How To Buy XRP (XRP)?

A common question you often see on social media from crypto beginners is “Where can I buy XRP?” Well, you’ll be happy to hear it is actually quite a simple and straightforward process.

Step 1: Create an account on an exchange that supports XRP (XRP)

First, you will need to open an account on a cryptocurrency exchange that supports XRP (XRP).

We recommend the following based on functionality, reputation, security, support and fees:

1

Binance

Fees (Maker/Taker) 0.075%*-0.1%*

Cryptocurrencies

Available for Trade 500+

Sign-up bonus

10% reduced trading fees*

Available in

Europe, Asia, Oceania, Africa

2

Bybit

Fees (Maker/Taker) 0.1%*-0.1%*

Cryptocurrencies

Available for Trade 400+

Sign-up bonus

$30,000 sign-up bonus*

Available in

Europe, Asia, Oceania, Africa

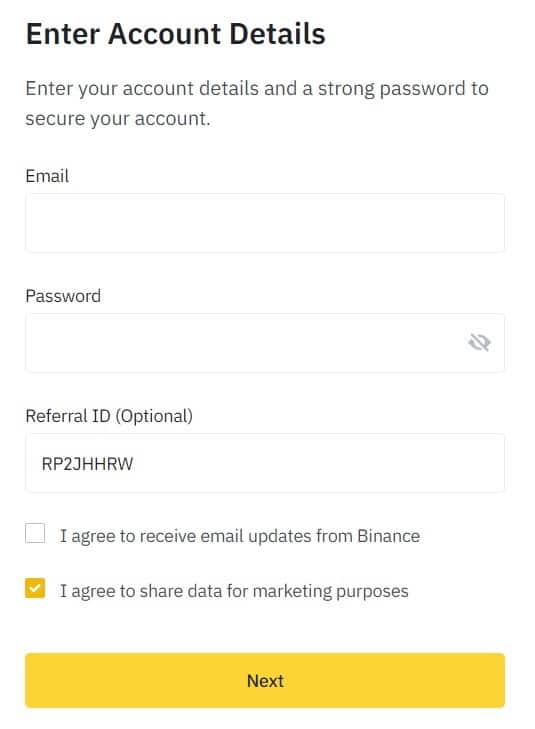

In order to sign up, you will need to enter some basic information, such as your email address, password, full name and, in some cases, you might also be asked for a phone number or address.

Note: On specific exchanges, you might need to complete a Know Your Customer (KYC) procedure in order to be able to purchase cryptocurrency. This is most commonly the case with licensed and regulated exchanges.

Step 2: Deposit funds into your account

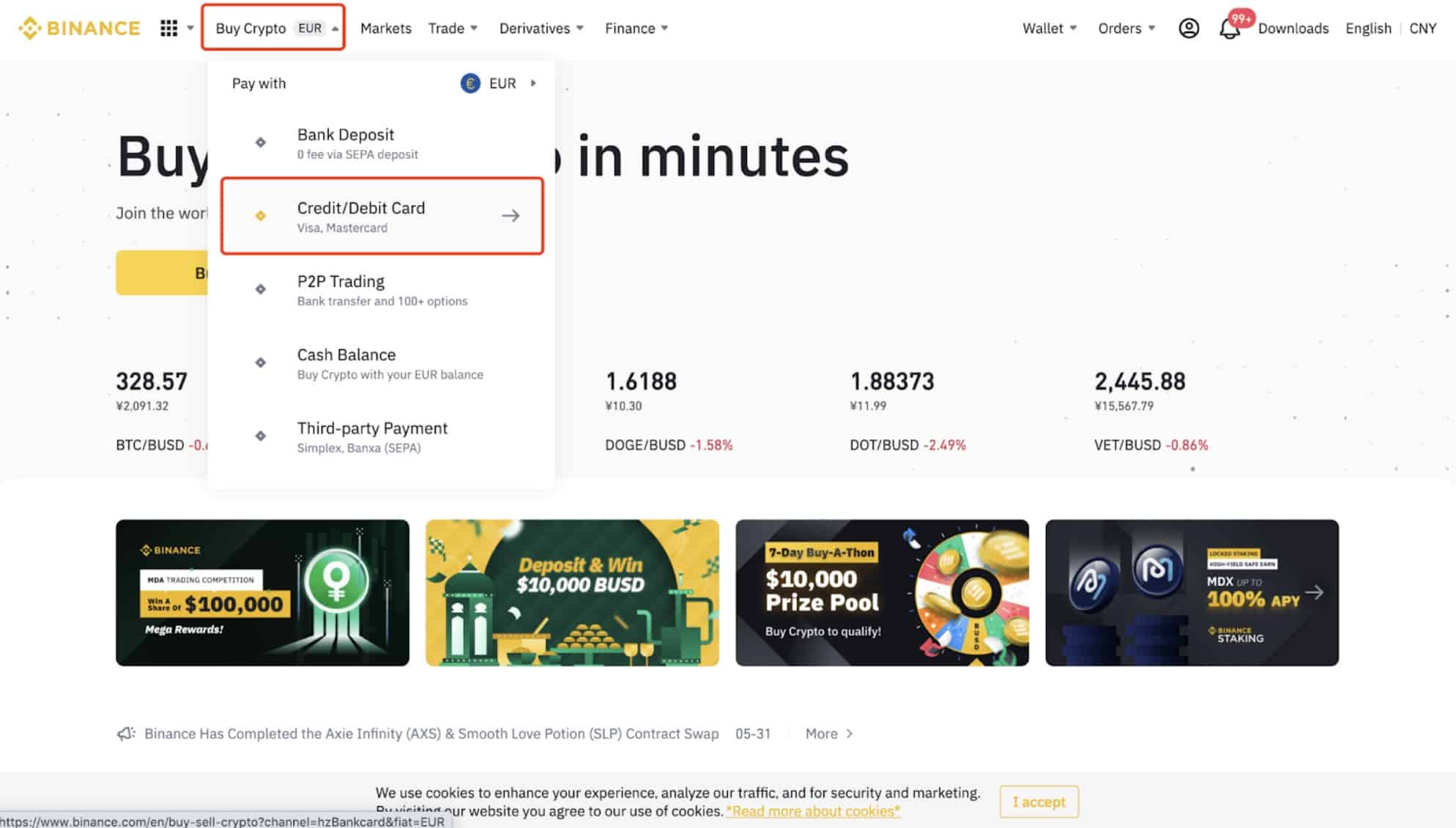

Many cryptocurrency exchanges will allow you to purchase XRP (XRP) with fiat currencies, such as EUR, USD, AUD and others. Furthermore, they will also provide you with multiple deposit methods through which you can fund your fiat account, such as credit and debit cards, ewallets or direct bank transfers.

Note: Some payment methods will have higher fees than others, such as credit card payments. Before funding your fiat account on your chosen exchange, make sure to do your due diligence to find out the fees involved with each payment method to avoid unnecessary costs.

Step 3: Buy XRP (XRP)

This process is similar across almost every cryptocurrency exchange. All you have to do is find a navigation bar or a search bar, and search for XRP (XRP) or XRP (XRP) trading pairs. Look for the section that will allow you to buy XRP (XRP), and enter the amount of the cryptocurrency that you want to spend for XRP (XRP) or the amount of fiat currency that you want to spend towards buying XRP (XRP). The exchange will then calculate the equivalent amount of XRP (XRP) based on the current market rate.

Note: Make sure to always double-check your transaction details, such as the amount of XRP (XRP) you will be buying as well as the total cost of the purchase before you end up confirming the transaction. Furthermore, many cryptocurrency exchanges will offer you their own proprietary software wallet where you will be storing your cryptocurrencies; however, you can create your own individual software wallet, or purchase a hardware wallet for the highest level of protection.

How to create a Binance account

Show Detailed Instructions

Hide Detailed Instructions

Step 1: Go to the Binance website.

Step 2: On the registration page, enter your email address, and create a password for your account.

Then, read and agree to the Terms of Service and click “Create Account”.

Note: Your password must be a combination of numbers and letters.

It should contain at least 8 characters, one UPPER CASE letter, and one number.

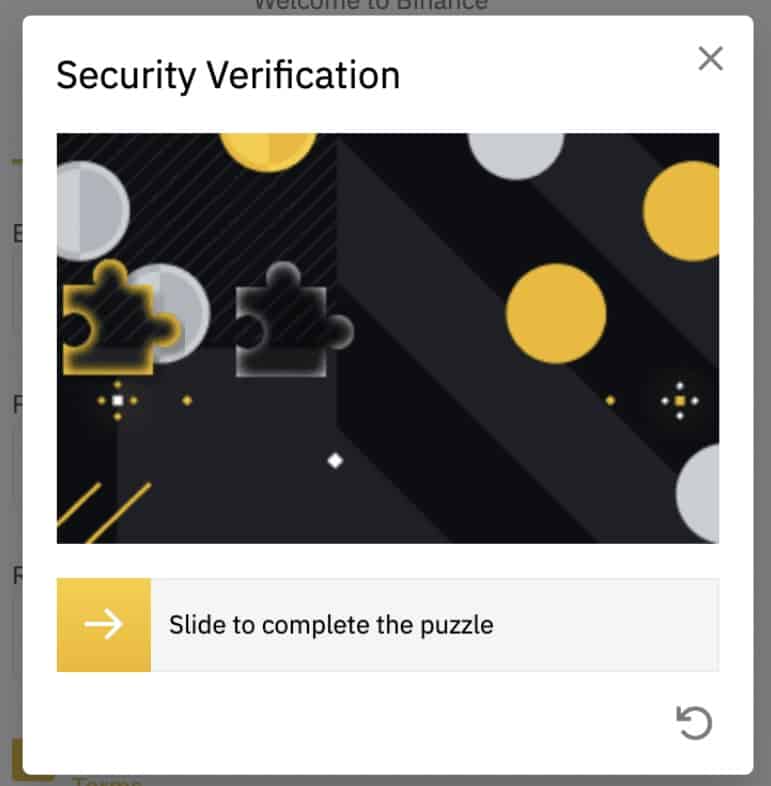

Step 3: Complete the Security Verification.

