What Is Bitcoin?

If you’re looking to purchase Bitcoin we’ve covered this process step-by-step in our “How To Buy Bitcoin” guide.

Chapter 1

Introduction To Bitcoin

What is Bitcoin?

Bitcoin, the first cryptocurrency, was introduced in 2008. (and launched in 2009). It allows users to send and receive digital money (bitcoins, with a lower-case b, or BTC). What makes it so appealing is that it cannot be censored, monies can only be spent once, and transactions can be conducted at any time and from any location.

What makes Bitcoin valuable?

Bitcoin is decentralized, resistant to censorship, secure, and borderless.

Because of this, it is tempting for use cases such as overseas remittances and payments when users do not wish to divulge their names (as they would with a debit or credit card).

Many people do not use their bitcoins, preferring to save them for the long term. Due to the limited amount of coins accessible, Bitcoin has been dubbed “digital gold.” Some investors consider Bitcoin to be a store of value. It has been compared to valuable metals such as gold and silver because to its scarcity and difficulty in production.

Holders think that these characteristics, together with worldwide availability and high liquidity, make it a perfect medium for long-term wealth storage. They think that the value of Bitcoin will rise over time.

One of the most difficult challenges for newbies to cryptocurrencies is understanding how and why a cryptocurrency like Bitcoin (BTC) might have value. The token is digital, with no real object to back it up, and the notion of mining may be somewhat perplexing. Mining, in a sense, produces new bitcoins out of thin air. In reality, however, effective mining requires a significant investment. But how does all of this add value to BTC?

Consider the money we all use on a daily basis. Our banknotes are no longer backed by gold or assets. Because of fractional reserve banking, the money we borrow frequently exists simply as digits on a screen. Through economic mechanics, governments and central banks such as the Federal Reserve may generate new money and increase its supply.

Despite significant changes, BTC, as a digital form of money, has certain parallels with the fiat money we are all familiar with. So, before we go into the cryptocurrency ecosystem, let’s talk about the worth of fiat money.

Why does money have value?

In short, what gives money value is trust. Money is essentially an instrument for exchanging value. As long as the local community accepts it as payment for goods and services, any item may be used as money. From pebbles to seashells, various types of things were utilized as money in the early days of human civilisation.

What is fiat money?

Fiat money is the one issued and officialized by a government. Today, our society trades value through paper notes, coins, and digital numbers on our bank accounts (which also define how much credit or debt we have).

People used to be able to go to the bank and exchange their paper money for gold or other precious metals. Back then, this method insured that the value of currencies like the US dollar was linked to an equal quantity of gold. However, the majority of countries abandoned the gold standard, and it is no longer the foundation of our monetary systems.

We now utilize fiat money with no backing after severing a currency’s connections to gold. This decoupling offered governments and central banks greater leeway in implementing monetary policies and influencing the money supply.

Some of the main characteristics of fiat are:

- It’s issued by a central authority or government.

- It has no inherent value. It’s not backed by gold nor any other commodity.

- It has an unlimited potential supply.

Why does fiat have value?

Why does crypto have value?

Cryptocurrencies have certain characteristics in common with our traditional concept of money, but they also have significant distinctions. Although certain cryptocurrencies, such as PAXG, are linked to commodities such as gold, the majority of cryptocurrencies have no underlying asset. Instead, trust plays an important part in the value of a cryptocurrency once again. People, for example, find value in investing in Bitcoin because they know that others trust Bitcoin and accept it as a payment system and means of exchange.

Utility is also a significant consideration for several cryptocurrencies. A utility token may be required to access specific services or sites. As a result, a high-demand service will contribute value to its utility coin. Because no two cryptocurrencies are the identical, their value is determined by the characteristics of each coin, token, or project.

When it comes to Bitcoin, we can boil it down to six characteristics, which we’ll go over in more depth later: utility, decentralization, distribution, trust systems, scarcity, and security.

What is intrinsic value?

Much of the debate about Bitcoin’s worth is on whether it has any inherent value. But what exactly does this mean? When we look at a commodity like oil, we can see that it has inherent value in the production of energy, polymers, and other products.

Stocks have intrinsic worth as well since they represent stock in a firm that produces products or services. In reality, many investors use fundamental analysis to determine an asset’s inherent worth. Fiat money, on the other hand, has no inherent value since it is merely a piece of paper. As we’ve seen, its worth stems from trust.

