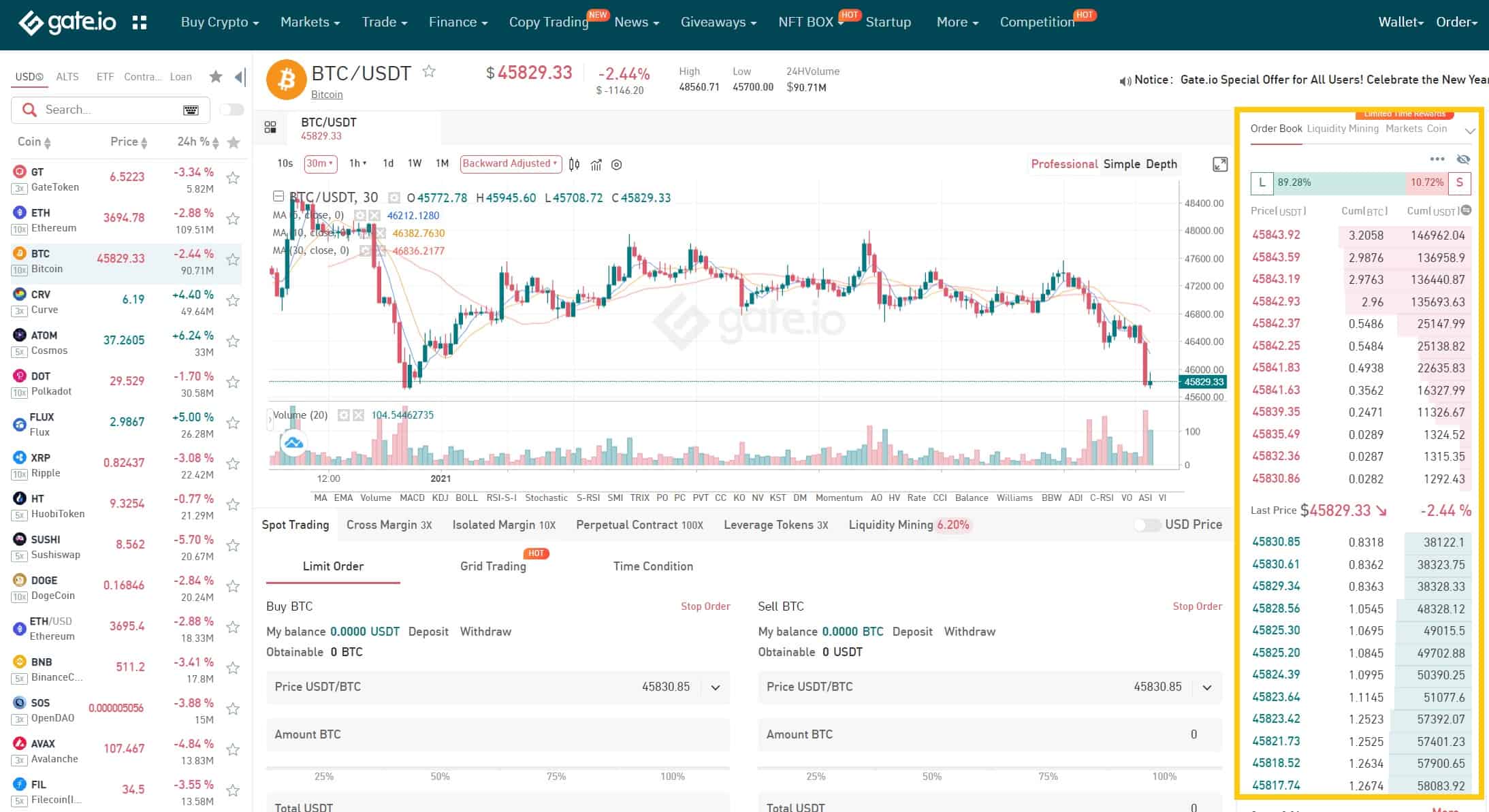

How to Conduct Spot Trading on Gate.io

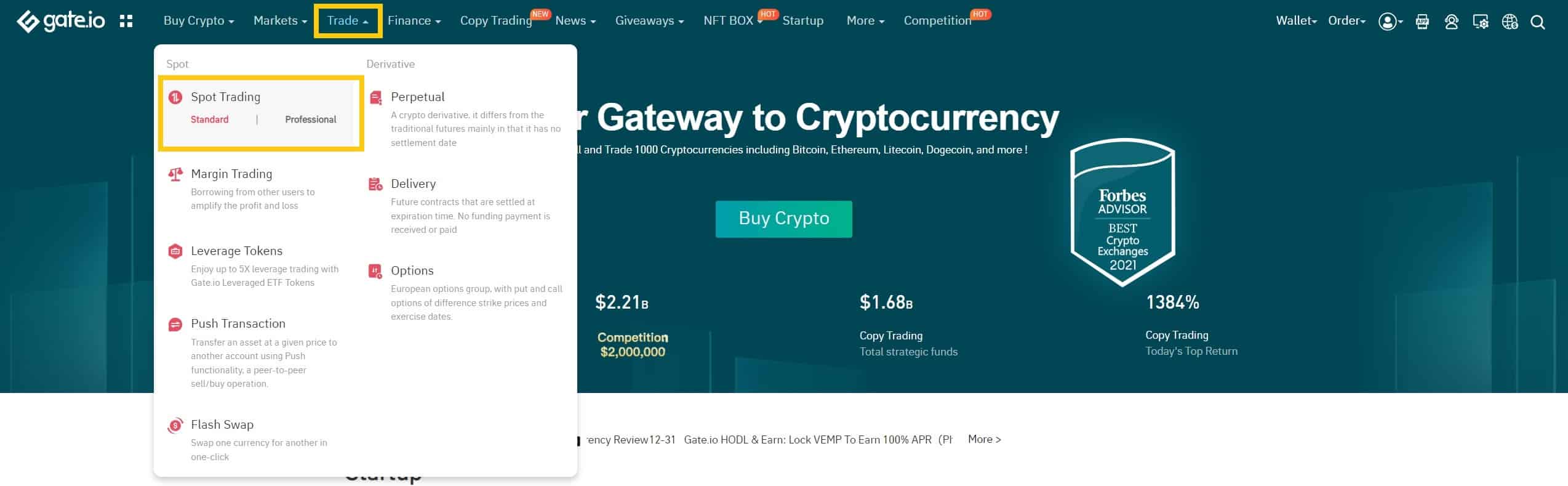

Step 1: Log in to your Gate.io account.

Click on “Spot Trading” under “Trade” on the top navigation bar.

You can either choose “standard” or “professional” version. This tutorial uses the standard version.