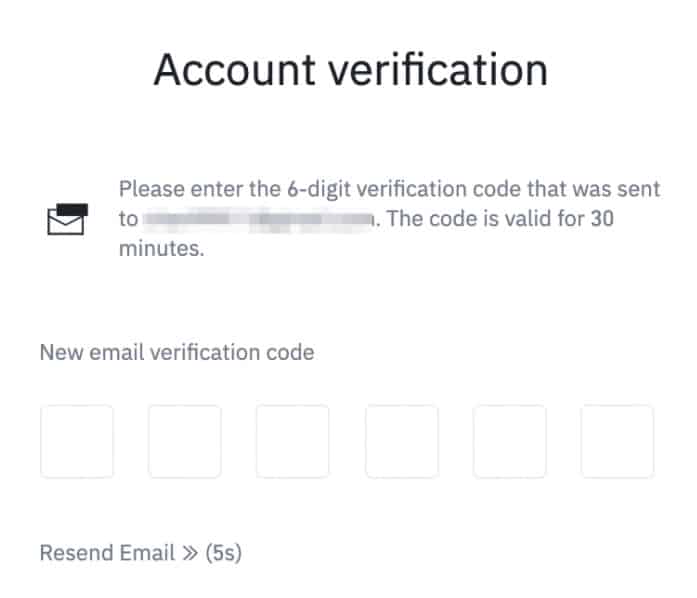

Step 4: The system will send a verification code to your email. The verification code is valid for 30 minutes. If you can’t find the email in your inbox, check your other mail folders as well, or click “Resend Email” to resend.

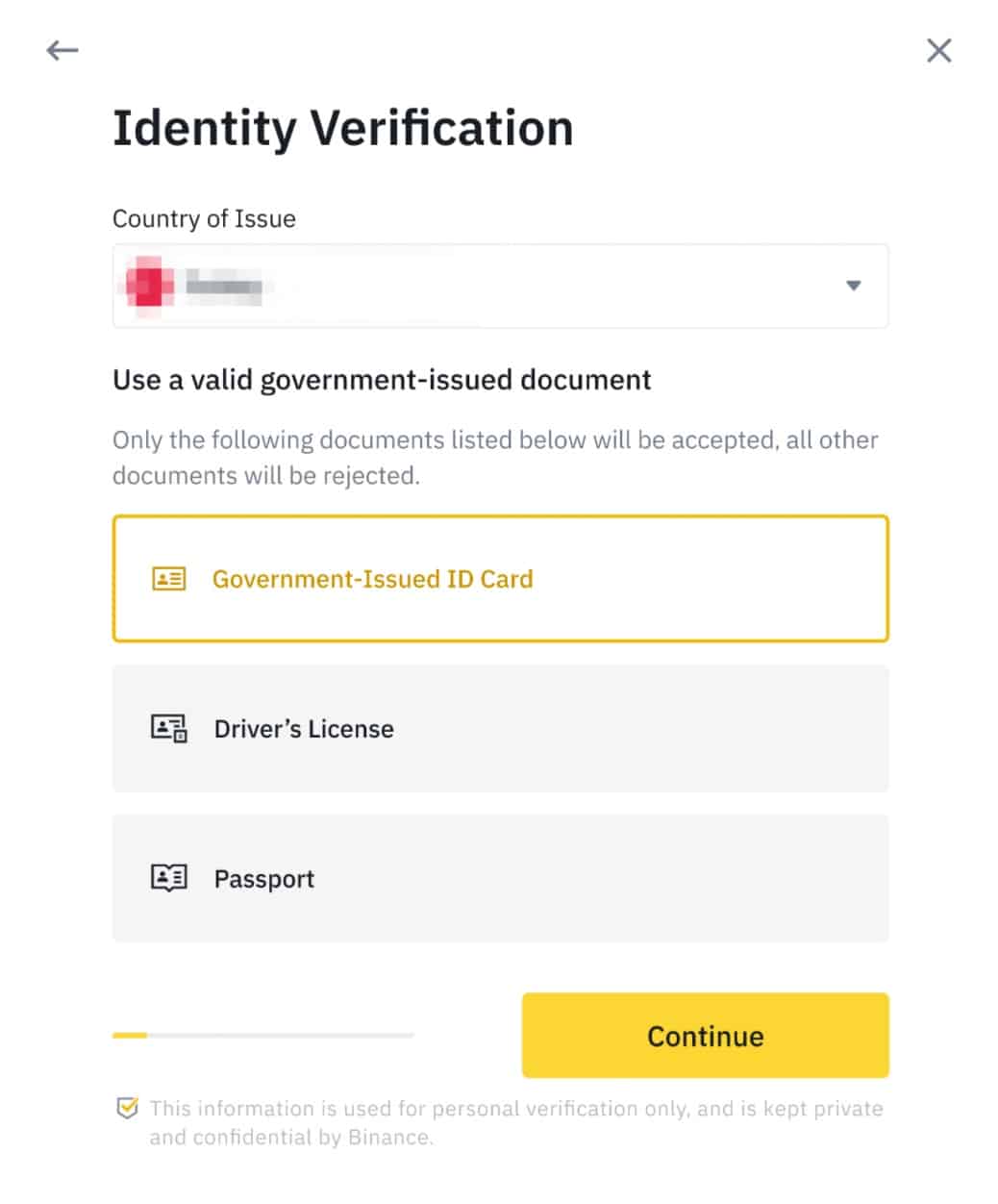

How to complete KYC (ID Verification) on Binance

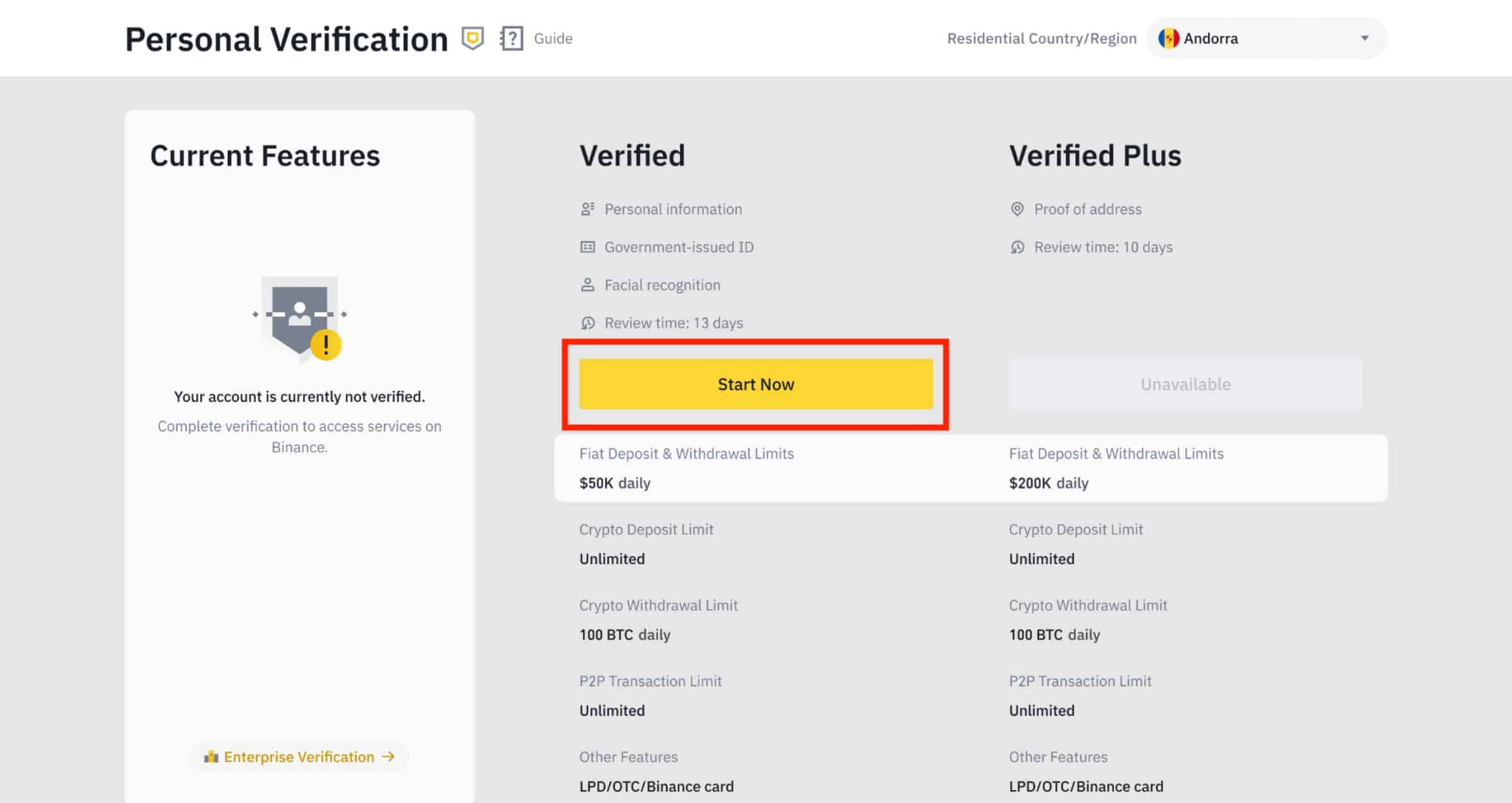

Step 1: Log in to your Binance account and click “User Center” and then “Identification”.

Step 2: click “Start Now” to verify your account.