From commodities to equities, the conventional financial system offers several investment possibilities with inherent value. Forex markets are an exception since they deal with fiat currencies, and traders often benefit from short or mid-term exchange rate fluctuations. What about Bitcoin, though?

Bitcoin’s value in utility

One of the most significant advantages of Bitcoin is its capacity to instantly move enormous sums of wealth throughout the globe without the need of middlemen. While fees might make sending a modest amount of BTC quite costly, it is also feasible to transmit millions of dollars affordably. A Bitcoin transaction worth around $45,000,000 (USD) is shown here, with a charge of slightly under $50. (as of June 2021).

While Bitcoin is not the only network that allows for this, it is the biggest, safest, and most popular. As a layer two application, the Lightning Network enables tiny transactions. However, regardless of the quantity, the ability to conduct borderless transactions is unquestionably beneficial.

Bitcoin’s value in decentralization

The decentralization of Bitcoin makes it an extremely resilient and secure mechanism. No one node in the network can make choices on behalf of everyone else. Transaction validation and protocol upgrades need group agreement in order to safeguard Bitcoin from mismanagement and misuse.

Bitcoin’s value in distribution

The Bitcoin network increases its overall security by enabling as many users as possible to join. The greater the number of nodes linked to Bitcoin’s distributed network, the greater its value. There is no need to depend on a single source of truth when sharing the ledger of transactions among several users.

We may have various versions of the truth that are difficult to check if we do not distribute. Consider an email-sent document that a team is working on. As the team circulates the document, it generates several copies with varying stages that might be difficult to follow.

A centralized database is also more vulnerable to cyber-attacks and disruptions than a distributed database. It’s fairly unusual to experience problems utilizing a credit card due to a server problem. A cloud-based system, like as Bitcoin’s, is maintained by thousands of users worldwide, making it far more efficient and safe.

Bitcoin’s value in systems of trust

Bitcoin’s decentralization is a significant network advantage, but it still requires some protection. It is always difficult to get people to collaborate on any vast, decentralized network. Satoshi Nakamoto created a Proof of Work consensus method that rewards good conduct to overcome this dilemma, known as the Byzantine General’s Problem.

Trust is a necessary component of every desirable goods or commodity. Loss of faith in a central bank is devastating for a country’s currency. Similarly, in order to utilize international money transfers, we must have faith in the financial institutions involved. Bitcoin’s operations are more trustworthy than other systems and assets we utilize on a regular basis.

Bitcoin users, on the other hand, do not need to trust one another. They simply need to trust Bitcoin’s technology, which has shown to be very dependable and secure, and the source code is available for public inspection. Proof of Work is an open system that anybody may use to verify and validate oneself. It’s simple to understand the usefulness of creating virtually always error-free agreement.

Bitcoin’s value in scarcity

Bitcoin should be deflationary after we have mined all of the BTC. As users lose or burn coins, the supply decreases, causing the price to rise. As a result, holders place a high value on Bitcoin’s scarcity.

