What Is Dollar Cost Averaging (DCA)?

But what if you want to make investments in the markets but you aren’t exactly sure how to get started? To be more precise, what would be the best strategy to create a position that is held for a longer period of time? In this piece, we’ll go through a method of investing known as dollar-cost averaging, which makes it simple to reduce the impact of certain risks associated with getting into a position.

What is dollar-cost averaging?

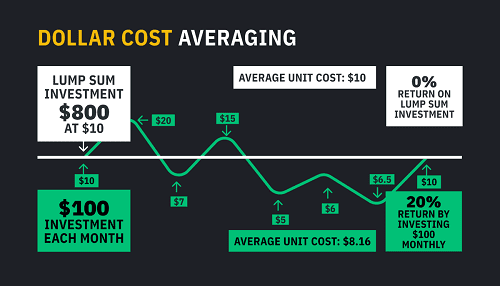

The goal of the investing approach known as dollar-cost averaging is to minimize the effect that price fluctuations have on the acquisition of assets. Buying a fixed quantity of the asset at predetermined intervals is required to carry out this strategy.

When joining the market in this manner, the investment may not be as susceptible to volatility as it would be if it were made in one big amount. This is the concept (i.e., a single payment). How so? Buying at regular intervals may help keep the average price from fluctuating too much. A method like this one, when used over the course of a longer period of time, lessens the detrimental effect that a poor entrance could have on your investment. Let’s take a look at how DCA works and the reasons why you would want to think about using it.

Why use dollar-cost averaging?

The primary advantage of using dollar-cost averaging is that it lessens the likelihood of placing a wager at an inappropriate moment. When it comes to trading or investing, one of the most difficult things to perform is to accurately time the market. Even if a trade idea is headed in the right direction, it is possible that the timing of the deal may not work out as planned, which would result in the trade not being successful. The strategy of dollar-cost averaging may assist reduce the impact of this risk.

If you invest the same total amount of money in many smaller pieces, rather than one huge chunk, you will almost certainly get higher returns on your money than you would have done otherwise. It is surprisingly simple to make a purchase at the wrong moment, and doing so might lead to consequences that are less than desirable. In addition to this, you have the ability to remove some preconceived notions from your process of decision-making. When you decide to use dollar-cost averaging as your investment plan, the strategy will handle all of the decision-making for you.

The dollar-cost-averaging strategy does not, of course, eliminate all risk altogether.

The only purpose of this plan is to streamline the process of entering the market in order to reduce the likelihood of poor timing. The dollar-cost-averaging strategy is not a foolproof method for effective investing; in addition to using it, one must take into account a variety of other aspects.

Timing the market correctly is very difficult, as we’ve shown. Even the most experienced traders have trouble reading the market effectively at times. [Citation needed] As a result of this, if you have used dollar-cost averaging to get into a position, you may also need to think about how you will get out of the position. That is, a method for exiting the position that may be used in the trading market.

Now, assuming you’ve already settled on a desired price (or a range of acceptable prices), this step should be rather simple. You, once again, portion out your investment into equal portions, and as the market is getting closer to the goal, you begin selling those portions. By doing so, you reduce the likelihood of missing the opportunity to leave at the appropriate moment. However, this is something that is entirely dependent on the trading system that you use.

Some individuals subscribe to the “buy and hold” investment philosophy, which states that the ultimate objective is to never sell the assets that they have acquired since it is anticipated that their value will continue to rise over time.

Take a look at the performance of the Dow Jones Industrial Average in the last century below.

The Dow Jones Industrial Average has been on an upward trajectory for quite some time now, despite occasional dips into negative territory. The goal of the buy-and-hold investment strategy is to establish a position in the market and maintain it for a sufficient amount of time to ensure that market timing is irrelevant.

However, it is important to bear in mind that this particular technique is often designed for the stock market, and it is possible that it does not apply to the markets for cryptocurrencies. Keep in mind that the success of the Dow is inextricably linked to the economy of the real world. The performance of other asset types will be somewhat different.

Dollar-cost averaging example

Let’s look at this approach using an example to better understand it. Consider the following scenario: we have a set budget of $10,000, and we believe that it would be prudent to make an investment in Bitcoin. We believe that the price will most likely range in the present zone, and we believe that it is a great spot to acquire and construct a position with a DCA technique.

