Bid-Ask Spread and Slippage Explained

The bid-ask spread is the difference between the lowest price asked and the highest price offered for an asset. Bitcoin, for example, has a lower spread than assets with less liquidity and trading activity.

Slippage happens when a trade settles at an average price that differs from the one sought. It often occurs while executing market orders. The final order price may vary if there is insufficient liquidity to fulfill your order or if the market is turbulent. To avoid slippage with low-liquidity assets, consider splitting your order into smaller parts.

Introduction

Market prices are closely tied to supply and demand when you buy and sell assets on a cryptocurrency exchange. Other essential aspects to examine besides price include trading volume, market liquidity, and order types. You may not always obtain the price you seek for a trade, depending on market circumstances and the order types you select.

Buyers and sellers are always negotiating, resulting in a gap between the two sides (bid-ask spread). Slippage may occur depending on the quantity of an asset you intend to trade and its volatility (more on this later). To prevent surprises, acquiring a fundamental understanding of an exchange’s order book will go a long way.

What is bid-ask spread?

The bid-ask spread is the difference between an order book’s highest bid and lowest ask price. Market makers or broker liquidity providers often create the spread in conventional markets. The spread in cryptocurrency markets is the difference between limit orders from buyers and sellers.

If you wish to make an immediate market price buy, you must accept the seller’s lowest requested price. If you want to make an immediate sale, you will accept the highest offer price from a bidder. More liquid assets (such as FX) have a lower bid-ask spread, which means that buyers and sellers may execute their orders without producing large price fluctuations. This is because the order book has a high amount of orders. When completing big volume orders, a greater bid-ask spread will result in more significant price swings.

Market makers and bid-ask spread

Liquidity is a critical notion in financial markets. When trading in low-liquidity markets, you may find yourself waiting for hours or even days for another trader to match your order.

It is crucial to provide liquidity, however not all markets have adequate liquidity from individual traders. Brokers and market makers, for example, supply liquidity in exchange for arbitrage gains in conventional markets.

A market maker may profit from a bid-ask spread by simply purchasing and selling an item at the same time. Market makers may benefit from the spread by selling at the higher ask price and purchasing at the lower bid price repeatedly. Even a minor spread may result in big gains if traded in sufficient quantities throughout the day. As market makers fight and lower the gap, assets in strong demand have smaller spreads.

A market maker, for example, may simultaneously offer to buy BNB for $350 per coin and sell BNB for $351, resulting in a $1 spread. Anyone who want to trade in the market immediately must meet their positions. For the market maker who sells what they purchase and buys what they sell, the spread is now pure arbitrage profit.

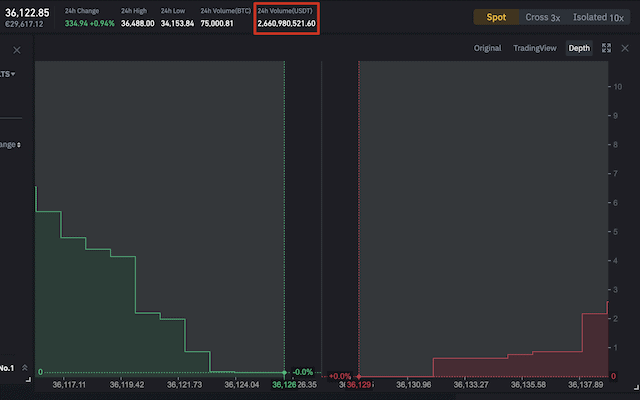

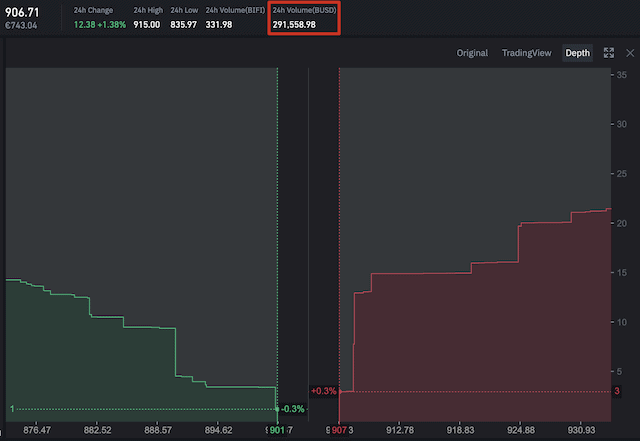

Depth charts and bid-ask spread

The [Depth] option shows a graphical representation of an asset’s order book. You can see the quantity and price of bids in green, along with the quantity and price of asks in red. The gap between these two areas is the bid-ask spread, which you can calculate by taking the red ask price and subtracting the green bid price.

As previously stated, there is an implicit link between liquidity and smaller bid-ask spreads. Because trading volume is a popular measure of liquidity, we anticipate larger volumes with smaller bid-ask spreads as a proportion of an asset’s price. Cryptocurrencies, equities, and other assets that are heavily traded face significantly greater competition from traders attempting to profit from the bid-ask spread.