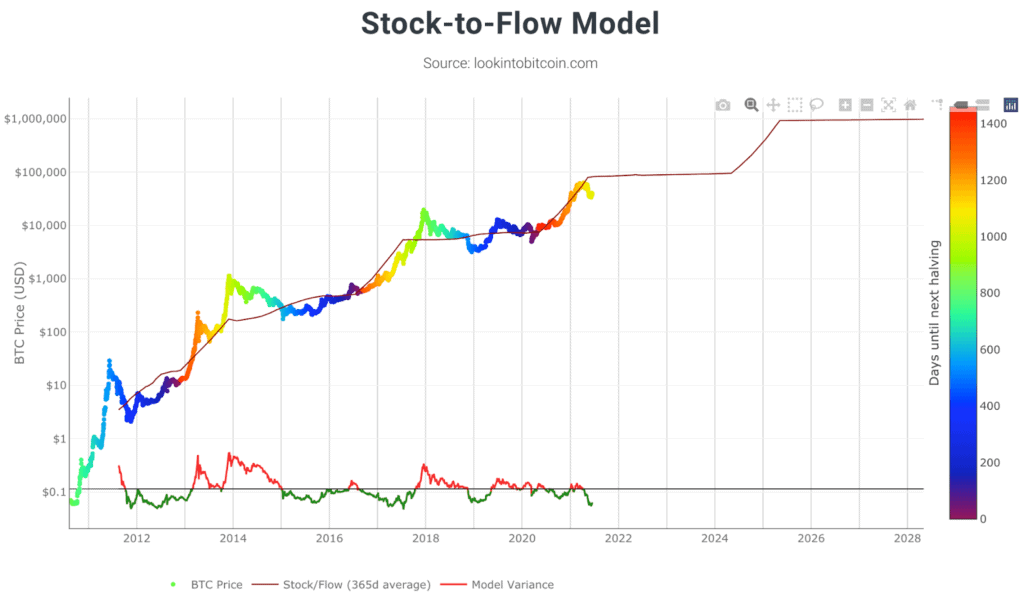

The scarcity of Bitcoin has also given rise to the famous Stock to Flow paradigm. Based on Bitcoin mining per year and the entire stock, the model tries to forecast BTC’s future worth. When back-tested, it properly mimics the price curve witnessed so far. The major driving factor in Bitcoin’s price, according to this hypothesis, is scarcity. Holders see value in utilizing Bitcoin as a store of wealth because of the potential link between price and scarcity. We’ll go over this notion in further detail towards the conclusion of the post.

Bitcoin’s value in security

There aren’t many other options that give as much security as Bitcoin in terms of keeping your investment assets secure. Your finances are quite safe if you follow best practices. In wealthy nations, the security provided by banks is often taken for granted. However, for many individuals, financial institutions cannot offer the necessary safety, and storing huge quantities of cash may be very hazardous.

Malicious assaults on the Bitcoin network need more than 51 percent of current mining power, making large-scale coordination very difficult. A successful Bitcoin assault is exceedingly unlikely, and even if it occurs, it will be short-lived.

The only real threats to the storage of your BTC are:

- Fraud and phishing attacks

- Losing your private key

- Storing your BTC in a compromised custodial wallet where you don’t own the private key

Bitcoin as a store of value

- Durability: So long as there are still computers maintaining the network, Bitcoin is 100% durable. BTC cannot be destroyed like physical cash and is, in fact, more durable than fiat currencies and precious metals.

- Portability: As a digital currency, Bitcoin is incredibly portable. All you need is an Internet connection and your private keys to access your BTC holdings from anywhere.

- Divisibility: Each BTC is divisible into 100,000,000 satoshis, allowing users to make transactions of all sizes.

- Fungibility: Each BTC or satoshi is interchangeable with another. This aspect allows the cryptocurrency to be used as an exchange of value with others globally.

- Scarcity: There will only ever be 21,000,000 BTC in existence, and millions are already lost forever. Bitcoin’s supply is much more limited than inflationary fiat currencies, where the supply increases over time.

- Acceptability: There’s been widespread adoption of BTC as a payment method for individuals and companies, and the blockchain industry just continues to grow every day.

If you’re looking to purchase Bitcoin we’ve covered this process step-by-step in our “How To Buy Bitcoin” guide.

There is, unfortunately, no single and neat answer as to why Bitcoin has value. The cryptocurrency has the key aspects of many assets with worth, like precious metals and fiat, but doesn’t fit into an easily identifiable box. It acts like money without government backing and has scarcity like a commodity even though it’s digital.

But, ultimately, Bitcoin runs on a very secure network and the cryptocurrency has a considerable amount of value placed on it by its community, investors, and traders.

If you’d like to view Bitcoins performance compared to various other assets over the past few years including precious metals such as Gold and Silver, public companies such as Apple and Tesla, ETFs (Exchange Traded Funds) such as Select Sector SPDR ETFs and iShares Treasury and Corporate Bond ETFs you can do so at PricedInBitcoin21.

Chapter 2

How Does Bitcoin Work?

