Impermanent Loss Explained

If you’ve had any kind of interaction with DeFi at all, you’ve almost probably come across this expression at some point. Impermanent loss happens when the price of your tokens changes compared to when you deposited them in the pool. The greater the degree of change, the greater the degree of the loss.

Wait, you mean that supplying liquidity might cause me to lose money? And why is the loss impermanent? Well, it comes from an inherent design characteristic of a special kind of market called an automated market maker. Providing liquidity to a liquidity pool has the potential to be a lucrative endeavor; but, you will need to bear in mind the idea of temporary loss throughout the process.

Introduction

There has been a significant increase in the number and liquidity of trades conducted using DeFi protocols such as Uniswap, SushiSwap, and PancakeSwap. Because of these liquidity standards, almost anybody who has cash may become a market maker and earn trading fees for their services. The decentralization of market making in the cryptocurrency ecosystem has made it possible for a significant increase in frictionless economic activity.

If you are interested in providing liquidity for these platforms, what information do you need to do so? The notion of loss that is just temporary is going to be covered in this article, which is why you should read it.

What is impermanent loss?

When you provide liquidity to a liquidity pool and the price of your deposited assets changes in comparison to one another in addition to their given value from when you deposited them, you incur an impermanent loss. This loss is in addition to the value that the assets had when you initially provided the liquidity. The more significant this shift is, the greater the likelihood that you may experience loss in the short term. In this scenario, the loss manifests itself as a reduction in the dollar value of the investment as compared to when it was first deposited.

Pools that comprise assets that consistently trade within a narrow price range will have a lower risk of experiencing a temporary loss of value. Coins that are wrapped in various types of stablecoins, for instance, will maintain a price that is confined inside a very narrow range. In this scenario, there is a reduced possibility that liquidity providers may suffer a temporary loss (LPs).

Why then do those who supply liquidity continue to do so if they are in a position where they might suffer financial loss? Well, temporary loss may still be compensated for by trading fees if one so chooses. In point of fact, because to the trading fees, even pools on Uniswap that are very vulnerable to transient loss have the potential to turn a profit.

Every deal that goes straight to liquidity providers incurs a 0.3% fee when executed via Uniswap. Even though a particular pool is very vulnerable to temporary loss, it may still be advantageous to offer liquidity if there is a significant amount of trade activity taking place in the pool. This, however, is subject to change based on the protocol, the particular pool, the assets that are deposited, and even more general market circumstances.

How does impermanent loss happen?

Let’s go through an example of how impermanent loss may look like for a liquidity provider.

Alice contributes one ether and one hundred dash to a liquidity pool. Within the confines of this specific automated market maker (AMM), the deposited token pair is required to have values that are comparable to one another. This indicates that the price of one ETH at the moment of deposit is equal to one hundred Dai. This also indicates that the monetary worth of Alice’s deposit at the time it was made is equivalent to two hundred United States dollars.

In addition, the pool has a total of 10 ether and 1,000 dai, both of which were backed by investors who are similar to Alice. Therefore, Alice has a ten percent stake in the pot, which has a total value of ten thousand dollars.

Imagine for a moment that the cost of an ETH token rises to 400 DAI. During this time, arbitrage traders will continue to add DAI to the pool while simultaneously taking ETH out of it. They will continue to do this until the ratio represents the current price. Remember, AMMs don’t have order books. The ratio that exists between the assets in the pool is what ultimately decides how much each asset in the pool is worth. Although the total amount of liquidity in the pool (10,000) does not change, the percentage of the assets that are included inside it does.

The ratio of how much ETH there is to how much DAI there is in the pool has changed since the price of ETH has increased to 400 DAI. Because by the efforts of arbitrage traders, the total pool value has increased to 5 ETH and 2,000 DAI at this time.

Therefore, Alice makes the decision to withdraw her money. As was established before, she is entitled to a ten percent part of the total prize money. As a consequence of this, she is able to withdraw 0.5 ETH and 200 DAI, which equals a total of 400 USD. Since she first invested tokens worth 200 USD, she must have earned some respectable gains, right? But wait, what if she had just held on to her 100 DAI and her one ETH? What would have occurred then? At this point in time, the total monetary worth of these assets would amount to 500 USD.

We are able to observe that Alice would have been in a better financial position if she had held on to her cryptocurrency rather than contributed to the liquidity pool. This is what we call impermanent loss. Due to the low quantity of the original investment, Alice’s loss was not nearly as significant as it would have been under other circumstances. Bear in mind, however, that even seemingly little setbacks might result in large losses (including a significant portion of the initial deposit).

In light of this, Alice’s scenario makes no consideration whatsoever of the trading fees she would have received for providing liquidity to the market. In many instances, the earnings from the fees would more than compensate for the losses, turning the provision of liquidity into a successful endeavor nevertheless. However, before giving liquidity to a DeFi protocol, it is essential to have a solid understanding of the concept of impermanent loss.