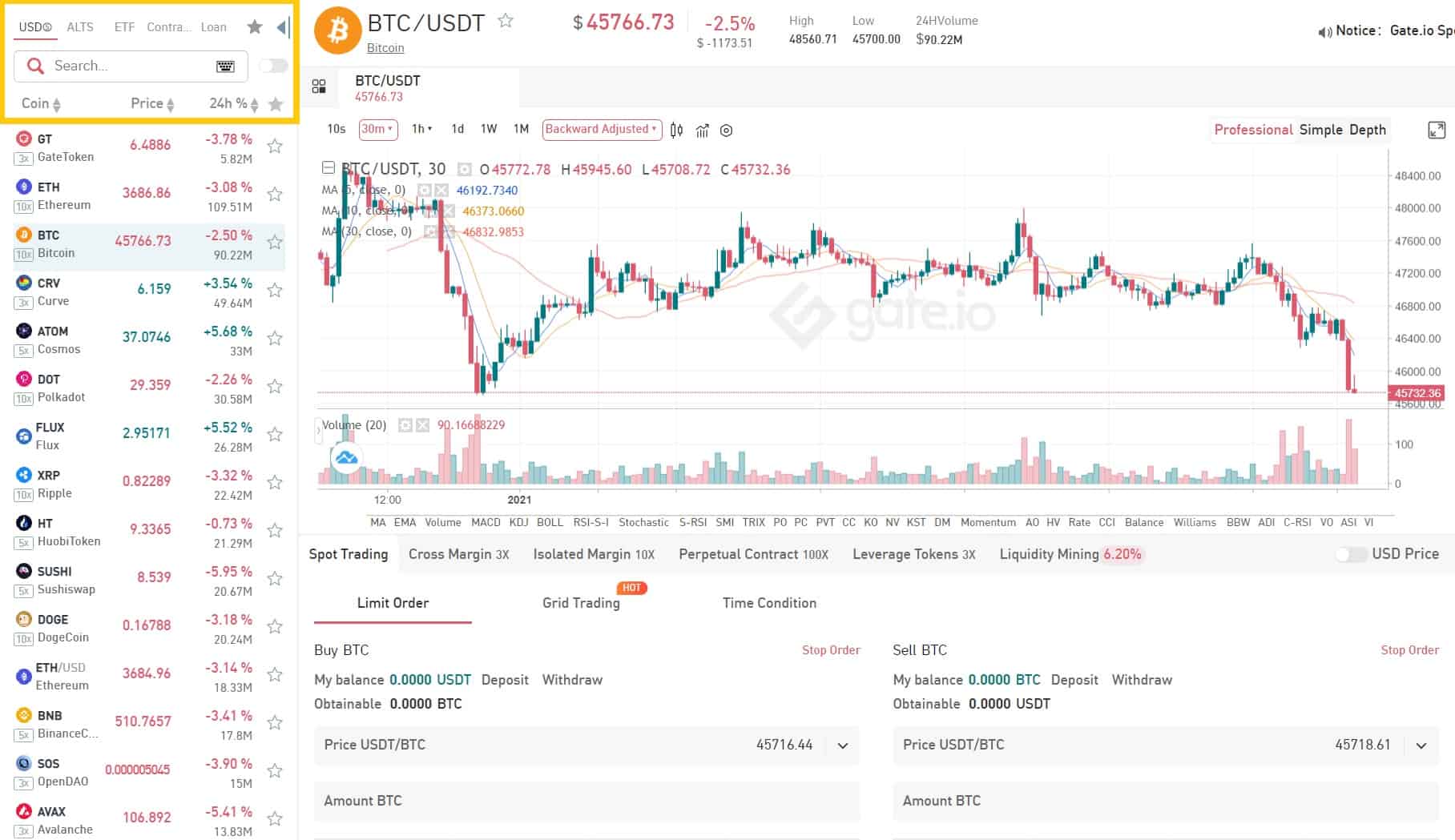

Step 2: Search and enter the cryptocurrency you want to trade.