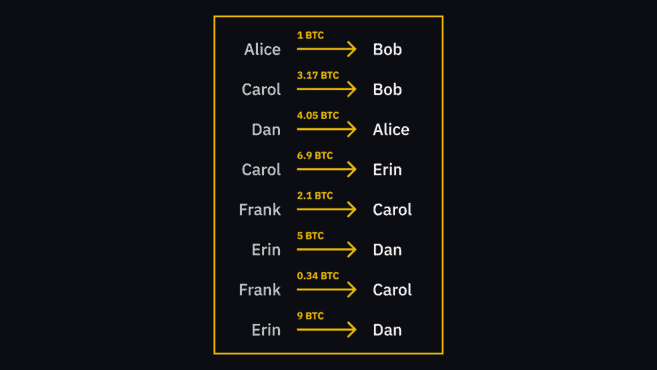

When Alice makes a transaction to Bob, she’s not sending funds in the way you’d expect. It’s not like giving him a $1 note in digital form. It’s more like her writing on a piece of paper (for everyone to see) that she’s giving Bob one dollar. When Bob attempts to transmit those same cash to Carol, she can see from the sheet that Bob has them. But, in the end, Bitcoin functions on a very secure network, and the cryptocurrency is highly valued by its community, investors, and traders.

The sheet is a blockchain, which is a kind of database. Every network member has an identical copy of this on their devices. Participants communicate with one another in order to synchronize fresh information.

When a user makes a payment, it is broadcast immediately to the peer-to-peer network; no centralized bank or organization processes transactions. The Bitcoin blockchain employs a unique method known as mining to add new information. New blocks of transactions are recorded on the blockchain via this procedure.

What is the blockchain?

The blockchain is an append-only ledger, which means that data may only be added to it. It is exceedingly difficult to change or remove information after it has been added. Every succeeding block contains a reference to the preceding block, which is enforced by the blockchain. The pointer is a hash of the preceding block. Hashing is the process of running data through a one-way function to generate a unique “fingerprint” of the input. If the input is even slightly altered, the fingerprint will seem entirely different. Because we link the blocks together, it is impossible for someone to change an old entry without invalidating the blocks that follow. A structure like this is one of the components that makes the blockchain safe.

For more information on blockchains, see What is Blockchain?

Is Bitcoin legal?

In most nations, Bitcoin is completely legal. There are a few exceptions, so be careful to research your jurisdiction’s regulations before investing in cryptocurrencies.

In nations where it is legal, government bodies treat it differently in terms of taxes and compliance. Overall, the regulatory environment is currently very immature and will most certainly evolve significantly in the future years.

What if I lose my bitcoins?

Can I revert Bitcoin transactions?

How can I store my bitcoin?

There are many options to store coins, each with their own strengths and weaknesses.

Storing your bitcoin on an exchange

Storing your coins on Binance allows you to easily access them for the purposes of trading or lending.

Storing your coins in a bitcoin wallet

Non-custodial alternatives, on the other hand, put the user in charge of their finances. A wallet is used to hold monies while using such a system. A wallet does not physically store your currencies; rather, it stores cryptographic keys that unlock them on the blockchain. On this front, you have two primary options:

Hot wallets

Cold wallets

Cryptocurrency wallets that are not exposed to the Internet are known as cold wallets. They’re less prone to attack because there is no online attack vector, but they consequently tend to provide a clunkier user experience. Examples include hardware wallets or paper wallets. Most widespead examples of this being the Ledger Nano and the Trezor.

Chapter 3

A History Of Bitcoin

Who created Bitcoin?

Did Satoshi invent blockchain technology?

Bitcoin essentially integrates many existing technologies that have been around for a while. Bitcoin did not invent the notion of a block chain. The usage of immutable data structures such as this dates back to the early 1990s, when Stuart Haber and W. Scott Stornetta devised a technique for timestamping documents. It used cryptographic methods to safeguard data and prevent it from being tampered with, much to today’s blockchains.

Surprisingly, Satoshi’s white paper never mentions the word “blockchain.”

Digital cash before Bitcoin

Bitcoin wasn’t the first attempt at digital cash, but it is certainly the most successful. Previous schemes paved the way for Satoshi’s invention:

DigiCash

David Chaum, a cryptographer and computer scientist, invented DigiCash in the late 1980s. Based on a study written by Chaum, it was proposed as a privacy-oriented solution for online transactions.

Although the DigiCash concept was a centralized system, it was an intriguing experiment. Chaum feels the firm went bankrupt because it was launched before e-commerce had completely taken off.

B-money

B-money was initially described in a proposal by computer engineer Wei Dai, published in the 1990s. It’s no surprise that it was mentioned in the Bitcoin white paper.

B-money advocated a Proof of Work method (similar to that used in Bitcoin mining) as well as the usage of a distributed database where users sign transactions. A later version of b-money proposed a notion similar to staking, which is now employed in various cryptocurrencies.