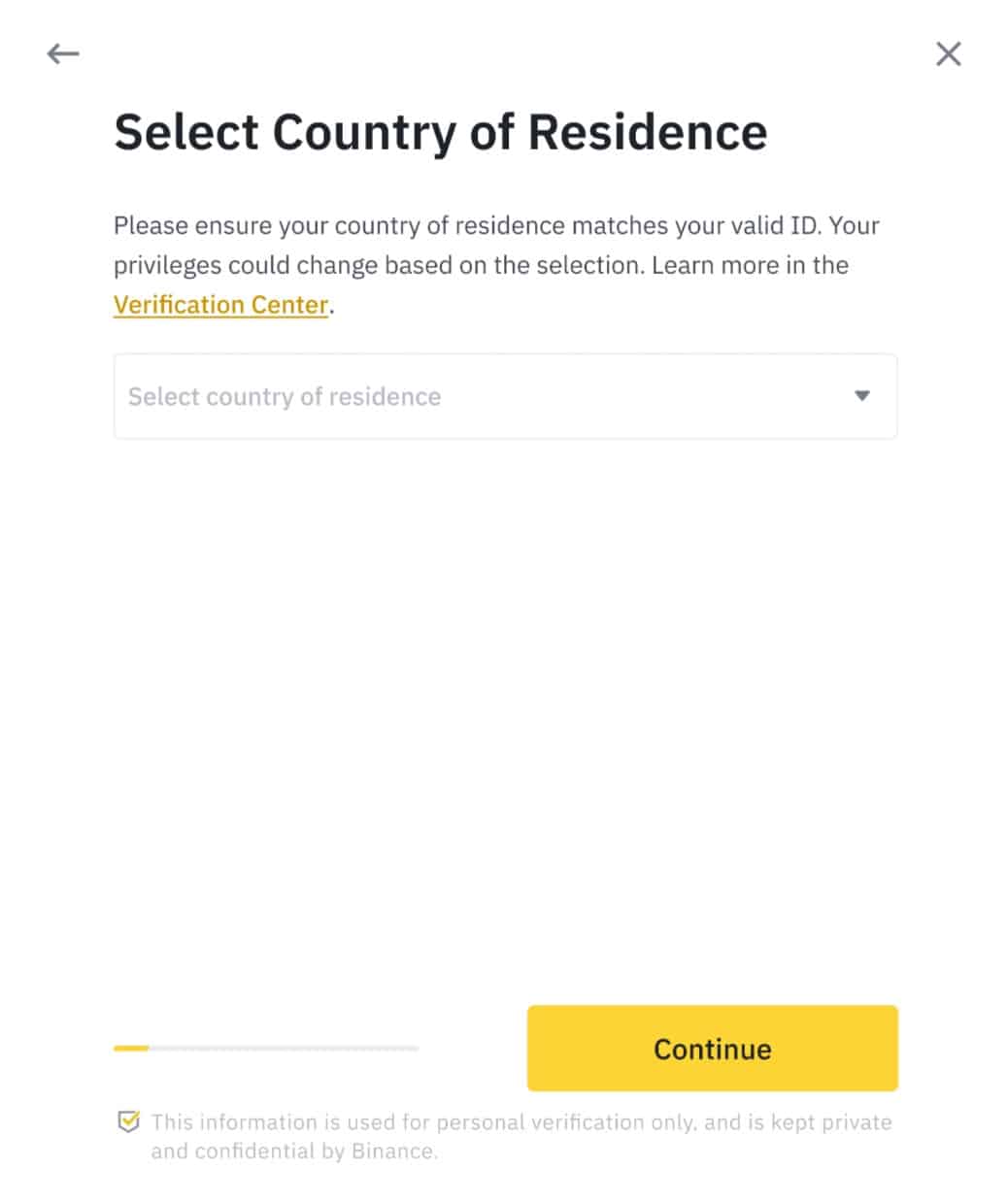

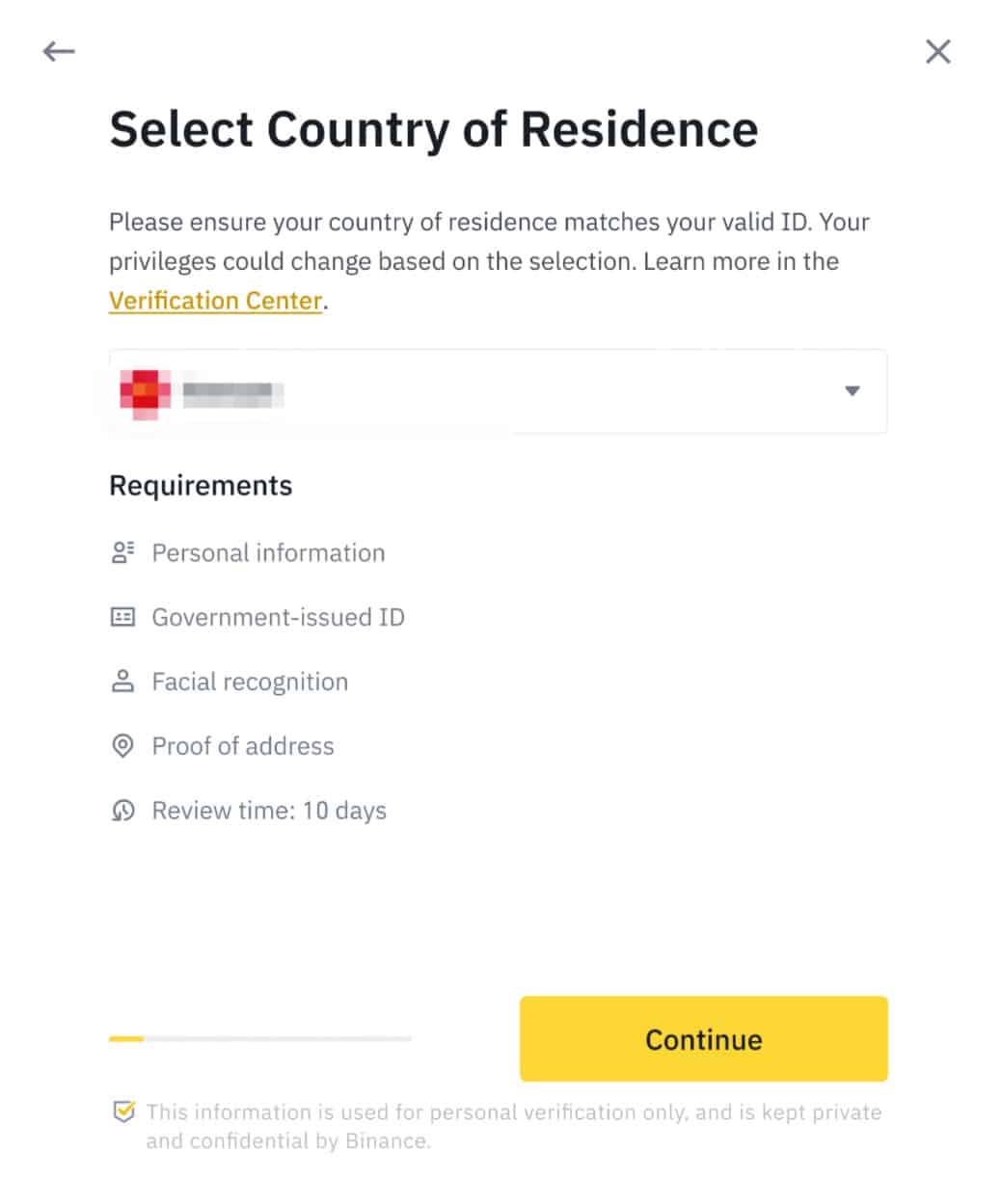

Step 3: Select your country of residence.

Ensure that your country of residence is consistent with your ID documents.

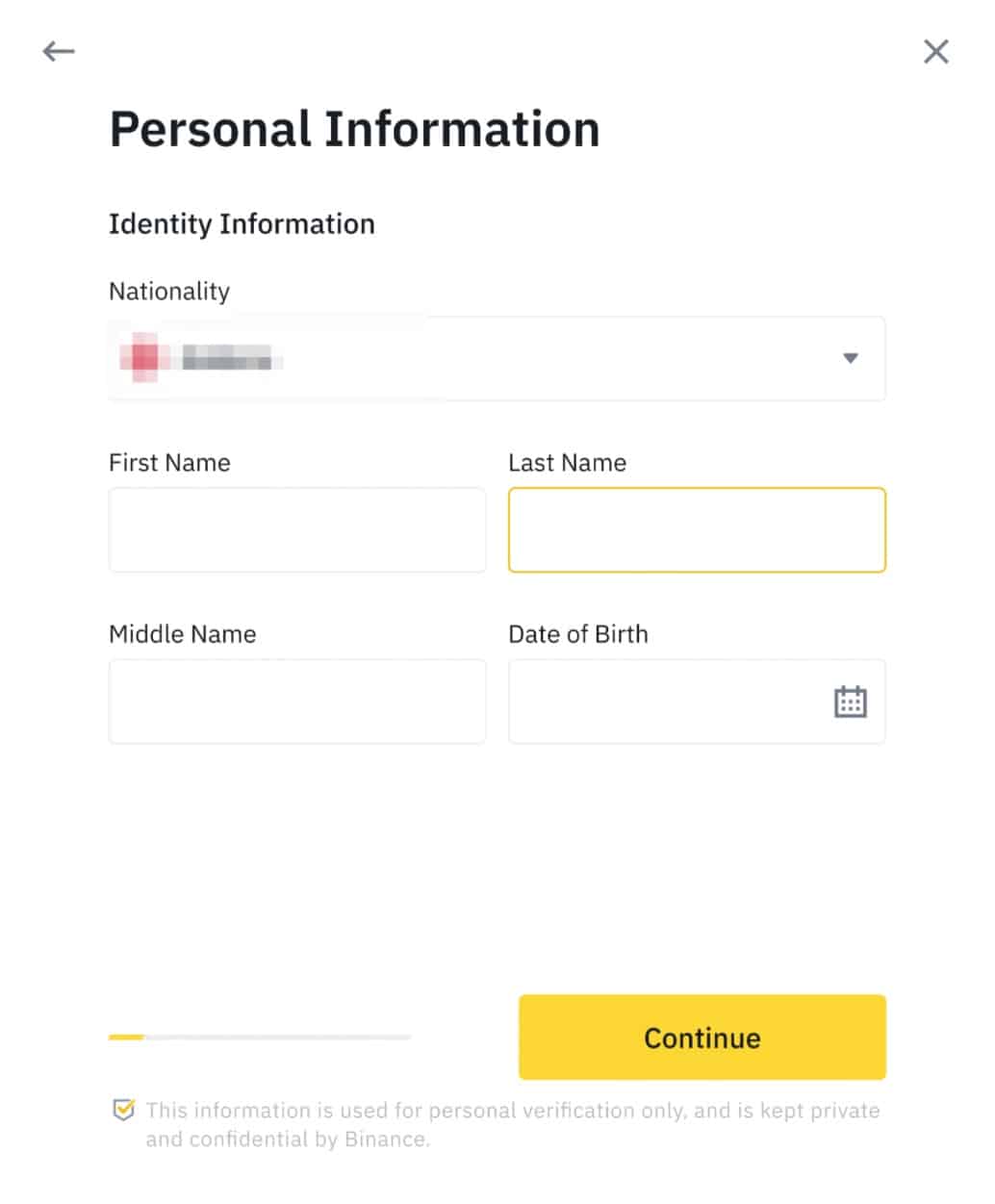

Step 5: Enter your personal information and click “Continue.”

You won’t be able to change it once confirmed.

Refer to the respective options offered for your country.

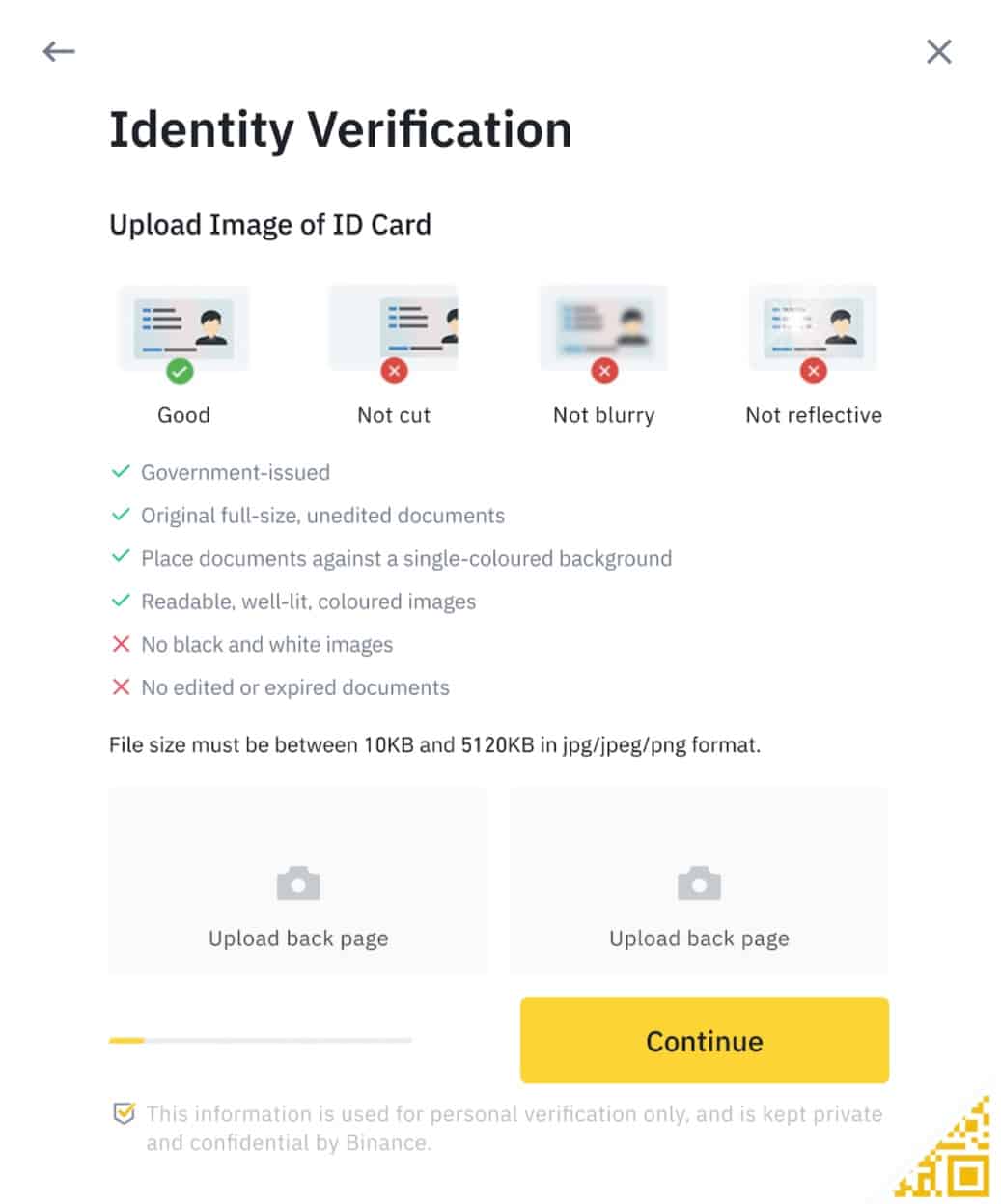

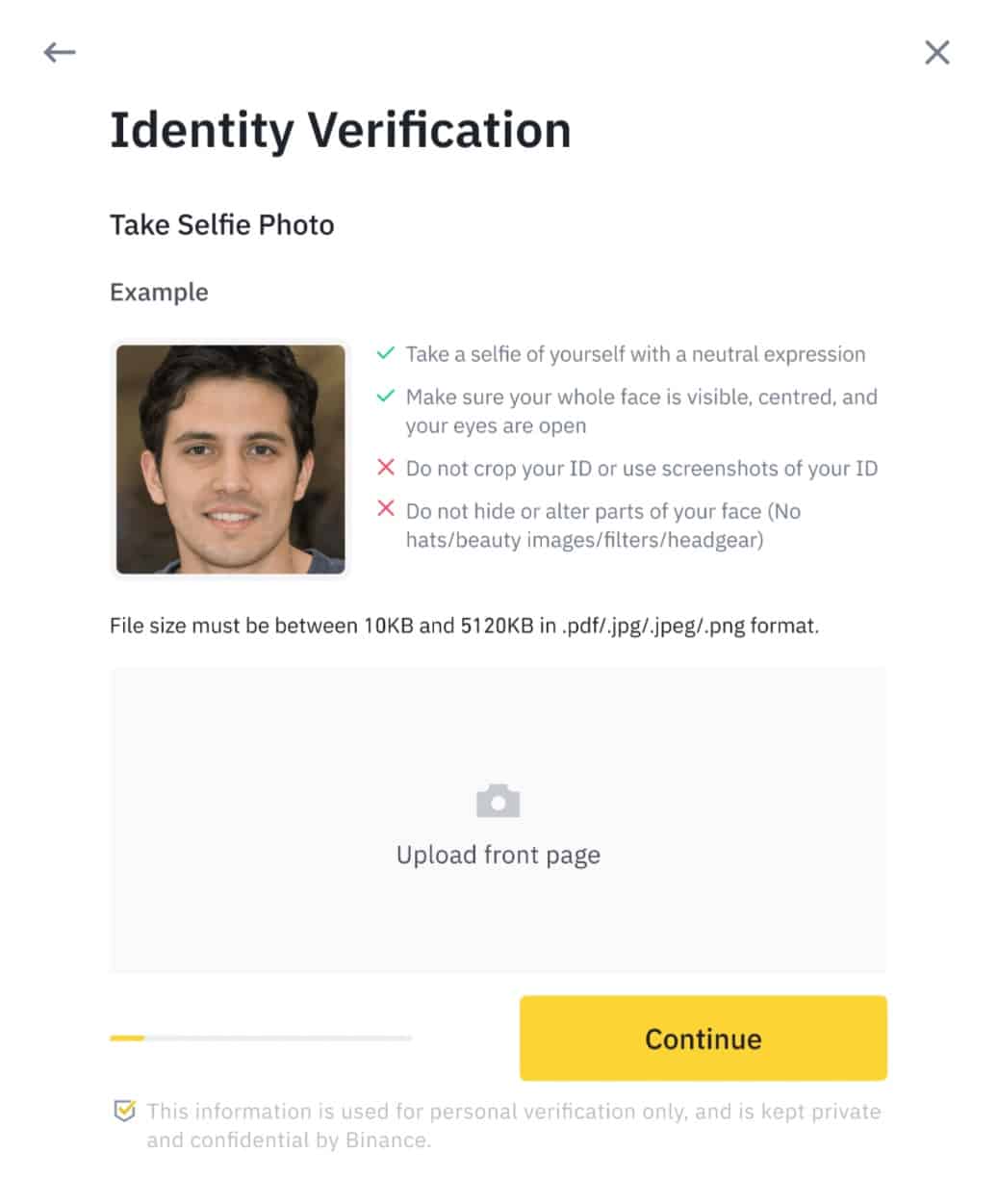

Step 7: Follow the instructions to upload photos of your document. Your photos should clearly show the full ID document.