Impermanent loss estimation

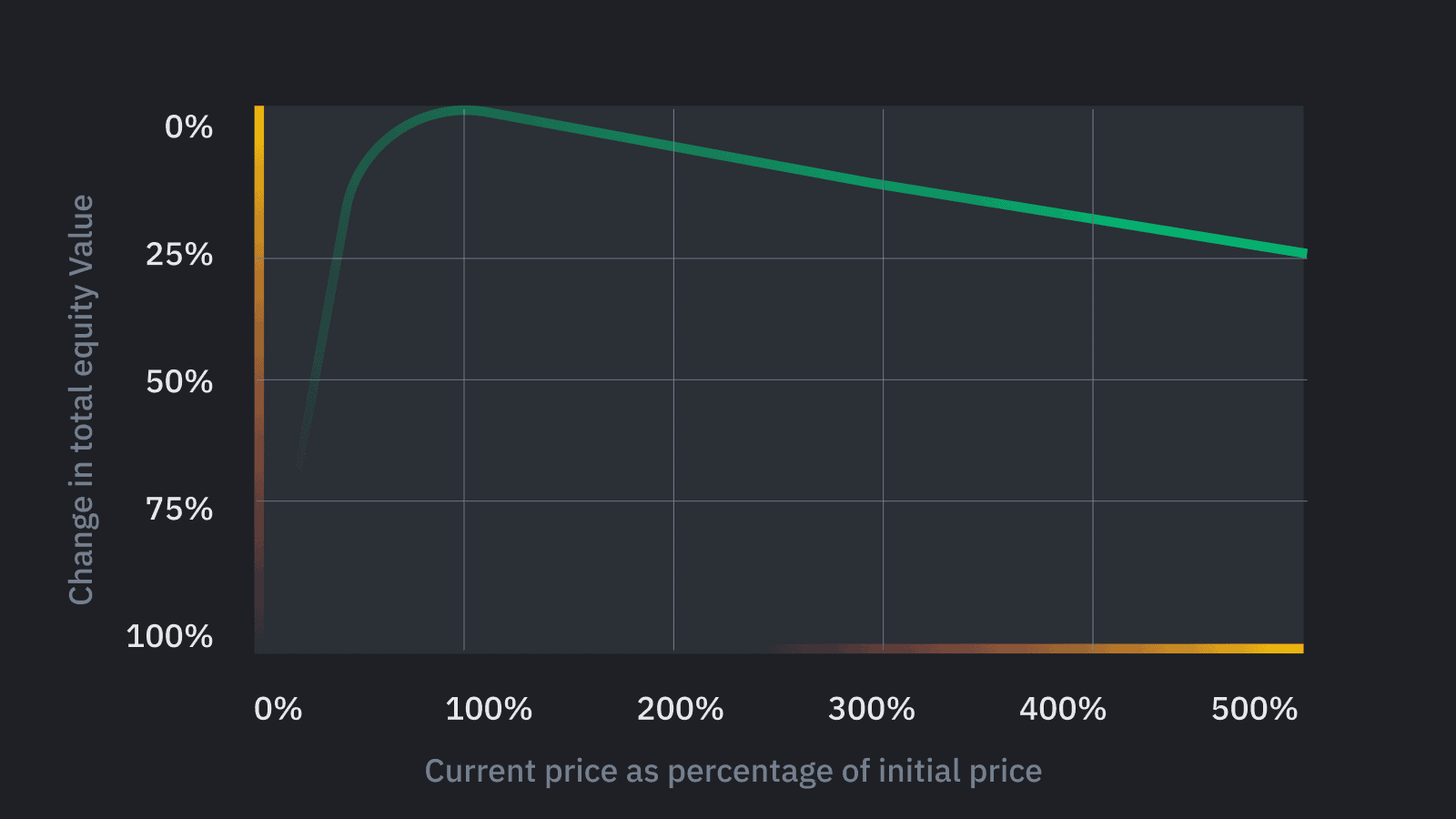

So, impermanent loss happens when the price of the assets in the pool changes. But how much is it exactly? We can plot this on a graph. Note that it doesn’t account for fees earned for providing liquidity.

Here’s a summary of what the graph is telling us about losses compared to HODLing:

- 1.25x price change = 0.6% loss

- 1.50x price change = 2.0% loss

- 1.75x price change = 3.8% loss

- 2x price change = 5.7% loss

- 3x price change = 13.4% loss

- 4x price change = 20.0% loss

- 5x price change = 25.5% loss

The risks of providing liquidity to an AMM

To tell you the truth, I’m not a fan of the word “impermanent loss.” It’s called impermanent loss because the losses only become realized once you withdraw your coins from the liquidity pool. However, at that time, the losses are very certainly going to be irrecoverable. Even while the fees you make could be adequate to compensate for such losses, the name of the service is still a little bit deceptive.

When you deposit money into an AMM, you need to exercise extreme caution. As was pointed out before, certain liquidity pools are far more vulnerable to transient loss than others. You are more likely to be put in a position where you are vulnerable to a temporary loss if the assets in the pool have a higher degree of sensitivity to changes in market conditions. It’s also a good idea to start out by putting in just a little bit of money. Before investing a more substantial sum, you will have the ability to get a ballpark figure of the returns to which you may look forward thanks to this method.

One last consideration is to search for other AMMs that have been tried and tested. Anyone may very easily fork an existing AMM and make some minor adjustments thanks to DeFi’s user-friendly interface. However, doing so may make you vulnerable to flaws, which may cause your cash to be stranded in the AMM indefinitely. If a liquidity pool offers abnormally large rewards, there is certainly some kind of tradeoff involved, and the dangers that are linked with it are probably also greater.