B-money never took off since it never made it beyond the draft stage. Having saying that, Bitcoin definitely draws influence from Dai’s ideas.

Bit Gold

Because Bit Gold and Bitcoin are so similar, some assume that their inventor, computer scientist Nick Szabo, is Satoshi Nakamoto. Bit Gold is built on a ledger that stores data strings generated by Proof of Work operations.

It, like b-money, was never developed further. However, Bit Gold’s parallels to Bitcoin have reinforced its status as the “precursor to Bitcoin.”

How are new bitcoins created?

How many bitcoins are there?

How does Bitcoin mining work?

Participants contribute blocks to the network through mining. They must devote processing resources to solve a cryptographic challenge in order to do so. As an incentive, whomever suggests a legitimate block will get a prize.

It is costly to construct a block yet inexpensive to validate it. If a miner attempts to cheat by using an incorrect block, the network quickly rejects it, and the miner is unable to repay his or her mining expenses.

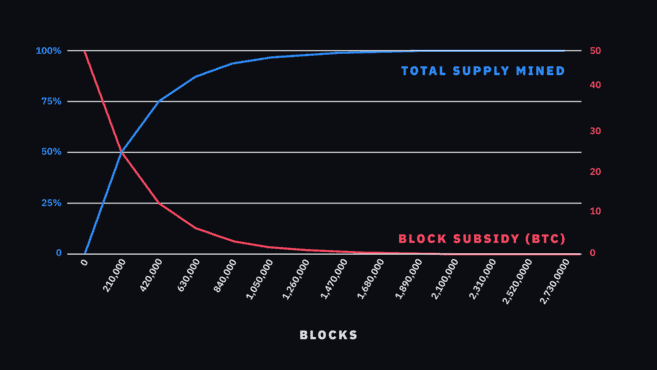

The reward, also known as the block reward, is made up of two parts: transaction fees and the block subsidy. The sole source of “new” bitcoins is the block subsidy. Every block mined adds a certain number of coins to the overall supply.

How long does it take to mine a block?

The protocol modifies the difficulty of mining such that finding a new block takes around 10 minutes. Blocks aren’t usually discovered precisely ten minutes after the previous one; the time required just varies around this target.

Chapter 4

The Bitcoin Halving

What is the Bitcoin halving?

A Bitcoin halving (also known as a Bitcoin halvening) is simply a reduction in the block reward. The reward provided to miners for verifying new blocks is halved by two when a halving occurs (they only receive half of what they used to). Transaction fees, however, are unaffected.

How does the Bitcoin halving work?

Miners would get 50 BTC for each legitimate block discovered when Bitcoin first began.

On November 28th, 2012, the first halving occurred. The protocol then cut the block subsidy from 50 BTC to 25 BTC. On July 9th, 2016, the second halving happened (25 BTC to 12.5 BTC). The final one occurred on May 11th, 2020, lowering the block subsidy to 6.25 BTC.

You may have seen a trend here. A fresh halving appears to occur every four years, give or take a few months. That is by design, although the protocol does not specify particular dates for halving. It instead proceeds by block height, with a half every 210,000 blocks. So, we should anticipate the subsidy to be cut in half in around 2,100,000 minutes (remember, a block takes 10 minutes to mine).

In the graphic above, we can see how the block subsidy has decreased over time and how it relates to overall supply. At first glance, it may seem that the incentives have gone to zero and that the maximum supply has already been distributed. However, this is not the case. The curves are quite close, but we anticipate that the subsidy will approach zero around the year 2140.

Why does the Bitcoin halving happen?

It’s one of Bitcoin’s primary selling features, although Satoshi Nakamoto never fully explained why he limited the supply to 21 million units. Some argue that it is just a result of beginning with a 50 BTC block subsidy that is half every 210,000 blocks.

With a limited supply, the currency is less likely to depreciate in the long term. It contrasts sharply with fiat money, which loses buying power over time as more units join the market.

It seems to reason that there are time constraints on how quickly players may mine coins. After all, block 210,000 contributed 50% of the total (i.e., by 2012). All units would have been mined by 2016 if the subsidy stayed unchanged.

The halving mechanism provides an incentive to mine for 100 years or more. This provides the system more than enough time to recruit users and build a fee market.

What impact does the Bitcoin halving have?

Those that are most impacted by halvings are miners. It makes sense since the block subsidy accounts for a major portion of their earnings. When it is cut in half, they only get half of what they used to. Transaction costs are also included in the prize, however they have only made up a small portion of the total payout thus far.

As a result, halvings may make it unprofitable for certain participants to continue mining. What this implies for the industry as a whole is uncertain. A decrease in block rewards may result in increased centralization in mining pools, or it may simply encourage more efficient mining operations.

If Bitcoin continues to use a Proof of Work algorithm, mining costs will need to climb in order to be lucrative. Because blocks can only carry so many transactions, this situation is fully feasible. If there are several outstanding transactions, those with greater costs will be prioritized.

Historically, a substantial surge in the price of Bitcoin has followed a halving. Of course, there isn’t a lot of information accessible since we’ve only seen two thus far. Many credit the price change to the market’s recognition of Bitcoin’s scarcity, which was sparked by the halving. Proponents of this hypothesis predict that value will surge again after the occurrence in May 2020.

Others disagree, claiming that the market has already factored in the half (see Efficient Market Hypothesis). The incident is not unexpected; participants have known for over a decade that the payout will be decreased in May 2020. Another often mentioned issue is that the industry was severely undeveloped throughout the first two halves. It now has a greater profile, more advanced trading tools, and is more welcoming to a larger investor base.

When is the next Bitcoin halving?

Chapter 5

Common Bitcoin Misconceptions

Is Bitcoin anonymous?

However, the system is highly secret, and there are ways to make it even more difficult for onlookers to find out what you’re doing with your bitcoins. To “break the connection” between addresses, freely accessible technology may provide plausible deniability. Furthermore, future enhancements might further improve privacy.

Is Bitcoin a scam?

No. Bitcoin, like conventional money, may be used for unlawful purposes. However, this does not imply that Bitcoin is a swindle in and of itself.

Bitcoin is a decentralized digital money that is not controlled by anybody. It has been labeled a pyramid scheme by detractors, however it does not fulfill the criteria. It works exactly as well as digital money at $20 per coin as it does at $20,000 per coin. It’s been around for almost a decade, and the technology has shown to be incredibly secure and dependable.

Unfortunately, Bitcoin is utilized in a variety of frauds, so be cautious. Phishing and other social engineering methods, such as phony handouts and airdrops, may fall under this category.

As a general rule: if something sounds too good to be true, it’s probably a scam. Never give your private keys or seed phrase to anyone, and be cautious of schemes that offer to multiply your money with little risk on your behalf. If you send your coins to a scammer or to a fake giveaway, they will be lost forever.

Is Bitcoin a bubble?

Bitcoin’s price is totally determined by free market speculation due to its unique characteristics as a decentralized digital commodity. So, although numerous variables influence the Bitcoin price, they all have an impact on market supply and demand. And, since Bitcoin is rare and has a fixed release schedule, long-term demand is expected to surpass supply.

When compared to regular markets, cryptocurrency markets are similarly modest. This implies that Bitcoin and other crypto assets are more volatile, and short-term market mismatches between supply and demand are extremely prevalent.

To put it another way, Bitcoin may be a volatile asset at times. However, volatility is a feature of financial markets, particularly those with low volume and liquidity.

Does Bitcoin use encryption?

No. This is a common misconception, however the blockchain of Bitcoin does not utilize encryption. To verify that transactions are genuine, every peer on the network must be able to view them. It instead makes use of digital signatures and hash functions. While other digital signature techniques employ encryption, Bitcoin does not.

However, it is worth mentioning that many programs and crypto wallets employ encryption to safeguard users’ wallets with passwords. Nonetheless, these encryption techniques have nothing to do with the blockchain and are simply integrated into other technologies that use it.

Chapter 6

Bitcoin Scalability

What is scalability?

Scalability is a measure of a system’s capacity to expand to meet rising demand. If you host a website that is experiencing high traffic, you may scale it by adding extra servers. You might improve your computer’s components if you wish to run more heavy apps on it.

In the context of cryptocurrencies, the word refers to the simplicity with which a blockchain may be upgraded to execute a greater number of transactions.

Why does Bitcoin need to scale?

To function in day-to-day payments, Bitcoin must be fast. It currently has a low throughput, which means that only a limited number of transactions may be handled every block.