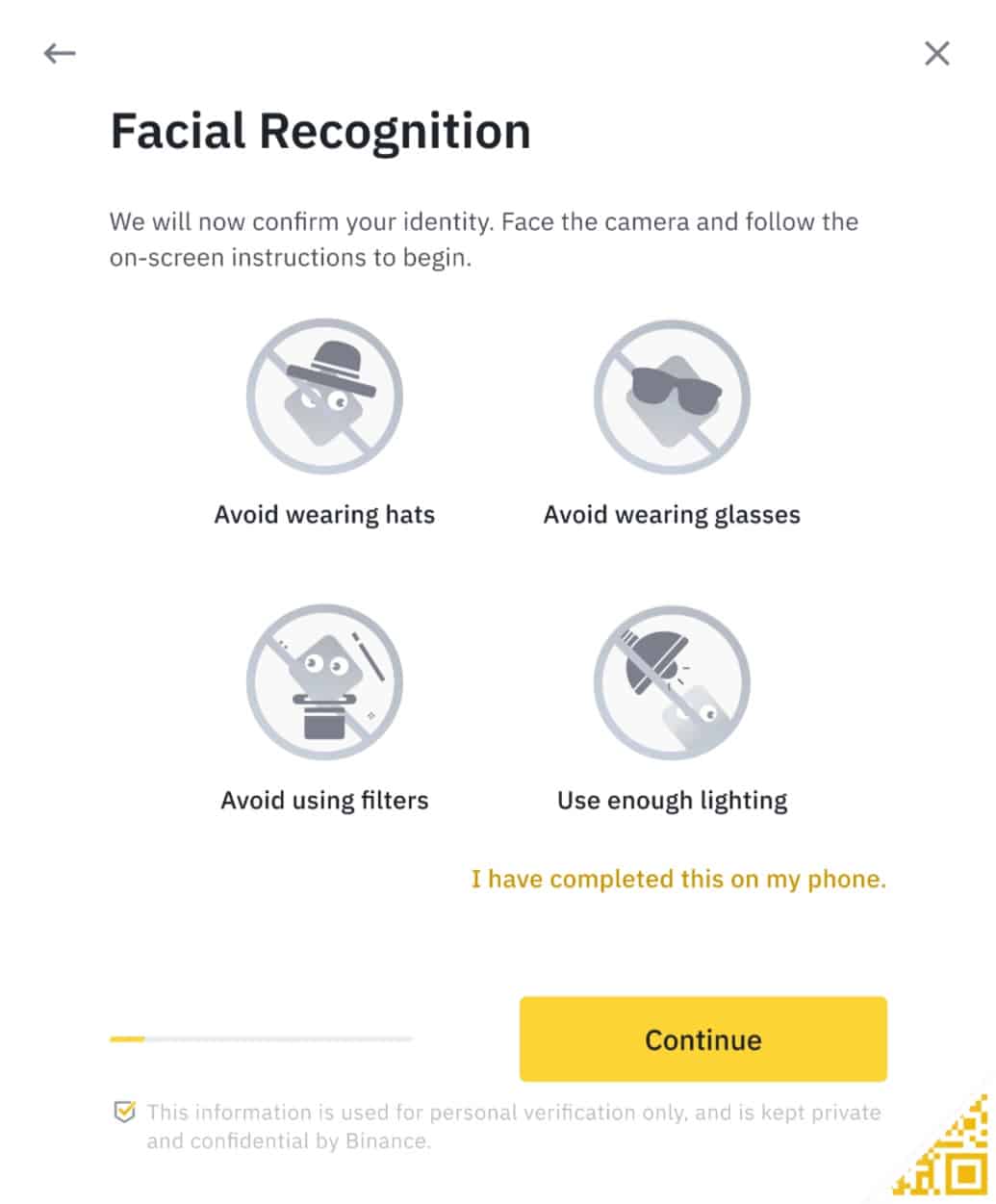

Do not wear hats, glasses, or use filters, and make sure that the lighting is sufficient.

Once your application has been verified, you will receive an email notification.

How to buy cryptocurrency on Binance

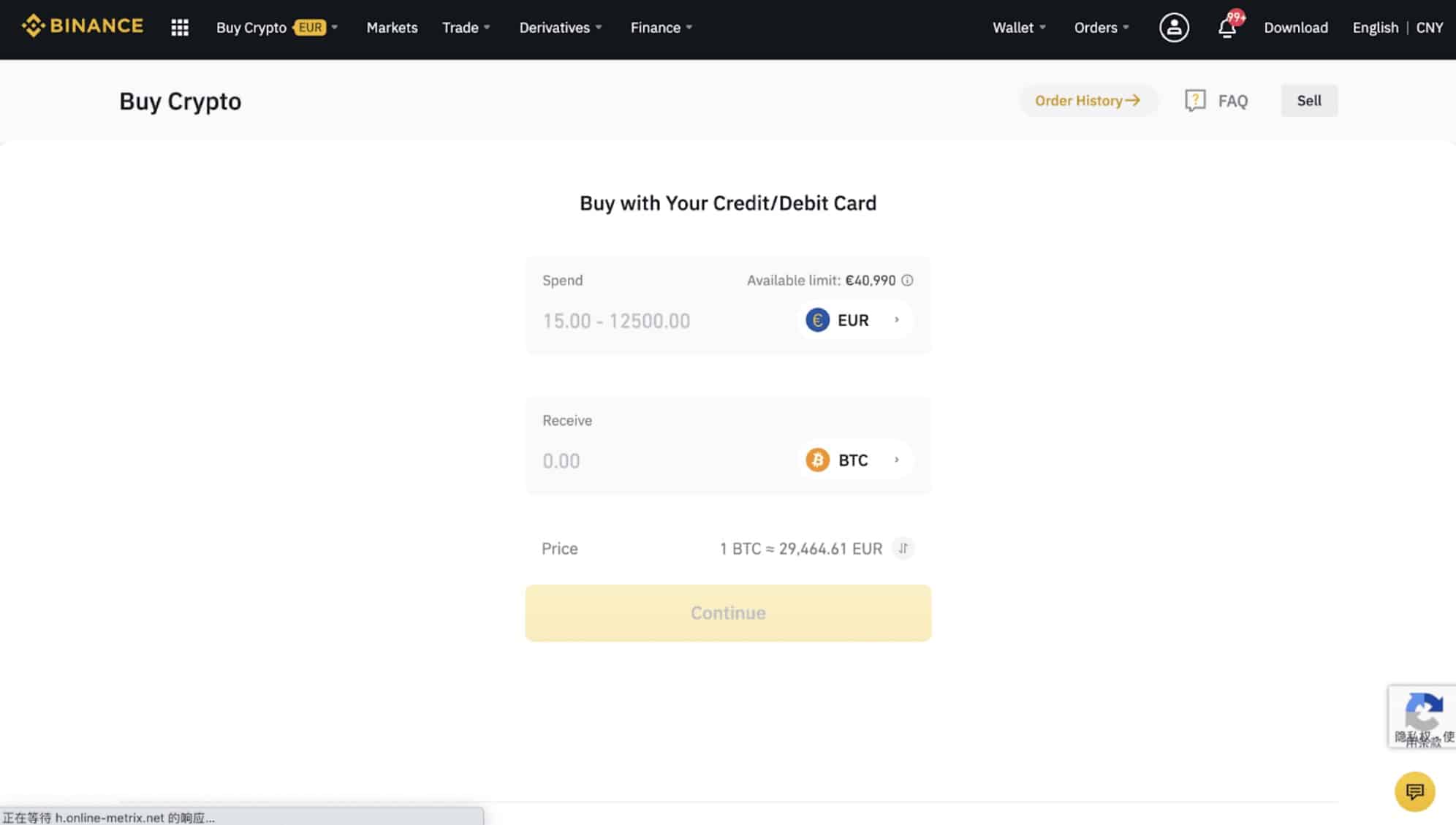

Step 1: Log in to your Binance account and click “Buy Crypto” and then “Credit/Debit Card”.

Step 2: Here you can choose to buy crypto with different fiat currencies. Enter the fiat amount you want to spend and the system will automatically display the amount of crypto you can get. When you have selected the amount you wish to spend then press “Continue”.

Note: You might not be able to purchase every cryptocurrency directly using fiat, if you’re looking to purchase something that isn’t offered in the currency list on this page, then you will want to purchase USDT. We will then show you how to exchange that on the spot-market for the cryptocurrency that you want in the next section of this guide.

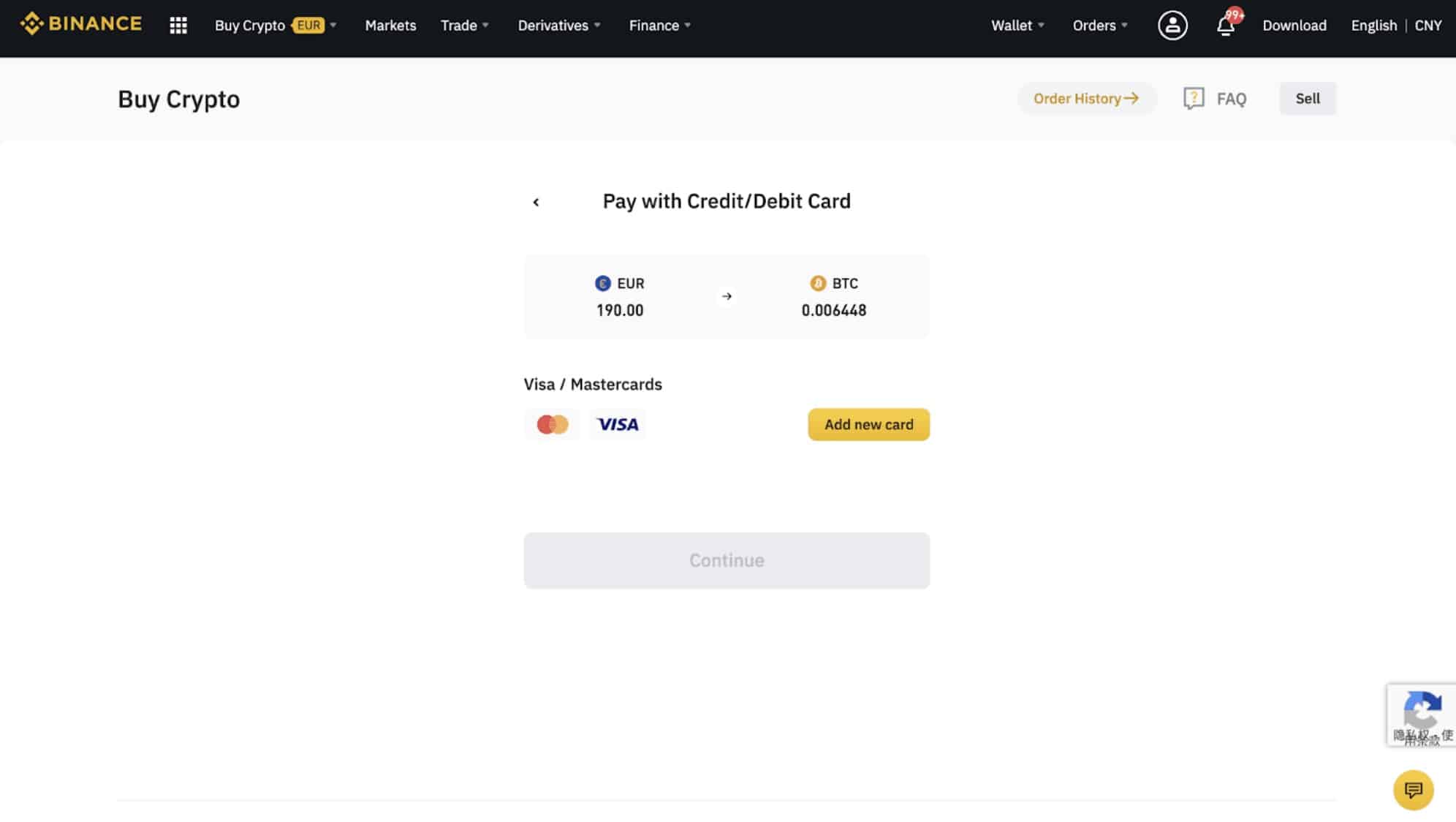

Step 3: Click “Add New Card”. Then enter your credit card details and your billing address.