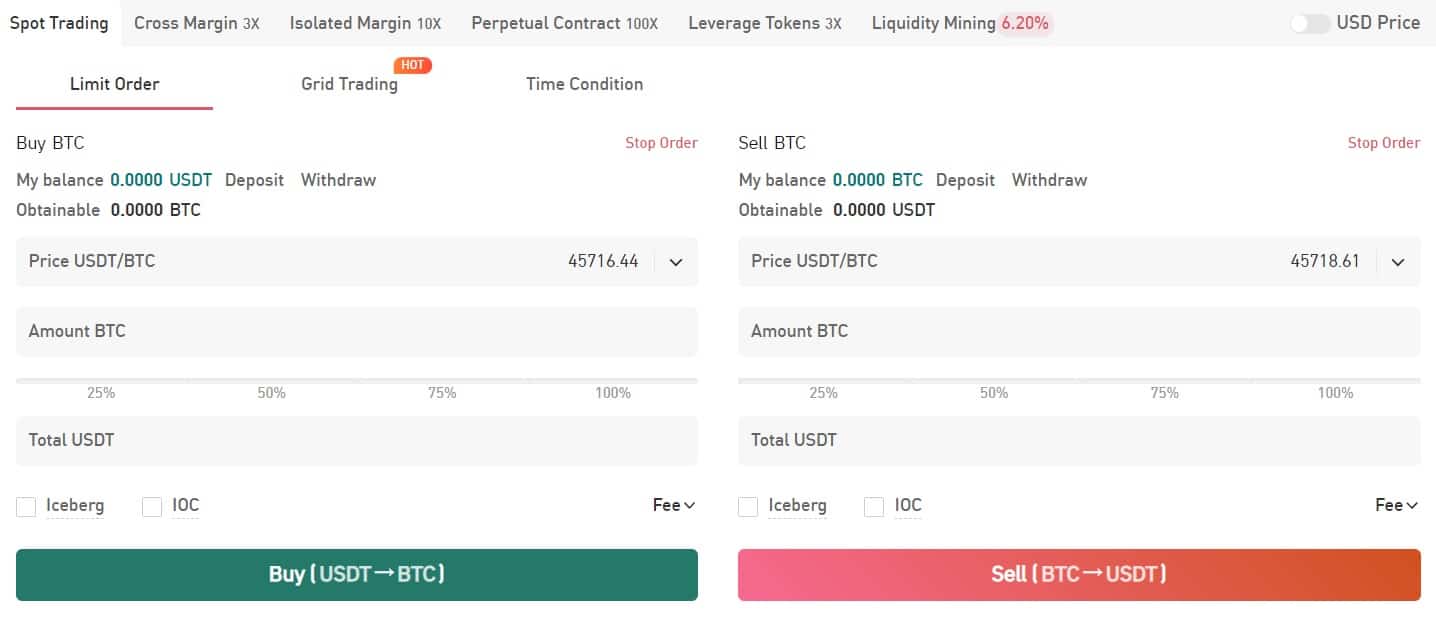

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

Step 4: If you don’t want to set a manual price, you can click on the last prices on the order book to set the buying/selling price automatically.

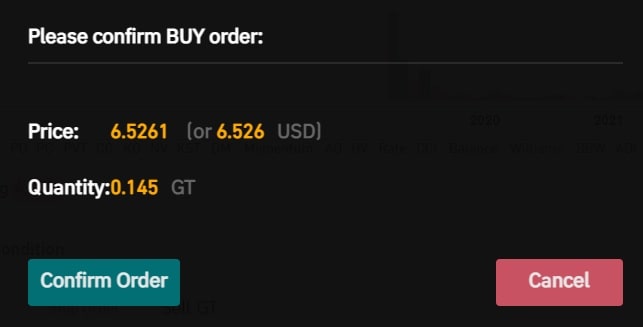

Step 5: Confirm the price and amount. Then click on “Place Order” to place the order, followed by “Confirm Order” to confirm it.

Hide Detailed Instructions

For more in-depth instructions, our ‘Absolute Beginner’s Guide To Cryptocurrency Investing‘ will take you through the process step-by step. In addition to providing instructions for sending and receiving your cryptocurrency.

And if you’re completely new to crypto our beginner, intermediate and advanced level articles will get you up to speed with everything you need to know about the cryptocurrency space starting out.

Simplecryptoguide.com

What Is Monero (XMR)?

This is Monero’s appeal. It still uses a blockchain to track the movement of funds, but it leverages some neat cryptography to obscure transaction sources, amounts, and destinations.

A very brief history of Monero

How does Monero work?

When researching Monero, you’ll stumble across the terms “ring signature” and “stealth address.” These are two of the key innovations that underpin the anonymity of Monero transactions. In this section, we’ll give a high-level overview of both concepts.