Miners get transaction fees as part of the block reward, as you may recall from the last chapter. Users include them in their transactions to encourage miners to add them to the blockchain.

Miners favor transactions with larger fees in order to recoup their investment in hardware and power. When there are many transactions in the network’s “waiting room” (known as the mempool), costs might skyrocket as users bid to get theirs included. At its worst, the average charge was more than $50.

How many transactions can Bitcoin process?

Bitcoin can now handle around five transactions per second based on the average number of transactions each block. It is far cheaper than for centralized payment alternatives, but this is one of the disadvantages of a decentralized currency.

Bitcoin must restrict the size of its blocks since it is not administered by a data center that a single organization can update at whim. A bigger block size capable of handling 10,000 transactions per second may be implemented, but it would jeopardize the network’s decentralization. Remember that complete nodes must download fresh information every 10 minutes or so. If it gets too difficult for them to do so, they will most likely go offline.

If the protocol is to be utilized for payments, Bitcoin supporters feel that successful scalability must be accomplished in a variety of methods.

What is the Lightning Network?

The Lightning Network is a potential Bitcoin scaling solution. It is referred to as a layer two solution since it transfers transactions away from the blockchain. Instead of logging all transactions on the basic layer, another protocol built on top of it handles them.

Users may transmit money almost immediately and for free via the Lightning Network. There are no throughput limits (provided users have the capacity to send and receive). Two users utilize the Bitcoin Lightning Network by storing some of their funds at a specific address. The address has a special feature in that it only distributes the bitcoins if both sides agree.

From there, the parties maintain a secret ledger that allows them to reallocate balances without informing the main chain. When they’re finished, they just broadcast a transaction to the blockchain. Their balances are then updated as a result of the protocol. They don’t have to trust one other, either. If someone attempts to cheat, the protocol will catch them and penalize them.

A payment channel like this one needs just two on-chain transactions from the user: one to fund their address and one to disburse the coins afterwards. This implies that in the meanwhile, thousands of transfers may be done. With future development and improvement, the technology has the potential to become an essential component of big blockchain systems.

What are forks?

Since Bitcoin is open-source, anyone can modify the software. To meet diverse demands, you might add new rules or eliminate existing ones. However, not all modifications are equal: some may render your node incompatible with the network, while others will be backward-compatible.

Soft forks

A soft fork is a rule modification that enables updated nodes to communicate with older ones. As an example, consider block size. Assume we have a block size of 2MB and half of the network implements a patch requiring all blocks to be no larger than 1MB. Anything larger would be rejected.

Older nodes may still receive or propagate these blocks. That is, regardless of the version, all nodes stay connected to the same network.

A soft fork is an example of Bitcoin’s Segregated Witness (or SegWit). It offered a new format for blocks and transactions using a creative method. Old nodes continue to receive blocks, but the new transaction type is not validated.

Hard forks

A hard fork is messier. Assume that half of the network now want to raise the block size from 2MB to 3MB. If you attempt to transmit a 3MB block to an older node, it will be rejected since the rules explicitly indicate that the maximum size they may accept is 2MB. The blockchain breaks into two because the two networks are no longer interoperable.

There are now two distinct protocols, each with its own money. All balances on the old chain have been copied, so if you had 20 BTC on the previous chain, you now have 20 NewBTC on the new one.

In a situation similar to the one described above, Bitcoin experienced a contentious hard split in 2017. A small number of participants want to raise the block size in order to boost throughput and lower transaction costs. Others thought this was a terrible scaling technique. The hard fork eventually gave rise to Bitcoin Cash (BCH), which separated from the Bitcoin network and now has its own community and roadmap.

Chapter 7

Participating In The Bitcoin Network

What is a Bitcoin node?

The phrase “Bitcoin node” refers to a software that interacts with the Bitcoin network in some manner. It can be anything from a mobile phone operating a Bitcoin wallet to a dedicated computer that stores a full copy of the blockchain.

There are several sorts of nodes, each of which performs a distinct role. They all serve as a network connection point. They provide information about transactions and blocks inside the system.

Different types of Bitcoin nodes

Full nodes

If a transaction or block meets specific criteria, it is validated by a complete node (i.e., follow the rules). The Bitcoin Core software, which is the standard implementation of the Bitcoin protocol, is used by the majority of full nodes.

