Technical Analysis (TA) Basics

One of the most popular approaches of analyzing the financial markets is known as technical analysis, or TA. The use of TA is possible in almost every kind of financial market, including stocks, FX, gold, and cryptocurrencies, among others.

Although it is not too difficult to understand the fundamental ideas behind technical analysis, becoming an expert in this field is rather challenging. Learning how to trade successfully on a constant basis is a process that requires time. Developing your own trading methods and learning how to come up with your own ideas for trades involves a significant amount of experience. You’ll have a better understanding of your capabilities, be able to pinpoint any areas in which you fall short, and ultimately feel more in command of the choices you make about investments and trades. In addition to covering some of the most typical blunders made in technical analysis, this article will also cover some of the fundamentals of the field.

What is a long position?

Buying an asset with the assumption that its price would increase is known as taking a long position, sometimes abbreviated as just long. Long positions are often discussed in relation to foreign exchange (Forex) or derivatives products; nonetheless, they are applicable to pretty much any asset class or market type. A long position may also be established by purchasing an asset on the spot market with the expectation that its price will rise in the near future.

Longing for a financial product is the most popular strategy to invest, particularly for new investors who are just getting their feet wet in the market. Buy and hold trading methods are examples of long-term trading strategies that are predicated on the idea that the value of the underlying asset would rise over time. In this context, the term “buy and hold” refers to simply going long for a significant amount of time.

However, just because a trader has a long position does not always imply that they anticipate profiting from an increase in price. Take leveraged tokens, for example. The price of BTCDOWN has a negative correlation with the price of Bitcoin. The price of BTCDOWN will decrease if Bitcoin’s price experiences an increase. The price of BTCDOWN will increase in response to a decrease in the value of Bitcoin. When seen in this light, establishing a long position in BTCDOWN is equivalent to anticipating a decline in the price of bitcoin.

What is shorting?

A short position, sometimes known simply as a short, is when an asset is sold with the goal of repurchasing it at a later date at a cheaper price. Because it is possible to engage in shorting with assets that have been borrowed, margin trading is strongly tied to shorting. Nevertheless, it is also commonly utilized in the market for derivatives, and it is possible to do so with a simple spot position. The question is, how exactly does shorting work?

When it comes to short selling in spot markets, the process is rather straightforward. Suppose you already own Bitcoin and you are anticipating that its price will decrease in the near future. You decide to sell your Bitcoin for US Dollars because you anticipate buying it back at a cheaper price in the near future. If you sell Bitcoin at a high price with the intention of buying it again at a lower price, this is a kind of shorting the cryptocurrency. Not too difficult. But what about using borrowed money to make short sales? First, let’s examine how well that works.

You lend yourself an asset that you believe will see a decline in value, such as a stock or a cryptocurrency, for example. You put it up for sale right away. In the event that the deal works in your favor and the price of the asset drops, you will have to purchase back the same quantity of the item that you have borrowed. You are responsible for paying back the assets that you have borrowed, together with any applicable interest, and you make a profit off of the disparity in cost between the price at which you first sold them and the price at which you repurchased them.

The question now is, what does it look like to short Bitcoin with borrowed funds? Let’s have a look at an example, shall we? We put up the needed collateral to borrow one bitcoin, and then we sold it right away for ten thousand dollars. Now we’ve received $10,000. Consider that the asking price is reduced to $8,000: We pay off our obligation of one Bitcoin plus the accrued interest by purchasing one Bitcoin. Because we sold Bitcoin at an initial price of $10,000 and then repurchased it at a price of $8,000, our profit is $2,000. (minus the interest payment and trading fees).

What is the order book?

The order book is a compilation of all of the active orders for a certain asset, arranged in descending price order. The order book is updated whenever a customer submits an order that is not immediately fulfilled by the business. It will remain there until either another order comes in to fulfill it or the original order is canceled.

Order books are going to be different for each platform, but in general they’re going to have very much the same information in them. You will be able to see the number of orders placed at various pricing tiers.