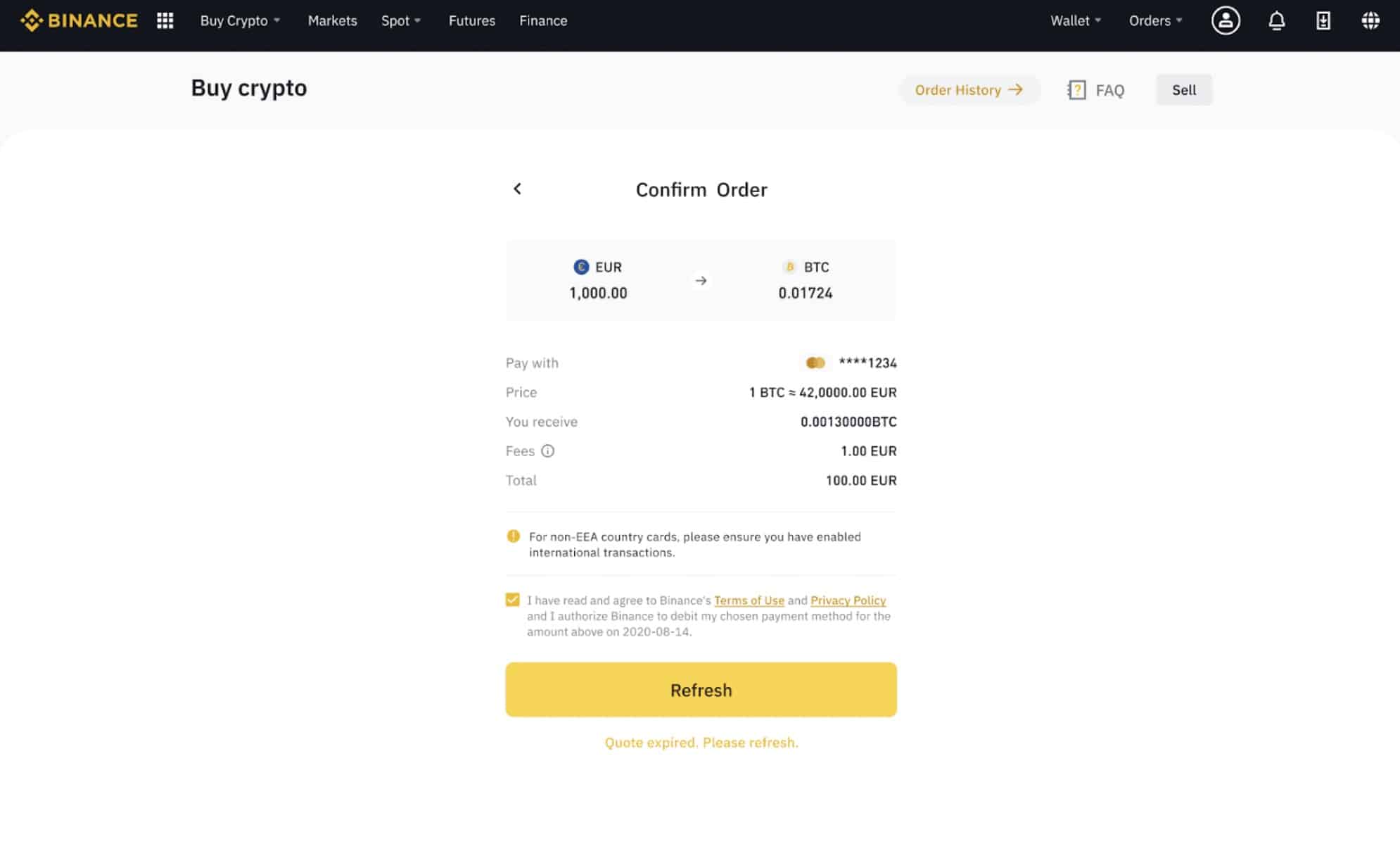

Step 4: Check the payment details and confirm your order within 1 minute. After 1 minute, the price and the amount of crypto you will get will be recalculated. You can click “Refresh” to see the latest market price. You will then be redirected to your bank’s OTP Transaction Page. Follow the on-screen instructions to verify the payment.