Satoshi Nakamoto launched Bitcoin Core in 2009; it was originally known as Bitcoin but was subsequently changed to prevent confusion. Other implementations may also be used as long as they are compatible with Bitcoin Core.

Full nodes are essential to the decentralization of Bitcoin. They download, verify, and distribute blocks and transactions to the rest of the network. The user does not rely on a third party for anything since they independently check the accuracy of the information they are given with.

A full node is referred to as a full archival node if it keeps a complete copy of the blockchain. However, some users remove older blocks to conserve space – the Bitcoin blockchain has approximately 200GB of transaction data.

Light nodes

Light nodes are not as powerful as full nodes, but they use less resources. They let users to interact with the network without having to conduct all of the actions that a full node would.

Light nodes download just a piece of each block (called a block header), while full nodes download all blocks to verify them. Despite its small size, the block header provides information that lets users to verify that their transactions are in the correct block.

Light nodes are suited for devices with bandwidth or space restrictions. This sort of node is often used in desktop and mobile wallets. Light nodes, on the other hand, are reliant on complete nodes since they cannot do validation.

Mining nodes

Mining nodes are complete nodes with an added function: they generate blocks. As previously said, they need specific equipment and software to contribute data to the blockchain.

Mining nodes hash pending transactions with other information to obtain a number. If the number falls below a protocol-specified threshold, the block is legitimate and may be broadcast to other full nodes.

However, in order to mine without depending on others, miners must operate a complete node. They wouldn’t know what transactions to put in the block otherwise.

If a participant wants to mine but does not want to utilize a complete node, they may connect to a server that provides them with the necessary information. When mining in a pool (that is, by collaborating with others), just one person is required to operate a complete node.

How to run a full Bitcoin node

A complete node may benefit developers, merchants, and end users. Running the Bitcoin Core client on your own hardware improves your privacy and security while also strengthening the Bitcoin network as a whole. You no longer need to depend on others to participate with the ecosystem when you have a complete node.

A few Bitcoin-related businesses provide plug-and-play nodes. The customer receives pre-built hardware and just has to turn it on to begin downloading the blockchain. This is more handy for less technically savvy people, but it is often far more costly than putting up your own.

Most of the time, an outdated PC or laptop will serve. Running a node on your main computer is not recommended since it will significantly slow it down. Because the blockchain is constantly growing, you must ensure that you have adequate RAM to download it in its entirety.

A 1TB hard drive will enough for the next several years, as long as the block size does not change much. Other needs include 2GB of RAM (most PCs come with more) and a lot of bandwidth.

How to mine Bitcoin

In the early days of Bitcoin, it was feasible to generate new blocks using standard laptop computers. Because the method was unknown at the time, there was limited rivalry in mining. Because there was so little activity, the protocol automatically established a low mining difficulty.

Participants required to update to better equipment as the network’s hash rate increased in order to remain competitive. The mining sector finally reached the Application-Specific Integrated Circuits (ASICs) era after transitioning through several types of hardware.

As the name implies, these gadgets are designed with a particular function in mind. They are incredibly efficient, yet they can only accomplish one duty. So, a mining ASIC is a customized computer that is only used for mining. A Bitcoin ASIC can mine Bitcoin but not other currencies that employ other algorithms.

Mining Bitcoin nowadays necessitates substantial expenditure, not just in technology but also in electricity. A decent mining equipment can execute up to ten trillion operations per second at the time of writing. Despite being very efficient, ASIC miners require enormous quantities of power. You’re unlikely to ever make a profit from Bitcoin mining unless you have access to several mining rigs and inexpensive power.

Setting up your mining business is simple once you have the resources – many ASICs come with their own software. The most common way is to direct your miners to a mining pool, where you will collaborate with other miners to locate blocks. If you succeed, you will earn a piece of the block reward according to the hash rate you supplied.

You may also solo mine, which means you work alone. The likelihood of creating a legitimate block will be smaller, but you will retain all of the benefits if you do.

How long does it take to mine a bitcoin?

Who can contribute to the Bitcoin code?

Because the Bitcoin Core program is open-source, anybody may contribute to it. You may suggest or evaluate new features for the 70,000+ lines of code. You can also report errors and enhance the documentation by translating it.

Changes to the program are subjected to a thorough review procedure. After all, software that deals with hundreds of billions of dollars must be devoid of flaws.