We may split the $10,000 into one hundred equal halves, each worth $100. No matter what the price of Bitcoin is, we are going to purchase $100 worth of it every single day. By doing it this manner, we will be able to space out our entrance over the course of around three months.

Now, let’s switch things up a little and use a new strategy to illustrate how adaptable dollar-cost averaging can be. Let’s imagine the price of Bitcoin has recently dropped into a bear market, and we don’t anticipate a sustained uptrend in the other direction for at least another two years. However, we do anticipate a bull market at some point in the future, and we would want to be ready for it now.

Should we continue using the same tactic? Almost certainly not. The time horizon for this investing portfolio is far more expansive. We would need to be prepared for the fact that this plan will continue to need a budget of $10,000 per year for the foreseeable future. So, what course of action shall we take?

Once again, the investment may be broken up into 100 equal halves, each worth $100. On the other hand, this time around, we are going to purchase Bitcoin in the amount of $100 every single week. Since there are around fifty-two weeks in a year, the complete approach will be put into action over the course of little less than two years.

By acting in this manner, we will be able to establish a position for the long term even while the downward trend continues to play out. We will not be late for the train when it begins to go upward, and we have minimized some of the dangers associated with making purchases during a downward trend.

Bear in mind, however, that this tactic might be dangerous since we would be purchasing during a downward trend in the market. If you are an investor, it may be in your best interest to hold off on making any purchases until the uptrend is well established before making any moves. If they wait it out, the average cost (or share price) will most likely increase, but in exchange, a significant portion of the risk that may lead to a loss will be reduced.

Dollar-cost averaging calculator

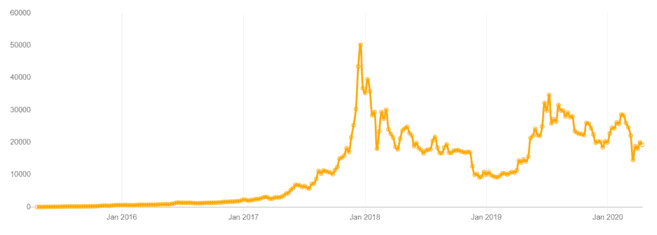

You can find a neat dollar-cost averaging calculator for Bitcoin on dcabtc.com.

You can specify the amount, the time horizon, the intervals, and get an idea of how different strategies would have performed over time. You will discover that the technique would have been continually performing fairly well in the case of Bitcoin, which is in an upswing that is expected to be maintained over the course of the long run.

You may get an idea of how well your money has performed below if you’ve invested the same amount of money every week for the last five years and purchased just $10 worth of Bitcoin. $10 a week doesn’t seem that much, doesn’t it? If we fast forward to April 2020, your total investments would have been around $2600, and the value of your Bitcoin hoard would be approximately $20,000 at that time.

The case against dollar-cost averaging

Even while dollar-cost averaging has the potential to be a successful technique, there are some people who do not believe in its efficacy. It unquestionably achieves its finest results when the markets are characterized by significant fluctuations. This makes perfect sense given that the strategy’s intended purpose is to reduce the impact that excessive volatility has on a position.

On the other hand, some people believe that it will cause investors to miss out on potential profits while the market is doing well. How so? The assumption that individuals who invest sooner would obtain higher benefits may be made if the market continues to be in a bull trend for an extended period of time. Using dollar-cost averaging in this manner may have the effect of reducing the profits made during an advance. In this particular scenario, investing a single large investment may provide better results than dollar-cost averaging would.

Despite this, the majority of investors do not have a sizable sum that can be invested all at once. However, it is possible that they will be able to invest little sums over a lengthy period of time; in this scenario, dollar-cost averaging may still be an appropriate method.

Closing thoughts

Dollar-cost averaging is a redeemed strategy for entering into a position while minimizing the effects of volatility on the investment. The investment is broken up into more manageable portions, and further purchases are made at predetermined intervals.

The following is the primary advantage that may be gained by using this method. People who don’t want to actively keep track on the markets but yet want to invest may do so using this method. Market timing is notoriously tough.

Dollar-cost averaging could, however, cause some investors to miss out on profits made during bull markets, according to some who are skeptical of the strategy. Having said that, missing out on some returns is not the end of the world, and dollar-cost averaging is still a viable investing approach for many people.