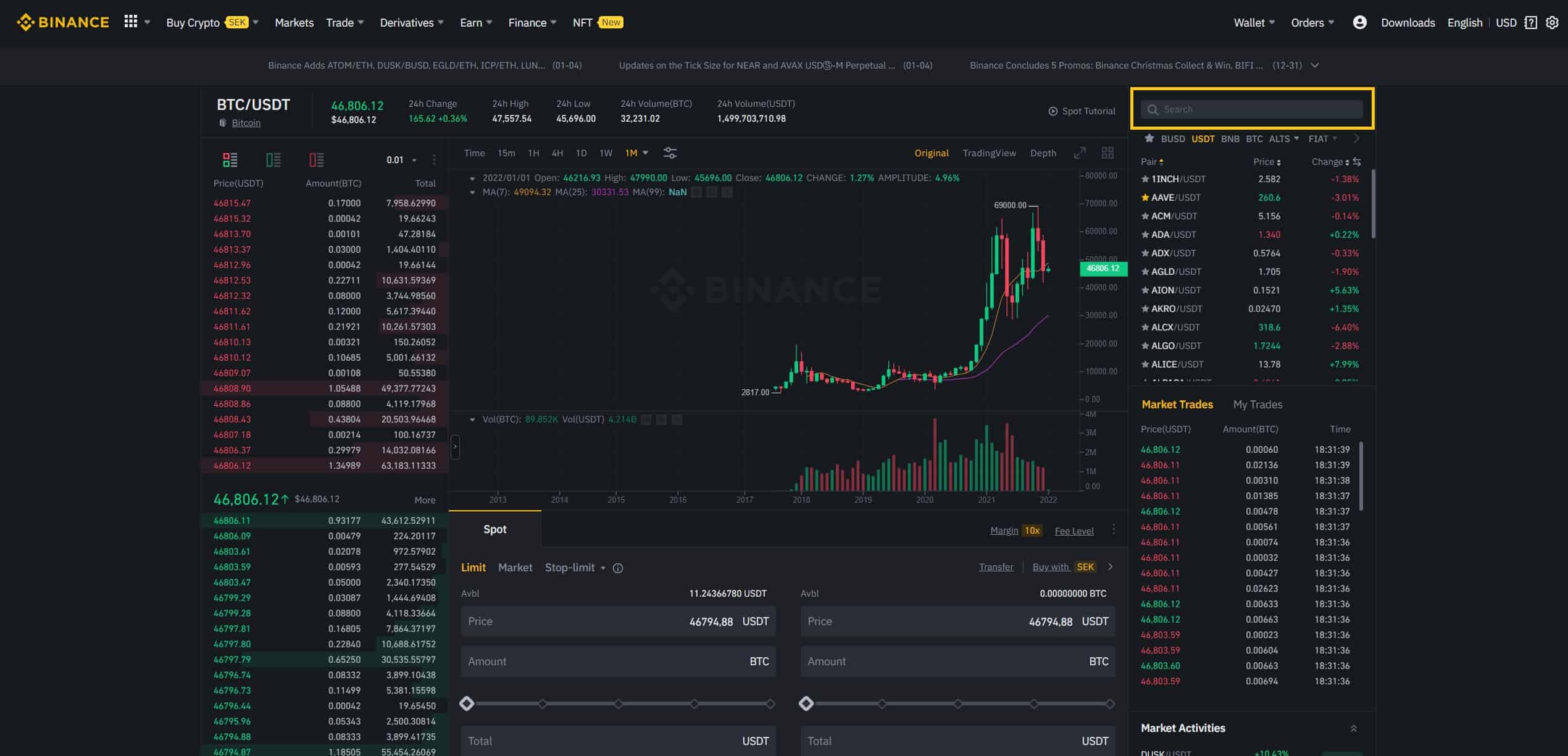

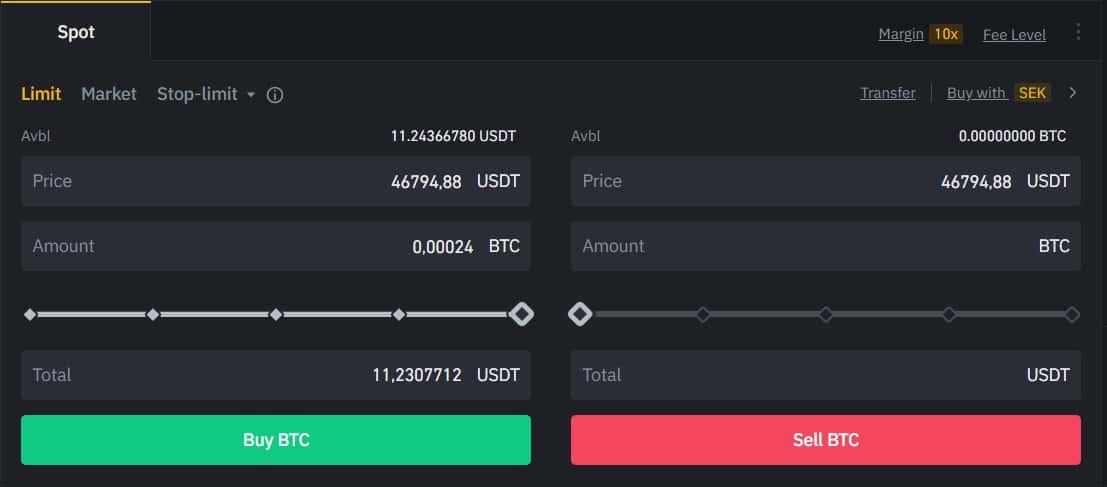

How to Conduct Spot Trading on Binance

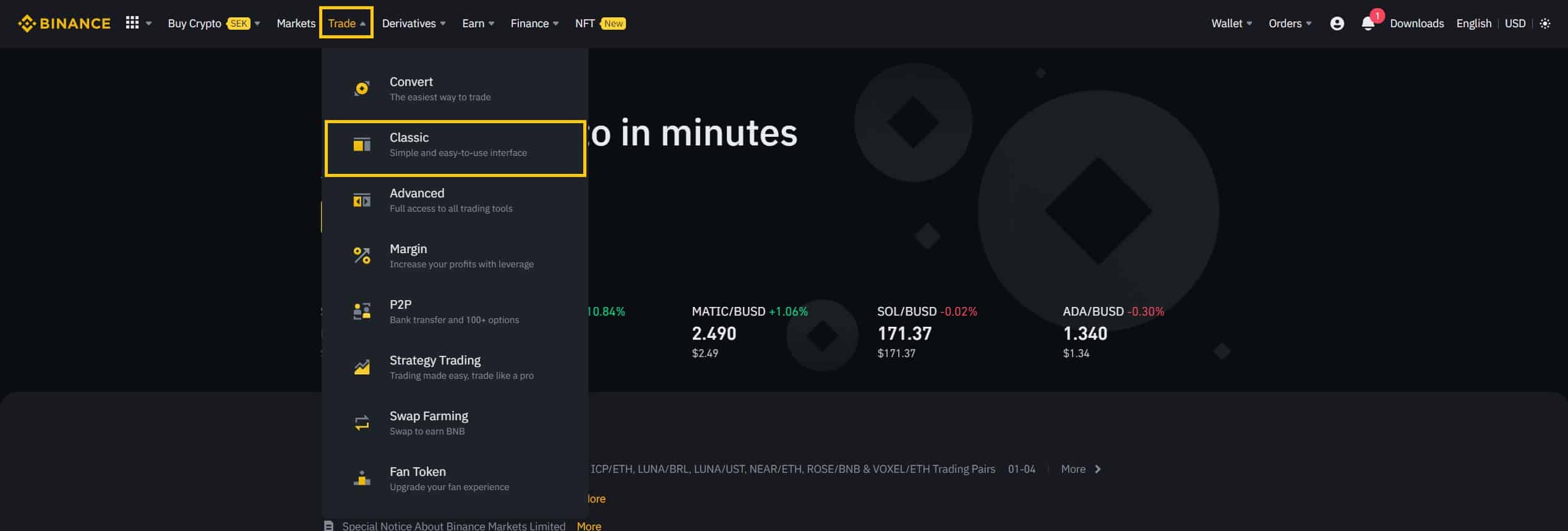

Step 1: Log in to your Binance account.

Click on “Classic” under “Trade” on the top navigation bar.

Step 2: Search and enter the cryptocurrency you want to trade.

Step 3: Set buying/selling prices and buying/selling amount (or exchange total). Then click on “Buy”/”Sell”.

(Note: The percentages under the “Amount” box refer to percentages of the total account balance.)

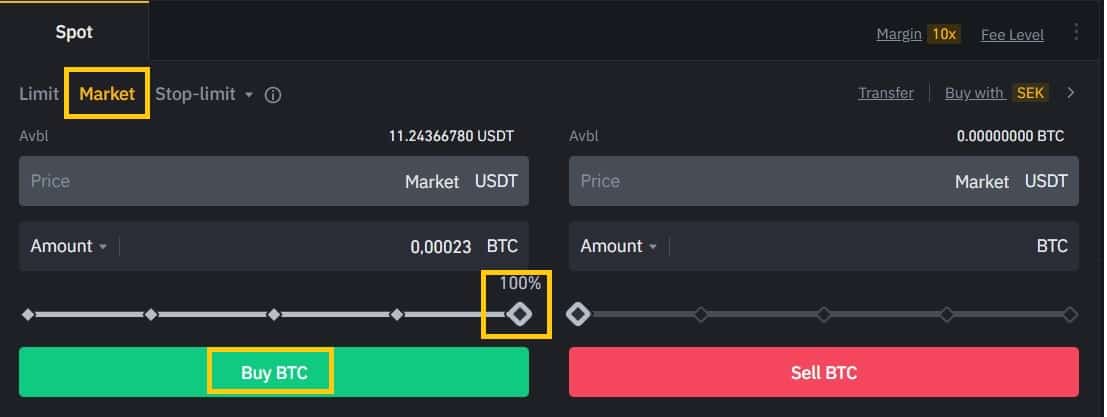

Step 4: If you don’t want to set a manual price, you can place a “Market Order” to set the buying/selling price automatically.

Hide Detailed Instructions

For more in-depth instructions, our ‘Absolute Beginner’s Guide To Cryptocurrency Investing‘ will take you through the process step-by step. In addition to providing instructions for sending and receiving your cryptocurrency.

And if you’re completely new to crypto our beginner, intermediate and advanced level articles will get you up to speed with everything you need to know about the cryptocurrency space starting out.

What is XRP (XRP)?

To begin, it is essential to have a solid understanding of the distinctions that exist between XRP, Ripple, and RippleNet. XRP is the currency that is used on a digital payment platform known as RippleNet. RippleNet is built atop a distributed ledger database known as XRP Ledger. XRP is the name of the currency. The XRP Ledger, on the other hand, is not based on blockchain technology but rather on the distributed ledger database that was discussed earlier. This is in contrast to RippleNet, which is managed by a company also called Ripple.

The goal of the RippleNet payment platform, which is a real-time gross settlement (RTGS) system, is to make it possible for people all over the world to make instant monetary transactions. Even though XRP is the native cryptocurrency of the XRP Ledger, you are free to use any currency you like when conducting transactions on the platform.

Although Ryan Fugger was the one who initially proposed the concept of the Ripple payment platform in 2004, it wasn’t until Jed McCaleb and Chris Larson took control of the project in 2012 that Ripple actually began to be developed (at the time, it was also called OpenCoin).

David Schwartz, Jed McCaleb, and Arthur Britto are the three engineers who initiated the process of developing the XRP Ledger in 2011.

They were intrigued by Bitcoin, so they decided to try their hand at developing an improved version of the cryptocurrency by addressing some of its shortcomings. Their end goal was to produce a digital asset that was more stable and was designed with the sole purpose of facilitating financial transactions.

The XRP Ledger was first introduced to the public in June of 2012. Chris Larsen joined them not long after that, and not long after that, in September of 2012, the three of them established the company OpenCoin (now named Ripple).

The eighty billion XRP that initially belonged to the XRP Ledger were donated to the company by its creators. Since then, Ripple has put the remainder of its XRP into escrow and sold some of its XRP.

The global XRP Community is responsible for the upkeep of the RippleNet ledger, of which Ripple, the company, is an active participant. As opposed to proof-of-work mining like Bitcoin uses, the XRP Ledger processes transactions approximately every 3-5 seconds, or whenever independent validator nodes come to a consensus on both the order and validity of XRP transactions (BTC). Anyone has the potential to become a Ripple validator, and the list of validators currently includes Ripple itself in addition to universities, financial institutions, and other entities.

The XRP Ledger (XRPL)

The XRPL works as a distributed economic system that not only stores all the accounting information of the network participants but also provides exchange services across multiple currency pairs. Ripple presents the XRPL as an open-source distributed ledger that allows for real-time financial transactions. These transactions are secured and verified by the participants of the network through a consensus mechanism.

The XRPL is managed by a network of independent validating nodes that constantly compare their transaction records. Anyone is able to not only set up and run a Ripple validator node but also to choose which nodes to trust as validators. However, Ripple recommends its clients to use a list of identified, trusted participants to validate their transactions. This list is known as the Unique Node List (UNL).

The UNL nodes exchange transaction data between each other until all of them agree on the current state of the ledger. In other words, transactions that are agreed upon by a supermajority of UNL nodes are considered valid and the consensus is achieved when all these nodes apply the same set of transactions to the ledger.

According to Ripple’s official website, Ripple is a privately held company that founded the development of the XRPL as an open-source distributed ledger. This means that anyone can contribute to the code and that the XRPL is able to continue even if the company ceases to exist.

RippleNet

RippleNet, in contrast to XRPL, is owned and operated solely by the Ripple company. It functions as a payment and exchange network and was built on top of the XRPL protocol.

RippleNet currently provides a three-product suite that is intended to serve as a payment solution system for financial institutions such as banks and other similar organizations. xRapid, xCurrent, and xVia are the three primary products that RippleNet offers at this time.

xRapid

In a nutshell, xRapid is a solution for on-demand liquidity that makes use of XRP as a global bridge currency between a number of different fiat currencies. When compared to other transaction methods, XRP and xRapid’s use of the XRP Ledger results in significantly reduced transaction fees and significantly reduced confirmation times.

Let’s take a simple example. Bob, who lives in Australia, has decided to send $100 to his friend Alice, who lives in India. Bob sends the funds through an organization known as FIN, which is a financial institution. FIN makes use of the xRapid solution in order to establish a connection with asset exchanges in both the country from which the transaction originated and the country to which it was ultimately headed. Because of this, the company is able to convert Bob’s $100 into XRP, which provides the necessary liquidity for the final payment to be processed. Alice is able to take the money out of the asset exchange in India because the XRP is converted to Indian Rupees in a matter of seconds. The asset exchange is located in India.

xCurrent

xCurrent is a solution that was developed with the intention of providing instant settlement and tracking of international payments made between members of RippleNet. The xCurrent solution, in contrast to xRapid, is not based on the XRP Ledger and does not use the XRP cryptocurrency in any of its default configurations. The Interledger Protocol (ILP), which was designed by Ripple as a protocol for connecting various ledgers or payment networks, serves as the foundation upon which the xCurrent was constructed.

The four basic components of xCurrent are:

- Messenger – The xCurrent messenger provides peer-to-peer communication between connected RippleNet financial institutions. It is used to exchange information regarding risk and compliance, fees, FX rates, payment details and expected time of funds delivery.

- Validator – Validator is used to cryptographically confirm the success or failure of a transaction and also to coordinate moving of funds across the Interledger. Financial institutions can run their own validator or can rely on a third-party validator.

- ILP Ledger – The Interledger Protocol is implemented into existing banking ledgers, which creates the ILP Ledger. The ILP Ledger functions as a sub-ledger and is used to track credits, debits, and liquidity across transacting parties. Funds are settled atomically, meaning that they are either settled instantly or not at all.