Orders that are placed in the order book of a cryptocurrency exchange or an online trading platform are matched by a piece of software known as the matching engine. You might think of this system as the brain of the exchange since it is responsible for ensuring that deals are really carried out. Along with the order book, this technology is a fundamental component of the idea of electronic exchange.

What is the order book depth?

A graphical depiction of all of the open orders that are now present in the order book is what is known as the order book depth, which is also often referred to as the market depth. The vast majority of the time, it arranges buy orders on one side of the chart and displays them in a cumulative fashion, while on the other side of the chart it displays sell orders. When referring to the order book in terms that are more general, the phrase “depth of the order book” may also refer to the amount of liquidity that the order book is able to take in. The “deepness” of the market is directly correlated to the quantity of liquidity that is available in the order book. In this respect, a market that has a higher supply of liquidity is able to absorb larger orders without having a noticeable influence on the price. In contrast, a market that lacks sufficient liquidity may not be able to do so. On the other hand, big orders have the potential to have a substantial effect on the price if the market is illiquid. This is because large orders need more resources to fulfill.

What is a market order?

An order to purchase or sell at the best price that is presently available on the market is known as a market order. Simply put, this is the route that will get you in or out of a market the quickest.

When you place a market order, what you are essentially stating is, “I would want to execute this order at the greatest price I can obtain right now.”

Your market order will continue to fulfill orders from the order book until the order is completely completed. Because of this, huge traders, sometimes known as whales, may have a disproportionate amount of influence on the price when they employ market orders. A large market order has the potential to remove significant amounts of liquidity from the order book. How so? In the context of our conversation on slippage, let’s go over it.

What is slippage in trading?

When it comes to market orders, there is something called slippage that you need to keep in mind at all times. When we state that market orders are filled at the best available price, we mean that they continue to fill orders from the order book until the full order is completed. This is what we mean when we say that market orders fill at the best available price.

What happens, however, if there isn’t enough liquidity around the price that you want to buy or sell at in order to fulfill a big market order? There is a possibility that the price at which your order is fulfilled will be significantly different from the price that you had anticipated it would be fulfilled at. Slippage is the term used to refer to this disparity.

Suppose you are interested in opening a long position in an alternative cryptocurrency that is worth 10 BTC. Nevertheless, this alternative cryptocurrency is being traded on a platform that has a limited level of liquidity, and its market value is only somewhat significant. If you use a market order, it will continue to fulfill orders from the order book until the full 10 BTC order is satisfied, even if you cancel any of those orders. You would be able to fulfill your 10 BTC order on a market that has a lot of liquidity without having a big effect on the price. However, since there is a lack of liquidity in this particular market, it is possible that the order book does not include sufficient buy orders to cover the present price range.

It is possible that by the time the full 10 BTC purchase has been fulfilled, you may discover that the average price paid was far greater than you had anticipated. Your market order was matched with orders that were much more costly than the original price as a result of the dearth of sell orders, which, to put it another way, led your market order to climb up the order book.

When trading altcoins, you should be mindful of the possibility of slippage since certain trading pairs could not have adequate liquidity to fulfill your market orders.

What is a limit order?

An order to purchase or sell an item at a specified price or one that is better is known as a limit order. The name given to this price is the limit price. Orders to purchase at a limit will be filled at the limit price or a lower price, and orders to sell at a limit will be filled at the limit price or a higher price.

When you place a limit order, what you are saying is essentially, “I would want to execute this order at this precise price or better, but never worse.”

When you use a limit order, you are able to have a greater degree of control over the point at which you enter or leave a certain market. In point of fact, it ensures that your purchase will never be fulfilled at a price that is lower than the price that you have specified as your intended pricing. However, there is a disadvantage associated with it. It is possible that the market may never reach your pricing, resulting in your order becoming unfulfilled. This might result in missing out on a possible business opportunity in many different scenarios.

The choice of whether to place a limit order or a market order is one that every trader must make for himself. It’s possible that some traders may just utilize one or the other, while others would use both strategies depending on the market conditions. It is essential that you comprehend their operation in order to arrive at a conclusion that is appropriate for you.

What is a stop-loss order?

