Crypto Market Cap Explained

Cryptocurrency market capitalization or crypto market cap for short, is a simple straightforward way of finding out how big a digital currency is — and it can help you make smarter investment decisions.

Introduction

It is quite straightforward to calculate the market capitalization of a cryptocurrency project. While most enthusiasts examine the market capitalization of particular projects, it may also be beneficial to keep an eye on the larger picture.

Even while Bitcoin and Ethereum are the two most valuable projects in terms of individual market capitalization, the overall worth of all crypto assets is far higher.

The overall crypto market capitalization is reported by all of the leading cryptocurrency data aggregators, making it reasonably simple to keep track of this measure.

What is the crypto market cap?

Market capitalization, sometimes known as “market cap,” is the current market value of a cryptocurrency network. It is computed by multiplying a crypto asset’s circulating supply by the price of a single unit.

Assume we have two networks, AliceCoin and BobCoin. AliceCoin has a total quantity of 1,000 coins, all of which are in circulation. BobCoin is a Proof of Work chain with 60,000 coins now in circulation out of a maximum supply of 100,000 coins. AliceCoin is now worth $100, whereas BobCoin is worth $2. Which currency has the highest market capitalization?

Market cap = circulating supply × price

AliceCoin market cap = 1,000 × $100 = $100,000

BobCoin market cap = 60,000 × $2 = $120,000

Despite the fact that one BobCoin is 50 times less expensive than one AliceCoin, the value of the BobCoin network is still greater than the value of AliceCoin. This is why market capitalization is a more accurate estimate of a network’s worth than the price of a single coin.

What is the total crypto market capitalization?

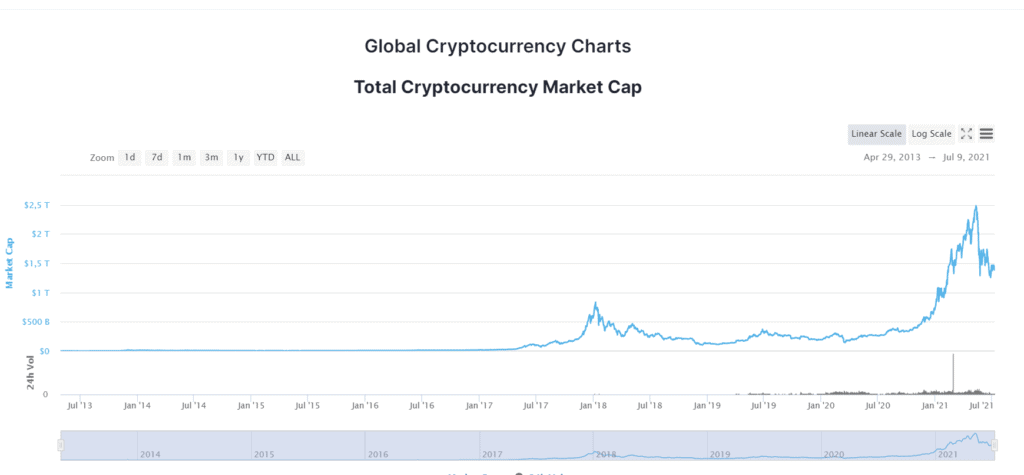

Because of the relatively high volatility of the cryptocurrency markets, the prices fluctuate quite a bit. During the first six and a half years of cryptocurrency’s existence, the overall market capitalization never exceeded $20 billion. While peaking at $770 billion in 2018, it has already surpassed $2 trillion in 2021.

Why does the total crypto market capitalization matter?

The aggregate crypto market capitalisation is often used to compare different sectors of the economy. Many experts, for example, often compare the entire crypto market cap to the market value of precious metals or equities.

Why would they do such a thing? It may, however, provide them with an approximate estimate of where the overall crypto market may expand in the next years and decades.

Still, no one understands the optimal approach to value cryptocurrencies and blockchain projects. These comparisons may be instructive, but they should not be relied on blindly.

Comparing various financial markets is sometimes a fruitless endeavor. Different sorts of investors are drawn to different sectors. Cryptocurrency will not appeal to stock traders, foreign exchange dealers, or precious metal speculators by default. Cryptocurrencies are a new and vibrant asset class that should be handled as such.

Why can the total crypto market capitalization be misleading?

Making financial choices solely on the entire cryptocurrency market capitalization might be deceptive for a variety of reasons.

The first order of business is to guarantee that each project is properly valued in the market. This is accomplished by multiplying the supply data by the price per asset.

However, determining the proper supply information might be tricky. If the data is erroneous, any subsequent computations will be invalidated as well.

Second, certain projects’ market capitalizations may be manipulated. Some projects use this to instill a false feeling of stability and worth. Looking at the entire market capitalization without analyzing what it represents may lead to possibly disastrous financial choices.

Finally, overall market capitalization is only a statistic that reflects a certain point in time. It may be nine digits today, 10 figures next week, and eight figures in six months. It is simply a glimpse of the cryptocurrency business at the moment.

Diluted crypto market capitalization

There are many methods for calculating market capitalisation. The diluted market cap is one method for estimating a network’s future worth. Let’s find out what it is.

The phrase “diluted market cap” originated in the stock market. This number shows a company’s worth in that sector if all stock options are executed and all securities are converted to stock.

It’s also critical to consider a crypto asset’s present and future supply. At the moment, not all coins, tokens, and assets have their whole supply accessible.

For instance, we know that there will be a limit of 21 million Bitcoin. There are now 18.505 million Bitcoin in circulation. At a price of about $10,550 per BTC, this equates to a market value of over $195.2 billion.

Calculating the diluted market cap would instead take into consideration the maximum supply of Bitcoin. As a result, we multiply 21 million by the current BTC price of $10,550. The result of this total is Bitcoin’s diluted market cap, which is around $221.5 billion.

This approach is applicable to all other crypto assets on the market. A diluted market cap essentially increases an asset’s current price by the greatest supply that can ever circulate. Given how the values of various assets will change, it is far from a precise statistic. Nonetheless, it may assist in determining if an item is cheap or overpriced.

Deflationary tokens

The circulating supply of several cryptocurrencies will grow over time. Even if the price remains constant, the diluted crypto market capitalization will be bigger than it is now.

At the same time, deflationary tokens are actively attempting to lower their supply. This may be accomplished in a variety of methods, one of which is by a procedure known as coin burning. This helps to decrease the asset’s maximum supply in the future.

If the asset’s worth does not rise over time and its supply continues to fall, its diluted market cap may be lower years from now.

As an illustration: BurnCoin currently has a maximum quantity of 20 million tokens available at a price of $1 per coin. However, the company chooses to purchase tokens back from the market and burn them, limiting the maximum supply to 18 million BurnCoin.

The BurnCoin price stays at $1 after the news of the currency burn. Knowing that future coin burns will occur, we can compute the diluted market cap as follows:

18 million BurnCoins multiplied by $1 is $18 million.

When the coin burn is disclosed, however, the market cap is:

$20 million = 20 million BurnCoins × $1

The diluted market cap is actually smaller than the existing one in this scenario. Keeping the preceding scenario in mind, a lot might happen between the announcement and the coin burn.

Even after the burn, the price might fluctuate. A diluted market cap is far from a perfect indicator, particularly for deflationary currencies with ongoing coin burning. You may think of it as a snapshot, similar to the present market cap, but one that attempts to predict future worth.

Closing thoughts

Crypto market capitalization is one of the essential metrics to watch. It displays the ebb and flow of the cryptocurrency industry’s value. It may also help to discern between what is being reported today and what the diluted market cap might be in the future.