Bid-ask spread percentage

To compare the bid-ask spread of different cryptocurrencies or assets, we must evaluate it in percentage terms. The calculation is simple:

(Ask Price - Bid Price)/Ask Price x 100 = BidAsk Spread Percentage

Let’s take BIFI as an example. At the time of writing, BIFI had an ask price of $907 and a bid price of $901. This difference gives us a bid-ask spread of $6. $6 divided by $907, then multiplied by 100, gives us a final bid-ask spread percentage of roughly 0.66%.

Assume Bitcoin has a bid-ask spread of $3. While it’s half of what we witnessed with BIFI, Bitcoin’s bid-ask spread is just 0.0083% when measured in percentage terms. BIFI also has a substantially smaller trading volume, supporting our argument that less liquid assets have wider bid-ask spreads.

Because of Bitcoin’s reduced dispersion, we may make certain inferences. A narrower bid-ask spread percentage indicates that the item is likely to be significantly more liquid. If you wish to execute significant market orders, the chance of having to pay a price you didn’t anticipate is generally lower.

What is slippage?

Slippage is typical in markets that have high volatility or limited liquidity. Slippage happens when a deal closes at a price that differs from what was anticipated or requested.

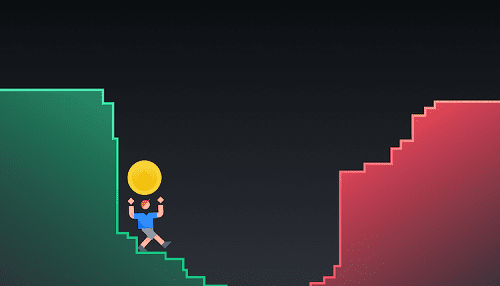

Assume you wish to place a huge market purchase order at $100, but the market lacks the liquidity to fill your order at that price. As a consequence, you will have to accept the following orders (above $100) until your purchase is completely completed. This causes the average price of your transaction to be more than $100, which is referred to as slippage.

In other words, when you place a market order, an exchange automatically matches your buy or sell to limit orders in the order book. The order book will match you with the best price, but if there is insufficient volume for your preferred price, you will go up the order chain. As a consequence of this procedure, the market fills your order at unexpectedly different pricing.

Slippage is widespread with automated market makers and decentralized exchanges in cryptocurrency. Slippage in volatile or low-liquidity cryptocurrencies might exceed 10% of the projected price.

Positive slippage

Slippage does not always imply that you will get a lower price than planned. Positive slippage might occur if the price falls while you place your purchase order or rises while you place your sell order. Positive slippage, albeit unusual, may occur in certain very volatile markets.

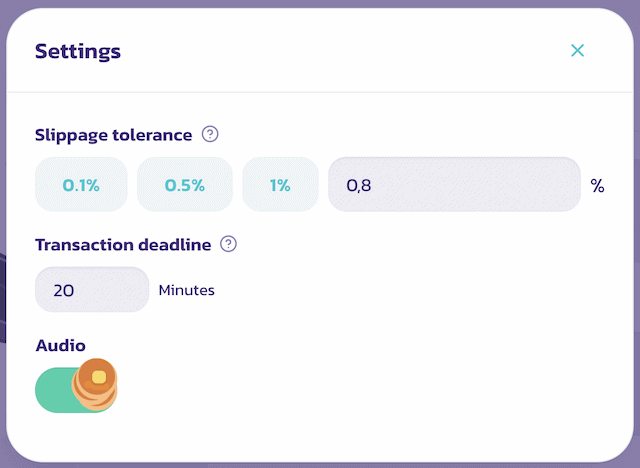

Slippage tolerance

The amount of slippage you specify might have an impact on the time it takes for your purchase to clear. If you set the slippage to zero, your order may take a long time or not be filled at all. If you set it too high, another trader or bot may notice your pending order and attempt to outbid you.

Front running occurs in this situation when another trader sets a larger gas charge than you to acquire the item first. The front runner then enters another transaction in order to sell it to you at the maximum price you are ready to accept depending on your slippage tolerance.

Minimizing negative slippage

While you can’t always avoid slippage, there are some strategies you can use to try to minimize it.

- Instead of making a large order, try to break it down into smaller blocks. Keep a close eye on the order book to spread out your orders, making sure not to place orders that are larger than the available volume.

- If you’re using a decentralized exchange, don’t forget to factor in transaction fees. Some networks have hefty fees depending on the blockchain’s traffic that may negate any gains you make, avoiding slippage.

- If you’re dealing with assets with low liquidity, like a small liquidity pool, your trading activity could significantly affect the asset’s price. A single transaction may experience a small amount of slippage, but lots of smaller ones will affect the price of the next block of transactions you make.

- Use limit orders. These orders make sure you get the price you want or better when trading. While you sacrifice the speed of a market order, you can be sure that you won’t experience any negative slippage.

When trading cryptocurrencies, keep in mind that a bid-ask spread or slippage might affect the final price of your trades. You can’t always avoid them, but they’re worth considering while making decisions. This may be minor for smaller transactions, but keep in mind that with huge volume orders, the average price per unit may be greater than planned.

Understanding slippage is a key component of the trading fundamentals for anybody working with decentralized finance. Without some fundamental information, you run the danger of losing money due to front-running or excessive slippage.