What is a Forex Broker?

A company that offers financial services and gives traders access to a platform where they can buy and sell different currencies is known as a forex broker. Forex is an abbreviation that stands for “foreign exchange.” On the foreign exchange market, every transaction always takes place between two currencies that are different from one another.

There are a few different names that can be given to a forex broker, including retail forex broker and currency trading broker.

Through forex (foreign exchange) brokerage accounts, you have the opportunity to place bets on the currencies of the world by buying or selling currency pairs that react to economic developments that occur in different parts of the world. The foreign exchange market is open around the clock, starting on Sunday afternoon in the United States and continuing until after stock traders have finished their work on Friday afternoon. The volume of currency trading is substantial, with transactions exceeding $6 trillion per day as of 2022; this is a greater amount than the total value of stocks or bonds traded on the global market.

Forex traders take long and short sale positions on currency pairs, which calculate the exchange rate between two forms of legal tender, the euro (EUR) and the U.S. dollar. The exchange rate between these two currencies is known as the “spot rate” (USD). A long position initiates a trade that generates profits if the exchange rate moves in the buyer’s favor, while a short sale generates profits if the rate moves in the seller’s favor. To open a short sale position, a trader does not need to borrow money or securities from a broker, as is the case when trading stocks; however, she may be required to pay a rollover fee.

Brokers are responsible for managing fees, which may include commissions, access to expert advice, and withdrawal requests. Additionally, your money is kept in an account whose value is subject to nightly fluctuations in response to daily profits and losses. Because some brokers conceal their fee schedules within legal jargon that is buried deep within the fine print of their websites, prospective customers need to do their research before opening an account with that broker. An in-depth look at how to choose a forex broker is provided in this article for the purpose of assisting you in avoiding unwelcome surprises.

How to Choose a Forex Broker

Before you can choose a forex broker, you need to first determine the type of investor you are and the objectives you wish to achieve by trading foreign currencies.

Every broker that provides access to forex investments comes with a set of benefits and drawbacks. Regulation, the level of security provided by these companies, and the fees associated with transaction are some of the most important factors to take into consideration. Different brokers offer a wide variety of different security features. Certain brokers have built-in security features, such as two-step authentication, to deter hackers from accessing their customers’ accounts.

A significant number of forex brokers are regulated. The National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC) regulate forex brokers in the United States. Other countries, including France, Germany, Switzerland, Austria, Canada, and the United Kingdom, also have their own regulatory bodies for forex brokers. Traders should exercise caution when dealing with unregulated companies because not all brokers are subject to regulation.

There are also differences between brokers in terms of the platforms they offer, as well as the required account minimums and transaction fees. You should probably make a plan for your investment life and create a budget before you start using a trading platform. Determine the amount that you would like to invest, the amount that you are willing to pay in fees, and the objectives that you wish to achieve. When deciding which platform is best for you, there are many aspects you should take into consideration. Before getting involved, you should make sure that you have considered everything that is relevant.

When looking for a trustworthy forex broker, make sure you take your time to ensure that both your money and your trades will be handled in the appropriate manner. The National Futures Association (NFA), a self-regulatory government body whose purpose is to provide transparency, requires registration from all forex brokers operating in the United States. Visit the website of the NFA to check the broker’s compliance with the regulations and to look for any complaints or disciplinary actions that might have an impact on your choice. You can also take a look at the recommendations in this guide, highlighting some great Forex Brokers in the UK.

Tips for Forex Trading Beginners

You should become familiar with the basics before beginning anything new. Let’s take a look at some trading advice that each and every trader ought to think about before trading currency pairs.

- Know the Markets

It is impossible to overstate how important it is to educate yourself on the foreign exchange market. Spend some time learning about different currency pairs and the factors that influence them before you risk any of your own money. This is a time commitment that could end up saving you a significant amount of cash.

- Make a Plan and Stick to It

The development of a trading strategy is one of the most important aspects of profitable trading. Your profit goals, your level of risk tolerance, the methodology you will use, and the evaluation criteria should all be included. Once you have a plan in place, you need to check that every potential trade you make fits within the boundaries of your strategy. Keep in mind that you are probably at your most rational before placing a trade, and at your most irrational after the trade has been placed.

- Practice

Utilize a risk-free practice account provided by FOREX.com to put your trading strategy to the test in real-world market conditions. You will have the opportunity to experience what it is like to trade currency pairs while simultaneously putting your trading plan through its paces without having to risk any of your own money.

- Forecast the “Weather Conditions” of the Market

Technical traders prefer to forecast market movements using technical analysis tools such as Fibonacci retracements and other indicators, whereas fundamental traders prefer to trade based on news and other financial and political data. The majority of traders employ a strategy that combines the two. No matter what your trading approach is, it is imperative that you make use of the tools available to you in order to identify potentially profitable trading opportunities in fluid markets.