- FX Ticker – FX ticker is used to define exchange rates between transacting parties. It tracks the current state of each configured ILP Ledger.

Although xCurrent is primarily designed for fiat currencies, it also supports cryptocurrency transactions.

xVia

xVia is a standardized API-based interface that enables banks and other financial service providers to interact within a single framework without having to rely on multiple payment network integrations. This is made possible by xVia’s ability to eliminate the need for multiple payment network integrations. In addition to enabling banks to attach invoices and other information to their transactions, xVia gives financial institutions the ability to generate payments by means of other banking partners that are integrated with RippleNet.

XRP Wallets

20 XRP is required to activate a new address.

This requirement can later be changed by the validators through the voting process. The reserve requirement protects the XRP Ledger from spam or malicious usage.

When you are sending XRP to an exchange, destination tag is very important. Destination tag is not needed when you transfer XRP to your own wallet.

How to Mine XRP?

XRP, in contrast to other cryptocurrencies, cannot be mined, and there will never be any additional tokens created. This is due to the fact that the company’s founders distributed the entire available supply of 100 billion XRP tokens upon the launch of the ledger in 2012.

Mining is the process that the majority of blockchain-based cryptocurrencies use as their distributed verification system. Additionally, it provides the mechanism through which additional currency can be introduced into a system that uses cryptocurrency. This is typically done as a reward for the efforts that verifiers put in to maintain the network. Bitcoin, for example, has a maximum supply restriction of 21 million tokens, which are gradually distributed as more and more transactions are validated. This happens because Bitcoin is a decentralized digital currency.

On the other hand, XRP was “pre-mined,” which means that the XRP Ledger created 100 billion units, which are then periodically issued to the general public. This is how XRP differs from other cryptocurrencies.

Because Ripple owns a portion of the XRP that is currently in circulation, the company has a financial incentive to support the continued existence of the cryptocurrency. Another portion of XRPs is set aside in a reserve for eventual distribution on the open market through sales.

Since relative scarcity is one of the factors that goes into determining the value of any currency, this has understandably given rise to concerns that a large amount of XRP could be released simultaneously, thereby undermining the value of other XRP that is currently in circulation.

“The organization has implemented a number of mechanisms (trust, release predictability, etc.) to reduce uncertainty,” Tim Enneking, chief executive officer of Digital Capital Management, explains. “The organization has implemented a number of mechanisms.” This disparity between the mine and the pre-mining may also be a factor in its fight with the United States Securities and Exchange Commission in the year 2020. (SEC).

As of the month of March 2022, the escrow account held a total of 46,100,000,000 XRP tokens. On its website, Ripple provides information regarding the total amount of XRP that it holds as well as the amount that it has distributed.

What is the XRP Token?

XRP is the native cryptocurrency of the XRP Ledger, a public blockchain that uses the federated consensus algorithm and that differs from the proof-of-work and proof-of-stake mechanisms, as participants in the Ripple network are known and trusted by each other, based mainly on reputation. In March 2022, there were about 150 validators on the network and approximately 36 on the default unique node list (UNL).

A unique node list is a list of trusted nodes within a network. Ripple, the XRP Ledger Foundation, and Coil (a Ripple-funded organization) maintain lists of preferred validators based on criteria such as past performance, verified identity, and safe IT procedures. These lists are the default unique node lists (dUNL). As more validators join the network, participants have more flexibility to choose who they add to their UNL, although that provides a level of risk because not all validators carry the same level of trust and performance.

As more validators join the network, participants have more flexibility to choose who they add to their UNL, although that provides a level of risk because not all validators carry the same level of trust and performance.

XRP can be used to provide on-demand liquidity or function as a bridge currency to settle cross-border transactions in under five seconds and for a fraction of the cost of conventional transfers.

To cover the cost of transaction fees, a small amount of XRP – about 10 drops, which are units of XRP worth 0.00001 XRP each – is destroyed. Despite the fact that the cost of transferring XRP fluctuates based on network activity, all associated transactions are processed and settled on the XRP Ledger.

Understanding the difference between Ripple and XRP

The terms “Ripple” and “XRP” are frequently used interchangeably throughout articles. But are they exactly the same? Alternately, what does XRP stand for? And how does it relate to the Ripple cryptocurrency?

Ripple is a for-profit corporation that promotes and develops XRP, its underlying software (the XRP Ledger), as well as several transaction-focused projects. XRP is the name of the cryptocurrency that Ripple develops and promotes. The company is adamant that the two organizations operate independently from one another.

When compared to other digital assets, Ripple’s XRP is touted as being “faster,” “less expensive,” and “more scalable” on the company’s website. It does this by utilizing the XRP Ledger, with the goal of “driving innovative technology throughout the payments industry.” The following is how the company characterizes their involvement with XRP:

“Ripple’s primary focus is on the development of technology that will aid in the discovery of new applications for XRP and revolutionize payments on a global scale. Additionally, third parties are conducting research into a wider variety of applications for XRP.”

Ripple was initially launched in September 2012 under the name OpenCoin, exactly one year after the initial stages of the XRP Ledger development were carried out. OpenCoin officially changed its name to Ripple Labs in 2013, and Ripple was officially adopted as the company’s moniker in 2015. Before it was rebranded as the XRP Ledger, the Ripple Open Payments System and the Ripple Consensus Ledger were both previous names for the distributed ledger.

After the XRP Ledger was fully operational, the people behind it came to the conclusion that they should give 80 billion tokens to a private company so that it could work with the cryptocurrency’s community to provide support. Ripple asserts that it made a conscious decision to sell XRP in order to “incentivize market maker action to improve XRP liquidity and strengthen the general health of XRP markets.”

Initially, the ticker symbol for “ripples” or “Ripple credits” was XRP; however, over the course of time, these terms were phased out in favor of XRP in order to reduce the likelihood of confusion.

XRP development updates in 2023

In 2023, XRP has experienced a number of significant developments:

-

Global Regulatory Developments: Ripple, the company behind XRP, has been engaging with global regulatory environments. In Asia, Ripple received a major payments institution license from Singapore’s MAS, indicating a positive regulatory stance towards Ripple and XRP. This contrasts with the ongoing lack of clarity in U.S. crypto regulations. Additionally, European and G20 leaders have been pushing for more comprehensive frameworks for crypto regulation.

-

SEC Lawsuit Against Ripple: One of the major events for Ripple in 2023 was the ongoing lawsuit with the SEC. In March, the court issued a decision regarding the admissibility of certain expert testimonies from both the SEC and Ripple. Ripple expects a decision on the summary judgment within the year, although the exact timing is up to the court.

-

On-chain Activity and Market Performance: The XRP Ledger saw substantial activity, with notable increases in transactions and volumes traded on its decentralized exchange (DEX). There has been strong activity in NFTs on the XRPL, reflecting the growing use of the ledger beyond its original remit as a payment and settlement system.

-

Developments in the XRP Ledger: Significant features were proposed for the XRP Ledger, aimed at enhancing trust and safety for issued assets and enabling developers to create innovative applications. Notable proposals included the XLS-30d AMM for a non-custodial automated market maker and XLS-38d for enabling cross-chain bridges.

-

Partnerships and Integrations: Ripple continued to expand its partnerships and integrations. Notably, Bitso, a leading crypto exchange in Latin America, announced significant transaction volumes through its partnership with Ripple, using Ripple’s On-Demand Liquidity (ODL) product for US-Mexico transactions.

These developments highlight Ripple’s and XRP’s continued progress and adaptation in a rapidly evolving digital finance landscape.

Official website: https://xrpl.org/

Best cryptocurrency wallet for XRP (XRP)

There are plenty of different crypto wallets available. The best one for you depends on your general trading habits and which provides the most security in your situation. There are two main types of wallets: hot storage wallets (digital) and cold storage or hardware wallets (physical). Both have their pros and cons, and there is not necessarily a right or wrong answer when it comes to figuring out which crypto wallet is best for you.

HOW DO I DECIDE WHICH cryptocurrency WALLET TO USE for XRP (XRP)?

Deciding which type of wallet to use depends on a variety of factors, including:

- How often you trade. In general, hot wallets are better for more active cryptocurrency traders. Quick login ability means you are only a few clicks and taps away from buying and selling crypto. Cold wallets are better suited for those looking to make less frequent trades.

- What you want to trade. As mentioned earlier, not all wallets support all types of cryptocurrencies. However, some of the best crypto wallets have the power to trade hundreds of different currencies, providing more of a one-size-fits-all experience.

- Your peace of mind. For those worried about hacking, having a physical cold wallet stored in a safe deposit box at the bank or somewhere at home, provides the safest, most secure option. Others might be confident in their ability to keep their hot wallets secure.

- How much it costs. It is important to investigate the costs associated with each wallet. Many hot wallets will be free to set up. Meanwhile, cold wallets, like any piece of hardware, will cost money to purchase.

- What it can do. While the basics of each cryptocurrency wallet are the same, additional features can help set them apart. This is especially true of hot wallets, many of which come with advanced reporting features, insights into the crypto market, the ability to convert cryptocurrencies and more. Security features can also be a good differentiator.

For a more in-depth overview of cryptocurrency wallets visit our “Cryptocurrency Wallets Explained” guide.

If you’re going to be dealing in larger volumes of crypto, investing in cold storage might prove advantageous.

Most widespead examples of this being the Ledger Nano and the Trezor.

Ledger manufactures cold storage wallets designed for users who want increased security. Their wallets are a physical device that connects to your computer. Only when the device is connected can you send your cryptocurrency from it. Ledger offers a variety of products, such as the Ledger Nano S and the Ledger Nano X (a bluetooth connected hardware wallet).

Trezor is a pioneering hardware wallet company. The combination of world-class security with an intuitive interface and compatibility with other desktop wallets, makes it ideal for beginners and experts alike. The company has gained a lot of the Bitcoin community’s respect over the years. Trezor offers two main models – The Trezor One and Trezor Model T (which has a built in touch screen).

XRP (XRP) Price & Charts

- Market Capitalization And Daily Trading Volume

- Current Market Price Of Every Cryptocurrency Relative To USD (And Some Local Currencies)

- Circulating And Total Supply

- Historical Charts With Prices Relative To USD, Bitcoin (BTC), And Ethereum (ETH).