Ring signatures and Confidential Transactions

Bob wouldn’t be able to do this with a regular digital signature. By comparing it with his public key, anyone could say with certainty that only Bob’s private key could have produced the signature. He could face severe consequences for blowing the whistle on the Prime Minister’s activities. However, if the other cabinet members’ keys were used in a ring signature scheme, you couldn’t determine which one sent the message. Still, you could say that a cabinet member leaked the information, thus proving its authenticity.

It used to be that the outputs included in the ring had to be the same size. Otherwise, it would be easy to figure out what was going on, as transaction amounts were visible. For instance, you might have a ring where only outputs of 2 XMR were included or one where only 0.5 XMR forms the ring.

Stealth addresses

Suppose that you use the same address for your e-commerce store for every order. Anyone that made an order could see the balance you’re holding and tell other people that it’s your business’s address. This could make you a target.

Stealth addresses hide the destination of funds. They do this by having the sender generate a one-time address based on a public address used solely for that transaction. The public address might look something like this:

41mT1gUnYHK6mDAxVsKeB7SP9hVesbESbWcupd7mMYC73GL4nSgsEwTGKHGT7GKoSEdMKvs8Fdu1ufPJbo5BV4d1PfYiEewMonero vs. Bitcoin – what’s the difference?

As cryptocurrencies, Monero and Bitcoin present some similarities. But in reality, there are many aspects unique to both.

Fungibility

In many digital currencies, it gets a bit more challenging to determine fungibility. Units in Bitcoin are fungible at the protocol level, as the software doesn’t make any distinction between each BTC unit. Where it gets more ambiguous is at the social and political levels. Some contend that Bitcoin is non-fungible because each output is unique, whereas others argue that it doesn’t matter.

In some circles, it’s thought that these practices could break some of the properties that make public ledger cryptocurrencies appealing. “Clean” coins that have been freshly mined (and thus, have no history) could be seen as more valuable than older “dirtier” ones.

Monero avoids these shortcomings from the get-go. Since observers can’t tell where funds came from or where they’re going, it’s perhaps more akin to cash than to non-privacy coins. Even in businesses with rigorous analysis policies, XMR from questionable transactions can be exchanged without issue.

Blocks and mining

Hard forks

Of course, forks are just protocol upgrade mechanisms. They’re often necessary to resolve critical bugs or to add new features. In Bitcoin, though, users prefer to avoid them as they can cause division, and may pose a threat to decentralization. Generally, hard forks in Bitcoin arise when a group wants to create a new cryptocurrency from the existing network. Other than that, they’re usually reserved for patching urgent vulnerabilities.

In Monero, however, frequent hard forks are very much a part of the roadmap. This ensures that the software can quickly adapt to changes and roll out security upgrades. Some view “mandatory” protocol updates as a weakness, though Monero hard forks don’t really carry negative connotations as they sometimes do in other cryptocurrencies. That’s not to say that they’re foolproof – frequent hard forks increase the risk of a vulnerability going unnoticed, and can push non-upgraded users off the network.

Monero development

As with Bitcoin, Monero’s development is open to all. Anyone can contribute to the source code and documentation. The community decides which features to add, remove, or amend. At the time of writing, the project has over 500 contributors. The Core development team is made up of developers such as Riccardo Spagni (aka FluffyPony), Francisco Cabañas (ArticMine), and pseudonymous devs NoodleDoodle, othe, and binaryFate.

Monero development updates in 2023

Monero (XMR) has undergone several significant developments in 2023, further solidifying its position as a leading privacy-centric cryptocurrency. Here’s an overview of these developments:

-

GUI Software Enhancement: Monero introduced an updated version of its GUI software (v0.18.3.1), which greatly improved the user experience, especially for Mac users. This update, launched by October 7th, 2023, included full compatibility with macOS ARM devices, improved error messaging, a new Ledger Stax display option, and enhanced messages for P2Pool failures.