Let’s speak about stop-loss orders now that we’ve covered market and limit orders in the previous section. An order known as a stop-loss order is a variation of a limit or market order that is not executed until a certain price has been achieved. The name given to this price is the “stop price.”

A stop-loss order’s primary function is to put a cap on a trader’s losses. An invalidation point is a price level that must be defined in advance for every deal. This point determines whether or not the trade is legitimate. At this point, you realize that your original concept was flawed, which indicates that you should get out of the market in order to avoid incurring any additional losses. Therefore, the place where you should normally placed your stop-loss order is at the invalidation point.

How does a stop-loss order work? As was discussed before, the stop-loss order may take the form of either a limit or a market order. Because of this, these variations are often referred to as stop-limit orders and stop-market orders respectively. The stop-loss order will only kick in if a certain price has been attained, which is the most important point to grasp (the stop price). When the price of the stop order is achieved, one of two orders, a market order or a limit order, is executed. You are essentially setting the trigger for your market or limit order to be the stop price that you choose.

Having said that, there is one thing that you need to bear in mind. We are aware that limit orders will only ever fill at the limit price or a better price, and never at a price that is lower. If you use a stop-limit order as your stop-loss strategy and the market suddenly collapses, the price may rapidly move away from your limit price, leaving your order unfilled. This may happen even if you have a stop-limit order in place. To put it another way, the stop price would cause your stop-limit order to be executed, but your limit order would not be filled because of the sudden decrease in price. Because of this, stop-market orders are often seen as being more secure than stop-limit orders. They ensure that you will always be assured to quit the market once your invalidation threshold has been reached, regardless of how harsh the market circumstances may get.

What are makers and takers?

When you place an order that is not immediately fulfilled but is put to the order book, you are considered a maker. You are considered a “maker” of liquidity since the order you placed added more liquidity to the order book.

In most instances, limit orders will be processed as maker orders; however, this is not always the case. Take, for instance, the scenario in which you place a limit purchase order with a limit price that is much higher than the price at which the asset is now trading. Your order will be carried out in accordance with the market price since you have specified that it may be carried out at the limit price or better. The market price is now lower than your limit price.

When you place an order that is instantly fulfilled, you are considered a taker of the order. Your order is instantly matched with an order that is already in the order book rather than being added to the order book as a new order. You are considered a taker since you are extracting liquidity from the order book. Due to the fact that you are executing your order at the best immediately available market price, market orders will always be considered taker orders.

Some exchanges use a charge structure with many tiers to encourage traders to supply liquidity in the market. After all, it is in their best interest to entice big volume traders to participate in their exchange since liquidity draws in even more liquidity. Since makers are the ones bringing liquidity to the exchange, they are the ones who often pay lesser costs than takers do in these kinds of systems. They may even provide fee refunds to producers in certain circumstances.

What is the bid-ask spread?

The gap between the highest purchase order (the bid) and the lowest sell order (the ask) for a certain market is referred to as the bid-ask spread. The difference between the greatest price at which a seller is willing to sell and the lowest price at which a buyer is ready to purchase is basically what this term refers to.

One technique to determine how liquid a market is is to look at the difference between the bid and the ask price. The lower the difference between the bid and the ask price is, the more liquid the market is. The difference between the bid price and the ask price may also be seen as a reflection of the supply and demand for a certain item. The “ask” side of the market represents the supply in this context, while the “bid” side represents the demand.

When you place a market purchase order, it will be fulfilled at the ask price that is the lowest currently available. On the other hand, if you make a market sell order, the order will be fulfilled at the highest available bid.

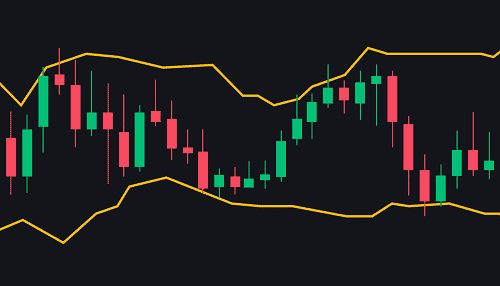

What is a candlestick chart?

A graphical depiction of the price of an item over a certain period of time is referred to as a candlestick chart. It is constructed from of candlesticks, with each one standing for a discrete period of time. For instance, a chart depicting one hour’s worth of data would use candlesticks, each of which will represent a period of one hour. A chart with a time frame of one day displays candlesticks, each of which stands for a period of one day, and so on.

The Open, the High, the Low, and the Close make up the four data points that comprise a candlestick (also referred to as the OHLC values). The Open and Close prices represent the first and final price recorded for the specified period, respectively, while the Low and High prices represent the price recorded at its lowest and highest levels, respectively.

One of the most significant tools for interpreting financial data is a kind of chart called a candlestick chart. Candlesticks were first used in Japan in the 17th century but underwent a period of refinement in the early 20th century thanks to the efforts of commercial pioneers like Charles Dow.

What is a candlestick chart pattern?

An important tenet of technical analysis is that the behavior of prices in the past may provide useful insights about the behavior of prices in the future. So, how exactly might candlesticks be of use inside this framework? The goal is to recognize patterns on the candlestick chart and develop trading strategies based on such patterns.

Candlestick charts provide traders with a useful tool for analyzing market structure and determining whether the current market environment is bullish or bearish. They may also be used to indicate regions of interest on a chart, such as levels of support or resistance or probable points of reversal, which are all examples of areas of interest. These are the points on the chart that often show an increase in the volume of trading activity.

Candlestick patterns are another fantastic tool for risk management since they may give trade settings that are specified and specific to the trader. How so? Candlestick patterns, on the other hand, may specify distinct price goals and points at which the pattern is incorrect. Traders are able to devise trade setups that are very accurate and regulated as a result of this. As a consequence of this, traders in both forex and cryptocurrencies make extensive use of candlestick patterns.

What is a trend line?

Trend lines are a tool that are used often by traders as well as technical analysts. On a chart, they appear as lines that link several points of data together. The price is almost always included in this data, although that is not always the case. In addition to this, some traders would draw trend lines on other technical indicators and oscillators.

The primary purpose of establishing trend lines is to facilitate the visualization of certain facets of the price movement. Traders are able to determine the general trend as well as the structure of the market using this method.

It’s possible that some traders rely only on trend lines to get a deeper comprehension of the market structure. It’s possible that other people will utilize them to generate trade ideas for themselves based on how the trend lines interact with the price.

A chart depicting practically any time range may have trend lines added to it to help interpret the data. On the other hand, just as with any other instrument for market research, trend lines drawn on higher time frames have a tendency to be more dependable than trend lines drawn on shorter time frames.

The strength of a trend line is another factor that should be considered in this context. In order for a trend line to be considered genuine, it is required, according to the standard meaning of the term, to make contact with the price at least twice, and preferably three times. In general, a trend line is seen as having a higher degree of reliability in proportion to the number of times the price has “tested” or “touched” it.

What are support and resistance?

When it comes to trading and doing technical analysis, two of the most fundamental concepts to understand are support and resistance.

A level that provides support is one at which the price “finds a floor.” To put it another way, a support level is an area with considerable demand, which is where buyers enter and drive the price upward.

The term “ceiling” refers to the point at which the price encounters resistance. A level of resistance denotes a location with considerable supply, which acts as a point of entry for sellers who attempt to drive the price down.

You should now know that levels of higher demand and increasing supply, respectively, are what constitute support and resistance. When thinking about support and resistance, though, there are a lot of other things that may be at play.

Indicators of price movement such as trend lines, moving averages, Bollinger Bands, Ichimoku Clouds, and Fibonacci Retracement are examples of technical tools that may be used to forecast possible support and resistance levels. In point of fact, certain components of human psychology are used as well. Because of this, the ways in which traders and investors use support and resistance into their unique trading strategies might vary greatly.

Common mistakes when trading with technical analysis

1. Not cutting your losses

Let’s begin with a quote from Ed Seykota, who is involved in the trading of commodities:

“The components of successful trading are, in order of importance: (1) minimizing losses, (2) minimizing losses, and (3) minimizing losses. If you are able to comply with these three guidelines, there is a possibility that you may be successful.

Even though this seems to be a straightforward step, it is critical that its significance be emphasized at all times. Protecting your financial resources should always be your first concern when it comes to financial activities like trading and investing.

Trading for the first time may be a very nerve-wracking experience. When you’re just getting started, a good strategy to keep in mind is that the first thing you should focus on is preventing failure rather than achieving success. For this reason, it may be beneficial to begin trading with a lesser position size, or perhaps to not risk any actual cash at all. You may practice your trading techniques on the testnet provided by Binance Futures, for instance, before putting any of your hard-earned money at danger. In this approach, you may preserve your wealth and only put it at risk after you’ve established a track record of delivering consistently positive outcomes.

Establishing a loss limit is sound business practice. Each of your deals need to have a point when they become invalid. This is the point at which you have to “take the medicine” and admit that your trading plan was flawed. If you do not approach trading with this frame of mind, it is probable that you will not do well throughout the course of a trading career. Even just one poor move may do a lot of damage to your portfolio, and you may wind up having to hang on to lost positions while you wait for the market to get better.

2. Overtrading

When you are engaged in active trading, it is a frequent misunderstanding to believe that you must constantly be in a transaction. Trading requires a significant amount of study as well as a significant amount of “sitting about” and patiently waiting. When using some trading tactics, you may be required to hold off on entering a trade until you get a signal that can be trusted. Even if they only make three deals a year, some traders may nevertheless generate exceptional returns for their investments.

Take a look at the following remark made by Jesse Livermore, an influential trader and one of the first proponents of day trading:

“Sitting is how money is earned, not trading,” as the saying goes.

Make it a point to steer clear of engaging in a transaction only for the purpose of doing so. You are not required to engage in a transaction at all times. In some circumstances of the market, doing nothing and waiting for a chance to reveal itself might actually be more lucrative than acting in the moment. Your investment will be protected in this manner, and you will be able to quickly put it to use if profitable trading chances become available again. You simply have to be patient and remember that chances will always present themselves again; all you have to do is wait for them.

A error that is similar in nature when it comes to trading is placing an excessive focus on smaller time periods. Analysis carried out on longer time periods will, as a rule, provide more trustworthy results than analysis carried out on shorter time spans. As a result, short time frames will generate a lot of market noise, which may attract you to initiate trades more often than you would otherwise. Trading on smaller time frames often results in a poor risk-to-reward ratio; this is not to say that there aren’t some profitable scalpers or short-term traders; there just aren’t as many of them. Because it is such a high-risk trading method, it is not suggested for traders just starting out.

3. Revenge trading

It is not unusual to see traders attempting to instantly make up for a huge loss they have incurred. This practice is referred to as “revenge trading.” It makes no difference whether you want to be a technical analyst, a day trader, or a swing trader; the most important thing is to avoid making judgments based on your emotions.

When things are going well, or even when you are making little errors, it is simple to maintain your composure. But are you able to maintain your composure even when everything seems to be going wrong? Are you able to remain disciplined and follow your trading strategy even while everyone else is freaking out?

It is important to note the term “analysis” in the phrase “technical analysis.” This, of course, calls for a methodical approach to trading on the markets, doesn’t it? Why, therefore, would you want to make quick judgments based on your emotions inside the confines of such a framework? If you want to be included among the finest traders, you need to be able to maintain your composure even after making the most significant errors. Avoid making judgments based on your emotions and instead concentrate on maintaining a rational and analytical frame of mind.

Trading right after experiencing a significant loss is often a recipe for much bigger losses in the future. As a consequence of this, some traders may choose to not trade at all for a certain amount of time after suffering a significant loss. They will be able to begin trading once again with a clear head and a clean slate thanks to this solution.

4. Being too stubborn to change your mind

If you want to become a good trader, you can’t be scared to shift your viewpoint when necessary. A much. One thing that can be said with absolute confidence is that market circumstances may change very fast. They are always subject to change. As a trader, it is your responsibility to identify these shifts and adjust your strategy accordingly. It’s possible that a business approach that does incredibly well in one market setting may be completely ineffective in another.

Let’s have a look at what the illustrious trader Paul Tudor Jones had to say about his holdings:

“I operate on the assumption that every viewpoint I have is incorrect,” you said.

It’s a useful exercise to put yourself in the position of the opposing side of your arguments in order to see probable flaws in their reasoning. Your investing theses (and conclusions) may become more complete if you proceed in this manner.

This brings up still another important issue, which is cognitive biases. Your preconceived notions may have a significant impact on the decisions you make, cloud your judgment, and restrict the range of options you’re able to take into consideration. You should make it a priority to at least have an understanding of the cognitive biases that may influence your trading strategies in order to improve your ability to resist the negative effects of these biases.

5. Ignoring extreme market conditions

There are instances in which the predictive capacities of TA are not as dependable as they formerly were. These may be black swan events or other sorts of extraordinary market situations that are mainly influenced by people’s emotions and the psychology of the masses. In the end, supply and demand are what drive the markets, and there are times when one of those factors is very out of whack relative to the other.

Take for instance the Relative Strength Index (RSI), which is an example of an indicator of momentum. In general, if the reading is lower than 30, the asset being tracked may be seen as having been oversold. When the RSI drops below 30, does this suggest that it is an indication that a transaction should be made immediately? Never in a million years! Simply said, it denotes that the selling side of the market is now in control of the momentum of the market. To put it another way, it simply suggests that there is more power in the hands of sellers than purchasers.

When unusual market circumstances exist, the RSI has the potential to reach high values. It is even feasible that it will go into the single digits, which is quite close to the absolute minimum reading (zero). Even such an extreme oversold signal does not always indicate that a turnaround is just around the corner.

If you rely your selections on the extreme readings that your technological equipment provide, you might end up losing a significant amount of money. This is particularly true during black swan situations, when it may be quite difficult to understand the activity in the price. When conditions are as they are right now, there is no analytical instrument that can stop the markets from continuing in whichever way they are now moving. Because of this, it is important to constantly take into account other aspects as well, and not to depend just on a single instrument.

6. Forgetting that TA is a game of probabilities

The analyses that are performed using technical methods do not deal with absolutes. Probabilities are the subject of this discussion. This indicates that there is never a guarantee that the market will react in the way that you anticipate, regardless of the technical approach that you are based your plans on. Even if your research indicates that there is a very high possibility of the market going up or down, nothing can be said with absolute confidence about the direction in which it will move.

When formulating your trading strategy, you really must remember to take this into consideration. It is never a good idea to expect that the market will follow your analysis, regardless of how much expertise you have in the financial markets. If you do so, you put yourself at danger of oversizing your bets and putting too much on a single event, which might result in a significant loss of money.

7. Blindly following other traders

If you want to become an expert in any field, it is imperative that you are always working to improve your skills. When it comes to trading on the financial markets, this is very important to keep in mind. In point of fact, the shifting circumstances of the market make it an absolute must. Following the example of expert technical analysts and traders is one of the most effective methods to gain knowledge.

To become consistently excellent, you will need to first identify your own talents and then build upon those abilities. If you want to achieve this goal, you must first uncover your own strengths. We might refer to this as your edge, which is the quality that sets you apart from other traders in the industry.

If you read a lot of interviews with great traders, you’ll realize that they all have quite unique trading tactics. This is something you should keep in mind. In point of fact, a trading technique that works faultlessly for one dealer might be seen as totally impractical by another dealer. There is an almost infinite number of methods to make money off of market activity. You only need to figure out which one complements your character and the way you trade the most effectively.

The decision to enter a transaction based on the analysis of another person could sometimes be profitable. On the other hand, if you just copy the actions of other traders without making an effort to comprehend the bigger picture, you should not expect this strategy to be successful over the long run. This, of course, does not imply that you should not follow the examples of others or gain knowledge from them. The most crucial question is whether or not you agree with the trade concept and whether or not it is compatible with your trading strategy. Even though other traders are knowledgeable and have a good reputation, you shouldn’t just mindlessly follow in their footsteps.