- Know Your Limits

Know where your boundaries lie; this is a basic yet essential step for your continued success. This includes being aware of how much of your capital you are willing to put at risk on each trade, adjusting your leverage ratio so that it suits your requirements, and ensuring that you never put up more money than you can afford to lose.

Understanding Forex Currency Pairs

It is important to have a solid understanding of the fundamentals of foreign exchange trading before opening an account. These fundamentals include everything from currency pairs and pips to profits and more.

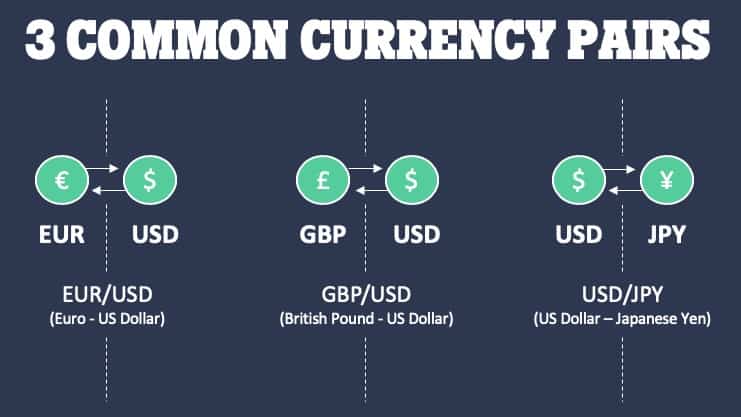

The value of two different currencies can be compared using a ratio called a currency pair. The initial unit of currency is referred to as the base, and its value is always one. The second currency is known as the quote currency, and it displays the amount that one can be exchanged for in terms of the first currency. If you see the quote “EUR/USD 1.23000,” it indicates that one Euro is equivalent to 1.23 dollars.

A flipped-over version of each ratio is also available, which results in the creation of a new currency pair that moves in the opposite direction. The ratios are quoted using two to five decimals, and both versions are available. To continue with our previous explanation, the EUR/USD pair indicates the value of the euro in relation to the dollar in the United States, whereas the USD/EUR pair indicates the value of the dollar in relation to the euro.

Historically, traders in various countries took long and short positions with their local currency at the bottom (the quote currency). However, this practice started to shift after the popularity of the foreign exchange market skyrocketed at the beginning of this decade. At this time, the majority of market participants from all over the world trade the currency pair that has the highest volume. The most popular version is also likely to have a smaller bid/ask spread, which results in reduced costs associated with trading.

Forex Trading Platforms

The pricing of currency pairs is done on the interbank market, which is a communications system utilized by large banks and other financial institutions. However, the interbank market does not have a central exchange like the NASDAQ or the New York Stock Exchange. Forex brokers take their cues from the transactions that take place around them, but they are not required to offer their customers the best interbank bid or ask. Instead, they may purposefully display wider spreads at less favorable prices, which adds to their profits when they complete trades through the system.

By reviewing the trade execution procedures on the broker’s website, prospective customers have the ability to check for any potential conflicts of interest. Find out specifically if the broker has a dealing desk that can make a market by taking the opposite side of a client trade if you want to work with them. A broker that is more trustworthy will post quotes directly from the interbank system by way of a wholesale liquidity provider or electronic communications network (ECN), which is the organization that manages the actual buy and sell transactions. These are independent businesses that have established strong ties to the professional infrastructure.

Forex traders open and close positions using the trading software provided by their brokers. This software should include a combination of web-based, stand-alone, and mobile trading platforms. In recent years, MetaTrader has established itself as the industry standard for stand-alone software. It offers a robust feature set that includes real-time quotes and price charts, as well as news, research, and watchlists that can be customized to meet individual needs. MetaQuotes Software Corporation, which has its headquarters in Cyprus, is the company that was responsible for developing the MetaTrader platform.

Web-based trading offers an alternative to the use of standalone software but typically consists of fewer features. As a result, account holders are required to consult additional resources in order to finish developing their trading strategies. Mobile apps offer the greatest convenience but the fewest bells and whistles in a streamlined design that typically allows trading with one or two clicks. It is highly recommended that you make use of the full-featured stand-alone software as much as possible, and that you reserve the mobile experience for when you are away from your trading desk.

The majority of forex brokers offer demo accounts, which allow prospective clients to test out the forex broker’s stand-alone, web interface, and mobile platforms by trading play money in forex pairs. Demo accounts are offered by virtually all forex brokers. Because this software displays the same quotes, charts, and watchlists as the actual system, it is an extremely helpful resource for evaluating the accuracy of the broker’s bid and ask pricing. If the broker doesn’t provide a demo account, you should be wary of them because it’s possible that they’re using an inferior or outmoded platform.

Summary

When several of these accounts are compared side by side with real-time quotes from a large financial website, it is easy to determine which foreign exchange brokers provide the most advantageous bid and ask prices when the market is operating normally. If it is at all possible, you should take a second look immediately after a rate decision made by the Federal Reserve or other events that move the market to see how the currency pairs move when conditions are highly volatile.