-

DeFi Integration: Monero expanded its utility by integrating into the DeFi ecosystem. This integration allows users to engage in anonymous trading on decentralized exchanges, partake in privacy-preserving loans, and contribute to liquidity pools, all while maintaining their anonymity.

-

Community-Driven Development: Monero continues to benefit from its decentralized, community-driven approach to development. The community actively contributes to the network’s enhancement, maintaining its ethos of privacy and decentralization. This includes the development of anti-ASIC mining algorithms to resist centralization.

-

Security Resilience: In September 2023, Monero faced a significant security breach, resulting in the unauthorized withdrawal of a substantial amount of XMR from the Monero Community Crowdfunding System (CCS). Despite this, the Monero market showed resilience with an increase in its value following the incident.

-

Privacy and Security Advancements: Monero continued to advance its privacy and security features. Implementations such as ring signatures and stealth addresses play a critical role in concealing transaction details and user identities, maintaining Monero’s status as a leader in private digital currencies.

-

New Miner and Community Concerns: Bitmain announced the launch of the Antminer X5, the first professional Monero miner. This development raised concerns within the Monero community regarding the potential centralization of mining power. Monero has historically resisted ASIC mining to maintain decentralization, and this new development poses challenges to that ethos.

These developments reflect Monero’s ongoing commitment to enhancing its ecosystem while staying true to its core principles of privacy and security. The community’s involvement and resilience in the face of challenges continue to be key drivers in Monero’s evolution and adaptation in the dynamic world of cryptocurrencies.

Official website: https://www.getmonero.org/

Best cryptocurrency wallet for Monero (XMR)

There are plenty of different crypto wallets available. The best one for you depends on your general trading habits and which provides the most security in your situation. There are two main types of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical). Both have their pros and cons, and there is not necessarily a right or wrong answer when it comes to figuring out which crypto wallet is best for you.

HOW DO I DECIDE WHICH cryptocurrency WALLET TO USE for Monero (XMR)?

Deciding which type of wallet to use depends on a variety of factors, including:

- How often you trade. In general, hot wallets are better for more active cryptocurrency traders. Quick login ability means you are only a few clicks and taps away from buying and selling crypto. Cold wallets are better suited for those looking to make less frequent trades.

- What you want to trade. As mentioned earlier, not all wallets support all types of cryptocurrencies. However, some of the best crypto wallets have the power to trade hundreds of different currencies, providing more of a one-size-fits-all experience.

- Your peace of mind. For those worried about hacking, having a physical cold wallet stored in a safe deposit box at the bank or somewhere at home, provides the safest, most secure option. Others might be confident in their ability to keep their hot wallets secure.

- How much it costs. It is important to investigate the costs associated with each wallet. Many hot wallets will be free to set up. Meanwhile, cold wallets, like any piece of hardware, will cost money to purchase.

- What it can do. While the basics of each cryptocurrency wallet are the same, additional features can help set them apart. This is especially true of hot wallets, many of which come with advanced reporting features, insights into the crypto market, the ability to convert cryptocurrencies and more. Security features can also be a good differentiator.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re going to be dealing in larger volumes of crypto, investing in cold storage might prove advantageous.

Most widespead examples of this being the Ledger Nano and the Trezor.

Ledger manufactures cold storage wallets designed for users who want increased security. Their wallets are a physical device that connects to your computer. Only when the device is connected can you send your cryptocurrency from it. Ledger offers a variety of products, such as the Ledger Nano S and the Ledger Nano X (a bluetooth connected hardware wallet).

Trezor is a pioneering hardware wallet company. The combination of world-class security with an intuitive interface and compatibility with other desktop wallets, makes it ideal for beginners and experts alike. The company has gained a lot of the Bitcoin community’s respect over the years. Trezor offers two main models – The Trezor One and Trezor Model T (which has a built in touch screen).

Market Overview

Coinmarketcap.com

Coinmarketcap will be your cryptocurrency go-to for just about everything. Here you can see the following: